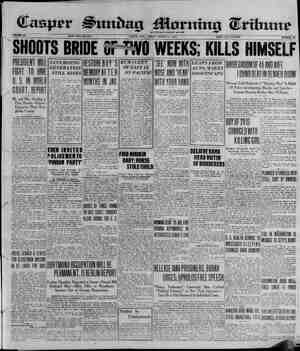

Casper Daily Tribune Newspaper, March 11, 1923, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

PAGE SIX. WYOMING GROWERS OF WHEAT AND CEREALS HAVE BIG PROBLEM BABSON SAYS Consumption Decreases Per Capita as People Be- come More Prosperous—A Fundamental Law Which Does Not Apply to Other Products. MINNEAPOLIS, March 9.—Last week we quoted Roger W. Babson relative to conditions in the industrial west. This, week Mr. Babson treats of the agricultural west. “The agricultural west,” he says, “is confronted with a fundamental law which is this; the consumption per capita of wheat decreases as a people becomes more prosperous. The business man eats less whe; than his chauffeur; the chauffeur eats less than the Italian gardener and the gardener eats less than the !mmi grant who has just landed. Each generation of a given family eats less Wheat than the preceding generation and so it goes. This law does not ap ply to cotton, sugar, rubber and cer. tain other products. It does not so much apply to corn, which is fed to live stock, because as people become more prosperous they eat more meat and they consume more cotton, sugar, rubber, etc. This does not mean there is no hope for the wheat grow: ers; but {t does mean that the wheat growers have a more difficu't prob- Jem than the growers of most other products. “So long as a million new tmmi grants were coming into this country every years, and so long as our birth ate remained high, there was an in- érease in the demand for wheat suf: ficient to take care of the excess sup. With the immigration practte- at off the net gain in 1922 was only about With the constant decline in our na tive birth rate, the wheat growers of the agricultural west are up against @ very difficult proposition. “As a result of these conditions I found the sma‘! farmers of Minne- sota, North and South Dakota, Kan sas, Nebraska, Iowa and even those of Missouri still in rather bad shape. It is true that conditions everywhere in the west are much better than two years ago. The banks are liquidating their frozen credits and the farmers ere paying their debts; but with low prices for their products and «high Prices for labor and all they buy— with taxes rapidly increasing—the growers of wheat and other cereals have a real problem. Fundamentally this is under present !mmigration and better rate conditions, a problem Which must be solved through export ing cerea's. But to increase exports our farmers must compete with the low cost of labor of Europe, the Ar Gentine and other cereal growing Countries. This means that our only hope is in mass production. “Wheat must be grow as automobiles are tiade—by the most efficient and inten- sive methods. In order to compete With the rest of the world in raising Wheat, either the next productivity of of our soil per acre must be increased 25 per cent. or else the labor cost thust be cut 25 per cent. If the latter tp to be accomplished, without reduc- ing wages, it means that about 20 per ent of the men now engaged in rais- ing wheat should either raise other products or else become carpenters, brick-layers, plasterers and painters tn their own or nearby towns. The future of such cities as Minneapolis Sf Paul. Kansas City, Duluth, Des Mo! Dayenport, Sioux City, Oma. ha, Topeka, Wichita, and even St Louis depends very largely upon a fearless recognition and solution of this problem. It cannot be solved by the potiticians or by handing out gifts to the farmers. It can be solved only by intelligent leadership with the active co-operation of the news papers. “Of course, no one should assume fiom these comments the idea that the agricultural west is dependent upon wheat. Tho industries of this Wonderful section of the United States are becoming more diversified €very day. Moreover, these divers!- fied industries are rapidly picking up. The lumber industry of Minnesota. the dairying interests of this section, @nd the various other lines are im Proving. Packing, which was flat on its back « year ago, is turning over onto its side preparatory to getting Up. All the live stock business looks better and the farmers are confident ly looking forward to higher prices. The improvement in the copper indus try and the great improvement in the fron and steel industry !s helping the fiorthern group of these states. Lead, inc, and other non-ferrous metals Will soon be in better demand as the great building boom develops further. This will help Missouri and certain Other portions of that section. ‘The People shou!d be taught that ‘divers! fléation’ applies not only to the dlt- ferent crops which a farmer plants; but “to the different lines which his boys enter. Let one or two of them €Ohtinue in farming; but let one go into the building trades, another into small manufacturing, a third into Merchandising, and the fourth into the ministry, medicine, banking, or law. This does not mean that such Boys should go to the Of the east of the west industrial cities to the large cities Statistics clearly show or even that the best opporunities today are in the sma‘ler cities and towns. More- over, most boys are better off to re Min in their home town than to go to large cities. One of the great trou- bles with boys today ‘s that disease known as ‘Green P: ’—which a Materia medica tells us means that to-rne afflicted with this disease ‘The ce farthe ways looks the greenest.’ od mitural well reased sa‘es The tmprovem to the increase barometer business for 25,000 people—and | e entire! 2.77% aske: country. “The Babsonchart today stands at 3 per cent normal compared with 18 per cent below nor mal a year ago. This is a great im provement and the task before all of us now is to keep business up to its Present figures. Statistically, Presi dent Harding has succeeded in bring ing business back to normal. Wheth er or ot he can hold it there, only the future can tell. Much depends upon the Agricultural West and especial'y upon the rafirom bankers, mer chants, newspapers, and other leaders of public opinion in this section. In above the end—as the great Agricultural West goes, so goes the whole coun try, Hence, the problems of the wes! re the problems of all of us. As us of Nazareth—tho greatest econ omist who ever lived—taught his hearers; ‘The prosperity of each is dependent upon the porsperity of al and’ we can help ourselves only as we help one another’ Livestock Chicago Prices. CHICAGO, March 10.—(U. 8S. De partment of Agriculture.—Hogs— Recolpts 7,000; market 5 to 15c higher; bulk desirable 150 to 210 pound averages $8.45@8.55; top $8.65; bulk 249 to 3825 pound butchers $8.00@8.20; packing sows around $7.25@7.50; medium to good pigs $6.75@8.00; estimated holdover 2.500: bulk of sales $7.90@8.50; top $8.65: heavywelght hog» $7.95@8.20; me diim $8.10@8.50; lght $8.40@s. Ught light $8.45@8.65; packing s smooth $7.30@7.65; packing 5 rough $7.10@ 8.35. Cattle —Receitps 600; compared with week ago: beef steers and year lings generally 15) to 25¢/ lower; week's top matured steers in load lots $10.00, weight 1,165 to 1,531 pounds; few head at $10.26@10.50 best long yearlings $10.00, weight 993 pounds; butcher she stock 25¢ higher; desirable beef heifers up more; bulls about steady; veal calves mostly 25c lower; better grade stockers and feed- ers steady; lower grades weak; week's 35; killing pigs $ bulk prices follow: beef steers and yearlings $7.75@9.35; stockers and feeders $6.35 @7. beef cows and helfers $4.65@6.75; canners and cut- ters $3.25@4.25; 9.50, heep— Receipts 4,000; mostly direct; market steady; compared with week ago: pritctically all classes around steady; week's top fat lambs $15.25; bulk desirable wooled lambs $14.50@15.10; heavies generally $12.50 veal calves $8.75@ @13.00; some weighty natives down to $11.00; fresh sh: mbs most! $11.75@12. ; heavies generally $9.50 @10.50; best yearling wethers = ir fleece $13.65 to shippers; bulk $1 @13.28; choice handy weight fut ewes up to $8.75; others mostly $8.00@8.50; heavies largely $6.50@7.50; bulk aged wethers $9.00@9.50; some two r olds up to $11.00; feeding and shear ing lambs $14.50@15.00;. week's top $15.30, Omaha Quotations OMAHA, Neb., March 10.—(U. 5. Department of Agriculture.)—Hogs receipts 8,500; butcher hogs fully five cents higher. packing grades steady to 15c higher; largerly 7.25. bulle of sates 7.80@7.90; top 7.90 Cattle receipts 250; cumpared with week ago. beef steers steady to weak; she stock 15@25c lower; veals steady; bulls 25@40q higher; stockers and feeders 15@250 lower; top steers 9.35; veal top 11.50; stocker and feeder early week's top 8.40; late 8.05. Sheep receipts 500; compared with week ago: lambs and yearlings steady; lamb top 14.60; sheep 25@50c higher; week's top ewes 8.85; feders stady. Denver Prices DENVER, Colo., March 10,—Cattle receipts 149; market steady. beef steers 7.00@8.25; cows and heifers 3.50@7.00; cables 4.50@11.00; stockers and feeders 4.50@7.75 Hogs receipts 72; market steady; top 8.00; bulk 7.80@7.95. Sheep receipts 2,191; market steady: lambs 12.50@14.00; feeder lambs 12 @14.00; @8.00. pid wait Le ‘i Foreign Exchange NEW YORK, March 10.—Foretgn| exchanges steady; quotations in cents:| Great Britain Semand 4.70%; cables 4.71; 60 day bills on banka 4.68%.| Fracs demand 6.04; cables 6,04%4.| Italy demand 4.79; cab‘es *.79%. Bel-| sium demand 6.21; cablos 5.21%. Ger. many demand .0048% Holland Norway Denmark 18.67, cables .0048% demand 39.69; cables 89.62; deand 18,04; Sweden 3 19.06; Switzerland demand Spain demand 15.63, Greece do- Poland demand .0028; vakla demand 2.97; Argen demand 87.2 Brazil demand ; Montren} 98%, = — Flax Seed Min Mareh A March 2.95% ask Ju 4 anked NULUTH ing flax ne: 10.—Clos Muy New York Stocks Allied Chemical & Dye _ 77% Allis Chalmegs _. 48% B American Beet Sugar — 43% American Can _.. 102% American Car & Foundry 108% American Hide & Leather pfd -71% B American International Corp _ 28% American Locomotive ~~ 134 American Smelting & Refg. -_ 65% American Sugar ~-_-.__. 80% American Sumatra Tobacco 81% American T. and T. 129% American Tobacco — 157% American Woolen - 104% Anaconda Copper 52 Atchison -____. 102% Atl, Gulf and West Indies Baldwin Locomotive, — timore and Ohio Bethlehem Steel “B* ‘anadian Pacific Central Leather — Chandler Motors Chesapeake and Ohio 3 Chica Mil d-St! Paul — 24% Chica R, I. and Pac. — 35% Chino Copper —_.— 29% Colorado Fuel and Iron 0B Corn Products 132% Crucible Steel 81% rie 12% Famou 88% General 50% eneral 184 neral Motors ~ 144% Goodrich Co. - 38% treat Northern pfd. 78% Illinois Central _. 115% Inspiration Capper — 40% International Harvester Int. Mer. Marine pfd. — International Paper Invincible Ol] —.___ 18% Kelly Springfield Tire 544 Kennecott Louisville Mexican Copper and Nashv Petroleum N. Y., N. H., and Hartford Miami Copper - Middle States Oil Midwale Steel — Missouri Pacific — New York Central — Norfolk and Western Northern Pacific ‘Klahomn Prod. Pacific Oil ‘an Amer'can nsylvania =. and Ref. Petroleum 29% Conosilidated Copper 15% ading a 18% Rep. Iron and 60% Royal Dutch, N. Y. 52% Sears Roebuck — 88% Sinclalr Con OW _ 33 Southern Pacific 92% Southern Ra‘lw: 33 Standard Oj] of 42% Studebaker 120% Tennessee Texas Texas Copp Co. - and Pacific Products be Tran continental Oil 13% ‘nion Pacific ___- 141 Tnited Reta'l Stores _ 80% 3. 8, Ind. Alcohcl .. 68% TInited States Rubber — 60 United States Steel 107% Utah Copper ~ 73 Westinghouse Electric — 63% Willys Overland — 6% American Zinc, Lead and Sm. _ 17% Butte anc: Superior Cala Petroleum Montana Power Shattuck Arizona Great Northern Ore 33% Chicago Northwestern 85% Maxwe'l Motors B 19% Consolidated Gas 66 American Linseed 35 Cosden — BRAIN PRIGES CLOSE LOWER Fear of Higher Money Rates Also Factor in Weaker Stock Prices. CHICAGO, March 10.—Early gains n today’s wheat market were wiped ut by profit taking in late trading f the short session and the close was easy at %c to %c net decline with May $1.19% to §1.19% and July $1.14% to $1,145. Rains in the southwest gave an !m- pulse to the selling. May in particu- lar was under pressure from spread- ers who were buying at Winnipeg. Corn declined with wheat. The close was easy at %c net decline to a like advance, with May 74%0 to 74%. Open High Low Close WHEAT— May — - - 1.20 1.20% 1.19% July — — - 115% 1.15% 1.14% Sept. - . - 1.13% 1.13% 1.12% CORN— May ~~ - .14% .75 74% 4M July =~ - - .76% 77 .76% Sept. - -- .17% .77% .77% OATS— May ~~ + 44% 45% 44% July - - = 44% 44% 44% Sept. - - - 48% 43% .43 LARD. May - - - 11.92 12.00 11.92 12.00 July . ~ 12,02 12.10 13.02 12.10 RIBS. May... - 11.15 a --+ 11.30 Cash Grains CHICAGO, March 10.—Wheat No. 2 hard 1.20@1.20%; No. 2 dark north- ern 1,23, Corn No. 2 mixed .74%; No. 2 yel- low 174% @75%. Oats No. 2 white .45% 46%; No. 3 white 44% @45, Ryo No, 2, .83%. “Barley .83Q70. Timothy seed 5.90@6.50. Clover seed Casper Sundap Morning Cridune Oil Securities (By Wilson. Cranmer & Company) LOCAL OIL sTOCKS Bessemer se aa | 24 i--Big Indian wen 27 29 Boston Wyomtng 1.00 Buck Creek -W 20 Burke =~... meee «29 Blackstone Salt Creek 120 Chappell -. As Cclumbine = lls Con. Royalty __ Cow Gulch Damino Elkhorn EB. T. Williams .. Frantz Gates Jupiter Kinney Coastal — Lance Creek Hoyant: Lusk Royalty , —._ Mountain & Gulf Mike Henry — . 02 Red Bank _ = -20 Picardy Z 03 Royalty & is 18% Sunset _ 08 Tom Bell Royalty 02% Western Exploration. 3.00 Wyo-Kan. So -80 Western Oll Fields 75 Western States 26 YOR = x At NEW YORK CURB CLOSING Mountain Prod. $18.75 $19.00 lenrock Ol 1.43% 1.50 alt Creek Prds. _. 87 24. It Creek Cons. 13.00 13.12% Marine Ol 5.00 6.50 Mutual . 14.50 14.62% S. O. Indiana — 66.87% 67.00 Citles Serv. Com. -.188.00 190.00 Fensiand ~ 18.00 19.00 New York Otl 18.00 19.00 Mammoth . 48.00 48.25 LIBERTY BONDS 34s .. $101.16 First 4s 98.00 Second 48 93.00 First 448 — 98.12 Second 4%s 98.0. Third 4X8 — - 98.54 Fourth 4%e - 98.70 Victory 4%s 100.14 | Crude Market Cat Creek - 2.15 Mule Creek 1.50 Big Muddy 1.65 Osage 2.10 Lance Creek ~ 2.10 Salt Creek 1.65 Rock Creek 1.75 Hamilton 1.65 Grass Creek 2.10 Torchlight -. 2.10 Elk Basin — 2.10 Greybull 2.10 Sunburst - 1.80-1.50 PROFIT TAKIN AULES MARKET Depression Hits Chicago Mar- ket as Profit Taking Sets Saturday. NEW YORK, March 10.—Fear of higher money rates as the résult of income tax payments and heayier commercial needs along with the dis counting of bull factors brought about large profit taking and short selling n today’s stock market. Losses of one to 3 points were quite common among the independen steels, foods, oils, equipments cop pers and some of the ordinarily inac tive rails. As usual however severa specialties | showed = independent strength notably tobaccos, Stewart ‘Warner Speedometer, Hupp Motors Mack Truck Transcontinental Oil and the Market Street Railway issues the gains running as high as five points The closing was heavy, Sales ap proximated 500,000 shares. Potatoes | CHICAGO, March 10.— Potatoes weak; receipts 81 cars; total United States shipments 934; Wisconsin sacked round whites 90c@$1.00 cwt.; bulk 85c@$1.00; Michigan bulk round whites mostly 85c cwt.; |Minnesota sacked round whites 85c cwt.; Idaho sacked Rurals $1.05@1.15 cwt.; Idaho sacked Russets $1.25@1.35 cwt.; branded $1.50@1.60 cwt.; Minnesota sacked Red River Ohios $1.20@1.30 cwt. tandard Oil Stocks NEW YORK CURB. 13.50@12.05. Pork nomfnal, Lard 12.00; ribs 1062@11.50, vedi taste Sugar NEW YORK, March 10,—Sugar c'oued steady; epproximato sales 11 050 tons, The market for refined was unchanged et 8 to 86 for fine gronulated, The der od was liebe.) but in the Improvement future fx antietp if Open Close Anglo 17% 17% Buckeyo ~ 88% 89% Continental - 46 46% Cumberland ~ 110 118 Calena -. 78% 14 Minos. 167 169 Indiana 101 102 Nat. Tran, 25% Y. Tran. 136 Nor. Pipe -- +106 108 {Ohio Ofl -.. 81% | Prairie Of 255 Prairie Pipe 115 | Solar Ref. 210 Sou, Pipe 1a 8. O, Kan. -. 53% |8. 0, Ky. 103% | 5, O. Neb, 272 |8, ON, ¥, «. 47% 8. O, Ohio .. 302 | Vacuum . 62 18. PB, On 178 | 8, O Ind. Cotton | NEW YORK, March 10,--Cotton lepet quiet; middling 80.75, | PIPE LINE RUNS _ Pipe line runs for the week ended March 8 in the Wyo- ming and Montana fields amounted to an average of 114,270 an increase over the previous week in Salt Creek runs accounted for and some other fields averaged higher barrels of crude oil daily, of 5,325 barrels. Increase a big part of the gain, deliveries but Lost Soldier is until storage tanks are emptied. Estimated daily runs by flelds follow: eld Mar.3 Feb, 24 Salt Creek -__.. 86,900 83,160 Bg Muddy -~. 3,750 3,515 Lance Creek ~. 585 Pilot Butte ..._.. 110 Lander 650 Lost Soldier Rock River Grass Creek Hamilton Dome Elk Basin Greybull Osage - Ferris .. Cat Creek Kevin Sunburst Miscellaneous 815 450 Totals -_. 114,270 108,945 Mammoth Operations. Operations of the Mammoth Ott ‘ompany brought forth no special features during the last week with he exception of the completion of Its ». 9 well on section 3439-78, Teapot lome, news of which has been pre- published. Other tests of the company show the following status: 6, section 21-39-78; cleaning out ‘17 feet. . 13, section 21-3978; cleaning out 870 feet No. 14, nection 27-2978; shut down t 2,815 feet. » 16, section 28-39-7 1 Creek sand at 2,857 feet. No. 15, section 28-39-78; shut down ‘or repairs at 2,991 feet. No. 17, section 2839-78; running 5 3:16inch casing at 2,875 feet. No. 18, section 27-39-78; shut down rt 2,095 feet. No. 216, section 20-39-78; shut down in the Shannon sand at 95 feet. No. 100, section 20-39-78; cemented rt 2,440 feet. No. 40, section at 2,214 feet. No. 44, section 11-38-78; 10-inch at 2,775 feet. No. 46, section 10 38-7! At 3,012 feet. No. 46, section 10-38-78; bailing oll at 2,290 feet. No. 47, section 15-88-7 at 2,375 feet. No. 48, section 14-38:7 at 3,275 feet. second 2-88-78; shut down running shut down ; shut down fishing tools Big Merger Discussed. With confirmation of reports that the Standard Oil company of Indiana 3 discussing merger p’ans with Cos len & Company, ofl and investment ~rcles are manifestly greatly inter sated in the proposal and further de- ails of the proposal will be awaited with interest. Cosden has outstanding 1,398,000 shares selling around $61 which indi sates a valuation by traders of $85,- 28,000 on the property, not including $6,930,000 shares of preferred stock Indiana has outstanding 8,588,836 shares selling around $68 a share, in vcating a valuation of $584,040,848 by nvestors. Both companies are prac tically without debt. Cosden is paying $4 a share a year: Indiana $2.2 share. While Cosden has one-sixth the stock out that Indiana has, Cosden’s earnings are said to be about one-fourth of Ind'ana’s, Both are complete units in the indusry, re fining, producing and disributing. Cosden's surplus, afer takng into con- sideration the undivided profits of 1922, will run close to $37,000,000, ac. cording to well-posted of! men in Den- ver. Indiana's surplus {s given at about $69,000,000, after the declara tion of the recent '00 per cent stock dividend. ‘The relations between the two com panies have long been friend'y, as much of Cosden’s agsoline has gone to Standard Ofl of Indiana. Cosden has a refinery at West Tulsa that is said to be one of the most complete in the world. Its estimated cost was $12,000,000. It can skim 75,000 barrels a day or refine 45,000 barrels. Cos dens’ own net dairy production of ol! is said to be in excess of 15,000 bar re's. Cosden earned about $1,000,000 mouth last year, The merger wou'd total assets ranging from $70,000,000 to $800,000,000. Basin Oil Summary. Manager Bishop of the Wyoming Gas company has returned from Den- ver where he had been in consulta- tion with Midwest-Wyoming officials relative to the gas line extensions for the coming year. The plans of the company call for an extension of the line to the Golden Eagle dome the coming year. So far the factory has given no indication of when the pipe will be recelved but it is expected to have May delivery. The pipe and fitting have all been ordered and !f May delivery can be secured work on ditching will commence in April. Some 42 miles of 14-inch pipe will be used and the balance of the main Ine 12-Inch. This will then be prob ably the longest gas I!ne in the state, comprising 82 miles. The production at Golden Eagle will be joined with the Hidden dome fleld, The new line SWAN UNDERREAMERS AT YOUR SUPPLY STORE BrzipdnedomTm LOSE NO CUT7ERS : — <r S SR PRES RPETON EAMED AND FIELD NEN SHOW INCREASE reported as being shut down ar SUNDAY, MARCH 11, 1923. 'S_ LEADING OIL, BUSINESS AND FINANCIAL DEPARTMENT MARKET, GOSSIP French Republic, French Repub! Kingdom of Belgium, 74 Kingdom of Belgum, 6s -. U. K. of G, B. & 1, 54g8, 1929 U. K. of G. B. & I, 5%s, 1937 - American Sugar, 6s American Telephone an: ‘elegrap! will run from the Nowood on: the east side of the Big Horn to near! Neiber, where it will cross the Big | Horn and go direct to Eagle Dome. Out at Neiber dome the drillers are | reported at 1,680 and again having | trouble with water. The hole was cemented at 1,602 feet and after drill ing another 80 feet a water sand was encountered and stands at about 1,400 | feet in the hole. More water sands | have been encountered in this test| than in any In this part of the state. The first gas producing sand is ex- pected between 2,600 and 2,800 feet. The filing of seventeen leases. last week by the Union of California on Possible black oll production, has created considerable interest among oil men and the activities of that company in this section awaited with | much speculation. Production Tests Continued. Kinney Coastal Oil Co. {s still en- aged in making“an exhaustive test! of the producing wells at Bolten Creek in an effort to determine the best manner in handling the water situation. No. 10 well of the Iowa- Wyoming Ot! Co. in which the Cas- per Bolton Creek Syndicate {is inter- ested, is still pumping at the rate of about 150 bbls. of ofl dally and is showing a little water along with the ofl. Until this week company has not been in shape to make a fair test of the field, as it has not had available storage. With this defect remedied, the company is now in a position to make a thorough test of the wells and a definite statement as to the water trouble. Company has started a deep test by drilling No. 9,| SEX sections 4-29-81, deeper from ,000 feet. It {s still a disputed ques- tion as to whether the production from the deeper wells is coming from the Embar sand or a stray sand. Government Oil Royalties Total net royalties accruing to the United States government up to Feb-| ruary 1, as the result of ofl and gas|{ easing operations on public lands, .mounted to $9,525,698 according to} the Bureau of Mines, which has tech. nical supervision of such operations. Royalties for the month of January| }Grand Trunk R; Armour and Ci y Baltimore and Ohio cv. Bethlehem Steel ref., Canadian Pacific deb., 58 - Chi. Burl. and Quincy ref., Chi, MIL and St. Paul cv. idodyear Tire 8s, 1931 joodyear Tire, 8s, 1941 -. of Can., Grand Trunk Ry. of Can., Great Northern 7s A - Mo. Kan. and Texas new ad Missouri Pacific gen., 48 Montana Power, 5s A . New York Central deb., 68 - Northern Pacific pr. lien 4s - Oregon Short Line, ref., 4s - Pacific Gas and Hlectric Penn R._R. gen., 6%s Penn R. R. gen:, 69 Reading gen., 4s — Standard Ol of Cal., deb., Union Pacfic first 4s U. S. Rubber, 74s - U. 8. Rubber, 5s -. Utah Power and Light 6s Weatten Union 6148 Westingh«tuse Electric ae 6s - qs - Dominion of Canada, 51s, notes 1920 American Telephone and Telegraph col, reserves of wheat many mill! week has risen in price for the May} on hand. Later deliveries, mean!ng wheat to be harvested this summer and fall,| have eased down, influenced by pared with a week ago, whent prices this morning ranged from %c decline- to 1%c advance; corn was unchanged to te lower; oats off %c to Kc to 4c) and provisions off 37c. | The approximate amount of wheat} |held on farms came in an estimate by an expert here whose figures widely accepted among traders. This unoficial estimate, which was virtu- ally {dentical with the government re- bort issued three days later, pointed are mounted to $308,093. The great| bulk of these royalties is the result | of operations in California, Wyoming! and Montana. Some returns are now! being reported from operations in| Colorado. Production on government} land in the Cat Creek field in Mon-| ana for January amounted to 177,592 barrels of ofl, an increase of 3,876 bar- | rels over the month of December Gas for Dougias Likely. DOUGLAS, Wyo.—The indications are that Douglas will soon be sup-| plied with natural gas. The Pro-| ducers and Refiners corporation, one of the live oll companies of Wyoming, will have a representative here soon to go over the matter, The com- pany is planning to go into Glenrock to supply the Mutual Refinery com- pany with gas and Secretary Ewel of the Community club wrote to Gen- eral Manager Wertz of the Producers regarding the prospects of the line being extended to Douglas, Mr. Wertz replies as follow: | “Please be advised that it is the intention of our Mr. Kampf, who fs ‘n charge of our land department, to, call upon the Community club and| the city council of Douglas with a, view of requesting a franchise in your town, If we go to the refinery in the town of Glenrock we can un- doubdtedly afford to continue our line to Douglas, thus having the pleasure of serving the good people of that town, “Mr. Kampf will undoubtedly call on you within the next week and we will highly appreciate any courtesies or favors you may be able to bestow upon him," ’ to an increased domestic consumption of 83,000,000 bushels as compared with last year. Rain and snow furnished help for sofl conditions in the greater part of the w'ntér wheat be't, al- though fat'ing to give much relief tn portions of Kansas, Nebraska and Ok-, lahoma. | Only @ transient downturn in wheat! values resulted from efforts to con-| strue the government report as bear-! ish in regard to wheat. The efforts { COMPILED Notary Public Service Open 8 A. M. to 10 P. M. Taylor & Clay Offices Oil Exchange Bldg. WEEKLY REVIEW OF THE GRAIN MARKET, IRREGULARITY SHOWN CHICAGO, March 10—With farm)were based on comparison with last ns of|year’s total of farm reserves of whea biishe!s smaller than until of late has|an amount been generally supposed, wheat this|than the present aggregate. Corn and c-ts were weakened by delivery, representing wheat already|the fact that stocks of corn !n Chi- cago are double the general average. Heavy exports of !ard gave a de- {ded lift to provisions, im-iing a new high price record for the provement in the crop out'ook. Com# Season. Butter and Eggs CHICAGO, changed. 19,000,000 bushels less lard touch- March 10.—Butter un- Es lower; receipts 26,318 firsts 26@26%; ordinary firsts 25@25%; miscel'aneous 25%@26, Surveying aud Locations Geologists Oil Field Maps, Blue Prints WYOMING MAP AND SWAN UNDERREAMERS AT YOUR SUPPLY STORE “PoRT Brivci THE PIPE-FOLLOWS” Oil Experts BLUE PRINT CO. P. O. Box 325 Room 10, Daly Bldg. Want land dritied this summer, J. G. CHRISTY, Manager, Lease Department. TEAPOT DEVELOPMENT Co. 218 Midwest Bldg., Casper, Wyo. ---Large Block of Leases for Drilling Contracts ‘We have five large independent operators from Oklahoma and Texus who want drilling contracts, See us quick if you want your ANNOUNCEMENT The undersigned will be permanently located in Casper and will handle oil properties, oil leases, townsites, oil well drilling tools and machinery, ~ ; At present have the following for sale:7 strings of Standard drilling tools with rigs complete, some slightly used, being in A-1 condition; 3 Star drilling machines, fully equipped; 2 National rigs complete and one Lei- decker. Can furnish new genuine wrought iron oil coun- try pipe and casing in car lots. At your service, Thirty-Five Years in the “Oil Regions” J.C. ROBERTS HENNING HOTEL Fifteen Years in “Wyoming”