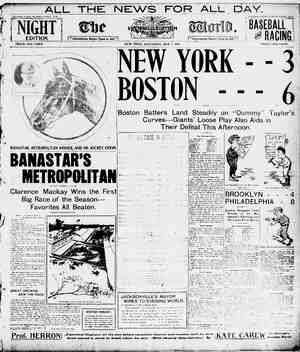

The San Francisco Call. Newspaper, May 4, 1901, Page 10

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

10 THE SAN FRANCISCO CALL, SATURDAY, MAY 4, 1901 OMMIRIAL SUMMARY OF THE MARKETS. Silver higher. Shipment of $163,706 in specie to China. Barley higher again, with light stocks. Wheat dull and unchanged. Rye very quict. QOats and Corn very firm, but dull. Hay in lighter receipt and steady. Feedstuffs unchanged. Nothing new in Beans. River Potatoes still higher. Butter and Eggs in free supply and the latter weak. Good Poultry sells off fairly at steady prices. Cherries and Strawberries still show the effects of the rain. Five cars of Oranges sold at auction. Lemons and Limes quict and in ample supply. Almost all Dried Fruits firm and in good demand. Seeded Raisins continue to sell well. Provisions quiet at previous prices. Hogs a fraction lower. Other Meats unchanged. Sugar stocks continue active at declining prices. il stocks rule dull, with fair sales. Currants appeared in market. Sugar marked up. Prunes in New York. Mgil edvices from New York say: ““The spot prune market advanced about %ic yesterday on the receipt of news that the price of prunes om the coast had gone back to the 3¢ basis at the expiration of the fifteen-day limi set for the reduction to 2c. Stocks here ere sgain veported quite light and supplies now on the way are stated not to be large. Although some holders, it is understood, were still selling vesterday on practically the old prices, yet the general talk is that the local market is much stronger and some predict a further advance of from %@%c within a few days. - The sizes of which reity is atest are 40-50s, 60-70s and 90-100s. Fair are stated to be on the way, The report that four of the coast’s large packing companies had | bought 20,000,060 pounds of prunes from the association at the 2c basis just before the ex- piration of the fifteen-day limit excited ide interet, and there was much anxiety as to the probable effect of the deal. Authentic de- tajled information, -however, was lacking. “Curramts have not been advanced as yet as a comsequence of the higher market in Greece, but the market is firmer. Some small holders will mot seli at the prices they quoted several days ago. If the country trade responds to the advance sbrcad with any marked increase in orders. the leading holder will likely mark | quotations up “Raisins are quiet. but few 40-50s. Sale of a car of Cali- | fornie 3-crown loose svas reported at Sic. | Coast advices reported that the seventy-five of 4-crown loose, reduced several days | 20 3%e f. o. b. California, have been dis- posed of to mince-meat men. “Apples are firmer and more ective. Sales of several cars of prime were reported at 5%c Chope and waste show much more activity | also, The lower prices here have attracted attention_on the other side, and sales of a | considerabie number of cars have been made 2 quotations. Weather Report. (120th Meridian—Pacific Time.) SAN FRANCISCO, May 3—5 p. m. The following are the seasonal rainfalls to e, as compared with those of the same date . and rainfall in the last twe | Lest | This | Last STATIONS. |24 Hours| Season. | Season. Eureka 47.97 Red Bluff.. 21.97 18.10 18.10 Fresno ........ s | Ind=pendence 344 | n Luis Obispo. 16.00 Angele: 6.10 444 San Diego. i an Francisco data—Maximum temperature, | : minimum, 46; mean, 50. | WEATHER AND GENERALJ pressure has risen slightly during the! past twenty-four hours over the country be- iween the Sierra and the Rocky Mountains There bas been a slight fall along the coast from Cape Mendocino northward. Warmer weather prevails in the valleys of California and over Nevada. It still continues cool r Utah. Unusually heavy rains are reported from Salt Lake City, over three inches having fallen from the storm thus far. No 2 len in California. Francisco for thirty May 4. 1901 California—Fair Saturday, with fog ; light yortherly winds in the | vesterly winds on the coast. e outhern California—Fair Saturday; warmer; at mortherly winds. Nevada—Fair Saturday; light ‘mortherly winds. Utah—Clearing Saturday, much warmer; light light north wind. | inity—Fair Saturday; with fog. ALEXANDER G. McADIE, Forecast Officlal. EASTERN MARKETS. New York Stock Market. NEW YORK, May 3.—This afternoon’s set- beck in prices was the most violent which has occurred since the present bull speculation set { n. It was absolutely without cause in news | of anything that would do harm to intrinsic | vaiues of securities,” commerce and industry. | A flurry in the money rate coming on over- | extended speculative accounts indicates the whole situation in a nutshell. It is charac- teristic of a boom that it should continue un- abated to the very teeth of such a situation, with every preliminary warning, but pushing onward untii the actual event forci! checked | the advance. The danger has been obvious that the speculation was overrunning the bounds of reason and safety. The buying was admittedly without motive or information be- yond the hope and belief that there Jwould be enough future buyeis to lift prices to a higher plane and so offer profits. There were excepti leaders, in which there were plausible theories and reperts of buying to change control. But in these also the horde of speculators who | have tailed on precipitately to each movement of this kind for several weeks past was a wvery large element in the buying. Increasing trepidation has been felt among commission brokers and lenders of money who assume re- sponsibility for speculative buyers that many of this class were stretching their resources wunduly, dependent as they are on the main- tenance of the prices of securities to kcop their credit good As a consequence thcre has been increasing pressure from commission houses upon their customers to take their prafits and lighten their load. But the buy- ing demand has been constantly reinforced by neweomers and the inroads upon the market exténded. The preliminary figures of to-mor- row's bhnk statement made it clear that only @ weak showing can be hoped for from that statement, and the bankers began calling Joans to recuperate their poeition. “The call 10aD rate ran up to 7 per cent, and the speculators began to manifest acute dis- trese as they found themselves forced o look | ebout for mew accommodations. The extreme | sensitiveness of the situation was made mani- fest in the violence of the reaction by what really was 2 moderate hardening in the money rate. The delicacy of the situation was en- hanced by the furious speculation this morn. ing in Atchison, St. Paul, Rock island, Baiti- more and Ohfo, Missouri Pacific 2nd a number of stocks influenccd by these movements. Ad- | vances of 3% to T5% had resulted during the | morning among these stocks, St. Paul being | particularly buoyant. When the pressure came upon the market these stocks were naturally among thore which were most acutely affected by the selling. Enormous blocks were un- | Jorded on the decline at successive drops of hsalf to a point to many points decline. The @rop in Atchison reacued $%; St. Paul, 9% | Rock Island, 8%; Northern Pacific, Balti- more & Ohio, T; Union Pacific. 7%; Missour Pacific. %; New York Central, 6; Tllinois Cen- | tral, 5; Wabash preferred. 5%; Kansas and Texas preferred, 4%; Atchison preferred, 4; @ large number of other siocks points. The bears | to the sub-Treasury, ably 164,200 46,100 131,000 3500 in the case of the great market | closing was feverish and unsettled and the | undertone continued weak. The preitmi; I BOSTON STOCKS AND BONDS. Money— West End . Call loans Westinghouse Time loans nds— |, Btocks— N _E Gas&Coke 5 IA T&SF. $2% | Mining Shares— !AT&SF p 0433 [Adventure . 17% | Am Sugar prefc | Dominion Coal Small Hopes. Standard Bell Telephone. Boston & Alban Boston Elevated Boston & Maine. Dom Coal prefd. Fitchburg prefd. General Electric, Ed Blec Iil... Bich Telephione.'. @2 |quincy . E Gas ‘oke. 1145 ‘o) 2 Ol Colomy .. oro1210 IR amarack oorre Old Dominion. . 83% Utah Mining. Rubber 2234 Winona :. Union Pacific 123" | Wolverines Bank Clearings. NEW YORK, May 3.—The following table, compiled by Bradstreet, shows the bank clear- ings at principal citles for the week ended May 3, with the percentage:of increase and decrease, as compared with the corresponding week last year: |—Per cent-— ry figures of to-morrow’'s bank | statement indicate a gain in interior move- | the extent of the disturbances Bonds gave way Total sales, $5,7 NEW YORK STOCK LIST. Shares Sold. Stocks— Atchison Atchison prefd Baltimore & Ohio. Baltimore & Ohio prefd. adlan Pacific nada Southern esapeake & Ohio. Chicago Burlington & Quincy. Chicago Ind & Louisville... Chicago Ind & Louisville prefd. icago & Eastern Illinois Chicago & Northwestern . ago Rock Island & Pacific. Chicago Terminal & T... Chicago Terminal & T prefd Chicago & Alton.... Chicago & Alton prefd. Great Western. Great Western prefd A. Great Western prefd B. C C C & St Louis Colorado Southern . Colorado Southern 1st prefd Colorado Southern 2d prefd.. Delaware & Hudson .... Delaware Lack & Western Denver & Rio Grande.... Denver & Rio Grande prefd 600 60, 21,500 e 2 s Great Northern prefd Hocking Valley ... Hocking Valley prefd. Tilinois Central - Iowa Central . Towa Central prefd. Lake Erie & Western. Lake Erle & Western prefd. Louisville & Nashville. Manhattan L.. Metropolitan Street Railway. Mexican Central . Mexican National Minneapolis & St Louis. Missouri Pacific. Missouri Kansas & Texas. ouri Kansas & Texas prefd. w Jersey Central . 43,200 New York Central 9.3% Norfolk & Western . 500 Norfolk & Western prefd 500 Northern Pacific ... orthern Pacific prefd. Ontario & Western. Pennsylvania. ex-di PCC & St L. Reading . “Reading 1st prefd. Reading 24 prefd. St Louis & San Francisco. St Louis & San Fran 1st vrefd. Louis & San Fran 2d prefd. Louis Southwestern ... St Louis Southwestern prefd. t Paul . Wisconsin Central Wisconsin Central ' prefd:. Express Companies— Adams .. American United States Wells Fargo Miscellaneous— Amalgamated Copper American Car & F. American Cer & F American ‘American ‘American American American Tobacco Anaconda Mining Brooklyn Rapid Tran: Linseed prefd. Smelting & Rel 2 Smelting & Ref pref Continental Tobacco Continental Tobacco prefd. General Electric Glucose Sugar Hocking Coal International Power international Paver International Paper Laclede Gas ... National Biscult National Lead Natfonal Salt . National Salt prefd. North American Pacific Coast Pacific Mail . People’s Gas Pressed Steel Car. Pressed Steel Car prefd Pullman Palace Car. Republic Tron & Steel Republic Tron & Steel prefd. SOar s Tennessee Coal & Tron. Union Bag & P.... Union Bag & P prefd. United States Leather. United States Leather prefd. United States United States United States nited States Western Unon .. Dist of Col 2.65s...125 Atchison gen 4s...102% Atchison adi 4s.... 9 Canada So 2ds.....108% Ches & Ohio 44s..105% Ches & Ohio 5. C & con 7s...140% C & NWSFdeb 35.121% Chgo Terminal ds. 94% Colo Southern 4s... 8§ D &R G és... Erie General 4s. F W & D C 1sts Gen Electric 5s.. Wis Cent 1sts. Va Centuries. in Closing ment of less than $2,000,000 to offset the loss | which was reduced in to-day’s statement by the payment of Govern- | ment checks and bond redemptions to 4,715,000, ut money market to-day indicates that the avail- ' able surplus of the banks had been consider- impaired by the- great demand of the | stock market speculation as well as by this | indicated loss in cash of nearly $3,000,000. The easier tone of the steriing exchange followed naturaily from the sharp demand for | money, and there was no further engagement | | of sold for export to-morrow. in sympathy with stocks, but there was no great activity in the generai st 000, United States 3s and 5s_declined % and the | new 4s and refunding 2 %, and do coupon % ! per cent on the last call. the market { i | i Bid. A DT0% .58 | L6 | .108 | o | 543 51% | xR Bl £ Paul prefd . uthern Pacific . B4l Southern Rafiway . Dy Southern Railway prefd. s sy ! Texas & Paclil sk | Tol St L & W. L 18% | Tol St L & W prefd. voese 36% Union Pacific .... -122% Union Pacific prefd 8%z Wabash - it Wabash pretd D a0 Wheeling & Lake Erie L8 Wheeling & Lake Erie 24 prefd..... 34 120 | 12% | 104 | sk 3 76% | “146% | ST CITIES. Clearings. | Inc. | Dec. New York. $2,238,478,739 | 93.2 Boston . 167,060,743 | 17.7 Chicago .. 160,912,228 14.2 Philadelphia 116,435,876 16.5 St. Louls 43,632,615 | 37.9 Pittsburg 48,848,668 | 39.3 Baltimore . 25,204,889 | ... San Francisco. 25190,717 | 17.1 Cincinnati 19¢125,700 | 21.4 Kansas City. 17,045,048 9.1 New Orleans 10,438,254 | 240 Minneapolis 10,045,775 % Detroit .. 9,189,616 | 9.9 Cleveland . 12,553,317 | 26.2 Louisville . 9,544,265 7.4 Providence 7,488,100 6.6 ;leyuul‘;ee 6,035,407 . St. Paul 5,791,246 | 1314 Buffalo 5,531,204 | 13.4 Omaha 6,606,672 | 9.7 Indianapolis 6,391,259 14.4 Columbus, O. 6,902,500 | 49.7 Youngstown, . 995 35.0 Savannah . 3, e Denver 3, b Hartford 2, 10.2 Richmond - 4,716, 194.0 Memphs . 2563,334 | 1.3 Washington 3,051 241 Peoria . 2,516,209 | 11,7 Rochester . 2, 7.4 New Haven LE%5,685 | 117 Wondester 1, 7 28.9 Atlanta . 1557 237 Salt Lake City. 2,781,640 15.6 Springfield, Mast 1488753 | 5.1 Fort Worth 2,312,048 [ 2.2 Portland, Me 24 Portland, Or. 18:3 St. Joseph. 13.1 Los Angeles 59.5 Norfolk 13.9 Syracuse 44 Des_Moines A Nashville . Wilmington, Del X Fall River. 74 % Scranton 1,601,718 | 3. Grand Rapids. 178047 | 10, Augusta, 6 3 Lowell 5 Dayton, O. =3 Seattle 2,123,891 L7 Tacoma . 1,186,961 | 187 Bpakang . 15,148 | ..., oux C 1,509,954 | 16 | New Bedford. 14,3 Knoxville, Tenn. 1.4 Topeka. .. 1.9 Birmingham 8.1 Wichita ... 6.7 Binghamton ¥ Lexington, Ky X 7.2 Jacksonville, Fla.. 241,995 . Kalamazoo - 404152 |- ‘419 Akron . 585,300 | 41.0 Chattanooga 4221155 | 2.9 Rockford, 111 304,062 | 300 Canton, O.. 340,000 | 3504 Springfield, O. 264,804 sses Fargo, N. D. 248,950 1.7 Sioux Falls, 8. D. 201,270 | 717 Fremont, Neb. 164,858 | 426 Daverport . $3.450 | 8.4 Toledo . 2,191,193 9 Galveston . 7. 5 | where."” | street this support vanished suddenly and a | from 178%@188@185. Union Pacifies were heavy | Northern Pacific perferred, 102}; Grand Trunk, | mercantile paper, 3%@4% per cent. 24 Houston . P Little Rocl i 2.1 Macon . 8 Helera . 434168 | 1.8 Jacksonvilie, Til. 185,185 | 12.0 Bloomington 224424 | 251 Chester, Pa. Wheelinig Colorado Springs Springfleld, 11 Evansville .. Totals, 3,033,409,578 - bo 794,931,139 DOMINION OF CANADA. U. e Totals outside New| York . CITIES. Clearings. Mcntreal Toronto Winnipeg Halifax Hamilton St. John, N. B, Varcouver. Victoria . Totals .. London Market. NEW YORK, May 3.—The Commercial Ad- vertiser's London financlal cablegram says: The activity and cheerfulness which have prevailed in the market here for some time were continued to-day. In the words of the brokers, ‘‘Americans were first, the rest no- Indeed, in this department the trad- ing was nothing less than frantic from start to finish. The oscillation of prices was of the most violent character, heavy waves of profit-taking being succeeded by equal heavy buying movements. New York took a hand in making the mad secsaw swing, but in the sharp collapse ensued. During the day on the board Atchisons | spurted from §7% to 92%, finishing in the street at £3%. Baltimore and Ohio went from | 113% to 116%; Chicago, Milwaukee and St. Paul all day at about 130%, slumping in the street to 126. The market opinion here is that Eries, Readings and Southerns are the only railway stocks left to take in hand. Steel shares re- lapsed on profit-taking. They were dealt in to-day o Amsterdam for the first time. Grand Trunks were buoyant. Call money and bills were steady. CLOSING. LONDON, May 3.—Atchison, 91%: Canadian Pacific, 102%; Union Pacific preferred, 100343 12%; Anaconda, 10%; United States Steel, 54%; preferred, 103%. Bar silver, strong, Money, 3% per cent. New York Money Market. NEW YORK, May 3.—Money on call firm, at 3@7 per cent; last loan, 6; ruling rate, 6. Prime Sterling ex- change, easler, with actual business in bank- ers’ biils at $488 for demand and at $4 84%@ 434% for sixty days. Posted rates, $4 855@$ 86 and $4 89. Commercial bills, $4 84@4 84%. Sil- ver certificates, 6lc. Bar silver, 59%c. Mexican dollars, 48%c. Government bonds, weak; State, firm; raflroad, weak. - Condition of the Treasury. %4 per ounce. WASHINGTON, May 3.—To-day's statement of the treasury balances In-the general, fund shows: Available cash | balance, $156,534,954; Eold, 397,374,690, —_— e Bradstreet's Financial Review. NEW YORK, May 3.—Bradstreet's Financial Review to-morrow will say: All records of activity have again been broken at the New York Stock Bxchange, the total transactions having been at the rate of nearly 3,000,000 shares per day all week, and on Tuesday the aggregate reached the limit of 2,400,000 shares. Remarkable advances have accompanied the intense activity and the pub- lic has been buying stocks in a way that is only seen at times of great speculative ex- citement.” That there is a great deal of mani- | pulation cannot be doubted, and to all appear- ances f{urther rallway deals of far reaching importance are in preparation. 1t is, how- eyt ko panlicia ol e ot sl Bh vancing figures whicl mainly responsi for the existing state of affairs. To some extent the demonstrations which have taken place this week would the idea that the culmination of the movement is to bear this out. At the same time the de- clines bad the appearance of constituting what Is termed a healthy reaction. Though it is customary for Wall street to argue that a Loom like the present one will not t, there seems In this case to be an absence.of posi- tively unfavorable factors, The street and the market certainly disregarded the gold ship- ments, which for this week amounted to $3,- 750,000, and which point to the probability of an’ unfavorable bank statement. Fully $30,- 000,000 of the new British consols have been awarded to this country, and a considerable amount of gold will undoubtedly be required. It may be noted that the London market is taking great interest in the boom here, and bas, in fact, shared in it to the extent of buy- ing considerable amounts of United States Steel stocks. [ el R ) B ) SHCA R Bradstreet’s on Trade. l RS N SRR A A LA S LS AT £ NEW YORK, May 3.—Bradstreet's to-mor- row will say: The sanguine feeling as to trade and speculation finds reflection in the enormous activity and stock speculation, which has attracted much money from the usual commercil channels and expanded clearings to unheard of totals. ‘Warm, sunny weather is helping retail trade in the cities and is likewise affording the farmers favorable opportunity to complete crop planting. General business, the country over, must be classed as satisfactory. The iron and steel trades, though reporting some- what of a lull in the cruder forms, continue to furnish the best reports, while the textile industries return the least favorable accounts. Wool is qulet, mills buying only to fill im- mediate wants.' There {s more movement at the West and on the Pacific Coast, however. London prices are higher for finer merino grades and lower for cross-breds. The crop situation at present 1s quite encour- aging. Warm, sunny weather is helping corn and ‘cotton and wheat maintains a generally &ood_condition, notwithstanding reports of dam- age by insects in the Southwest. Grain plant- ing is almost finished in the Northwest, and liberal rains in Californa have helped the situation theere. Iron trade production naturally appears to be catching up with demands in the cruder forms. Bessemer pigiron is 25 cents lower this week and sales have been made of Southern Pi§ 50 cents below the asking price of some weeks ago, although _Birmingham reports schedules aflhered to. Other metals are quite steady, except as to tin, which is slightly lower ‘on the week. Wheat, including flour, shipments for the Week aggregate 5,100,763 'bushels, against 4,- 282,120 bushels last week, 4,687,088 bushels fn the corresponding week of 1900, 3,484,051 bush- els in 1899 and 2,923,775 in 198 From July 1 to date this season wheat ex- gon- are 176,916,238 bushels against 166,035,802 ushels last season, and 201,198,463 in 1§95-99. Fallures for the week number 163, as com- pared with 214 last week, 173 in this week a year ago, 164 in 1599 and 340 in 188, Canadian failures in April numbered 103. the same num- ber-as a vear ago, but labiilties aggregated Only §790,385, a decrease of 20 per cent from —_— % Dun’s Review of Trade. o el ORI L 8 SO S NEW YORK, May 3—R. G. Dun & Co’s Weekly Review of Trade to-morrow will say: The greatest activity ever seen in Wall strest diverts attention in a measure from progress in distributing and manufacturing operations. But while on every hand stock market interests are counseling caution and attempting to yrove that prices are really more than the condition of some of our rail- roads warrant, the fact remains that, without a_brilllant crop outlook and a great activity of general trade, Wall street could hold no such carnival. Labor difficulties are fewer and less threatening than for several years before in the first week of May and prices of merchandise hold well. Stabllity of prices and vigorous prosecution of work at milis indicate the wholeeome po- sition of the iron and steel market. Through- cut the entire range of products of this in- dustry the current demand for immediate de- livery exceeds all previous records, yet makers maintain a conservative position and prices are not pushed up to the danger point. It is in the finishing steel plants that there is the greatest urgency for shipments and full ca- pacity is assured for the next thres months. After July there is a prospect of respite. Judging by the light engagements of pigiron and following the unparaileled activity of the past six months, a season of comparative quiet would not be surprising nor unwelcome. There was a rush to get in orders for steel rails before the higher prices became effective, and the erection of new office buildings provides a great demand for structural material, which is also In considerable request on foreign con- tracts. Dullness is still reported in the textlles. A further reduction to 215-15 cents for standard print ecloths did not accelerate sales, as buyers appear confident that goods will soon be available at 2e. d There is no improvements in woolens and Coates Brothers' average of 100 quotations of wool on May 1 was 17.7lc, against 11.99c on April 1, and 22.76c a year ago. Small conces- sions are reported in a few grades of shoes. Western jobbers are ordering more freely and shipments from Eastern shops are larger than in the previous week or a vear ago. Leather is_quiet, .aside from activity in belting. Further advances were scored in the cereal market, Chicago epeculators being forced to cover May corn contracts at 5ic. Attractive prices brought more liheral receipts at interior cities and also stimulated operations on the farm. traders having forced the next erop options to what seems an unreasonable level, since there is evidence of g large yield, de- spite delayed planting through excessive mois- ture. ‘Wheat also attained a high point, advancing in sympathy with corn. According to corre- spondents of R. G. Dun & Co. there is reason to expect a heavy spring wheat crop this In the principal States a full acreage vear. bas been planted and the weather is_most favorable for germination. On the Pacific Coast and in other domestic spring wheat sec- tions, as well as in Manitoba, a larger area than usual is devoted to raising wheat this year. The marvelously healthy condition of Lusi- ness is best appreciated when it is discovered that the defaults last month were the small- est in ninety-one months, with the exception of May to August, 1899, inclusive. In manu- facturing lines there were but 163 failures, with a total indebtedness of §1997,694, against 178 last year for $4,514,603. As 1399 reported the smallest failures of anv year in two decades, last month’s good showing is made manifest by default in manufacturing concerns 377,975 smaller_than two years ago. Trading failures were 555, for $3,169,823, and banking defaults were $529,000. 2 New York Grain and Produce. NEW YORK, May 3.—FLOUR—Receipts, 13,- 390 barréls; exports, 11,640 barrels. Unsettled and lower to sell. WHEATRecelpts, 33,250 bushels; exports, bushels. Spot, firm; No. 2 red, 84%c f. o. T afloat: No. 2 red, 81%oc elevator; No. 1 North- | ern Duluth, 88%c f. o. b. afloat; No. 1 hard Du- luth, 92%c 1. o. b. afipat. Options, after opening firm and active on cables and a jump in corn, turned weak, de- | clining under active liquidation, improved crop late break in corn and bear pounding. Closea weak, 14@%c net decline. May, SUAG &2, closed 8like; July, 79 1-16@80%c. closed T9%c; September, 71%@7st%e, closed T7%c. HOPS—Quiet. WOOL—Quiet. SUGAR—Raw, strong; fair refining, 3%@ 313-18¢; centrifugal, 95 test, #3c. Molasses su- ", 8%%@3 9-16c. b, R EBpot Rlo, dull; No. 7 fnvolce, 6%e: mild, market dull; Cordova, 84@i2c. Futures closed quiet, net 10 points Jower. Sales in- cluded: June, 5.40c; August, 5.60c; September, 5.60@5.65; October, 5.70c; December, 5.85@5.90c; March 6.05c. SHOPIEE: Buayy 4300. Firm; creamery, 15 19c; factory, 11@18%ec. EGGS—Receipts, 13,348 kages. Steady; Western regular ' packed, 1214@13%c; storage, DRIED FRUITS. 13%@14c; Southern, 11@12c. NEW YORK, May 3.—Trading in the mar- ket for evaporated apples was confined ciiefly to meeting immediate requirements. State common, 3@ic; prime, 4%@4%c; choice, 5@3%c; fancy, G@bc. A California dried fruits unchanged at 34@7c per_pound for prunes, as to size and quality. APRICOTS—Royal, 7%@I12c; Moorpark, S4@ 13¢. z PEACHES—Peeled, 12%@20c; unpeeled, 6%@ 10c. Chicago Grain Market. CHICAGO, May 8.—The wild course of prices for May corn had lttle to do with gen- eral market conditions. Its manipulated con- dition was more than ever apparent. The July delivery was comparatively as placid as a summer sea, but it was at least an index to corn values when all the product in sight is ot in the hands of one man. But the May op- tion was the center of attraction. Shorts were panic stricken and bid the market up mn tre- mendous léaps from Soc to Géc at the opening to ffc compared with yesterday’'s close at idic. Phillips, wWho controls the market, sold 00,000 bushels to shorts between G6c and 58c. Tail- ing longs, fearing that their leader was about o unload, dumped thefr lincs into the pit and the market broke to 5dc before it was realized that Fhillips was not vet prepared to loose his hold. He sold nothing under Gic, at least not openly, and the market reacted and closed her at oo%c. July opened strong and en- Jjoyed a general demand for a time, but liberal realizing caused a decline. Part of this' was recovered later in anticipation of wet weather ‘West. July closed a shade higher at 4i%c. The wheat trade was fairly active, but the strensth with which the market staried under the influence of light 'Argentine shipments and firm cables fail to nold. July opened %c to 3¢ higher at T4%c to 743%c under a heavy local demand. Southwestern pecple, apparently con- Diced Tt ccop Ing e Kl tutare who bought earlier or during the past few days. The bears joined in the movement and asa result the market slumped to T2%@73c and closed weak, 5@%c lower, at T3%@T3%c. Oats were active, but seemed to be more in- clined to sympathize with other grains than to follow an independent course. May closed ¥c lower at 20¢; July closed ¥%c lower, at 26%cC. Provisions cpened steady, -but declined on liberal offerings, mcstly In the way of realiz- ing. ) July pork closed 27%c lower, lard 10c¢ down and ribs Tl down. The leading futures ranged as follows: Articles— Wheat No. 2— Open. High. Low. Close. % T 2 ) T4% % 73 % a1 4T 1% 4T% 46 4% 20 2% 2% B M 2% 2% 26% 5% R Bh D% Mess Pork, per bbl— 15221 152214 14 9Tl 14 97% 15 30 15 02% 15 07%2 g00 800 7% 79% May .. s12% 812% July T92% 792% September . T87% 790 Cash aquotations were as follows: Flour, mod- erate; No. 3 spring wheat, 7114@73c; No. 2 red, 73@74%c; No. 2 corn, E44@sbe; No. 2 yellow, B5c; No. 2 oats, 20@29%c; No. 2 white, 26%e; No. 3 white, 28@28: No. 2 rye, 53%@54c; good feed- ing barley, 51@Sic; fair to choice malting, 56@ 59¢; No. 1 flax seed, §168%; No. 1 Northwestern, $1685; prime timothy seed, $275@3 25; mess pork, per bbl, $15@15 15; lard, per 100 lbs, $8 62% @8 73; short-rib sides (loose), $3@8 20; dry salted shoulders (boxed), 67@7%c; short clear sides i?«ged), 8 25@8 37; whisky, basis of high wines, Rye, bushels . Barley, bushels On the Produce Exchange to-dav the butter market was dull; creameries, 14g19c; dairy, 11 @16c. Cheese, 9%@llc. Eggs, 1lic. Foreign Futures. LIVERPOOL. ‘Wheat— May. July, Sept. 511l b1y 5 1% s u% May. July-Aug. L1910 198 Closing L9 199 Flour— Opening 2 05 24 95 Closing 242 %1 Chicago Livestock Market. CHICAGO, May 3.—CATTLE—Recelpts, 1500. Generally steady. Good to prime steers, $5@ § 90; poor to medium, $3 95@4 90; stockers and feeders, strong, $3@5; cows, $2 65@4 50; heifers, $2 0G4 75; canners, $2@2 65; bulls, $2 %5@3 40; calves, $3 50@5 12%; Texas fed steers, $1 2@ Texas grass steers, $3 50G4; Texas bulls, HOGS—Recelpts _to-day, 15,000; _to-morrow, 16,000; estimated left over, 3500. Strong to 5¢ higher. Top, $ 97%. Mixed and _butchers’, $5 65615 9; good to choice heavy, $5 S0@5 973%: rough heavy, $5 65 75; light, $ 60@5 90; buik of_sales, $5 S0@5 90. SHEEP—Receipts, 5000. Sheep and lambs, steady ‘to slow, clipped lambs up to $4 6. | Good ta choice wethers, $4 2094 10: falr to choice mixed, $4@4 25; Western sheep, $t 20@ 450; Texas sheep, $4 25@4 50; native lambs, $4 20@5 25; Western lambs, $4 50@5 25. New York Metal Market. NEW YORK, May 3.—Copper in-London con- tinues its upward course, prices to-day advanc- ing 12s €4 and being attributed to a good de- mand for that metal from America and a bet- ter outlcok in statistics. The close here was quiet, nominally unchanged, at $17 for Lake and $16 621 for casting. There was a slight gain in the price of tin locally In sympathy with a rise of 10s abroad, the latter sald to be due to a speculative movement, but trading in both markets was slow. The close was quiet, at $25 %@25 05. Lead was without change either here or abroad. Pigiron warrants, unchanged. New York Cotton Market, NEW YORK, May 3.—Cotton declined to-day to nearly the level reached in March, July sell- irg off to 7.78c and the other near months pro- portionately. By midday a net decline of 6@11 points was apparent. The close was nervous but steady, with prices net 2@13 polnts lower. California Fruit Sales. CHICAGO, May 3.—Porter Bros. Co. sold the first car of cherrles in Chicago at the following prices to-day. Tartarlans, $1 4@ | 210; Chapmans, $1 70@2 20; Advance, $1 %@ P. Guignes, §1(5@1 89; Rockports, 75c@ : Marbrae, ' §105; Belle' de Orleans, 70c; Black Heart, $135. 740 packages sold. London Wool Market. LONDON, May 3.—The offerings at the wool aucticn sales to-day numbered 14,180 baies, half of which were crossbreds. The demand continued good. Home buvers increased their purchases while the Continent bought a small quantity of the best grades. Fine merinos were taken by America, some flne halred Dbringing 5 per cent higher rates, Portland’s Business. PORTLAND, 3.—Clearings, $334,622 balarces, $57,587. Northern Wheat Market. May OREGON. PORTLAND, May 3.—WHEAT—Walla Walla, €0c. WASHINGTON. TACOMA, May 3.—WHEAT—Quiet and un- changed; Bluestem, 60%c; Club, &c. - Foreign Markets. LONDON, May 3.—Consols, 9 13-16. Sflver, 27%d. French rentes, 101f 60@101f 85c. Cargoes on passage, quiet and steady; cargoes No. 1 Standard California, 30s; cargoes Walla Walla, 29s 10%d; English country markets, firm. LIVERPOOL, May 3.—WHEAT—Firm; No. 1 Standard California, 6s 21.d@6és _3d; wheat In Paris, firm; flour in Paris, firm; French country markets, quiet and steady; weather in England, fine. COTTON—Upland, 4 7-16d. CLOSING. LIVERPOOL, May -WHEAT—Spot, firm; No. 2 red Western, 6s; No. 1 Northern spring, 8s 1%d; No. 1 California, 6s 2d. Futures, steady; July, 58 11%d; September, 5s 11%d. CORN—Spot, quiet; American mixed new and old, 4s 9%d. Futures,” quiet; May, nominal; July, 4s 1%d; September, 4s %d. el L LOCAL MARKETS. " Exchange and Bullion. The Nippon Maru took out a treasure list of $168,706, consisting of $2519 in Mexican dollars, $1053 in gold coin and §165,134 in silver bullion. Sliver was higher. » Sterling Exchange, 60 days: 3438 Sterling Exchange, sight. 48 Sterling Cables . 4% New Fork Exchange, sighi 2% Neiw York Exchange, telegraphio 15 Silver, per ounce. — 59% Mexican Dollars, nominal L 1% @ 5 Wheat and Other Grains. WHBAT—Liverpool and Paris futures were higher. Chicago opened firmer on better foreign ad- vices, but the demand Wwas moderate. Forty thousand bushels were sold to Germany. Crop advices on Oats were somewhat unfavorable. Argentine shipments for the week were 920,000 bushels, against 2,556,000 for the same weex last year. Later on in the session the market broke. Rain was predicted in the West and Southwest, and St. Louis started in to sell heavily, throwing a good deal of- Wheat on the market. _Another bearish factor was Snow's report, showing a condition of 914 per cent for the whole Wheat area, and 100 for this suggesting a winter wheat crop of large size. The market dropped from Taic to 73c. Minneapolis estimated a decrease of stocks for the week of 450,000 bushels. not matertally This market was dull and changed. Spot Wheat—Shipping, §101%; milling, $1 03% % CALL BOARD SALES. Informal Session—9:15 o’clock—] 18,000 otls, $1 0534 2000, §1 05%: 2000, ST 0%, ‘Second Session—December—4000 ctls, $1 05%; 06%. O a™ Morning Session—May—2000 ctls, P titnoon _ Session—December—24,000 . ctls, $105%; 2000, $1 05%. ‘BARLEY—The market has worked around very firm_again, and quotations have made another advance. Stocks are so light that the bearish effect of the rain has completely dis- appeared. The demand is good, but holders are disinclined to sell. % *'Feed, s0c for No. 1 and Tiie for oft grades; Brewing and Shipping grades, 82%@Silc; Chev- alier, nominal. % CALL BOARD SALES. _ Informal w mNo ‘Bales. Session—9:15 o’clock—December— Regular Morning Session—No sales. ; mMumom Se-ln.fll—m‘ ber—2000 ctls, %0 OATSDu changed. White, §1 STH@ = hmmrlif“mnm;eu Red, $1 32%01 6: ack, $1 11ea1 5 COHN AT inds ate quoted at §130 per ctl. RYE—S0GS2%c per ctl. BUCKWHEAT—Is quoted at $1 65 per ctl, ex- warehouse. Flour and Millstuffs. FLOUR—California Family Extras, $3 40@3 &, usual terms; Bakers' Extras, $3 30@3 40; Ore- gon, §2 50@2 75 per barrel for family and $2 5@ 3 for bakers'; Washington bakers’, §3 75G3. MILLSTUFFS—Prices in_sacks are as fol- lows, usual discount to_the trade: Graham Flour, §3 per 100 Ibs; Rye Flour, §2 7; K. Meal,’ $250; Rice Flour, §7; Corn Meal, 3275 extra cream do, §3 50; Oat Groats, $4 50; Hom: iny, 33 50@3 75; Buckwheat Flour, 4 25 Cracked Wheat, $350; Farina, $4350 Wheat Flour, §3 25; Rolled Oats (barrels), $6 10 @7 60;_in sacks, $5 75@7 25; Pearl Barley, 3 Split Peas, $; Green Peas, $ 50 per 100 Ibs. Hay and Feedstuffs. Hay 1s rather steadier under lighter receipts and a good demand, but prices are unchanged. Feedstuffs stand as before. BRAN—$16 50@17 per ton. DDLINGS—3$16 50@19 50 per ton. PR STUR P Relted Biriey. 31@18 per ton; Ollcake Meal at the mill, $25@26; jobbing, 326 50; Cocoanut Cake, $17@18; Corn Meal, £26 ésoorl; Cracked Corn, $2@3S; Mixed Feed, $15G16. HAY—Volunteer, $5@8; Wheat, $11§13; Wheat and Oat, $9@12; Oat. $9g11 50; Clover, nominal; Alfalfa,"$3@9 50; Barley, §7 5099 50 per tom. STRAW—35@4T%c per bale. Beans and Seeds. Thers are no further changes in the Bean market. White kinds are quoted very firm. BEANS—Bayos, §2 50@2 70; Small White, $4 85 mhm ‘White, $4@4 20; Pink, $1 60@1 $5; $3@3 25; Blackeye, §2 75@3; Limas, $6 25 @6 50; Pea, nominal; Red Kidney, $4 50 per otlL SEEDS—Brown Mustard, nominal; Yellow Mustard, nominal; Flax, $2 50@3; Canary, 3% 3%c for Eastern; Alfalfa, nominal; Rape, 2%c; Hemp, 3ic; Timothy, §%c. DRIED PEAS—Niles, $2G2 30; Green, $2 0@ 3 per ctl; Blackeye, nominal. Potatoes, Onions and Vegetables. River Potatoes have again advanced, selling at the top figure. FEarly Rose are now being taken .for table use, owing to the scarcity in the other kinds. Oregon desecriptions show no further changes worthy of note. Australian Onions are jobbing at a further advance, while new red are slightly lower. Vegetables are about the same. String Beans are weak snd deciining under increasing re- celpts. Receipts were 709 boxes Asparagus, 534 boxes Rhubarb, 1694 sacks Bay Peas, 170 sacks String Beans and 736 sacks New Potatoes. POTATOES—Early Rose, 75c@$l; Burbanks, $1G1 40 for River and $150@1 70 for Oregon: Garnet Chiles, $150; Sweets, 65@T5¢ for Merced; New Potatoes, 2@2%c per Ib. ONIONS—Cut Onions, 50c@$125 per Australians, jobbing, at’ $4 @t5c_per box; New Red, 51509175 per sack. VEGETABLES—Rhubarb, 30c@$150 per bo: Asparagus, §185@2 for fancy, $1 25@1 75 per box for No. 1 and T5¢@s$1 for No. 2; Green Peas, Sic @$1 25 per sack; Garden Peas, 2c per Ib; String Beans, 5@sc for Los Angeles and 5@10c for Va- caville; Horse Beans, 40@6sc per sack; Cabbage. 90c@$1 per ctl; Tomatoes, Mexican, $1 25@1 50 per crate; from Los Angeles, §1 %5@1 Dried Peppers, 12@18c; Dry Okra, 15¢ per 1b; Carrots, 2%@le per sac) othouse Cucumbers, 4)@0c per dozen: Garlic, 10@15c per Ib: Green Peppers, 12%@15c per 1b; Egg Plant, 20c per Ib. Poultry and Game. sacl Green Ontons, 30 There was little change In Poultry yesterday, good stock selling off well at about the prices of the preceding day. POULTRY—Live Turkeys, 9@11c for Gobblers and 11@13c for Hens; Geese, per pair, $1 35@1 50; Goslings, $225@250; Ducks, $#@5 for old and $550@650 for young; Hens, $4@550; young Roosters, $7@8; old Roosters, $4@4 50; Fryers, $5 50@6 50: Broilers, $4 50@5 for large and 32 5@ 350 for small; Pigeons, $125@1 7 per dozen for old and $15032 60 for Squabs. GAME—Hare, $1@1 %: Rabbits, $150 for Cot- tontail and 75c@$: for Brush. Butter, Cheese and Eggs. The situation in Butter remains about the same. If anything, stocks are larger again, and would be excessive were it not for the packing and storing of the surplus. Quotations show no change. Cheese is weak with free receipts. The weakness in Eggs continues, and the tendency of the market s downward. There are 00 many here for the demand at the mo- ment. Receipts were 54,600 pounds and 117 tubs of Butter, 1548 cases Eggs, — cases Eastern Eggs, 23,300 pounds California Cheese and — pounds Eastern Cheese. OPEN MARKET QUOTATIONS. BUTTER—Creamery, 17@17%c per Ib for fancy and 16%c for seconds: dairy, 14@l6c per Ib. CHEESE—Choice mlld, new, 10@10%c; old, 9@9%c per Ib. EGGS—Ranch, 15@16c for good to fancy; store, 13@14%c per dozen. DAIRY EXCHANGE QUOTATIONS. BUTTER— Creamery—Extras, 17c; firsts, 16c; seconds, Dairy—FExtras, 16c; firsts, 15¢; seconds —; store, 12%ec. CHEESE—Fancy, full _cream, 9¢; cholce, $lic; common, nominal; Young Americas, 10%c; Eastern, full cream, 14@l6éc per 1b. EGGS— California Ranch—Selected White, 15¢; mixed colors, 1c per dozen. California Gathered—Selected, 13%c; standard, 13¢c; eeconds, —. Deciduous and Citrus Fruits. Receipts of Cherrles continue to Increase and the market continues to decline. Most of the arrivals are cracked by the rain. Strawberries have again declined, and are coming in muddy. fl Five cars of Oranges were auctioned, as fol- lows: Fancy Navels, §1@190; choice do, S5c@ $150; standard do, 65c@$110; Mediterranean Sweets, 55c@$1 15. Limes are quiet and easy, with liberal sup- plies, and the same may be said of Lemons. The Orange market s moderately supplied end eady. The first Currants of the season came In from Sam Rogers, San Leandro. selling at $2 50 per box. Only one box came in. DECIDUOUS FRUITS— CHERRIES—Receipts were 1500 boxes, selling at 50c@$1 per box for red and 75c@$1 25 for dark. STRAWBERRIES—$6@9 per chest for Long- worths and §3 50@6 for large berries. Receipts UITS—Navel Oranges, Seedlings, T5c@$l; Tangerines, Tic@sl 25: Lem. ons, 75c@$125 for common and $1 50@2 50 for g00d to cholce; Grape Frult, 50c@s1 50; Mexican Limes, $50; Bananas, $125@250 per bunch for New Orleans and $12%@2 for Honolulu; Pineapples, §1350@4 per dozen. Dried Fruits, Nuts and Raisins. Previous prices rule. There is a continued demand for Apples, Apricots and Peaches at firm quotations. Prures are very firm in the East, with expectations of an advance, as will be seen in the first column. Seeded Raisins continue to meet with & good demand. FRUITS — Apricots, _5@7%c for Royals: Evaporated Apples, 4@6c: sun-dried, 1%@: Peaches, 3u@ic for standard, 4%@54c for cholce and 6@6lc _for fancy: Pears, 2@7e: Plums, pitted, 3%@5c; unpitted, 1@1%c; Nec- tarines. 4@#%c¢ for red and 4@5¢ for white. PRUNES— sizes, 3c; 40-50s, c; 50-60s, 60-708, 3%c; 70-80s, 3e; $0-30s, 2%c; 90-100s, 2e; 1001208, 1%e. RAISINS—The Ralsin Growers' Assoclation has established the following prices: Bleached Thompson’s fancy, 12 per 1b; choice, Iies standard, 10c; prime, Sc; unbleached Thomp- B B otce. Siaos. sandards Paa: pebiie 1o B2 1b; cholce, 9%c; ; prime. S¢: un- bleached Sultanas, Sc; Seed - 6le; d-crown, 7¢; Pacific brand—2- 4-crown, z nc Tondon Layers, 2-crown, $130 per s crown, $1 60; Fancy Clustérs, §2; Dehesa, $2 50: Imperial, $3. All prices f. o. b. at common shippiug points in California. NUTS—Walnuts, No. 1 softshell, 10@1lc; No. 3, T%@sc; No. 1 hardshell. 1oc; No. 32, g@ic: S Tmonds, %x.{cc for papershell, 10@11c for sofc. shell_and for hardshell; s, Sgpte for Eastern: Brazil Nuts, 11@1ilc: Fiibecrs toc:; Pecans, 11@13c: Cocoanuts. $3 505 ONEY—Comb, 13%@4c for brizht and 13 13 for light amber: water White extracied: G Tighe smber extracted, S@se; Sern 1 6c_per 1b. "BEESW. box. The market continues quiet at previous CURED MEATS — Bacon, 12 per 1b for } Mess, $19; Smoked Beef, g compou; or- pure; FBazrel pure, 10c: 10-1b tins, ke o-ib n:"..'nm4 ¥ . COTTOLENE—One _half-barrel, $%c; ihree ‘half- $%c: one tierce, $e: two tierces, th’cflu $%c per Hides, Tallow, Wool and Hops. $%c_per Ib for Salted Kip, %c; Salted Veal, Sc: Saiteg Calf, 10e; Dry Hi Culls, 13%@ide; Dry Kip, 16c; Dry Calf, : Culls and Brands, idc; Sheepskins, - shearlings, 15@2%c each; ool, 30@45c each; medium, 89@Te; lon Short N oe1 cach: Horse Hides. sait, 32 50 for large and $2@2 25 for medium, $1@1 25 for small and sbe for Colts; Horse Hides, dry, 3175 for Jarge, $125 for mediunt, $1 for small and 5o for Colts. Deerskins—Summer or skins, 330: fall or medium skins, 3jc; winter or thin skins, 20c. Goatskins—Prime Angoras, Tic; large and smooth, 50c; medium, 5. TALLOW-No, 1 z,x:ndend. 4#3e per Ib; No. 2, pic; grease, C. 061 Spring, 1900 or 1901—Humboldt and Mendocino, 15@1c per 1b: Northern, free, 129 13c; defective, 9@llc: Middle County, free. 16g do, defective, 3@l0c; Southern, i2 months, $@9c: Southern, free, 7 months, T@10c; do, de- feetive, 7 months, 7@Sc; Oregon Valley, fine, 15 @lée; do, medium and coarse, U@l5c: Oregon, Fastern, choice, 12@l4e; do, fair to good, I@lic; Nevada, 10G12 HOPS—15G20c per I General Merchandise. BAGS—San Quentin Bags, $565; Calcutta Grain Bags, To; local make, ¢ less than Cal~ cuttas; Wool Bags, 30@3¢; Fleece Twine, T%@Se. COAL—Wellington, $9_per ton: Southfield Wellington, 39; Seattle, $7; Bryant, 3650: Co.s Bay, $550; Wallsend, $9; Co-operative Walls- end, $9; Cumberland, $12 In bulk and $132% in Pennsylvania Anthracite Egs, 314; Can- nel, §i0 per ton: Coke, $15 per ton in bulk and $17 in sacks: Rocky Mountain _descriptions, $8 45 per 2000 pounds and 38 30 per tom, accord- ing to brand. = Harrison’s circular says: “During the week there have been seven coal arrivals from Was ington, 15,406 tons, two from Oregon, 1430 ton: one from British Columbia, 3100 tons; five fro Australia, 13,612 tons; total, 33,548 foms. The above are the largest weekly deliveries we have had for some time, although there has been but one cargo from British Columbia. The coal shipments for last month were 30 per cent less than April of last year, showing conclustveiy that fuel oil is asserting itself very pro- nouncedly. Prices are well sustained for the moment, although a number of our heaviest coal consumers have been contracting for ofl as thelr future fuel. This conclusion has been ar- rived at after critical calculations, and to in- suve the receipt of their full requirements they have purchased all they may need for the next one or two years from responsible venders. Th selling price leaves a very meager margin for profit. after deducting pipe line charges and fransportation. In fact, as the business is now regulated the consumer occuples a much more preferable position than the well owner. Some radical modifications must be ina: or ofl prosvecting will markedly diminish, except in such localities where the product can reach a market by water, instead of by rail. The late Very seasonable ratnfall should improve outward grain freights, and tend to depress inward coal freights from Australian and English ports. OTLS—California Castor Ofl, in cases, No. 1, 75c; pure, $130; Linseed Ofl, in barrels, bolled, T5c: raw, 73c: cases, Sc more; Lard Ofl, extra winter strained, barrels, 80c; cases. S5c: China Nut, G5@65c per gallon; pure Neatsfoot Ofl. bar- §5c; cases, Tc; Sperm, pure, 85c; Whale Oil.” natural white, $7%@42c per gallon; Fish Ofl,_in barrels, 3ic; case: 3 COAL OILWater White Coal Ofl, in bulk, 13c; Pearl Ofl, in cases, 1%c; Astral. 1Sc: Star, 18c; Extra Star, 2c: Elaine, 24c; Eocenme. Ilo; deodorized stove Gasoline, In bulk, 15¢; in cases, 21c; Benzine, in bulk, ldc; in cases, 20c: 86-de- gree Gasoline, in bulk, 20; in cases, 2. TURPENTINE$ic per gallon in’cases and 49¢ in drums or iron barrels. SUGAR-Prices are higher. The Western Sugar Refining Company quotes, per Ib, in 100~ %c; Powdered, 5.85¢; Candy Gran- Dry Granulated, 5.750; Confec- tioners’ A, 5.75c: Frult Granulated, 5.30c; Mag- nolfa A, 5.35c; Extra C, 5.%¢; Golden C, 5.15¢; barrels, 10c more; half-barrels, 25c more; boxes, 50c more; 50-1b bags, 10c more. No orders taken for less than 75 barrels or its equivalent. Dom-~ inos, half-barrels, 6.50c; boxes, 8.75c per Ib. San Francisco Meat Market. Hogs are a fraction lower, as the local pack- ers say that they are filling their wants at §l4c. Other meats are unchanged. BEEF—7@Sc for Steers and 6g7c per Ib for cows. VEAL—Large, 7@Sc; small, $@%c per Ib. MUTTON—Waethers, 308%c: Ewen. 7480 pev pound. | LAMB—Spring. 9@%%c per pound. PORK—Live Hogs, 180 Ibs and under, 6%e; 180 to 225 Ibs, 6%@6%ec: 225 and over, 6@6%ec; feeders, —; dressed Hogs, 313@9%ec. Receipts of Produce. FOR FRIDAY, MAY 8. Flogr, ar sks ... Z.080|Lime. bbls =3 eat, ctls 10,450 Tallow, ctls . =8 Barley, ctld ..... 4,100|Sugar, ctis 20 Potatoes, sks .... 3,260 Peits, bdls . m Ontons, 'sks 457|Hides, No. - m Bran, sks . 941 |Raisins, bxs .[l0 1500 Middiings, “sk: 200| Leather, rolls .. 19 Hay, tons 235/ Wine, gals 60,209 Wool, bales fllflsnmiy. gals Broomcorn, bdls. I Family Retail Market. — Butter, Cheese and Eggs are about as quoted last week, though Eggs are in large supply and declining in the wholesale markets. Meats and Poultry are about as before. Fruits and Vesetables are showing the ef- fects of the recent rain, as the Cherries are coming in eracked and the Strawberries and some of the more delicate Vegetables are sandy and gritty. This will wear off in a few days. however. 'Prices for Cherrias are lower. Cannel Southfleld Wellington. ——@11 00| Wellington o Seattle ..... 900@—-/Coos Bay. 50 pairy Produce, e utter, choice, ch Eggs, Do, good %5@30| dozen . e Cheese, Cal 12@15| Honey Comb, per Cheese, Eastern..17@2| pound .... Cheese, Swiss. 5| Do, extracted. 12 20@835 Common Esgs....15@17 Poultry and Game— Hens, each 3065 Young Roosters, each ... 014 Roosters, ea Fryers, each . Broilers, each. Meats, per 1b— each...51 Pigeon: ir | Rabbits: pair Hare, each .. Bacon . Rou: eal Beet, choice '\’SIYI:I(!!: g‘!nk, Do, good Fruits and Nuts— Almonds 5¢ Apples Bananas, \;!:monl. oz ... spberries, bskt.. .. i2%@% | Raisine, per Tb. . Blackberries, bsk.—@25 Strawberries, per Cherries, per 1b...15@30| drawer . Oranges, doz_....15@35 Walnu 1. Limes, per doz..12@15| s Vegetables— o Asparague, per Ib. 8t Artichokes, doz. 'M Cfl# {: Beets, doz .. 10@— | Potatoes, per Ib Beans, white, 1b.1214@—| New, do Colored. pér 1b..10@—| Rhubarb, per 5. Sg Dried Lima, Ib.. 8@ § Sweet Potatoes, b 3@— Cabbage, each.... 5@— Parsnips, per dz.10G— Caulifiowers, each 5@— Radishes,dz bchs. 15@20 Celery, head ..... 50— Sage, doz bnchs..2%5@30 Cress, doz bnchs.15@20 String Beans, 1b..10915 Cucumbers,dz.35c@S1 2 Summer Squash Egz Plant, Ib. per I .... Green Peas, Ib 5 Sprouts, per 1b. Lettuce, per doz..15@20|Spinach, Onions, per Ib. i New Onions 10g% Whitensii . . 50— Clams, galion ... 50@— .15@—| Do, hardshell, Ib $@10 12%4@15 Crabs, each ......15G20 15@40 | Mussels, quart.... 5@10 —83‘—’0!81«!. €al, 100..40@50 10| Do, Eastern, dz.25@40 STOCK_MARKET. The sugar stocks Continued the center of interest on the morning session of the Bond Exchange. All were off except Hutchinson, which recovered from $19 to 320. Honokaa was lower at 326 50@25, Paauhau, $21@2; Kilauea, §16 0@15 50, and Hawaiian, $3G50. and Electric was lower at 36 7. There was a steadier feeling b stocks In the afternoon, the only exceptioay being Hawafian, which deciined to $51, and Hutchinson, which fell back to $18 75. Gas and Electric was still lower at 33§ 121G 620, There was nothing new in the oil stocks. ex- cept a sharp decline In Petrol in_the afternoon. e The following bond Interest has recentl; PUR R of ca ; ",..,,, e 8. P. of ifornia, i guaranteed gold Ss. 1907, $EAGI0 pag e May L (dison Light and Power erly, § per cent (1921). 39345, pavable May & United States 3s, 3 -g,m‘,s .m( L Tegular quarterly, o dates 4 (new tasae Iy, $1.823,158, “payable May 3. T duarter- North Pacific Coast R. R. Co. Co.. regular quar-