The Nonpartisan Leader Newspaper, March 9, 1916, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

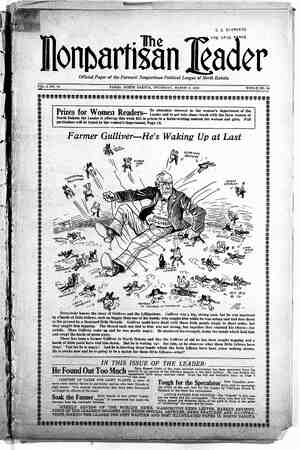

HE farmer of North Dakota might learn much concerning taxation from the provinces lying across the Dominion boundary in Canada. Roughly speaking, the provincial, governments are supported by taxes upon corporations, upon business, up- on the liquor traffic and from the revenue from excise taxes and the sale of public lands. The local government in the cities and villages is supported by a land tax, a business tax and in some in- stances a general property tax. In -rural communities practically all personal property and improve- ments upon real estate are exempt from taxation and local revenues are raised from land taxes in some form. While conditions are somewhat dif- ferent in the provinces of Alberta and Saskatchewan, owing to the timber acreage in Alberta, the large income from the sale of pub- lic lands and the enormous a- mount of land owned by spec- ulators, in Manitoba condi- tions are almost identical with those in North Dakota. In 1913, the year of the ab- olition of the flat tax per acre on lands, land in the province of Alberta paid an average of 5% cents per acre for the maintenance of all local in- stitutions and in Alberta. from one to 7% cents per acre, while in North Dakota we are paying fourteen cents per acre for the maintenance of our local institutions; in addition to a local tax on personal property. EXEMPTS PRODUCE, STOCK AND MACHINERY In Manitoba the local rev- enue is raised almost alto- gether from land. We find that in addition to the usual exemptions covering property of educational institutions, hospitals, churches and ceme- teries, the law also exempts all - farm products in the course of shipment to market, all cord wood, all farm pro- ducts, all horses, sheep, swine poultry and other farm stock, all farming implements of bonafide agriculturists and farmers, house- hold effects and furniture, books, and wearing apparel of any kind whatever in use by the person posses- sed or his family. Although real estate is defined by law to include all buildings and other things fixed to the land, the law pro- vides, however, that all unoccupied land shall be assessed at the same value as lands engaged in farming, stock raising and gardening. This statute compels the speculator‘ holding unimproved lands to pay the same tax as the resident farmer pays upon his land together with its im- provements. = In addition to placing a tax upon the land of the speculator equal to the tax paid by the resident farmer upon his improved lands together with his buildings, local taxing authorities may reduce the valuation of improve- ments one-half on the land of the non- resident, improved for the purposes of general farming, stock raising or gardening, provided the improvements are for purposes of local industry. The single tax idea;‘however, does - not apply to cities and villages. They assess improvements, stocks and trade as well as the land. In Winnipe land and improvements are assesse at two-thirds of their full value; at Brandon land is assessed at full value while improvements are assessed at 50 per cent. The same is true of St. Boniface. Portage la Prairie assesses ‘--land at full value and improvements at 60 per cent. 3 1 NEW SASKATCHEWAN LAW EXEMPTS FARM IMPROVEMENTS Sagkatchewan is a rairie province lying to the west of : anitoba. - No provincial ‘tax is levied on the _land or property generally. Formerly . . -'was a flat- acre charge and the tax THE NONPARTISAN LEADER ' OUGH FOR THE SPECULATOR How the Northwestern Provinces of Canada Have Lightened the Burdens of the Producing Farmer by Tax- ing Idle Land and Land “Increment” and by Exempting I mprovements and the Personal Property of the Farmer TIGTIETR TR AT ey THREH By FRANK E. PACKARD CHAIRMAN OF THE STATE TAX COMMISSION OF NORTH DAKOTA the average land levy in 1913 was 5 1-7 cents per acre. For the same year in North Dakota it was 14 cents per acre for local purposes. In 1914 this flat tax was changed to a land value basis. The rule of valuation under the law is, “Land shall be assessed at its actual cost value exclusive of any increase in such value caused by the erection of any building thereon or by any other expenditure of labor or capital,” exempting improvements from taxation. - Crown lands leased for grazing are Saskatchewan has another law which provides that rural municipalities, which correspond to our counties, may upon the favorable vote of the land owners at the annual election, levy not in excess of 4 cents per acre to supply a hail insurance fund. The revenue accruing from this tax is used for the payment of hail losses in that district. The non-resident land owmer can receive no benefit from this tax and he is further incensed because the law contains a provision permitting residents to withdraw from the op- eration of the act any number of A new farm home in Northwestern Canada, where the farmer is not penalized in taxes for improving his place and giving his family comforts. original home on the place. subject to a tax of one-half of one cent per acre. cent an acre is levied upon- all lands outside of cities and villages. 5 SURTAX ON UNUSED LAND HITS SPECULATORS HARD In addition to the regular tax the 1914 law provides what is known as a “surtax” on improved land. This is aimed at speculators. It is very popular among the settlers, but bit- terly resented by the mnon-resident land owners. b This- law provides that the coun- cil'of every rural municipality, which corresponds with our board of coun- ty commissioners, shall levy and col- lect a tax of 63 cents per -acre, in addition to the regular tax, on the following classes of land: . 1. The land of any owner or occupant not exceeding 320 acres which has not less than one-quar- ter of its area under cultivation unless such owner or occupant is an actual resident upon such land; 2. The land of any owner or occupant exceeding 320 acres but not greater than 640 acres which has less than one-quarter of its area under cultivation; ; 3. The land of any owner or occupant exceeding 640 acres but not greater than 1280 acres which has less than one-quarter of its area under cultivation; % 4, - The land of any owner or occupant exceeding 1280 acres but not greater than 1920 acres which- has less than one-half of its area under cultivation; 3 5. The land of any owner or occupant exceeding 1920 acres. - ° This law is having the effect of bringing many large areas under cul- tivation. . 12 : s This “surtax” is not the only griev- ance ‘of the non-resident landowners. A school tax of one quarter sections of land which are inclosed by a substantial fence and used for grazing or hay purposes or a half section held under the home- stead entry act from the Dominion of Canada upon which there are less than 25 acres under cultivation. Non-resident . owners of Saskatche- wan are further irritated by the weed tax. Under the provisions of this law a tax may be levied against the land of mon-residents for the pur- os&a of cutting the weeds upon the and. —~ALBERTA TAXES “INCREMENT” BUT NOT IMPROVEMENTS Like the other provinces of Canada, Alberta raises little money from di- rect taxation on property. The three forms of direct. taxes on property which are levied for provincial pur- pose are all types of special land taxes. They are the unearned incre- ment tax, wild land taxs and.timber acreage tax. - On October 25, 1913, the first in- crement tax on this continent was put in operation by the provincial government of Alberta. The idea was obtained from the famous Lloyd- George budget of 1909, and levies a tax of b per cent upon the increase of land values. The law was so drawn, however, that it applies almost entire- ly to city real property. The value of' the improvements is ‘included in the tax. GdVERNMEl:IT GRABS SHARE WHEN VALUABLE LAND IS SOLD In addition to the allowance for the cost of improvement exemptions, farm lands, within certain limitations are also exempted. Farm lands are de- seribed as land of which 10 per cent is under cultivation and which are actually used. for agricultural pur- poses during the 12 months preced- Above to the left is shown the ing the transaction which resulted in the transfer. Land in excess of 640 acres is subject to the tax but only to the extent of the excess of $50 per acre value of the land transferred. This virtually exempts all agricultural land from the operation of the law. In order to avoid an appraisement of the lands of the province the pro- vincial government has fixed the mini- mum valuation of $15 per acre. This can only be changed by the land owner applying within one year to the proper officials and having the actual valua- tion fixed. A great deal of property attached to municipalities which is worth as high as $1,000 an acre, through negligence or some other reasons, has this low valuation placed upon it. As a result when this land is sold, if it sells for $1,000 an acre, the government will step in and take 5 pe:' cent of the $985 incre- ment. The operation of the law is very simple. The records show the value of the land as of 1913. When such land is transferred the government takes 5 per cent of the differ- ence between the price in 1913 and the price when sold, buildings and improvements being excluded from consid- eration. ALBERTA LEVIES TAX ON “WILD LANDS” In 1914 the legislature of Alberta passed an act levy- ing a special tax on wild lands. One per cent was im- posed upon the value of all lands in the province which were not specifically ex- empted. sigiad The most important ex- emptions are laid upon land on which homestead entries has been made, land held un- der a grazing lease from the Dominion and actually used for that purpose; lands within corporate limits of a town, city or village, enclosed land used for grazing purposes and land owned by a bona fide farmer actually resid- ing on the same to the amount of 640 acres and the land of any owner where one-fourth of its acreage is under cultivation. A very small acreage tax is also imposed upon timber areas. Prior to 1912 all land taxes in or- ganized municipalities, which are fixed districts 18 miles square, were raised by a land tax running from 1 to 7% cents per acre. Now such revenue is reised by a tax upon land values. PLAZA SMITH AND THE LEAGUE Plaza Smith has had a terrific fall- ' ing out with the Nonpartisan League and is now saying unkind things about that organization. Smith ac- cuses the League of being in the hands of the Socialist leaders and says. that if the League survives, the So- cialist party in the state will go to the bow-wows. one of the main supporters of the League ever since it was organized a year ago, but since the official organ of the League, the Nonpartisan Lead- er, showed him up politically a couple of weeks ago, he has not been quite such an admirer of the organization ~and he can be expected to knife it whenever an opportunity presents it- self. From what the Independent can learn about the Nonpartisan League, that organization desires to keep professional politicians in the back- ground.- When Smith wrote a let- ter to one of the leaders recently, proposing that he resort to a political trick in order to place himself in a powerful position to assist Smith, the Leader exposed him. Smith never had an opportunity of being elected governor anyway, but the editorial in the Leader spoiled his chances of get- ting even a resgectable vote, Smith is more ‘success: man than as a politician.—Ward County Independent. = "% “Froggie” has been, ul as a newspaper. i | | g ST e