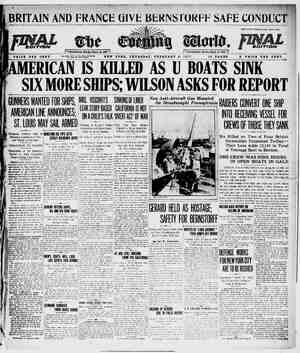

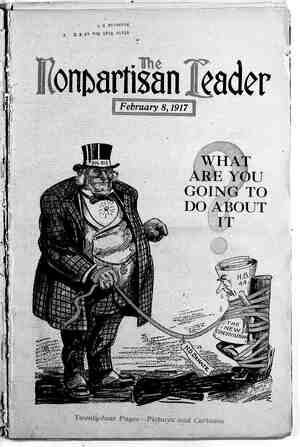

The Nonpartisan Leader Newspaper, February 8, 1917, Page 14

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

A B e ot 7 S Insurance--The Safest Business" Plea That It is Risky Does Not Justify Present High Rates— Regulatlon by State the Only Solution suppose that a business that depended for profits on chance circumstances was at least a highly speculative proposition if mot actually a gambling venture. Whether a cer- tain building will be destroyed or dam- aged by fire within a certain time is a matter of chance. The fire-resisting properties of the building, its age and condition, its surroundings and other factors make the chance of its burning within a certain period either near or remote. But after taking into consid- eration all these things it is still a mat- ter' the purest chance whether or not that particular building is or is not go- ing to be destroyed or damaged by fire within a certain period. There- fore it might be argued, the business of insuring property against fire loss is a risky one, highly speculative—perhaps actually a gamble, and therefore en- titled to big profits. O N FIRST consideration one would Such, however, is not the case. As a matter of fact chance is one of the most certain things in the world. A known number of buildings of a certain type burned down last year, the year before, and so on back. From this knowledge fire underwriters can esti- mate the number of buildings of that type that will burn down this year and next year. Their estimates are in the realm of certainties—the actual facts vary from them so little that the differ- ence is negligible. It may bhe pure chance whether a certain building will burn down, but for all practical pur- poses it is a certainty how many build- ings of that type will burn down in a year out of -each 5000 or 10,000. Mathematicians, basing their work on krown facts and the experience of a century in-fire loss, have made fire insurance one of the safest, if not the safest business. On capital invested it returns large and sure dividends, and the even flow of profits of the under- writers is not affected by the condi- tions that make most other business risky. NO COMPETITION IN RATES BY COMPANIES Merchants and manufacturers com- pete, but there is no competition in re- gard to rates among insurance com- panies. Bureaus maintained by the insurance companies fix and enforce uniform rates for all companies. There is no competition with companies that enter the field with less assets and less conservative policies and which at- tempt to cut rates, because the various states require certain responsibilities and assets for doing business, and these are uniform in each state for all insurance companies. Unlike the merchant and manu- facturer, the insurance company is not affected by tariffs, trade conditions, crops, labor conditions and the thou- sand and one things that make other business risky. Underwriters face a fire loss each year, known almost ex- actly beforehand, and their bureaus simply fix rates to cover the expected losses, pay all expenses of doing busi- ness and yield handsome dividends. The argument that the fire insurance business is risky on account of its na- ture, and therefore should pay profits in excess of those obtained by capital in so-called ‘“safer” businesses, is not warranted by the facts. This is no argument, as the facts clearly show, against regulation of ' fire insurance rates by the states and cutting of the immense profits now exacted from the people. The financial condition of the com- panies’ themselves gives enough evi- dencé to prove the business is one of the safest and most profitable, and that there is nothing risky or uncertain about it at all. Year after year the capital invested in the great joint stock fire insurance companies goes on paying from 16 to 50 per cent dividends. HUGE DIVIDENDS MADE BY STOCK COMPANIES . One hundred and one joint sfock fire insurance companies, practically all that did business in the states of North and South Dakota, Minnesota and Montana during 1914, paid dividends of $13,122,474.74 for that year. The total cagital stock of thesa companies was $78,267,575 that year. The dividends foy these 101 companits for the year were /therefore over 16 per cent on the average. After these dividends were paid these companies had a surplus over all liabilities of $135,212,000.95, more than one and one-half times their e e The people of the states of Minnesota, North Dakota and South Dakota pay annually about $11,000,000 to the joint stock fire insurance companies. Only about half what these peo- ple pay in for fire insurance goes to pay fire losses. What becomes of the rest? The rest .goes to pay dividends and for “expense.”’ Fire insurance is a vital necessity to business men and to farmers. Why should the corporations which exist to furnish this necessity be allow- ed to exploit the public \ at will? paid up capital, all representing profits of the business. A list of the 23 largest of the com- panies above mentioned in 1914 had a total capital stock of $41,250,000, on which they paid that year in dividends $9,253,000, or 22 per cent. These figures are taken from the reports of the companies as given by the insur- ance commissioners of the states men-. tioned. Fire insurance is a matter of the utmost importance to all people. It is as important -to the farmer, who must have protection against loss of his barn by fire, and to ‘the city wage earner, who owns his home. and must insure it, as it is to the merchant and manufac- turer, who protect business property by fire policies.” ‘How important it is in the matter of dollars ' and cents is shown by the fact that the people of - North and South Dakota and Minne- sota pay in round numbers over eleven million dollars annually in fire insur- ance premiums, divided as follows: Minnesota, $7,600,000; South Dakota, $1,700,000; North Dakota, $2,000,000. These figures do not include mutual companies, but are for the joint stock companies. What becomes of this vast income of the insurance companies, obtained from the people as premiums on fire insur- ance policies? Approximately half of it goes to pay for fire loss. In some vears a little over half goes for this purpose, and in some years a little less, but on the whole only about half of the money collected from the people ‘for fire: protection goes to pay fire losses incurred. What becomes of the rest? It goes to pay ‘“expense of doing busi- ness” and for profits for the insurance company: stockholders. It is the way the insurance com- panies spend the half of the pfemiums they collect that does not go to pay fire losses that has caused the movement in many states for state regulation of fire insurance rates. Companies charge rates sufficient to pay all the fire losses they sustain twice over. Their “costs of doing business” and profits equal the fire losses they sudtain. Mutual or co-operative companies, on the other hand, do not find it necessary to assess their policy holders to such an extent as this for “expense” ‘over and above- fire losses. Where states have taken over the fire policies on their public buildings® and carry their awn insur- ance, they find the expense of doing business is less than 5 per cent of the premium collécted, instead of 50 per cent. State governments are operat- ing employes’ liability insurance funds, and workmen's' industrial insurance funds, at an expense rafio of less than 5 per cent. Canadian provinces are handling state hail insurance for less than 4 per cent expense ratio. joint stoek fire insurance companies collect enough premiums from the peo- ple to cover an expense and profit ratio of 50 per cent. HIGH EXPENSE RATIO ROBBING THE PUBLIC The chief single item of expense of old line fire companies is commissions and brokerage. Eighty-one companies doing business in the northwest in 1914 reported that they spent $49,838,748.70 in commissions and brokerage. In other words, they paid agents this amount for getting business for them, and this big commission and brokerage cost is one of the things that is making fire insurance high. These 81 companies in ° 1914 collected $244,935,614.88 from the people in fire insurance premiums. Their expenditures that year of over Commissioner Olsness and Staff This is a picture of the new North by the farmers and his two chief assistants. Commissioner Olsness is sitting. Standing back of him are, left, Thomas Sheehan, in charge of the hail insurance can not control the economic situation. s Dakota insurance commissioner elected dcpartment, and W. D. Austin, right, chief deputy insurance commnssloner. FOURTEEN Yet the ° $49,000,000 in commissions and broker- age is therefore 20 per cent of the amount of premiums they collected. It runs the same every year. In fact, 20 per cent is the usual commission a fire « insurance agent gets. One of the chief evils of the distri- bution of these vast sums annually, aside from the fact that the commis- sions are a great drain on the people who must take out fire insurance, is the fact that the money is distributed to an army of people who thereby be- come a compact organization to op- pose any movement of the people to regulate or lower fire insurance rates, or force the companies to more econo- mical and efficient methods that would result in lowering rates. Insurance agents, among whom these millions of dollars annually are distributed, have been able in many states to prevent needed insurance legislation. They are organized and are generally influen- tial busniess' men, who handle insur- ance as a side line. The bankers and the real estate men deal in insurance on the side. ARMY OF AGENTS TO OPFOSE REFORMS No figures are available on the total amount .of commissions paid by insur- ance companies to agents in the United States, but the total must be staggering if 81 companies alone annually distrib- ute on this score about. $50,000,000. The annual commissions paid-agents in the three states of Minnesota and North and South Dakota. at 20 per cent of the premiums collected would be about two and a quarter million dollars. The object of fire insurance regula- tion should be something more than merely enforcing uniform rates . and preventing discrimination by insurance companies. It should go. further than forcing companies to charge the same rate for the same risk in all localities. It should regulate rates like the states “and the United States have found. it neeessary to do in the case of railroads. An effort should be made to compel insurance companies to give policies at somewhere near ‘the actual cost under . efficient business management, plus a reasonable return on the capital in- vested. ‘When this is done insurance will not be conducted on the lavish plan of charging rates high enough to pay “ex- peuse” and profits that equal the fira losses and double the cost of insurance. Commissions to agents could easily ba cut in two and the business conducted at least on lines as efficient as other business. Dividends can be cut down. ‘Why should capital invested in insur- ance cQmpanies pay an average of 16 per cent when 8 or 10 per cent, or less, are considered splendid mwestment re- turns? If insurance companies continue to fight all moves for regulation in. the interests of the people and oppose all attempts to have states take over some of the minor branches of insurance, like public employes' liability, work- men’s compensation, insurance on state buildings and hail insurance, they are going to have to submit sooner or later to extinction—the people will take over _ as a government adjunct all kinds of insurance, including fire insurance. FROM NEW YORK ’ Syracuse, N. Y., Dec. 21, 191& Editor Nonpartisan Lea.der' I desire to say I am in hearty sym- pathy with your moveme% having had some experience in nonpartisan poli- tics, The ward in which I live in the city of Syracuse, one I moved into 10 years. ago, had no/ improvements whatever, was absolutely controlled by the Republican machine and no con- . sideration could be got:-from the’ clty administration at that time. I took up the matter of forming 8' nonpartisan association and succeeded in building up a strong one with the . result that we’secured all the improve= ments we desired and we are now con- sulted as to the choice of nominations for officers to control our city govern-< ‘ment. In fact, we demonstrated the fact ‘that’ party machinery ‘could not control and, as I said, since that time we have ‘only to ask and we are recog- nized at once. T would be more pleased to see.your movement spread through- : outithe entire country I Rriow yuur moverient Wil be fought bitterly by the old party ‘macHines, but the past few years have demonstrated the fact that the people are waking up ‘and doing their own thinking and there i3 no reason on earth why they H. D. CALL. ’ ’ b g B gfi ¥ i | g