The Nonpartisan Leader Newspaper, March 8, 1920, Page 4

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

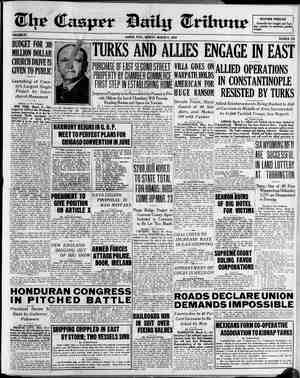

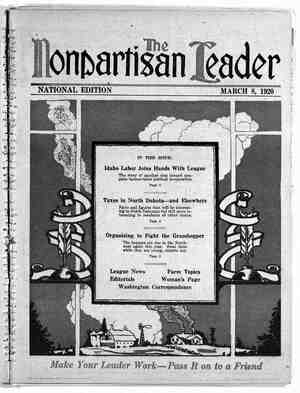

8 RIS e . tomer, so in -the last analysis the _ing, in figuring the rent that he Taxesin North Dakota—and Elsewhere Increase Is Smaller and Per Capita Tax Less, Figures Show—Second BY E. B. FUSSELL : N A previous Leader article it was shown clearly that in- f| -creases in North Dakota’s state: states, who have been pointing with horror - to increased taxes in North Dakota in the hope that people would forget about increas- ed taxes at home, but it has to be done. First let us take the only three northwest- ern states that enacted soldiers’ honus laws—North Dakota, Minnesota and Wisconsin. The North Da- kota law is the most generous of the three, giving the returned soldiers $25 a month, as compated with $15 a month in Minnesota and $10 in Wisconsin. North Dakota raises its money all by taxation on the “pay as we go” principle. Minnesota raises most of its bonus money by the sale of bonds, pay- ing only a small part of it by taxes this year. Wis- consin raised most of its money by taxes but left a portion to be paid by bonds. This is the way the state taxes states compare: - of these three Inorease State taxes State taxes State 1918 191! Amount Pect. North Dakota ...$1,690,155 $ 3,676,039 $1,985,884 117 Minnesota. ...... 6,107,0 14, 400 743 8,293,737 136 Wisconsin «..... 5,087,447 14 055,723 = 8,968,276 176 That doesn’t look so bad for North Dakota, does it? The comparison might have been made even stronger. - Wisconsin certified to its counties, to be raised as state taxes, a total of $15,- 875,865, but some of the counties chose to go in debt for part of this amount, raising a total of $1,820,142 by the sale of bonds and thus leaving the total amount actually raised by taxation for state purposes $14,055,- 723." If we had included the amount raised by bonds for current purposes it would have ‘made the increase in Wisconsin state taxes $10,788,418, or 212 per cent over 1918! TAX BURDEN IS BORNE BY ALL OF US The diagrams at the top of this- page indicate accurately -how the state taxes of these three “bonus states” compare, both as to percent- age of increase and as to the per capita taxes, or the amount that ‘each person in the state would pay if the total taxes of the state were divided evenly among the entire pop- ulation. This is an important point. In the first instance the ownmer of real “estate or other property pays the tax. But the owner of a build- charges a tenant, adds enough to cover taxes and the merchant who pays the rent' adds enough to cover the increase, and also his own taxes, on the price of articles sold the cus- general public pays every tax that is levied. Now let us turn our attention to some of the other states in which readers of the Leader live—states that failed to make any provision for the returned service men. ' To com- pare North Dakota’s state taxes with the state taxes of these states we will deduct from the North Dakota tax funds. We will also deduct from Artlcle of Tax Series TAXES IN “BONUS STATES” Percentage increases in state Per capita state taxes of north--‘ taxes of northwestern states that enacted soldiers’ = . -enacted soldiers’ bonus laws. bonus laws: Minnesota and Wisconsin the amounts le\ned for isoldiers, so as to make the comparison fair all around. = This is what we find: Staag ltaxes smenm Ok]ahoma e - “Wisconsin .. ‘Washington Locking over this list two things will stnke every person at once—first, that total state taxes in North Dakota (soldiers’ bonus taxes bemg' deducted) are less than those of any other state in the list; and, second, that the increase in North Dakota state taxes is less than the increase in any other state, . 9,240,578 11,072,882 1,832,309 with the exception of South Dakota and Colorados: In the case of South Dakota a big increase in state taxes was made in 1918, so it was not necessary to : TRAPPING SEASON BREAKS RECORDS | —Drawn expressly for the Leader by W. C. Morns ‘Morris writes us, in sending this cartoon; “It’s a pity there aren’t bounties of- the amount raised for soldiers’ bonus \ fered for this kind of varmints.” But the farmers are trapping them, just the same, Lies about North Dakota taxes form a good-sized portion of the catch. PAGE FOUB‘ western states that = ‘Wisconsin, so that these states can be compared make such a large increase in 1919. A com- parison, takmg the three years into consid- eration, is favorable to North Dakota. The taxes for 1918 and 1919 combined, in' South s i bie ot dis todhe Alata 117 pet. 136 pct. 176 pct. $4.49 $6.05 $5.45 Dakota, were $6,573,143. The taxes for the < industrial program (which ® : ~ same two years, in North Dakota, were takes only 4.4 cents of each $4,604,318. - South Dakota taxes for 1919 " dollar raised for state taxes), but were due increased $1,532,189 over 1917.. North Da- to these three causes: First, generous relief = kota taxes for 1919 increased $1 256,554 provisions for returned soldiers; second, the - over 1917. need of building up the state’s educational (] < 1 But some critics may be expected to say, system; third, the decreased purchasing E &1 “But North Dakota is a small state; it is not power of the dollar. ] g & « o 8 g fair to compare state taxes with the larger This week we intend to look into the taxes _ @ a ) 2 ‘é states. with more people.” of some other states and compare them with '5,: E S ':E "E’ 8 As & matter of fact many of the neces- - taxes in North Dakota. ' It may be a trifle = o 3 =) R = sary expenses of a small state are appro}u- embarrassing to the politicians in these “ = & ~ = 5 mately as great as with a large state. Each state must have a governor and other state officials, a capltol a penitentiary, regardless of the number of cnmmals, and other neces- sary expenses. But since this question will* be raised, let us compare this same list of states, on a populatlon basis, The latest figures of population -available are those of the 1919 estimate of the United States census bureau. = This is the way the same states line up on the basis of the average state taxes chargeable to each md.lvaduat : Population, U. Per camm State taxes S. census esti- state tax 191! mate for 1919 1919 $ 2,914,166 817,564 $3.56 11,289 471 2,378,128 4.74 .. 7,486,000 1,309,627 5.68 5,049,317 1,040,842 4.85 3,695,763 753,897 4.90 6,015,698 1,896,520 3.17 5,825,671 2,465,402 2,37 7,125,865 2 580,800 2.77 11,072,882 - 1728,757 6.42 In this ta,ble, as in the precedmg one, the sol- diers’ bonus taxes have been deducted from the total state taxes in North Dakota, Minnesota and fau’ly with states that made no provision for the service men. Taking the per capita taxes of North Dakota, Minnesota and Wisconsin, and - including the soldiers’ benus taxes for all three states, we find the per capita taxes are: North Dakota, $4.49; Minnesota, $6.05; Wisconsin, $6.45. . OTHER STATES HAVE . EVEN HIGHER TAXES Even with the soldiers’ bonus taxes included, the per capita state taxes in North Dakota are less than the per caplta state taxes in most of the'sstates that have done nothing | for the soldiers and they are far less other two bonus states. The Leader, in presentmg‘ tax figures from> the preceding list of -states, has not attempted to pick and favorable comparison. We have sought tax information from all 13 states. in which the Nonpartisan league is organizing. From some of the states we have had only partial reports and thus have beén unable to include them in the comparison. ‘For Idaho, for instance, we have been unable to get the total amount of state taxes levied in 1919, but the - total tax levy was jumped from 2.5 mills in 1918 to 7.8 mills in 1919, an increase of more than 200 per cent! For Montana 'state tax levies: which covered all property in the state in 1918 were $4,188,818. For 1919 state officials say they can not yet produce accurate figures, but on an estimated assessed wvaluation of $590,000,000 the 1919 state taxes (in- cluding general school taxes as with other states) will be $5313,200, an increase of $1,124,382. Even this will not meet appropriations. There isan estimated deficiency for 1919 of $1,- 278, 220 in spite of mcreased taxes. than the per capita taxes of'the . choose states in an effort to make a =