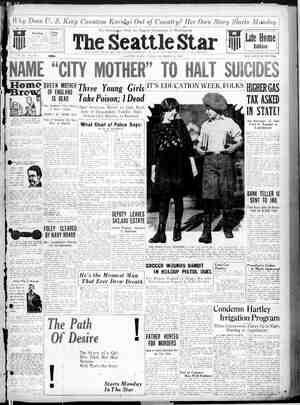

The Seattle Star Newspaper, November 20, 1925, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

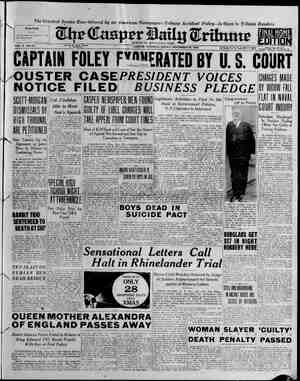

ay @ Privilege-Seekers Are Warned by Coolidge Legitimate Business Praised by Presi- dent in New York Speech WOULD PREVENT ANY INJUSTICE \ SAYS TRUE BUSINESS 4 NEED HAVE NO PRA : i ASKS ENTRY INTO WORLD COURT Commercial Possibilities to Be Talked at “Frisco” SAN FRANCISCO, N 1. P)—P i! t URGES PAYMENT OF WAR DEBTS City to Bring Action for|! Recovery of Award S| Man hi Town f rs and en t par Seek Wild Bird Reserve in City 4000000 i> protcr vol | Paid brash toate ot ener growth of body and bone in childrenand is astrength-pro- tectingfoodforgrown people. } ~ Scott's Emulsion ‘, is cod-liver oil made into a rich cream. It builds up ae vigor and strength. on Take it for its health- “" protecting benefits. AX | Scott & Rowne, Bloomfield, N.J. 2 Be Sure Its WiLL Price 30¢ cy CASCARA 9 QUININE Cet Red Box ous with portrait , Peers See Your 1 | i ! : Les Melt Away | No Confinement—-No Hospital Bils | t © MY celebrated non-surgical! I t : Piles d 001 your work as atment you will fM nd _ M.D, Inc. 9 10 OFTICES: SEATTLE orrices. f uid RE sis ieee TUE SEATTLI rar What Savings and Loan Associations Are Doing for the <ublic SOME INTERESTING FACTS TO BE REMEMBERED SAVINGS AND LOAN ASSOCIATIONS—KNOWN IN MANY STATES AS BUILDING AND LOAN ASSOCIATIONS—ARE MORE POPULAR TODAY THAN AT ANY TIME IN THEIR HISTORY This is evidenced by the figures available as to their activities in the years 1924 and 1925. For example, the highest peak they ever at- tained was in 1924 when they increased their assets eight hundred and twenty-two million dollars, an increase of nearly'21% over the total assets reported for the preceding year. One million three hundred and forty-one thousand persons became members of such or- ganizations in 1924, an increase of about 19% over the gain in the preceding year. it is significant of the present day popularity of these associations that it took them over three-quarters of a century to accumulate as- sets equal to last year’s growth. The total re- sources of such organizations now are five times as large as they were {fifteen years ago. The reasons for such growth are not hard to find. These associations are devised to meet the special needs of the masses—those with com- paratively small means who cannot afford to lose a single dollar and are at the same time under the necessity of making every dollar bring them maximum earnings, coupled with absolute safety. Every person who becomes a member at the time of making his first deposit, regardless of how small the amount may be, shares propor- tionately in all earnings of the association. These earnings are divided as dividends semi- annually. When such dividends are not with- drawn by the members, they, as a consequence, receive compound interest on their savings. Because of this arrangements, persons of . small means can through such organizations receive larger returns on their savings than is possible in any other way with the same degree of safety. The unusual element of safety characteristic of these organizations also make a strong appeal to persons with comparatively small funds. This safety arises out of the limitations placed upon the nature of loans which such as- sociations are permitted by law to make and by the strict supervision to which all of their methods of operation are subjected. Probably the best evidence of the unusual degree of safety surrounding funds placed in such associations is the fact that in 1924 the percentage of loss in building associations throughout the country was only eighty-four ten-thousandths of one per cent, based on to- tal assets. Apart from the personal appeal of such asso- ciations to the man who is looking for a safe and profitable place to put his savings, these associations have exerted a far-reaching influ- ence in providing homes for the wage-earner, as well as in otherwise contributing to com- munity development. For example, during 1924 it is estimated that savings and loan associations throughout the country loaned one billion four hundred and sixty million dollars—an increase of two hun- dred million dollars over the amount similarly placed in the preceding year. It is, therefore, estimated that these associations in the United States assisted their members in building or buying over four hundred thousand homes dur- ing the year 1924—a public service of incal- culable value. In The State of Washington In this state the service rendered elsewhere by organizations known as Building and Loan Associations is performed by SAVINGS AND LOAN and kindred associations. The small investor gets the maximum earn- ing power and also helps the man who wants to borrow and build a home. All securities of the Savings a>_Loan Asso- ciations are deposited with the State. The expense of conducting the operation is limited by the State to two and one-half per cent on the average amount of assets of the as- sociation throughout the year. : There were sixty-eight Savings and Loan As- sociations in the State of Washington in 1925, with a total membership of 195,853, and total assets of $68,638,049.86. The increase in mem- bership in that year in this state was 44,810, and the increase in assets $15,395,738. And not a dollar of loss to any member de- positor. — These figures do not include the members or savings of mutual savings banks, nor the savings placed in commercial banks maintaining savings departments, The latter pay a fixed interest on de- posits instead of dividends on all earnings of the organizations.