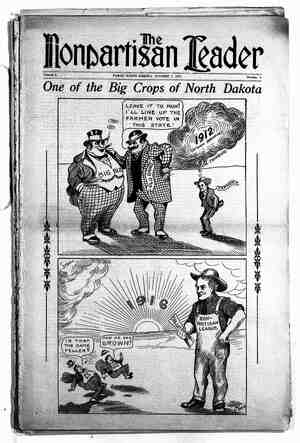

The Nonpartisan Leader Newspaper, October 7, 1915, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

THE NONPARTISAN LEADER The Tug of War-One of the Most Popular Games of the Northwest at the Present Time MR THE NONPARTISAN LEADER = e PAGE EIGHT PAGE NINE COME. ACROSS AND PAY THIS MORTGAGE! . WISH I COULD GET| oy sToP HER UP TO (IBEATING HIS A DOLLAR KNUcK LES! HOLD 'ER, PA! There Will Be WISH I None COULD GET |T OUR CREDIT CHOAS NE OF the definitions of chaos is “yawning chasm.” To say, then, that our present ‘“credit system”. is chaotic . may mean that there is a yawning chasm—between the ‘borrower and the lender. ‘This chasm is artificial—it is dug by the lenders. . It is artificially- maintained—by the lenders. : - That explains why the borrower cannot get- across to: the lender at the time the borrower needs money the most. . An ostensible effort was made by our federal government to bridge this chasm a short time ago. It established wha its called a federal reserve banking system...It will be recalled that the bankers of the nation rose up against this bill while it was blocked up on the ways at Washington, D. C. Then the bankers -had a nice little chat with the sponsors of the bill and the next issue of the papers informed us that the bankers were helping grease the ways to expedite the launching of the bill. When it hit the waves there was a shout of joy went up on high. . ‘They told us all about how nice it would work. We have forgotten just HOW they said it would work. But one thing we DO know is that it has NOT worked. At least it has not worked so that the Northwest farmer would notice it. He still stands on the brink of the yawning chasm—on the same bank he stood on before. The lenders still stand on the other: brink. . And so, the much heralded Federal Reserve bank law has not helped us a cent. It has not helped the farmer—nor hurt the banker. : * It has not helped the farmer hold his crop for higher prices. The yawning chasm is still yawning. 7 The farmer is still dumping his wheat onto a “glutted” mar- ket Because he can’t hold it—because the Federal Reserve bank has not helped him to hold it. Look at the above cartoon. That will explain why he can’t hold it. It might also eplain why the Federal banking law did ‘not fix things so he could hold it. We say it “might.” In fact we believe it does, ’lamentabvlc thing about-it_is that not a few IT WAS UP HERE- Who Makes Grain Prices Now? Look At this And Think OLD WHEAT IN THE MILL HEN speaking. of absolutely-safe things we used to say, w “It’s:as good as wheat in the mill.” 5 2 A very expressive statement, that. ‘What is more safe and secure' than, wheat? Of three primary necessities of life.wheat stands third—air, water, bread. - Wheat is one of the few indispensables: It is a staple. It is non-peris?nxble and is as good as geld. “And yet: No sane and just system of credits has been put into practice whereby the farmer can realize on his wheat—except to sell it To sell it at whatever price prevails at threshing time. There are those who see to it that the price which prevails at that time is not excitingly high. 5 S There is no sane and just system of warehousing and stor- ing the wheat against the day’of an equitable price. As soon as wheat is threshed the farmer must have money, Will the banker loan him money on his wheat and thus enable him to hold it? Try it and see. 2 The farmer is forced to sell it—to dump it on the market— a market forced down by munipulators and speculatots. It looks more and more like a criminal conspiracy. It wears the respectable label of “business,” but so did chattle slavery. Bewhiskered gentlemen of patriarchal appearance will un- ctuously advise the farmer to “hold” his' wheat, knowing that at the same moment a soulless lawyer is whacking said farmer over the knuckles with a mortgage foreclosure and forcing him to let it go. The banker will say, “we want to clean up the books, so bring in your wheat and straighten up.” Meantime newspaper men, with a knowledge of ‘the whole game will also shout, “hold your wheat,” knowing that it is im- possible. % And yet every one of these men will swear on'his mother’s SOME TELL-TALE FIGURES ERE are some interesting, though unpleasant figures. The unpleasantness of: them i5 no’ fault of this office. They were not made here: " They were made at Washington, D. C. They were made by experts. They may not be true and cor- rect. But we believe they-are. - We wish they were not. They relate to the oats ¢rop of North Dakota. According to these figures, on' the -first of August North Dakota's oats “crop was éstimated at 80,000,000 bushels. The market price at that time was 40:cents per bushel. S In one short month the crop had increased to 86,000,000 bush- els, a gain of 6,000,000 bushels. And in that same short month the average price slid down to 29 cents per bushel and instead of being worth $2,400,000 more it had shrunk to a total loss of $7,000,000 for the state. ‘This knocked a big hole'in the wallet of the North Dakota . farmer. Tt likewise put a big lump in the pocketbook of the speculator. - There is only one light in which this can be explained. And that is the light of criminal:greed. . The inter-locking league of _ lenders, creditors and speculators had the power to pick the. farmer’s pockets to the tune of $7,000,000 and did it. They did it legally to be-sure. They did it in the holy name of business. So, the more the farmer raised the less he made—and the more the inter-locking-league made~—or got. Better farming as- sociations: told the farmer that if he would make more he must -xaise more. - ; - Jim Hill told the farmer the same. - : Other railroad kings and leading citizens repeated the ‘ad- _vice. And why shouldn’t they? 7 - The more the farmer raises the more the railroads have to haul—and feight rates NEVER go down. By grace of the Inter- « - state Commerce Commiision they: oceasionally go up—when it bible that he has the farmer’s interest at heart. most he: farmer pays:the fbill&-;pays all the bills, INTEREST-MADE LAWS AT THE BOTTOM :ND so we ‘have no credit system. We have chaos. On A rather we have half system—system for the lender. A’ perfectly smooth system. A system that works admirs ably for the lender. The reason it works so nice for the lenders is because the lenders and their friends made the laws which provides the “sys« tem.” We depend upon them to niake our laws and as a resulff we have to depend upon them for financial aid. We must ‘depend upon them' for warehouse and storage fa« cilities. ¢ And ‘we must therefore depend upon them for prices. S they have a snap. ‘Well, they ought to; they make it. It.is for these reasons that the: farmers of North Dakota lost more than $40,000,000 in-one short month. For the same reasons a gang of political highbinders and industrial pirates raked into their tills that same $40,000,000 in that same short month. i e It is altogether a matter of laws. The laws of the stateé * and nation are at the bottom of it all. Lawmakers of the state and nation are at the bottom of the laws. Big interests which profit by such laws are at the bottom of such lawmakers. In order that there be a change in laws there must be a change in lawmakers. In order that there be a change in laws makers there must be a change in-the men back of the lawe makers. Those who profit by our present unsystematic ‘system of marketing have been selecting and backing the lawmakers, This must be changed before the unsystematic system will change. S It will not be changed as long as the laws are made by law« makers who are backed by men and interests who in turn profi# by such laws. S ¢ i They will~have to be changed by men who will profit by va, change. “Men who will profit by a:change must select:and back the men who are to make the laws, " 5 § H i