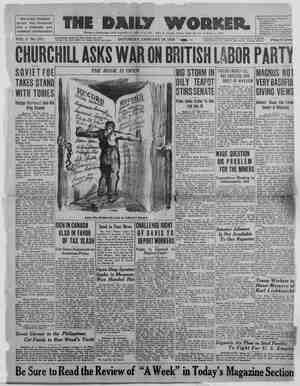

The Daily Worker Newspaper, January 19, 1924, Page 10

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

THE TAXATION TANGLE r taxation. Taxation is a tally affects every farmer, every worker, and the family of every far- mer and worker. The total gross debt of the Na- tional, State, Municipal, and County ERHAPS the most pressing prob- is the national home of the Associa- lem hefore Congress today is, tion of Stock Exchange Firms. An analysis of the Mellon scheme question which yi-| shows exactly why the Big Busi- ness interests lost no time in taking up the cudgels for it. The chief feature of the Mellon tax scheme is a reduction of the present surtax from 5 per cent. Rovernments increased 3s1 per cent,| to 25 per cent.. This means a reduc- in the last decade. Tri this period the national debt increased nearly 700 per cent.—to be precise, 672 per cent, _ Exclusive of the tarif law which is an annual tax of about, three and a half billion dollars on the country, our yearly tax bill is in the neich- borhood of $7,750,000 000, The steady rise in the government bu- reaucracy entails the expenditure of billions of dollars every year. The react'snaries launched their attack cn ‘‘~h taxation affecting them in the Sixty-Seventh Congress. Then 50,000-60,000 of our wealth- lest taxpayers were relieved of $511,- 500,000 through the lowering of the surtax rates and the repeal of the excess profits tax. Before the new Concress opened the bankers and manufacturers or- ganized a powerful campaign to cut their own tax bill still further. Through their control of the Na- tional Government in this case it was the Treasury of the United States they put forward the well- advertised plan sent out in the name of Andrew W. Mellon Secretary of the Treasury. The Mellon Plan Though it was not before De- cember 29th that the Mellon tax re- duction plan was made public its general principle of “soak the poor and save the rich” was known weeks in advance. Never before not even in the worst fever days of jingoism and preparedness wag the country subjected to so well organized a country-wide advertising campaign as the one launched by the Cham- ber of Commerce, the Union League clubs and the’ numerous other em- ployers’ associations ~indersing the Mellon millionaire tax evasion scheme. We reproduce the follow- ing typical piece of capitalist pro- aganda in behalf of the scheme: “The George L. Dyer Co., 42 Broadway, New York. ice 18, 1923, “Publisher, Herald, Louisburg, Kansas, “Near Sirs: “Our clients, including some of the largest manufacturers from all parts of this country, have asked us to write every newspaper, regard- less of party, to endorse the Mellon tax reduction plan as the best and most constructive idea now before Congress. They strongly suggest that this can only be made effective by continuous front page publicity. “All business will be greatly help- ed and the resulting prosperity will be shared by all. “Yours truly, ; “THE GEORGE L. DYER CO. “(Signed) W. L. Dotts, “Vice-President.” This letter is from the heart of Wall Street and the above address tion of about $200,000,000 to the big capitalists. The normal tax is to be fixed at 3 per cent. instead of 4 per cent. on the first $4.000 net in- come. The present 8 per cent. tax on the next group ranging up to $10,000 would be reduced by Mel- lon to 6 per cent. Surtaxes are to begin at $10,000 instead of at $6,000 as at present, Taking the subject out of the realm of percentages and into the realm of dollars and cents, one finds that the Mellon plan would mean that a person with a $5,000,- 000 income would save annuall about a million and a half dollars: those receiving ‘an annual income of one million dollars would save over a quarter of a million every year; those having an annual income of a quarter of a million dollars would save about $50,000; people passing’ es on an income of $100,000 would save annually more than ten thousand dollars; those whose in- come is $50.000 a year would save almost $2,000; those having an in- come of $25,000 would save more than a thousand dollars a year; those’ aving no dependents und an income of $5,000 a year will save $25; the! people in the $4,000 group without dependents, will save $15; and the people having no dependents and who are in the $3,000 group will save only $5 a year. Thus four hundred heads of fam- ilies each having an income of $2,500 —total one million dollars—save nothing under the Mellon scheme, | to while one millionaire saves more than a quarter of a million dollars. Two hundred and forty-six taxpay- ers with incomes ranging from $300,- 000 up whose annual tax , bill amounts to about ninety million dol-| of lars save about $45 million dollars a year on the Mellon basis, This is an average saving of about $180,- 000 annually for the biggest finan- ciers and bosses, Democratic and Insurgent Measures No sooner had the Mellon plan been whispered to the press. than the Democratic solons put their politi- cal heads together to offer some- thing different. The Democratic spokesman, Representative John N. Garner of Texas, then came forward with the following proposal: All single persons having incomes of $2,000 or less and all smarried per- song or heads of families having in- comes of $3,000 or less are exempt. All taxes on incomes up to $10,000 are cut in half. The surtax begins at $12,000. While the Mellon plan would reduce the surtax on incomes above $10,000 to the maximum of 25 per cent. the Democrats would reduce these rates to 44 per cent. as their maximum. The plan proposed by Representa- tive Frear of Wisconsin is the tax- ation program of the insurgents. This plan would cut the present tax of 4 per cent. on incomes of $4.600 to 2 per cent, and reduce from 8 per cent. on incomes over $4,000 to 4 per cent. The present surtax of 50 per cent. is to be continued. Frear also proposes to restore the excess profits tax, to tax state and munic- ipal securities, increase the inher- itance taxes, and tax undistributed profits and gifts. : Class Line Seen The above summary of the pro- posed tax reduction plans show how the tax question reflects the | dominant class divisions of Con- gress. Mellon’s scheme plays right into the hands of the biggest capi- talists and disregards to a large ex- tent the mass of small income tax- payers. The Democratic plan caters the less big capitalsts, makes a rmless scratch or two on the 12,000 wealthiest men; and makes an empty gesture to the mass of taxpayers—the gesture becoming emptier the lower down the line income one traveis, The Rep- ublican Mellon plan stresses the im- a, THE TAXATION BURDEN The Heavy End of the Pole. By JAY LOVESTONE portance of the interests of the upper most strata of the capitalist class; the Democratic scheme favors. the next layer of the 2mploying class; and the Frear plan defends the in- terests of the lowest section of the city and rural owning class, Conclusion The problem of taxation is of utmost importance to the working and farming masses cf the country. In 1922 the farmers paid $1,749,- 000,000 in taxes. This sum was more than 30 per cent. of what they received for their eleven crops— corn, wheat, oats, barley, rye, buck- wheat, flaxseed, potatoes, sweet potatoes, hay and cotton. The far- mers actually gave away almost 25 per cent. of the value of the total yield of their farm crop. In short, last year the farmers were compelled to give away the monetary equi- valent of their entire wheat, oats, and tobacco crops, and of one-half of their potato crops in order to meet the tax and interest demands. Obviously the workers and poor farmers have a tremendous interest in the character and plan of taxa- tion that is in vogue. It should be eur policy to force the growing bur- den of taxation on the owning class. Instead of a 50 per cent. surtax we should strive to have a hundred per cent. surtax. An excess profits tax of 100 per cent. is also desirable. ikéewise a 100 per cent. inheritance tax should be favored by us. The taxation program of ihe Commu- nists today should be the minimum possible to be paid by the workers and the maximum possible to be paid by the capitalist. The work- ingmen and exploited farmers should be exempt from all taxation. The capitalists and wealthy land mag- nates should be compelled to bear the entire burden of taxation. The taxation tangle is most close- ly interwoven with the whole prob- lem of the growing government bu- reaucracy that is weighing capital- ism down. Practically ene-seventh of the country’s national income is devoured by the maintenance of gov- ernment. In the last hundred years America has seen its civilian gov- ernment payroll increase about 6,000 per cent. Every family in the coun- try pays $400 a year to help run this gigantic machine. The growing class conflicts of capitalism compel the ruling class steadily to increase and strengthen the government. bureaucracy, the machinery of which it keeps the working masses in subjection. But this vital political necessity is a staggering economic burden. It should be the task of the Commu- nists to throw as much as possible of this burdensome load of the cost of maintaining the capitalists’ offi- cial strikebreaking machinery on the shoulders of the employing class. It is the task of the Communists to re- lieve the workers and farmers as much as possible of the oppressive payments the capitalist class now compels them to make for the main- tenance of the very machine that serves to perpetuate their exploita- tion. THE FARMERS AND THE AMERICAN REVOLUTION (Continued from page for a moment, whether the revolu- tion be near or far off. In America we are not at the threshold of a pro- letarian revolution. But we stand at the threshold of one of the deepest social and political crises of our country. In this crisis our greatest tasks are to develop a communist mass party of industrial workers and to win the confidence of the masses of working farmers. In other words, during the present crisis and thru nt crisis we must forthwith lay dawn the foundation for the pro- letarian revolution which sooner or later will come and must come. In the correct estimation of work among the farmers, the Workers Party has played the role of pioneer in the whole Communist International. We can be proud that our young and in many respects imperfect party was the first in the whole Communist International which grasped the great lessons of the Russian revolu- tion and the deepest sense of Marx- ian -Leninism (e in the writ- a- of janie, Z ev, Radek and ue! 2 Many comrades say that the alli- ance the farmers is well enough for Russia and that it is perhaps cor- pean countries, but it is not right, narrow .class interests of the and timely for the United States. The Communist International has E American Communists have concen-| helped Fro d the dard American E ‘rect as a policy for certain Euro- be Gfees ree g : iu ge | fe 4 revolution, a different opinion. We wish to quote|the _hegemo here Zinoviev’s article is ees é aS i i : a F i prole- but a party of letarian pate yg toe li nm gets elie re te awe the pioneer work of the Workers “tn She seapett the American Com- Party of America on the ural} munists first felt out the new path. field: “It is quite na that the} The American ve ha to found the Federated Far- to be trated their activities above all in mentabes Party (preserving this most suitab' But a yy wed ted in this re- America deserves serious ‘ement, “The failure to appreciate proper- the role of the 3 E iE a by an assiduous attention from|seriously our role in whole international communist - far- mers which with-correct tactics on our part will aid the fulfill its historical mission.” = Zinoviev says that the Workers Party of America was the first which felt out the new path to the alliance with the farmers. says that the rejection of the alli ance of communists. with is the original sin of international Menshevism. The alliance with the farmers is not opportunism, but on Q the contrary is the real revolutionary and not al-|Leninism. form prove |liance with the farmer means that in any case | we conceive our role to be as a steady opposition within the capitalist order, The position against al- means that we do not consider The ir Ht ring story of the Russian Revolution ERE RoE rn pred, cay ey, FREDERICTON TORE ane REINS ea NLL bs A ;