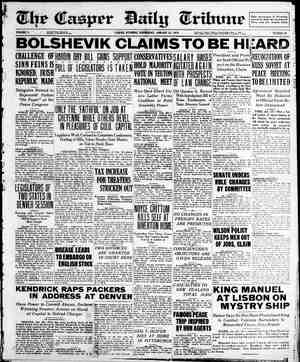

Casper Daily Tribune Newspaper, January 22, 1919, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

Page 8 THE STM-ANNIIAL PAYMENT (IF TAXES INCOME TAX DRIVE FOR 1919 ALREADY UNDER WAY IN CASPER DAILY TRIBUNE [S PROPOSED IN HOUSE MEASURE. West WITH PREPARATIONS 10 HANDLE THE LARGEST Indications Point to Enaction of Bill Designed to Im- COLLECTIONS IN THE HISTORY OF THE DEPARTMENT prove Collections; Recommendations of Governor Carey Appear in New Bills (Special to The Tribune) CHEYENNE, Jan. 21.—Representative Niblitt has a bill provid- ing for the payment of taxes semi-annually, and indications are that Mark A. Skinner, Collection, Outlines Pro- visions With Request That the Public Take Prompt Action DENVER, Colo., Jan. 22.—‘The big Income Tax drive of | incurred in business or trade are al- sent, when added to all prior pay- ments on the annuity, an amount; greater than the original cest of the| jannuity.. Dividends.an unexpired life insurance policies: are not. income, j but dividends on paid-up policies |must be considered income. Alimony jis not income to the recipient, nor is it an allowable deduction on the part of the person who pays. “From the total of all items of* come, | i there are certain deductions! WEDNESDAY, JAN. 22, 1919: HALF-MILL LEVY FOR —— There should be an annual good allowable by law. All interest paid |to2ds levy of not less than one-half on personal indebtedness and all taxes mill in Wyoming, says State High- paid during the year are deduetible,|W2Y Engineer Z. E. Sevison. Such a except Federal Income and Excess| | Profits taxes, inheritance taxes -and| assessments for local improvements, | such as sidewalks, sewers, etc. Losses | it will be enacted. Many states have adopted this plan, which has 1919 is now under way, and every preparation is being made |lowable, also losses arising from fires, | proven successful in getting in a larger percentage of taxes when to handle the largest collection in the history of Income Tax. “I storms, shipwreck or other casualty, | due. The advantage to the taxpayer is in having to dig up but half, 2™ net waiting for the final passage of the new Revenue bill 0" rom theft, in eases where losse: | by congress,” bers and secret of the state board | vious fairs, $50,000 for the 1919 fair, complete, I urge that we all begin of livestock commissioners seeks to! and a one-sixth mill leyy for future! now.” carry out the recommendation of | fairs, This, it is said, Would provide! “The income tax obligation im. Governor Carey in consolidating the) ample funds and insure the continued posed by the old laws, as well as the state’s two livestock boards with the | success of this institution. The un- measure now in congress consists of tute veterinarian’s office. Tho bill certainties of appropriations from |two distinct operations. One is, to if enacted will consolidate the activi- year to year detract from the fair file returns or statement of all items ties of these three state departments | and make it difficult to plan ahead. of income and items of deductions al- and effect substantial economies as dowable by law, and to do this within well as increa > efficienc . according: Senaters and representatives evi-! the period named in the law. The to its sponsors. In addition the meas-’ denced their appreciation of the good | other is, to pay the tax, if any is due. ure provides for local inspection in! work of the local Red Cross by tak-| “Neither of these ebligations Cnn addition to that at markets, and| ing lunch en masse at the booth in'ie met without a cheerful review of would make it unlawful to ship the the depot here. The chow handedout | income and expenditure for the tax stock of another without the owner's! to returning soldiers and sailors was' year, That is the big job right now. written consent. Economies effected | dished up to the members in just the | and that is why I say the Income Tax. by the consolidation, the sponsor’ came way—sandwiches, doughnuts, | drive is already under way. Every- 4ay, would enable the board to em-! cakes and coffee—who pronounced it where the pencil is busy whe ola Ploy competent legal counsel for the! rood enough for anybody. Each year is done; all its fruits are gleaned prosecution of spe ©: involving ember paid; none planked down less. and every person who fared well, ot violation of livestock laws and reru-! than a dollar and some yielded green- Jearned a good competence mnUctrane lations. The estimated saving iS backs, but none asked or received | alyze his own case in cald figures. given as $50,000 a year. change. ‘ eae 2 The county inspection law has been : [peuunenttHemnes: Dill is enacted into a failure, say the sponsors of the new aw, will have ie proper return bill and should be repealed. “Three forms distributed throughout the dis- years’ experience have proven this a and everybody will be informed law impractical and ineffective. Most of the date when the sworn return must be filed. It is my plan to send of our counties have abandoned it and placed inspection duties on the | my men out to central locations, and of the amount at a time. Representative Ewart, who com from Attorney General Walls’ home town, thinks the salary of the at- torney general should be raised to $6,000 and has introduced a bill for this purpose. He will push it. sheriff's office. Good inspection Poh a have jhem travel through the dis. generally cannot had from the New House Bills rict, aiding: taxpayers in the prepa- sheriff's office, as his duties usually es : ration of the returns and in deciding » | HH. B. 18 by Kelly—Authorizing! goubtful points. We will go right tc people with the Income Tax, and | with the co-operation which the pub- run along entirely different lines. These men also recommend the en- actment of a practical hide inspection law, and say that before railroads should be permitted to ship hides, each hide should bear an inspection tag. Several hundred copies of the employment of two attorneys to as-| the sist as advisors. H. B. 19 by Ewart—Increasing ae of atorney general to $6,000 | returns will be filed by everybody who| LS BALD ° |comes under the law’s provisions, the H. B. 20 by Brubaker—Making ap- | right taxes will bi ij ” di A | xes e paid, and the dis- measure proposed will be sent over propriations for the state fair. trict will have dgneits full patrioti RRewatatey anuctolthex brass. H, B. 21 by Frazen—Providing for duty toward the government's, sup- Opposition to the consolidation, so|t#xation of | mortgages, notes, etc.. port, vigorous two years ago, appears to| eating interest in excess of 8 per! “Meanwhile, let me say again, ther PP eae n Py H. B. 23 by Kirk—Creating a/|40es now will not e ect the amount men and a horsegrower, many be- county board of education lof a person’s earnings for 1918. Let lieve the measure will yo thru. "HL B. 24 by Walls—Relating to the US avoid the belated throwing togeth- CareniP Be Demands | payment of wages of employees of °* of figures that may hit or miso | Governor. Carey, in an effort to} Failroads, oil and gus concerns, mill * ; j workers, etc. promote and i t in carrying out} De Ss he proxram outlined in his messue,|, Te, B- 25 by Walls—Hours of In as held frequent conferen With | poUmMOne Omen: basis of taxation. It is clearly the ;duty of every person to compile cor- ect figures and ascertain whether his income for 1918 was sufficient to 36 by Platt—Prohibiting Phombers}ol both houees, indy eae: iusticee: sete Fa fa pa make necessary a sworn return. Pearance of several measures em-|iing 1,500 or more population| “Tha year 1918 was a banner year Fee that Cen the eaceative apd leg: | from practicing law or acting as col:| for selatics andi wages,jand|the Bal z, ;. % 5 aes lection agents. var prices broug! unu) sual pro its to islative branches are working in har- ‘New Senate Bill |the farmer. Tho opinion in Wash- The governor's time has been very much taken up by frie those secking appointment of one kind or another, as well as by others interested in legislation, but he finds Suanares i time to see everyboc nd to accord | —— them courtcous hearing. One of the INDIAN BILL FUND 10 governor's hobbie is well known, is good roads leyislation, and he has had frequent conferences with other road enthusiasts the session opencd. mony. S. Be 4 by Fonda—-Providing that| ington is that a million citizens any - fhe average small tradesman and to counties shall not collect a percent-| bhe ! 2 t aye from cities and towns for the col- Tesidents will make this year their | first income tax réturns, lection of municipal taxes. indicate that the “All signs in- | every working man and woman, and ‘nearly every merchant, shop keeper ‘and farmer. Not all will have to pay since |to make a sworn statement of the ‘year’s income. . {oa “Tam therefore advising every un- RIVERTON, Wyo., Jan, 22.—(Spe | married person who earned $100 or Representative Franzen of Platte) cial.) —Increased appropriations for) over during the year 1918, and every county will be vastly obliged to any- irrigation development work in this married person, who together with body who can help him out with s section, carried in the current Indian) wife or husband, earned $2000, to gestions for the provisions on a appropriation bill, contemplates the sharpen his pencil and figure out how sorter “local option’? herd law—a,employment of many returned sol-. he stands. measure affording some protection to d The total appropriation fo. “He must ascertain accurately hiy the dry farmers in particular yet not this work carried in the bill is $526.-| pross income from all sources. There’s sufficiently stringent to draw the fire 000, which will be expended on road pis salary or wages, including over- of cow men in the legislature. Previ- work and development of irrigation | time pay and any bonus received as ous attempts to enact such a statute projects on the Wind River reserva-| j dditional compensation. A married havo met with failure, and the Platte tion, Extension of the Leclaire ditci: | herson having children under 18 who county solon prefers to at least pre- which will cost $50,000 and $200,-| are working would include the earn sent the matter from another angle 000 for the Riverton canal are two of ings of such children. if at all, in the hope of yetting by. He the items carried in the pending bill.’ “y¢ he sold any property at a profit is, of; the opinion that in’ certain) set: =e | the gain must be completed and in- tibns jai herd lis woulll be) genera. cluded in gross income. If he rent- favored, and his idea is to construct a bill along this line—making it pos. sible for a community of dry farmers, for example, to invoke a herd law when its provisions would not be like- Sy to work hardship on any but negli- gent neighbo! Viewing past fail- ures along this line, Representative “Franzen has hoisted the S. 0. S. flag “Local Option’ Herd Law The English government has order- ed the expenditure of five million dollars for the exploration and drill- ing of oil fields in England, reports T. St. John Bashford, prominent capi talist of Great Britain. total rents received in the year must be ascertained and from that figure a deduction may be taken for taxes paid on rented property, the necessa- Cli and proposes to keep it up until he gets help —or hep row his idea will take. Tribune Is in Demand = The Tribune circulator would have felt greatly complimented had he heard central Wyoming people com- plaining because they could not buy a copy of the Casper daily at the Plains news stand. Members and v itors from all along the Northw ern, from Lusk to Lander, insi they had become so used to ing track of things thru the Tribune that they must have it. The need has been supplied, und central Wyoming folks here are happ: NOW OPEN FOR BUSINESS Breakfast 6:30 A. M. to 10:30 A. M. Lunch 11:00 A. M. to 2:00 P. M. Dinner i (Special to The Tribune.) CHEYENNE, Jan, 20.—A bill re- quiring the attendance of either day ight schools by non-English i 2 OF aking citizens of the state is fath- 4:30 P. M. to 8:00 P. M. ered by Representative Kirk. The measure has the backing of the edu- cational commission, and provides for holding night schools for this pur- = 4 => pose where necessi WYATT CAFE CO. Mrs. Lovey Scott and Mrs. Harvey Wisner Proprietors Representatives Brubaker has in- troduced the state fair bill alluded to heretofore in these columns. The to appropriate legislautre is asked j $98,000 to cover deficiencies of pre-| MAMMAANIIANUNNHANNUMINNNNINiH AHN NHN NutHiunn ;lic can give the government men, the | come tax this year will reach nearly | forms to be issued. To get this f= minor repairs, fire insurance, any interest he may have paid on mort gage, and a reasonable allowance for | annual wear and tear of the rented property. The balance is included in gross income for the year. | “Interest on bank deposits, whethe: withdrawn or added to his bank bal- |ances, must be included in all cal. |eulations of income. Bond interest received during the year must also be included, except interest on muni-, : cipal county or state bonds. Interest on United States bonds need not be |included by the ordinary bond holder who purchased small amounts. Hold. ers of large amounts of Liberty bonds however, should ask their bankers to write te my office for the rule ap plying to tax on such interest. “Dividends on stock shares are in- come, and must be included in thy gross figures, altho the law does not impose the normal tax on distribu- tions made by domestic corporation | “A person buying and selling mer- |chandise must find his profits for the year on the following basis:, First, ascertain the gross sales or total cash receipts. Then add together the ii ventory at the beginning of the yeu. and the pure es of goods for resale. From this latter sum subtract the in- ventory of goods on hand at the year’s ‘end, and the result is the cost of roods sold. This cost plus necessary expenses incurred solely through con- duct of the business, is to be deductea from the gross sales, and the result is the net earnings of the business. “4 personal man arrives at his pro- fessional income by ascertaining the total of fees for services and deduct- ing therefrom all expenses connected directly and solely with his practicu “A farmer must figure up all in- come derived from the sale or ex- change of products during the yeas, whether such produce was raised on is allowed to deduct from this total) his ‘expenses of the year connected | with the planting, cultivation, han vesting and marketing of the crop, or! the care, feeding and marketing 01! live stock. He is not allowed to de- duct the amount expended in 1918! in purchasing stock for resale; but| when such stock is sold its cost is td be deducted from sale price in as- tertaining the gain to be included in| his return of income. The cost price} bf stock bought prior to 1917 cannot! be deducted as in the case just citea, | if such cost was included in the de- duction made in the year of purchase. “The farmer is not required to in- flude in his income tax computation bhe value of farm products consumed by himself and family. But in cases where he exchang'es produce for mer- chandise, groceries, etce., the market value of the articles received in ex- {change must be included. “Ail other items of income arising during the year through personal ser- \viee, business or trade, through use of property or money, should be ad- ded into the gains for 1918. “Everybody wants to know what ‘income is exerfot from tax. Very few plums that fall to the average man {may be legally disregarded in figur- ing up his 1918 income. Gifts and be, quests can be eliminated also pro ceeds of life insurance received by the beneficiary of an insured person. A person who cashed in an endow ment policy need report as income ed any property to other persons, the only that portion which ‘exceeds the | total of the premiums he paid in all |yearg on that policy. Annuities are not taxable unless the person receiv. ed in the year payments which repre- said Collector Mark A. Skinner today, “nor for 27° "®t compensated for by insur- ance or otherwise. Losses incurred outside of gains reported from similar transactions within the year. Debts due to the taxpayer actually ascer. | tained to be worthless during the| year are deductible. “Depreciation on property used in| a profession, in business, or in farm-! |ing is another item that may be claim. ! ed as a deduction. The storekeeper| may claim depreciation on his fixt | ures, and on his delivery horses and} |wagons, but not on for sale. The profesional man may claim similar deduction on his in-| | struments; and in the case of a phy-| sician who maintains a team or auto} for making his calls on patients, reas- | onable depreciation may be claimed. | |The farmer may claim depreciation jon his farm buildings, aside from his | personal residence, also on his farn. | machinery, his work horses and farm| work wagons. The theory of depre-| ciation, in connection with the Income| Tax, is that wear and tear by use| in earnirlg income is a real expense | jin the earning of that income. The | rate is determined by the number of | years that the property ordinarily would be useful, and the cost of the |property is the basis of the compu- tation. If the property suffering | depreciation was bought or acquired | prior to March 1, 1913, the market lue as of that date is used, instead of the cost in figuring depreciation. “Contributions or gifts actually |made in 1918 to organizations oper- ‘ating exclusively for religious, chari- table, scientific or educational pur- poses, and to societies for the pre vention of cruelty to children or ani- | mals, may be deducted, to an amount |not exceeding 15 per cent of the to- tal of all income is found, and the, deductions allowable by law have been computed as an offset, amount of income in excess of such deductions is the net income, which jforms the basis of the assesment o1 | Stax. ses cannot be accepted as the| the farm or purchased and resold, He |. oe “If every person in this district wits examine his own 1918 income and his allowable deductions, in line witn| date that I have given, he will know} beyond doubt whether he must file his return when the blanks arrive.| And here is how he will determine his liability to file a return. If he is single’he must file his net income) was $100 or more, and this require. | ment is enforced whether or not he is | the head of a family. If he is married} he must file his return if his net in. | come; including that of his wife and) minor children, was $2000 or more. tion feature of the collection of the Income Tax this year. The poiicy of the Intergal Revenue Bureau is| to aid taxpayers to meet the require- his stock helc!, z Our Telephone No. is 601 the % “I want to emphasize the co-opera- x levy would be lower than that in many other states, he says, but he does not care to urge a higher one until the mileage of state highways re- quires it. When the 1917 legislature created {the state highway department it fail- ed to provide adequate funds with which to get the work started. A one-fourth mill levy for the years 1917 and 1918 was the only provision authorized for financing the various projects. Since the creation of his office Mr. Sevison’s experiences ii j the work and in co-operating with} the government authorities under the federal aid road act have led him to believe that there is an imperative need of additionai legislation if the results expected of his department are to be secured. In addition to the half-mill levy, the highway engineer believes that both a deficiency appropriation and a motor vehicle tax graded accordin; to the weights of the cars are desir- able. In order to make prompt pay, ments on construction of federal aid projects under way, he _ explains, funds should be available at all times A deficiency appropriation would not be necessary now had the legislature made one when the department was created ments of the law. We are goin, right to the people, not to swing clubs or to mulct the wage-earner of his savings, but offering every helpful governmental function that will as- sist people to do their duty.” CONSTRUCTION OF EIGHT .. ROADS. OF STATE 1S HUNDRED SCHOOLS HELO URGED BY ENGINEER ~ UP BY WAR CONDITIONS Contracts for 800 public school houses totaling some eighty million dollars, have been held up as a result of the war, according to but a partial tabulation of building conditions thru- out the United States, which has been made by the Statistical Section of the Division of Public Works and Con- struction Development, U. S. Depart- /ment of Labor. It is estimated that {the completed tabulation will show |that these school projects, now be- |ing held in abeyance, aggregate more than ohe hundred million dollars. In round numbers, this is about one dollar per capita*throughout the United States. As school buildings are customarily financed on twenty- year serial bonds, this means an in- | stallment payment of about five cents |per capita per pear by the people of thig country, if they would haye | their school program put through av | the present time. ‘JOHNSON COUNTY MAPS: QUT BIG ROAD PROGRAM | BUFFALO, Wyo., Jan. 22.—(Spe- cial_—Johnson county roads are to be vastly improved during the coming year, the county commissioners hav- ing appropriated $10,000 for this work, in addition to the regular main- tenance work. This board has also instructed the representatives from | Johnson county to support any, meas- jure which will bond the state for high- | way improvement work, a K, P. Dance, Temple hall, Friday night. 1-22-1 Pea a os a ee a a Se oh ie a st Sk Ss ss ss ss : $ Pick up your phone at any time and give us your order. We assure you of a ice and delivery. and as interestedly as if chase in person- prompt and courteous serv- ” We will fill your telephone orders as quickly you had made your pur- Try it and satisfy yourself the next time. Holmes Hardware Co. _ Pependablo The Store of Truthful css:'secona eee Advertising cannte + LPP LP Pree ered o-cMe-o% osteo Moateo% Urterenye NOV OC UOC ICS %, M% wee 1M o e fetes ? M% o K ° M% ? 1M e K? ? M% o vote ete-eto-ate-sie-oleetet Me oo M% - x * $0-4So-aSo-eto-eto-et sacs sO 1M ‘- KD nT in I O4, ateet 1% ? so-ofoeteetot 1% o ¢ There’s not a fraction of extra weight in Munsingwear. Every ounce of weight is an ounce of warmth and comfort. No other underwear wears longer, washes better, fits and covers the form more perfectly # or gives more real solid comfort. ° Meets every requirement of © men, women and children. Priced At $1.75 And Up \\ 3 Webel Commercial Co. es THE BIG BUSY STORE, | United States Food Administration License No. G-18057 3 | Watch Our Windows BUY W.S. S. ~ Watch Our Windows Pos LOOT eteoeede poaso-efereso-ete et a a a a Winter Comfort Wintry days will find you snug and warm in Munsingwear Union Suits. Warmth ovis as 3