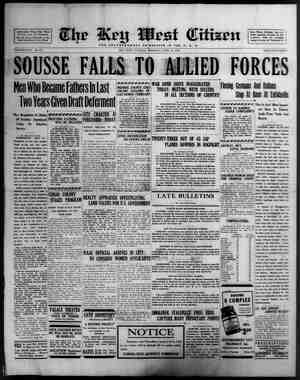

The Key West Citizen Newspaper, April 12, 1943, Page 4

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

PAGEFOUR ~ and such other employees, offi- cials, and assistants, as ay pe found necessary to carry int a fect thé provisions of this Act, and shall fix their compensation. A majority of the board shall be au+ thorized to transact business} they shall provide the time of their meetings; shall make rules for their own government and adopt their own seal. All their contracts shall be made.in the name of the city, shall be’signed by the Presi- dent of tha\Board and attested..by) their @lenk.)./No; contract shal be made bythe board with any mem-. ber thetieof, and no member shall be intérested directly or indirectly in any-contract: in any way. or share in the profits, and any im- provements which shall involve the expenditure of more than Two Hundred Dollars ($200.00) shall! only be let or made after ates tisement thereof, and shall be let to the lowest bidder therefor, upon! such terms and secured by. such ¢ bond as the board may require. _[ The members of said board) shall not be entitled to any com-| whatever for their serv-| i Section 43. It shall be the duty, of the:Board of Public Works to) take charge of and sell: all bonds! that may be issued by the City ‘of; Key West for the purpose’ of pub- lic improvements, ahd after such sale to'turn over the -proceds to’ the City Treasurér: They’ shall) receive @ll money appropriated’ ty | pay interest on the bonds or ¢teate a sinking fund for’ thé payment’ of bonds'issued for public’ itprove- ments‘and shall have full author ity and power to invest said sink- | ing fund’ either in bontis’ “of ‘the city, United States’ Government; | State or County Bonds: ‘ 5: “Estimate Of Expenses Section 44. The Board of Pub-| lic Works shall, on or before the, 12th day of June in each year, pre- pare and submit to the City Coun-' cil an itemized statement or esti- mate of the amount necessary and advisable, in their opinion, to spendin the execution of the du- ties entrusted to them, for the en- suing year, giving in detajl the plans of construction and répairs |persons violating “ordinances on’ the amount hereinbefore speci-| West once a week for four con-Wekceed eight 6%) per cent. per | in the same manner and at the] crease in writing with the City | this subject. : | Selary Of Officers | Section 47. The City Council, by ordinance, shall prescribe the} salary or compensation of all the elective and appointive officers of said city. : Payment Of Fines—Sentences | Section 48. Every person con- | vieted of any offense against the | city laws, shall forthwith pay all ae ae costs imposed against im in United States currency; in ‘default he or they. shall be com- |ihitfed to the City Prison. for the’ ‘term preseribed..in: the judgment of the Court, and while thus com- | mitted shall work for the city at j such labor as his of her strength | and health will permit. | Officers Not To Retain Fees Section 49. No officer or em- ployee of said city shall retain }any fees or costs for any service ie may perform, nor shall he re- eéive any compensation other than the salary fixed by ordinance ex- cept as hereinafter prescribed, and all fines shall be a part of the rev- enue of the city, and shall be paid into the City Treasury by the of- ficer receiving same. Sewers Section 50. The City Council shall have power to order the con- struction of sewers on all streets and the grading’ and paving all! streets'th the City of Key West! IL streets ahd avenues which are be paved ‘and those which ‘ate tobe sewered.) : i;(Whenever any street, park, al- ley, or other highway ‘shall have been héretofore ‘or may hereafter be paved, graded, curbed, laid out, opened, repaired or otherwise im- proved by the City of Key West, except sidewalks, including works and improvements now in process | of construction, or whenever such street, park, alley or other - high- ay shall Have been-or may here- after be ordered paved, graded, laid out, opened, repaired or oth- erwise improved, except side- walks, or whenever any drain or sewer shall have been heretofore or may hereafter be constructed or repaired in the City of Key West, the City Council shall, as} and estimates of experiditures, | goo) ete., proposed by them with ‘the estimated cost of each’ itmprove-|'th ment, specifying the ‘character ‘of: the improvement, and’ thé amouit | yssess required for’ the streets, ‘sewers, public ‘ buildings, > waterworks; lighting plant, ete!’ All \ts | of money expended ‘by the Board’ of. Public Works from the levy for’ such improvements shall be‘ made ‘upon ‘warrants drawnvand: regus larly countersigned, the: same” as other payments from, the treasury, and all vouchers therefor,shall re- main on file in the Auditor's: of-, fice, and.shall at the first, meeting of the City Council in January of. each year, or as soon thereafter as practigable, report .to the City Council, in writing, a full and: de- tailed statement of the transac- tions of said board, showing, among, other things, the amounts | of money received by or placed to the credit of said board, and the sources from which the same was | received, as well as the expendi- | tures of said board and the pur- | poses for which said expenditures were made. The said Board of Public Works shall keep a com- plete 'récord of their proceedings. Tax Levy | Section 45. It shall be the duty of the City Council in their-annual levy of taxes to make. such levy, as the budget made. by the. Board of Public Works for. said..years shown,shall be necessary, to;be not less than three (3), mills upon, the assessed valuation, , of, ;each year, for expenditure ,under the direction of the Board of Public Works, and the amounts. so levied shall be collected and carried to the credit of the Board of. Public Works, and it shall not be diverted from said board or be used by the Mayor and City Council for any other purpose, but the same shall remain as a separate fund in the hands’of the Treasurer, Markets Section 46, The City Council shall have power to establish mar- ket houses or places, and require | each and every person’ who may have for sale any fresh meats or fresh fish, to bring the same into said markets, so established, and offer the same for sale only ‘in| such markets: to make such po- lice and sanitary regulations in| regard to such markets’ and the! sale of fresh meats and frésh' fish | therein as they, may deem reason- able aftf'faSt? provided, that after’ any fFes'mieat has been brought? to the tity market’and duly” im! spected,’ that ‘pérsons desiting to! sell thé same at any points in the | city outside of said market, shall! §oon as the cost of such improve- iment shall have been certified to im. by the’ Board of Public Works, as hereinafter. provided, sess against the abutting prop- erty one-half of the cost of such itiprovements in proportion to the frontage of such abutting property, ‘on Such street, alley, park or high- way so improved; provided, that anders ‘nd greater and shall, by ordinarice, designate | fied; provided, that in any street| secutive weeks. In all proceed-| annum, in which case such bonds|same rate of valuation as other where there may be a street or other railroad track or tracks Heed or paving which is herein provided for the said railway company to construct shall be deducted from the total. amount of cost of the paving before the the said:-abutting owners. | If, however, the Board of\ Pub»! lic Works deems it expedient ‘and for the ‘best interest»of:;the: City of Key West that said wort! ‘or improvements be done: byi city instead of by a contracto: and shall adopt a resolution to that effect, then and in that event the said city is hereby au- thorized and empowered by and through its Board of Public Works to perform the said. work and make the said improvements including the purchasing of ma- terials and all necessary equip- ment but said purchases where the amount exceeds Two Hun- dred Dollars ($200.00) shall be made only after advertising for bids to furnish materials and equipment. The entire cost of said improvements shall be cer- tified to thé City Council just as though the work had been per- formed by a contractor and thereupon the City Council shall make the “assessments against the, abutti pre i ii against any abutting land own- ers. On account of, any paving, grading or repairing of any street or public highway, or the laying of any sewer, the City Council shall cause to be entered in a book kept for that purpose, to be known as the “Street Im- Frovement Lien Book,” a short description of the lot upon which the lien is claimed, amount or amounts due according to the said assessments, and when due, and such other information as the board shall deem advisable. Upon the payment of any as- sessment against any of said lots so entered in said “Street Improvement Lien Book,” it shall be the duty of the City Clerk to} issue a‘ receipt’ for the same and cancel in‘ red mk across the face of the Said‘entry in said book, [the date of payment and the amount so' paid, at the same time sign His' name to said can- céliation.' Partial ‘payments shall be eritered’ in ‘like’ manner. Prima‘ Facie Evidence Of Lien ‘Section 54: Upon? any suit améunt’ of the cost therefor shall/ brought to enforce such lien or be ‘assesSed agaitist the ‘abutting Property than three-fourths (%) of. the ‘cost of laying ‘an’ eight-inch’ (8) ‘sewers provided further,’ the entire Cost of the imropvements the intersection of streets: shall be paid by the city except as here- inbefore specified, Assessments For Improvements Section 51. All such assess- ments for ‘such® improvements heretofore made, or which may hereafter be made, shall constitute a prior lien to all other liens, ex- cept taxes and those for construc- tion or repair of sidewalks, with which liens they shall have equal dignity, upon the real estate as- sessed. The amount of said as- sessments shall bear interest at the rate of eight (8) per cent. per an- num, and shall be payable in three (3) equal installments, in one (1), two (2), and three (3) years. But the owner of the real estate so as- sessed Shall have: 'the right to pay ‘said assessment with the matured jinterest “at any tithe before suit. |, n at.any time the City Council of the said ‘city shalt detide to pave, grade, ‘curb, layout, opeéri, repair or otherwise improve any strect, alley.or other public highway, or any part there- of, or to construct or repair any céllection ofthe amount due upon any such assessment, a copY of the entry of such lien in the “Street Improvement Lien Book” duly certified by the City Clerk, under the corporate seal of the ‘city, shall be» and constitute prima facie evidence of the amount and existence of the lien upon the property describ- ed; and in all cases mentioned in this Act where the City of Key West has acquired or may) hereafter acquire liens for im- provements, such liens, or any of them, may be enforced in the following manner by said City: First, by a Bill in Equity; Sec- ond, by a suit at law. ~ ‘The bill in equity or the dec- laration at law shall set forth briefly and succinctly the asses- ment made and entered aforesaid on account of said improvements; the amount thereof and the de- scription of the property upon which such lien ‘has been ac- quired and shall contain a prayer that the owner be*‘eompetied to pay the amount of sai@-lién, or in ‘default thereof; that ‘the said property Shall be ‘s0ld@ to satis- fy’ the ‘same; but ‘the judgment ot decree obtainedin said suit shall not be enforced against cr be a lien upon any other prop- sewer, the’ said City Council shall pass an ordinance ordering the same done, and thereupon the Board of Public Works shall ad- vertise for bids for making said improvements; said ~ advertise- ment shall contain among other things, a description of the ma- terial to be used, width of pav- ing, if the streets is to be paved. and shall designate with reason- able certainty the limits within which said work is to be done and the nature thereof in which advertisement the right to reject any and all bids must be reserv- ed by the city. In advertising the, street. pav- ing, the Board of Public Works gn grading, curbing’ and paving and enter into separate contracts therefor. accepted any bid or bids for any of the above mentioned im- erty than that against which the assessment was made, and in the decree was made, and in the de- cree or judgment as the case may be, for the enforcement and col- lection of the amount for which said lien is given; decree or judgment shall also be rendered for a reasonable attorney's fee, not to exceed Five Dollars ($5.00), for the institution of the suit and the sum of ten per cent (10%) on the amount of the recovery, together with the costs of the proceeding, which attorney's fees and costs shall] also become a lien upon the said land and shalt be collected. at the time and in the manner, provided for the,.col- ymay advertise for. separate bids} lection of the amount for, whi¢! the lien was, originally given,,but, in no event -shall the city beyhisr - _ ,}ble -for,the payment of attarneyss Whenever the said Board has. fee herein provided for. Owners To Be Parties Defendant Section 55. In the proceedings be permitted to do so upon the! provements, as soon as the said provided for in the preceding payment to the city of the samé| improvements have been com-|section, the owner or owners of fees, costs and charges which they | pleted under the terms of said|the land, if they can be ascer-|to be issued therefor, their num- would have to pay if said fresh)contracts and the same have|tained, shall be parties defend-| bers and denominations, the date meats were sold in said and subject to the same poliée su- pervision and regulation. { The City Council shall provide for licefising the keeping of dogs, and for the destruction of dogs, jany regular or special the oWhers or keepers of which) Called for that purpose, shall as-|fendant. In such ca have failed to comply with the, sess against the property abut-|shall be had by a arket,! been accepted by the Board of| ant. | Public Works, th said improvements shall be cet 1 ae to the City Council, where. |upon the said City Council at meeting If the owner or owners gent inquiry, the proceedings shall be against the property on which the lien is claimed wit out mentioning any party as e, servi case, notice of regulations prescribed by said) ting on each side of said street. institution of said suit for ordinances in fespect thereto, and| alley, or other public highway in| enforcement of such lien by al said City Council may by ordi- |proportion’to the frontage on advertisement “in a ings to enforce. said liens or any of them save in cases where the certained, service shall be made in the same manner as is provid- ed by law for service in other cases, In such proceedings, appeals assessment shall be made against| and writs of error may be taken; to the proper Appellate Courts, iastin other cases. The proper Appellate Gout shalko:;om. - the Wnotionsbf either sparty, advance! rand ty and determine. the Bamelassearly. 3s possible. noi? -fod 1M ATRaNES x . Section,,66,,) No.officer of. the City ‘of Bey, West shall. draw a warrant! on,ithe Treasurer of said city unless the money to meet said warrant is actually in the hands of the Treasurer at» the time it is drawn. And all war- rants so drawn in violation of this section shall be null and void. May Borrow Money Section 57. The City Council, by and with the consent of the Mayor, shall have the power to borrow money to the extent of three-fourths of the amount of taxes in any one year and to is- sue as evidence of indebtedness for the money borrowed, rev- nue bonds, which bonds shall be signed: by the; Mapér atf xtins city) President ofzthe .City .)\Coundib and Auditor: efithe cityy:and att: tested by: the. Gity::Glerk, under the seal of the veity2sosiob Said bonds shall e issued, arately against any or alk) ithe: funds for which taxes, aresassess; | ed, and when issued against any fund, the amount realized from the loan on said bonds shall be carried and credited to the fund against which said bond was issued; that said bonds shall be issued in serial numbers begin- ning with the number one, as against such separate fund, and the holder of said bonds shail have a first lien upon the uncol- lected taxes to the extent of the amount borrowed and as against each fund for which said bonds were issued; and ‘as the taxes are collected, the bonds shall be paid in the order in which they were issued, out of the fund against which said bonds were negotiated. No revenue bond shall-be issued for a longer time than one year and shall bear such interest as the City Council may fix. 10. 2N Indebtedness Section 58. It shall be unlaw- ful''for the City of Key West in jshall be made redeemable at any time at the option of said city. the amount of value of the grad-|owner or owners cannot be as-| Tax Levy For Payment of Bonds Section 60. The City Council is ‘further authorized and empowered | to levy a sufficient tax upon all j real and personal property situat- ted within the corporate limits of such city, each year, to pay the annual interest, and to pay not! Tess thant two pee ce @) ay or} Ht separately, except that all,the writ-| Council. property. Taxation | Assistant to Tax Assessor- Section 72. All | Collector | by the City Council shall be noted | Section 66. The City Council! in his preliminary assessment roll changes made rs may, by ordinance, provide for! by the Assessor, and said assess- ““ and elect competent assistants to, ment roll, so corrected, shall be assist the City Tax Assessor-Col-| copied as corrected, and such copy. lector in making assessments. All' after being approved and adopted .property shall be assessed at its} by the City Council, shall stand Saji cagh value. Each lot and sep-|as the assessment of the taxable avate tract of land shall be assessed! property within the city ign, requests of the owner of lotsj able, after such approval and adop- (i or treats; of land adjoining each}tion of the assessment roll, the 4return:,thereof in such.,.manner,' amount and fix the rate of tax- — wi § nd’ rémaird “s 3 fun the same’ ma: vested by the City Council in United States, State or County bonds or in the bonds of the City'of Key West, including revenue bonds; and no bonds shall be issued under this provision un- til a levy as hereinbefore provid-! ed, shall have been made, and when such levy shall have been; made, thé'same shall continue in force until the whole amount of pal and interest shall sen fully paid. Provided, that nothing herein shall be con- strued fo authorize the City Coun- cil to levy any tax in excess of that authorized by law. Miho Qualified ta,bipld Office | Sen p 2 Section 61), [Nai pettson shalt be dligible/t® ithe: :uisition of City Councilman: exeept-qualified elec- tors ‘ofi the City, of; Key West. ‘And #tishanbé the duty of the Board of Election Commissioners | hereinafter ‘provided for to care-| fully ¢xXamine the qualifications/ of each candidate for any elective office, and: if it be found that hej is not qualified hereunder his name shail not be placed upon the official ballot herein provided for, | and he shall, under no condition, | be given a certificate of election. | Assessments | id ‘Bonds, as} | on or before a date to be named in ojmer.or when such owner makes; City Council shall determine the ;such adjoining lots or tracts may! ation, and make the annual tax \be assessed together. levies for the current year. Such The designation personal prop-! levies shall not exceed in any year erty shall be a sufficient descrip-! for ordinary municipal purpose tion of all personal property for thea higher rate of tax than one per purpose of city taxation, and per cent. of the assessed vahiation of j; sonal property asses$ed need not | the taxa@ple property within the be otherwise specified or describ-| corporate limits of said city. The ed on the tax assessment roli. | word ordinary is to embrace all Assessment Roll ees arieg gas, electric Section 67. Upon his prelimi-| #8hts or other illuminating ma- nary assessment roll, the Assessor- terial ee ee a + Collector may indicate in some ty municipal s ss = ea a convenient manner the property | ™4y be made pene ape subject to taxation for each of the} est on debt and sinking fund, aad ; oe ‘also fpr a special tax not exceed- purposes for which taxation is au-| . ™ thorized. Said assessment roll shall 1" One Per cent 1%) on the said be completed and submitted to the | V@luation for water and fire pro- City Council at their first regular | tection, and also a special tax not meeting in Juné of eah year, or'as; ©¥eeeding one-half of one per theteetter as’ practicable. cent. on the city valuation for city Sectiot 68! -Ke''g as practic jindebtedness purpose, which’ in- Beh ian Brat 7@ebtedness fund shall be ‘used for abl after te ean ot St te payent af wry oestanding j . f ‘4 . | inde! or for the purpose Count sileuseto be published of paying any wmumual or extra has been submitted to them for ap- See acarred tr saad ety Proval, and requiring ald persons /rhe City Council shall’ have pow- Gesiring to have corrections there-| er by resolution to transfer from ae, *! one fund of the city to any other Met ediatd bit eho te Aled one, | fund whenever the financial con- benaeaion vated! e City Clerk) dition of the said city may war- |rant such transfers, excepting the | interest and sinking fund levied and collected for the payment of interest and sinking fund on out- standing bonded indebtedness said notice, which day shall not be less than ten (10) days after the first publication of said notice, their petition to the City Council Section 62. All property which is subject to State taxation shall! be assessed and listed alphabet ally or otherwise for the entire} city in the name of the owner whenever, the name of such own-; er is known to the assessing of-| ficer, or when the property has! been returned as herein provided; | provided the owners of such prop- erty are unknown and have failed to return as herein provided shall! be listed and assessed according | to lots and plots of the several} tracts or plats of land within the! tity. The City Council is hereby! #uthorized ‘to adopt by ordinance | dn ‘official map or plat book of | setting forth their objections to shall not be transferred. Transfer of Funds Section 74. It shall be the duty | of the City Auditor of the City of Key West, as and when taxes are collected and reported and paid to ithe City Treasurer, to forthwith appontion and credit the propor- said assessment and the correction | which they desire made. Said no- tice shall name the time and the place where the City Council will meet for the purpose of equalizing the assessments and making prop- er corrections. From the date of publication of the notice provided for herein, to and including the| tions thereof due the respective day named therein as the Jast day | agcounts and funds of the City of for filing said petitions, the pub-|Key West, a copy of which appor- lic shall have access to said assess-| tionmient shall forthwith be de- Section 73. As soon as, practic- » poration therein described; and ii cate the taxes so imposed are not paid? at the time prescribed; by law, you © collect the same im such as is provided by law: and all sums collected you are to pay into the treasury of the City Key West; and vou are further re- quired to make ail collections and reports and a final report t& and settlement with the Treasurer and City Council as required by law and ordinances. Given under my hand this day of AD 1% Mayor of the City of Key West. When Taxes Due Section 78. All taxes shail be due and payable only in United States mey, on the first day of Janu: { each year or as soon thereafter as the assessment roll may come into the hands of the Collector of Taxes, of which he shall give notice by publication m @ newspaper published in Key West and the collection of taxes remaining due and unpaid on the first day of June thereafter shall be enforced in the manner pre- scribed by law; and interest at the rate of eight per cent. @%) per annum from the Ist day of June shall be added thereto and celiected. Taxation 79. The Tax Assessor- Collector, in estimating and car- rying cut the taxes assessed upon the assessment roll. shall comply with the terms of the City Ordi- nance on that subject, not imcon- sistent with this Act. Section 80. The Tax Assessor- Collector shail have the power, and it is hereby made his duty, to issue distress warrants in the name of the State‘and City to enforce ‘the collectio#¥ ‘of taxes on personal property privileges. Such warrant shal? be executed by the Chief of Police or by any Con- Section ment roll at the office of the City Clerk each day, Sundays excepted, from 9 o'clock a. m., till 5 p. m, excepting between ithe hours of 1 p. m. and 2\p. m.,-for the: purpose any one year to incur any in- debtedness in excess of the ap- propriation fog said year except as provided in this Charter. May Issue Bonds Section 59. The City of Key West shall have the right to is- sue and sell bonds for municipal purposes; provided, such issue of bonds shall be ratified by, @ majority vote of all those free- holders who are qualified elec- tors of said city voting at an eléction to’ be held for that pur- pose, not to exceed in amount twenty (20) per ‘cent. of the as- sessed valuation of all taxable | of examining the same and pre- livered to‘the City Treasurer. It shall be unlawful to transfer, appropriate.or expend any tax! moneys collected for the interest, ‘sinking fund dnd Board of Public the City of Key West, and when | ‘adopted assessments, with descrip- | tions referring to said official map; or plat book, shall be validated | and held sufficient for any and) all assessment purposes on the tax} rolls of said city, and said official) map or plat book shall be recei =| ed in evidence in all proceedings in any cdurt relative to tax assess- ments of said city. This assesment annul any other legal method or) plats used by said city in describ- | ing assessed properties on its tax) rolls. All property shall be assess- | ed as of the first day of January) property in said city. And whenever, for the pur- pose of extending the time of the payment of the now exist- ing indebtedness, which from its limits of taxation the city may be unable to pay at matur- ity, or whenever it appears to the said City Council to‘‘be: for the best interest of the aid City to refund any such,.inde| now existing, the City,’ i i's, Poem i Passed at any Tegwlar(/OF, rau meeting, is beteby , aul and empowered :/t9:, 9 is compound, refund," *s ith and to fund any now existing indebtedness lawfully made and undertaken by the said city un- der authority of law or ordi- nance; and for this purpose, and without submitting the same for ratification to the qualified elec- tors of said city at an_ election as hereinbefore provided, the said City Council shall have pow- er to issue negotiable coupon bonds of the City of Key West of such denomination as they may see fit, bearing interest at a rate not to exceed five percent. (5%) per annum, and said bonds shall not be sold for less ens par; provid iowever,,, that no | ebtednese at anid Cy of Ki the aggregate amount of bonds of maturity, the rate of interest entire cost of|cannot be ascertained after dili-| they shall bear and the place or places of payment of principal and interest. the time under and by the virtue of of the year for which such assess- | ments are made. | Returns fe Be Made of Property| Section 63. All persons, cor-| porations or firms owning prop: erty, whether real or personal, sub- | ject to taxation by the City of Key| Wiest, are hereby required to make | returns of the same before the ‘irst day of March in every year} the ne eo Assessor- £3 GDA gr i ‘Section 64. Suchq yetucn shall | pe;made upon and ip,,compliance} reine livythe City of Key West and shall.,contain a complete list of all property taxable by the city belonging to such person, corpora- tion or firms, on the first day of January ithe year for which such return is'fhiade, together with the full cash Value thereof, giving sep- arately an’ inteligible description and. full ‘cash value of each sep- arate lot or parcel of real estate. The description and valuation thus returned, may be considered ax Assessor-Collector in making assessment, but he shall not be bound thereby. Should any person, corporation or firm omit to make return as above required, | Tax Asse SC Collector shall ee know! eahe assess in the owner, and inno tase whéterthies real owner has failed to make re-| -turn of his property as herein re- quired, shall the assessments thereof be declared invalid or not lawfuliy:tmade, or the enforced payment of taxes thereon be re- sisted by reason of such property Reilroads Subject to Taxation | subject to taxation | pose of reviewing and equalizing Works accounts, except for ‘the purpose for which any such taxes may have been levied ‘and ‘collect- paring petitions for the correction thereof. Section 69. All. petitions.’ correction of assessments so filed directly or indirectly in any such within the time preseriped, with | unlawful transfer, the City Clerk, shall be by the|or expenditure, shall be severally City Clerk, delivered to the City! personally liable for such un-| Council, and the said Council by | Jawful ‘expenditure, together with committees or otherwise shall in-/ their sureties if any, and it shall vestigate concerning the same, and| he the duty of the City Attorney the day named therefor in! t sue, recover and collect any id notice shall meet and sit 85| such unlawful expenditures in a tax reviewing board for the put-' the name of the city, and when collected to be deposited to the credit of such fund, or which said moneys have been unlawfully . . taken, and further such officers credo a overdone and) shall be liable to immediate sus- sha make suc! i al il f valuation or listing of bce prop.| Dean See shal hus Siow erty or otherwise as may be neces-} 4 sary to the proper, just and legal 50°00? To Tote the cold sew. correction of said assessments. a a A | eral levies on the assessment roll, Opportunity dil rear fo Be in said calcula- said assessments and correcting the same and shall consider and act upon said petitions and the re- | and shall reject tions the fraction of a cent when Jess than half and count as one vent any fraction of one-half or \ F over. He shall also make in his petition objections to said aS-) assessment roll such recapitula- essment as hereinbefore pro- tion as may be necessary to show vided, to,p¢ heard in person jor by flearly and concisely the totals attorney, BS, Welien artuneent, and|(of the various tax levies ‘made. on such evidence as.may be pre- sented to sustain such petition, Be nt kos ie Hg the City and shall sit from day to day Un-| Oouncil for the correction of any Section 70. The City Council shall give opportunity to such pe- titioners,a5 may, have filed their til said petition and objections for | ed;‘and ‘any officers participating | in 2 court at law’ or im equity. Section 81. If appropriation | ter the tax roll into the hands of sor-Collector, the Collector shail advertise the real estate for the taxes * and for the cost of advertisement. The cost of the advertisement shall {not exceed seventy-five cents (T5c) for each item. The said ad- vertisement shall be in the same manner as provided for unpaid State and County taxes. At the date stated in the advertisement the Tax Assessor-Collecer shail proceed to sell the property ad- j Vertised at public outery to highest bidder for cash. In there is no bidder for the of tax which the property i ing sold, the Tax Assessor-Callec: tor shall bid the said for the City of Key West. the said sale and within days thereafter the Collector shall issue | tificates to the purchasers: | Shall enter the said sale im a. book. tain a description of said property as it appears on the assessment y ee > | Sor panera and reports have all been passed upon, and the correction of said | assessment Toll shall have been completed. The work of equalizing said as- sessment by the said City Council may extend to any change of the figures of the Tax Assessor-Collec- tor either increasing or decreasing each item of valuation on the said roll, and may increase the total | valuation of the said tax roll such an extent as’ i of the said City Council may be necessary to reach a full cash value of all the taxable ecstces city. ‘The*'said City Section 71. “If the City’ ¢ valuation any property on the assessment roll, except by a reduction of the valuation or in accordance with to any| Section 65. Railway and rail-| owner assessment in the manner above roll, the name of the person in Provided then he shall not here-| whose name the property was as- efter be heard as of right to| sessed, the amount of the question the validity of such as-| and cost; and the sessment. was Section 76. The Tax Assessor- Public sale~ Collector shall make a copy of said! The Tax assessment roll with the levies the City of West made thereon and shail deliver the ue to assess the said same to the collector of Taxes, the he same as if the taxes had original, he shall deposit at the of-| P@id. and the former fice of the City Clerk. To the said | D°S. sSigns, or grantees, assessment roll and said copy Tedeem the said property thereof shall be attached substan- City of Key West at any ti tially the following certificate: i" two @) years after “This is to certify that the fore- going is the assessment roll of the’ Ny E fi i bef i t bf HF i RE ik i i i 1 li & i th ibe t gf #FE uy ta j i nagey oe ait § 5 it eeeSber