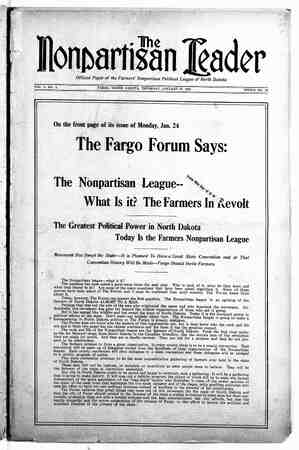

The Nonpartisan Leader Newspaper, January 27, 1916, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

.,’" ' Jorgenson Defends Ta ---County Auditbrs Reply State Auditor Claims He Is Not After Farmers or Small Taxpayers. : . As a result of articles in the Leader reporting what will be the effect .of the new personal property schedule, :‘which brought forth protests against the state board of equalization from ‘taxing officials and taxpayers iin all ‘]())arts of the state, State Auditor Carl . Jorgenson, who drew up the new plan of taxation for the board, has issued a statement defending his work. Mr. Jorgenson justifies the new schedule first on the plea that the state” can” not raise needed revenue ander the limit levies fixed by law, unless valuation of property in the state is increased greatly. "T'he valu- -ation can be increased, he says, as in the past, by general, arbitrary raises applying to all progerty alike, .similar to 20 per cent flat raise put on all property valuations in the state last year. Or, says Mr. Jor- genson, the valuation can be increased so the levies limited by law will bring ‘enough revenue if enough “escaped property”—that is, property not now on the assessment roll—can be added to the roll. He says that it is to get this “escaped property” that the new schedule is adopted, thus obviat- ing the negessity of making a flat .percentage raise on all valuations. Hits Burdened Taxpayer If the new schedule would catch even a small part of the escaped property: of any other class of tax- aners save farmers and city house- olders the objections to it would be greatly decreased, those who have rotested against it claim. But Mr. Jorgenson’s new schedule, it has been ‘pointed out, makes an effort to get .the “escaped property” of only one class of taxpayer, and that class the one most burdened with taxes at the -present time. The new schedule, for instance, adds classifications to catch ‘every pocsible article of household goods. It adds fences, dogs, new classes of horses, poultry and numer- ous other classifications not before included which apply merely to house- holdders in cities and farmers, and so far as a close study of the new . schedule shows, not a single new clas- ‘sification is ‘added 'to the personal property list for stores, businesses of all kinds and, corporatoins. On the contrary, Mr. Jorgenson’s new sched- ‘ule reduces the mumber of -classifi- cations formerly existing for stores, ‘businesses, etec., in most ‘cases allow- ing them to make a single, lump val- uation for all their personal property. Taxing officials throughout the state are claiming that this means placing whatever raises in’ valuation the new schedule will bring entirely on one class alolwing others to_ es- cape. The state tax commossion es- “timates that it will increase farmers’ and city householders’ taxes material- ‘ly, and will lower taxes of other classes. Jorgenson’s Argument. “One argument,” continued Mr. Jor- genson, “which is brought out-is that the farmer is assessed under 12 .classifications covering~ ‘household goods,” while the man who runs a hotel is assessed in a lump sum. 'As Ador the hotel assessment, I believe that the assessment can be made in a lump sum without any discrimination -in favor of the taxpayer. I would Jlike to ask whether you consider the houcehold furniture contained in the home to provide comfort for the family as valuable as furniture found in the hotel and used for the pur- :pose of producting revenue? Is it not true, in your opinion, that the -automobile, which is a part of the -automobile garage operated for the sole purpose of making money, bears a different valuation than the auto- mobile owned by~ another .taxpayer for pleasure? his will also apply to horses, one being used simply ‘as a convenience to the farmer or as a means _of pleasure to the city man, “while the horse ‘in.ithe city barn is 1@ revenue producer.” 5 The tax commijssion and. many of ithe icounty auditors of the state de-’ clare that the proposition.of Mr. Jor- genson in _the above quotation is wrong in theory .and worse in prac- tice.. He’says it is intended to lump : "hotel assessments of household goods, eater valuation can bhe m, as they are used for 80 ‘that a .placed on t profit, while ‘the farmers’ hausehold Loods are segregated into 12 cla-si- Afications, so that :a less valuation can ““"be placed upon them, as they are not iused for profit ‘but for. comfort. i The new schedule will-have just the opposite effect of this, it is pointed -out. If ‘an assessor wants to be as- - . sured-he is getting every possible ar- . THE NONPARTISAN LEADER ticle of household goods, so that none -will escape assessment, he will do exactly what a lawyer does when he wants to get every fact possible out of a witness—he will ask as many questions as he can think of. Thus, under Mr. Jorgenson’s assessment plan, the farmer is asked 12 ques- tions. 'He is asked how many rugs and carpets he has and their valua- tion. He is asked how many books, pictures, etc., he has and their ‘vau- uation. This covers two classifica- tions in Mr. Jorgenson’s schedule. He is asked, a question and gives a valuation on each of the other 12 classifications in Mr. Jorgenson’s schedule covering household goods, and is given a valuation by the farmer in each. Then the farmer Las to place a value on other property “used in the home” and not contained, sessed under the one -classification, “Stock, furniture, equipment of all kinds of hotels.” Why discriminate? Is Backward Step Mr. Jorgenson’s statement contends his schedule is better than the old one and he proceeds to show the in- consistencies of the old one. The state tax commission in tke columns of the Leader has already condemned the old schedule and nobody has made any defense of it. Mr. Jorgenson cites the personal property classifications of other states, and in most cases the state referred to has simplified its schedule instead, of making it more complicated. The new North Dakota schedule has 95 classifications against 28 formerly in this state, while Min- nesota has four classifications. Tax- ing officials and experts of North Da- kota have repeatedly pointed out that g What Auditors Say Abaut Tax Schedule “The state board may have a plausible reason for such a monstrosity and I hope they have.”—Charles E. Best, auditor of Ransom county. “If one kind of property is classified all kinds should - be and it seéms as if this schedule bears harder on the farmer and small householder.”—Auditor Andrew Blew- ett; Stutsman county. “The Jlump assessment plan for certain classes of property .is unfair. We find in some lines of business that all property owned by individual companies and cor- porations is listed under one heading, while with farm property it is divided and segregated into various classi- fications. This is discrimination.”—Auditor M. C. Mec- Carthy of Golden Valley county. “I expect to instruct the assessors of this county to follow the forms furnished (the new schedule) as nearly as they can. I believe that a strict adherance to these forms will hasten the day when taxes will be levied only on land, income and inheritance and the listing of prop- erty will then be simplified as it should be. I approach the assessment work this year under the new schedule with fear and trembling, for I can see breakers ahead.” —Charles E. Fouts, auditor McHenry county ; “The schedule in my opinion is so complicated that it is quite a task to figure out all of the difficulties the assessors will experience in taking the assessment.”—L. J.. Thompson, auditor Ward county. “The lump assessments for certain classes of tax- payers while other classes must segregate their property into numerous classifications is unfair. The schedule will require an assessor who holds a first grade certificate.”— Auditor John Hildenbrand, McIntosh county. “Very few local assessors can handle this schedule. Much complication will result.”—Auditor D. K. McPher- son, Sargent county. in the 12 classifications before cover- ed. Undér this system nothing has es- caped and the chances are 10 to 1 the farmer, if he gives any valuation at all in each of these classifications, has greatly boosted his valuation of the year prior, when he answered only one question ‘as to ‘household goods. ‘Different for Hotel The assessor then comes to a hotel. Here the schedule makes no classifi- .cations and the valuation of all the property held by the hotel, includ- ing household goods, is set down in one lump -sum. The aszessor is en- couraged to ask .only one question of the hotel by this system. He has no vplace on field slip to set down valuation of rugs and carpets, ‘pictures, books, etc., as he does in the case of the farmer. He may mean to assess the hotel on a higher basis for the same class of goods than he as- sessed the farmer but he can not seg- regate the hotel’s property as he can the farmer’s, thus getting every pos- sible item, and, the result is bound to give the hotel the same assessment as the year before ‘or a :less one. This result ‘can ‘not be escaped, say tax experts. 5 If it -was intended, according tothe inion of “critics of the new sched- ule, to get more assessment out of hotels, then hotels ‘should have been submitted to the detailed examina- tion farmers will be, and if it was intended ‘to get-less out of farmers, * then farmers should have had the ad- vantage of the lump assessment. - Also, protestants are asking ivhy_ could not Mr. Jorgenson’s plan of get- ting more assessment proportionately . out ‘of hotels work just as well if farmers alio were permitted to lump ‘assessments? Why, ‘it .is asked, not as- ‘sess farmers under the classification, “Stock, furniture and -equipment of “all kind‘_s-éf' farms?” Hotels -are as- Mr. Jorgenson’s schedule in the sin- gle matter of increasing the classifi- cations has departed from the best’ practice and the ideas in .all states. Mr. Jorgenson’s statement to the Leader follows in part: ‘Need More Vaiuation “In this state we have met with a very serious ?roblem of getting am- ple assessed valuation to provide nec- essary income for the several subdi- visions of government according “to the fixed levies which are prescribed by law. The assessed property toes not increase as fast as the needs of the state and' its subdivisions. - In 1909, .during John Burke’s admisitra- tion, it became mnecessary to increase the assessed valuation of ‘every kind of property a flat raise of 123 per cent after equalization, in order to get a high enough valuation to pro- most progressive _duce ‘the required revenue. In 1915, tke State Board of Equalization again found that the valuation was too low. From .the bhest information which ithe Board .could gather it seemed that a flat raise of 80 :per cent on all property would be necessary. The Board finally decided that the in- - crease ‘be placed ‘at ‘20 per eent. “It will only be a question of ‘2 year or two before another flat raise will have to be -applied, unless ‘the: escaped property .can be placed on the assessment rolls. . Dieapproves .Flat Raise . . “I believe ‘you will agree. that so long -as ‘the .law .of our ‘state pro- vides that all property is taxable (with a few -exemptions) there will be a better .chance of securing the as- cessment now escaping by adopting a new schedule, than continuing to use the flat -raise on all property- “which is assessed. “I would like the reader to ‘refer to the assessment schedule .covering . personal property as it-has been in - effect u&to ‘this time. Now T wish ntinued on Page 18). . - - FIVE Convention Is Called To Trjr To Patch Up -Schedule---- Officials Aroused. After practically unanimous protest of taxing officers of the various coun- ties of the state and objections of taxpayers that promise to ‘become widespread, the state board of equal- ization, through its secretary, State Auditor Carl O. Jorgenson, has issued a call for a convention of county auditors of the state to consider the new 1916 personal rroperty schedule. This schedule, adopted by the state board, puts an added burden on farm- ers and city householders and bids fair to reduce the assessment of other taxpayers, such as stores, hotels, liv- ery stables and most other businesses. %‘he auditors’ meeting is scheduled to be held at Bismarck January 26 ard follows a series of articles pub- lished in the Nonpartisan Leader ex- posing the effect of the schedule.. Schedule Condemned The call for the convention by the state board states it is for the pur- pose of “deciding if it is the opinion of the county auditors that the state board shall provide a set of rules for assessors” to go with the new schedule, and “to decide upon what ercentage of the actual value shall ge used for the assessment of prop- erty in 1916.” It is believed this meeting is called really to see if some of the evident injustices of the new schedule can not be obviated, and thkat one of the principal reasons for its calling was a resolution of the convention of county commissioners which met "at Valley City last week, and numerous other protests. This resolution roundly condemned the schedule and while it did not go into detail, asked the board of cqualization to make some effort to simplify the -classifications and make other changes that would wipe out -some of the evident injustices. Secretary R. B. Cox of the North Da- kota Commissioners’ as-ociation sent a copy of the resolution to each mem- ber of the board of equalization. Dis- cussion of the commissioners brought oul the fact that most of them felt the schedule was so complicated that it would require extra employcs in all the counties and much added, ex- pense next spring in making the as- ses ment, -besides working injustices among taxpayers. Books ‘Alroady ‘Printed It develops that many. counties al- ready have ordered assessment books rrinted to correspond. to ‘the new .schedule and it is ‘doubtful if the schedule itself will be changed by the board as a result of the auditors’ con- vention, for this would entail the ex- pense of many-thousands of dollars, in getting. new books :printed. How- ever, it is probable that.sgpecial in- terpretations may be.put on. several classifications to-simplify-evident con- . flicts and .otherwise lessen injustices. The Leader recently wrote every county auditor in the state for his opinion of the “new schedule, and while not all the replies are in those received indicate practically a unani- mous condemnation of the mew-sched- ule: ‘because of its = complications, which will ‘increase ‘the -cost ‘of ‘mak- ing the assessment, and because of the injustices to the farmers and other small ‘taxpayers, who ‘will have to submit to a-rigid and: minute ex- amination of their personal property while storesand otker businesses need give -only a lump value in one classi- fication for :their goods. ' Auditers Protest . Auditor Blewett of Stutsman coun- ty -writes: “I. have motified the state 'auditor that I.do .not.approve .of the .new schedule and, think that the number of items should have been Peduced instead of increased. If one kind :of property is classified all - kinds 'should be ‘and it-seems this ‘schedule -hears harder on the farmer and small Householder. T do -not think that fences..should he assessed and that househeld - furniture, should be listed .din mot to exceed four items instead dogs ‘should -be .assessed. \ : - Auditor Charles E.. Fouts of Me- “Henry county ‘writes:’ “The -oniy -re- sult that -can pessibly ;acerue will be :an -increaséd valuation on: personal propertfi';}ll)eiongiflg “to-the small tax- .rayer.--The board of :egualization has apparently lost sight of the machin- ery “we ‘have ‘for making an assess- ment; - - idering the time allotted the-assessor and the limited compen- sation ‘he can receive :and the sta- tax his ability to cover the ground sander-this schedule, even ‘in a super- ~ficial ‘way; ‘and -it is-my-opinion that of 12. "1 .do mot think ,;poultry and .«_pr?ert_y will not be assessed as well - ‘as fermerly. The of supplies {Continued on Fage 1) it will - § E i ot D i A