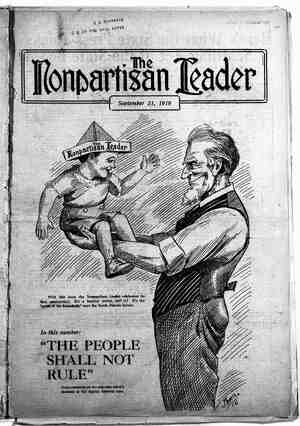

The Nonpartisan Leader Newspaper, September 21, 1916, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

' ISMARCK Sept. 16—The state . tax commission recently lost a i . suit in the supreme court against . State Auditor ICarl O. Jorgenson. : The tax commission found out that supreme court decisions ‘do. not mean what they say. Also that judges may play _politics. But the worst part of it is" that a_ state department, depending i on past decisions of ‘the supreme court, finds itself badly crippled for funds and probably forced to quit some of its valu- able investigation work for the taxpayers the court has reversed itself. { The “suit just decided. ends another chapter. in- the long series of attempts to_abolish or hamper the state tax com- . mission. .- The.- commission- has had . to fight to keep in existence and to get enough money. to pay its expenses since - lt was: created in “1911: From the start it was a progresslve y and sought-changes in’tax laws and readjustments * of taxation in the interests - of the. great.common ‘run. of taxpayers, as opposed to the special inter- ests and the body.of privileged taxpayers - . escaping their, just _share of the burdens: -The commission has sought.to tax hither- %o untaxed wealth in this state and has had great, suceess; it has sought to force many. profitable busmesses to pay a more Jjust share of the public burden; its object has been to lessen the burden on farm lands by finding néw sources of tax' revenue from pnvxleged classes; it has s been steadfast in its efforts to ‘increase : - railroad .taxation and has proved rail- roads are and always have'been gmssly undertaxed in North Dakota. - TAX CQMMISSION’S- WORK MADE “INTERESTS” HOSTILE & This “activity ‘on belialf ‘of the people of .the state has of course got the tax commission “in- bad” ing hl@h ‘places: The . politicians who take their. orders from ‘Big “Business' and special interests have . after _the. tax. commission. - - shut off its revenue so that it could not i do business: ' The -1dst legxs]ature attempted to- abolish the commission and , Zailed" to do- so‘by*only ong vote. { It was all framed-in the last leglslature $odo away with the. :tax commission and i replace it by orie -tax commissioner. v This would oust. the members of the com- mission’ ' who 'had been fighting the people’s fight and enable the polmcmns, through ‘the governor, to appoint one tax commnssmner acceptable to those who did 5 3 ; not like the commission’s activities. i i The legislature actually did pass an appropriation for a one-man ifistead of a ‘three-man commlssxon, but on the last day of the session the bill to abolish the : commission. “and® create the one-man - department failed to -pass by one vote. i " So the tax commission -was left in exist- ence but without ap appropriation. :The appropriation made was for a one-man commission and not for the tax commls- -&ion as it was allowed-to exist, ? AUDITOR JORGENSON ASSISTS FOES OF THE COMMISSION .The state audltor then took up the fight to: crlpple ‘the commlssmns activ- e refused to pay salaries for omfiu&smners, ‘alleging that the appropriation,: obvxously not intended for ‘the three-man _Commission, held good.: So the' tax comxmssxon brought suit’ agairst the auditor; ¢ ; ing - that singe no . appropriatig nade for ‘the commission: By leglslature the appropnafipns ik ;hade a . ;.tp appmpnatlon'fo 2 one-man : ; madven‘tende and a ppropriations r“Ina of ithe QuJeglslature for the three-man Da.kota It Decides One Way, Then Takes It Back When Political Conditions Change N. D. 564-570, and is as plain as a court decision-can be. Even before .that ‘the supreme court had held that the tax commission was working under the 1911. appropriations and that these appropria- tions were clearly “definite and distinct annual appropriations.”. This ; was decided in 25 N. D.,.539-561. So the tax: commission proceeded under these decisions: to work under the 1911 appropriations, as amended in 1913, and _ the state auditor was forced to pay the salaries of three commissioners. - A short time ago, however, the - state -auditor although some of them pulled the wires pretty hard to _get indorsed. Then the primaries ' came " and Judge Goss was eliminated from the race and the other two judges running for reelection, Fisk and Burke, were badly beaten by the farmer . vote. . The ' farmers supported the League candidates.” * - g _..Members of the supreme court. may have blamed the two majority members of “the 'tax comniission, who had: given - aid and comfort to the League movement, for the result—the defeat of the present Judges. Whether'. ~this' feeling con- ~have acted dlfferently. again questioned the appropriations of the tax commission. The: fight on the . commission was not going to be allowed to stop, regardless of the two decisions, This time the state auditor alleged that, while the supreme court had held that the salaries of ‘the three- commissioners - could be paid; it had not.held"that the appropriations ‘for a one-man commxssxon-'_ for office help, etc., ‘were void. - The auditor held up warrants for office-help, claiming that the tax: commission’ had exhausted appropriations for this item contained in sub-dunsxon 18 of the ‘budget - Repeatedly attempts h@ve been made, to bill. REVIVING.SAME ISSUE ONCE DECIDED BY COURT . - - Remember, this sub-division 18 of the budget was the one-man. commission appropriation that the supreme court had held. plainly to be an “inadvertence and nullity.” It looked as though. the state auditor was actually in contempt of court in refusing to consider sub-division 18 a nullity, as declared by the court. The tax commission, “trusting in the past supreme court decisions, had gone ahead in its' investigations and work for the taxpayers under the 1911 appropriations, which the supreme court held | still applied. So' the tax commxssxon brought suxt4 against” the state auditor again in the supreme court, feeling that the outcome was-a “ech.” It considered it practic- ally certain that the supreme court would stand by its past_decisions, especially . because, ‘relying on_those decisions, the . commission had consndered the -one-man appropriation a nullity and had 'been spending money and conductmg .1ts work under the old appropmtlons COURT CHANGES ITS MIND 3 ‘AND FOOLS THE COMMISSION . .~ . But _here i was fooled; its. mind. The ' political situation had changed where the tax commission the supreme court changed " since the former decisions.. The majority . members on " the tax commission had espoused .the cause of the North Dakota farmers in their fight for _Dolitical and economic . justice.” Tax. Commlsmoners Wallace and Packard’ S w_in the Nonpar- tisan. League a genui nient see'kmg badly needed * political reforms, not only. for -the farmers, ‘but for all the ‘people. They gave what aid ‘they could ‘to the- new movement; fur- -nished facts and figures for the benefi powerfal eneniies in high places’in North A d the League did not mdolse = The two decisions in the tax eommlssmn cases are in absolute conflict with -each other. . court had meant to punish the tax commissioners - for -aiding the Nonpartisan League it would not - An instance showmg the : ‘people that ‘it will pay to take a hand innaming - thelr supreme court Judges. ‘ " people’s’ move- If the 7 sciously or “subconsciously” affected the court’s decision, nobody. but the judges themselves can tull. At any rate the supreme .court. reversed its formér decision .regarding the. tax commission and held the state auditor was nght‘ in his_contention- that the-.commission: was working - under the one-man appropria- tion- so far as .office help and other expenses .were concerned. - The court assigned Judge Goss to write the opinion. This- may not have been politics - either. -But -if the court looked upon its reversal of its former decision as a -punishment .for- the tax commission on account of .-the. tax commission’s vertent”Supreme . commission. division 18 is_a one-man appropriation. espousing the farmers’ ‘cause, it was a - clever stroke' to et Goss be the goat. Goss was eliminated at the recent primaries and -is—net a -candidate for election this fall, as Fisk and Burke are. So.it was: probably wise to “let Goss do it” instead of any of the others.. ° THE COURT'S “iNADVER_TENT‘ USE OF WRONG WORDS - The court does not take back its former opinien manfully, makmg it ‘plain it is reversing itself.’ Tt refers to the old opinion ' as an. inadvertent. use ‘of language. It was mot the intention of the court to rule as its language indicated in the old opinion, the court says. “Counsel for the.petitioners,” says the court, “in their brief contend.that this court in 31 N. D. 563 held sub-division 18 to.be void in its entirety. . That. ques- tion was not in interest there. - THERE IS LANGUAGE . .INADVERTENTLY rourt USED TO THAT ‘EFFECT IN THAT OPINION but only the first-item of sub- division 18 was there under consideration and was the only part of said subdmslon .passed upon.” This paragraph is the only excuse the court gives for reversing itself. Its decision is that the one-man commission appropriation does not apply to the present three-man commission so far as the salaries of the commissioners are concerned, ‘but it holds that the one-man appropriation does apply to the present commission when it comes to clerk hire and other expenses of the tax commission office. " Tlns, of course, has put the tax commission badly up against it for funds. - The. court has to throw logic to the four winds -to make this decision. It has $o make it appear that the legis- lature in.the same appropriation would provide for a three-man and a one-man The court. . holds and .void.so far as the salaries. of the commissioners are concerned, but is a three-man appropnat:on and valid so far as the Trest of the expenses are concerned. Yet this act’ was passed by the legis- lature when it was expected the one- man plan would go through and with the evident intention that the whole of sub- division 18 was for a one-man commis- sion, as the supreme court formerly held. The legislature did not know till the last day that the plan to make a one-man commission would not pass, and it had no time to change the appropriation to a three-man” basis. Yet the supreme court gives no weight to these considera- tions in its last opinion, théugh it did in~ its former one.’ - Pu'l.lman ‘740:“‘7. Pullman cars are distributed by MORE BROS. Fargo and Wimbledon, N. D., Minneapolis, Minn. Call and receive™ a dem- onstration. ‘EQUITABLE AUDIT CO.,Inc. " s> Han Farmers ‘Elevator Companies’ Home of Auditing and - Systems for Accountmg Write: for- References. wl Dakota Monument Co. =101 Front Street> Fargo N. D. Our skillful workmanshi; _1s at your ! semce Our reputatlon is your sa.fegua Best eqmpped plant in- the Norflmiést Write'for our catalog showing designs” 0+ that. wfll pleuse you. 3 fau'ness R 7] Wefave a number of Bull Tractors and other nds of small and medium size Gas I:.ngmes, y down dtrect prz .7 One’ of our moderate priced: * i Monuments = farmers. - sub- ° At i !