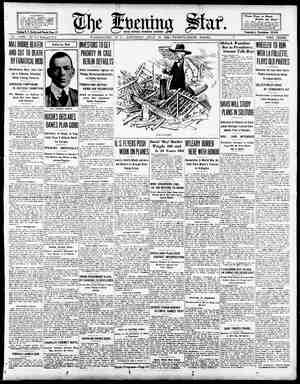

Evening Star Newspaper, July 19, 1924, Page 10

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

10 * RAILROAD SHARES SUORE NEW HIGHS Rubbers and Oils Also Very Active in Today’s Brief Trading Session. . FIN B the Associated Press. { NEW YORK. July 19.—A sustained demand for the railroad shares, twen- of which bettered their previous 1op prices for the year, was the out- $tanding feature of today's brief, but active, stock market. Industrials showed more uniform strength, with exceptionally good buyving noted in the rubbers and Pacific Coast oil Buying of the rails, which embraced both the high-grade and non-dividend issues, was based on pectation of larger sible incre: in gommon stock of peculative ex- nings or pos- dividends in the some of the larse completion of some s reported to be under| way. Rubbers moved up on rumors| of an « upward prices. Congoleum, International H Slectric, Dupont shares. INDUSTRIALS TURN STRONG. BY STUART P. WEST. Special Dispateh to The Star. NEW YORK. July brief session on the was the stron 19.—Today's tock exchange cek end market P’rices rose in many instances to highs for the nd in the u swing the rails held the lead the industrials for the most part kept abreast of the railway group, and a number of the more active issues were bid up sharply General Electric, American Can and Baldwin Locomotive were among them. the first named gett to 1ew top. United State fnon, selling around posed to take part in Profit-taking sales, which were natural on the had_slight effe market In_ the v stocks rose to their year. As the recent rails has broadened | veloped strength in the shares of the | strong angd weak roads alike. With | v York Central, Atchison, Atlantic line, Delaware and Hudson Southern Pacific, as well as other high-grade issues, all at their best, prices. | Stewart-Warner Weak. Stewart-Warner was one of the few soft i > industrial share list. It was offered down to a new low for the current movement, an- ticipating unfavorable dividend tion. Around the 50 level the stock appeared to be discounting a Teduc- tion in the dividend at the forth- coming mecting fragm the present $10 | to a $5 or $4 annual rate. When the stock was selling 10 to 15 points higher, Wall Street was talking of an_ $8 dividend The high level Chalmers common trading was primaril the satisfactory earning company has shown throughout rece 1 in general business. In 1 Allis carned over $6 a share on the common. Net income in the first six months of 1924 is esti- mated to have equaled $1 a share or at the annual rate on §5. The growth of Allis-Chalme Lusiness in the field of public utility electrical equip- ment aas been steady Industrial The industrial the rubber shares, with strength in Ajux and in U. S ber, the coppers. particularly conda and Kenn: d the tobaccos. acco Irodu was a_feature in ?r?:d a public utilit were ste s further sell- ing in An and numerous highest for the advance in the out, has de- | reached All in t recent a reflection of | s which this the by ori vorites included ts The There w 1 Wat tment pre rk ather depre s news. Stutes that for the first wholesale qugtations dvanees, even were | con- time in 2 show though the gains fined to food stuifs. rapid rise in grain has had a ing effect upon sentiment who have business or indirect, with the of relations, western New York stocks strong; 20 rail is- st new 1924 highs Bonds—Firm: St. Paul liens active. exchanges—Higher: sterling over Cotton—Low- favorable news. ar—Holi CHICAGO. creased crop unfavorable evenly lower. higher. Texas Coffee Wheat — estimate weather. C: {ogs—Ac crop —Holid. rong; Corn ttle- de- irm; Un- and POLICY TO BE CONTINUED ON COTTON COLLATERAL By the Associated Press. RICHSOND, Va. J banks in the fifth F al district will continue to accept col lateral in the form of cotton ware- house receipts from other than United States licensed warehous where the responsibility of the pri warehouse is assured, seorge 3. ¢ of the Federal R Bank of Richmond said vesterd formed of the announcement that St. Louis Re: tinue the practice, that his bank had rec structions to carry out adopted by the St. Lo The fifth Fed Re includes Virginia, North Carolina and Maryland. Atlanta Plans No Change. ATLANT. July 19.—The At- lanta Fed rve Bank will con- tinue ehouse re- ceipts that seem safe, Joseph A. Mc Cord, chairman of the bhoard of di- rectoss, said here. There seems no immediate likelihood that directors of the bank will change the present practice, he said, asserting that this was a matter for settlement by the in- dividual bank Member Reserve ived the bank. erve d and no policy trict South _— BOSTON STOCK MARKET. BOSTON, July 19.—Following is a list of today’'s highest, lowest and closing pri for the most active stocks dealt in here: Am Tel & Tel rts. Arcadian_Cons Arizona Com.... Boston & Albany Boston & Boston Elevated. Calumet & Arizon: Calumet & Hecla Copper Range Dubilier . East Butt East Mass. Edison El New England T & T New York N H & H. North Butte 0ld_Colon Pacific Mill iney t. Mary' Bwift & Co. Tnited Fru | Cosden Co. . | Cub Cane Su ANCIAL.’ Received by Private Wire Open. High. Low. Close. 88% 88% B88% 88% 79% TOW 9% T9% Ajax Rubber.... 8% 8% 8 8 Allied Chem (4).. 76% 76% 76% 76% Allied Chm pf (7). 117% 117% 11T% 117% Allis-Chalm (4).. B6% 56% 56% Allis-CMpt (7). 95 95 96 Am Bosch. . 28% 28% 28% Am Can (16)..... 116% 117% 116% 117% Am Car & Fy(12). 172% 172% 171 171% Am Chain A (2).. g22% 22% 22W 22% AmDrugSynd.. 4% 4% 4% 4% Am Express (é). 112% 112% 112 112 Am & F P 259%(7) 105 105 106 108 Am For P{pd(7) 104 104 104 104 AmHide & Lpf.. 56% 56% 66% 56% AmIce (75. L o92u 92% 92% 92K Am Tnternatl. 23% - 23% 23% 23% Am Linseed. 18% 19 18% 19 Am Linseed p! 39% 39% 389% 39% Am Locomo (8). 79% 79% 79% 79% Am Metal (3). 42% 43% 42% 43% Am Ship & Com. 13% 14 13% 14 AmSm & Re (5). 67% 68% 67% 68% AmS& Rpf (7). 102% 102% 102% 102% Am Stl Fdys (3). 36% 86% 36% 36% Am Sugar. . 42 42% 42 42% AmSugarpf (7). 86% 86% 86% 864 AmSumatTob.. 7% % 7% % AmT & Tel (9).. 123% 123% 128% 123% AmTel & Telrts. 3% 8% 8% 3% Am Tobac (12).. 143% 143% 142% 143% Am Water Wkas 94% 97% 944 AmWWopt (6). 90 90 90 Am Woolen (7)., 70 70 70 Am Wool pf (7). 100% 100% -100% Am Zinc. 8% 8% 8% Am Zinc pf. 21% 28% 27% Araconda. 31% 32% 214 Arm pf Del (7) 87% 87w 8% Assets Realizat. % % Asgo Dry G (5) .. 95, 94% As DG 1st pf (6). 89 89 Asso Ol (13%)... 28% 28% AtT&SFo16).. 105% 105% AT&SF ot (5). 91k 91 AtI Birm & At... 2% 2% Atl Coast L, (18). 127 126 Atlan Frult cfs.. mo 1% AtGulf& WI... 21% 21% AtGulf & WIpt 25 24% Atian Ref (4) 844 83% Atlas Tack ™% % Auto Knitter 2% 115% 60% o . 2% Bald Loco (7)... 116% Bal & Ohfo (5)... 60% Barnsdall A 204 20 Barnsdall B. 15% 15 Beh Nut (2.40).. 51 b1 Beth Steel (5) . 42% 42% Beth St1 pf (1)... 90% 90% Brk Edison (8).. 14 114 Br'k-Man Tran.. 29% 2?« Br Man T pf (6). 70% 69% BrklynUnG (4) 69% 69% Butte C & Zinc. . 5% 4% Butte&Superior 17 16% Butterick Co..... 17% 2 84 21% Caddo Cen O & R. Cal Packing (6).. Cal Pet (1%) Callahan 7 Les 3% Calu & Ariz (2) 46 Calumet & H 50c. 16% an Pacifie (10). 148% Case JTPlow. ... W 1% Case Threshi 22 Cent Lea Co p! 47% Chand Mot (6). 45% Ches & Ohio (4) 85 Chicago & Alton.. % Chic & Alten pf.. 1% Chic Gt West. . 6% Chic Gt West pf. 17% 'h Mil & St Paul. 16% Ch Mil & St. P pf. 2715 Chi & Nwn (4). 60% Chiz R1& Pac. 35% CRT&P pf (6) 78% CRI&PDf(7).. 90 Ch StP Min & O 40% Chile Cop (234). 29% 29% Chino Copper. . 19 19% CCC&StL (3).. 130% 130% 130% Coca-Cola (T) 1% 1% 1% Colo Fuel & Iron. 46 45% 45% Colo Southern. 37 87 87 52 52 4 41 43% 43% 46 52 41% 43% 46 46% 6% 0% 0% 1% 4% an 64% 54% Bd% 6% 6% 6% 24% 84% 84% 26% 26W 624 52% 29% 29% 13% 134 59% 60% 574 58 16% 16% 59% 59% 4 119% 120% 126 126 105% 105% 16 16 2% 2% 5% 5% 125% 127% 12 12% 31% 31% 387 38% 3% 3% 80% 804 4T 4T% 1% 11% T T 59% 59% 9% 9% 42% 42% 91k 914 244% 247% 1% 11% 14% 144 425 43% 37% 374 13% 13% 20% 20% 5 5% 54% 55 94 15% 65% 29% 12% 20% 69% 88 34 33% 25 12% % 110% 110% 111% 111% 6% 6% 33% 384 108 103 24% 24% 36% 37 95% 954 45% 45% 26% 26% 91% 91% 10% 10% 88% 388% 17% 18% 8% 87% 54% 56% T4 4% 6% TI% 1 11 23% 23% 24% 24% 14% 15% 43 43 A5% 46% 41% 41% 2 2% 56 56 87 97 10 10 49% 49% 60% 60% 60% 60% 63% 64 16% 16% 6% 6% 61% 61% 87% 37% 7 87 91% 9% 94 94 20% 29% 22% 23% 481 48y 28 28 30% 30% 33% 33y 39 39 49% 49% 12% 12% %0 90 0% 20% Adams Exp (6).. Alr Reduct (4) 17% 81 21% 3% 46% 16% 148% 1% 22 4T% 45% 85% ey 1% 6% 18% 16% 27% 60% 36% 9% 90 40% 21% 3% 47 16% 148% 1% 22 4T% 45% 85 A% 12% ;] 18% 17 27% 61% 35% 78% 904% 401 &F Col Carbon (4). Congoleum (3) 1Gas (5)... Textile. Cont Can (4. Cont Motors Corn Products. Crucible St1 (4) Cub Am Sug (3) Cuban Cane Sug. it Cuyamel Fr (4). Dan! Boone M (3; Davidson Chem. De! & Hud (9) Del L& W (6). Det 151 Co (8) Dome Mines (2) Dul So Sh & Atl. Dul S S & At pt. DuPtda N (8). icaton Ax (1.60).. rie. ... Erie 15t pt. Erie 2d pf. Famous Pl (8)... F'dM&SDpt (D). Fifth Av B (640). Fisk Rubber. .. Fleishan (3). Freeport-Texas. Gen Asphalt Gen Cigar (8) General Elec (8) Gen El spe (60¢). Gen Mot (1.20). Gen Petm (2). Gold Dust. Goldywn Pict. Goodrich Gondrich pf (7). Goodyear pf. . G'dyear prpf (8). Granby Congol. Gt North pf (5). Gr Nor Ore (3). Gr Canan Cop. Gulf Mo & Nor Gulf StStl (5).. Hartman Co (4) Hayes Wh'l (3). Househ'd Pr (3) Hud Mot C (3) Hupp Mot C (1) Hydraulic Steel Ilinos Cent (7) 111 Cent pf (6) Indian Refining. 6% Inland Stl (2%).. 83% Inland Stl pf (7). 103 Inspiration Cop.. 24% Interb Rap Tr...* 87% Int Bus Ma (8). 95% Int Cement (49... 45% Int Com Eng (2). 26% Internat Har(5). 92 Int Mer Marine... 10% Int Mer Mar pf. 39 Internat Nickel.. 17% Inter Nick pf (6). 87% Internat Paper... 55% Int Papptst (6). 74 IntT&T (6). 6% Invinzible Oil. 11 Kan City South. 23% Kayser Jul & Co.. 24% Kelly\Spr Tire. 15 Kelly Springfd pf. 43 Kelly Sprg 1st pf. 45% Kenne Cop (3)... 41% Keystone T&R.. 2 Kresge Dept Stor. 56% 97% Laclede Gas (7) .. Lee Rub & Tire... 10% Leh Val (3%).... 49% Lig & Myrs (3).. 60% Lig & Mvrs B (3). Lima Loco {4). Loews Inc (2) Loft, Incorpor. Loose-Wiles Bt Lorrillard (3).... Louis & N'sh (6). Mack Trucks (6). Mack T 2d (7)... Magma Copper. .. Mallinson & Co. .. Man El modgtd 4. Maracaibo Ofl..... Marland Oil Martin Parry Mathieson Alkali Maxwell Mot A Maxwell Mot B... May Dpt St (5)... Mex Seaboard(2). 42% 244% 11% 14% 43% 373% 1314 .. 20% 75 54% 94 16 65% 29% 12 20% €9% 88 34 33% 25% 13% % 110% 111% United Shoe Machinery . T 8 Smelting... 3 U S Smelt ptd..... Ventura 0il Warren Bros. Winone . MexSeabd ctfs(2) Miami Cop (2)... Middle St Oil. 19% 19% 22%. 224 1% 1% -| Phillips Pet (2). THE EVENING NEW YORK STOCK EXCHANGE Direct to The Star Office Open. High, Low. 2% 3 2% 15% 156% 165% 45 45K 4d% 18% 19% 18% 49% 49% 49 67% 6Tk 67% 29% 29% 29% 20 204 20 % % T 30% 30% 30% ol A ¢ . 60 60% 60 36% 386% 35% 38 39 88 22% 22% 21% 146% 146 145% 114 114 114 1% 1% 1% 55% 65% 655% 13% 13% 13% Minn & St Lout, Mis Kan & Tex. Mis K & Tex pf. Missour! Pacific. Missourt Pac pf.. Mont Power (4). Montgom Ward. . M>0n Mot (3). Mother Lode 75c. Munsingw'r (3).. Nat Acme....... Nat Biscuit (3). Nat Dalry (3). Nat Dept Stores Nat En & St Nat Lead (8 Nat Lead pf (7) Nat Ry.M 2d pt. . Nat Supply (3).. Nev Cons Cop. NYAIrBr4)... 44 44 44 NYABrA).. 51% 61% b5l N ¥ Central (7).. 107% 107% 107% NYC&SL (6), 99% 99% 99% Ny C&StLpf (6). 89 89% 89 NY Dock. .. 334 334 334 NYNH& Hart... 27% 28% 27% NYOnt& West.. 21% 22% 21% Norfolk South.... 20% 21 20% Norf & W (18)... 124% 124% 128% North Aneer (2).. 26% 26% 26% North Ampf (3).. 50 50 50 North Pac (5)... 65% 66% 65 Ontario Mining. 5 6% 6 Onyx Hospf (7). 84% 84% Otis Elev (n) (4).. 66% 66% OtisSteel........ 7% 7% Pacific Develp. .. % PacG & E (8). 94% Pacific Of1 (2). 48 Packard (1.20).. 1n Packard pf (7). . 99% Pan Amer (4). 524 Pan Amer B (4). 51 Benn Railrd (3). Penn Seab Steel.. Peop Gas Ch (7). Peoria & East. ... Pere Marq (4)... Phila Co (4) . Phila& R&T Phil Mor (500) Close. 3 16% “n 19% 49 67% 20% 20% % 0% k4 60% 35% 39 21% 148 114 1% 55% 13% 44 51% 107% 99% 89% 33% 28% 21% 21 123% 26% 50 €5 6% 84% 66% ™% % % % 94% 47% 1 99% 51% 50% 45% 1% o8 15% 54% 1% 46 12% 33% 9% 13% 49% 63 52% 25% 45 ¢ b4% 16% 126% 49% 20% 116% 11% 58 21 12% 46% 124% 71% 64 37% 284 264 63% 43% 69% 59% 124% 15 80% 94% % 6% 16 24 23% 12% 16% 17% 94% 64% 10% 80% 86% 57 24 29 51% 37 % 943 48 11 99% 51% 49% 45% 2% 98y 15% 54% 51 4T% 12% 83% 9% 13% 49% 652% 52y 25% 45 B5% 16% 125 20% 20% 116% 116% 11 11% 53% 681 21% 21% 13% 13% 45% 46% 124 12% % 71% 61 6% 37% 3% 28% 28% 26% 26% 53% 63% 4% 44n 11 Plerce-Arrow. . Pitts U1 ot Pitts & Weat v Postum Cer (4).. Presa StiC (4)... Prod & Refiners. . Pr&Rpf (3%).. Pub Ser N J (4).. Public Serv rta Pullman Co (8).. Punta Al Su (5).. Pure Oil (1%)... Ry St Sgpf (7). Ray Cons Cop. Reading (4). Reading rts, Replogle Steel. Rep Ir & Steel. . . Reynolds Spr (2) Rey Tob B (3) Royal Dutch rts Rutland pf. . St Joseph 1d (2). St1,San Fran. St L-San Frof... St L Southwest. StLS'thpf (6).. 69% 69% Savage Arms. . 60% 60% Schulte (8)...... 125 125% Seaboard AirL.. 14% 15 Seab'd AirLipf.. 30% 80% Sears-Roeb'k (6). 95 95 Seneca Copper... % % Shattuck-Ariz. 6% 6% Shell Un Of1 (1).. 16% 16% Shell Unpf (6).. 94% 941 Simmons Co (1). 23% 23% Simme Pat. 124 12% Sinclair O 16% 16% Skelly Oil 17% 17% South Pac (6).... 94% 94% Southern Ry (5). 654 Spicer Mfg. .. 10% Spicer Mf pf (8). 80% Std Gas & El (3). 86% StOil Cal (3).. 57 StOIIN J (1) 3¢ Std Plate GI( 29 Stew't War (10).. b2%4 Studebaker (4).. 37 Submarine Boat.. 10 9% Superior Ofl. 7% % Telautograph. ... a Tenn C & Ch. ‘ % Texas Co (3). 39 Tex Gulf (16%4). 72 Texas & Pacific. . 34 Tex & PacC&O. 8% Third Avenue. ... 16% Timken (13%)... 83% Tob Prod (6). 62% Tob Prod A (T)... 1% Transcont Oil 4% Undereaood (3).. 87% Un Bag Pa (6) 50% Un Pacific (10) 138 Un Pacpt (4). ... 7 Utd Alloy Steel 224 Utd Cigar Stores. 49% United Drug (). 81 Utd Fruit (10)... 202 Utd Ry Invest.... 16% Utd Ry Invest pf. 47% U S Cast Iron P.. 9914 U S Distributing. 24% U S Hoff Mach. .. 21 U S Ind Alcohol. . 1% USR&Im@®)... 6% U S Rubber...... 29% U u 72 34 9ta 164 33% 63% 1% 4% 37% 50% - 137% 138 518 22% 22% 49% 49% 80% 81 204 204 16% 16% 47 48% 99% 99y 24 24% 20% 21 1% 71% 95% 95% 29 30 9% 79% 27 28 45 45% 100 100% 122 122 2% 73 29% 29% . 21% 21% . A% 4% 63% 63% 16% 15% 45% 45% 30% 380% 16% 17 41% 4l% 78 8 12 12 214 21k 109% 109% 62% 6215 9% 79% 18% 13% 24 24 28% 28% 1% 1% 8 8 8% 8% 110% 110% 78 18 SR 1st pf (8). 79% S Smelting.. 28 U S Sm't pf (3%4) 45% U S Steel (16) 100 USSteel ot (7). 121% Utah Copper (4).. 73 Utah Securities. . 29 21% Vanadrum Corp. 4% 63% 16% 44% 0% 17 41% 8% 12% 21 109% 62% 79% 13 23% 28% 1% 8 8% 110% 73 Web & Hellb (1). Wells Far (2%). West Pen (4).... West Maryland. . ‘West Mary 2d pf. West Un Tel (7). West E&M (4).. W E 1st pf (4) Wheel & L Erio Wheel & L Er pf. Wh Eag Oil (2) Wickwire Sp Stl... Wilson & CO...... Willys-Overland. Woolworth n (3). WthPDfA (7).. Wright Aero (1).. 124 12% 12Kk 12% Wrig WJr (3)... 38% 38% 88% 38% {Partly extra. $Payable in preferred stock. Dividend rates as given in the above table are the annual cash payments based on the latest quarterly or half-yearly declarations. Unless otherwise noted, extra or special dividends are not included. JOBBING TRADE ACTIVE. Bradstreet’s Sees Better Buying at ‘Wholesale in Near Future. NEW YORK, July 19.—Bradstreet’s today says: “Trade is mainly of a midsummer character, with retail lines, aided by 13 23% 23% 1% 8 % 110% 3 crop improvement and ‘sales’ rela- tively most active. There is evidence, however, that the continued rise in grain prices, the very decided gain in corn and other crop conditions, and the cheerful tone of security markets are causing the better feeling in wholesale lines to take more definite form in the shape of a willingness to buy more freely of textiles for the nearer future. “While jobbing trade is naturally of a refill or reorder character, there is evidence of a fairly active trade in this line and of some expansion of primary purchases for the late sum- mer and early fall. Collections are a shade better. Weekly bank clear- ings, $8,388,636,000.” . HUMBLE OIL CUTS PRICES. HOUSTON, Tex., July 19.—The Humble Oil' and Refining Company has posted another 25-cent reduction in_the price of gulf coast crude, A grade going to $1.50 ‘a barrel. ' B grade was cut from $1.45 to $1.30. Similar prices were posted later by the Texas Company and Gulf Pro- duction Company. A STAR, WASHINGTON, D. C., SATURDAY, JULY 19, 1924.° [ v BONDS s Recelved kv Private Wire Direct te The Star Office. LOW-PRICED RAILS FEATURE N BONDS Today’s Changes Fractional, But Tone Is Firm—Week’s New Issues, $50,000,000. BY GEORGE T. HUGHES. Spécial Dispatch ot The Star. NEW YORK, July ‘19.—The feature of the trading in bonds on the last day of the week was the low-priced rails. Some such development was to have been expected from the ac- tivity in the stock market. While the stocks have been going ahead rapidly, the corresponding bonds have lagged behind. Comparison of prices leads to the belief that either the stocks are too high or the bonds are too low. A case in point is the St. Paul. While the preferred stock has been ad- vancing from 25 to 27% during a week's time, the 4 per cent bonds of 1925, selling around 80, are up only about a point. And the successtul refunding of this large bond issue is essential to a solution of the St. Paul's difficulties. Seaboard Bonds Strong. Seaboard Air Line adjustments have advanced more than 3 points this week and held the gain today. But even at today's price the current income yield is around $ per cent, and there is 12% per cent accumulated back interest which must be paid off before the pre- ferred stock can come in for dividend consideration. The movement in the Erie issues has been more logical. All the junior bonds were up from 2 or 3 points on the week, which is about in keeping with the rest of the market and with earning conditions. The market for the purely investment bonds has been quietly firm, without the activity which accompanied the new high records in the Government list earlier in the year. At the same time prices have been creeping upward, and during the last two days the high-grade railroad mortgage issues have been par- ticularly strong. United States Govern- ment loans are very little changed. Brazilian Bonds Steadier. In the foreign group attention has been almost monopolized by Brazilian bonds, the market for which, however, steadied at the end of the week, partly on short covering and partly on more favorable news. Frénch bonds have dragged. The week's new financing totaled nearly $50,000,000. The most interest- ing new issue was the Great Consoli- | dated Electric Power Company 7s, the successful placing of which showed that the market would still take kindly to a Japanese obligation. Changes Only Fractional By the Associated Press. NEW YORK, July 19.—Bond trad- ing lapsed into midsummer dullness today with prices of most issues fluc- tuating within fractional limits in the early dealings. Buying of the semi-speculative rail liens, however, gave a firm tone to the market. St. Paul obligations attracted most of the orders and scored gains ranging from small fractions to 1% points. Third Avenue Adjustment 5s and Chi- cago and Eastern Illinois 5s ad- vanced about a point each and fur- ther recovery took place in Brazilian Central Railway 7s. CHICAGO LIVE STOCK MARKET. CHICAGO, July 19 (United States Department of Agriculture).—Hog: Receipts, 6,000 head; active, 5 to 15 higher; mostly 10 up; lightweight scored 'full advance; light lights and slaughter pigs, 15 to 25 higher; top. 8.20; bulk good and choice 170 to 300 pounds, 7.95a8.20; packing sows, 7.00a7.35; desirable strongweight slaughter pigs, 6.50a7.00; estimated holdover, 4,500 head. tle—Receipts, 500 head: most killing classes unevenly 25 to 75 lower; mostly 50 to lower grades light grass steres, arlings, heifers and in-between cows showing most ru cows practically unsa 1.00 decline; bulls sharing general downturn; vealers. 1.00 to 1.25 lower; stocker and feeder, trade light; sup- ply smallest of season; extreme top handyweight and weighty steers, 11.00; best long yearlings, 10.60; Brassy native southwestern steers numerous at 6.50a7.75; week’s bulk prices follow: Beef steers, 8.25a10.00; stockers and feeders, 5.50a7.00; fat cows, 4.35a6.35; fat heifers, 6.5028.00; veal calves, 9.25210.50. - Sheep—Receipts, 1,000 head; today's receipts practically d11 airect; market nominally steady; for week around 8,400 head direct: 63 care, feed lots: compared with week ago, fat lambs and yearlings around 50 higher; sheep steady to strong feeding lambs 25 higher; top range lambs, 14.50; native, 15.00; yearlings, 12.00; feeding lambs, 12.25; week's bulk prices fol- low: 'Fat range lambs, 14.00a14.5 culls, 9.00a10.00; fed vearlings, 11.00 al2.00; fat ewes, 4.50a6.00; feeding lambs, 11.75a12.00. TREASURY CERTIFICATES. (Quotations furnished by Redmond & Co.) Bid. “Ofter. 100% " 1009-10 :s? 13-16 100 15-16 101916 1017; 101 2332 101 2 102 9-16 101% 103532 103 932 108316 108 5-16 SHORT-TERM SECURITIES. (Quotations furnished by Redmond & Co.) —Close.—, Bid.” Asked: 1083 5%s September 15, 1924... 4igs December 15, 1924, 4% March 15, 1925... 4%s March 15, 1925, 4148 June 15, 1925, 4%s December 15, 4%s March 15, 192 41,8 September 15, 4%s March 15, 1927 418 December 15, 1927. Aluminum Co. of Amer. 7s 1925. Aluminum Co. of Amer. 7s 1933. American Sugar 6s 1937 2 American Tel. & Tel. 6 1925, Anaconda Copper 65 1920 ‘Anglo-American Oil 7 Associated Oil 6s 1935 Bell Tel of Canada Os 1925 Canadian Northern 5%s 1924, Central of Georgia s 1 Central Leather s 1925 : Chi., Mil, & St. Paul 6s 1934, Chi.. R. I. & Pac 5%s 1926.... Gas & Elec. 1st 0s 1927, Du Pont 7%s 1931, Federal Sugar ief. Fisher Body Corp 6s 1 Fisher Body Corp 8s 1928 Goodyear T. & K. 85 1831. Great Northern 7s 1936. Gult Oil of Pa 5is 1928, Humble Oil 5%s 193: : Kennecott Copper 78 1 5 M., St. P. & 5. 8. M. 6163 1961 Morris & Co. %8 1930 New York Centr 1 Oregon Short Lines 45 192 Penna. R. R. 7s 1830, Tidewater Oil 618 1931 Union Tank Car '7s_1980. U. 8. Rubber 7%s 1830. Western Union 63s 1936, 5 Westinghouse E. & M. 7s 1931.. Wheeling Steel 6s 1 I T T CHICAGO STOCK MARKN\T. CHICAGO, July 19.—Following is a report of today's sales, high, low and closing quotations at the Chicago Stock Exchange: Sales. 150 Armour of Del pfd... 170 Com’wealth Edisos 60 Montg Ward *'A" 78 Nat Leather. 5875 Stewart 95 Swift & High. 127 hivig 425 Wrigley 850 Yellow Mig Total sales, 18,000 'WAGE DEMANDS DENIED. SEATTLE; July 19 (Special).—The demand for skilled workers in the metal trades for an increase from 3830 to $9.50 a day has been re- ‘used by employers, who have issued advertisements announcing an open shop. Three bundred workers have qu! (Bales are in §1,000.) o gm'rsn STATES B‘OND& “ {Fra Sty gbaon Exampie: T101o3 hreans 101 3830 Bale High. Low. Close. . 151 io1=14 10114 10114 2 102-1 102 102-1 95 101-16 101-14 101-15 . 268 102-6 102-: US4%s1952, 59 104-26 104-24 104-28 FOREJaN. Sales. High. Argentine 6s°37... 17 98 Austria 7s. . 4 92% Belgium 7i4s, 1 105 Belgium 83 ee. 14 105 Bolivia 7 91 Bordeaux 6u. 2 854 Brazil 7s 10 84 Brazil 7% 5 98% Brasi .20 94% Canada 651926.... 5 101% Canada 6s 1931 18 101% Canada 952 21 102% Canmada 5%s 19 103% Chile 78 1943. 98 Chile 8s 1. 105% Chile 8s 1946. . 105% Chinese Gov Ry s 45% Copenhagen 5% 93% Cuba 538, 97 Czechosloval 26% Denmark 6s 98% Denmark 8s. 110% Dutch EI5%s. 20 DEI5ksect...... 89% Dutch East I 65°47 95% Dutch East I 6: 95 French Govt 7 99 French Govt 8s.... 48 102 Haiti 6 1 90 Itdly 6 100% Japanese 4 80 Japanese 6% 91% Jergens U M 6s’ 80% Netherlands 6s’54. 13 98% etherlands 68 '72. 95% Norway 6s 1943... 97% Norway 6s 1952.... 98 78% Paris-Ly’s-Med 6s. Porto Algere 8s... 96 Prague 7%s. .. 89 Rio de Jan 831 94% Rio de Jan 83 1947 93 Sao Paulo State 8s. 17 97% Seine Deptof 7s... 8 89% Serhs Crotes Slo 8s 21 85 Sweden 68 5 103 Swiss 535 1946. 96% Swiss Confed 8§s. 118% Tokin bs.... lg;% Ud Kingm 5%s Ud Kingm 5%5'37. 34 104% Ud Steam Copen 65 1 90% MISCELLANEOUS. Ajax Rubber »: 33 Am Agr Chem 7%s 17 AmChainsf6s'33. 2 Am Cotton Oil 5s.. 4 Am Repub deb 6s.. 4 Am Smit&R 1st bs. x: 9 9 Low. Close. 93 93 92% 92% 105 108 104% 104% 90% 90% 86% 856% 82% 83 98% 98% 98% 94% 101% 101% 101% 101% 102% 102% 103% 103% 97% 9% 105 105% 105% 105% 45 45% 93 93 96% 97 9615 96% 98% 98% 110% 110% 89% 90 89% 89% 95% 95% 94% 94% 98% 98% 101% 101% 90 90 100% 100% 79% 80 91 9% 79% 80% 981 98% 95% 95% 97 91% 98 98 8% 8% 96 96 89 €9 04% 94% 93 93 97% 97% 89% 8% 84% 85 103 96% 96% 118% 60% 61 109% 104% 20% 85 8T% 94% 88% 92% 93% 100% 97 101% 102% 116% 1% 96% o8 85% 9% 98% 99% 83% 94% 88 96 974 100% 97% 99% 102% 100 100% 100% 934 88% 90% 105% 108% 105% 105% 92% 100% 96% 104 116% 1034 99% 97% 9415 26 86% 93% 9754 92% 90% 97% 117% 96% 111% 105% 97% 9% 101 1124 101% 975 106% 964 & 100% 93% 103% 108% 95% 93% 93% 93% 10214 99% 8% 99% 7% 10135 107 84 90% 9% 99% 84% 98 102 95% 105% 97% 103% 108% 82% 1023% 104% 2% 61 32 94 102 984 111% 108% 69 97% 88% 101% 95% 90% 86% Am Sugref6s..... AmT& Tcltrids.. AmT& Tel trbs.. Am T & T deb 5% AmT&Tcv6s.... Am Water Wks bs Anaconda 1st 6s. .. Anaconda cv db 7s. Armour & Co 4%s. Armour of Del 513 Atlantic Refin bs.. Bell Tel Pabs..... Beth Steel pm b8 Beth Steel rf bs. Beth Steel 5%s'63. Beth Steels f 6s. .. Brier H St 1st 5%s Bklyn Ed gen 5s Bush T Bldg 5s '60. Central Leather §s Chile Copper 6 CinG & E5%8'62. Col Gas & El5s.... Col Gas & Fll 5s sta. Commonwth P 6s.. Con Coal Md 1st 5s Denver Gas 5s. Det Edison ref 6 Du Pont de N 7%; Duquesne Light 6s. Est Cuba Sug 7%s. Empire G&F 1% Fisk Rubber 8s.... Goodrich 634s. ... Goodyear 8s 1931.. Goodyear 8s 1941.. Hershey 68 1942... Humble O&R 5%s. Mlinois Bell 1st 5s. Illinois Steel 4% Int Mer Marine 6s. Inter Paper b5 '47. K CP&Lt5s A'52. Kan G & El 65| Kelly-Spring 8s. .. Lackawa S 55 '50. . Liggett & Myrs 5s. Liggett & Myrs 7s. Lorillard (P) 5s... Magma Cop cv 7s.. Mexican Petrol 8s. Montana Power 5s. Morris&Co 1st 4%s New Eng Tel 6 N Y Edsn 15t 6% NYG EL H&P 58 NY Tel 4% N Y Tel6s'41... Norta Am Ed 6 North am Ed 6%s. Nor States Pow 5s. Nor States Pow 6s. Northwst B Tel 7s. Otis Steel 8s... Pacific Gas & Ei bs Pacific T & T 53 °'52 Phila Co 5%s '38 PhilaCoref 6s A.. Phil & Rdg C&I 5s Plerce-Arrow 8s.. Pierce Oil deb 8s.. Public Service 5 Pub Serv Elec 6s. . Punta Alegre 7s. Sinclair Oil 6%s. Sinclair Oil 7: Sin Crude Oil 5%s. Sin Crude Ol 6s. .. Sin Pipe Line 5: South Bell Tel 5s. . So Por Rico Sug 73 Southwest Bell5s Steel & Tube 75 Tenn Elec Pow 6s. Tide Wat Ofl 6%s. Toledo Edn 1st 7s. USRublstrbs.. U S Rubber 7%s. USSteel sfbs.... Utah Pow & Lt bs. Va-Car Chem 7s... Va-Car Ch 7%s W. Vertientes Sug 7s. Warner Sug 7s "41. Western Elec 5s. .. ‘Western Union 6% Westinghouse 7a. . Wickwire Spen 78. Willys-Ov 6%s '33. Wilson & Co 1st 6s. Winchester A 7%s. Youngstn S& T 6s. 2! MORE FREIGHT MOVED. BALTIMORE, July 19 (Special).— Freight loads moved on the Sea- board Alr Line railroad, showed an increase of 11.6 per cent, for the week ending July 15, as compared with the corresponding week of 1923. The total was 34,086 cars, as against 30,- 547 last year. CARS NEEDING REPAIRS. Freight cars in need of repair on July 1 totaled 194,869, or 85 per cent of the number on line, an in- crease of 2,398 over the number on June 16, the American Railway As- sociation reports. 10 15 5 88 54 45 88 14 12 e NP e NS e N e G €3 P - - P Fowe =Naraa8is monoaBeihin ~aman - 62 324 94 102% 98% 111% 108% 69 98 88% 101% 5% @ = 8 38Y wamle 4 1 3 8 e SBSPTE'U'B.ESINWEEK. B. G. Dun & Co. reports 388 commercial failures in the United States this week, an increase of about 100 over the total a year ago, 217 having liabilities of §5,000 or more in each case. RATES ON BAR SILVER. LONDON, July 19.—Bar _ silver, 34 5-164 per ounce. Money, 2% per cent. .Discount rates: Short bills, 3%a3% per cent; three-momth bills, 3 9-16a3% per cent. RAILROADS. Sales. High. Low. 6l 61% 90% 90% 86 85% 91% 91% 9% 99% 87% 87% 90 90 85% 854 103 102% 101 100% 29% 99% 68% 68% R0% 80% 110% 110% 114% 114% 81 81 98% 98% 102 102 103% 103% 88% 88% 95% 95% 90 89 61% 60% 39% 38% 89% 89% 100% 100% 3% 13% 56% 56 56% 65% 80% 80% 72 12 64% 53% 62 61 b54% 63% 59% 68% 100% 100 96% 98 107% 107% 7% 71 82% 824 1n7 17 95% 956% 108% 103% 9% 9% 106% 106% W TT% 44% 44% 40% 39% 70% 61% 63% 63 72 105% 114% 93% 101% 109% 86% 68 104% 68% 68% 1% . 91% Int & G Nor 1st 6s. 974 Int & G Nor aj 6s.. 63% Kan City Ft S 4s 81% Kansas City S3s.. 1% Kansas City S §s.. 90 Kan City Term 4s. 86 Lake Shore 4s *28.. 98 Lehigh Valley 6s.. Manhat Ry en 4 Market St Ry 7s. Mil E1 Ry & L bs. & St L 1stref 4s Close. Ann Arbor 4s... 61% & O Toledo 4s... 1 Bklyn-Manhat 6s.. 36 BKIRT 78’21 ctst. 2 Canad North 7s.... 11 Canad Pac deb 4 Car Clinch & O bi Car Clinch & O 6s. Cent of Ga 6s Central Pacific 4 Ches & O cv 434 Ches & O gn 4% Chi & Alton 3s Chi & Alton 3% Chi B&Q gn 45 '68. Chi B&Q 1st rf bs. . Chi & ETll gn 6s Chi Great West C M & Puget Sd Chi M & St P 45 °26.193 Chi M&St P 4s°34.. 1 CM&StPdb4s Chi M&St P cv 4348 Chi M&St P rf 4% Chi M & St P cv ba. Chi M & St P 6 Chi & N W ret Chi& NW 7s. Chi Rys 6s. ChiRI&Prf4s Chi Un Sta 6%; CCC&StLébs. . CCC & StLrt Cleve Term i Cleve Term 6%s. Den & Rio G cn 4: D& RG 1st rf 5 DesM&FtD 4s Erle 1st con 4s Erie gen 4s. . Erie conv4s A Brie conv 4s B... Erie couv 4sD.... Gr Trunk ef db 6s. Grand Trunk 7s... Great North bs. Gr North gen 5%s. Gr North gen 7s. .. Hud & Man ref 6s.. Hud & Manaj Bs.. I Cent ref 5s'55.. Int Rap Tran bs... Int Rap Tr 53 stpd. 3 99 19 61 83 98 92% 85% 99% 108% 95% 102% 49 6% 86% 85% 66% 39% 39% % 4% 63% 53% 124 86% 96 106% 83% 937% 103 110% 109% 34% 80% 97% 0% 8l% 92% 86 0% 86% 8% 69% 102% 82 B4% 80 5% 65 81% 86 90% T4% 100% 102 107% 59% 55% 100% 93% 87% 9% 106 26% 94 100% 63% 89 83 FOREIGN EXCHANGE. (Quotations furnished by W. B. Hibbs & Co.) Nominal Selling %0ld value. checks today. 4. 4.38% Mo Pacific gn 4s... 87 Mo Pacificbs’65... 1 Mo Pacific6s...... 2 NOTex&Minbs. 11 NYCentcn4s'38. & NYCentribs.... 18 N Y Cent deb 6s... 228 NYChi&SL5%s. 18 NYC&StL6sA.. 1 New Haven 7s fr.. NYOnt& Wrefds 2 New York Ryrf4s 5 NYRyrfdsctfs.. 5 New York Ry aj 58 30 NYRysadjbsct.. 13 N Y State Ry 4%s. NY W & Bos 4}4s. Norfolk & W cv 6s. Northern Pac 43 Northern Pac 5s D. orthrn Pacri6s. 18 Ore-Wash 1strf4s 1 Pennsyl gen 4%s.. 15 Pennsyl gen 5s. Pennsyl 6%s Pennsyl gold 7s. Peoria & E inc 4 Pere Mrq 1st 4s ' Pere Marq 1st 6s.. Rio G West cl RIArk & L4%s.. St L IM&S 45°29 St L IM&S R&G 48 StL&SFplisA. StL&SFprinbs. 17 StL&SFadj6s.. 23 StL&SF inc StL& S F pl 6 7 StLS W 1st 4s. StLS W con 4s°32. 10 StP & KCShL 4%s. 5 Seab'd A Liref 4s.. 122 Seab'd A L adj bs.. Seab'd A L con 6s. Sou Pacific clt 4s. . Sou Pacificref 4 Southern Ry gn 4 Southern Ry 1st 5s Southern Ry 6s ct. Southern Ry 634s. . Third Ave ref 4s Third Ave adj bs. Toledo Trac 6s. Union Pac 1st 4s. Union Pac 1strf Union Pacific 48 '27 Union Pa&l1st rf 53 Virginia Ry 1st Gs. VaRy &P 1st bs.. Wabash 1st Ba.... Western Md 4a.... Western Pacific s ‘Wisconsin Cent 4s. 4 4% 63% 52% 124 86 95% 106% 83% 93% 102% 110% 109% 34% 80% 9% 70% 81% 92% 84w 0% 86 8 69 102% 813% B4y 80 5% 64% 81% 36 90% 4% 100% 101% 107% 59 54% 100% 9314 87 9% 106 96 93% 100% 63 88% 82% 29 10 86 0% 102% 82 84% 80 65% 65 81% 86 90% 4% 100% 102 107% 59% 55 100% 93% 87% 99% 106 964 94 100% 63 89 83 Montreal Paris, franc. Rruseels, fran Rerlin, mark. Rome,'lira. Zurich, fra Athens, drachm: Madrid, peseta. Vienna, crown. Budapest, crown. B crows 0514 L0457 ‘24 trillion. 0432 Waj Christiania,’ crown. Stockholm,’ crown. By the Associated Press. NEW YORK, July 19.—Forelgn ex- changes firm. 'Quotations (in United States dollars): Great Britain, de- mand, 4.38%; cables, 4.38%; 60-day bills on banks, 4.35%. France, de- mand, .0513; cables, .0514. Italy, de- mand, .0431; cables, .0431%. Belgium, demand, .0456; cables, .0457. Germany, demand (per trillion), 23%. Holland, demand, .3801. Norway, demand, 1342, Sweden demand, .2660. Den- mark, demand, .1606. Switzerland, demand, .1825. ' Spain, demand .1326. Greece, demand, .0173. Poland, de- mand, .0019%. ' Czechoslovakia, de- mand, .0297%. Jugoslavia, demand, .0119%. Austria, demand, .000014. Rumania, demand, .0045. Argentina, demand, .3250. Brazil, demand, .10. Tokio, demard, 41. Montreal, .99 9-16. ONLY 508 LOSE JOBS. DETROIT, July 19 (Special).—The decrease in industrial employment in local plants for the week has been less than for any week since March 16, with one exception, totaling only 508, compared with 1,416 last week and 5,207 the week before. Total em- ployment by Employers' Assoclation members now is 194,670, FINANCTATL.' COTTON QUOTATIONS VERY UNEVEN TODAY Market Opens Easy, But Prices Ad- vgnce Later on Week End Covering. By the Associated Press. NEW YORK, July 19.—The cotton market opened easy today at an ad- vance of 3 points on July, but gener- ally 14 to 32 points lower under re- alizing in anticipation of the govern- ment crop report Monday and scat- tered selling encouraged by reiterated reports that dry hot weather had caused little or no damage to Crop Dprospects in Texas. July was in demand, however, sell- Ing up to 31.60 on further coverire or 20 points net higher. After declining to 26.14 at the start. October rallied to 26.20 in sympathy with the near month strength. 4 Cotton futures closed barely steady. High. Low. Cle . 31.60 31.40 . 26.25 25.88 25.01 2488 - 25.17 ul 45; October, .32; January, 25.17; Mai July . October December January March Opent cember, bid. New Orleans Market. NEW ORLEANS, July 19.—The cot- ton market opened a trifle easier and first trades showed losses of 13 points on active new crop months. Prices eased off further during and imme- diately after the call until October traded at 25.28, and December at 25.12, or 20 and 16 points under the closing prices of yesterday. The sell- ing was due to reports of beneficial rains in west Texas, which are said to have covered a fairly wide area. The market raillied slightly after the first rush of selling, awaiting the showing of the weather map. Cotton £00ds news was more encouraging. Cotton futures closed steady at net decline of 38 to 40 points. High. Low. g 27.40 25.03 25.82 24.78 Close. July . October’ December January March . 2 : 24.88 bi Opening: July, . asked: October, 25, December, 25.15; January, 25.05; Marcl, Mo CHICAGO GRAIN PRICES. CHICAGO, July 19.—Rains in Can- ada and in parts of the domestic spring crop belt led to fresh de- clines in the price of wheat today during the early dealings here. Un- expected firmness of Liverpool quo- tations had only a temporary bullish influence on the Chicago ~market. Reports, however, that the weather of the next few days would determine the rust question for South Dakota and southern Minnesota attracted considerable notice. Furthermore, there were complaints of a wet harvest in Nebraska. Opening prices, which ranged from a half-cent de: cline to a half-cent advance, Septem- ber 1.24a1.25 and December 1,27%a 1.28, were followed by a material set- back all around. Cool weather unfavorable for corn growth tended to strengthen the corn market. After opening un- changed to 1 higher, September 1.04%al04%, values sagged some- what, but soon scored a general upturn. Oats were easier, sympathizing with wheat. The start was un- changed to % off, September 47%a 47%. Further losses ensued. Higher qoutations on hogs gave firmness to provisions. WHEAT— Open. High, July ... o 1.28% September D 2482 b Close. 1.25% September . October GRAIN AND PROVISIONS. BALTIMORE, Md., July 19 (Spe- cial).—Potatoes, new, barrel, 1.00a 2.75; beans, bushel, 1.25a1.85; beets, 100, 3.00a5.00; cabbage, 100, 3.00a5.00: carrots, 100, 4.00a6.00; corn, celery, bunch, basket, 75a8 50a5.50; lima beans, 4.00a45.00; lettuce, bushel, spring onions, bushel, 1.50a1.75; peas, bushel, 2.00a2. peppers, basket, 2.00 a2.50; ‘spinach, basket, 2.00; rhubarb, 100, 3.00a4.00; radishes, 100, 1.50a3.00° squash, basket, 75al.00; tomatoes, basket, 3.00a4.00. Apples, barrel, 1.50a3.50; bushel, 50 al.75; cherries, pound, 5al5; blackber- ries, quart, 10al4; pineapples, crate, 2.50a4.00; Huckelberries, quart, 13415 plums. basket, 50a1.00; peaches, crate, 75a1.50; melons, 100, 15.0040.00; can- taloupes, crate, 1.00a3.50; raspberries, pint, 12a15. Settling Prices on Grain. Wheat—No. 2 red winter, 132; No. 2 red winter, 1.27%; No. 3 red winter, 1243 Sales—Bag lots of nearby sold at a range of 1.05 to 1.25 per bushel. Car- goes on grade No. 2 winter, garlicky, at 127%; No. 3, L14%; No. 4, 1,20%: No. 5, 1.16%. Corn—Cob, new, 5.00 per barrel for yellow and 4.85 per barrel for white; No. 2 corn, spot, 1.08; No. 3, no quota- tion; track corn, yellow, No. 2, nominal Oats—No. 2 white, 65% and 66; No. 3 white, new, 64% and 65. Rye—Nearby, 90; No. 2 rve, 90. & Hay—Receipts, 32 tons. The local hay market is amply supplied with both grades and kinds and the move- ment of old hay has been so sluggish that dealers have refrained from en- couraging shipment of new hay. The poorer qualities of grassy, weedy and dark mixed hay are particularly hard to_dispose of. 50a1.00 spot, garlicky, garlicky, 2 spot, 1 timothy, 28.00; No. 2, 26 No. 3, 22.00a24.00; No, 1 light clover, mixed, 25.00a25.50; No. 2 light clover mixed, 23.00a24.00; No. 1 clover mixed, 24.00a24.50; No. 2 clover, 21.00a22.00. Straw—No. 1 straight rye, 23.00a 24.00 per ton; No. 1 tangled rye, 18.00 a20.00; No. 1 wheat, 17.00a17.50; No. 1 oat, 16.50a17.00. GRAIN PRICES LOWER. WINNIPEG, July 19.—Fairly gen- eral rains throughout Manitoba and some parts of Saskatchewan and Al- berta last night imparted a weak tendency at the opening of tne wheat market today. Lower Liver- pool cables also created easier feel- ing, opening prices ranging from 1% cent lower. Within a short period further declines were recorded July touched $1.34%, a loss of about 2 cents; October, $1.27%, a decline ot 2%; December, $1.23%, and May, $1.26%, a loss of 2%. WEEKLY BANK REPORT. NEW YORK, July 19.—New York bank _clearings, $808.000,000; New York bank balances, $94,000,000; New York Federal Reserve Lank credits, $74,000,000. ‘WOOL AGAIN ACTIVE. BOSTON, July 19 (Special).—The wool market continued strong and animated today, although many traders believe the buying movement of the mills has spent itself tempo- rarily. The Western growers, how- ever, have taken advantage of the advance in prices and have disposed advantageously of considerable of their holdings. Prices are 10 to 15 per cent higher than a fortnight ago. NEW YORK EGGS FIRM. NEW YORK, July 19.—Butter, weak; receipts, 18,502. Creamery, higher than extras, 40%a41%; cream- ery, extra (92 score), 40%: creamery firsts (88 to 91 score), 38a40. Eggs, . firm; receipts, 10,839. Pa- cific Coast whites,~extras, 38%a39%; do., firsts to extra firsts, 32a38. e LIVE POULTRY PRICES. CHICAGO, July 19.—Poultry market easy; fowls, 16a20%; broilers, 28a35; roosters, 14. ~ 1400 DELEGATES - VISIT CAPITAL Members of Banking Institute Guests of Local Chapter on Special Tours. BY CHAS. P. SHAEFFER. Approximate!y 1,400 Juniors in the banking business, young men and women, who have been in attendance on the convention of the American Institute of Banking at Baltimore during the last few days, arrived in this city this morning and are spend- ing a large and very generally per- fect day as the guests of the local chapter of the national body. This organization, which will pro- vide the next banking generation, is largely supported by the American Bankers' Association as its educa- tional branch, so that there is avail- able to the banking world a continu- ous supply of trained and thoroughly competent assistants. After discussing serious and tech- nical topics and being surfeited by the entertainment offered by Balti- more, the guests are finding the beauty of Washington and the char- acter of their reception acteor D altogether Guests of Local Chapter, The Washington Chapter. has spared no effort nor expense in of- fering to the visitors the best the city affords. About $4,000 is being expended on the day's entertainment, it is said, which will be culminated tonight at the New National Museum in a reception lasting from 7 to 11 o'clock. Automobiles have been com- mendeered from every known source by Francis G. Addison, jr., chairman of the transportation committee, and failing to raise the necessary number he has called on the taxi companies around town to make up the balance These will be used for the extensive sightseeing tour which has been planned for 2:30 this afternoon. The complete itinerary for the day follows: 8:30 a.m.—Leave Baltimore, Penn- sylvania Railroad and Baltimore and Ohio_Railroad. 9:25—Arrive Union Station, ington. 9:40—Board Washington Railway ‘Wash- and Electric cars for Mount Vernon wharf. 10:15—Boat leaves for Mount Ver- non; wreath will be placed on grave of ‘Washington; group picture at mansion. 12:30 p.m.—Boat leaves Mount Ver- non” for Washington; luncheon on —Arrive in Washington. 0-—Autos leave wharf for sight- seeing trip; wreath will be placed on grave of Unknown Soldier. 4:30—<Reception at Pan-American building. to 7—Marine Band concert, the Ellipse. Many places of interest will be left for individual selection of the guests. 7 to 11—Private view of exhibits, New National Museum; music. Route Taken by Visitors. The route of the sightseeing tour is as follows: Starting point, Sev- enth street wharves, Mount Vernon boat, up Water street to Fourteenth street, around west side of Bureau of Engraving and_ Printing, through park, Monument Grounds and Exec- ufive ~ Grounds, through Madison street, east side of White House to H street, through H street to Sixteenth street, out Sixteenth street to Alaska avenue, to Georgia avenue and Kal- mia street, enter Rock Creel Park, through Rock Creek Park to Zoo, through Zoo to Jewett street and Connecticut _avenue, on Connecticut avenue to Woodley road to Wisconsin avenue, on Wisconsin avenue past St Alban’s Cathedral to Massachusetts avenue. Down Massachusetts avenue past United States Naval Observatory to Twenty-third street, down Twenty- third street to Q street and out Q treet to Thirty-third street, out Thir- ty-third streei to M street, out M ect to Memorial Bridge, cross Key Bridge to Fort Myer and Arlington Cemetery. Return by way of Highway Bridge, through Potomac Park to Seven: teenth street past Bureau of Engrav- ing and Printing, up Seventeenth street, past Navy Buildings, D. A. R. Red Cross and Pan-American Build ings to Ellipse, south of White House. End of tour. ames C. Dulin, ex-president of the chapter, is in charge of the day's entertainment. IMMENSE EXPANSION IN GRAIN TRADING Gain of 30 Cents, Per Bushel in Wheat in Week—Crop Re- ports Cause. By the Associated Press, CHICAGO, July 19.—Record-break- ing high prices and immense expan- sion of trading have been witnessed this week in the grain and provision business here. Indications that the wheat crop in Canada might be less than half of the vield in 1923 were largely responsible. Compared with a week ago, wheat this morning was 83 to 10% higher, with corn 5 to 7% up, oats showing 1% to 3% gain, and provisions at a rise varying from 40_to 90. Much of the excitement among grain traders arose from assertions that as a result of drought and hot winds the wheat crop outlook for Canada was the worst in 20 years. A tremendous rush of buying ensued and an immediate jump of 5 cents a bushel took place. Then waves of profit-taking sales and of new buying succeeded cach other day after day, with_price fluctuations so wide and rapid that blackboard records were frequentiy i cent or more at_vari- ance with actual pit values. Mean- while foreign markets advanced even faster than Chicago, and it was pointed out that for the first time in many months wheat grown in the United States was in a position to compete the world over. At the crest of the advance in wheat prices a gain of about 30 cents a bushel was shown since the low level some six weeks ago, and the volume of transactions had multiplied mil- lions of bushels. Toward the close of the week, however, drenching rains in Canada were reported, and enthu- slasts whoh had been talking of $1.50 as a wheat price goal were at least temporarily inclined to waver. Corn and oats swung upward with wheat. Temperatures remained too low for corn to grow well and re- ceipts were abnormally meager. Provisions and hogs kept pace with the extraordinary ascent of grain. BUSINESS TURN SEEN. NEW YORK, July 19.—Better crop reports, higher prices in grain and commodity prices and the rise in Se- curities on the stock exchange have combined to produce an optimistic outlook for an ear}y revival of busi- ness. The flood of money in the finan- cial district, some of which is being sent into New York by rural banks that have thawed out their frozen as- sets has brought predictions of a pos- sible drop to 11 per cent in the call loan rate which has been around 2 per. cent for weeks. Improvement in prices of farm products was said to have caused an increase In the accu- mulation of loanable funds. —_— FLOUR PRICES EASY. NEW YORK, July 19.—Flour— Easy; spring patents, 7.40a7.80; soft winter straights, 5.75a6.15; hard win- ter straights, 6.40a6.90. Rye—Easy; No. 2 western, 95% f.0.b. New York and 93% c.if. export. Lard—Easy; middle “west, 12.90a13.00. Other 2= ticles unchanged.