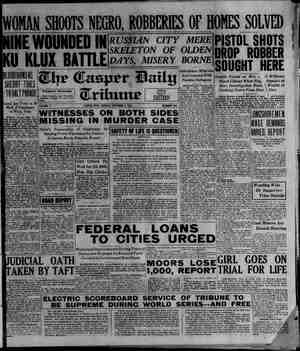

The Nonpartisan Leader Newspaper, October 3, 1921, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

/ ; IN THE INTEREST OF A SQUARE . DEAL FOR THE FARMERS ! Min; d h | ddress, 427 Sixth 8. Entered ‘as_second-class m-m} at_the postoffice at Minneapolis, n., under the act of March 3, 1879. Minn. "L drces s 47, SLeD syehe, B, Minncapolts, . i all re nces e Nonpartisan Leader, Box 2072, Minneapolis, Minn. P VOL. 13, NO. 7 : M Published at Minneapolis, Nonpartisén Teader OLIVER S. MORRIS, Editor. INNEAPOLIS, MINNESOTA, OCTOBER 3, 1921 A MAGAZINE THAT DARES TO PRINT THE TRUTH th ntfis n applicatis ber Audi! One year, $1.50. Classifled rates on classified page: other advertising 1 [ on. Member Bureau of Circulations 8. C. Beckwith Special Agency, advertising representatives, New York, Chicago, 8t. Louis, Kansas City. ., Every Two Weeks WHOLE NUMBER 282 HE Republican machine ring politicians and press helped or- \ ganize the Minnesota Farm Bureau federation and got their ) henchmen on the “inside” in the movement, with a view of using it for their own sinister purposes, among which was opposi- tion to the Nonpartisan league and other genuine, progressive farmer movements. It was unfortunate that the federation should be formed under such auspices, especially as the The Row in local farm bureaus in many counties were run Minnesota by actual farmers and were doing good work. Over U. S. G. G And now the farmers of the state have had a clear demonstration of the danger of letting . broken-down politicians and business men run their affairs. The result is that the local bureaus will probably un- seat the federation officers foisted upon them, and will put the fed- eration in contrel of actual farmers, who will not be used by the un- speakable Republican machine of the state. The demonstration of what can be expected to result from con- trol of farmer organizations by non-farmers and business men has been perfect and complete. The Minnesota federation officers, in connection with the organization of the U. S. Grain Growers, Inc., tool_t the position that, unless they could rule the new co-operative grain pooling and marketing movement, they would wreck it. They objected to the U. S. Grain Growers co-operating with the Equity Co-Operatlye exchange, the great farmer-owned grain marketing agency which owns a terminal elevator in St. Paul and strings of country elevators in several states. The Equity, with 20,000 .or more farmer stockholders, has become firmly established in the ° Dakotas, Minnesota, Wisconsin, Iowa, Montana and other states. The fight that the farmers made to successfully establish this great _co-operative agency is old history. The point here is that the Min- nesota Farm Bureau federation officers wanted\to wreck the Equity by having the newer organization, the U. S. Grain Growers, build up a_competing organization, which they, the state bureau officers, could control. They opposed thelogical proposition that the U.S. Grain Growers should enter into a contract with the Equity, so that the newer organization could use, on fair terms, the terminal and country elevators of the older co-operative. hile it was becoming more and more evident that the direc- tors of the Grain Growers would not consent to a war on the Equity, the Minnesota state securities commission, run by the Re- publican politicians with whom the Farm Bureau federation offi- cers have co-operated, refused the Grain Growers the right to organize their finance co-opera- tionin the state. This blow was followed by a meeting of the di- rectors of the Farm Bureau fed- eration, at which it was decided to oppos. the Grain Growers or- ganizing in Minnesota, simply because the Grain Growers thought it wise to -co-operate with the Equity and to use the Equity’s: already . established marketing machinery, insvead of trying to build up competing machinery. : The Farm Bureau officers felt they could not control the new pooling and co-operative move- ment in Minnesota if there was co-operation with older farmer organizations which are not Re- publican machine adjuncts, and so they decided, since they could not rule the Equity and the Grain Growers’ corporation, that they would ruin both. The di- rectors of the Minnesota feder- ation are now out in open war- fare against the U. S. Grain Growers, Inc., and against ‘the Equity. They are telling farm-: ers to withdraw their support. But they will not wreck either of these organizations. Unless the —Drawn expressly for the Leaider by John M. Baer. Farm Bureau Officers Gone Wrong— Other Comment Leader is vefy much mistaken, the Minnesota- Farm Bureau feder- ation faces a housecleaning at the hands of the farmers of the state _and the progressive local bureaus, and it will not be long before the Republican machine, its politicians and its: press will be out in the cold, so far as the Bureau movement in Minnesota is concerned. HE large part-played by the land speculator in causing high I prices of .things farmers must buy, low wages to workers and consequent diminishing of the demand for farm products, has not been fully realized by farmers. The Nonpartisan league program contains-a plank for exemption of land improvements from taxation, a medsure that is intended to be a first step toward curb- = ing the evils of land speculation. Obviously, to ex- Reaching empt farm improvements from taxation means to the Land force the holders of vacant land to pay the same tax as ¢ Lan the owners of improved land, and thus to discourage Speculator tpe holding of large tracts of land out of use for the purpose of reaping future profit from increase in value, caused by owners of adjacent land improving the country and bringing in new population. John Lord in his article in this issue, on Page 5, discusses the various evils of land speculation, some of which can not be fully iminated by exemption of improvements from taxation. He points out that only 'a small per cent of city residents are land owners. Nearly all pay rent. When land speculation causes high rents it absorbs workmen’s wages. Generally in good times rent eventually absorbs all or more of the increases in wages that good times bring workmen. The irresistible result of this is that workmen have less than they should have to buy farm products, thus cutting down the farmers’ market and causing bad times for farmers. Farmers who are not land ownérs also suffer from land speculation. They can not get access to land at reasonable rent, due to excessive land values and rents. So that, besides the farmer having his market lessened from land speculation and monopoly, and besides having to pay more taxes than he should because land speculators and monopolists never have carried their fair share of the tax burden, the farmer'is often a direct sufferer through high rents for land. All this Mr. Lord shows. He believes a remedy for this condi- tion is some such plan as the Keller tax bills now before congress, which aim to levy a Tand values tax on big land owners, speculators and monopolists. While the Leader has not indorsed the Kel- ler bills, we have endeavored in previous articles to publish the facts about them, and have open- ed our columns to letters by farm- ers both approving and opposing the bills. We believe Mr. Lord’s analysis of the evils brought about by land speculation and glad to publish his reasons for believing that the passage of the Keller bills will help reach these evils. However, it is up to the farmers to study the question themselves and decide whether gl}fiy want to support the Keller ills. Many farmers are unduly prejudiced on principle against a land tax. Farmer land owners often feel that any land tax or land values tax, in addition to other taxes, is bad for agricul- ture. That would be true if such a tax did not take into account the fact that farmer land owners are producers and that we must not put any more taxes on pro- duction. But a land tax that ex- own land and niake it produce, and which at the same time hits the holders of unused or monop- ‘olized natural resources in the ground, and\ also hits those PAGE THREE t monopoly is sound, and we are - empts farmers who own their : B e ]