The Nonpartisan Leader Newspaper, April 21, 1919, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

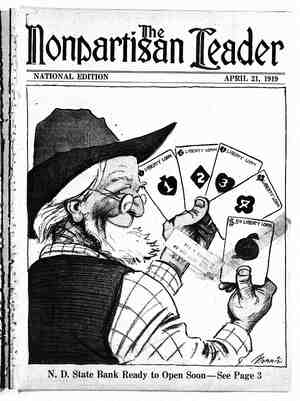

Subscribers enjoy higher page view limit, downloads, and exclusive features.

In the interest of a square deal for the farmers VOL. 8, NO. 16 Tlonpartigsn Tader Official Magazme of the Natlonal_ Nopparhsan League ~ ST. PAUL, MINNESOTA, APRIL 21, 1919 B e m el asasecasueare A magazine that dares to print the truth WHOLE NUMBER 187 N. D. State Bank Ready to Open Soon James R. ‘Waters to Manage New Bank—Bank Space Secured in Bismarck— " Oliver S. Morris Made Secretary of Industrial Commission \ 2\ Leader News Bureau, Bismarck, N. D HE North Dakota Industrial com- “mission; created by the recent legislature. to carry out the farmers’ program, has organ- . ized and taken the first big steps m the actual carrying out of the “new democracy” in America. The commission organized soon. after the adjournment of the legislature by appointing Oliver S. Morris, edi- tor of the Nonpartisan Leader, as its secretary, and opened offices in the capltol bulldmg here. The first big work of the commission is to get the Bank of North-Dakota, the central financial organization and the keystone of the industrial program, estab- lished and domg' business. One of the first acts of the commission was to appoint James R. Waters, - who was bank examiner under the farmers’ admin- 1str;tlon for two terms, as manager of the state ban Mr. Waters, a tried and loyal advocate of the * farmers’ program, earned his promotion to manager of the new state bank by three years of faithful and efficient service as bank examin- er of the state; a position whose duties are supervision of state banks and enforcement of the state banking laws. He has had more than 700 state banks under his supervision, and more than any other man who has held this position in North Dakota he-has gained the confidence, not only of the people, but of the bankers themselves. He is a graduate of the Ames Agricultural college and has been a resident of North Dakota for 20 years. As manager of the - new state bank Mr. _Waters will have duties and _ responsibilities equal in importance to those of the biggest financiers in the United States. STRONG COMPETITION FOR BANK LOCATION Following™ the appointment of Mr. Waters, the industrial commission, by resolution, fixed Bis- marck, the seat of the state government, as the temporary location of the bank. Every city of im- portance in the state endeavored to obtain the bank and sent delegations to' Bismarck and filed briefs setting forth- their advantages as head- quarters for what is to be one of the biggest and most important financial institutions in the West. -However, the commission decided, until the state mills and elevators are located and in operation, to have the bank at Bismarck. If, when the other industries are in operation, some other location in the state will better serve all the state enterprises, the bank will be moved. The commission, in its resolution, specifically reserves the right to relocate the bank if necessary after the entire program is in actual operation. As temporary quarters for the bank the commis- sion has leased one of the largest and best build- ings in Bismarck, a four-story brick and concrete structure -of recent_construction now occupied by a motor company. It-is onthe corner of Main and South streets, one of the best business corners of the city, and is strictly fireproof. . The building was erected for the motor company and the company is giving up the space in it neces- sary for the bank as a public-spirited act to facili- tate the work of the industrial commission. The Commercial club' and business interests of Bis- marck, as well as the same interests in other North Dakota cities, havé shown a splendid spirit of co- operation. The Bismarck ICommercial club aided the commission -in securing this building for the . temporary quarters of the bank. The state bank law requires the bank to be opén and be doing business within 90 days of S0 the adjournment of the legislature, and the institution will be formally open as soon as $2,000,000 in state bonds, the capital of the bank, are issued and signed and placed in its vaults. It is not even necessary for the commission or the bank to sell these capital stock bonds before the bank is open for business. The lawyers of the com- mission are now busy preparing the form of the bonds and they will be signed and sealed by Gov- ernor Frazier within a week or so. Immediately the capital stock bonds are deposited in the new bank’s vaults, the bank will accept for James R. Waters, who is to m'anage the new North Dakota state bank. Mr. Waters has been bank examiner under Governor Frazier’s administration . for the past three years. The Nonpartisan legisla- ture of two years ago greatly strengthened North Dakota’s banking laws, and Mr. Waters’ efficient management has made them effective. deposit all the public moneys of the state, including those of the state itself, the counties, cities and school districts. This will give the bank initial de- posits of from $15,000,000 to $20,000,000. The plan, however, is for the state bank to redeposit as much of this' money as necessary in the various private state banks to enable those banks to take care of immediate seed and other loans for farmers this spring. ~ Private banks which desire to have public money redeposited ‘with them must become “‘members of the state bank of North Dakota . much as national banks throughout the country become members of the National Reserve bank. The state bank will then become the depository of the reserves of the private state banks.. These reserves are now carried in Twin Cities and Chicago banks. This condition in the past has not only made the people, hut-the private banks of North Dakota, a mere tail to the Inte PAGE THREE T T L D RN R P S T R S U AN/ of the big financial interests outside the state. Besides the issue of $2,000,000 in bonds for the capital of the state bank, the legxslature has pro- vided for an issue of $10,000,000 in bonds to furnish funds for the Bank of North Dakota to loan money to farmers on land and on farm products stored in. the public warehouses which the commission eventually will erect throughout the state. This money also will be used in financing the Home Building association, another important part of the program, under which the credit of North Dakota will be loaned to returned soldiers and others for the erection of homes or the establishment of farms. Already local home building associations have been formed to take advantage of the act at Fargo and Grand Forks, although the home building act ear- ried no emergency clause and will not be in effect until July 1. The Bank of North Dakota will free the state from domination of the big financial interests and will enable the entire farmers’ program to be suc- cessfully financed, no matter what double-crossing the big interests hostlle to the carrying out of the program may attempt. RAILROAD LAWYERS ENGINEER ATTACK Coincident with the location of the state bank and preparations to open it for business, a group of North Dakota railroad attomeys filed suit at Fargo in the federal court to enjoin the carrying out of any part of the new North Dakota industrial pro- gram. The suit, as a camouflage, is brought in the name of North Dakota cltlzens, one from each coun- ty joining in it; but it is known that this is the last desperate attempt of the big interests to pre- vent the inevitable. The roll of legal “talent" appearmg in 'the suit against the industrial commission is enoug'h to prove that. The best corporation lawyers in the state, principally railroad lawyers,; are in the case. It is claimed that the North Dakota program. con- flicts with the Constitution of the United States— that is, that the Constitution of the United States prohibits states entering into “private business,” even though the people of a state, as in North Da- kota, have adopted by overwhelming majorities: amendments to their own constitution permitting the people to establish a central bank and other state enterprises to-free the people from the grip of market monopolies and financial combinations. It is believed here that the interests bringing the suit do not hope to win it but are merely seeking delay They think that as long as this suit can be kept in the courts hanging over the industrial com- mission it will be difficult for the commission to dispose of the state bonds:to finance the program, and they hope to delay the program until the im- possible happens—until the people of the state change their minds and vote to repeal the acts carrying out the program, before they are even given a fair trial. The state of Louisiana owns and operates a terminal grain elevator and a terminal cotton warehouse and other terminal marketing ma- chinery, for which $30,000,000 in bonds were authorized. The state of North Dakota owns and operates a street car line at Bismarck, several states own and operate public utilities of various kinds and enterprises which anti- reformers are pleased to call “strictly private business.” The Bismarck Tribune, for four years a vicious and consistent enemy of the North Dakota farm-- ers’ program, calls the federal court suit “a big mistake” and declares it is the “wrong way” to at- tack the program, and can not succeed. The in- dustrial commission and the friends of the pro- (Continued on page 18)