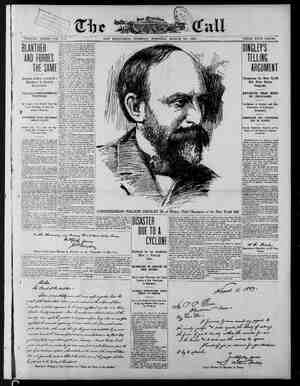

The San Francisco Call. Newspaper, March 23, 1897, Page 2

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

1897 MARCH 23, succeeding fiscal year would resch $220,- 000,000; but this” expectation was bl sied when auticipated tariff legislation that would Jargely reduce duties began to defer tmporta- and subsequently to disorganize indus- In the light of this course of events and in the face of the chrouic deficiency requiring im- diate relief, the Commitiee of Ways end Means has reported the pending bill to_revise the tariff for the ends indicated by the titie, 10 wit, 10 provide additiona! revenue to carry n the Government, and at the same time, in josting the duties, to encourage the in- dustries of the Uniied States. Ia this re- vision the committee has endeavored to dis- card mere theory, aud has addressed them- of a pracucal remedy, part, for the ilis which have months overshadowed the country. It is itior anA not a theory which conironts us.” - Our problem is to pro- vide adequsie revenue from duties on imports 1o carry on the Government, snd in imposing dutles to secure this resuit to so adjust them 85 10 secure 10 Our owh people the productio and_manufacture of such articies as we cun produce or make for ourselves without natural agisadvartage. and thus provide abundant op- portunities for our labor. For rest assured ihat no cconomic policy will prove u success unless it shall in some manuer contribute (0 opening up employment to the masses of our people ot +0od wagzes. When this shall be ac- complished and thus the purchasing powe: of tbe Masscs restored, then, and not until the:, wiil prices cease {0 he depressing in fluencs of under-consumption, and the pros- of our people Tise 10 tne standard of selves to the {ramin in at least for so The past four years have been enlighten- ing. especially to candid investigators ot economic pr We have been attending rgarten on & gigantic scale. The tuition has come high, but no people ever learned <o much 1 £o brief & time. Here siter theories, preached in however capti- wge, will have to give away to the xrerience. as been -the favorite assumption of ieorists that revenue and_vrotection in the seme tariff sehedule are impossible, but we neve h the past seven years in the con- trasted wor of the protective wool and woolens sehedn similiar non-protective schedtie tariff o1 1894, & mos: striking Jemonstra otherw of the n portations of clothing wool in 1893, 01 1890, was about 40,000,000 he manufactures of wool about ainiy goods worn by the well- it the thing willing to_puy the Frop these imporia- Govern- 44,500,000, € wool in the fiscal ),000 pounds—t -and of manufac- tures of wool m vice as many pounds in 1896 as in 1893, aud vet the revenues de- the Government from this enormous the imp and woo'ens ar 1896 was only $22,000,000— $21,000,000 from t alized i . In other words, by the piacing of wool on the ist and riducing the duties on manufactures ot the treasury $21,000,000 of revenue, our farmers lost 3 marke: 80,000,000 pounds of wool which t n 1 excess of what 1l as nearly 10 ving a loss w0 00 per annum alread product, and our manufac- their workingmen losta market for the g0ods which increased for- had supolanted, but &iso a mar- t for goods which the farmers and masses of ble to purchase in 1893, but d not buy in 1896, because of a loss of employment and purchasing power. Beyond this it has been demou.Strated that by piecing wool on the free list to the injury of and the manufacturer. we Lave not been thereby enabled to increase our ex- ports of wool (s § revorted would be the case), and we have greatly increased the use ot thoddy by diminishing the purchasing power of the masses and thus compelling them to seek the cheapest clothes. 1r 3t be claimed that t costof clothing to the obvious that it has donme ance ment deriv The impor year 1596 times as mu ved b not on eign impor has reduced the ople, the reply is 50 only in appear- because in point of fact the mas: prived of work and wages by that which has given foreign manuiscturers the making of solargea part of our goods, have found § harder to buy their clothing than they did be- ofiting by Mexns Committ is experience, the Ways and e, iu_framivg the pending ol from the free list, where Iy placed by tie present iariff, ed it 10 the dutiable listat the same retes as it bore in the tariff of 1890, and have also restored the same compensatory du- ses on manuiactures of wool &s were provided by that act in order to place the manufacturer of wool on the same basis as to his competitor as was given by the latier aci—a system always Decessary in order 10 provide a market for the domestic wool. Tothis has been atded in & partly specific form duties practically equivalent 1o the ad valorem duties imposed by the tariff of 1590 and 1894 as s protection to the woo! manufacturer This, it is believed. will greatl grower, stop th aud presently regain what we have lost in the ast four y nd uitimately resultin the home production of near.y ail the clothing Wool that we require. It will aiso greatiy courage the wool-manufseturing indus: tariff of 1894. At the same time we will ulti- mateiy increase the revenuc from duties on wool and woolens not less then $25,000,000 per annom. The duty on sugar has also been increased, both for purposes of revenue and slso to en- courage the production of suger 1 the United States, and thus give to our farmers a new and much needed crop. We now pay foreign coun- tries about §$34,000,000 for imporied sugar, notwithstanding the sbnormelly low price and this sum will s00n be increased 1o $100,- 000,000. “The success which has attended the growing of sugar beets and the production of beet sugar in Celifornia and Nebrasks in the past four years, not to men:ion the progress in the production of cane sugar in Louisiana, has made the problem of producing our own sugar no louger doubtful, and now that we must bave the increased révenue irom sugsr for the aid the wool- Y fes \ have suffered o severeiy under the present, a favorable resents 115 boon 10 our agriculinre. azar proposed is specific ac- ari-copic test of the degree of saccharine matter, commencing at 1 cent per pound for sugar po'arized not mors than 75 degrees and incressing the duty .03 of & ceut for each sdditional degree. This would make the duty o raw | sugar of the same polariscopic test 25 refined sugar (100 degrees) 13 cents. To this is added one-eighth of 1céut lor such sugar sbove number 16, Dutch siandard, in color (refined sugar), making the duty 1.873¢ cents. This eighth, with whatever may be added by the countervailing duty on ail sugar imporied {rom export pounty paying coun- tries, is_the protectio ch it is believed will maintain the refining industry here (not- withstai ding the present differential one. eighth and a 40 per cent all round duty is double that proposed). Tiis wiil be the only differentiel between and refined sugar, for if the refiner used sugar of less stceharine strength than 100, as he must, it reqnires portionaily more of such sugar to m: pound of refined sugar. An increase has been made in the duty on flax and hemp, &s well as jute and menufec- tures thereof, to practically the same as that borne by cotton goods, both to incresse the revenue for the time béing and ultimately to develop the linen manufacture here. From the evidence before the comunitiee, we are yersuaded that the time has come for & grad- ual development of both flax culture and flax manufaciure in this country, which has been possible oniy to & limiied extent on coarse articies under lewer duties. Specimens of g00ds made from Minnesota flax are exhibited which seem 10 give promise of & new develop- ment in this direction. For the most part, otherwise, the increase of duties in the vending bill to the fizures of the tariif of 1890 has been in the schedules or par- agraphs covering articles like tobacco, liquors, silks, lnces, etc., which, belng artic: untary consumytion, are always regarded us objects which will bear the birhest duties. Tae exceptiors are tke edrthenware and ginss schedules, the egricultural schedule, on which the duties have been placed the same as in the act of 1890, because no other raies seem o be ective. The iron and steel schedule, except as to some advanced products, have nut changed from the present law, because this schedule seems to be one of he two of the present law which are differentiated trom most of the others and made in the main pro- tective. Thus, iron ore, pigiron, siecl, stract- ural iron and most other forms of common iron ard steel remain in the pending bill as fixed in the tariff oi 1894. [in plate, whose manufacture was so suc- cessiuily established under the iariff of 1890 by the duty of 2 1-5 cents, has been inereased from .he 11-5 cents duty of the present law to 1% cents, whica 1 js believed wili prove as protective us the higher rate of 1890, as the esiablisnment of the industry has been suc- cesslul. In ail other schedules the rates proposed in the pending bill are between the T tariff of 1890 and the present lay. There have been transferred from the fres Jist of the tArifl of 1894 to the dutiable iist of the proposed bill not only wool, lumber, salt, burlaps, bags, cotton bags and cotton ties, wuich should never have been made mnon- dutiable, but also argols, crude cpium, asphal- tum, chickle, puintings and statuary, straw orngments, eic., which, under existing condi- tious, oughit to_contribute something toward the mucl-needed additional revenue. So far as possible, thewim has béen to avoid exclusively ad valorem duties on ariieles waich have been notoriously undervalued and thus failed to pay tne duties intended—a loss of revenue which has been more serions than ever—and the pre-ent tariff, i whien, outside of the metal and cotton schedule, al- most exclusive ad valorsm rates prevali, e | o fariff of 1890 and of | e further depletion of our flocks | o1 vol- | been | | better_class of importers hiave united with the | manufacturers and administrators of the law |in asking for this piece goods in the silk | schedule, and some embroideries have for the | firs: time been given exelusively specific rates, | & desiderstum wiich was eafuestly recom: | mended by both Secretaries Manning and Fairchild severai years 8go. |~ 'In many cases where exclusively ad valorem | duties are impracticable, because of the varied | character of goods, compound duties have ‘ been devised which so minimize the ad val- | orem feature as to take away & large part of the inducement to undervalue. While it is dif- ! ficult 10 compere the rates of a tariff almosten- tirely ad,valorem with & bill whose rates are 50 lurgely specitic as the pending measure. yet the fact that very few duties in this bill are higher than those of the act uf 1890 and nearly all outside of the few schedules re- | ferred to are lower and that two important schedules sre for the most part the same as the duties of the present law, clearly show that the actual average rates of the propesed bill are low: han those of the tariff of 1803 some higher than of the present {ariff—nol- withstanding the average percentum ad val- orem duty under the pendiug bill on the present reduced prices, will appear to be bigher thun the preseut luw +nd a littie higher than that of the act of 1890. Per centum averages are always misleading when estimated on a changed basis. Thus a duty 0f 50 per cent impesed upon an imported article valued at 60 cents abroad and 90 cents here, making 30 cents difference of cost of production, becomes a duiy of 60 per cent when the foreign and domestic cost are each reduced 10 cents, but the duty is siill 30 cents. ferent specific or compound duties Iines ot value always give a rich opportunity for juggling with the percent- ages. For example, 1f & duty of 75 cents is i1a- posed on an article ¥alued betweeu §1 and 3 on the same kind of aricle valued %2, and so on for higher lines, then the unsound critic, shutting his eyes 10 the tact | that the imporier will adapt his goods 50 as to | fail slightiy below the lines erected, proceeds | to declare that a duty of over 70 ceuts been placed on an article vaiued at $1 05, | when as & matter of tact goods anywhere near in value will come in under that price, and cents duty will be on those valued at 50 that in point of fact the actual duty is less than 40 per cen 1t is because of tiese facts thatit has been found difficuit 10 so compare rates under two | taciffs of so different character by equivalent | ad valorems so as 10 make the comparison sai- | isfactory. | The average ad valorem of dutisble sched- | ules under the act ot 1890, on the basis of im- ports of 1893, wa< 4934 pes_cent, and with the lower price of 1896 1t would nave been at least 53 per cent, But thjs was with sugar on the free list and liquors 7 per cent less than in the oposed bill. 1t sugar aud liguors had borne me duties as under the wet of 1890 and es haa been #s low in 1893 as in 1896, the rage duty would have excceded 60 per cent under the nct of 1894 The average duty in 1896 was 40 per cent, but this was with sugar | atonly 40 per cent, and tobacco, liguors, laces and si ks considerably less than either in the | act of 1890 or the proposed bill. touestionsbly the average duty under the | act oi 1894, if sugar, tobacco, liquors, silks and iac-s had borne the same duty as in the proposed bill, would have rcached at least 47 per cent. The average duly under the pro- posed law, with the high duties on sugars and luxuries, is estimated by the experts at 55 per nt The report of the Committee on Ways and Meaus has set forth the fact that the pending | bill has not only restored the provisions of the | tariff of 1890 as to reciproeity, under which | our trade was so successfully enlarged, but | | the has extended that policy The inquiry naturally arises as to what will be the probsble annual revenue derived from the provosed tariff revision in case it should become law. The obly solid basis from which we can draw inferences is that suppied by the estimate of Mr. Evans, the statistician, who has made the comparative statement that, on the basis of the importations of the fisca year 1896, the pendiug bill enacted into law would yield increase of revenue of about $113,000,000, the details of whica are given in ihe report of the Committee of Ways aud Mesns. The committee estimstes, after mak- | ing liversl reductions, that for the first year, in case the bill should become & law by Mav 1, the additional revenue wouid reach $75,000,- 000, and that, for every week therealier, in | casé 1is passage should be deferred, thers would have to be & deduction of from one to two million dollrs for woul, sugar and other | articles on speculation to avoid the mereased duties. For the second year 1t is believed the orojosed bill would yieid $100,000,000 of in- creased revenue. 1t must be obvious from any point of yiew | that prompt action oy the two houses of Con- gress is indispensable lo secure the revenue | woieh the pending bill is intended :o yield. The exigency is an unusual ozie. The peopie, without regard to party afliliations, are asking for setion. ~ Business awalis our f With this great question of adequate revenue tocarry o7 the Government settled favorably by su justment of duties as will resiore our Wwhat nas been surrendered: to eopie | others during the past. four years, with | stored confidence in the future, there is ev. | reson. to believe that gradually and surel | there will come back to us the zreat prosperit which we enjoyed in the decade prior to 1393 and which the greatest of iving English stati- sticians so strikingly eulogized when he said, in 1892, toat “1t would'be impossible to find in history any paraliel to the progress of the United States in the (then) last ten years.” | Some applanse came from the Repubii- | can site when Dingley deciared that in the second year of the operation of the proposed law the revenue of the Govern- ment would. be increased by at least $100,- 000,000; the Government would be puc on its feet again and the interest-bearing debt would be reduced. Its effect for the first year would cepend largely upon whether it became a law by the 15t of May next. In conclusion he quoted from an Eng- lish authority 1o the effect that no coun- try on the fuce of the earih had ever wit- essed such unparalleled prosperity as ihe United States in the ten years preced- ing1892. With this quojation he took his | seat amid demonstrations of applanse. | Wheeier (D.) of Alabama, a member of | the Commiiiee on Wavs and Means, was | the first 10 oppose the bill. | “Hopkips (R.) of Lilinois, also & member | of the Committee on Ways and Means, | foliowed Wheeler. The Republican party, be saiy, was again in power, and had been | commisioned to enact legislation that | | would give confidence to capital, restore | prosperity to indusiries and to agricul- ture and give employment to labor. The bill now before the House is in accordance with the almost universal demand of the veople for taniff iegisiation. It was framed on principles that were purely Republican in character, and were designed to meet the wants ot the Government as well ag those of the people. until he had heur. tleman from Alabama (Wheeler) that no American beiieved in free trade. He had thought that even Democrats would ac- knowledge the uster failure of the Wilson | bill, and would recognize the importance | anil necessity of the proposed legislation. | But the argament of the gentieman from | Alabama only illustrated the truth of tne saying that the genuine Bourbon Deuo. crat rarely forgot any of the errors he had learned, or learned anything new. [Ap- | plause and Jaugnter ] A reference to ihe increase of American territory ercouraged Wheeler 1o come over to Horkins’ vicinity and ask him to which political party :hat increase was | due. The iuestion was countered by Hopkins, who told Wheeler that the Democratic party had done all that ft | could to take eieven States out of the | Union, Applause from the Republican | side proved now tne reply wus approved in that quarter, and Wheele: went back | to his seat without another word. Maguire (D.) of California_asked Mr. Hopkius how it was that the Republican party had bren “turned down so unmerci- fully in 1892 7 +It was,”;said Hopkins, “through the false pretenfes of the Democratic leaders ; but the peoyle realized their hollowness and their utier inability to lead or control their varty.” In the course of his speech the depre- ciation of livestock during the last four years of Democratic administration was referred to. Jerry Simpson (Pep.) of Kansas asked whether livestock had not been on the in- crease of late. Hopkins admitted that it bad been, bat said that it was owing to McKinley’s eiec- tion. He added that Irom the close of Mr. Harrison’s administration to the close of Mr. Cieveland’s the decrease in the value | of livestock wa- $164.000,000. | Kerr (R.) of Ouwo asked Hopkins whether i.e supposed tuat the allowance of one-cighth cent a pound on Cuban sugar wouid be regarded by the Spanish Government as sutlicient recipro ity for ger withdrawal of her duty on American our. Hopkins said that that was the opinion of those who had the best opportunities for forming a judement. . Bell (Pop.) of Colorado was the next speaker, his argument being in antagon- ism to the bill. ' Bell referred to the im- ul decision. | He had supposed | the speect: of the gen- | peius given tothe iron and steel industry 1 ! by the dissolution of the steel rail pool | showing a large demand for rails employ- ing thousands of workmen in their pr duction. This employment, he said, was | not due to McKinley’s election or to the prospect of areiormation of the tariff bill, but to the breaking of t e steel rail trust. Vhy not,” he said, “‘smash all the trusts and open the mills?”’ [Applause.] There could be no return of prosperity, Beli continued, until the mines o the si ver-producing States were opened. ‘The | Repnblican party, by its unfriendly legis- | lation upon silver, had killed the goose | that laid the golden egg. It was the de- | velopment of that country and the growth of those States that was the basis of pros- perity of the country from 1878 to 1890. It was the fight of the strong against the weak. Had the silver been in the moun- tains ot Pennsylvania and the iron in the Rocky Mountains it would have been the cry of demonetization of iron resoundiag throush the land. [Laughter and ap- plause.] | . At the conclusion of Bell's speech the | committee rose, and at 5 o'clock the | House, under the order of proceedings, took a recess until 8 o’clock. At the evening session of the House about 100 members were in their seats, while the galleries, as at all night sessions, were filled to overflowing. ’rTor (R.) of Indiana was the first | speaker in opposition to the bill, He de- voted some time to a criticism of the ma- jority for rushing through the House the lour appropriations last week, and turn- ing his attention to the tariff bill ridi- culed the free list. He was followed by.Green (R.)of Ne- braska, who made a general politcal speech around the question, “How are the people to buy the products of idle mills which are to be started by the Ding- ley bill when they cannot buy what tte mills now produce?”’ Toward the close of his speech Green was asked what relief he proposed for the farmers, in whose behalf he was attacking the tonstruction of the tariff bill. I will tell you,” was his response, fol- lowed by the derisive laughter from the Republican side. *“Go back to the use of the money of the constitution of which you have deprived them.” |Democratic applause.] “And Il tell you another thing you can do. You can keep your hands out of our pockets.” [Democratic applause.] A Repuolican asked: ‘“Whose hdndsare in your pockets?" “T'll tell you,” sharply responded Green. “The hands of the protected monopolies and trusts of the East arein them. [Dem- ocratic applause]. Prosperity wouid not return to the land, Green said, until plenty was restored to the home 'of the consumer, and that could be secured best, he said, as all nistory demonstrated, when the circulating medium was greatest among the people. The friends of silver wanted that restored to its old-time privi- leges and uses, and they proposed to have it. Then there would be protection to the, farmer, the wife, the miner, and the time would come when equal rights should be extended 1o all and special privileges to none. [Applause on the floor and in the gaileries.] | The last,speech of the evening was | made by Brucker (D.) of Michigan, who inve ghed against tue iniquity of 1hé pro- | posed increase in the duty on lamber. He | denounced any duty on lumber as an out- | rage. A110:30, haif an hour before the Jimit of the session, no one eise was desirons of | eddressing the House, whereupon the committee rose and the House adjourned until 10 o’clock to-niorrow. ————— EEPORT OF 1Hi& MINORITY. Democrats Claim the Bill Will Only In- erease the Zax. WASHINGTON, D. C., March 22.—The | views of the minority of the Committee on | Waysand Means on the tariff bill were | presented to the House this evening by | | Representative Bailey (D.) of Texas, the | |leader of the Democracy. It reads as | follows: This bilt was framed with the avowed pur- { pose of protecting the manufacturers of the | United Stutes against foreign competition and | it 15 perfectly obyious if it accomplishes that purpose it must result in compelling the con- umers of this country to pay more for their uufactured goods, and for this reason we | think it should not pass. We rest our opposition on the broad princt- ot t Congress was invested with the power of taxation &s & means of collecting from each eitizen his fair proportion toward the support of the Government, and that it is a gross per- | version of that sovereign power 0 emp oy it | as 2 means of ensbling favored classes to levy { unjust charges upon the great body of the people. We believe that after contribu dnghis | proper share toward the maintenance of the Government, every citizen of this Repubiic is | entitled to the fuii possession and enjoyment of ail he eceu honestly earn, end we deny the ght of Congress to make or enforce anv regue lation which requires one man to gi any | part of his honest earnings toward encoursg- | ing the enterprise or increasing the fortuue : of another, | 'No man, however blind he may be, would | defend & system of taxation under which the Government first coliected the mo ey and | niworward d.stributed 1t among its favorites. | I is true that the tariff act of 1590 ventured to this extent in dealing with the sugar- growers, but the disapproval of that policy was 80 overwhe miug and so bitier that the advocates have been furced 1o abaudon it, and they have not dared to incorpprate any pro- vision for & direct bounty in ihe present biil. | We are unabe, however, to perceive eny dif- | ference in principle betiveen a law which re- | quircs the Goverameut to coliect the money wnd distribute it among the protected indus- | tries and & law which enabies these iudustries | 10 coliect the money directly froma the people. | There may be some difference in the metnod of making the colleciion and in che cost of doiug 50, but theze is no diffrence whatever in | the principle involved. If the Government | has the right to levytaxes upon the peovie | tor the purpose of inducing men to establish unprofitable industrics or iudustries which | can only be made profitable by compelitig the consumers of the United States to pay exorb: 1ant prices for their products, then the boun: system is a more direct and less complex way of attaining that end,'and at least has the ad- | vantage of directness and simplicity. | _The majority of the committee seems to think that taxation can be made a blessing, and that the support of the Government, in- stead 0f being & burden UPon taxpuyers, can be made to enrich them. If thisopinion is well founded then all the struggles for free- dom which have revolved around the ques- tion of taxation have proc:eded upon a false theory, and the American colonists when they jdeterimned that they would no: submit to taxation without represeutation indulged a mistaken zeal for liberty. The patriotic re- solye of our forciathers not o use goods upon which Great Britain had 1aid an import duty was wrong if the argument the British im- porters were really paying the tax ovec which the American colonists went to War was rigot. There cannot be found in the wide range of economic literature an authority with the few and rare exceptions which only serve to em- | phasize tue genersl concurrence, who does | not treat taxatiou, direct or indirect, as @ bur- den; and when wé remember that s protective tariff not only col ects. more ior the Goyern- ment than _is needed for jts economical ad- ministration, but that it also enabies favored classes 10 collect more_than the Government itself, the injustice becomes 0 clear and 80 enormous that it would be a re- ficction upon the intelligence of the American people 10 suppose that it can-escape their swiit and deeisive. condemnation. Tt foliows as & matier of course that a bill based upon a vicious principle must be fu- jurions in its effects, and perhaps no effect couid be more pernicious than the extrava- gance which tae bill encourages. The tnbu- iated statement embraced in the commities Teport shows that the bil. is oue to ruise $113,- 000,000 more revenue than was Collecied in customs duriug the last fiscal year; .and vet, as is shown by the same report, ihe differ- ences between the Governments receipts and distursoments during that year was only $25,000,000. Itis well known that the im- poriaiions of last year were smaller than u-nal, owing to the general depression that existed in all circies; but even supposing thas the importations hereatier can be kept at & level with the mportations of 1896, the bill will collect from thie veople more than §90,- 000,000 annually above the requirements of our present extravagant and wasteful appro- printions. 1t may be, hcwever, that the majority should not bé arcaigned for their open en- couragement of extravagauce, because it can- rot be surprising thet gentgmen. who think that taxes are noi a burden should feel that money derived ircm luxation ought 10 be lavishiy spent. Nothing could beiter illus- trate the vice of the protective system than the fact that there flows from itas a direct cunsequence the habit of treating the cxpen- diture of public funds as a bevefit tather than a burden to the people. It would be cause enough for complaint if the burden were the only result of ihe extrayagance, bui in a freo tendencies It not oniy Government government extravagance breeds of the most pernicions character. teaches the people to 10k 10 th for the promotion of all kinds of enterprides, whether for pleasure or for profit, but it makes them. impatient againsi public ser- vaats who believe in economy and who be- leve that public moneys are & trast fund to be jeslously guarded. An overfl \wing treasury I8 a constant temp- tation to enter upon expenditures that co rupt both the public mind and the public's servauts. Under a system of higi _taxes there must be & surplus or there must be waste, and both sre serious evils. President Jackson hardly overstated the danger of a sur- Pius when hestat-d that it was more danger- ous than a standing army; and yet, dangerous a8 8 surplus is, it isnot 5o dangerous as the exiravagance which is always resorted to fn order to prevent ite accumulation. Itcannot be forzotten that many ol those Who nOW & vocate & high tariff and defend the extrava- gance whicn it engenders did not hesitate to denounce the ‘admin:stration of President Buchanan because in its last’year the appro- gmuom exceeded the sum of $60,000.000. ur population at thattime was nearly nalf oi what it je to-day, and if the Government was now properly and frueally adminisiered our expelises, including liberai pensions for the soldiers of the late war, ought not to and would not exceed the sum of $330,000,000. The friends ot the protective system_know that to keep the taxes high they must find some way of spending the money which iz collected. They periectly understand that they cannot resist the demand for a reduction of taxes if they permit their excessive collec- tions to accumu ate in the treasury, because they understand that the dullest msh knows that the Goverumen: is collecting 100 much when {t is coliecting more than it is spending. 1t is. therefore, the inevitable_consequence of collecting more than is proper that 1mproper ways should be devised to spend it. The ex- travagance which necessitates the billion dollar appropriations which have been such & scandal upon Congress hed its origin in the unjust sysiem of levying taxes for the pur- pose of enabling private intercsis 1o prey upon the public through the favoritism of the iaw. If the system of unnecessary taxation is in- defensible because of the extravagauce which it encourages it is still more so on account of the trusts which it fostersand promotes. Itis not more certain that protection encourages extravagance than it is that it breeds unlaw- ful combinations of capital. Indeed, protec- tion is justified upon the avowed theory that competition should be _restricted. True enourh, it assumes the patriotic pretense that forelgn competition ought not to be permitted against our home industries; but they little understand the selfishness of humsiv nature, and especielly they little understand the se! ishuess of that-human mature which relies upon the favoritism of the law to increase its fortune. Who supposes that these men, having secured themselves against foreign compe: tiou by the favor of Congress fail to secu themsélves against domestic competition by voluntary combinstions among themselves ? I is au old aduge,and it is as iruc as it 18 old, that “competition is the life of trade,” an: whatever tends 0 restrict competition must tend to restrict trsde. The majority of the committee seem to think it an easy matter for us to build up a teriff wall about our borders, and thus prevent the foreigners from trading with us, but they forget the same wall that shuts the foreigner out shuts us in, and that regulations to prevent the foreigner from trading with us must at the same time pravent us from trading with the foreiguer. We believe in the vrinciples of competition, and we believe the peovie of the United States can successfully comvete againsi all oiher people of the world; and we denounce as s crime against tho best interests of our people any law which leaves the consumers of this d subject to the exactions of reckless and corrupt combinations formed (o destroy com- petition and control the prices. The report of the Committee on Ways and Means is singularly silent upon the oid pre- text that these bigh (sXes are imposed for the beuefit of American labor,and the silence may be taken as concediug the Democratic contention that the fntelligence and skill of the American faclory operative are all the protection which he niceds or desires. The la- bor argument of the projectionist can be re- duced io an absurdity which makes it amazing that it should ever have been seriously ad- vanced. To say in oxe breath that the welfare of labor depends upon its wages and that its wages in turn depend upon its skill and in- telll ence, and, in the next breath t say ‘hat the very intellizentand highly skilied labo ers of this country cannot successfully com- veie with the ignoraat and unskilled laborers of the Old World, is equivalent io sayinz that skill aud intelligence are not of great advan- Tage to the iaborers who possess them, To our mind it involves a contradiction in history as well as {n economie theory, to hold that the factory laborer of & civiiized country needs profection against the factory laborer of an uncivilized country. The fact that the | 1lled labuters of & hall-civilized country live more cheaply than the illed laborers of a highly civilized country is more than coun- terbalanced by the greater productiveness ot the skilled and intelligent laborer. If this view of the question needed further support than the mere statement of it it can be found in those exceilent works which assert that the skiil and intelligence of the American laborer are such that he is able to produceseven times & much as the less skilled and less intelligent laborer of Continental Europe, and fifteen times as_much as toe ignorant and unskilled laborer of Asia. Surely it wiil be admitted that a productive capacity seven times as great as the one and fifteen limes as great as the other should be ull that the American laborer needs to pro- tect himself against the competition of Euro- pean drudges and Asiatic slaves. We are un- able to offer & substitate for the pending bill because we have notbeen allowed a reasonable time to prapare one. Congress convened in extraorainary ses ion on Monday, the 15th day of March, and his bill was introduced The same day aud referred to the Committes on Ways and Means which met the nextmorn- ing, aud on Thursday it was ordered to be re- yorted 10 the Hovse. The mujority of the committee had spent the three months of the lust session of the last Congress in the pre- varation of their bill,and yet they refused o nllow the minority (hree weeks in_which o prepare a substitute. We are unwilling to propose & measure that has not been carefully maiured, and we must therefore content our- selves with protesting against the passage of the commi.iee’s bill - ESTIMATED REVENUES. Detailed Matemens Made by the Ways and Mrane Committee, WASHINGTON, D. C., March 22.—The Ways and Méans Committee made public to-day a detailed statement showing the estimated revenue under the new meas- ure for each schedule, with the average ad valorem rates under the McKinley law, the present law and the pending bill: Dati:ble vaiue of merchadise tor the year 1693, $100.063,658; for 1896, $399.796, 161; estimated by proposed law, $497,540, 408 Revenue collected in 1893, $198,373,452; in 1896, $158,104598; estimated by pro- posed Iaw, $273,501,72L. Equivalent ad valorem under the law of 1893, 49.58 per cent; under the law of 1896, 30.94 per cent; under proposed law 57.03 per cent. et o SESS10N OF THE SENATE. Arbitra- Committee Amendments to tie tion Treaty Agreed To. WASHINGTON, D. C., March 22,—The legislative session of the Senate to-day lasted but forty minutes, the arbitration ireaty between the United States and Great Britain being taken up thereafter behind closed doors. In the short open session neariy 200 bills were introduced. Many others were reported back from committees. Included in the latter were the “free homesiead” bill and the immi- gration bill, with the provision as to Can. dian eliminated, both of which were un- der consideration in the last Congress, the latter failing to become law owing to Pres- ident Cleveland’s veto. The four great ap- propriation bills which als failed for lack of Mr. Cleveland’s signature, which were reintroduced and passed last week by the House, were referred 1o the Committee on Ap ropriations, he House joint_resolution was. passed extending until Decemter next the in- vestigation as 10 the use of alcobol in the arts by a joint commission of Coneress. A resolution was agreed to cailing upon the President for tie correspondence be tween this Government and Spain and between the State Department and Con- sul-General Lee in regerd to the arrest, imprisonment and death at Guanabacoa, Cuba, of Dr. Ruiz and inquiring what steps Liuve been taken in the matier. A similar request was denied by the late administration because of incompatibility with public interests. At 5:35 P. M. the Senate adjourned. The Senats in executive session sgread to all the committee ameudments to the arbitration troaty, but final action on that convention was not had. Pucifle Coast Fosial and Prusion Notes, WASHINGTON, D. C., March 22.—The postal service from Los Alamitos, Orange County, Cal, to Anaheim has been dis- continued, alo the service between Los Angeles and Port Los Angeles. Pensions have been issued as follows: California: Original—George W. Elderly, San Francisco; Lorenzo Dow Watson, San Jose; Frank McGovern, San Fran- cisco. » i Oregon: Oriemnal—Oliver M. Sawyer, Eugene; Jordan Fuqus, Willamina; Miles A. Holmes, Glendale. Washington: Increase — Abner Wise- man, Clyde; original widows, etc.—Bar- bara Tayior, Napavine. s S ol WEYLER AGAIN IN THE FIELD. And Now ths Usual Butcheries May Be Expected in Central and Eastern Cuba. HAVANA, Cusa, March 22.—Captain- General Weyler, accompanied by his staff, lett Havana on board the trangport steamer La Gaspi tnis afternoon. His destination is not krown. ENGLAND, Exc., March 22 —The Mad- rid correspondent of the Standard tele- graphs that Captain-General Weyler has | informed his Government that he is leav- ing Havana to resume his operations against the central and eastern parts of Cuba. A dispatch from Madrid to the Central News says that General Primo de Rivere, Coptain-General of Madrid, has been ap- pointed to succeed General Polavieja, Captain - General of 1he Philippine Islands, who is to be invited home. Gen- eral Polavieja is disgusted with the lack of support furnished him by the Govern- ment in his attempt to crush the rebeliion in thesiands.. The nomination of Gen- eral Rivera as his successor has created a big impression, as he is regarded as want- ing in energy. NEW YORK, N. Y., March 22.—A dis- patch to the Sun from Havanasays: Itis declared here in Spanish circles, upon the strength of private dispatches received from the United States, that the adminis- tration in Washington is preparing ior co-operation with the Spanish Minister, | Senor de Lome, some solution of the | Cuban question. - A mercantile firm of Havana has received a communication from its correspondent ut New York | which gives what the correspondent be- | lieves to be “reliable news” from Wesh- | ington. The news is that the plan which is be- ing considered by the American Govern- ment and the Spanish Minister is the old scheme of ending the war in Cuba vy in- demnity to be paid by tue island to Spain in exchange for the recognition of its in- dependence. It is added that in the opinion of some persons well acquainted in Washington with the Spanish Minister Spain under the Government of Senor Canovas is in- clined to offer mors liberal home rule to Cuba than tuat contained in the last de- cree of reforms, instead of accepting the plan of indemnity, which meaos the sale of the island, and which would produce a storm of opposition in Spain against the Cabinet. A great sensation has been created by a dispatch from Madrid in which it is said that Senor Sagasta, leader of the Spanish Liiberal party, bas declared that bhe is willing to accept office if the Queen Regent calls upon him to form a Cabinet, and that he is confident he can extricate Spain from the grave situation in which she is at present involved, justas he saved her from the tremendous difficulties‘that | environed her monarchy when the death of the late King Alfonso XII occurred. In the opinion of the more important persons here Senor Sagasta ratier than Senor Canovas is the nsan to accept the plan of the sale of Cuba to the Cubans. | The plan meets with the approval of all | thoughtful business men bhere, provided the United States would act in an inter- mediary capacity and guarantea the fulfiil- ment of the compromise of both sides. The insurgents are ready to accept it. All the reports from Sancti Spiritus con- tain terrible details about the conduct of the Spanish troops there. The city isina state of terror, and as it is inland and the Spanish columns swarm ail around it, there are no means of escape as there are at the seaports, where, when the barbar- ities of the troops begin, many of the peaceful residents take refuge abroad. S g | Three Fictims of a Freshet. ; LA CROSSE, Wis, March 22.—To-day | Bernard Koch, a farmer living in the val- | ley near here, hitcned up his horses and wth his wife and the latter's little | brocher, Jim Hermann, started for Leon, | Monroe County. Two mileseast of Ban- gor they came across a rapid freshet caused by rain and meiting snow. On driving in the current upset the wagon ani hrew the occupants into the water. All three were drowned. The bodies have been recovered i Jusmped From Wind.ws at a Fire. i LAWRENCE, Mass, March 22 — The | Gleason block was totally destroyed by fire early this morning. The adjacent | buildings also were damaged. Several per- | sons were badly injured by jumping from | windows, It was at first teared that sev- | eral lives were lost, but all_have been ac- | | accused “saved counted for except one. The total loss is $100.000. | BLANTHER AND FORBES THE SAME Continued from First Page. be tried, it is said, to sell a patent on a raised map, but the company discovered, itis saia, that he did not own the patent and refused to buy it. 7 This matter led to a dissgreement and Blanther resigned. He succeeded in sell- ing the patent to another firm, it is de- clared, and got into so much trouble over the matter that he soon alterward went to Canada.: , This is all that is known of his Chicago career. The murder of Mrs. Langleldt took place May 16, 1896. Shewas found in her room the morning of that day with her throat cat. Her jewelry was missing. Blanther was looked for by the police in connection with the crime, but they were unable to find him. It was learned that as J. A. Forbes he had purchased a ticket to El Paso, Texas, but there all trace of bim was lost. At the time of his arrest he was teach- ing school and stood well in the com- munity. < A CEIMINAL HEBLO. The Sherburn Bank Robber and Mur- derer Finds a Friend. MASON CITY, Iowa, March 22.—Lew Ke lihan, the Sherburn bank robber and murderer, will bs put on trial at Fair- mount, Minn., to-morrow. He is charged with shooting and killing George R. Thor- burn. cashier of the Bank of Sherburn. Ketlihan is willing to plead guilty and re- ceive a life sentence, but Gounty Attorney Voreis prefers to try the case on its merits. The Minnesota law makes any one who conspires to do an unlawful act from which the takiny of life results guilty of murder in the first degree and makes | hanging the penalty. H. G, McMillan of Rock Rapids is defending Kellihan. The the life of McMillan’s daughter a few years ago. She was skat- ing and broke through the ice, and would have perished had it not been for the bravery of youne Kellihan. ———— THREE ¢0OD BOXING BOUTS. Creedon Lands @ Knookout on a Col- orea Heary- Height. NEW YORK, N. Y., March 22.—The New Arena Athletic Club, Broadway and Forty-second street, celebrated its inaugu- ration to-night with three well-contested boxing bouts. There was a.large crowd present. The first preliminary bout w between Charlie Peeker of Newark, N. J. and Tom Carter of California, ten rounds at 138 pounds. Carter won in the sixth round. The second bout, between Jack Hanni- zan of Pittsburg and Joe Murphy of Prov- idence, 1en rounds at 122 pounds, resuited in Murphy getting the decision at the end of the sixth round. The chief attraction was a twenty-round bout between Dan Creedon of Australia and Charley “Strong (colored) of Newark at 165 vounds. In the fourth round, after fighting two minutes and eighteen sec- onds, Creedan hit Strong a terrible blow on the jaw, sending him to_the floor, where he remained until he was counted out. s Two Draws and a Dazer. PHILADELPHIA, Pa, March ‘Three good six-round’ bouts were puiled off to-night at the Arena. The opening bout was between Billy Springtield and Clarence Haldeman- of this city. The bout was stopped in the sixth round, as Springfield was vory weak and was going fast. Horace Leeds ot Atlantic City and Maurice Hagerstrom, the clever New York light weignt, were very. evenly ma:ched, and though both men were beginninz to show signs of wear at the end of the sixth round, the fight was fairly a draw. Tommy Wkite of Chicago, tke lad who stood George Dixon off for twenty ronnds, and George Holland of Philadelphis, also boxed six even rounds and neither was ;nutled to a decision at the end of the out, 29, LS g B Careon’s Colicium to Stand. CARSON, Nev, March 22—t was re- ported on the street this morning that Al Livingston, Dan Stuart’s agent, had re- ceived a letter from Stuart instructing nim to sell the lumber in_the big arena, as well as the chairs and other equip- ments. Livingston says the report was unirue, but he has been given tie power of attorney to use his judgment in all matters relating o Stuart’s interests in thir section, Stuart will return to Carson in May and will get up another carnivai of some kind to take place during Septem- ber or October. S D Racing at New Orleans. NEW ORLEANS, Ls., March 22—Six fur- longs, Pirate won, The Seuiptor second, Pat Morrissey third. Time, 1:19%. One and & sixteenth miles, Gomes won, Kenston second, Nobilis third. Time, 1:57. One mile and fwenty yarcs, Rob Roy I won, Jacx the Jew secoud, Al Mfies third. Time, 1:51. Seven furlongs, Irish Lady won, Albert S second, Orinfla third, Time,1:32, Six furiongs, Nasnie Lord won, Pert second, Oily Gamin thi'd. Time, 1:19, Seven iur ongs, Eikin won, Dawn second, Ollean third. Timne,1:343; £k A REAL SWEET-LOOKING GIRL, WITH FINE EYES AND HAIR AND TEETH and complexion, would look very bad indeed if her face was saddenly to become filled with pimples, or facial sores, or Sarsaparilla blood spots. Now the reason cheap sarsaparillas bring out the spots is because they contain mineral drugs. 8o you see how careful vou must be in buying. A real good sarsaparilla contains no minerals, is made from herbs, and can be used moderatly all the year. Sucha sarsaparilla is the bird rsaparilla—JOY’'S VEGETABLE SARSAPARILLA. Itis a appetite, fair dizestion, and sieep at night. #ood biood medicine, gives you a fine It is laxative. It is a remedy women take who are looking for tiie vim and energy, the brace and bounce of actual life. JOY’S VEGETABLE SARSAPARILLA brings roses to the cheeks. Druggists who substitute one medicine for another in compounding 8 prescrip- tion are also iikely to substitute the cheap for the good. They do it for money. Don’t let them substitute. A-k for and receive JOY'S VEGETABLE SARSAPA- RILLA, - MAN!" MAN! erious way. Are you going to wait until you have not one speck ‘of vitality Teft before you get those pains in the loins and the head stopped? Come, now, be-honest to yourself. You have got to face a condition and, besides those shaking hands and that sense of gloom and a weak and failing memory, you must see that those awful drains and losses are stopped atonce. You can be cured now; but who will say that you can be six months to come? No one can say s Why, MAN! MAN! How much longer will you dream? Awake and go or send to the ad- \dress given here and ask to be told @ll about ‘“Hudyan.” Not one moment should you lose. Get the free circulars and testimonials this day. Nocost toyou, and you get free advice, too, if you want it. ‘And, better than all, you can be icured in less than notime. Losses stoppedin lessthan notime. Come, the “sensible act” for once, and :you will find that you are yeta MAN! MAN! All cases of primary, secondary or tertiary blood diseases are un= failingly cured by the wondrous «30-Day Blood Cure.” No fear of failure. No; none. Hudson Medical Institute Stockton, Market and Ellis Ste. BAN FRANCISCO, CAL. Philadelphia Shoe Co, No. 10 Thiso Sr. STAMPED ON A SHOE MEANS STANDARD OF MERIT {21 0X-BLOOD 1S THE COLOR. BEY HERE. & §AVE MOSEY. STYLISH RED SHOES. | Lace Shoes are all the they look | neat and stylish aud can be fitted o any foot. 'Ihe Spring trade s about starting inand we are still blockaded by tie Cail buiiding and the o.d Nocleus We want some of that trude, and to get it we will sell cheaper than any retail shoe store in tmis city. This week Ox-Blood Sprinzneel Lace shovs for Ladies,- Misses and Chidren, trimmed with biack patent leather front stays, biack eyele s and Iac Child’s sizes, 8 to 1014 Misses’ sizes, 11 (o TAN SHOE WEAR WELL D0 NOT SHOW DUST 0% D.RT For one week only. Misses’ and Child- ren s Russet Leather Spring-heel Button Shoes. with square toes and Lips, sold at { || actuai cost. “cvery pair guarantewd. Child's sizes, § to 103 #100 Misses’ sizes, 1110 2... 125 AT~ Country orders soliclte1. A3 Send for New Lllusirazed Catalogs. address B. KATCHINSKI1, FHILADELPHIA SHOE cCo., 10 Third St., San Francisco. AUCTION'! THURSDAY. THURSDAY. MARCH 25, 189 At 12 3. at sa'esrooms, A. M. SPECK & CO., 602 Market Street, 14--CHOICE PROPERTIES-- 14 Haight-Strest Building Lot 25x150 feet on 8. line Haigh: st., bet. Rroderick and Baker sts. 2 Huight-Street Business Corner. Lot_68:9x70 feet, with § stores and 6 fla's. on the SE. corner of Halght aod Scott sts ; Lutlding cost $30,000; rents $239 a month. Mission Business Corner: s116 4th and Shotwell Monthly. Lot 50x90 feet, on N K. cor. sts., With stores, 2 flats aud 4 houses, renting for $116: gooa duildiug; g0d improvemsnis. Downtown kusiness Property; $126 onthly Lot 50x80 feet, with 2 stores and 4 flats. at 81§ to 864 rolsom st Let. Fourth and Fifth; $12,600 MOt 4ge can Tema.n. Western Addition Flats; Reats $181 Monthiy. Lot 75x187:6 on N. line Pcs: st., with 14 flaty; 1708 10 1716 Post st . near Buchanan. Hayes-Street I roperty—Probate Salh. Lov 27:6x120 feet, on & lne of Hayes si., throuzh to Linden ave., 165 feet W. of La,ufa st.; 2-flat houses un Linden ave., No. 618, 410 Page Street, 1wo Frontages—Pro- bate Nale. Lot 54:22120 feet, with two flats on part of lot renting for $15, near Buchaoan st 919 Golden Gate Avenue, Jeffergson ~quare. Lot 26X137:6 feet, with improvements, at 919 Golien Gute ave. 1625 Pine Street, Near Van Ness Ave.— ¥ Lo: 20x1. 1625 Pine st and cottuge Tents §48. Valencin-itreet Fusiness Property. Two lots, $1:414x80 feet. on W. line of Va.cncla » bet. Twenty-cuird and Twenty-fourth. uildine Lot 01 Kroad wav. Lot 18:9x60 feet, on S line of Broadway, bet. Taylor snd Jones. Union-Street Build ng Lot. Lot 26x187:6 feet, N. line of Union st., 112 feet E. of Piorce. Bank Foreclosurs Sale Lot 20x114 feet, with pretty 5-room neary new gottage, 35 Jersey sk, bet. Diamond and Dous Beautif.l Home in the Mission. Lot 23x85 feet, with a neiv 5-roo; 2 Twenty-third s, near Cagro e S04 Bale commences ut 12 . sharp, st salesrooms of A. M. >PECK & Co. 60: Market St. ‘NOTARY PUBLIC. (CHARLES M. PRILLIVS. ATTORNEY-AT- Law and N Public, 638 Market site Palace (] i I«:&"M. 70, s saguidence Renty Rents Opposite 'Just one word with you in’ a veryk K ) i