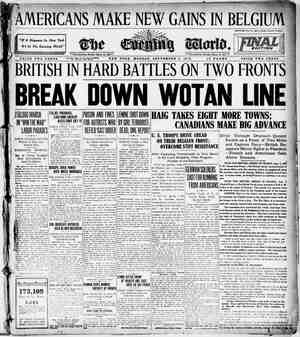

The Nonpartisan Leader Newspaper, September 2, 1918, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

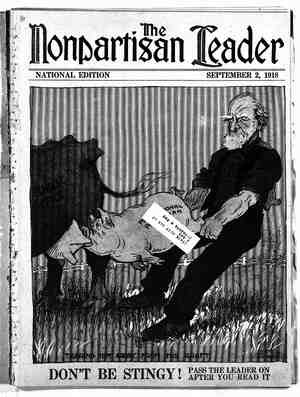

(] i 1, i e i SO R 4“"; ¥t W N L _x_.\?; ! \‘1;.: 3 PR L G o 3 i -tax crush ours" " far better able to pay an.80 per:cent . between British. and American busi- ' In the interest of a'square deal for the farmers VOL. 7, NO. 9 Nonpartisan Teader Ofiicxal Magazme of the Natlonal Nonpartisan League A magazine that dares to print the truth ST. PAUL, MINNESOTA, SEPTEMBER 2, 1918 WHOLE N UMBLR la4 Patriotism the Cure for Profiteering “An Artlcle by Amos Pinchot on the Need for Higher Taxation of Those Who Can Best Stand It—Praises the Nonpartisan League There are some men of wealth whose vision of the truth is not obscured by their pilcd-up riches. One of these is' Amos Pinchot. Him- ‘self . a millionaire, he has since the day war opened urged heavier taxation of great for- tun:s and of profits brought by war contracts. The article herewith is his letter to Claude Kitchin, chairman of the ways and means com- mittee of the house of representatives. It is Mr. Kitchin who is framing the new_taxation bill, which threatens to take heavy toll from articles necessary to every American, no mat- ter how poor, and leave the great fortunes and _incomes untouched. Tax the pcople who can best bear it, is Mr. Pinchot’s demand. It is intercsting to note that in his letter he in- ‘dorses the consistent course of the National Nonpartisan league in advocating taxation ‘of the profiteers. " BY AMOS PINCHOT E READ in the newspapers that the framers of the revenue bill had decided that the English 80 per cent tax was too high; . that the excess profits tax mnow favored - by your committee will j . probably yield on- ly $1,690,000,000, or about $290,000,- 000 more than the present law which is approximately levied at an average rate of 31 per cent; and finally, that the reason for this comparatively light tax on American profiteer corpora= tions is that our business can not stand a heavier one. The questxons which naturally rnse to one's mind are: What is the mat- ter with American business? English business corporations have prospered under an 80 per cent profits tax; why can not ours? In 1915, Great Brit- ain’s export trade was 5384,900,000; in /1916, £506,300,000; in 1917, £526,- 000,000. Does this- show that an 80 per cent tax is crushing British busi- ness? If not, why should a similar , A BILLION AND A HALF Ry FOR THREE HUNDRED Moreover, our corporations have a decided advantage over British ones from the fact that, for almost three years before: we went into the war, . and while we had no excess profits tax at all, they were making big money selling to the allies. In fact they put themse!ves in an excellent position to pay taxes, most of them writing off, ‘as they went along, the cost of new plants buiit especially for war busi-. ness. For this reason, they are today _excess profits tax than. the Enzlish companies. - Why, then, shoud they = . not-do 's0? What is the distinction ness that makes necessary a special “coddling of. Amencan war profitmg concerns ? Walh i ‘T have tabulated' the earnmgs “of 87 of our more important companies. rom 1911 up to and through the'last fiseal year (1917 ). The figures, which should be accurate as the, e taken th . business available for taxation. ports, show the so-called excess profits, that is to say, the amount by which present earnings exceed average earnings before the war. The sum of $1,559,331,730, which these. 287 com- panies have made this year in excess of the pre- war average (an average-taken in years of un- usual prosperity), represents, of course, only a small part of the total excess profits of American And .yet, if you subject just these few companics to the English 80 per cent tax, you will get over $1,247,000,000 of revenue, or, according to the Times, within about $440,000,000 of the total sum you propose to raise from excess profits taxes on all our war-profiting companies. The corporations that are performing the -tre- mendous. work of supplying the government with war materials should be encouraged. They should be well paid for their efficient and invaluable serv- ices in helping to beat the kaiser. But it seems a little too much that.the pub’ic should have to pay fifteen hundred million dollars a year to less than three hundred companies, in order to keep them 'on the job, and key them to the necessary degree of patriotic activity. After all, intense’ as e SLIPPING ‘ | e —-Drawn expressly for the Leader by Congressman J. M. Baer There s a fat man on the toboggan. His name is Big Biz. greased the way with the National Nonpartisan league, which offered a plan : for equal rights to all and special privileges to none.: Yes, the farmer made the path alt shppery, and then President Wilson and the federal trade commission. 4 ike any dying man, he can’t take his gold with him, ‘the riicle on ‘this page and you may conclude that A hoarded' profits. to THE GERMAN WAR POWER. £ I do not think I exaggerate when" First the farmer may be the patriotic effort of the executives and stockholders of these companies, it amounts to a lesser sacrifice than does the effort of our officers and common soldiers in France, who are facing death on the firing line for a much smaller reward. In war we are all in the same boat. This war, we hope, will prove a mighty leveler; indeed, to make the war a democratic force which will de- stroy special privileges throughout the world is the American people’s dearest purpose in partici- pating in it. If this is true, the man who serves with his brain here at home should be satisfied with a reasonable return. He should scorn to en- rich himself out of the war, while so many of his fellow citizens across-the sea are fighting at modest pay and in surroundings that are far less safe and comfortable. If our profiteers do not see this now, it is not because they are unpatriotic Americans; it is rather owing to the fact that they have not . yet learned to think in- terms of present-day pa- triotism. When they do, they will quit worrying about how much excess profits they will be allowed to keep, and DEVOTE THEMSELVES EXCLU- SIVELY TO THE PROJECT OF DEFEATING I say that there is a strong, and I country that the war should be paid . believe growing, conviction in this’ = for by those who can do so thhout” far as England in this direction. To do this is not in any sense an “attack” on wealth; it is not trying to punish anybody either. On the contrary, the object is to prevent anybody from being hard hit by taxes. It is nothing more or less than a necessary war measure of proved practicability, bas- ed on the experience of England, on sheer common justice and plain com- mon sense. It is merely a case of war where it will result in the least economic overstrain to the fighting war’s backbone. SHALL WE PROTECT OUR OWN SOLDIERS?. . men who are at the front. these men are poor, that is, they have selves. and their families will not find them- absolutely necessary by a great bonded debt, to be paid as bonded debts always have been, out of the pocket of the average citizen. . ~bonded debt by levying: excess profits income, luxury and inheritance ‘taxe: he has acted upon’his convictions pe - .as; well as through vork fighting for America. actual hardship; and that we should: go (as we certainly can without un- duly disturbing business) at least as. placing the financial weight of the and producing classes that are the' ' selves embarrassed any more than is Again, it is immensely important,. as a measure of war morale, as well as justice, that we should protect the Most ‘of ~ no “capital” and no income surplus. They are, for the present, in Europe: fighting our battles, and consequently:. . they are unable to speak for them- . *We should therefore make it a point of honcr to teke care of their : interests during their absence by see- - ing to it that, when they return, they = : President Wilson has not only seen the necessity of keeping down: the: