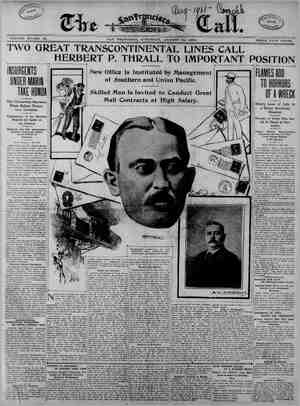

The San Francisco Call. Newspaper, August 31, 1901, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

SUMMARY OF THE MARKETS. Silver and Exdfange unchanged. Wheat a fraction lower and Barley a fraction firmer. Qats, Corn and Rye dull and unchanged. Hay as before quoted. Bran and Middlings steady. % Large Bean crop expected all over the State. Potatoes and Onions as firm as ever. / Buitter dragging, Cheese and Eggs steady. Poultry in sufficient supply and Fresh Fruits about as before quo featureless. ted. Dried Fruits firm and in continued demand. A few new Prunes coming in. Provisions steady, with a fair inquiry. Hides, Hops”and Wool unchanged. Packers report sufficient Hogs at Less activity in the oil stocks. Sugar stocks continue active. unchanged friccs. No more grain markets till Tuesday. All Eastern exchanges adjourned till the Linseed Oil declined 5c. 3d. The Labor Day Holiday. The New York and Chicago exchanges have urncd till Tuesday. over Labor day, and Francisco Exchange has followed their Hence there will be mothing doing in grain to-day or Monda: o t e Produce Exchange Sales. Produce Exchange Call Board sales in Au- gust were 31400 tons wheat and 1800 tons bar- Jey, making a total for the first two months of th vear of 113,100 tons wheat and 7300 tons b Weather Report. th Meridian—Pacific Time.) SAN FR. CISCO, Aug. 30—5 p. m. following maximum temperatures Wwere repo: om stations in California to-day: Eureka, 62; Mount Tamalpais, 62; Independ- ence, 84; Red Bluff, $6; Frespo, 91; Los An- 8); Sacramento, San Luls Obispo, San Dieg The imum and minimum tem- ed from Eastern stations: . 38-72; Jacksonville, 3 Philadelphia, 86-66; 1, 50-60: New York, 52-66. 20 data: Maximum temperature, mean, 6. COAST RECORD. g Bk 0O B %W H RE = 3 g 28 g% B STATIONS. H - s g8 £ § ] a® 8 - 5 Fox s 5 SW Pt Ciay .00 §W Cloudy .00 W Clear .00 W_ Clear .00 Los Ar Phoen Portiand Red Bluft Roseburg .. Sacramento..... Salt Lake Ean Francisco San Luts Obispo. 8an Dieg Seattle eles NW Pt Cldy .00 Cloudy T. W Clear .00| t 7a m, 53 degrees. WEATHER CONDITIONS AND GENERAL FORECAST. 11y cloudy weather prevails over Wash- ington, Oregon. and Northern Nevada, partly clouds’ Arizona and foggy along the Cen- Light thunderstorms are emucca and Flagstaff. has risen over the Pacific siope the east of the Rocky Mountain: T mperature has falien over Oregon and remained nearly stationary in other distri Forecast y along | ; fresh westerly wind. Fair Saturday except | t Saturday morning; * cloudy, probably with show- | ooler in north portion; fresh isco and vicinity—Cloudy and foggy morning, clearing during the day; est wind. FRUIT AND WHEAT BULLETIN. i ETATIONS. 2 = 5 253 Cloudy Clear Clear Pt Cldy 00 00 00 00 o0 » 0 ster—Crops doing orunes drying sicwly | r!‘{nrv.’u-i Condition of fruit and grain favor- | able Napa—High fog in morning. Winery crush- Ing grapes an Jose—Prunes will be at height beginning > next week Palermo—All crops are doing well, | Ventura—Fog and cooler weather will benefit | veans and corn Santa Maria veans well. Peaches Due to late morning fogs pink mildewing along coast. White beans ing well here G. H. WILLSON, Assistant Section Director. - — EASTERN MARKETS. £ New York Stock Market. NEW YORK, Aug. 30.—The stock market a made rather striking demonstration of strength “o-day. The increasing disposition to buy stocss as the day progressed indicated that the demand to cover outstanding con- acts came largely from the bear party. There | was, however, also steady absorption of a aumber of prominent stocks which was difn- 2ult to explain on any other basis than as an sccumulation, for what purpose it was mot fisclosed. The buying of this character was | particularly obvious in the Erles. The buy- g here was very concentrated and was by srokers usuaily employed by the inside inter- ssis of the property. A single commission | ouse took between 10,000 and 15,000 shares of | she common and considerable speculative feel- | | ng was attracted, some large buying of this | stock coming from Western sources. Union Pacific, St. Paul and Atchison showed the be- | sted effect of the very large net earnings for July reported earlier in the week and Canadian Pacific and St. Louis and San Francisco gon- snued to move upward from the same cause. This was a general influence in holding the whole rafiroad list firm. The transactions and e movements in general were not consplcucus. The increase in the volume of business over sesterday was mostly confined to the stocks samed. There was considerable damage also ‘or Amalgemated Copper.. The Gould South. westerns were well held to the accompaniment sf vaguely defined rumors of coming develop- nents, The ®Wabash issues rose about a pofnt tach and Denver and Rio Grande preferred gained 2% upon intimations of a coming favor- ible annual report. The strength of the Chicago Terminal Trans- er stocke was due to talk of absorption by the Shicago and Alton. American Tobacco ad- anced 3% without explanation and Colorado Tuel and Iron 2. The New York, Chicago and t. Louls stocks rose 2 to 2%. The bears were jeemingly discomfited by the absence of a lurry in the call loan market. New York rounted on_the demands for loans to carry | realize by tbe professionals and | G € C C & St Louls. 700 Colo Southern .. 1,400 “olo Southern ist pfd... 4.000 Colo Southern 2d pfd.... 2,600 Del & Hudson, 500 Del Lack & Western.... 100 Denver & Rio Grande... 2,000 Denver & Rio G pfd.... 4100 | Erie .. © 62,600 Erie ist pf © 10,400 Erle 24 pfd. . 5,000 Great Northern pfd 100 | Hocking Valley .. | 8t L Southwestern. in spite of a very unpromising forecast of the week's cash changes. London bought stocks quite freely here, and the resulting decline in the exchange market added to the sentimental effect of this buying. The market closed mod- erately active and firm. The railroad bond market was very dull but firm. Total sales, $2,059,000. United States bonds were all unchanged on the last call. The stock market of Monday suggested and that of Tuesday confirmed the inference that | the elaborate efforts that had been making by a contingent of professional operators for two weeks to awaken a speculative movement in stocks on the part of the outside public had been ineffectual. The recognition of this fact caused considerable throwing over of stocks to and the sharp break In prices of Tuesday afternoon. The sub- sequent firmness of the market, in spite of the anti-stagnation, indicated that the liquidation had come from the weaker class of operators. Better fortified holders seemed disinclined to let go, and there were evidences of quiet ac- cumulation of various stocks. The market had, however, in the main reflected a waiting attitude toward securities pending the clear- ing away of various uncertainties overhang- ing the market, with the undertone of confi- dence in ultimate values of curities ob- viously undisturbed. The chief déterrent fac- tor against speculative ventures is the future requirements om the currency to move the crops which are daily growing more defined. An additional consideration was_the decision to close the Stock Exchange on Saturday pre- ceding the Monday holiday, which served to check speculation, as a three-day interval of trading always does. Opinion in Wall street ie that the steel strike has spent its force. But the technical market position of the United States Steel stocks is in some doubt. There has been a comsiderable outlay of results to support and protect the prices of these stocks while they were under pressure. Up to this time any advance in their prices has brought out offerings indicating a disposition to market the holdings thus acquired. Speculation in the stocks has consequently been very light here. The effect upon the market is fear .of a possible drag from this source on any at- tempted general advance. The action of the market on Tuesday, when the price of corn turned etrongly upward, again showed that a renewal of unfavorable crop reports might £till have power to depress the stock market. The deterioration of cotton is an influence in the same category. The reopening of the dispute between France and Turkey is kept under observance. Only slight disturbances have thus far been shown in any of the securities markets. But any event threatening a recrudescence of the East. ern question and its complicated conflict of na- tional interests in Europe is necessarily taken account of in the financial world. In the money market the large shipments of currency to the interior have demonstrated that New York would be subjected to the usual demand for financing the crop movement at & period rather earlier than last year. Mean- time, there is no indication of relaxation of the unexpected requirements n the money market of the Treasury operations by reason of the surplus. It is reported that after the coming visit of the Czar to France, the Russian Government will piace a large loan in Paris. The Trans- ket is still cut off. Between September 1 and November 1 the official year cash reserves of New York banks were reduced mdte than forty millions. There is not much ground for ex- pecting, therefore, that the New York money market will not be subject to the usual pro- cess of loan contraction this fail to offset the inro-ds upon reserves to meet Interior de. mands and an escape from more stringency will depend on the rellef to be afforded by gold imports and the readiness of fereign money markets to respond to demands for that pur- pose. Railroad bonds have been dull, but firm. United States 3s advanced % per cent over the final call price of last week. NEW YORK STOCK LIST. Stecks— Sales. High. Low. Close. Atchison - 21700 80Y 793 soi Atchison prd . 3,500 981, 97% 98% Baitimore & Ohio. 1043, 1043 Baltimore & Ohio pfd B 1V Canadian_ Pacific 3, 125 113% Canada Southern [ Chesapeake & Ohio 47 415 Chgo & Alton. 40 401 & Alton pfd e T8Y% 78Yy Ind & Louis. 399 38% 391, Ind & Louis pfd.. & East Illinois. & Great West &G W Rock Is & Pac. Chgo Term & Trans.... 4,2 Chgo Term & Trans pfd 1,200 Hocking Valley pfd. Illinojs Central Iowa Central . Iowa Central pfd. Lake Erie & Western.. Lake E & W pfd........ Louisville & Nashviile.. Ma, > Metropolitan St Ry Mexican Central Mexican National . Minn & St Louis. Missouri Pacific . Mo Kan & Tex. Mo Kan & Tex pfd. New Jersey Central 'w York Central Norfolk & Western...... Norfolk & Western pfd. Northern Pacific pfd. Ontario & Western. P C C & St Louis Pennsylvania . Reading 1st Reading 2d pfd. St L & San Fran. St L & § F_1st pfy StL &S F 2d pfd Exitzaiianches D St L Southwestern St Paul . St Paul Southern Pac Southern Railway . Southern Railway Texas & Pacific. Toledo §t L & Toledo St L & West pfd jon. Pacific jon Pacific Wabash - Wabash pfd Wheeling & Lake . Wheeling & L E 24 ptd Wisconsin Central Wisconsin Cent pfa Express Compani Adams American United_States Wells-Fargo Am-l:n-neou-— malgamated Copper Amer Car & Foundry. Amer Car & Fndry pfd American Linseed Oil. Amer Linseed Ol pfd.. Amer Smelting & Refng Am Smeitg & Refng pfd American “Tobacco nacon in Brooidyn Rapid Transi Colorado Fuel & Iron. Consolidated Gas Continental Tobacco. Continental Tobacco 100 190 13,600 900 1, o wver until Tuesday to stiffen rates and bring Socks upon the market. ‘nfi-tsl'edmmnr General Electric . Glucose Sugar ., 400 300 200 900 ,300 200 400 300 400 o vaal gold supply to the London money mar- | Evansville . 3, Wilmington, Del 9.7 Davenport 82 % | Fall River 28.9 | Birmingham 3.0 Topeka. 2.3 Macon | Little Roc] 2024 | Helena . 5.0 Knoxville 55 141 , | Lowell . 444,313 168 | Wichita, 4122 % | Akron 660,700 482 New B 349467 623 | Lexington + B8L3T 1T Springfield, 459,610 < 292 , | Binghamton 200,300 10.0 | Chattanooga 341,902 4.8 | Kalamazoo 5.1 Fargo oungstown 30.2 Springfield, O. Rockford . 32.4 Canton . 29 Jacksonvile 6.0 Sjoux Falls 2.1 Fremont . 51.2 Bloomington, Il 48.9 Jacksonville, T11 . 17.6 *Columbus, 'O.. 5,036,700 1.6 *Galveston . 6.275,000 40.0 *Houston . 8100843 415 tColorado Springs . 955,262 tChesters ... 289,761 +Wilkesbarre 18,728 Totals, U. S.. $1,740,055, 664 Totals outsideN. Y. 643,333,527 - A Hocking Coal Tnternational s B3 International Paper 300 9% 79 International Power. 900 96l 961 Laclede Gas .. National Biscuit . National Lead National Salt Natfonal ‘Salt pt: North American . Pacific Coast Pacific Mail People’s Gas Pressed Steel . Pressed Steel Car Pullman Palace Car. Republic Steel . Republic Steel Sugar . Union Bag & Paper Co. Union Bag & P Co pfd. United States Leather.. U S Leather pfa. United States Ri T S Rubber ptd 100 58 88 United States B . 19,500 45% 45 Eg'i United States Steel pfd 7,300 %Y, 4% 9ly Western Union ....... - 2,900 94 9% 93% Shares eold .......... 08,300 CLOSING BONDS. U S 2 refunding N Y Cent 1sts.. reg . -107% (N J Cent gen do coup . i | North Pac 3s. 3s reg. do 4s . coup . NYC& 1107 Norf & W con 4s..102 Or Nav Ists. do 4s ... Or S Line 6s. ¥ do con &s. 1% Reading gen 96 R G W ists....... 10004 Atchison gen 4s do adj 4s . Can South 2ds St L & I M con 5s.116% StL & S F gen 6s.127% St Paul cons .. St P C & Pac 1sts.115% 8 +do Bs - 116% con 7s..137 |South Pac ds 92 do S F deb 5s....123% | South Railway bs..117% Chi Term 4s S Rope & T 6s.... 52 Colo South - 8813 Tex & Pac lsts. D & R G 4 210133 do 2ds .. Erie gen 4s ........ 8 Union Pac 4 Ft W & D C Ists.105 | Wabash lsts . Gen Elec 6s .. 200 do 2ds .. it 01 Towa Cent 1sts. L & Nash uni 4s. MK & T 2s...... 825 do ds .... . 98% NEW YORK MINING STOCKS. West Shore 4s . Wis Cent 1sts . Va Centuries Adams Con . - 25|Little Chiet 12 Alice 46{Ontario 850 Breece + 1 40{Ophir . 0 Brunswick Con .... 08| Phoenix 03 Comstock Tunnel.. ' 06| Potosi 03 Con Cal & Va. Deadwood Ter: Horn Silver . Iron Silver . Leadville Con ..... 07 BOSTON STOCKS AND BONDS. Savage . Sierra_Nevai Small Hopes Standard Money— Union Land .. 3% Call loans . West End . 96 Time loans 5| Westingh Elec % Stocks— Bonds— Atchigon .. . % |IN E G & Coke 5s. 57 do prefd - 383%| Mining shares— Am Sugar 13543 | Adventure ..... Am Telephone ....168 | Bingham Min Co. Boston & Albany..28 |Amalg Copper l%ol!og &‘ Maine. alm'/) Atlantic om Coal . 407 Carumet o pretd ‘115% | Centennial .. U S Steel . . 45% | Franklin . a0 prefd - % |Humboldt Fitchburg prefd ..146 |Osceola | Gen_ Electric . 71| Parrot Ed Elec 11 . |Quiney " h@exlcan Cent % Santa Fe N E G & Coke | Tamarack . | 01 Colony * | Utan Mining | Old Dominion {Winona .. Union Pac Wolverines Bank Clearings. - * ——— % The following table, compiled by Bradstreet, shows the bank clearings at all principal cities | for the week ended August 20, with the per- | centage of increasé and decrease as compared with the corresponding week last year: Percentage. CITIES— Clearings. Inc. Dec. | New York. -$1,006,722,137 73.9 | Chicago 135,134,094 3219 | Boston . 105,946,882 Philadel 121,323, | St. Louis . 38,402,628 | Pittsburg . 31,258,078 Baltimore . . 18,760,731 San Franci 22,742,612 Cincinnati . 15,432,500 Kansas City 16,951,915 Minneapolis . Cleveland . | New Orlea 1 Detroit . Louisville . | Indianapolis . | Providence | Omaha ... | Milwaukee bte st 6,511,728 5,110,209 | Buffalo St. Paul . Savannah . | Denver .. | St. Joseph . | Richmond . | Memphis | Seattle . Washington . Hartford .. | Los Angeles . | Salt Lake City | Toledo .... | Portland, Or. Rochester . | Peoria. . Fort Worth . Atlanta { Norfolk Des Moines | New Haven . 1.314,648 | Springfield, Mass 1,138,458 | Augusta . 591,376 Nashville 1,371,598 Worcester 1.333:438 Grand Raplds Sioux City . Dayton, O. | Syracuse | Scranton 1,118,416 | Portiand, Me. 1,210,435 Spokane 9 | Tacoma DOMINION OF CANADA. Montreal ... $14,667,386 Toronto . 10,870,025 Winnipeg 2,184,632 Halifax . 2,478,002 Vancouver, B! 920,925 Hamilton ... 629,843 St. John, N. Victoria,' B. tQuebec’ .. Totals, Canada....... $33,002,477 *Last week's total. {Not included in because of no comparison for last year, New York Money Market. NEW YORK, Aug. 30.—Close—Money on call, steady at 2@3 per cent; last loan, 2 per cent. Prime mercantile paper—4%@5 per cent. Sterling exchange—Weak, with actual busi- ness In bankers’ bills at $4 85@4 88% for demand and at $4 84 for sixty days. Posted rates—$4 8534 &7, Commercial bills—84 83%@4 53%. Bar silver—58izc. Mexican dollars—ssike, Government bonds, “steady; State bonds, in- active; railroad bonds, firm. London Market. NEW YORK, Aug. 30.—The Commercial Ad- vertiser's London financial cablegram says: The stock market was i imate , but uotations held firm. - Consols. wers A firm on- leap money, although a reduction of the bank rate is not expected. The onal support, but at the same time the ple bought big blocks of Erie, running It-vrfo.: up to 4%, a new record, while there was a strong i tip here that the stock will touch 60. _ The 1,644,542 r / § ey o \ R y { THE SAN FRANCISCO CALL, SATURDAY. "AUGUST 381 report is that the road is to AR Boara outler for megomtowoct system. The general list close¢ at the top on New York support. The bears were afrald to sell before the holidays lest the steel strike should suddenly collapse, Priyate cables also say. the corn crop is turning out better than the recent doleful reports would lead one to suppose. L ONDON, cmsm,,fm' 9%; Atcht: LON! Aug. 3.—Anaconda, 9%: - son, 81%; Canadian Pacific, 11%; D. & R. G. 4T%; do prefes , 95; Northern Pacific pre ferred, 101%; Southern Pacific, 62; Unlon P cific, 104%. Bar silver, steady, 27d per ounce. Money, 1 per cent. e E consoli Condition of the Treasury.. WASHINGTON, Aug. 30.—To-day's statement of the treasury balances in the general fund, exclusive of the $150,000,000 gold reserve in the division of redemption, shows: Available cash balances, $178,147,312; gold, $107,338,096. NEW YORK, Aug. 30.—Bradstreet's will say to-morrow: A further improvement in corn crop advices, confidence of an early ending of the steel strike, a further advance in cotton and the advent of favorable weather were unitedly responsible for a further enlargement of trade distribution at nearly all markets and perceptibly better and more cheerful tone of business generally. Specially good reports come from such centers as Chicago, which re- Ports a very heavy buying of dry goods, cloth- ing and stores; from St. Louls with advices of unusual strength of demand among jobbers and dry goods trade in August beyond expec- tations; from Kansas City, which reports ihat Jobbers have all they can do to handle business offerings, and from Omaha, which reports Au- gust trade larger than last year. ’ Wool is moving actively on good manufac- turing demand, but is no higher in prices. Re- ports from the woolen goods market continue favorable. Aside from the strength in textiles, the feature in prices is the lower range of cereals and farm products generally. Wheat is off a little on liquidation, based on large receipts at the Northwest, smaller clearances and less ac- tive export demand. Corn is lower on good crop reports, inducing longs to unload. With the exception that the cheaper grades of shoes are not in active request this trade 18 in good shape at the East. Shoe shipments are increasing. The air of patient serenity with which the iron and steel trades view the trade and strike situation is significant of the confidence grow- ing that the end of the strike is in sight. Leaving out this matter the. trade Is in good shape and consumption is large. Finished products, such as hoops, tubes, sheets and tin plates, are still bringing higher premiums. Structural material, plate and bar mills have orders for months ahead. Wire is scarce at Chicago, owing to the Joliet shutdown. At Pittsburg merchant fur- naces are at the end of their orders and must pile stocks next month if the strike lasts. Foundry iron is in good demand at St. Louis and hardware is in active distribution at all ‘Western markets, ‘Wheat, including flour, exports for the week aggregate 6,607,611 bushels, as against 6,606,- 989 last week and 3,248,213 this week last year. Wheat exports from July 1 to date aggregate 57,286,932, as against 25,388,477 bushels last sea- son. Business failures for the week number 188, against 181 last week, 165 in this week a year ago, 131 in 1899, 164 in 1895 and 198 in 1597. Canadian failures number 29, as against last week, 32 in this week a year ago, 2 1899 and 26 in 1898. T 1 NEW YORK, Aug. 30.—Bradstreet's will say 0-morrow: Late advices as to the corn crop yield and to the resulting effect on the general busi- ness of the country have made for a rather | saner view of the subject than could have been taken some six weeks or two months ago, when the intense dry heat wave.prevailed, With the idea of getting a clearer view of the actual situation in the closing week of August Bradstreet's sent inquiries to all its offices and correspondents, not only in the surplus corn-growing States. but in the leading Middle and Southern States as well. This in- quiry contained instructions as to the probable yield as compared with a year ago, the price being paid on the farms for old corn as com- pared with a year ago, the situation as to the wheat yield and the probable effect of the crop out-turn upon the course of general trade through the fall and winter. The general tenor of the report as a whole is quite favorable. On the face of the returns, however, a yield of mot less than 1,400,000,000 bushels’is indi- cated for 1901, a decrease of about 30.per cent from a year ago. 24} in Bradstreet’s Financial Review. * =7 ¥ ' Dun’s Review of Trade. #* 7 NEW YORK, Aug. 3.—R. G. Dun & C Weekly Review of ‘Trade to-morrow will say: Even in cotton goods. which have been the slowest to respond to the vigorous tone of do- mestic trade, the past week has brought dis- tinct improvement. Pressure at Fall River be- ing removed the print cloth market became strong, while in the bleached goods division the gains were still more pronounced. In some cases the only drawback is the lack of avall- able supplies for immediate delivery. Such evidences of better things In the market for goods naturally gave a firmer tone to the raw material, which was further supported by the unsatisfactory weather in Texas. Against losses by drought in the largest State there is compensation in the greatest increase through- out the entire cotton belt, but an advance of 3c a bale since the advance began does not appear unreasonable. ~ Somewhat lower quotations for wheat are not surprising, in view of the genera! endency to increase estimates of, the crop far beyond the quantity indicated by official figures of condition. Another weakening influence fs the | slight decline of exports below the record- breaking movement in the first two weeks of August. Shipments for the week, however, were still phenomenal, aggregating 6,307,032 bushels, compared with' 2,804,567 last vear and 3,307,917 in 1899. Moreover, this gain occurred despite the mterruption to’ shipments from the Pacific Ocean by the strike of grain handlers, These figures of exports omit the movement from Canadian ports, usually included in other records, and causing confusion as to the actual state of domestic trade. With a vield of 50,000,000 bushels in Manitoba. these shipments from the Dominion are falling little short of 1,000,000 weekly. August opened with a commercial sky over- cast by *storm clouds that threatened serlous injury to the steel industry, while drought in the Southwest aroused pessimistic predictions that business was on the verge of a severe set. back. Thousands of idle strikers, together with a profitless season in agricultural regions, meant inactivity in manufacturing, trade and trans- portation, according to the prophets of evi Instead of these calamitous econditions, how- ever, the month ends with a horizon that is almost clear and each resumption of work at an idle mill adds to the productive capacity. Jobbers and manufacturers report that or- ders for fall goods have exceeded any previous year, with notable increase in the demand. for the better grades, and there is a definite meas- ure of active trade in banking exchanges at this city, 74 per cent larger than in the same week last year and 20.5 above 1899, while at other leading citles the increase is 36.2 and 2 respectively. ‘Although scarcity of freight cars holds back a large tonnage rallway earnings thus far re- ported for August show a gain of 12.1 per cent over last year and 23.6 per cent over 1399, Quotations of steel products are still nomi- nal, owing to the difficulty. experienced in securing prompt delivery. It is estimated that not more than 20 per cent of the steel compa- Dies’ capacity has been stopped by the strike, and this_proportion daily decreases, Consumers of tin plate have sccured supplies abroad, £o that their work is not badly handi- capped, and while it is to be deplored that American capital and wage-earners will lose the profits of this business it is fortunate that other industries are not disturbed. Hides are sharing the Improvement, with higher prices and activity at the West. Woolen mills are crowded with orders, even the smaller concerns participating, and fhe wool market is_steady. Failargs for the week numbered 202 in_the United States, against 175 last year, and 21 in Canada, against 19 last year. New York Grain and Produce. NEW YORK, Aug. 30.—FLOUR—Receipts, 27,849 barrels;- exports, 17,355 barrels; firm and fairly active; winter patents, $3 60@3 85; winter straits, $330@3 45; winter extras, $2 502 80; winter low grades, $2 30@2 40: Minnesota pa- its, $3 do bakers’, $2 85@3 15. . WHEAT—Receipts, 26,450 bushels; exports, 78,78 bushel spot, firm; No. 2 red, 7Tic f. o.'b. afloat; No. 2 red, 5lc elevator; No. 1 Northern Duluth, 79%c f. 0. b. afloat! No. 1 hard luth, 83%c f. o. b. afloat. Options had a sh: advance on Southwest buying, large ‘seaboard clearances, damage reports from Rus- sia and Argentine, small Argentine shipmerts, covedlng for. fhe ""“fi?ie o fhn oeee tember, 75 11-16@75%c, closed at T5%c; October, cltol‘fig‘c at 75%c; December, 76%@77%c, closed af 3 HOPS—Quiet; State, common to choice, 1900 crop, 11 ; Pacific Coast, 1900 crop, 11@15c. HID] Steady; California, 21 to 2 pounds, ‘WOOL—Quiet; domestic fleecs, FFEE—Spot , steady; No. 7 Mo’ 3 $550; mild, quret; Cordove: So1ee. g "BUGAR-Raw, barely steady; fair refining, | market was steady; creameries, 14@19%c; dair- | boxes; white cling, 4aG50c, boxes. | weather. 8 5-16c; centrifugal, 96 test, 3 13-16c; molasses , 3 1-16c; refine No. 4.85¢; R by ol oy 4 s RT3, Adbo: Ne. 3o, 4.35¢c; No. 11, 4.80c; No. 12, 4.30c; No. 13, 4.20c; No. 14, 4.20c; standard A, 5.05c; confectioners’ A, 5.05c; mold A, 5.80c; cutloaf, 5.75c; crushed, 5.75c; powdered, 5.35c; granulated, 5.25c; cubes, E%HER—MEIDQI. 4381 packages. steady; State dairy, 14@19c; creamery, 16@20c; June packed factory, 14%;@15%c. FEGGS—Receipts, 6680 packages; Western candled, 17@17%c; Western uncandled, 14@17c. DRIED FRUITS. Demand for evaporated apples to-day was fairly active. Offerings were free. State, com- mon to good, 5@Sc; prime, 8%@8%c; choice, Se; fancy, Sic. California dried fruits, dull; 3%c r§§'°§m’; Apricots—Royal, _8%@isc; Moor- park, 8@i2c, Peaches—Peeled, 11@iSc; un- peeled, 6@dc. PV o S 1 0 il S A R T, 5 90; cows and heffers, : 75; bulls and stags, u%u: .lock!rl -ndfu $2@3 %0; veals, $2 25@5 2. per sack; Alameda, T5c@31 per Berl ,_30@T5¢c; Summer Squash, large s Batoe, New Marrowiat Squssh. nom HOGS—Receipts, 6500. Market steady to 10c | inal. higher, mostly 5c lower. Light and light mix- ed, $6@6 35; medfum and heavy, $6 05@6 40; pigs, $3 25@5 50; bulk, 36 15@635. SHEEP—Receipts, 2000. Market steady to strong. New York Coffec Markel. NEW YORK, Aug. 30.—The coffee market opened steady with prices unchanged to 5 points_ higher. _Cable news contained nothing of in- fluential importance and primary receipts were as anticipated. Heavy domestic warehouse de- liveries and a steadler spot department wers bullish factors which started room buying on a limited scale around the opening. Later in the session foreign houses bought liberally with local bears supplying the demand. The afternoon session was featureless. Prices did & g t vary more than 5 points all day: final Chicago Grain Market. THgures were net unchanged to 5 points met higher and then steady. Total sales, 21,000 bags, % ——— % | Including: September, 4.70c; December, 5.05c; €HICAGO, Aug. 30.—Higher prices ruled on the Board of Trade to-day. Light Argentine shipments, together with stronger cables than anticipated, caused wheat to open active and higher. A'lessened pressure to sell September was aiso a strengthening factor, the absence of any considerable offerings being taken as in- dicating that longs had pretty well sold out. There was also a good shipping demand. Dis- inclination to make any contracts over the three holidays resulted in bringing about a heavy feeling to the market. December opened a shade to %@%c higher at Ti%c to T1%@Tl'ac, and on covering by shorts the price advanced to 72%c, but reacted to 71%@71%c on selling by Northwest. A rally occurred toward the close, Which was half a cent higher at TL%@7i%c. Corn opened active and higher, the bull fac- tors being higher cables, which caused some covering by shorts. The market became dull 1oter: pending tie holldase._Dedimber, iélosed th a zain o e a . Oats followed corn. December closed %@%c higher at 33%c. A Provisions were strong In sympathy with higher' prices for hogs and on buying by pack- ers. January pork closed with a gain of 173c, lard 7%c higher and ribs 7%@10c higher. The leading futures ranged as follows: Articles— Open. High. Low. Close. Wheat No. R September . .8 695 6% 69 December Lomy T T TR May . 5% % Tl 5l Corn . September . 54 5% B3% BA% December 56% 5T G6% 5T May . 8% 9% S 394 Oats No. September . By BwY B B December .......... 3% 3% ' 35 2503 May ... P T O T ) Mess pork, per barrel— September .. 1435 1440 1430 1440 October . U453 1450 January . 1545 155 Lard, per 100 pounds— & % September . .89 89T 88T 80Tl October . D897 9025 895 52y January ............ 830 88T 88 587% Short ribs, per 100 pounds— September . . 835 840 8324 840 October ... T84z 850 8425 8350 January . LT T TIME 19T Cash quotations were as follows: Flour, steady: No. 3 spring wheat, 66@68'%c; No. 2 red, 0%@71t%e; No. 2 oats, 34@3t¥c: No, 2 white, 36%4@3T%c:, No. 3 white, 3t%hc; No. 2 rye, 343 @dic: fair to choice malting barley, 5T@élc; No. 1 Northwestern, §143@1 44; prime timothy seed, bdc; mess pork, per barrel, $14 40@14 4. lard, per 100 pounds, $895@S 97%; short ribs sides (loose), $8 25@S'43; dry salted shoulders (boxed). TY@Tisc; short clear sides _(boxed), §8 85@8 9; clover, contract grade, $9 T5@9 5. Articles— * Recefpts. Shipments. Flour, barrels . 25,000 12,000 ‘Wheat, bushels . 53,000 95,000 Corn, bushels 20,000 229,000 Oats, bushels 258,000 | Rye, bushels ... 1,000 | Barley, bushels . 1,000 On the Produce Exchange to-day the butter fes, 13@17c. Cheese, steady, 9%@10%c, Eggs, firm; fresh, 13c. 2 — Foreign Futures. * LIVERPOOL. “'h‘el!— _5?‘7: é):; [s) .5 6% Cl‘:f;lln:s -5 6% 581 PARIS. Wheat— Aug. Feb. Opening 21 10 35 Closing 21190 22 20 Flour— Opening 27 30. 28 35 ClosIng ceecopeecen 27 30 23 35 Rt il et He Lol LA California Fruit Sales. T % NEW YORK, Aug. 30.—The Earl Fruit Com- pany to-day sold California fruit here and realized the following prices: Pears—Bartletts, boxes, $1 40@3 45, average $2 36; half-boxes, average $170. Grapes—Muscats, single crates, Toe@$1 35, average §1 27; Malaga, single crates, $115@1 50, average $13. Plums—Columbia, single crates, §1 30@1 55, average $147; Yellow Egg, single crates, 70c@$1 80, average $1-27; Yellow Igg, quarter crates,” 75@S80c, average 78c; Kelsey Japan, single crates, §110@2 35, average, $1 76; Quackenboss, single crates, $2 10 @2 50, average $217. Prunes—Gros, single crates, $155@1 9, average $182; Silver, single crates, 9c@$1 30, average §122." Six cars sold here fo-day. Weather favorable. Porter Bros. Company’s sales: Car from Winters: Peaches—Crawfords, av- erage S0c, boxes; orange cling, average fac, Pears—Bart- letts, 32 90@3 20, average $3 09, boxes; $1 60@1 90, average $1 77, half boxes. Grapes—Tokays, §1 40 @2 30, average $19, single crates; gross sale, $1165. Car from Vacaville: Prunes—Hungarian, av- | erage $2, single crates. Pears—Bartletts, $3 3@ 365, avérage 8 &, boxes, Grapes—Tokays, $ 30 @2 40, average 32 28, single crates; Muscats, 4y erage $150, single crates; gross sales, $1660. Car from Hookston: Prunes—Silver, average $105, single crates. Pears—Bartletts, 32 60@3 25, average 33 02, boxes: gross sales, $1675. Car from Newcastle: Peaches—Strawberry | cling, 70@Slc, average 72c, boxes; free stone, 40 @lse, average Sle; McKevitt, 65@S0c, average 78, boxes: orange cling. 55c@$1 10, average 95e, boxes; lqmon cling, 85@dc, average 93c, boxes: Georgla ' late, average Sc, boxes. Plums— Blood, average §ic, single . crates. Prunes— Gros, ' $1 70@2 20, average $1 87, single crates; French, $1@105, average 3101, single crates: Red Nectarines, average $16), single crates. Pears—Bartletts, average $2 8, boxes; Vicar, average $1 95, boxes. Grapes—Muscats, average 50c, single crates; scedless, average 40c, single crates; gross sales, 3865. Six cars {ruit sold to- s i CHICAGO, Aug. 30.—The sales by the Earl Fruit Company here to-day of California fruit at_auction realized the following prices: FPears —Bartletts, boxes, §2 @3 15, average §3 03: half-boxes' $130G1 60, average $152. Grapes— Tokays, sipgle crates, average $167; Malaga, single crates, 95c@$l 5, average $1 3 Clusters, single crates, $2 06@2 50, average | $2 25; Muscats, single crates, $1 30@1 3, aver age $133. Plums—Columbia, singie crates, S @31 10, average Sic; Yellow Eggs, single crates, TeG$1 10, average 95c. Prunes—German, sin: gle crates, $1 06@1 average §129; Giant, single crates, $1 30@1 5, average. $1 48; Gros, single crates, $1 25G1 70, average $156; Silver, single crates, S0c@§l, average %c. Eight cars sold here to-day. Dry and favorable weather. tP&rier Bros.” Company sales of California ruft: Car_from Winters: Pears—Bartlett, avi $295 box; half boxes, average $1 05, o Car from Vacaville: Pears—Bartlett, $2 63@3, hal? Doxes, average $1 10. average 32 86 bo: Peaches—Salway, average 3¢ box. Nectarine average §1 single crate. ~Grapes—Tokay, 245, average §190 singie crate. Gro Car from Vacaville: Pears—Bartlett, $2 35@ 2 9, average $2 82 box; half boxes, average §1 2 Peaches—Susquehanna, 30@T75c, average box Piquot's Late, average 5sc box. Prunes—Robe ds Sacgant average $110 single crate. Grapes —Tokay, . average §2 07 single crate. Gross sales, $1435. Car from Anderson: Pears—Bartlett, $1 60@ 0. average §2 24 box: Clairgeau, average $2 2% 2.6 box. Gross sales, $1075. Car from San Jose: Pears—Bartlett, $1 60@ 170, ‘average $162 box: Howell, average $2 60 box; Beurre Hardy, $220@2 55, average $2 50 box. Plums—Yellow Egg, average 70c; Quack- enboss, average $1 07; Kelsey Japan, average §i. Prunes—German, average $1 47; Gros, average §1 44; Italian, average $130; mixed, average $115, Gross sales, $1130. PHILADELPHIA. Aug. 30.—The Earl Fruit Company to-day sold Caliifornia fruit here at auction and realized the following prices: Pears—Bartletts, boxes, §195@2 7, _ average $221. Ome car sold here to-day. Favorable $1@ sales, Eastern Livestock Markets. CHICAGO. CHICAGO, Aug. 3).—CATTLE—Receipts, 2500, including 600 Texans. Steers, 10@l5c higher, active; butchers’ stock, strong to 10c higher; to_prime _stee 0@6 35; # 4 25: cows, $2 45@4 50; heifers, $2 50@5; canners, £150@2 40; bulls, 33 60; calves, $3@5 65: :‘ml steers, $4@5 10; Texas grassers, $3 30@4: Hoictls, ipts to-day. 16,000; to-morrow. 13.000; left’ over, estimated 4005, active: good to | choice, 10c higher; others, steady. Mixed and au’xlnle :; & 70; s‘%s m”ahfilo-(hnvy, 5 95 Dl of satee, 38 506 s - ent: ¥ 5506 50; SHEEP—Recelpts, 5000. Steady to 10c h < lambs, strong. Good to choice 425 fair to cholce mixed, §8 1008 50; Western sheep, $3 S;znlfive lll'bl. @5 25; West- % ST, JOSEPH. ST. JOSEPH, Mo., Aug. .—CATTLE—Re- ceipts, 1800; strong to 1'01: higher. Natives, $3@ January. 5.10c; February, 5.20c; March, 5.30c, and May. 5.48c. ' New York Metal Market. NEW YORK, Aug. 3).—The metal market assumed a holiday appearance and trade was of an evening up character. Tin closed steady at $27 85@26 here and in London was quiet at £113 for spot and £114 15s for futures. Copper in London and here was unchanged at £66'11s 3d for spot and £66 185 9d for futures, while lake was nominally $16 50@17 and casting 16 3744 @16 6214 respectively, ‘Luydia;n Tonton Aeciined 1s 34 to £11 16 3d, while at home prices were unchanged at $4 37%. Spelter ruled quiet and unchanged at home and abroad. Pigiron warrants, $9@10; No. 1 _foundry, Northern, $15@15 50; No. 2 foundry, Southern, $14@14 50; No. 1 foundry. Southern, $14 T5@15 25; No. 1 foundry, Southern soft, 3li 75@15 2. Glasgow warrants closed at 53s 44 and Mid- dlesboro closed at 45s. New York Cotton Market. NEW YORK, Aug. 30.—Cotton futures closed quiet, .4 to 7 points lower. Northern Wheat Market. OREGON. PORTLAND, Aug. 30.—Walla Walla, §5%@ s6c; bluestem, 5ic; valley, 57c. WASHINGTON. TACOMA, Aug. 30.—Wheat unchanged; blue- stem, 57c; club, 36e. Portland’s Business. PORTLAND, Aug. 30.—Clearings, balances, $84,200. Foreign Markets. $303,118; LONDON, Aug. 30.—Consols, 94 13-16; silver, 27d; French Rentes, 101f 2C; cargoes on pas- sage, quiet and steady: cargoes of No. 1 Stand- ard California, 30s; English country markets, aquiet. LIVERPOOL, Aug. 30.—Wheat, steady; No. 1 Standard California, 5s_ 11%d@6s; wheat in Paris, weak; flour in Paris, weak; French country markets, part cheaper; weather in Eng- land, fair, but cloudy. COTTO: Uplands, *- > * Exchange and Bullion. h: , 60 d: — 34 855 Sterling Exchange, sight... =& S Sterling Cables . - 4 884 New York Exchang - 10 New York Exchang - 1255 Silver, per ounce - 5835 Mexican Dollars, 41 @ 4y Wheat and Other Grains. WHEAT—Liverpool was weak and Parls fu- tures were lower. Chicago was firm with an upward tendency 2nd advanced to but fell back to 7i%c. The demand was purely speculative. St. Louls bought freely. Snow gave the condition of win- ter wheat at 92.3, or one point better than in July, and that of spring wheat at 3.4, against 341 a month ago. On this basis he figures out @ crop of 460,000,000 bushels winter and 300,000,- 000 bushels spring wheat. Argentine shipments for the week were 176,000 bushels, against 984,- €00 for the same week last year. In this market shipping grades are a fraction lower again. Futures show little change. The Produce Exchange stands adjourned to Tuesday, following the course of the Chicago and New York exchanges. %e; milling, $1@1 02 Spot Wheat—Shipping, Der ctl. CALL BOARD SALES. Informal Session—2:15 o’ clock—December— 6000 ctls, $1C0%. Second Session—No_sales. Regular Morning Session—No sales. Afternoon Session—December—2000 ctls, $1 00%; 8000, 31 00%. 3 BARLEY—Strictly bright feed is-firm and in light supply and the local millers are paying e for it. Otherwise there is nothing new. 3%@75c for choice bright, 72%c for No. for off grades; Brewing and Shipping grades, 7734@s5c; Chevaiier, 5c@$1 05 per ctl. CALL BOARD SALES. 15 o’clock—No sales. Second Session—No sales. Regular Moérning Session—No sales. Afternoon ‘Session—December—2000 ctls, T2c. OATS—The market continues inactive and easy at previous prices. Grays, $1 10@120; whites, $115@1 35; black, $1@110, and red, $105 @120 ver etl. CORN—Chicago continued firm at a further advance. Snow stated that all his correspond- ents reported the crop deficient, the ears being poorly filled and the proportion of barren stalks unusually high. He gave the condition of the crop September 1 at 58.9, against 64 a month ago. Argentine shipments for the week were 1,320,000 bushels, against 562,000 for the same week last year. There was no change in the San Francisco market. Small round Yellow, §173; Eastern ;Yellow. $165; White, $1.75@180 per ctl; mixed, 1 63. RYE—T5@T%c _per ctl. BUCKWHEAT—None in first hands. Flour and Millstuffs. FLOUR—California Family Extras, $ %@ 3350, usbal terms; Bakers' Extras, §3 15@3 25; Oregon, $250G275 per barrel for family and $2 5@ for bakers'; Washington bakers', 8275 @ MILLSTUFFS—Prices in sacks lows, usual discount to the trade: Graham Flour, $3 per 100 lbs; Rye Flour, $2 7; Meal,” 2 50; Rice Flour, $7; Corn Meal, extra_cream do, $4: Oat Groats, $ $4@4 25; Buckwheat Flow 4 Wheat, 3 Farinz, $450; Whole Wheat Flour, $325; Rolled Oats (barrels), 36 $5@s 35; in sacks, $ 50G8: Pearl Barley, $; Split Peas, $5: Green Peas, $6 50 per 100 Ibs. Hay and Feedstuffs. There was little change in anvthing yester- aay. BRAN—$20 50@21 50 er ton. MIDDLINGS—$22@23 per ton. FEEDSTUFFS—Rolled Barley, $16@17 50 per ton; Oilcake Meal at the mill, $23@26; jobbing. $26 50: Cocoanut Cake, $17@18; Corn Meal, $33 50 @34; Cracked Corn, $34G34 50; Mixed Feed, $18 30 19 5¢ flu.\\'-—wneaz. $7@9 50; choice, $10@10 ‘Wheat 2nd Oat, $650@9: Oat, 36@S 50; Barley and Oat, $6@s; Alfalfa, $§ 50@10 50; Clover, $ 30 @7; Volunteer, $4 50@5 50. STRAW—-25@42%c per bale. Beans and Seeds. Beans continue qulet and unchanged. ' The crop is reported large all over the State. The current cool and moist weather is good for the development of the berry, but unfavorable to those crops already threshed. Receipts of new ure slow and scattering. BEANS—Bayos, §2 %@3; Small White,$4 90@5; Large White, §3 @4 10; Pink, $23@2 4: Red, $2 75@3; Blackeye, § 30; Limas, $6 40@6 50 Red Kidney, $4 per ctl. SEEDS—Brown Mustard, nominal Yellow Mustard, nominal; Flax, $2 %@" ; Canary, e for Eastern; Alfalfa, nominal; Rape, 1%@2%c; Hemp, 3%c per Ib. DRIED PEAS—Niles, $165 per ctl Potatoes, Onions and Vegetabies. ‘The firmness in Potatoes and Onlons continues and quotations for both are m ntained as a rule, while there is no diminution In the de- mand for both shipment and local use. Vege- tables show little change. Tm;;;mes from Napa are T box. Rs"" Potatoes are plentiful, dull and weak. POTATOES—S$1 %5@1 60 in sacks and $1 35@1 & in boxes for Burbanks, §115@125 for Garnet Chiles and _$1 10125 for Early Rose; Salinas selling up to % Burbanks, §1 40@1 65; Sweets, 50c@$l for Rivers and §i 25 for Merced. ONIONS—Yellow, $115@135 per ctl; Pickle Onions. 50@75c mer ctl. Beam U0 Limas, 2055 Cabbage. S@we per ctl; Tomatoes from the river, 35@60c; from Alameda, 0@Tc: Dried Peppers, 10@1%ie: Green Okra, 33@€0c per box; Carrots, 25@35¢c per sack: Cucumbers, Bay. 30@50c: Pickles. 1%4@1%c per 1b for small and 1c for large: Garlie, 2@3c: Green Peppers, 3@60c per box for Chile and 2 @ilc for Bell; Egg Plant, %@5lc per box; Green Poultry and Game. The Poultry market shows little change. Sup- plies are sufficient for the demand, which Is nothing extra. A car of Eastern came in, making three for k. t";O".”e’:'l'R!—LIVI\ Turkeys. #@10c_for Gobblers and 10@12 for Hens; Young Turkeys, 20c; Geese, per pair, §1 25@1 75; Goslings, $1 50@1 Ducks, $3@3 50 for old and $350@5 for voung: Hens, $350@450; young Roosters, 5@ old Roosters, $3 50@4 50: Fryers, $4 50; Broilers, 33 50 @4 for large and $2g3 for small; Pigeons, 3125 @150 per dozen for old and $12%@130 for Squabs. GAME-—_Doves, per ddken, $1@125: Hare, 51 ‘Rabbits, $1@1 50 for Cottontail and for Brush. Butter, Cheese and Eggs. Butter continues to drag, receipts and stocks being rather more than the demand calls for, though there is no decline. Cheese remains steady. Quotations for Eggs are maintained under moderate stocks, but the demand is not sharp by any means. Recelpts were 22,900 pounds of Butter cases of Eggs, 40 cases of Eastern Bggs, 1 % pounds of California Cheese and — pounds of Eastern Checse. BUTTER—Creamery, 26@27c and 25¢ _for seconds; dairy. I b for fancy store But- ter, 15@1T%¢ per Ib; Creamery Tub, 18G2uc. Pickled Roll, 17@19; Keg. 16@iSc per Ib. CHEESE—New. lic: old, nominal: Young America, 113 per Ib: Eastern. 13@lsc. EGGS—Ranch, 2@2Sc for good to fancy; store, 17@22%¢c per dozen; Eastern, 16@2lc. Deciduous and Citrus Fruits. The market is quiet all around, with no par- ticular features. Nutmeg Melons are firmer, but Cantaloupes and Watermelons continue to drag. Grapes are slow of sale and weak. The continued cool and foggy weather is against all these varieties. Peaches, Pears and Plums remain about as before quoted. Berries came in late and some were carried er. “The cool weather is against citrus fruits, which are dull. Bananas are lower, DECIDUOUS FRUITS. APPLES—T75c@31 25 per box for good to chofcs and 35@ssc for ordinary. CRABAPPLES—60@T5¢ per box, according to package. PLUMS—2@60c per box; Prunes, 35@6c per crate; \;";:’hzioumn' Gages, 320 per ton; kgs per ton. Pl:‘:’g:}:nr:s—mqsoc per box and 3$20@30 per ton for frees and $35@45 for Clings; Peaches in car- rlers, 45@%0c, according to size of carrier; Mountain Peaches, 50@73c per box. NECTARINES—White, 25@40c per box; Red, g EARS—Bartietts, $1@1 25 per box for No. 1, 60@%0c for No. 2 and $30@40 per ton; other Pears. %@ilc i r box. UINCES—40 per_box. g‘l‘RAWBF.‘RRIES—W7 per chest for Long- worths and $3@5 for large berries. BLACKBERRIES—$3@5 per cher LOGAN BERRIES—Per chest, $@4. RASPBERRIES—$4@7 per chest. HUCKLEBERRIES—6@3c per 1b. FIGS—Black, 65@75c for double layer boxes; White, 25@s0c. MELONS—Nutmegs, 20@50c per box: Canta- loupes, 25@50c per crate; Watermelons, $@20 P ERAPES Fontainebleau and Swestwater, 35 @30c per box and crate; Tokay, 40@75c per box: Muscat, #0@75c; Seedless, $5c@$l; Black, 0@ 65¢c; Isabella, 75c@$1%5; Wine Grapes, $25 per ten for Zinfandel. CITRUS FRUITS—Oranges,_ $1 50@3 50; Lem- ons, $1@1 35 for common and 32 50@3 50 for good to choice; Grape Fruit, 30c@$150; Mexican Limes, $350@4; Bananas 5c@$1 3 per bunch; Pineapples, $1 50@3 per dozen. Dried Fruits, Nuts and Raiswns. There s nothing new in this market. Several small lots of new Prunes have been received and are selling on the basis of 3%c for the four sizes. All fruits are firm, and dealers do not look for any lower prices in any kind, while some are expected to do better later on. FRUITS—Apricots, §@10c for Royals and @ 143c for standard to fancy Moorparks; Evapo- rated Apples, 7%@8%c; sun _dried, 4@i%c: Peaches, 6@sc: Pears, 5%@9c; Plums, pitted, § @5%c; unpitted, 1@2¢; Nectarines, 8@8c for Ted and 6@S%e for white: Figs, 3%c for black. PRUNES—OMd crop quoted by the Asso- clation on the basis of 3%c for the four sizes New crop are quoted on the basis of 34@¥4c for the four sizes. RAISINS—Are cleaned up and nominal. NUTS—Walnuts, No. 1 _softshell, 12@12% No. 2. 8@8%c: No. 1 hardshell, 10910%¢; No. §%@7%4c; Almonds, 13@Mc for papershel 1lc for softshell and 5@6c for hardshell: nuts, 5@7c_for Eastern: Brazil Nuts, 12@12%c: Filberts, ic; ns, 11@i3c; Cocoanuts, 50@5. ufloéqNsEY—Comh 12812%c f(‘g"mh“;- “aad 109 light amber; water white cted, 5 g:c-ml‘un-z amber extracted, 4%4@Sc; dark, 63 Hpswax—m5a23e per 1 A Provisions. 1! ‘The situation remains unchanged. La#d rules firm, CTRED MEATS—Bacon, 12¢ per Ib for heavy, 1234¢ for light medium, 13%e for light. 14%e for extra light and I6c for sugar cured: Eastern sugar-cured Hams, 14@14#%c: California Hams, 13%ec; Mess Beef. '$Il per barrel; extra Mess, $12: Family, $12 30; prime Mess Pork, $15; ex- tra clear. $33; Mess, §19; Smoked Beef, Mc per und. PLARD—Tierces quoted at T per 1b for compound and 1lc for pure; half-barrels, pure, 1Yc; 10-1b tins, [i%e: 5-b tins, L%e. COTTOLENE — One half-barrel, %ec; three half-barrels, S%c: one tierce, Sigc; two tlerces, Sc; five tlerces, 8¢ per Ib. Hides, Tallow, Wool and Hops. HIDES AND SKINS—Culls and brands seil about 1%4c under quotations. Heavy salted Steers, 10%c; medium, i4c; light, % Cow Hides, Sc for heavy and Sc for light; Stags, 6l4c; Salted Kip, 9i4c; Saited Veal, l0c; Salted i Dry Hides. 16@16%c; Cuils, lic: Dry Kip, i6c: Dry Calf, iSc; Culls and Brands, iSc: Sheépskins, shearlings, 15@30c each; short Wool, 30@50c each; medium, 50@75c: long Wool, Sic@$i each; Horse Hides, salt, $2 50@2 75 for large and $2@2 25 for medium, $1 50@1 75 for small and 30 for Colts; Horse Hides, dry, $175 for large, $125@1 50 for_medium, $125 for small and for Colts. Deerskins—Summer or red skins, 35¢: fall or medium skins, 30c: winter or thin skins,. 2c. Goatskins—Prime Angoras, ime: large and smooth, 30e; medium, 35e. TALLOW—No. 1 rendered, i%@4%c per Ib; No. 2, 3%@dc; grease, 2%@dc. ‘WOOL—Spring. 190 or 1901 Mendocino, 14@15%e; . llc per i Middle County. defective, §@10c; Southern free, 7 months, T@l0c: do, defective, 7 months, G 8c; Oregon Valley fine 14@l5c; do, medium’ and coarse, 11@13c: Oregon, Eastern, choice, 11@l3c; do, fair to good, 3@llc: Nevada, 10@1l%e. Fall— San Joaquin, §%@S%c; San Joaquin Lambs', %@ HOPS—New, 12@15c per Ib. San Francisco Meat Market. Previous prices are quoted for all kinds. Packers still report sufficient Hogs for thetr needs. Wholesale rates from slaughterers to dealers are as follows: BEEF—6@6%c for Steers and 5@5%e per Ib fur cows. VEAL—Large, 7@8c; small, 3@Sc per Ib. MUTTON—Wethers, 1gic: Ewes, 7G7%c per ound. PLAMB—sgoc per 1. PORK—Live Hogs, 200 Ibs and under, 8%c; over 200 Ibs, 6c: feeders, —: sows, 20 per ceat off; boars, 50 per cent off and stags, 4) per cent off’ from 'the above quotations; dr Hogs, THGI%e. General Merchandise. GRAIN BAGS—Calcutta Grain Bags, 7% @T%c; local make, Yc less than Calcuttas; Wool Bags. 33@35c; Fleece Twine, T%@Sc; Fruil Bags, 5%@6%¢ for cotton and 7@T%e for Jute. COAL—Wellingten, 39 per ton: Soutnfield | Wellington, $3; Seattle, §7: Bryant, $ 30: Coos Bay, 35 50: Wallsend, $3: Co-operative Walls- end. $9; Cumberland, $12 50 in bulk and 313 7 in sacks; Pennsylvania Anthracite Egs, $i4: Can- mel, $10 per ton: Coke, $I5 per ton in bulk and $17 in sacks: Rocky Mountain descriptions, 33 4 per 2000 Ibs and $8 50 per tonm, according to brand. arrison’s circular says: During the week there have been two arri. vals of coal from British Columbia, 3030 tom: one from Washington, 4200 tons: three from Oregon, 1430 tons; one from Australia, 4222 ton one from Swansea, 3540 tons: total, 18,443 tons. Our deliveries this week are about twenty-fiva per cent less than last week; at the same tim= there is ample here for current requirements. The amount discharged this week from our coast steamers has been larger than for several weeks past. Laborers, although not plentiful, are fully sufficient to meet ail our urgent de- mands. The present strike has besn more se- riously felt by diminishing the deliveries of do- mestic coals, still thers-are more carts run- ning this week than for some time past. The deliveries of Steam coals are made principally y barges, hence are not material the labor disturbances. A feel m::’m mise, or early settlement, is more ap- parent daily, and it is sincerely hoped that this irely for same is light.. Oil is ls attention. which has resulted in im- provement of val . It can b-‘n-f:l';-u«l that large con for future cannot made within twenty-five to thirty per cemt S e I NIy I ath mow oo