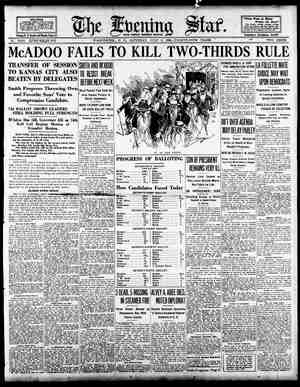

Evening Star Newspaper, July 5, 1924, Page 11

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIAL. TODAY’S VEGETABLE AND FRUIT REVIEW Receipts Only Moderate, With Few Changes Noted in Price Quotations. The daily market report on fruits and vegetables, compiled by the market news service bureau of agri- cultural economics, follows: Cabbage—Home grown light; demand limited; stronger; home grown, uncovered, slat barrels, pointed type, 1.25a1.50. Cantaloupes—Supplies cleaning up; demand good; market stronger; early s, California, Saimon Tints, stand- s, 36s and 455, 3.00a2.25, mostly ponys, 54s, 2.50; flats, 12s and 1.25; late sales slightly higher. Peaches—Supplies moderate; demand £ood; market steady: Georgia, 6s, (‘armens, medium to large size, 3.00a 350; small sige, 2.50a2.75; Hileys, medium size, few sales, 4.00. North rolina, 65, Greenboros, all sizes, 50a3.00: Atps, medium to large size, 3.50a4.00; small size, 3.00a3.50. Potato Supplies Moderate. Potatoes—Supplies moderate; de- mand moderate, market steady; North Carolina, cloth-top stave _barrels, Irish cobblers. U. S. No. 1. 3.25a3.75; few 4.00; Virginia, Norfolk section, cloth-top'stave barrels, Irish cobblers, 1 No. 1, 3.25a. Rappahannock River section, 3.50a3.75; few 4.00. Cucumber: upplies light; demand moderate, market_steady: Virginia, Norfolk section, 7%-bushel hampers, hotbed stock, fancy, 2. 0. Tomatoes £ood, market i Mississippi, 4s, ripes and turning. wrapped. No. 1, 1 R wuth Carolina, s, ripes and apped, poor condition, many wasty, fancy count, 2.50. Watermelons—Supplies moderate; demand moderate, market steady: Fiorida, bulk, per 100 melons, Tom Watsons, 25-30-pound average, 60.00a 70.00; 24-pound average, 40.00250.00. Sweet corn—Supplies liberal; de- mand good, market steady; North Carolina, crates, 2.00. 5. Other Vegetable Receipts. Lettuce—Supplies, moderate mand, moderate; market, steady. York, 2 dozen crates big Boston type, well headed, 1.50al leafy, 1.00a 1.25. String beans—Homegrown, sup- plies moderate and supplying market; demand, moderate; market, firm: own, uncovered slat barrels. Raspberries—Homegrown, es moderate; demand, moderate; steady: homegrown, 32-qt. crates, Ted and black varieties, 20a25 ber qt. Lima beans— Supplies. mode- rate: demand, moderat market, steady. North Carolina, bushel ham™ pe 50a3.00, mostly 3.00. A CLOSE-FITTING STORE. supplies market " demand de- New York Lock Shop Only Three Feet at Widest Point. From the Detroit News. New York's newest “smallest store” 1s on 7th avenue. The front is only cighteen inches wide, while the rear wall, which is five feet back, is three feet across. The small space is oo- cupied by a locksmith who pays §15 a month for the privilege of doing busi- ness there. No customers can enter, so the pro- prietor waits on trade through the front window, in which rests the ma- chine for making keys. His other equipment so fills his store that he hardly has room to move, vet he makes a living_ In case he gets fat, however, he will have to surrender his leas Young Philosophers. From the Los Angeles Time: lecturing his whether he needed it or One day he chanced to hear the fol- lowing conversation between the boy one employed next door. How much does he pay you?" the latter. 00 a year,” replied the 5 week and the — The Dangerous Speed. From the Topeka Capital. Seventy-five per cent of motor car accidents take place when cars are traveling_at_fifteen miles an hour. Dr. W. R. Reddin, Red Cross lec- turer, tells this to audiences daily, adding that a great percentage of ali auto accidents are due to “hooch, hugging and haste’—a shocking statement. Twenty-eight per cent of all the accidents the last three years, he says, have occurred in homes, a large percentage due to falls. Thir- teen thousand persons were killed last year by falling, most of them more than sixty years old. There- fore, if you're sixty, watch your step. When Chinese Plant Rice. From the New York Times. In Cochin China there is no irriga- tion. Rice is planted at the beginning of the rainy season, and all the nec- essary water is subplied by the rains that fall continuously during the growing period. The use of seeders and drills is im- possible, as the ground is entirely covered with water at seeding time. The rice is planted in little patches and then transplanted when a suffi- cient maturity is attained. —_— ven to the End. From Jodge. id you hear of Smith's death?" 0. ‘When did he die?” “This morning. Quite suddenly, I understand.” “Just like him. He was the most Ampulsive man I ever saw. Birds Still Best Flyers. For untold ages before the Ameri- ;:n ‘round-the-world flyers started on eir adventurous trip, certain birds Jalled Arctic terns have been making & trip of 22,000 miles each year from their breeding grounds in the north polar regions to feeding grounds in the Antarctic and back again, says The Popular Science Monthly for July. Man still his some distance to go to match this bird's records! Pat’'s Smart Bank. From Life. Pat had opened his first bank account and had taken to paying most of his debts by check. One day the bank sent him a statement, together with a vacket of canceled checks. Of the statement Pat made neither head nor tail, but the returned checks greatly pleased him. he said to a friend, ‘‘sure t bank I'm doin' busi- *How's that “Why, Oi paid all me bills wid checks, an’ be jabbers if the bank wasn't slick enough ‘to get ivery check back for me again.” Fresh Eggs Every Day. From Capper's Weekly. California and the coast have devel- oped the egg business to a point where they are now producing eggs for the United States duflni the entire year, and fresh eggs can be shipped and be in the hands of the copsumer ten days from the time they are laid. This ten- day egg is superior to the storage egg, which usually holds the market from Christmas until March. Califarnia no tupplies eggs to any part of the Unite States, thanks to its development of co- operative marketing and organized pro- duction and grading. st i Up-to-Date. From thy Utah Humbug. Slats—Dl4 you mest u\! tage rob- 01 ‘bers while ¥ou were gu) - e of cho- -Yes; I took a ¢ Fus girls-out to dinper. BY WILLIAM F. HEFFERMAN. NEW YORK, July 6.—It was na- tural that trading in today's short session on the curb exchance should have been dull and the volume of business small, in View of the session coming between two holidays. How- ever, the market was not entirely without feature. Operations for the rise were carried on vigorously in & few selective oil stocks. The persistent strength in Red NEW _YORK, July 6.—Following 1s an official list of bonds and stocks traded in on the New York Curb Market today: Sales in BONDS. thousands. High 1 Allied Packers 6s.. 80 2 Allied Packers £x 1 Am Gas & Elec 68 Am dee Txowi o Am Thread Co Gx Anaconda €8 AntillaSugar Awso Sim _Hdw ALG Low. D Deere & Co Tia.. Detroit City Gas Bs Dun Tire & Rub 78 Dug L P Siax B wl Fisher Body s Intern Mat 6, Kennecott Cop Leh V1 Hr & Libby MeN & L Mzhitoba Power 7 Leather S Nor 8t P Mi 6 Italian Pow King of Nether 6. 93 2 Solvay & (v 6% 3¢ B 1001, 1 Swhs Gost LI 36 Swiss Govt. [ 1004 Sales STANDARD OIL ISSUES, in units. Anglo Am 0il Ruckeye P L Eureka P L . Humble 0 & R Imp Oil of Can. . Indisna P I, . Inter Pet Co Lid Prairie Ol & G South Penn OIl ... Southern P L . § 0 Indiana . 8 0 Kentucky Vacuum Oil ew .. INDEPENDENT OIL STOC! in Lundreds. 18 Lago Pet..... 2 Latin Amer 0. 1 Liviogston Pet . 1 Mount Prod 21 Mount Gult & Mutual 0l b § New Eag Fuel Oii.. 20 Penn Beaver Ol .. . 1 Pennock Ol ...... 78 Red Bank Oii new 4 Roral Cana 0 & R 1 Sait Cle Prod ... 10 Sunstar Ol 5 Woodley Pet ' INDUSTRIALS. 1 Adiron Pow 7s pfd 06ily 44m G & E ow wi 1 Am Multigraph Co 1Am T & T ow wi 1 Brit-Am Tob Cou Prod Corp wi Dubilier ¢ & Radio 2 Du Pont Motors ... ec Boud & 8h pf & W Grant 5t wi 1018 8% BOSTON STOCK MARKET. BOSTON, July 5.—Following is a list of today's highest, lowest and closing prices for the most active stocks dealt in here: Am Tel & Am Tel & Amoskesg ... Boston & Aibany Boston & Maine Connor J T Edion Elec Island Creek 1 Libby McNeil & Libby.. Mass Gas . Mexican Investment Nat Leather ... w Dominion A New Eng T & T NYNHG&H Pacific Mills . &t Mary's Land Swift & Co Swift Int . Tnited Froit United Shoe Mach U 8 Smelt pfd . Ventura 0il Waldorf Tel .. Tel rts. . RS Spau® PR CEX NEW YORK CURB MARKET Received by Private Wire Direct to The Star Office . Bank Oil was cause for considerable comment. It crossed 30 to a new high for the year and compared with the previous close of 274 on reports that he company had brought in & well of considerable importance in the Elk Hill structure. S New England -~ Fuel' opened 2% points higher and later established a new top at 37. It is undersiood that a contract with one of the Standard 0il companies calling for one million barrels a year has expired and that arrangements are being made to con- tract for this amount at an increased margin of profit for Red Bank. Gillette Safety Raz Gen Mot pew w i Hudson & Man RR Herden Chem .. Hudson o pfd . lehigh Power Sec. Tepigh Val Coal . Leb V Coal new wi Me(rory Stores B McCrory Stores war Mosabi” Tron - at Tea Co . ¥ Tel Co pfd Y porta Nor Sta Pow Corp Omnibus A pfd wi Omnibus vot cf wi temmmBae S an B e - D e e Tean Bl Pow 2d pf United Bakeries . United Bak pfd .. Unite¢ Pft 8h new U S Lt & Heat Ward Bak (o B wi Werd Bak Co pfd Ware Radio wi Yel Taxi Corp N ¥ MIN obe Cop 1d Minex [SP Arizona Bl Oak Butte & Western Canario Copper Conx Cop Min Cortez Siver .\ m Black Buite. dfieid Deseiop iold Zone .. Independence les a0 Tonx Kay Copper Corp 2 Nipising ... Ot Copper 1 Ply Lead Aines. .. . Promier Gold Mio. R Mt § & R.. Rocky Mt 8 & R pf Ruby Rand Mines Spearhead Gold Tonopah Extens .. 2 United Verde Ext.. U Contin nw Wi . Wenden Copper Yukon Gold . B = Time to Get Busy. From the London Passing Show. Rustic—Be you painting them old trees, sir? Artist—I am. But it's no business of yours. Why not get on with your own work instead of interrupting mine? Rustic—Well, my work is to chop ‘em down, so vou'd best hurry up with your paintin; nw Unduly Alarmed. From London Opinion. Territied Bride — George, n's getting smaller. erely the ebb tide, dear.” “Oh, thank goodne: You know you just said you'd love me till the ocean went dry—and 1 was begin- ning to get scared.” He Didn't Wait. From the Edinburgh Scotsman. “You may refuse me now,” said the persistent suitor, but 1 can w. All things come to him who wai “Yes,” replied the dear girl, think the first thing will be father. 1 hear him on the stairs.” —_— Found Out Early. From the Pittsburgh Chrouicle-Tejegraph. “My dear,” remarked Jinks, who had just finished reading a_book on “The Wonders of Nature,” “this really is a remarkable work. Nature is marvelous! Stupendous. When 1 read a book like this it makes me tRink how puerile, how insignificant is_man.” “Huh!" sniffed his better half. “A woman doesn’t have to wade through 400 pages to discover that.” 3 the o Jack Getting Scarce. It we could interpret the sermon that Jack-in-the.pupit is preaching it would Enjoy Us But Do Nature Magazine. The species I8 becoming increasingl scarcer on account of the promiscuous, thoughtless manner in which it is being picked at every opportunity. Birds have two flying speeds—a normal rate which is used for every- day purposes and for migration, and an accelerated speed which is used for protection or pursuit. Low Money Excitement Ends, But Market Continues Advance Financiers Await Turn in Trade and Watch Political Moves for Bear- ing on Railroads, BY STUART P. WEST. Special Dispatch to The Star. NEW YORK, July 5.—The week just ended has brought little change in the business and financial situa- tion. Judging from the course of the stock market it would seem that prices pretty well adjusted them- selves to the recession in trade which began in the last week of March and which appears to be In its final stages. In the investment market the enthusiasm derived from very low money rates has subsided for the time being at least. Bonds are still selling below what they were in 1932, when Interest rates were equally low. They are selling considerably under the average of 1917, when the money market occu- ied a similar level, but when, owing o the preparations for the first war loan, conditions were somewhat arti- ficial and could not have been com- pared with the present. Qn the ground that inyestment se- curities are still ranging below what they were in these two other periods of extreme money market ease, and on the ground that surplus invest- ment capital is undoubtedly more abundant, the prognosis is for a con- tinuation'of the upward tendency in the market for bonds and 1n the high- est grade of investment stock. All experience teaches that after havin exhaus ibilities of the b securities, stment funds must congent to descend to a lower rank, where there is an element of risk. This is the sart of thing which ap- pears likely to happen under present eircumstances. Politics Element. The money factor is, therefore, an important backlog, although it c: not be a stimulating element unl other conditions are right. Wall street has paid little sttention to the Democratic convention and it has refused to be djsturbed by the defi- nite announcement that there s te be a third party in the field. This in- difference may not continue. There have been other presidential cam- paigns where a like attitude was ab- served at the start, and where later on it gave way ta a serious scare. Consequently, toe much reliance should not placed upon the pres- ent steadiness of the price moyement. But it Iy a fact that the divergencies disclosed 3t Madigon Square Garden o, SR et G R conserval ‘Wal reet view of the outlook. + A& for she third” party movement, the possibility is admitted that the election may be thrown into the House of Representatives, where con- trol would rest with the radical bloc committed to government ownership of railroads, a valuation of 50 per cent on railroad properties as com- pared with that fixed by the Inter- state Commerce Commission, repeal of the Esch-Cummins act, and a dras- tic all-around reduction of freight rates. Why has Wall street not been more unsettled over this possibility, and why particularly have raillway securities held as steadily as they have? ‘. Better Position of Farmer. The answer lies in the remarkable increase during the last month and a half in farm prices. The farmer made good profits on corn last year, with peices lower than the present. 'While he government cotton report indi- cated a much larger yield than ex- pected, this will be offset by the fact that there will be scarcely any carry- over from the old crop. As the result cotton raisers are still able to sell for future delivery at quotations well above the average. The wheat grow- er claims he can make no money with the price under $1.25 3 bushel. But this takes account of a fair income for the farmer himself and a rental value on land purchased or leased during inflation times. After the re- cent 20 cents rise, the wheat grower is not going to make out so badly. He does not stand in need of govern- ment help. He can get on quite well on his own feet. Recession in Business. This is the season of dullness in general trade. The indicatios are that no recovery from the reaction of the last three months need be expected before August or September. On the contrary, the prospect is for @ further falling off. The stock mar- ket at length recognized this in its movement ‘toward the end of the week. Tt had heen going shead pre- viously as if the stage was set for a general upswing. p It now has perceived that what occurred. during June was merely a recovery following.a period of ‘ex- cessive “operatjons for 'the decline, founded upon the false idea that the country was in for a term of depres- slan. 'This short selling was very much overdone and ' has takel three or four weeks to re-cstablish equilibrium.” But, having done this, it has to be acknowledged that there is ‘little before the market than perlo1 raf wt:‘ltgn;.r&nt to be -uur:! ustrial p iction.” EaMclontly cut down. aady m-‘%' Sond. o get a clearer line .upan. pol eveats, 7 COALINDUSTRY NEARER TONORMAL Babson Finds Demand Gain- ing on Supplies in Storage. Urges Buying. BY ROGER W. BABSON. Special Dispatch to The Star. WELLESLEY HILLS, Mass., July 5. —The coal industry, important in it- self and becausg of its effect on other industries, is getting back onto a normal basis. The feast and famine program promises to give way to something approximating three square meals a day for the operator, the miner and, finally, the consumer. The latest upset started last win- ter with the threat of a strike for this summer.' To prepare for such an emergency the operators rushed to builg up a.reserve supply, and the 1922 production of bituminous, total- ing 422,000,000 tons, was topped with a volume of 545,000,000 tons in 1923. January of this year followed suit with 50,000,000 tons, and February totaled 45,000,000 Then i became apparent that business was slowing up; the threatened strike was called off, and a three-year agreement with the miners was signed. Demand Declines; Prices Drop. Demang declined and the operators found themselves with a tremendous stock on their hands. In fact, April 1 showed our reserve supplies at 60,- 000,000 tons, the largest in recent years. Prices dropped to $2.10 at the mine and operations were curtailed. During April. May and June produc- tion ran about 60% of the average earlier in the year. Stocks are still relatively heavy, but prices are down to $2.01 at the mine, and demand is overtaking the supply. Under these circumstances it is probable that some of the high cost properties will have to close, but every one will be better off with fewer producers working a greater part of the time. Prices may not g0 much below present quotations, and certain keen buyers look toward slightly higher 'levels. However. there is little in the present situation to justify any radical change in either direction. Production mean- time should follow its normal sea- soned tendency with a possible slight increase as fall business demands materialize. Prudent buyers are covering their needs in the present market. Quiet Period Ahead. Once the industry gets back into its stride, it should hold it until some development threatens another coal shortage, then 1 suppose we shall all have to run the gantlet again, tak- ing our lickings by turn. Such a shortage ordinarily develops from a combination of three factors. 1f business gets to booming and the de- mand for coal is unusually heavy, prices climb and the buyers rush in fo protect their need. Result, a tem- porary shortage. There is nothing in the present situation (the Babson chart_shows general business activ- ity 13 per cent below normal) to promise -any shortage from this source for the remainder of this year, at _least. Threatened labor difficulties have a similar effect on the market, but the three-year agreement now in force precludes the probability of shutdowns on this score. The third factor is transportation. When coal cannot be moved from the mines it might as well not exist as far as the market is concerned. Plenty of cars and no congestion promise rapid transporta- tion of coal during the remainder of the year. Hard Coal Status Best. The anthracite industry has not suffered so great a slump as the bitu- minous, because no strike was threat- ened and stocks were not built up to such a great extent. Production In 1923 of 95,000,000 tons has been fol- lowed by production around 7,000,000 tons a month this year. Low prices for the year are ordinarily reached in April, when a differential is put into effect to speed early deliveries This usual monthly increase is now scheduled and will probably con- tinue. Little change in wholesale prices may be expected. Retail coa] dealers are facing a serious problem. The public is not buying this summer in the usual vol- ume. Many of the retail dealers, lack- ing more storage space or sufficient capital, are being forced to refuse their shipments as they come from the ines. The operators in this case curtail production and are only min- ing as much coal as the dealers can take. Thinks Prices Near Bottom. 1f this continues we will find every one clamoring for coal September 1. Tt will be physically impossible for the dealers to get and deliver in a single month the coal he should have been delivering all summer. Under these circumstances a local shortage may easily develop and we will all be rushing around trying to get coal at any price. “There is little chance of prices go- ing any lower under the existing con- ditions and the wise man will get his coal in now when he can get deliv- eries, thus avoiding possible shortage prices and the bother of trying to get it late this fall. Shortage Lex- ¥ikely. The consuming public may also be interested in the recent findings of the Canadian geological survey, which Teports on new flelds in Alberta, which promise to supply anthracite, DBituminous, and lignite coal for all of Canada for many years. This spells Smaller exports from our own supply and precludes the probability of more Shortages, as severe as the last two. ———————— HUGE SUMS FOR REPAIES. Approximately a million American railroad employes are constantly en- gaged in repairing things that wear . The cost of this work last year O¥as approximately $2,300,000,000, an average of $6,390.000 a day, represent- ing approximately 36 per cent of the receipts of the railroads last year. COMMODITY NEWS WIRED STAR FROM ENTIRE COUNTRY RICHMOND, July 6.—Virginia this year is expected to produce 8,871,000 bushels of wheat, according to an estimate by H. M. Taylor, state crop statistician. Oats will be a bumper crap, acreage exceeding 170,000 but the outlook for corn is poor. ST. LOUIS, July 5.—The coal move- ment in this territary s light and no buying for winter needs is in evi- dence. The increased use of oil and electricity for heating has & strong effect on the situation. PHILADELPHIA, _July 5.—Many shoe factories which closed for the Fourth of July will remain clased for a week or ten days for the purpose of taking stock. onal orders for rompt delivery are large and press- ng. NEW ORLEANS, July 5.—Ship- ments of vuot-.wu and fruit tram Louisiana and saissippl brought better returns in'the last week. but prices are stif upsa to' BTowWers. ESNO, Calif.,, July 5.—The Cali- fornia Pegch and Fig Growers' Asso- ciation is nolllyin‘? }rokers that be- cause of continued dry weather not more than 50 s ceat of the normal fig crop will Be gyailable this year. s{»m price increases are predicted. ST. PAUL, July 5.—The shops of the Twin Cities Rapid Transit Company are turning out one-man tre cars fof use on Ilines where 7‘-!‘1 has been cut by competition of mi busses. 4 afactory Ask Your Banker. How much real value stands back of the stock you are asked to buy? Are you sure that the mnice, honest- iooking stranger is telling you the truth? Ask your banker to look Into what nelamy 7 ° T T Money to Loan Secured by first deed of trust oo real estate. Pievailing interest and commission. Mhl.wfllfl‘ 430 Wash. L. & Trus. Bidg.. 9th & ¥ N.V Wanted Second Trust Notes We have clients with funds purchase good SECOND TRUST NOTES in denomina- tions of from $500 to $10,000. Low rates if security is good Apply at Once to Our MORTGAGE DEPARTMENT 713 and 715 14th Street NW. Main 2345 First Mort.gag Loans Lowest Rates of lnu’ul and Commission. Prompt Action Thomas J. Fisher & Com, , 1 736 156k Street T FIRST MORTGAGES| FOR SALE THE TYPE OF SECURITY CONSERVATIVE IN- VESTORS BUY IN DENOMINATIONS TO SUIT PURCHASERS JAMES F. SHEA 643 Louisiana Ave. N.W. When Buying Our 7% First Mortgage Notes You Can Be Assured First—A very careful and con- servative appraisal bas been made. Second.—The loan we recommend 18 less than 50% of the market price. Third —After you have purchased one of our notes you get a serv- ice that assures you interest the day due. Notes on bhand in amounts of $100 up. Chas. D. Sager 924 14th St. Loan Dept. 30 Main 37 3 WE FINANCE Apartment Houses Busimess Property Residence Property Hotels, Ete. Hl'h.:u&uu- st N.W. In6, O T T I Continental Trut Company tal One M:fi;z:n Dollars Invest Your Savings In Our First Mortgages “The Safest Security on Earth” 7 % Interesy .Denominations $100 to $10,000 JHORRIS CAFRIZ. €O 1416 K Street N.W. Main 617 Northwest Residential and Business Property Only Co-Operative Building Association Qrganized 1879, » 44th YEAR COMPLETED Assets e -84,755,170.52 Surplus .. -$1,248,320.98 The Time to Save Is Right Now The systematic saving plan of the Equitable leads to the greatest finan- cial sccomplishments. Join pow. Subscription for the 87th Issue of Stock Being Received Skares, $2.50 Per Month EQUITABLE BUILDING 915 F ST. N.W. JOHN JOY EDSON. President FRANK P. REESIDE, Sec'y. 617 First Mortgage Notes Secured by Improved Real Estate Every mortgage we sell is guaranteed—both principal and interest—and provides these five investment fundamentals: Security of Principal All the Time—Attractive Normal Income—Prompt Consecutive Interest Payments—Full Return of Principal When Due—Freedom From All Care and Management. Our written guarantec of fulfillment of all these fundamentals is backed by over $1,500,000 resources. Real Estate Mortgage & Guaranty Corp. (Resources Over Ome and a Half Million Dollars) L. E. BREUNINGER, President, 26 Jackson Place = = = g = = = = = £ E = % 738 15th St. T O L2 APARTMENTS FOR RENT In the Suburbs All outside rooms overlooking wooded park 3945 Connecticut Avenue Corner of Tilden St. A Apartments of 2, 3 and 4 rooms with bath 70 apartments—only a few left Representative On Premises Thomas J. Fisher & Co., Inc. Payments 0‘ Interest reach you promptly and without need for attention on your part. There is no in- convenience or delay. 61% First Mortgage ~ Investment Notes . Denominations as low as $100 FINANCIAL. ' 6%-7% For July Investment For August Investment ? % A guly interest and dividend period are wartzell; Rheem & Hensey Com- pany First Mortgage Notes, secured by in- come-producing properties located in the Nation’s Capital. Interest rates are declining and we feel especially fortunate in being able to still offer First Mortgages bearing a return of 61%4%, with the D. C. tax refund feature to bring the yield to 7%. g Reservations may be made immediately for your July investments. Our suggestion is that yoy act quickly while we are still able to secyre the present rate of interest. FAVORITE form of investment in the Swartzell, Rheem & Hensey Co. 727 15th Street N. W. 55 Years Without Loss to An Investor For Thirty-seven years We have sold without loss To an invester FIRST MORTGAGE NOTES We are now offering for sale notes in any amount at 62% and 7% Security carefully selected Wm. H. Saunders Co., Inc. Realtors 1433 K Street N.W. Main 1016 and 1017 MONEY TO LOAN ON FIRST MORTGAGES 3 AT CURRENT RATES OF INTEREST Randall H. Hagner ¥ Co. 4207 %fimfiw/ .,dunan . . Poor Jim--he paid the penalty —of his own folly; or, perchance, of taking bad advice concerning his investments— RESULT! Depreciated values, loss of income and the consequent mental anguish which is so nerve racking. Don’t Follow This Unwise Course —but place your funds, large or small, where the SECURITY IS ABSOLUTELY 1009, NO DEPRECIATION OF VALUES LIBERAL INCOME RETURNS UTTER ABSENCE OF CARE We furnish you FIRST MORTGAGE NOTES on improved D. C. property worth (_lnuble the loan, and attend to all the details for you. Call Our MORTGAGE INVESTMENT DEPARTMENT -& LUCHY 713 and 715 14th St. N.W. Main 2345 WHEN WE MAKE FIRST MORTGAGES —we accept only those which will meet the requirements of the tors—individuals, banks or in- most conservative inves- surance companies. Investment’ Service goes with the canservative investments which we sell. F. SAUL CO. 1412 Eye.St. N.W.