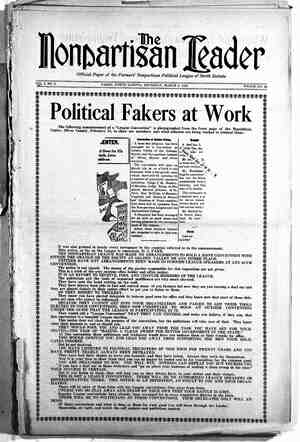

The Nonpartisan Leader Newspaper, March 2, 1916, Page 11

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

H brses; . Wanted (Not for War Purposes) For Southern rice and cotton fields. Horses from 4 to 8 years old. I will be at Tuttle, N. D., Thurs- day, March 2; Wing, N. D,, Friday, March 3; Wilton, N. D., Saturday, March 4. Call on me on above dates or write me at Grand Pacific Hotel, Bismarck, N. D. Jack Charles WM. C. BENZ Moffit, GARAGE and N. D. General Blacksmithing P The Farmers and Merchants Bank of New Rockford, N. D. A Home Iristztution Capital and Surplus of $30,000 Largest Deposits of any Bank in Eddy County Does a General Banking, Farm Loan and Insur- ance Business ) BLUE-BLOODS at AUCTION SALE at Minot, N. D., March 16th The North Dakota Pure Bred Live Stock Breeders’ Association ill Se 36—Pure Bred Draft Stallions—36 Percherons, Belgians, Clydesdales, Shires—Ages 2, 3, 4 and 5 14—Pure Bred Draft Mares—14 i Same Breeding and Ages ~ 5—Pure Bred Standard Bred Stal- lions and. Mares—5 38———Pure Bred. Bulls———38 Shorthorns, Herefords, Pole Angus and Holsteins—1, 2 and 3-year olds Some She Cattle will also be in sale Every animal consigned will be right in every way and fully guar- anteed. The consigners to this sale have agreed to consign only prize winning horses and cattle and to fully guarantee them in every way. Schoefield’s Barn, Minot, March 16 Sale Starts Promptly at 9f30 a. m. For further particulars write Frank H. Hyland, Auctioneer, Devils Lake. N. D., or E. S. Person, President Union Na- tional Bank, Minot, N. D. PERCHERONS Having come into possession of ‘White . Bros. Percherons I desire to - reduce the herd this spring. With this end in view I am offering some ve! attractive bargains " in young stallions and young mares. Am also offering our herd horse Pink Champ- ion" No. 64399. - M. M. WHITE ' Successor’ to: White Bros. N. D. THE NONPARTISAN LEADER Elevator Taxes Not Equalized Apparently No Effort Made by Board to Treat All in State on Fair Basis. _ The state tax commission has dis- covered that the state board of equal- izafion has been making practically no effort to eqalize the assessment of elevators in the various counties, with the result that unjustifiable differ- ences in the taxes paid by elevators in the various parts of the state result. The commission is now attempting to get a list of all elevators, showing their cost, capacity and other data, so that assessors can. be instructed to + rectify the inequalities. This work will be greatly compli- . cated by the state board of equaliza- tion’s new personal property .schedule which lumps elevators and grain warehouses in one item for assessment and does not require a statement of the capacity in bushels as was former- ly required. . Boards of equalization in the counties and the state board therefore will have a hard time get- ting the information wanted for the proper equalization. They will not know whether it is an elevator or _ warehouse which is assessed in any given case or what its capacity is if it is an elevator. So if the state is to get a fair value put on elevators for taxation this year it must be through the tax commission’s instructions to . assessors and as a result of the facts concerning the elevators of the state that are now being compiled. Great Inequalities Shown That the state board of equal- ization, consisting of Governor Hanna, State Auditor Jorgenson and other office holders at Bismarck, has made little or no effort to see that counties are all assessing elevators on the same _basis is shown by the tax commission figures, which show great inequal- ities in the various counties. For instance, the Andrews Elevator company at Robinson, Kidder county, 35,000 bushels capacity, is assessed there at only $1007, and the Great Western Grain company elevator at Steele, same county, 83,000 bushels capacity, is assessed at only $1000. On the other hand the Equity Elevat- or company at Abercombie, Richland county, is also one of 35,000 bushels capacity but is assessed at $1738. Also in Richland county is the Os- borne-McMillan Elevator company at Lidgerwood, 35,000 bushels capacity, assessed at $1800. Even more in contrast with the Kidder county basis of assessment is that in "Morton county,-where 30,000 to 35,000 capac- ity elevators are assessed at $2640 each, four in that county in different towns each having that assessment, as ‘follows: Curlew Elevator com- pany, Elgin, 32,000 capacity; Occident Elevator company, Gwyther, 385,000 capacity; Farmers’ Elevator company, Mandan, 30,000 capacity; Occident Elevator company, Flasher, 85,000 capacity. Difference Unexplained Why should a 35,000-bushel elevat- or in one county be assessed at $1000, in another at $1800 and in still an- other at $2640? This is what the state tax commission wants to know. Hundreds of contrasts like the above are shown by the figures from the various counties. The inequal- ity among assessments in the various counties on the larger elevators, 40,- 000 and 45,000 capacity, which ap- parently there has been no effort by the state board of equalization to correct, also is great, as the following figures show: Figures Show Variation Farmers’ Elevator - company, Bu- chanan, Stutsman county, 45,000 ca- pacity, assessed at $2880; Farmers’ Elevator company at Buffalo, Cass county, 40,000 capacity, $1500, and ° Farmers’ Eleyator company at Dur- . bin, Cass county, 40,000 capacity, $1740; Farmers’ Elevator 'com;i)anti and Occident Elevator company, bo at Eldridge, Stutsman county, $1800 : each; Pingree Grain company and Equity Elevator company and Supply company, also both at Eldridge and both 40,000 capacity, $2160 each; Pow- ers- Elevator company, Dawson, Kid- der county, 40,000 capacity, $1000; O. D. Brault elevator and J. R. Smith Grain company elevator, both 40,000 capacity and 'both at Beach, Golden Valley county, $2780 cach. No two' elevators likely would be exactly the same in value even if the same in capacity, owing to age or im- provements, but’ the tax commission does not believe that the wide differ- ences shown by the above figures can by any . stretch of ' the imagination represent the actual differences” in value of the properties or anywhere near it. = They must be due to differ- ent systems of valuations in the vari- ‘ous counties and to fail\ge of the state - board to properly equa b ELEVEN Paid Advertisement All those who 'signed and sent Thank You *" i retion. | Also all those who intend to do : so but have delayed— Thank You Please don’t put it off. ” Remember This . No additional taxes— Capital fund— $1,199,216.37 Land Values will increase all over state. You need not vote for Capital Removal unless we prove our case. CAPITAL REMOVAL ASSOCIATION New Rockford, N.D. - SIGN THE PETITION TODAY Farmers and Farm Workers Your prosperity is helpful to the ecity worker as well as to yourself. Likewise his success is an indirect aid to YOU in the selling of your farm products. . Help the city worker—the Unon shoe worker by the purchase of UNION STAMP FOOTWEAR. ! Do your share towards building up mutual prosperity. Insist on shoes bearing the UNION STAMP and you will be certain of the best possible shoe for your money. ; UNION STAMP FOOTWEAR is sold by reliable retailers all over the United States. : BOOT AND SHOE WORKERS’ UNION 246 Summer Street, Boston Mass. JOHN F. TOBIN, CHARLES L. BAINE, President. Secretary-Treasurer. %OOT &SHO€ WORKERS UNION AMP| Before Buying a Fanning Mill Be sure to see us and let us demonstrate to you -the Jos. Volz Fanning Mill the best grain cleaner on the market Yolz Fanning Mill Company ELLIOTT, N. D. You Need GROCERIES, DRY GOODS - CLOTHING and SHOES You will find good stocks of them at reasonable prices at the store of ASLAKSON & PETERSON EDMORE, N. D. They also buy all l.tinds of Farm Produce. Give then: your trade. GEO. A. WELCH, President J. P. FRENCH, Sec. - Treas. . - FRENCH & WELCH HARDWARE COMPANY Harness Farm Implements Plumbing and Heating Shelf and Heavy Hardware PRI Ty T e Y T e S —