Evening Star Newspaper, March 14, 1933, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

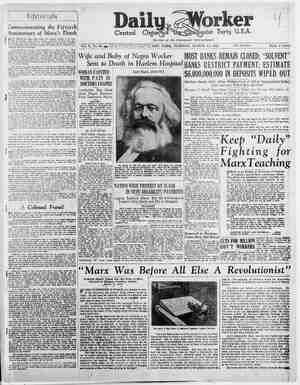

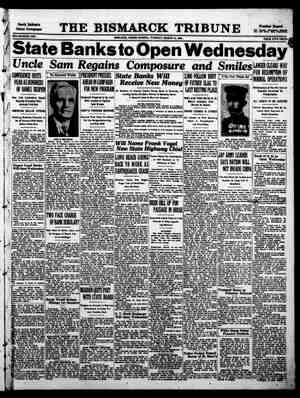

MONEY1S PROVIDED FOR STATE BANKS R. F. C. and Federal Reserve Members Can Advance Funds, Says Woodin. ' By the Assoclated Press. State banks which are not members of the Federal Reserve System can ob- tain currency to meet their needs from member banks and from the Recon- struction Finance Corporation under the emergency banking act, it was ex- plained by Secretary Woodin in a state- ment issued last night. The Secretary’s statement, issued in response to inquiries from all parts of the country, calleg attention to the Sunday night radio address of President Roosevelt, in which Mr. Roosevelt said: “The banks can and will receive as- sistance from member banks and from {_hc _Reconstruction Finance Corpora- ion.” Advances Are Authorized. He also said that Federal Reserve ‘Banks are authorized to make advances to individuals, partnerships and corpo- rations on their promissory notes. This is for a period not exceeding 90 days and must be secured by direct obliga- tions of the United States. He said the non-member banks could avail themselves of this privilege. ‘The Secretary’s statement follows: “Responding to inquiries today as to what facilities are available for enabling State banks which are not members of the Federal Reserve System to obtain currency to meet their needs, Secretary of the Treasury Woodin calls attention to the statement of the President in his radio talk on March 12 that ‘these banks can and will receive assistance from member banks and from the Re- construction Finance Corporation.” “The Secretary also pointed out that Federal Reserve Banks are authorized to make advances to individuals, part- nerships and corporations on their promissory notes for periods not ex- ceding 90 days secured by direct obli- gations of the United States, and non- | 000. member banks avail themselves of this privilege. Rediscount Authority Extended. “The Federal Reserve Banks also are authorized, he stated, to rediscount for member banks, with their indorsement, eligible and acceptable paper acquired from and bearirg the signature for in- corsement of non-member banks and to make advances to member banks se- cured by other paper acquired from non-member banks. “The Secretary said he understands it is the purpose and desire of the Re- construction Firance Corporation and the Federal Reserve Banks to be as helpful as possible in meeting the needs of the present situation.” MILEAGE REDUCTION FOR CONGRESS URGED Borah Will Ask Reconsideration of Resolution Providing $200,000 for Item. By the Associated Press. Senator Borah of Idaho, who formerly declined a raise of $2,500 a year in pay until his constituents approved by re- electing him, intends to ask the Senate either to cut out entirelv or reduce sharply the allowance of 20 cents per mile paid to_mem! of Congress for coming to Washirgton to earn the $8,500 a year each is to get under the economy bill cut. Borah plans_to_ask today or tomor- row that the Senate reconsider its ap- proval of a House resolution approved yesterday and carrying approximately §200.000 for mileage payments to mem- ors. Borah was absent when the Senate approved the measure and when he heard of it, sent to the Vice President’s | desk notice that he would ask recon- sideration. The railroad fare averages around 3 cents a mile, but in 1932 the 96 Sen- ators were paid $46.329 for traveling from their homes to Washirgton—some of them drawing mileage without le2v- ing the Capital. House payments ran around three times that figure. SUPPORT OF G. 0. P. PLEDGED ECONOMY MEASURE IN SENATE reduction in Government costs and added that it fully recognizes the “need for economy.” Since debate promised to continue through today, leaders could not be more specific as to the possible time of passage They felt, though, that a test vote yesterday on a motion by Sénator McCarran, Democrat, of Nevada, to pigeonhole the bill in committee was in- dicative of what could be expected. The new Serator's moticn was rejected, 60 to 20. Majority Forecast. Senator McNary of Oregon, the Re- | Rubllcan leader, said that after the bflli ad_been discussed in conference, the | G. O. P. Senators likely would give a | “substantial majority” of their votes to | the measure. Some members, including Senator YLong of Louisiana, conceded the bill would pass, but showed in debate that they would not be so amenable to the 5 wishes of their President. The economy bill strode triumphantly through a tempestuous debate yester- day, the first Senate test showing a; Ppreponderant sentiment for the meas- ure. Twenty Republicans joined with 40 Democrats to keep the bill frem :e!ng sentenced to a committee pigeon- ole. Senator McCarren, who proposed that the measure be recommitted for a|=22 study of its_constitutionality, although a new member, has become identified with the leaders of the opposition, who are seeking to kill the bill. Heated Debate. The day's fiery debate was marked by spirited personal clashes. McCarran ecame involved in a heated exchange | with Senator Glass of Virginia afier the latter had attempted unsuccessfully to interrupt a bitter assault on the bill by Senator Robinson, Republican, Indiana. The Nevadan rose to a point | of personal privilege and said: | 1 have j & heard a remark of the Senator irom Virginia addressed to me and a remark addressed to another Senator. I want tc stop those remark&‘ If they are not stopped I will invoke the rules of the Senate.” Robinson told Glass he did not wish to be interrupted because, he said, the Virginian had “misled us so many times and so often on this banking legisla- =17 take my own time in responding | that,” Glass shot back. “The Senator from Virginia alwavs' takes his own time,” the Indianan said. “Yes,” Glass renlied, “and I don either.” i “It was sheer waste of time when the Senator said the bapks would re- open, and they are not open yet,” Robinson returned. | voted ngflnst[ Eleven Democrats tabling_the McCarran motion. They were: Black, Caraway, Clark. Connally, | Duffy, Long, McCarran, MgGill, Neely, | Reynolds and Thomas, Oklahoma. Nine Republicans voted with the 11 Democrats, as follows: Borah, Couzens, Frezier, Hatfield, La Follette, Nye, Pat- ters>n. Robinson of Indiana, and Van- I total of all money—bank deposits and THE EVENING STAR, WASHINGTON, D. C. TUESDAY, MARCH 14, 1933. How New Money Is Issued CURRENCY EXPANSION NOT NECESSARILY ,mlp\’non. HOW TQ EXPAND CURRENCY LOMAHNOSN0 ) AT ‘gfi\\““\ ON: 1.BANK TAKES US BONDS AND OTHER COLLATERAL TO FEDERAL RESERVE 2.FEDERAL RESERVE GIVES MONEY FOR BONDS. 3.BANI K GIVES MONEY TO DEPOSITORS. Controlled currency expansion as distinguished from mecre “printing press” money, is looked to as a means of mak- ing up in part for the shrinkage in the Nation’s total money, both that in circulation and. in the form of bank deposits, indicated above. The sketch below indicates how currency may be expanded and yet have a substantial backing. Lo} BY J. R. BRACKETT. EW YORK (#)—Expansion of the currency does not neces- sarily mean inflation of the Na- tion’s money supply. | ‘This is because bank de- | posits, not currency, constitute the bulk | of the money. Bank depcsits at the | calling of the bank holiday were about | $40,000,000,000; money in circulation, including currency, about $6,700.000,- . This is a total of $46,700,000,000. If this sum were increased beyond the Nation’s economic needs or in- creased artificially, there would be in- flation. - In the present situation currency expansion is planned only to the extent necessary to satisfy the demands of bank depositors. Thus, if, on the re- opening of the banks, the people with- drew $2,000,000,000, money in circu-| lation would increase to $8,700,000,000, but this same $2.000,000,000 wculd be withdrawn from bark deposits and the money in circulation—would be the same. Currency expansion might be infla- tion if the Government simply issued it and distributed it to the public. This would be net addition to the money supply. ‘The new money now planned gets into circulation just as money always does normally. The banks of the coun- try go to the Federal Reserve banks and are given the money ‘when they give the Federal Reserve the required Government bonds. The banks give out this money to thcse of their de- positors who demand it. In time the depositors may be expected to rede- posit the money. Then the banks will take the money back to the Federal | Reserve and get their securities again. Inflation need not be artificially in- duced in the sense of printing currency. It is easier to inflate credit, which is inflating bank deposits. - In 1929 bank deposits were $55,200,- 000,000; money in circulation, $4,700,- 000,000—a total money supply of $59,- 900,000,000. A large part of the bank deposits had been invested and reinvested beyond a safe point; to a point, that is, where there was a credit inflation. A bank’s deposits are increased large- ly by loans. Thus if Mr. A deposits $10,000 in the bank, the bank may lend | $5,000 of it to Mr. B. Mr. B redeposits | it and the bank’s deposits are new | $15,000. If the bank lends, say, $2,000 to Mr. C, which is 2lso redeposited, the deposits now are $17.000. This process on a Nation-wide scale may go too far, with the result that §383,030,000 SAVING ONVETERANSURGED Table Showing Possil for Economies Is Given to Congressmen. ties| By the Assoclated Press. | While President Roosevelt has not | disclosed details of his plan to pare some $400,000,000 a year from veter- ans’ costs, some members of Congress have been given compilations showing | how the saving might be effected. One such table, placing the total to be saved at $383,530,000, follows: Estimated Annual Savings. . Eliminate pensions to_re- married widows: (a) Civil s, $2.487,000 omiciliary care: Income Pprovisions on non-service connected cases ... . Reduce benefits to §20 for single men hospitalized or domiciled ............ . Emergency officers’ retire- ment act restricted to causative fa s 5,370,000 3,386,000 575. $100 airment .. 40,000.000 rm - insurance 15.000.000 101,652,000 average . Eliminate claims . EsEae . Eliminate disability allow . Eliminate ' Spanish ~ ‘War pension where Govern- ment can rebut service origin Income provision ' Spanish War soldier gensions, service ‘connected. ... .. Income_saving under pres- ent Spanish War veter- . Eliminate ail ‘presumption Zor disability compensa- tion and emergency offi- cers. Regulation 11. in- Tuded: (a) Presumptive June $40.640.000; I other presis tions. $59.360,000. . ... 100,000,000 . Enlistments after November 95,000,000 1,653.000 16,000,000 rates . 4.000.000 . Retroact! it ed to date of filing claim 25.000,000 . ‘Reduce $50 statutory award for_arrested tuberculosis to $25 after five years. . . Eliminate $25 payment in ulosis cases where been no activ- 9,000,000 1,500,000 6,000,000 300,000 ty s= . Repeal sections 305 "and 309, included in No. 6. . . Eliminate $2.65 per diem allowance ..... Eliminate compénsation’ or pensicn to_civil service employes of the Federal Government A | | 15.600.000 2,000.000 600,000 . Decentralize | tivities . 8.000.000 . Eliminate compensa= tion for, specific' losses o pec 2.000.000 21. Permanent —cases not Terate: SR 1.000,000 Reduce all remaining fits by 10 per cent. 774,000 Savings from s 12,970.000 | expenses ... 101.662.000 alaries and Total saving ....... Minus 25 per cent of direct benefits for overlapping. Net approximate sav: ings ... - .gsn.n.’m.nno APPENDIX PROVES FATAL | - | CLEVELAND, March 14 (#).—War- ren S. Hayden, president cf the Cleve- land Union Terminals Co., died today at Lakeside Hospital, where he under- | went an emergency operation for a ruptured appendix Friday. Hayden also was president of the Metropolitan Park Board and a partner of Hayden, Miller & Co., investment brokers. INSTALL GAS HEAT Now Gas heat is the modern w: your gas company. Sou facts and figures. _ Phone for Stacy NOW COlumbia 0462 2418 - 184 ST. N.W. '| By the Assoclated Press. | 9,000,000 | swu Elven LILY PONS IS GIVEN BALTIMORE OVATION Metropolitan Opera Is Greeted En- thusiastically in Opening Three-Day Season. BALTIMORE, March 14—Baltimore | gave the Metropolitan Opera Co. an enthusiastic and at times a vociferous | reception on the opening of its three- | day season here last night. | The entire cast was cheered lustily, | but to Lily Pons, the French coloratura soprano, went the lion's share, as she took the role of Gilda in Verdi's “Rigoletto.” Her rendition of “Caro Nome" brought applause that Baltimoreans who have attended opera here for years said probably never had been equaled. For fully five minutes the performance was interrupted. Another ovation was given Giacomo Lauri-Volpi after his rendition of the aria “La Donna E Mobile.” The Lyric Theater, where the opera | , was crowded and many took | Toom. : Dairy dishes @ 57 money is diverted to speculation and bad loans are made. When the speculation gets out of | hand and the bank attempts to collect the bad loans, deflation sets in, and the reverse of the policy described in the foregoing begins. If the loans are held down, there is no_inflation. or, at least, the inflation | is not harmful. Thus inflation of credit may be good or bad. In 1928 there was credit inflation, but it did not go bevond the Nation’s needs. Inflation or deflation of the credit supply is always going on according to the needs of business. Likewise mo:%v in circulation varies in time, but 1t 50 widely as credit—bank deposits. BIG DETROIT BANKS | IN FEDERAL HANDS Conservators Take Charge Pending Satisfactory Per- manent Plan. By the Associated Press. DETROIT, March 14.—Detroit’s two largest banks, the First National Bank- Detroit and the Guardian National Bank of Commerce, today were in the hands of Federal conservators pending development of a satisfactory perma- nent plan to provide the city with ade- quate banking facilities. ‘The conservators, Paul Keyes of the United States controller of currency’s office for the First National and J. L. Schram, assistant administrator of the National Bank Redemption Agency, for the Guardian National, took over the banks last midnight, one month—almost: to the hour—after Gov. William A, Comstock’s proclamation placed all Michigan banks on a “holiday” schedule. $464,000,000 in Deposits. The PFirst National, as of February 11, had deposits of approximately $360,000,000; the Guardian National ap- proximately $104,000,000. Meanwhile, two other Detroit banks, the Detroit Sevings Bank, with deposits of approximately $30,000,000, and the | United Savings Bank, with approx-| imately $11,340,000 in deposits, were | ready for business under authorization announced by the Federal Reserve Bank of Chicago last night. The same authorization was granted five ogher Michigan banks, three in Battle Creek and one each in Grand Rapids and Kalamazoo. | The Government’s own accountants | and examiners today were checking the books of the First National and Guard- ian National Banks, which were closed |for that purpose. They had been |opened on a limited withdrawal basis | since February 17, making 5 per cent | of deposits avallable to customers. Halted New Bank Plans. In Washington Secretary of the Treasury William H. Woodin explained that under the conservatorships the banks may receive deposits, to be segre- gated and kept in cash.or Government securities, while the conservators may Reupholstering 5-Piece Parlor Suites.... Antiques 3-Piece Overstuffed Suites Dining Room Chairs [ PAY A LITTLE DOWN ‘WHEN FURNITURE IS RETURNED Thereafter A LITTLE EACH MONTH WILL DO! ® g WOOL TAPESTRY-FRIEZZA BROCADES AND DAMASKS Also Chair Caneing and Porch Rockers Splinted by Our Experts at New Low Prices Estimates and Samples Given Free. Write, Phone or Call ME. 2062 or ~icur rrone CL. 0430 CLAY ARMSTRONG 1235 10th Upholstering Street N.W. Justifying Your Confidence Is Our Success DOWN .) OUR DAIRY , PRODUCTS lend themselves perfectly to Coata - that men like AKE NOTE of what appears on the menu, day after day, in restaurants and clubs that cater to men. Serve these same dishes at home and watch your husband beam approval. Favorite desserts with men are . . . Rice Pudding— yellow with eggs, chock full of raisins, served with thick cream . . . Apple Dumplings—flaky biscuit crust wrapped around a fragrant cinnamon apple ... Tapioca Pudding—covered with a 2-inch meringue. Men consider Oyster Stew and Clam Chowder a real meal. Au gratin and Escalloped Potatoes, Macaroni and Cheese, Veal Chops baked in Cream, Pork Chops 204 MEIL Gravyiave & hatipey a5 sdaa of Good sats. Masculine preference for Waffles, Popovers and Muffins amounts to a tradition. MILK DISHES ARE ECONOMICAL— MEN LIKE THAT, TOO. .. The food bill goes down when a quart of milk is used for each member of the family. This supplies practically a fourth of the day's food meeds. Why wot enjoy the ecomomy of adequate dairy service. ’Phowe WEST 0183, or wri Wise Brothen. CHEVyY CHaSE DAIRY A-Division of Natimel Dairy 3106 N STREET,N.W. Nt / Sercing the yncd Capited f make available for withdrawal by de- pflm«xbl:nubhmmmu 8s may be justified, while assets are being liquidated. Announcement of the conservator- ships halted; for the time at least, plans dor formation of a new bank, to take over liquid assets of both old banks. NEW TREASURY ISSUE IS OVERSUBSCRIBED More Than $800,000,000 Offered to U. 8. First Day Books Are Opened. By the Associated Press. Oversubscription of the Treasury’s first offering of securities under the new administration, less than eight hours after the books were opened, was announced last night by Secretary Woodin. More than $800,000,000 was subscribed at the rate of about $100,- .000 an hour. It was announced that the subscrip- tion books for the offering of five months’ 4 per cent Treasury certificates of indebf ess and nine months’ 4%, per cent certificates had been closed at the close of business yesterday after- noon. The books were opened yester- day morning. = laced in the mail before 9 o'clock to- night would be considered as having been received before the close of the 3m and the allotment will ater. ‘The $800,000,000 issue was to provide $694,000.000 to meet certificates matur- ing on March 15 and to pay approxi- mately $59,000,000 in interest on the public_debt due the same day. The oversubscription in one day follows the record set by recent offerings which have been oversubscribed the first day the books were opened. JUDGE SENTENCES 15 IN RUM CONSPIRACY Terms Breaking Up of $5,000,000 Ring a Triumph Gver Crime. By the Associated Press. ELPHIA, March 14.—Call- & “triumph of organized Gov crime,” Fed- organized eral Judge George A. Welsh yesterda; imposed prison sentences of 2 : Derahip in s $5006,000 Nauer Svmaieae & $5,000, dicate. Nineteen others were m Pro- victed, and 2 were freed by agreem o’l Prln; Hilton . 5 A of Brookl, lantic City, was described g; o He is fighting extradition from Montreal, Quebec, to Trenton, N. J., where he is wanted on a charge M(?nit""&' Col.lx st Guardsman. eyes, special assistant United States attorney general, who rosecuted the case, sprang a surprise announcing additional indictments will be sought for 22 of the defendants, alleged liquor salesmen. | Imposition of the sentences was in- terrupted geveral times as women rel- atives of the prisoners screamed and were led from court. Judgs Welsh said: “The Government can always deal with individual crime, but it is becoming more difficult to deai with organizations. case goes to show that organized Government, when honestly fearlessly and ably conducted, can circumvent any means which priv- | ate citizens may attempt, even as an | e ose placed on probation that a prohibition-law conviction with in the next two years would mean serv- ing 15 months in prison on the present charge. Starting Tomorrow . . . s A5 ' BANKS IN NEW JERSEY T0 BE REOPENED TODAY State Law Restricting Withdrawals ‘Will Be Invoked Under 0. X, of Federal Reserve, By the Associated Press. TRENTON, N. J, March 14—Gov. A. Harry Moore last night announced all New Jersey banks in the clearing house cities will re-open for business today, although some will open under the State law restricting withdrawals. A list of the banks tc re-open for business will be announced shortly, Col. William H. Kelly, State banking com- missioner, announced after the confer- :ll;!uwlmouv.lmmdmot Legislature. Invoking of the Altman act, permit- ting restriction of withdrawals for some of the banks in the clearing house centers, is approved by Federal Reserve officials, John Milton, counsel to Kelly, explained. Milton said the Altman law could be invoked under a ruling by officials of the Federal Reserve Bank of Philadel- phia, if the State law was not broader than the provisions laid down in the President’s proclamations. . cften se: many e be reduced b Bookiet tells how to' belp natare Fid the body of toxic impurities, which Is ood Hi_gb}loflgflh Pressure one of the causes of increased bis rressure. PHONE Informati WRITE TODAY for Booklets and Sample Mountain Valley Water America’s Foremost Health Water From HOT SPRINGS, ARK. 1405 K N.W. MEt. 1062 a grand new group of uits & Topcoats 21 Well, we've got a new President and he didn’t lose any -and. so would a looking for you lot of other stores. in the morning! time. People are feeling a lot better today than they did last week. Money is being released and it won’t be long before people will be going their usual way again. But a week gone is a week gone forever, and gee! how we'd like to make up-the business we lost last week! So we’re doing something we didn’t think we were going to do for a long, long time . . . we're taking a group of Suits and Topcoats that were bought with every intention of getting so much more than $21.75 for that it isn’t funny. Don’t ask us for the original prices . .. we hate to think of the losses we're taking! The patterns are in fine taste . . . they're spring ideas that you’ll want to put on right now. Bi-swing Suits, Sport Suits, Flannels and Worsteds; Bal Topcoats, Polo Coats, Half-Belted Coats. We'll be Drape Suits, USE YOUR CHARGE ACCOUNT —If you haven't one . . . your credit is good with GROSNER of 1325 F STREET —our Ten Pay Plan is more popular than ever, ¥ No charge for alterations, £ A ’ BTN W