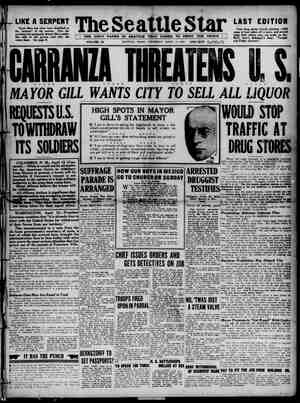

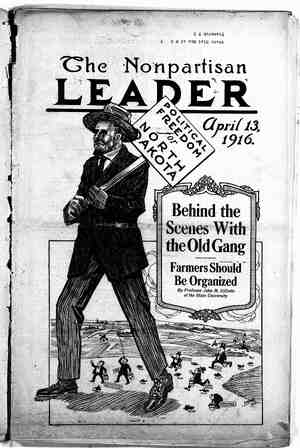

The Nonpartisan Leader Newspaper, April 13, 1916, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

i EIGHT Hann THE NONPARTISAN LEADER i the Bankind espot Power to Make or Break the Country Banker Wielded With an Iron Hand at State Capital “We have the banking board against us. Even if you should win out they might hold you down very closely on doing business. We know that you realize that it is impossible to do a banking business and do it to the letter of the law.” banks in North Dakota and in- terested in starting a new bank wrote the above statement to another man with whom he intended starting the new bank. What did this banker mean by that statement and why is it of interest to every person in North Dakota who has dealings with banks, especially farmers? . - This banker says that it is impos- sible to do banking business in North Dakota and live up to the letter of the law. He ought to know; he is interested in a dozen banks. ‘Then he says, in -effect, that if the banking board is against you when you want to start a bank you might as well quit. ‘What ‘did he mean by that? He means just this: ; There is a complex system of laws overning state banks in this state. ome of them are enforced liberally, some strictly. The persons whose duty it is to enforce these laws have a power over the banks and finances of this state that is almost unlimited for evil or good, according to the char- acter of the persons charged with en- forcing them. These persons can break any bank, it can almost be said. If they do not like a banker they can enforce strictly against him the laws which are enforced mot so strictly against other bankers. They can en- force the laws liberally against bank- ers who have their favor. This system in unscrupulous hands can drive good men out of the banking business and keep bad men in it. MAN WHO WROTE IT KNEW THE CONDITIONS That is what this banker meant when he wrote that statement quoted above. He put it briefly, tersely, to a,_ fellow banker who would under- stand, without going into the detail necessary to make it plain to the ordinary person who is not a banker. But he meant just that. The banker who made this state- ment is A, J. Johnson of the Granite Falls bank, Granite Falls, Minn., as- sociated with J. S. Johnson, his father, and L. O. Johnson, his brother, who have a bank at Van Hook, N. D., and at several other places in this state. The Johnsons of Granite Falls intended to start a bank at Upham, N. D., with Jay G. Johnson of Upham, and the statement referred to above was in a letter to Jay G. Johnson re- garding the establishment of the new bank. The reason for this statement and the set of circumstances it referred to reveal how those charged with the enforcement of the banking laws are using their authority. The story takes us back to May, 1913. ; A BANKER’S POWER . AS STATE’S GOVERNOR - L. B. Hanna, banker and financier, had just been elected to his first term as governor and qualified for the office. By virtue of his official posi- 3. MAN interested in a string of tion he became chairman of the state - banking board, the ‘authority charged with the enforcement of the banking laws of the state, and he became the authority who appointed the state bank examiner, who is secretary, ex- officio, of the banking board. Mr. Hanna, then a director of the First’ National bank of Fargo and credited at that time with being interested in a score of banks in the state, became the author of a resolution, adopted by the state banking board, which utter- ly changed the policy of the state in regard to state banks. This is Hanna’s famous bank reso- lution .of May 19, 1913, What was it? ' In brief it put into the hands of the governor and the state banking board authority that the most solidly intrénched dictator would have envied —it created a monopoly in banking in North Dakota. It gave the governor and his board the ~far-reaching authority to prevent banks from being started in competition with existing banks if these public officials saw fit. The,,nature' of the authority thus placed in the hands of the governor and fellow office holders was this: By giving power to prevent competition against established banks, it put a continual threat, if it was desired to do so, over the. heads of existing banks—if they.- would not be “good”. the board could let in other banks to com- pete with them. Thus existing banks could be made to shiver and shake, if it was so desired. Favored persons could be given bank charters; those who were not “right” could be refused them. This whip-hand over one of the most important businesses of the state was such that it would be sought by an unscrupulous public official who was interested in banks—it would - protect his interests. . These were the potentialities of the authority the resolution gave. Whether it was used for these .pur- poses the facts and the facts only must show. The legislature had not seen fit to delegate this sweeping authority to the state banking board and the gov- ernor. The governor and the board assumed the authority themselves. They had previously had no power to . refuse bank charters and no such power was exercised. A bank could be started anywhere where -honest men organized one and had the neces- sary capital. Now no bank can be started unless the governor and”the board see fit to permit it. FIFTEEN BANKERS ARE REFUSED CHARTERS At the time this famous resolution was adopted Andrew Miller was at- torney general and by virtue of his office a member of the banking board. He did not vote for the resolution, on the ground that no authority to pass it existed—the legislature, he held, had not given such authority to the board. Despite this view of the then attorney general the governor’s reso- lution was passed and has since been enforced, The records of the secretary of ° state show that 15 banks already have been refused charters under it. In other words some 15 North Dakota towns have been denied new banks and such competition and perhaps lowering of interest rates as these new banks would give. In some towns the refusal to charter a new bank has resulted in forcing the people to do business with the one ex- istingt bank, whether they wanted to or not. If the attorney general has held that no authority exists for this as- sumption of authority by the govern- or and the board, why have not persons intending to establish banks brought the matter to court, to test the legality of the resolution and force the The answer to that brings the story around to the banker’s quotation with which this article is opened. No banker wants a charter for a new bank unless the banking board is in sympathy with him and his enter- prise, because the banking board can make conditions too onerous for a bank to exist, so the banker quoted by the Leader says. Does this ac- count for failure to take the matter to court on the part of those denied charters under the Hanna reso- lution? - AN ACTUAL INSTANCE .OF THE HANNA POLICY In January, 1914, there were two banks ‘at: Upham, N. D., the State Bank of Upham and ‘the Security State Bank of Upham. The Tallman issuance of a charter? . ........O.....Q..Q......O....,....0...0..........0.. What do you think it means to have the state in the grip of a ruthless banking oligarchy? “You can’t do business if the ® banking board is against you,” writes one banker to another. _k_b‘qqo,oo’op@qj_boq’qqc5‘@’06.&9000Qooo’o‘oo.ooh'009’0“00_0_90,9'09.'06 Investment company, controlling the State Bank of Upham, sold its assets to the other bank in the town, leaving one bank for the community. - Jay G. Johnson was cashier of the bank which' was sold. In October, 1915, Mr. Johnson with the Johnsons of the bank ‘at Granite Falls, Minn., organ- ized a new bank for Upham and com- plied with all the requirements of the law.’ They then sought a charter, as prescribed by law, of the secretary of state. They proposed to call the new bank the Farmers and Merchants State Bank of Upham. Here was where they ran up against the Hanna bank policy. Their appli- cation for a charter was held up until the banking board passed on it. The banking board referred the matter to Attorney General Linde. Now. when the State Bank of Up- ham was sold to the other -bank of that city and consolidated with it the Tallman Investment company .entered into a contract with the Security State bank, purchaser of the other bank, providing -that neither the in- ~vestment company or officers of the sold bank were to enter into the bank- ing business in Upham. As cashier of the sold bank Jay G. Johnson signed this agreement, He saye he signed it as an employe of the bank and not as an individual and that the agreement could not bind ‘him. This view of it was also taken by: the Tallman Investment company, which did not consider that it bound l{r. Johnson as an indiyvidual. EMPLOYERS’ AGREEMENT - BARS OUT JOHNSON The Tallman Investment company ‘and nof the officers of the sold bank was the party of the first part in the agreement, and directors of the Se- curity State bank were parties of the second part. It was contended also that the contract was void so far as Johnson was concerned under the laws of North Dakota referring to restraint of trade. Those laws state that such agreements can not bind anybody except the person selling the “good will” of a business, and there are decisions holding that a man in Mz, Johnson’s. position could not sell the “good will” of the bank in which he was cashier. : At "any rate there was a legal point very much in doubt. The Se- curity .State bank held Johnson could not enter the banking business in Up- ham under the agreement and John- son claimed he could. It was a legal controversy strictly between Johnson, who was organizing the new bank, and the Security State bank, purchas- er of the bank in which Johnson form- erly was cashier. It was a point which rightfully would be settled be- itween them in court and in which the banking board could have no interest. But Attorney General Linde deliv- ered an opinion to the banking board and those interested in organizing the new bank for Upham holding it would be improper for the banking board to grant a charter to the new bank and thus violate the agreement which it was alleged bound Johnson not to enter into the banking business in Upham again for 10 years. : THERE “WASN'T ROOM” FOR TWO BANKS But this was not the sole ground on “which the attorney general and the banking board rested in refusing the charter. The real ground and the real reason was contained in the fol- lowing from the attorney general’s opinion: “The history of banking at Upham would indicate that there is no room there for two banks.” ; In other words the real motive was to give the existing bank at Up- “nation’s most prominent workers -connected “with the ‘movemen [ ] [ ) { ] 3 (] 3 ® { ] © has honored My, Behrens, " ham a monopoly on the banking ‘busi- ness there. The other reason—the contract—was a ~mere pretense. This was proved later when the at- torney general withdrew from his position that it would be improper to grant the charter on account of this agreement. In & later letter address- ed to an attorney employed by the organizers of the new bankthe at- torney -general said: “It is true the banking board has no official interest in the matter of the - contract with the other bank at Up- ham. It is immaterial so far as I am concerned and the matter of the enforcement. of the contract is a question for the court to decide.” - Then the attorney general went on to say again that the banking board thought one bank was enough at Upham. : : The governor and the banking board did not refuse the charter to- Mr, Johnson' at once. They allowed the matter to drag on. While they said they- thought one bank was enough at Upham they indicated that they would grant the charter anyway. But finally on February 17, 1916, they wrote that they would not grant the charter. The application for it had been made over four months be- fore. The application for a charter was returned February 17 with a no- tation it had been refused Novem- ber 26, 1915, the afternoon prior to the evening -on -which Mr. Jchnson says he had assurances from the at- torney general that the charter would be ‘granted. : 2 Jay G. Johnson is a young business man of ability. He has the respect of the community in which he lives. With a number of substantial farmers of the Upham district he is now pro- - posing to start a farmers’ bank at Upham under the direction of the Equity Rural Credit association, the cooperative banking organization of the state formed by Equity farmers. Another banking effort is to be made to get a charter and it promises in- teresting developments. ’ WHAT JOHNSON WROTE TO THE BANKING BOARD Mr. Johnson has a keen sense of humor. When the banking -board finally turned him down he penned the {ollowing gem to the state banking oard: Upham, N. D., Feb. 22, 1916. The State Banking Board, Bismarck, N. D., Gentlemen ? I have your letter of recent. date with reference to issuance of charter for the Farmers and Merchants Bank of Upham. I note carefully the re- sult of ~your mental gymnastics, Not being a caster of pearls I have no other. comment to make’ than'to misquote, 3 “But men, proud men, Drest in a little BRIEF authority, * * * * * S * Play such fantastic tricks before high Heaven, ; : As make the angels weep.” In connection therewith: T suggest‘ that you study Shakespeare as you seem to make“such little progress in law, and perhaps in politics. Trusting that we may all live to know politics with a “less ancient and fishlike smell,” T vremain: i * Sincerely, . .- JAY G. JOHNSON. . BEHRENS HONORED : . H. E. Behrens, one of the organiz- ~ ers and lecturers of the Nonpartisan League, whose home is.in Fargo, has " been honored by being designated as one of the. official' lecturers of: the committee having in charge the indus- trial service movement, which com= mittee has headquarters in New York - City. commissioner of the York, who spoke in 3 recently, also is one of the official speakers is . committee. 1 industrial and social betterment are Frederick C. Howe, immigration art of New - orth Dakota we- [ A N ¥ ] P " . f b A 3 b 1 [ S ) g | i ' - > g 2 3 A 3 3 . A i ! B