The Seattle Star Newspaper, April 28, 1919, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

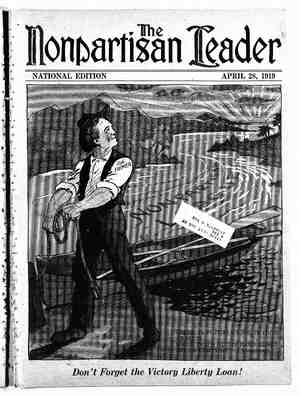

ICH MAN, POOR MAN, THE VICTORY LOAN AP- PEALS TO YOU—wWhether you count your wealth in dollars or in millions, the Victory Loan is the supreme investment offering placed before the American people by their Government in fifty years. With fine financial acumen treasury officials have given Victory Bonds, or notes, attractive features that appeal to investors of every type. * * To the man whose individual dollars count, there is the 434 per cent. interest that is an except- ionally favorable return on money loaned the government, with the additional feature of having that return exempt from normal income tax and all state and county taxes save those of estate and inheritance. * * The man of large means doubtless will prefer the 3 3-4 per cent. Victory Notes, which are absolutely exempt except for estate and inheritance taxation. * *. It is the carefully considered opinion of investment bankers and experts in problems of taxation that these 3 3-4 per cent. tax-free notes are equivalent to the full taxed investment returning 10 per cent. or higher. Ready convertibility from one type to the other, or back again, adds remarkable flexibility. * * By giving Victory Bonds a higher rate of interest the government meets the money market fairly and squarely; it asks no odds of the investor, but makes ever stronger the appeal of patriotism to support this last of the great war loans. By giving the bonds but four years in which to mature the government insures such stability and strength as a long-time issue can scarce command. ¥ ¥ The prediction is freely made that never after the close of this loan period, May 10, will the public be able to buy these bonds as low as the dollar-for-dollar price at which they are now offered. Refusal to - accept over-subscriptions strengthens this prediction. ¥ » Seattle and the State of Washington have never yet failed to take their quota of Liberty Bonds. THEY WILL NOT FAIL NOW!