The Nonpartisan Leader Newspaper, March 7, 1921, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

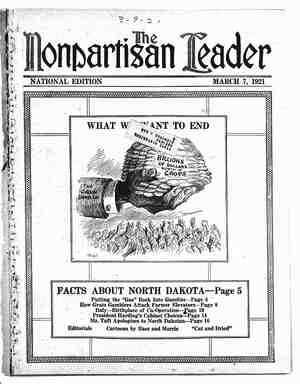

FACTS ABOUT NORTH DAKOTA The Financial Condition of the State and the Reason for It—A Plain Statement of the Truth for Every Leaguer T GRAND FORKS, N. D., stand the half-finished buildings of a terminal elevator and flour mill, the property of the state of North Dakota. After the people of North Dakota have voted nine separate times for this terminal elevator and have been sustained by the highest courts of the state and of the United States, on three separate occasions, they are being blocked by “direct action” on the part of politicians of North Dakota and financial*interests of other states. This “direct action” has meant a financial block- ade of North Dakota that threatens to result in the closing of at least 100 banks, the foreclosure of thousands of farmers and loss to the majority of the inhabitants 6f a great state. Following is a plain statement of what has hap- pened in North Dakota to cause the present situ- ation: : The-farmers of North Dakota voted for a termi- nal elevator for the first time in 1912 and for the ‘second time in 1914, approving constitutional amendments by big majorities. The legislature of ..1915 refused to act and farmers were told to “go home and slép.the hogs.” They went home and or- ganized the Nonpartisan league, adopting a pro- gram that pledged, besides the terminal elevator, a flour mill, state.rural credits at cost, state hail in- surance, state inspection of grain and dockage and exemption of farm improvements from taxation. - The farmers voted for the terminal elevator for the third and fourth times, and also for all the rest of the program, by nominating and electing Leaguers in the primary and general elections of 1916. Holdover senators blocked action on' the farmers’ program. The farmers came back and voted for the fifth and sixth times, in the primary and general election of 1918, electing not only their state officers but members of both houses of the legislature, and the legislature of 1919 enacted the entire industrial program into law. THE CREATION OF THE BANK OF NORTH DAKOTA AND ITS POWERS To carry out the promise of “rural credits at cost” the legislature created the Bank of North Dakota, which was autharized not only to furnish rural cred- its, in the shape of farm mortgage loans, but also was given power to loan money to any state indus- tries that might require financing. The intention was to finance the state indus- tries by sale of bonds, but the Bank of North Dakota was provided as an addi- tional safeguard. After the people of North Dakota had thus voted for the terminal elevator six times, the anti-League politicians were not yet satisfied. They said the laws passed by the legislature went farther than the pledges of the League pro- gram, calling especial attention to the fact that the Bank of North Dakota had power to finance state industries, as well as to supply rural credits. The League opponents demanded a special referendum election on these measures. This was held. in June, 1920, and every measure attacked was upheld by the people by a substantial majority. This was the seventh time the people had .spoken. : * The Bank of North Dakota was estab- * lished immediately. Under the law creating it all public funds (state, coun-- ty, city, school district, etc.) were to be deposited with the bank. The Bank of North Dakota announced that it would redeposit the bulk of these funds with private banks in the counties and cities from which the money came. Un- der the law, of course, the Bank of North Dakota was authorized to use as much of this money as might be required to make farm loans.and to finance state in- dustries. It was intended, however, to finance the state industries mainly by the sale of state bonds.. In September, 1919, agreement was entered into between the state and a syndicate of bond buyers, .~ headed by William R. Compton & Co. of Chicago, to purchase $3;000,000 of 5 per cent bonds. The contract provided, as is usual with bond sales, that the sale was first to be approved by legal counsel for the syndicate.: . Meantime, in spite of the fact that the people of North Dakota had voted seven times in favor of the League program, politicians and business in- terests opposed to the League had started a suit at- tacking the validity of the bonds. When the League opponents saw that in spite of this suit the industrial program was about to be carried into effect, anti-League papers within and without the state began a bitter attack upon the state of North Dakota. It was reported, among othér things, that the state was bankrupt, a wholly false statement. It has been reported and never denied that the attorney for the Northern Pacific railroad in North Dakota made a special trip east, calling upon the attorney for the bond buyers and informing him that this attack on the state would be kept up, so that it would be difficult for the bond firm to dispose of the bonds again to their clients if they bogght the issue. BOND SALE FIRST BLOCKED IN 1919 BY ANTI-LEAGUE POLITICIANS As a result the attorney for the bond firm advised the Compton company not to purchase the bonds until the suit attacking their validity had been finally determined. William R. Compton, in a let- ter written at the time, admitted that the real rea- son his firm withdrew from the bond contract was the opposition to the League program on the part of the anti-League minority within the state, who threatened to make it difficult to sell the bonds. The first suit attacking the bonds came up in the federal district court in North Dakota and the validity of the bonds was upheld. Another suit was brought in the supreme court of North Dakota, and again the validity of the bonds was upheld. However, the anti-League .interests immediately appealed the cases to the supreme court of the United States. Under ordinary conditions the suit could not have been decided in the supreme court of the United States in less than two years. The anti-Leaguers hoped to delay the program that much longer. The legislature of North Dakota was called to E SPIRIT OF NORTH DAKOTA —Drawn expressly for the Leader by John M. Baer. ° meet in special session in November, 1919, how- ever,’ and passed a memorial asking the supreme court of the United States to take up the North Dakota case ahead of the regular order. The su- preme court heeded this request, heard the case in April, 1920, and in May, 1920, handed -down a unanimous decision upholding the North Dakota program and the bonds. In the meantime, however, faymers were demand- ing that the Bank of North Dakota use the powers given it by law to make farm loans and finance state industries, without delaying the program, for which the people had voted seven times, any longer. The Bank of North Dakota therefore advanced nearly $3,000,000 in farm loans at 6 per cent interest (the average rate before was 8.7 per cent) and advanced approximately $1,000,000 more to start work on the terminal elevator and mill at Grand Forks and to the Home Building association. This took about $4,000,000 of the funds of the Bank of North Dakota. The rest of its funds were redeposited with about 800 private banks in various parts of North Dakota. : In the primary election of 1920 the people of North Dakota, by renominating Governor Frazier and defeating Attorney General Langer, the leading opponent of the League, voted for the League pro- gram for the eighth time, and at the general elec- tion of 1920 the people voted for the League pro- gram for the ninth time, not only re-electing Gov- ernor Frazier but electing Leaguers to every posi- tion on the industrial commission. ; Enemies of the League, however, put up a num- ber of measures claiming that they were intended to strengthen the industrial program. One of these initiative measures was a bill providing that county and city treasurers could deposit their funds either with the Bank of North Dakota or with a private bank. Through a misunderstanding of the real meaning of this law it was adopted at the same time that Governor Frazier was re-elected. A MANUFACTURED “RUN” ON THE STATE-OWNED BANK The real purpose of this law was to create a “run” on the Bank of Noirth Dakota, gnd that was what happened. The majority of the county and city treasurers demanded their money. The Bank of North Dakota undertook to draw in the money which had been redeposited with the 800 private banks. The private banks com- plained that they were unable to repay. A number of.them closed. e Prices of farm products had dropped . and many farmers were refusing to sell their wheat at prices far below the cost of production. In many sections of the state if the farmers had sold their en- tire crop they would have been unable to meet their debts to the bank because prices had dropped so low. .The private bankers said they were in trouble and wanted to co-operate with the state ad- ministration. At a conference of the bankers with state officials they promised to go to their Wall street affiliations and urge the purchase of the North Dakota bonds if Governor Frazier and the state ad- ministration would aid them to collect their debts from farmers. Governor Frazier issued a statement to farmers, urging sale of sufficient products to ease the financial situation. The bankers came back from their conference with eastern financiers and stated that before North Dakota bonds could be sold the farmers of North Da- kota would have to give up part of the program, for which the majority of the ernor Frazier and the. industrial com- mission declared they had no authority from the people to give up any of the -program, at the behest_of Wall street or any other interests, and negotiations ended. ] Thel} the League opposition began to put on the screws in earnest. County (Continued on page 20) people had voted, year after year. Gov--