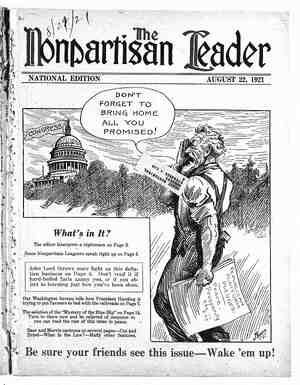

The Nonpartisan Leader Newspaper, August 22, 1921, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

e & il ) L ° Reserve Bank System Is Found Guilty How It Protected Wall Street While Ruining Farmers and Business Generally by Its Deflation Policy—Second Article on Present Crisis BY JOHN LORD The pen name of a man who until recently was financial editor of a large eastern daily paper. N MY previous article I charged the board of the federal reserve banks with partial responsibility for the sud- den and drastic deflation of the value of farm products. This is a serious charge. It should neither be made lightly nor without due regard for substantial facts. The sudden and drastic deflation of the value of farm products amounted in essence to robbery. The effect in actual losses to the farmers was precisely equivalent to someone entering the farmer’s gran- ery and carrying off 40 per cent of the grain, or in- vading the pastures and feed lots and driving out 40 per cent of the livestock. But, as emphasized in my previous article, the farmer is now not the only sufferer. * Kill the goose and there are no more eggs. Destroy the ability of the farmer to purchase generously and factories will shut down. Later on will come bankruptcies. You may read of all these in the financial columns of the great dailies. Since my previous article was written, Louis K. Liggett, head of the greatest chain of drug stores in the world, has been forced to turn his private affairs over to trustees. Dun and Bradstreet report an increasing number of bankruptcies. Many busi- ness institutions are operating under the supervision of banks, which means that these institutions are in the pro- cesses of liquidation. Some of them will survive the ordeal, others will perish. But to return to my charge that the federal reserve bank board deliberate- ly precipitated deflation and purpose- ly began with the farmers. What proof may I present that my charge is true? I have the very posi- tive testimony of John Skelton Wil- liams, who for eight years, and until March, 1921, was comptroller of the currency. The comptroller is an official of the United States treasury department and has supervision of national banks. He also has supervision of what is known as “bank currency,” which is now of two kinds, national bank notes and federal reserve notes. The comp- troller is also ex-officio a member of the federal reserve board. Mr. Wil- liams is, therefore, an expert witness. On July 14, 1921, Mr. Williams made an address before the Georgia Press association and the board of com- merce at Augusta, Ga. Later, on July 20, this ad- dress was inserted in the Congressional Record by Senator Heflin of Alabama. Mr. Williams’ address begins on page 4281 of the Congressional Record for July 20, 1921. “LET ’EM FAIL,” RESERVE BOARD MEMBER SAID Mr. Williams makes two specific charges against the federal reserve bank. 1. He charges that the board decided on a policy of deflation in the summer of 1920, knowing that the processes of deflation would fall first of all on the farmers. 2. He charges that the processes of deflation were designedly handled so as to favor the financial district of which New York is the center. I now quote as follows from Mr. Williams’ ad- dress: ? “The heart-breaking and purse-breaking collapse in prices of farm products and other commodities were referred to in the board in terms of .satisfac- tion, and in response to my appeals to apply the subscriber. the dogs. brakes and secure a more orderly recession in - values, their response was, as expressed by the gov- ernor of the board, to the effect that a balloon was merely being punctured to let the gas escape. My reply on this point was that wise and sensible men should try to bring a balloon laden -with human e lives and fortunes safely to earth by the intelligent use of valve ropes and ballast, not by presenting a sudden and ruinous crash. “I recommended that, in an emergency, securi- ties other than government bonds and business paper, for example warehouse receipts of corn, wheat, cotton and merchandise, might become necessary in order to prevent failures and avert a._ financial crisis. (What Mr. Williams was recom- mending here was federal reserve bank loans ex- tended against warehouse receipts or federal re- serve bank currency issued on warehouse securi- ties.) The majority of the members of the reserve board opposed my recommendation and one of .the speakers in doing so said, in effect, with a heartless- ness which to me was incomprehensible, ‘Let ’em fail.” ” : Upon another occasion, when certain policies were being discussed in the federal reserve board which were being opposed on the ground that they might result in the failure of many state banks, a certain member of the board said, in effect, that: “If this plan means the failure of the small state banks, they need not stop it; in fact, if we can not get rid of the small state banks by any other method, it might be as well to get rid of | HOUNDS AND A DAY’S CATCH | This fine pack of hounds belongs to Ben Ammar of Ponylake, Neb., a Leader The three coyotes hung on the barn are one afternoon’s catch of Mr. Ammar says that the big white dog in the center is the best fighter and fastest runner of the pack. He can run down and kill a coyote alone, having done it many times. more interesting pictures from Leader readers! them that way—that is to say, by their failure.” A large number of state banks did fail, in North Dakota particularly, where it seems the federal re- serve squeeze was the hardest, but a great many other small banks all over the nation have failed . also. The banks which have failed are not members of the federal resérve board system. It is the fail- ure of such banks that was meant by the member of the board quoted above by Mr. Williams. Now let us return to-Mr. Williams’ second charge, that while the squeeze was being put on the banks in the agricultural section, no such squeeze was operative against the New York district. Mr. Wil- liams says+ “In the latter part of 1914, while the European war was raging and world finances were in a deli- cate condition, three or four members of the board made a determined effort to secure the closing up of four of the 12 federal reserve banks, their efforts to do so being finally defeated as a result of Secre- tary McAdoo’s appeal to President Wilson and the effective action of the attorney general. I think it will surprise you to know that again in the early part of this year the governor of the federal re- serve board proposed at a board meeting the dises- tablishment of the two reserve banks of the South, Atlanta and Dallas.” ’ This is directly in line with charges made in Henry Ford’s paper, the Dearborn, Independent, which has been devoting a series of articles to the origin and processes: of the federal reserve system. PAGE SIX . Let’s ‘have The charges made “in Mr. Ford’s paper and which are well sustained by proof are: . K 1. The federal reserve banking system was de- signed expressly for the purpose of centralizing .and monopolizing the control of currency and credit so that such control would be in the hands of the super-financiers. 2. Mr. Ford’s paper charges that it was orig- inally intended that there was to be but one federal reserve bank. Public opinion, voiced by bankers themselves, forced a change in the plan so that when the law was passed by congress this law pro- vided for 12 reserve banks. But according to Mr. Ford’s paper, substantigted by testimony before a senate investigating g®mmittee, it was expected that the New York branch would dominate the pol- icy of the federal reserve system. The articles above referred to ‘appeared in the Dearborn Inde- pendent, Mr. Ford’s weekly, during June and July. HOW BOARD FAVORED WALL STREET INTERESTS The paragraph from Mr. Williams’ speech as quoted previously bears out the charges made in the Ford weekly. Mr. Williams specifically charges the reserve board with favoring the speculators in the New York financial district, while at the same time punishing the farm- ers. Says Mr. Williams: ~ “I heard much talk while I was a member of the federal reserve board about forcing the farmer to sell his wheat, or the cotton plant- er his cotton, or the cattle raiser his livestock, the wholesaler or re- tailer their stocks of goods, but I must tell you frankly that I do not recall a single occasion during the past year or two of deflation when the board ever discussed seriously the importance or desirability of requiring the big banks in New York City, some of which were lending millions of dollars to their own executive officials on highly speculative securities and to big syndicates in which those officials were actively interested and which those banks had been car- rying for months and sometimes for years, to liquidate a portion of these loans, in order that by so doing those banks might have more money to supply the legiti- mate use of trade and commerce. “In a letter to the federal reserve board on January 17, 1921,” continues Mr. Williams, “I poiuted to the ex- traordinary fact that the federal re- serve bank of New York was lending to one partic- ular institution in that city more money—in one in- stance more than twice as much—than the seven federal reserve banks at St. Louis, Kansas City, ° Minneapolis, Dallas, Richmond, Atlanta and San Francisco were lending to all member banks both national and state in any of those seven districts. “I pointed to one instance where the federal re- serve bank of New York was lending to one institu- tion about $130,000,000—twice as much money as the federal reserve bank of Dallas was lending to all the 1,000 member banks in that great district, embracing the state of Texas and parts of the states of Louisiana, Oklahoma, New Mexico and Arizona. It was also shown that the New York reserve bank was lending to that particular institution at one time an amount equal to nearly six times the total capital of the federal reserve bank of New York. “The deflation policies of the past 12 months,” continues® Mr. Williams, “have borne their fruit. The mercantile agents tell us that since October last there have been about 14,000 business failures—an increase of not far from 10,000 failures over the same period last year.” . S I recall now a visit I had in the summer of 1920 with Wharton Barker, a noted economist of Phila- delphia. Mr. Barker is now an old man, but in his prime he was an important figure in Republican na- - tional councils. While waiting in his outer office I overheard a conversation between Mr. Barker and 8 client who had come to the office after visiting