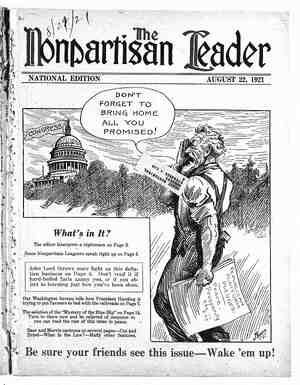

The Nonpartisan Leader Newspaper, August 22, 1921, Page 12

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

The Keller Bill A Reader of the Leader Gives His' Opinion DITOR Nonpartisan Lead- er: One of the most vicious - bills - introduced standpoint of the home- = owning farmer, is the Keller land tax bill, providing for a -tax of 1 per cent on all land holdings over and above $10,000 and all im- provements. Mr. Keller states in his speech before congress that this meas- ure is advocated by the Committee of Manufacturers and Merchants and the Farmers’ Tax League of America. What kind of farmers the Farmers’ Tax league is composed of I do not know, but I am sure the Committee of Merchants and Manufacturers will not work for our interest. o Mr. Keller states that under this law less than 4 per cent of the actual farmers will pay a tax. In the tables he uses to support his contention he has left out all the middle western agricultural states, where the land on the average is the highest in value. Our state of Nebraska, I think, is about an average state in the Middle ‘West and Stanton county is about an average county in the eastern half of the state. Now I can tell you how this law will work herc at home. In the precinct where I live, com- posed of 86 sections of land, there are 63 farmers who own and operate | farms from 160 acres up and make ° their homes thereon. The assessed valuation of these 63 farms, without all improvements, runs all the way from $18,000 to $115,000, so you see the proposed tax will hit them good and hard. Besides these 63 home- ~~ owners in our rrecinct there are 38 farmers that own small farms or are tenants. These would be exempt un- der the law but that will make a big majority of taxpayers instead of less than 4 per cent. -SAYS IT WILL HIT LARGE NUMBERS The assessed value ought to be a fair valuation for tax purposes, but Mr. Keller demands that landlords, as he calls them, give in any offer they received for their land during the last two years and also the price the owner would sell for and then give the reve- nue department the right to fix the value. Now a very large part of“-these farmers that come in under this law, are not speculators but people that make the farm their home and they should not be forced to set a price on their home, because in most cases it is |~ not for sale. Mr. Keller states that land escapes all taxation under the . federal government, but all incomes from land or any other source is taxed under the incomc tax law, which law, if rightly applied; is the most just way for the government to raise the revenue needed. Many people claim that all taxes are shifted back to the producer and consumer and therefore the farmers and laboring men might as well pay all taxes in the first place, but that is true only to a very small extent. About all business is conducted on the basis of all the-traffic will bear and I believe in making everybody pay his just share in taxes. I believe it is about time for farmers to investigate this law.and let our congressmen know what we think about it. Leigh, Neb. S. P. PETERSON. EDITOR’S NOTE—The Leader is glad to publish letters for or against this bill or any other in which farmers are interested. We have printed the facts about the Keller bill, but have (Continued on page 15) in congress, from the |- ADVERTISEMENTS Has the Farmer a Real Grievance? Yes, he has! He has a real grievance because the prices he receives for his products have declined more than have the prices he must pay for almost everything he buys. Because of these facts the farmers are not making as large profits as they believe they are entitled to make. Some blame their troubles largely on the railroads. “Freight rates,” they say, “are the cause of low prices for grain and live stock.” The real cause lies much deeper. The decline in the prices of farm products began before freight rates were advanced, and would have occurred if freight rates never had been advanced. It is due to world-wide changes resulting from the transition from war to peace. The Railways Have the Same Grievance As the Farmer The rates the railways are getting, although they have been advanced, are much lower in proportion than the cost of almost everything the railways must buy. The average passenger rate is ?.bout 50 per cent higher, and the average freight rate about 74 per cent higher, than five years ago—in 1916, before this country entered the war. From these facts it might be thought that the railways should be making money. BUT—the prices the railways are pay- ing for Materials and Supplies are now 65 per cent higher than in 1916; Taxes are 90 per cent higher; Coal per ton is 144 per cent higher; and Wages of railway employees are still 124 per cent higher per hour. In consequence of these things,- while the total earnings of the railways are 60 per cent greater than in 1916, THEIR EXPENSES ARE 110 PER CENT GREATER and THEIR PROFITS, SINCE THE PRESENT FREIGHT AND PASSENGER RATES WERE MADE, HAVE BEEN LESS THAN ONE-HALF AS GREAT AS IN 1916. What has happened to fhe Railroads since 1916: Increase in Revenue IS Increase in Expenses 60% 110% In 1916 railway wages were $1,469,000,000. After the Railway Labor Board advanced them last year they were at the rate of $3,900,000,000, an increase of 165 per cent. The recent reduction ordered by the r Board was only 12 per cent, leaving wages about $2,000,000,000 greater than in 1916. Coal cost $1.76 per ton in 1916, the total fuel bill being $250,000,000. In 1920 the average price was $4.20 per ton and the coal cost $673,000,000, or $423,000,000 more than in 1916. The average cost of rail- way coal is now $4.29 per ton. With prices of materials and supplies still 65 per cent higher than in 1916, the materials and supplies which the railways bought for $447,000,000 in 1916 would now cost them $750,000,000, or over $300,000,~ 000 more. Present Railway Rates Chiefly Due to Labor Costs —Not to Return on Capital Existing railway rates are higher not because railroad capital is receiving or seeking a l?rggr : abor return, but because railroad LABOR, and producing things the railroads must i)uy, is get- ting so much more than formerly. EVERY INCREASE in rates since 1916 has been intended to meet—but has not met—these in- creased expenses,- CHIEFLY LABOR, and NOT to increase profits. Railway profits have GONE DOWN. In 1916 the railroads earned 6 per cent. In 1921 they will be fortunate if, on present rates and present expenses, they earn 3 per cent. A GENERAL reduction of rates now could not be made without BANKRUPTING most of the railways and making business of ALL KINDS much worse for everybody. The managements of the railroads are making every effort to reduce expenses so that rates can be reduced later. Some reductions of rates al- ready are being made. There is NO OTHER WAY than by reductions in expenses to secure general reductions in rates that will not be ruinous to the railways and make them unable to render to the farmers the trans- portation service they need. Those who obstruct reduction of expenses not only hurt the RAIL- ROADS but the FARMERS as well. Association of Railway Executives 61 BROADWAY NEW YORK 764 TRANSPORTATION BUILDING : CHICAGO, ILL. Those desiring further information on the railroad situation are requested to address MUNSEY BUILDING WASHINGTON, D, C., the offices of the Association or the presidents of any of the individual railroads. PAGE THIRTEEN * Mention the Leader When Writing Advertirers S