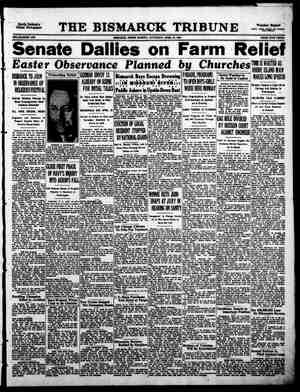

Evening Star Newspaper, April 15, 1933, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

. all showed remarkable strength in view | FINANCIAL LIST SHOWS GAINS Decision Not to Call Liberty Loan This Year Results in Advances. By CHARLES F. SPEARE. 8pecial Dispatch to The Star. NEW YORK, April 15.—An advance of necwly a point in U. S. Fourth Lib- erty 41;s today followed the announce- ment that the Treasury had decided not to call this loan next October. This brought heavy buying orders into the market for them, on which they opened at about 103 and later sold better than 103%. Their range for the year has been between 10035 and about 104. At the same time the First Liberty 31.¢ advanced ¢ to above 102 and there was a slight rise in the First Liberty 414s. The long-term Treasuries were inclined to react, especiaily the 4s. To some extent the policy of the Treasury should help corporation bonds, for it eliminates an operation of tre- mendous size that might make it diffi- cult while it was in progress to bring out any new corporation loans. On the other hand, its position was a dis- appointment to those ‘who had con- tended that the refunding of the Fourth Liberty 4%4s was & necessary part of the Treasury’s work of this year and that it would have a good effect on all Government credit. Movements in the domestic list were trregular, with some substantial ad- vances in the industrials and not much change in the rails or public utilities. Goodyear 5s advanced 134 points, which put them on a level 10 points above their recent low. Goodrich 6s were also strong and 8!, points over their mini- mum price this year. Dodge 6s held their recent gain of 7 points. Youngs: town Sheet & Tube 5s rose a point. United Drug 5s were strong around ‘Thursday’s level. The local traction issues advanced, with a 3-point gain in Manhattan Railway 4s and in Brooklyn-Manhattan Transit 6s, selling up to 90. Fractional gains took place in a few of the specu- lative rails like Chesapeake Corporation Bs, Chicago & Northwestern 4%s and Great Northern 7s, while Missouri Pa- cific bs, Baltimore & Ohio 415s and New ! York Central 4128 were off. There was & sharp decline in Ger. man government 7s, which broke 3% points to a new low for the year and were 30 points under the high of last! January. They are still 14 points above 1 B the low of 1932. The government 5!%s | acted better, although they were off a point. Japanese and Argentine loans were steady. Canadian government 5s sold at -the best price on their recent recovery and Italian government 7s re- covered 12 point. In the high-grade domestic list Atchison 4s, Union Pacific 4, Duquesne Light 4's and Consolidated Gas 5s! of the increasing talk of the prospects | for inflation. American Telephone & Telegraph issues held up in spite of the | poor statement of earnings by the com- pany for the March quarter. . OUTLOOK FOR RAILROAD TRAFFIC HELD BRIGHTER By the Assoclated Press. NEW YORK, April 15—E. N. Brown, chairman of the Readjustment Commit- tee of the St. Louis-San Prancisco Rail- ‘way, said the general traffic outlook was encouraging. “The demand for lumber has shown a sudden spurt,” he asserted, adding that this improvement also applied to the Rock Island road, of which he is Ex- ecutive Committee chairman. Brown said it would take “some time" to put into effect the Prisco’s reorgan- ization plan, although deposits of se- curities now amounted to more than the two-thirds necessary to operate the plan through use of the recently enacted bankruptcy legislation. A total of 66.8 per cent of the Kansas City, Fort Scott and Memphis bonds have been deposit- ed, while deposits of all securities af- fected by the plan amount to 70.75 per cent. Counsel for the Frisco, Brown stated, is studying the advisability of taking advantage of the amended bankruptcy BANK CLEARINGS DROP 29 PER CENT UNDER 1932 By the Associated Press. NEW YORK, April 15.—Bank clear- Ings make even a poorer showing those of the two preceding weeks of this year, or since the virtual ter- mination of the recent bank holiday. The change, however, is not very gre: Total clearings for the week at all lead- ing cities in the United States, now re- porting, as shown by the records of Dun & Bradstreet, Inc, of $3.285- 860,000 were 29.2 per cent under those of a year ago. At New York City, clearings were $2,278,178,000, a reduc- | Con G NY 534845 DS Received by Private Wire Direct to The Star Office. UNITED STATES. (Sales are in $1.000.) High. Lib33%s32-47 Lib 1st4%s 3 Lib 4th 438 33-3 U S 35 51-55. US 348 46-49. %5 M41-43. s 40-43.. 101 101 101 103 Ab & St53%s43. .. | Alleghany 55’44, . Alleghany 55’40 Alleghany s '50 Allis-Chalm 55'37. Am Beet Sug 65'35. Am F P 532030 AmIGCh5} Am Intl 5358 4 Am Sm&Ref 53 '47. Am T&T 4%s'39.. | Am T&T c tr 5846, Am T&T deb 55 '60. Am T&T deb 58 '65. Antioquia 7s "45. .. Argentine 5148 '62. Argent 63’61 Ma Argentine 65 °59 Ju Argentine 6s B '58. Argentine 6s ‘59 Oc Argentine£s A '57. Arm & Co 4%s'39. Arm Del 535 '43. .. Atchison gn 4s°95. AtIC L 1st 45’52 AtICL col 4552 Atl Ref db 55 '37... Australia 4138°56. . Australia 5555, ... Australia cese Austrian 7s'57.... B&O1stds™s.... B&O 4%5760..... B&Orf5sD2000. B&OTf6sC95... | Belzium 655 3 Belgium 614849, . 3 Belgium s '5: Belglum 7s'56. .. .. tell Tel Pa s B'48. Benef Loan 65 '46. . Berlin Cy El 6s°5 Berlin 635 '50. Berlin CEl 6%8'51. 1 Berlin C El 6145'59, Beth Stl rf 55’42 Bos & Me Brazil 6% Brazil 635 '27-'5 Brazil CR 7s '52 ‘Brazil 85 '41. : Bklyn Ed 5s A 49. . Bklyn Man 6s A L = O Ea 9 e SRwake waw 31 5 Bklyn UnGas 5s'57. Budapest 68 '62. ... Bush Ter con 58’55, Bush T Bldg 5s'60.. Calif Packing 55’40 Canada 4s°'60 : Canada 4%s'36 Canada 53’52 Can Nat Ry 438’51 Can Nat Ry 4155’54 Can Nat Ry 41 8'56 Can Nat Ry 414857 Can Nat Ry 4% 8'55 Can Nat 55 '69 July Can Nat 55 '69 Oct. Can Nor db 614846, Can Nor deb 7s "40. Can Pac deb 4; Can Pac 4%5'60. Can Pac 55 '44 ctfs. Can Pac 58 '54. Cent Il E&G 58 '51. Cent Pac 58 60. C&Ogen4ys’y C& O con 5539 CB&Q4%s'77. CB&Q 1131540 60 1 1t et 33 53 00 80 10 On 1 1D 1 00 19 00 1 9 19 00 00 i 1 1t e 9. Chi M & StP 4% C Chi M&StP 43%s E. C M StP&P b8 '75. . CM&StP ad 5s 2000 Chi&NW gn 315" Chi & NW gn 4587, Chi&NW 4145 2037, ChI&NW 43;5C'37. Chi & NW 4%s 49, Chi Rwys 5527 Chi RI&P gn 45 88, Chi RI&P rf 4524, ChiRI&P 4%s'52. Chi RT4%s'60..., Chi Un Sta 55 B'63 . Chi Un Sta 63%'6. C& W Ind cn 4s'52. Childs deb 55 °43. .. Chile 65 ‘61 & Chile 65°61 Sept... Chile 65°63.. B Chile Cop db 58 47, Chi Mtg Bk 6%s '57 Chin GVtRy 58 51. . Cin Un Trm 6s 2020 CCC&St L 434 5E'77 CCC& St L 55 D'63. Clev Term bs B '73. Colomb 65 '61 Jan.. Colomb 65°61 Oct. . Colo & Sou 4%s 50 Col G&E 55 '52 May Com Inves 534549, Con G NY 4%s'51. Con Gas N Y 5s°57. - - PSP R R T To Yo o aulnaRtaneSRen Copenhag 55’52, Cuba 5% 845 Cuba R R 65'36 Czecho 8s '51. = tion of 27.2 per cent, while the aggre- gate for centers outside of New York of $1,007,682,000 was 33.3 per cent smaller. | Losses now are somewhat in excess | of those for the closing months of last | year. There are exceptions, however, | to this fact, especially at some of the | Southern cities, where the decline is| at a lower ratio than that shown for| cities in most other geographical sec- tions. This has continued to be the case for some time past. The losses mainly are at Eastern and Western centers and to some extent at Pacific Coast poinfs. This week’s clearings | are $960,661,000 below those of last| week; a year ago the decline was $942,- 115,000. A large reduction in bank set- | tlements for the second week of the| month is to be expected. The report for leading centers, com- pared with those of last year, showing decreases is printed herewith; also, daily bank clearings since October: (Totals in_thousands.) Week April Boston .. .. Philadelphia Dallas : Ban Francisco. Portland Seattle Total New York Average daily: {D&RGren4s’3 | Duguesne4; sA’67 . | Brieref5s'75. Denmark 43%s 62 PEENEFTOI - JUpPpeypape -] D&RGr4%s’36.. D&RG W 58'55.. Det Ed 435 D'61.. Det Edison rf 55'49 Det Edison 58 '52. . Dodge Bros 6s " Duquesnes 12 sB'57. Dutch East I 6s'47. Dutch East I 6562, Erie cv 4s A ‘53, Erfe gen 4596, Erle ref 55 '67. po 85~ Finland 53%s '68. .. Fla E Coast 55 '74.. French Gv 7549, .. French Gv T%s'41. Gelsenk'hen 65 '34. Gen Baking 53%s'40 GenP Sy 5%s°39. . Gen Th Eq 55 '40 Ger Cen Bk 6560 J Ger Cen Bk 65 '60 O Ger Cen Bk 7s'50. . Ger Gen FElec 65'48. Ger Gen E17s'45. . Ger Gov5%s German Rep 7s Goodrich 6s *45. Goodrich 6145 '47. . Goodyr Rub 58'57. . | Grand Trunk 6s'36. Grand Trunk 7s" Gt Brit&Ir 5%s Grt Nor 5155 B '52., Grt Nor gn 7s'36.. | Greek 6s°68. .... Haitl 65 '52 Hudson Coal 5 Hud & M adj 5; { Hud & M rf 58'57.. Humble Oll 55 °37.. PRSTSIN) @ mao B 7. Sales. 1 12 103% 1 5 2% Low. THE EVENING STAR, WASHINGTON, D. C. SATURDAY. APRIL 15 1933. ON NEW YORK ST Close. 102 3 10128 102 3 10216 101 3 102 3 103 10 10229 103 9618 96 8 9611 9814 9810 9813 1 10031 10031 3101 3101 3 101 1 101 2 10224 10226 10416 104 2 104 10 10814 108 8 108 8 High. Low. 85% 4 86% 102% 102% 103% 1034 1004 99% 100 99% 104 103% 52% 52% 7 7 45 4R 49 4 04 T6% 27% 3814 39% 381 7% 3% 25 103% 103 90 99 98 98 03 27% 10 31% 69 83% Close. 85% 102% 1034 29% 993, 103% 52% 7 45 11024 102% 1024 2 102% 102% 1025 11 2 104 76% 27% 35 3914 381 1% 53 22% 22 20 23% 103% 89 4 106% 106% 106% 98 103 OCK EXCHANGE Low. Close. 51 514 3 3 3 35 109 109 122% 124 56 56 96% 964 24% 24% 98 % 25 25% 33% 37 65 65 101% 101 82% 83 84% 6514 29 37 Bales. High. Laclede5%sC'53. 6 51% Lautaro Nit6s'5¢.. 1 3 Leh Valen 582003, 1 35 Lig & Myers 5s'61.. Lig & Myers 7s "44. Loew's 63 '41 Lorillard 58 '51 La & Ark 5569 LouG & El s A’ McKes & R5%s Manhat Ry cn ¢8'50 Market St 7s A *40. Marseille 6534, ... Midvale Stl 55 * Milan 6% ‘52 Mil E Ry&L 5 MSP&SSM cn 45 '38 MSP&SSM 5%5 T MEK&T ist4s” MK & T adj 58’ Mo Pac gn 4s°75. ., Mo Pac rf 55 A '65.. Mo Pac 55 F 77 Mo Pac 55 G T8, Mo Pac 55 H'80. 84 65'% 29 38 T4% 0.. 7. 33 2 Montevideo 7s *52 Mont Pow 5s*43..., 4 Nat Dairy 53 s'48.. 11 Nat Steel 55°56.... 7 N Eng T 1st 58 NOT& M 5= B'54. NOT&M5%s'54.. Nw S Wales 58'57.. Nw S Wales 5s8'58. . NYCentds'42.... N Y Cent 4s *9| . NYCrf4%s2013. NYCrf4%s2013n NYCrt5s2013... N Y Cent ab 6 NYC&StL 1st 4s NYC&StL 41578, NYC&StL5%SA'T4. N Y Edison 55 B'44 N Y Edison §s C'51. NYEArf6%s'41, N Y EL H&P 4549, NY EL H&P 55 48, NY NH&H 6548 NY O&W rf 43°92.., N Y Steam 5s '56 N Y Telgen 4% Nia Sh Md 5%s Nord 6%s'50 Norf Sou rf 5561 Nor & Wn div 45’44 North Am Co 6s'61. Nor Am Ed 55 C'69. Nor Ger Ltd 6s°47. Nor OT & L 65 '47. Nor Pae gn 3s 2047, Nor Pac 48'97..... Nor Pacr 1 6s 2047, Nor St Pw 5s A *41. Nor St Pw 65 B '41. Norway 5%s’65... Norway 6s'43..... Norway 6844, Norway 6s'52. . Ohio P S 7%s'46... Ore Sh L 5s gtd "46. Oreg-Wash 4s'61. . Orient Dev 5%s ‘58 Orient Dev 6s '53 Owens Il G1 5539, Pac GRE 5s *42 Pac T&T 1st 5 Pan Am Pet 65 *40.. Paris Or 535 68.... Penn sta 4548, Penn 4%s D81 Penn 4% s D70 Penn 55 '64. Penn gen 5s Penn 6%s '36 Penn P&L 4% ‘81, Pere Marq 435 '80. Pere M 1st 58°56... Peru 6s 6 Phila Co 55 '67. Phila Elec 45 '71. .. Phila & Read 65 43 Phillip Pet 5% '39 Pillsb F M 65°43. Pirelli 78'52. ... PCC&SL 4345 CT7 PCCaStLssA70 PCC&SL 55 B'75. . Poland 65’40 Poland 7s’47. Poland 8s '50. Port Gn E14% Pos Tel & C 68 53.. Prussia 6s 52 Prussia 6%s '51.... Public Serv 4sT1.. Pub Sv G 434567 Pure O11 5%5'40. .. Queensland 6s *47.. Queensland 7s"41.. Read 4%s A'97.... Rem Arms 6s A "37 Rem R 5% sA’4Tww Rhinelbe U 75 '46. . Rhine Ruhr 6s'53., ® o phdantvea~Sananamio=Samenen [T N e R T e L) o 00 IS POTNOD R 100D 53 1Ot it S Riode Jan 6%s'53. RioDeJan ext 8’46 R Grdo Sul 6s 62.. RIAr& L 4%s'34. Rome 6%s '52 Rumania 7s '69 StL IM R&G 48'33.. St L&SF 4s A '50. .. StL&SF 4%s'78. StL SF 4% s'T8ct st StP&KCSL 414841 St P Un Dep 5572 Sao Paulo 85°36. Sao Paulo 7540 Saxon P W 6%8'51. Saxon 7545 Seab A L 63 A *45 Serbs-Cr-81 7 Serbs-Cr-S18s°62.. Shell U Ofl 5547 Silesia Prov 7s '58.. Sinc Ofl 6% 8 B '38. Sinc Ofl 73 A '37. Sinc P L 58 ‘42 Skelly Oil 5% Sees mmrorre o Son Pac rtf 45 ’56... Sou Pac 4%s 81, Sou P 4%s’69 ww.. Sou P&OT 4% 8A'TT Sou Ry gn 4sA'56.. Sou Ry 55'04. . . Sou Ry gn 6s'56... Sou Ry 6%8 '66 SW Bell T 55 A StOIINJ5s’46.... StOIIN Y 4%s'51 Studebaker 6s '42. Sweden 535 '54. Tenn EI P 65 A 47, Tex Corp cv 58 '4: Third Av rf 4s'60.. Third Av adj 65'60. Tob P NJ 6%s 2022 Tokio 5%s 61 Toklo El Lt 65°63. Un EIL&P ref 55'33 Union El L&P 55’87 Un Pac 1st 4s Un Pac 4s - Un Pac rf 4s 2008. . Uait Drug 5s'63... U S Rubber 65 '47.. Un St W 6345 A'47. Un St W 6%45 A'51. Uruguay 6s‘60. ... Utah P & L 55 "44.. Util Pw 55’59 ww. . Util Pow 5%s°47.. Vanadium St 58’41, Va Ry 15t 58 A '62.. Wabash 4%8°78. .. Wabash 1st 55°'39.. Wabash 55 B'76. .. Walworth 6s A "45. Warren Bros 6s’41. P NP ACNNIONCINABNAANAN B - IIRS R o= woabhas Cuaaan IRETURNS OF GOLD 0 BANKS CONTINUE Federal Reserve Institutions Report Stronger Position in Metal Holdings. By the Associated Press. Gold continued to flow into Federal Reserve Banks last week in response to President Roosevelt's anti-hoarding or- ders and the banks strengthened their gold reserves and gold backing for Fed- eral Reserve notes. In the week closiny yesterday, gold reserves of the Federal Reserve banks increased $36,609,000 to a total of $3,- 315,446,000. It brought the total gain since March 8 to $613,907,000. That which came in last weck was $3,400,000 less than the week before. Ratio Shows Increase. While more than a half billion dollars in gold and gold certificates have been returned to the Treasury under pres- sure of the anti-hoarding edict it has been estimated that approximately $1,000,000,000 still remains outside the Government vaults. As the gold continued to pile up in the banks the gold ratio back of Federal Reserve notes in circulation increased from 73 per cent to approximately 75 per cent. A week ago $2,651,884,000 in gold backed $3,644,137,000 in circulation, while the Federal Reserve Board's state- ment today showed $2,664,216,000 in gold back of $3,547,285,000 in notes. Monetary gold increased $10,000,000 in the week to $4,293,000,000, a total gain of $50,000,000 since March 8. Money in circulation dropped $114, 000,000, leaving a total of $6,147,000,- 000. ‘The decrease was $1,391,000,000 since March 8. Deposits in the banks increased dur- ing the week, amounting to $2,273,730, 000 yesterday as compared with $2,196. 055,000 the week before. Since March 8 deposits have gained $322,508,000. Use of the new Federal Reserve Bank notes increased slightly. The total in circulation yesterday was $19,890,000 or $3,760,000 more than a week ago. Decrease at Boston. In the New York district use of the new money climbed from $10,232,000 tc $12,805,000 and in the Philadelphia dis- trict from $2,830,000 to $4,330,000. The Boston district decreased its Federal Reserve Bank note circulation by $192,000 to 81,719,000 while the Cleveland district used $79,000 more with a total of $997,000. The banks’ reserve ratio to outstand- ing deposits and note liability was 60.6 per cent compared to 59.7 per cent a week ago. BONDS ARE IMPROVED BY BUDGET PROSPECT Fiscal Balance Would Insure Suc- cess in Conversion of Maturing Government Obligations. Special Dispatch to The Star. NEW YORK, April 15—The prob- ability that the Roosevelt administra- tion will succeed in reducing govern- mental expenditure for the next fiscal year by more than a billion dollars is bound to have a favorable effect on Government bonds. A genuinely bal- anced budget will not only result in continued firmness of such obligations, but should make possible the conver- sion of some $3,000,000,000 worth of maturing obligations. Thus far the United States is the only imrorum power which has not been able or willing to effect a con- version of existing commitments into long-term bonds at a material saving to the Treasury. Great Britain and France did it to the extent of about $10,000,000,000 and $3,500,000,000, re- spectively. ‘There is no reason why the nited States should not attempt it. Pending such conversion, which if undertaken is sure to prove successful, the securities markets are expected to give a satisfactory account of them- selves. This, rather than vague talk of inflation and other fantastic fiscal policies, is likely to make for an in- crease in the turnover on the New York Stock Exchange, accompanied by higher quotations. 1% | (Copyright, 1933, by North American News- paper Alliance, Inc.) Markets at a Glance NEW YORK, April 15 (#).—Stocks irregular; American Telephone heavy. t:gndl irregular; U. 8. Governments steady. Curb mixed; metal shares higher. Foreign exchanges erratic; gold cur- rencies subside after sweeping advance. Cotton, sugar and coffee closed. U. 8. TREASURY BALANCE. By the Associated Press. Treasury receipts for April 13 were $4,093,770.62; expenditures, $17,128,- 611.85; balance, $493,059,192.96. Cus- toms duties for 13 days of April were $7,575,653.27. Crude Oil Deliveries. NEW YORK, April 15 (#)—Crude oil deliveries by nine pipe line com- panies representing the old standard oup totaled 20,955,350 barrels in the rst_quarter. This compares with 23,- 170,985 barrels during the same jod of 1932. March deliveries totaled 7,011,- 083 against 6,153,979 in February and 8,019,935 in March, 1932. CHICAGO STOCK MARKET CHICAGO, April 15 (#).—Following is the complete official list of transac- h in stocks on the Chicago Stock Exchange today: Saly STOCKS. High. Low. Close. 26 ' 281, 28 93, R ' % ) Abbot Lab = 550 Bendix Av : 1100 Borg-Warner & 150 Butler Bros o 20 Cen Il Pb 8 ) 100 Cen 1 S 8 14 3 ICURB SHARES GAIN, WITH LS IN LEAD More Cheerful Trade Reports Are Reflected in Stronger Securities. By JOHN A. CRONE. Special Dispatch to The Star. NEW YORK, April 15—The Curb Exchange moved irregularly higher to- day. Leading issues, like Electric Bond and Share, Standard Oil of Indiena, \ Niagara-Hudson, American Gas and 1 Electric, Deere gnd Co., and Aluminum Co. of America pointed upward. Week end business reviews for the most part were cheerful, though the decrease in car loadings was larger than expected. Although many of the | commodity exchanges remained closed today, that fact did not prevent specu- lators from bidding up b3sic raw ma- terials or their finished products. See- ing these trends, professionals resumed bidding up of so-called commodity mg:" gth of the oils was an out ren, of the o - standing feature during the first half hour, with Humble Oil the first of the standerd group to reach a new high for the year. Later silver shares, such as Bunker Hill-Sullivan stiffened. Then the gold shares pushed ahead. Firming tendencies of meat prices helped the packing securities. Creole Petroleum and International Petroleum quickly rose to new peaks. Then_Imperial Oil, Ltd., turned active and higher. Hudson Bay Mining & Smelting and subsidiaries reported 1932 net loss of $298.955 against net loss of $301,947 in 1931. This report, how- ever, had been forecast by market move- ments _earlier this week. A. O. Smith Corporation reported a | net loss of $1,716,936 in the six months ended January 31 last, againts a net loss of $2,872,827 in the six months | ended January 31, 1932. The recent rise in this stock was due to the fact that the company is making steel beer kegs, which enabled organized opera- tions in . D. Emil Klein halved its common quarterly dividend payment, but_this had been discounted. The rise of raw sugar rather than the general activtity of refineries ex- plained the advance of sugar issues. BONDS ON THE CURB MARKET. Salesin DOMESTIC BONDS. thousands. High. 5 B3 '3 0 Asso EI Ind 413s || 1Ast0 G & E 4% 47 a8 :>>E 313 LU [} 11 58 i 4 10134 1 1031 1 87 LT oA 15 o5 > aa B > Adm 58 "33 xw rolina P&L_Bs Cent Ariz T 0 ‘ent St_El 5las 54 2Cnt 8t P&L Blas ‘53 Chi Dis El 425 '7Q A Cities Service 50 ties Service 5s '60 5 Cit Brv Gas blas '42 Pw Blas 52 rv PL 5'as '40 T 5s 39 5 Cleve E1 Tilu 5 8 Clec El Tliu 55 A 5 Com Edis 55 A 10 Con Gs Bito 45 '81 1 Con Ut 6'ac A '43 3Con Gs Ut 65 A '43 & Consum Power s '3 7 Gatin w 55 '56. 14 Gatineau Pw 65 '41. 4 Ge ) 7 Georgla P y 1 Gillette 8 51 1Glidden Co 528 3 Grand Trok Al3s W 1 25 B 61 b Houst GIf G s A 6 Hous L&P 4135 E 4 Hudson BM&S 65 35 53 W & L 5ls 87 41 61ndnp P&L 55 A '57 2 Intern Sc_Am 55 *47 ey cesmaz o B EEREEE St e O 2ZZ2Z2Z: 203 e 30902015 DRGS0 e S D1 SRS Dtk 1135 PY T IO Gl SEESAT L " . 290 el T . 101 64 100 4610 FINANCIAL. N. Y. CURB MARKET Received by Private Wire Stock and Sale— Dividend Rate. Add 00. High. Low. Close. Alum Co America..5008 48% 47% 47% Alum Co ofApf 1% 100s 42% 4212 42% Am Beverage. 8 3% 3 31 Am Cynamid (B 64 64 Am & For Pwr war, 3% 3% Am Founders. .. N % Am Gas & Bl (1) 214 21% Am Lt & Trae (2). 14% 14% Am Superpower. 5.9 Ark Nat Gas (A)... M 1% Asso Gas&Elec (A) £k Atlantic Lobos. % % Atlas Utilities e Th Atlas Utilities 2%, Atlas Util pt A(3).. Biue Ridge pt (a3). Brillo Mfg (60c)... B A To B p37 3-10c. Brit Celanese rets. Buft N&E pt (1.60) Bunker Hill & S,vtc 508 Cable&Wire Arcts 4 Cable & Wire Brets 4 Cab& Wpfké1-5e. 1 Celanese Cp pf (7).1268 Cent States Elec... & CORPORATION REPORTS TRENDS AND PROSPECTS OF LEADING ORGANIZATIONS. 36% 23% 1% 16% 1% 1% 1% i & 2% 57 2 1% 16% 1% 1% K b 2% 57l NEW YORK, April 15—The follow- ing is today’s summary of important corporation news prepared by Standard Statistics Co., Inc., New York, for the Associated Press: Aircraft. United_Aircraft & Transport Corpo- ration.—Revenue passengers carried on United Air Lines in quarter ended March 31, 16,855, vs. 12,986 in 1932 pe- riod. Automobiles and Trucks, Ford Motor Co. of Canada, Ltd.—Net loss for 1932, $5,206,737, vs. net loss of | $1,384,757 in 1931; total sales and other income for 1932, $17,168,770, vs. $21,- 596,851 in 1931. Hudson Motor Car Co.—Dealers’ de- liveries for two weeks ended April 8 to- taled 1,352 cars, against 961 during preceding fortnight; factory shipments in same period 1,386 units, against 940; orders are on hand for 2,074 cars. ‘White Motor Co. has obtained orders for 59 trucks from three brewing com- panies, Food Products. ‘Ward Baking Corporation deficit, 12 weeks ended March, 1933, $101,359, vs. net income of $162,724 in 13 weeks to March 26, 1932. - Investment Trusts. Chain & General Equities, Inc., liqui- dating value March 31, 1933, $55.04 a prefered share, vs. $54.31 on December 31, 1932. Metals (Non-Ferrous). MclIntyre Porcupine Mines, Ltd., de- clared a bonus of 121 cents a share, an extra dividend of 12! cents and regu- lar quarterly dividend of 25 cents on capital stock, payable in American funds June 1; distributions are tax free: on March 1, 1933, an extra dividend of 121; cents was paid. Utah Copper Co. 1932 deficit before depletion and inventory adjustment of $749,183 was $2,469,704, vs. net income of $2,027,149 before depletion of $822,- 195 in 1831. Miscellaneous. McAndrews & Forbes Co. 1932 com- mon share umm% ‘:en $1.83, vs. $1.99. Buckeye Pipe Line Co.—March pipe line deliveries, including intercompany transfers, were o%’l.! per cent; three months, declined 29 per cent. Indiana Pipe Line Co.—March pipe line deliveries up 23 per cent from a year ago; three months, up 22.1 per ©iperior Ol Corporation 1932 net u) income, $9,436 vs. deficit, $1,864,364. Railroad and Railroad Equipment. Baldwin Locomotive Works—Business booked in March totaled $513,000 vs. $759,000 in March, 1932; three months’ bookings, $1,507,000 vs. $2,295,000; un- filled orders March 31, $2,342,000 vs. $2,627,000 on December 31, 1932. Union Pacific Railroad—] system's traffic is running ahead of preceding weeks and that percentage drop from a year ago u'beeomln smaller. Retail Trade. Great Atlantic & Pacific Tea Co— Sales, five weeks ended April 1, off 15.7 per cent; March tonnage sales, off 4.8 per cent. Steel and Iron. 4 United States Steel Corporation— Subsidiary, Nation Tube Co. and Youngstown Sheet & Tube Co. par- ticipating in order for 4,500 tons of steel pipe. 243 Utilities. Monongahela West Penn Public Serv- ice Co. 1932 preferred share earnings, $2.56 vs. $3.5 New York Power & tion 1932 preferred $19.15 vs. $21.29. Parmelee Transportation Co. 1932 deficit, $2,801,471 vs. deficit $3,165,954. Shawinigan Water & Power Co. de- clared regular quarterly dividend of 12 cents on common stock, payable in Canadian funds. Syracuse Lighting Co. 1932 share earnings, $18.60 vs. $24. Baltimore Market Special Dispatch to The Star. Light Corpora- share earnings, g BALTIMORE, Md., April 15.—White || potatoes, per 100 pounds, 1.00a1.05; new, bushel, 1.25a1.50; sweet potatoes, bushel, 40a90; yams, barrel, 1.25a1.60; asparagus, dozen bunches, 75a2.50; beans, bushel, 1.00a1.50; beets, per half crate, 1.00a1.25; cabbage, per ton, 15.00 a17.00; carrots, bushel, 50a60; cauli- flower, crate, 1.25a1.40; celery, crate, 1:25a2.00; cucumbers, bushel, 2.00a 3.50; eggplants, crate, 1.00a2.00; kale, bushel, 15a20; lettuce, crate, 3.75a5.00; onions, per 50-pound bag, 60a1.50; lima beans, bushel, 2.25a3.00; peppers, bushel, 75a1.25; spinach, bushel, 25a40; tomatoes, lug, 1.00a2.50; squash, bushel, 1.25a1.75; radishes, bushel, 1.50; apples, bushel, 35a1.50; strawberries, quart, 10 al5; grapefruit, box, 1.50a2.25; oranges, box, 2.00a3.25. Dairy Markets. Live poultry—Turkeys, hens, pound, 22a23; gobblers, 15a16; old hens, 20; old toms, 13al4; capons, 20a25; your{g chickens, 20a22; broilers, 20a2: ol hens, 11al3; Leghorns, roosters, 8a9; ducks, 11al3; fowls, each, 25a45; pigeons, pair, 15a20. gs—Receipts, 1,324 cases; current receipts, 12%al3. Butter—Good to fancy, creamery, pound, 20a22; ladles, 16al7; store packed, 12a13. Direct to The Star Office. Stock and Sale— Dividend Rate. Add 00. High. Low. Close. Cent Sta Elec war & * Centrifugal P 40c. % Cities Service. .. Cities Service pt Citles Serv pf B. Cities Service (BB). 708 Clev El llum (1.20) 1 Col & & E cv pf (5). 758 Colum Of1&G v. 1 4 2% i \ 22% 7 | Comwlth Edis (5).. Comwlth & Sou wr. Comstock Tunnel. . C A M Co ctf: B Cord Corp (10c). 1 Creole Petroleum.. 38 Crocker Wheeler... 1 Cust Mexicana Min. 7 Deere & Co . 20 Derby Oil & Refin.. 1 Dublifer Cond & R. 1 East G&F prpf 41 25s Eisler Elec Corp... 1 El Ba & Share b6 % . 132 EIBd & Sharepf 6. 17 El Bd & Sharepf5. 1 ElPwr Asso A 40c. 1 El Sharehold pf(6). 1 EmpireG&F 6%.. 508 Frst Nt S 1st pt Fisk Rubber(new). Florida P & Lt pf.. 258 Ford Motor Can A.. Ford Motor Ltd. ... Gold Seal El(new). Goldman Sachs. Great A&PT pf ( Gulf Ol of Penn Hecla Mining. ... Hudson Bay Min. Humble Ol (2). Imp Oil Ltd cou 50¢ Ind Pipe L (30c)... Ins Coof N Am(2). Int Petrol (1)..... Int Products. Interstate Eq cv Italian Superpw A. Kopper G & C pt(6) Lake Shore M (2).. Lefcourt Realty pt Mavis Bottling A. . Mid Sta Pet vte A, Middle West Util.. Montgom Ward (A) 50 Nat Bella Hess. ..., Nat Fuel Gas (1).. Nat Investors, Nat Service. v Nat Sugar N J (2) New Bradford Oil., New Jersey Zinc 2. 13 Newmont Mining.. 13 N Y & Hon Ros (1 5 13 N Y Steam (2.60).., 1 37 NY Tel pf (6%)...1258 113% Niag Hud Pwr (1). 15 Niag Hud (A) war, 1 Novadel Agne (5) Pan Am Airways. Parke Davis (1) Penn Wat & P (3. Penroad Corp.....; Pilot Radio Tube A. Pioneer Geld (24c). Powdrell & Alex. .. Premier Gold(12c) . Prent Hall cv (3)., 50 Prudential Invest ;ut l{'m HId xw ub Util Hid ep: 18 Pure O1l pf (1%)., 20s 22“: Quaker Oats pf (6) 1008 111 Reynolds Investing Roan Antelope Rossia Intl. ... .. Russek’s Fifth Ave St Anthony Gold. .. 3t Regis Paper, ... Salt Creek Prod (1) Seaboard Utilities. Seiberling Rubber. Selected Industries | Sentry Saf Control, Shawin W&P (50¢). Shenandoah Corp. Shenandoah pf.... Southern P L (40c) Stand Invest cm pf Stand Oil Ind (1).. Stand Ofl of Ky (1) Stand Oil of Ohio. , Sun Investing. Swift & Co. Swift Inter: (2) Tampa Elec 2.24. .. Technicolor. .. Tech Hughes (60c) Texon Ol & Ld (1), TransLux DL P S. United Founders. 3 82 1 1 . 15 2% ). 408 120 6 32 : 15 4 1 4% % 1 1 2 1 4 5 1 1 3 s 1 9 110% % 10 a3 0 RO RO MOV OO g0 I 1000 0Nt O 6B TNk ek T B ket 10 1 O bt bk 2 1 United Gas war. United Lt & P (A). = pt. Utd Verde Ext 40c. Util Pwr & Lt. . Venezuelan Pete. .. Willlams (RC).... Woolworth (F W) Ltd (p24 ‘Wright Ha Dividend rates in dollars based on Juarterly of semi-annual payment. *Ex ividend. fPartly extra. iPlus 4% in stock. a Payable in cash tock. b Payable in stock. . s 5% 13% 4 last 13% 13% 4 4 |1t INVESTORS AWAIT RAIL RELIEF AGTION Securities Reflect Uncer- tainty Over Government Program for Carriers. Special Dispatch to The Star. NEW YORK, April 15.—The slow progress of the administration’s rail- road bill through Congress has had the effect of taking the “edge” off railroad | securities, for Wall Street had expected that the measure would .be announced |in detall this week and that its - eftect visions would have a stimulating on_stocks and bonds of the carriers, It is obvious that such a bill, in order to be successful in the way of reducing railroad costs, must contain a number of radical changes in the method of railroad operations. These cannot be planned quickly. Once de- cided upon they will be siow in taking effect. The longer the subject is con- | eidered the greater is the skepticism regarding the amount of savings that can be effected without revolution- | izing railroad practice as it exists today and seriously curtailing the number of cmployes now in the pay of the trans- | portation companies. Prince Plan. Discrepancies of large amounts are | to be found in the various estimates | of economies to be produced by & | system of co-ordination plus one of consolidation. ~ The Prince plan claimed for it an annual saving of | about $750,000,000. Under a more scheme J. F. Loree recently stated that the railroads should be able to cut down their costs by $1,400,000,000 & year. On the other hand, veterans in the railroad service would be surprised under the authority of a ‘“co- ordinator,” economies - amounting to $100,000,000 & year would be brought about. Even this, they claim, would be at the sacrifice of much railroad service to which shippers and the trav- eling public have been educated and which they would reluctantly abandon. Last November the Western roads . engaged the services of a “co-ordinator,” whose business it was to attempt to re- duce the amount of train mileage on the railroads within his Jufladl‘c‘tlnn It was recognized that there was mucl duplicate passenger service and that many revisions could be made in freight traffic that would not destroy the effi- ciency of this throughout his territory. He has just made a report on the save ings that have been accomplished. The amount is somewhat less than $1,000,- 000. There is still considerable work to be done, so this may not be a fair test of the labors of such an pfficial. It suggests, however, that in ofder to save $100,000,000 a year on all of the railroads, their services to shippers and to the passengers on their trains must be cut to a point where it may tend to drive business to other transporta- | tion agencies. Co-ordination Is New Policy. ‘The principle upon which railroad- ing has been carried on during the past generation is that. inasmuch as rates are legally fixed, new business can only be produced by one line offering a bet- ter service to its patrons than another one. In other words, the successful' raj or co-ordination, and that the of service be minimized or al ‘While railroad men are present emergency to acce code and realize that it considerable amount of sa not nearly the sum they do not should produce a Copyright. 1833.) —_— BRITONS DENY PLANS FOR GOLD BASE RETURN By the Associated Press. purec! flhnd. which have raised the total to £179,336,000, a new th for year, caused specula as to whether the purchases indicate prepa- rations for a return to the gold vernment spokesmen rsistently deny any such intention for gfi present. A little more than a month ago Neville Chamberlain, chancellor of the ex- chequer, said the termined not to tially he explained the bank's : chases as incident to m""‘uu.‘“fir prevention of wide fluctuations in sterling. RANDALL H. HAGNER & COMPANY INCORPORATED REAL ESTATE Competent Management of Rental Properties in All Sections of the City N2 133/ Conneotiont Soonue N W MORTGAGE LOAN CORRESPONDENT AN Bk S Sesweres Compiny PROPERTY Apartment House MANAGEMENT (o) MANAGEMENT UR Property Management Department has charge of April to date. . March .. many of the most impottant apartment house properties in the National Capital, and has rendered efficient and satisfac- tory service to them for many years. Such properties placed in our charge are operated without worry to owners—and for & nominal fee. B. F. SAUL CO: 925 15th St. N.W. NAvl 2100 LOAN 111 Bell Tell 6s '56. . |11 Cent cl tr 45 '53. 111 Cent 4% 566 111 CCStL&N 4%s 111 Steel db 43" Inland St 4 Int &Gt Int & Gt Int& G Naj6s'52. Int Hydro El 6s'44. Int Mer Mar 6s'41. Int Pap 6s°55. Int Rap Trrf Int Rap Tr 6s IntT& T 4%s"39.. IntT&T 4%s 52 Tnt T& T 5s'55. Italy 78 '51. Italy Pub 7s'52 Japanese 53 ‘65 panese 635 ‘54 Kan City Ter 43'60. ®5 waate o 103% 414 3s 39% 98 70 19% 21% 5% 29 311 11 561 207% 26% 21% 234 9814 89 514 64 West Eldb 5s '44 0035 West Pac 55 A "46.. West S West Union b Westphalia 6s '53.. Wil & Co 1st 65 "41. Yokohama 6s '61 Ygstn S&T bs A'78, 2 i Ygstn S&T 5s B'70. 14 e PETROLEUM SHIPMENTS GAIN SINCE JANUARY 1 By the Associated Pre LOS ANGELES, April 15.—Prelimi- nary estimates by the Oil Producers’ Sales Agency indicated the first quarter off-shore tanker shipments of petro- leum and petroleum products of the Pacific Coast in 1033 held fairly even with the same period of 1932. The 1933 estimate was 13,053,149 bar- rels, compared to an actual shipment of ;:Jg:{as barrels in the first.quarter ! 50 Godchaux Sug B 50 Goldblatt ... .. 100 Gt Lakes Dredge . . 200 Grigsby-Grunow . 100 Kalamazoo Shovel 10 Ky Ul I December November ALLEGHANY CORORATION MAKES ANNUAL REPORT By the Associated Press. CLEVELAND, April 15.—The Alle- ghany Corporation Van Sweringen Holding Co. has reported net income for 1932 of $215,525 while there was a loss of $11,939.227 from sale of securi- fies. The was charged to paid-in Burplus. The net income was added to earned surplus. Income for the year from dividends and interest totaled $4,402,677. penses included: $3,933,386; other interest, 352; general, $143.412.67. surplus at the end of the year -0 38 ‘was $4,758,506 and paid-in surplus was K 38% $7,449.032 compared with $4,548,722 and s . $19,388,430 in 1931, Laclede Gas 55 "34., 82 W ¥ P TR sroatan el 3 . 1 19: 10 1931 1 14012 106.2 20 117600 308 s 14 Buen Al Pr 6 C WSS o DS=AL bt 2 3 SBIBR A 1933 86% NC 19 T9% xw. 98% ¢ 56 mebacs Y Se3me3sezc poranave A3ZREaRE2s Belbtameai @ 8 (Oepyright, 1933, Stand. MBS b PHIEGE SRBIR5aR Xw—Without warrants, n—New. . wi—When issued, MORTGAGE