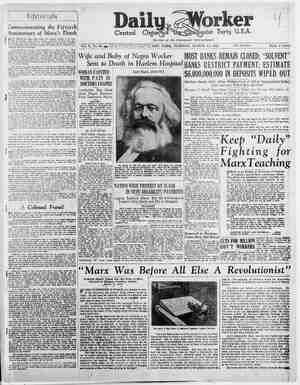

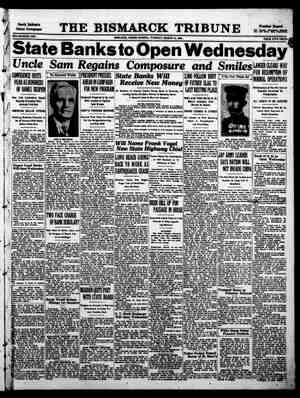

Evening Star Newspaper, March 14, 1933, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

20 DISTRICT BANKS OPEN FOR BUSINESS Deposits Flood Tellers as Institutions Get U. S. Licenses. (Continued From First Page) conservators placed in their institu- tions. The conservator will try to work them out of their present difficulties and get them back on a solid basis. Many of these banks are now rated “as sound but not liquid.” The conserv- ators will attempt to “unfreeze” their assets. Many of these banks have done business in the city for many years, have served their communities well and faithfully and in normal times have done an excellent business. They were caught with frozen assets, frozen so tight that their cash, position became severely hampered. Reorganizations are predicted in some instances. Others may enter into mergers with other and perhaps larger banks. These are problems that the conservator will assist in working" out. The Treasury, it is understood, has al- ready assigned an experienced bank of- ficial to assist conservators in reor- gaffizations, where such moves are de- sired and practical. “ ‘The emergency bank bill gives banks, which do not have Government licenses, power with the permission of the conservator and Treasury officials, to put preferred ' stock _which may be purchased by the Reconstruction Finance Corporation. Later, if the bank’s situation improves, the preferred stock may be taken up and the bank turned back to the common_ stockhold- ers. This is the first time bani have had an opportunity of issuing preferred stock and bankers feel that this right may prove an extremely important fac- tor in clearing up the present situation. Keeps Banks Open. ‘Bankers today called attention to marked advantages in having a con- servator instead of a receiver. The conservator keeps the bank open and makes every effort to get it back on its feet. The receiver cloges the bank up tight and winds up its affairs. The expense of a conservator is also much lighter, which works to the benefit of all depositors. At noon today 1t was reported in all the banks that deposits were far exceed- ing withdrawals. Lobbies were crowded and in many ceses extra receiving tell- ers had to be placed on duty. In some ‘banks it was impossible to keep up with the new accounts, the applications being left for later attention. In one bank it was stated that 90 per cent of the customers in the lobby ‘were depositcrs. In several financial institutions the officials received a shower of flowers from customers and business firms with which they have had close banking relations for many years. Congratulations were heaped upon the officials and a remarkable feel- ing of renewed confidence was every- ‘where expressed. While the local banks were operating on a nearly 100 ver cent basis, the licenses which they received limited their payments of gold and of gold cer- tificates. They were also under in- structions not to permit any large with- drawals that appeared to be for “hoard- ing” purposes. They had to exercise no such limitations, however, as customers were much more anxious to put in money than take it out. It was one of the most amazing banking days that the National Capital has ever wit- nessed. Deposits His Hoard. One of the most interesting incidents occurred in one of the city’s smaller banks. It was related by the president of the institution. He said a colored | man came to the bank two days ago with $1.200 in gold certificates and asked that they be changed into Fed-| eral Reserve notes, since he had heard the Government had called in gold notes. Today he came back with the $1,200 and an additional $500 and de- posited it. He said he had been keep- ing his hoard in an old inner tube hid- den in his home. Joshua Evans, jr. president of the District National Bank, was at the Treasury Department early today con- | cerning his institution. Mr. Evans said the District National Bank was oper- | ating by authority of the Secretary of the Treasury under regulations Nes. 1 to 19, inclusive. He did not care to go into detail as to just what his bank would do during the day nor how it would interpret these regulations. George W. Offutt, president of the Potomac Savings Bank, while waiting at the Treasury Department this morn- ing for a conference with officials, said his bank was operating on the “holiday Pam" and awaiting further instruc- ions. The Franklin National Bank will con- tinue under Treasury regulations 1 to 19, Thomas P. Hickman, vice president, said this morning, allowing no with. drawals, but accepting trust deposits. No information concerning the appoint- ment of a conservator had been re- ceived. William H. C. Brown, president of the Industrial Savings Bank, said his bank would operate for the present on the same basis as during the national bank holiday. Continue Restrictions, Robert T. Highfield, vice president and cashier of the Mount Vernon Sav- ings Bank, said the bank’s officers would issue a statement later in the day. Meanwhile, he said, the bank would continue to operate on the same re- stricted basis as last week. The Northeast Savings Bank also will continue under the emergency Treasury regulations, according to George F. Hoover, vice president. Mr. Poole said the Federal-American will continue to operate under Treasury regulations issued under the presiden- tial bank holiday proclamation but will not receive trust deposits as authorized by Secretary Woodin. Mr. Poole char- acterized the present restricted-opera- tion of the bank as “a_breathing spell SPECIAL NOTICES. THE REGULAR ANNUAL STOCKHOLDERS' meeting of The Agol Chemical Co. will be held Wednesday. April 5. at 10 am.,, in the office_at 1100 14th st. n.w MORRIS_G. GOLDSTEIN, CHARLES B. GASS, 1 President. Secretary. 0 PIANO AND RADIO PRICES ARE AT ROCK 2: the wise customer will buy now 3 y are at the lowest point. DE MOLL PIANO CO.. 12th & G. _____16° WE WILL SELL FOR STORAGE AND other charges. on March 15th, 103 7 erlat CHAIRS FOR _RENT, SUITABLE FOR BRIDGE PARTIES banquets, weddin meetings, 10¢ ur per day each: new Also_invalid rolling chairs for rent or UNITED STATES STORAGE CO.. 41 n. Metropolitan 1844, _ . 81, Cal WILL NOT BE RESPONSIBLE POR ANY debts contracted by any one other than self. WILLIAM TUCKSON. 476 Kings ct, “POOL” CAR SHIPMENT TO PACIFIC Comnat Jatke saving in freight chatges. March 24._Security Storage Co., 1140 15th st. FOR PROMPT. EFFICIENT AND REASON- able eiectrical repair service. call the Electrie Bhop on Wheels, Inc.. and a compiete shop will be brought to_your door. Wis. 4821, LONG-DISTANCE_MOVING BETWEEN ALL Eastern poirts. “Service since 1596." Da- vidson's Transfer & Storsge Co. 1117 H OR PART LOAD st nw. Nat. 0960, A T en ae Wichimond. Boston, Fit speclal” ras or from New burgh_and all way points: NATIONAL DELIVERY OR 7 combs, am d, tight—{ree from ruinous leaks. Why Dave the other kind? We make s inlty” of repajrs. | Send for . us! ROOFING. 933 V 8t NW. COMPANY North 4423 er hold the bag.” i| year, is provided in a new order issued 13 Washington Banks Not Yet Licensed; Inquiry Continued ‘Thirteen Washington banks failed to receive licenses to re- :fin today. It was pointed out t this does not mean th:& are unsound, but that their condition is still undergoing examination. ‘The list of those whose functions are still restricted follows: District National Bank. Federal - American National Bank & Trust Co. Franklin National Bank. Chevy Chdse Savings Bank. Industrial Savings Bank. Mount Vernon Savings Bank. Northeast Savings Bank. Park Savings Bank. Potomac Savings Bank. Seventh Street Savings Bank. United States Savings Bank. ‘Washington Savings Bank. ‘Woodridge-Langdon Savings & Commercial Bank. during which we will decide what must be done.” At the Chevy Chase Savings Bank, John C. Walker, president, explained that his bank is operating on the re- stricted basis it adopted for March 1,! 2, and 3, before the banking holiday. ‘i'he bank makes change, allows 5 per cent withdrawals on all accounts opened prior to 3 p.m., February 28, only for purposes of alieviating distress. e | new Bailee accounts, which have been opened with the bank since that time on the basis of & trust fund, are now | open to deposit and withdrawal. For further operation of the bank officials are awaiting additional advices from the Treasury Department. One of the chief problems of Wash- ington bankers today and for the next several days is the handling of checks on out-of-town banks whose status is not definitely known here, George O. Vass, vice president and cashier of Riggs National Bank, said shortly be- fore noon. Hundreds of these checks were drawn before the individual States declared banking holidays and when Washington payees undertook to de- posit them they found the checks were caught in those State holidays and so the checks were returned to Washing- ton. The national holiday added to the jam by prolonging the period in which the checks could not be cashed. Now these checks fairly swamp the banks here and since the local insti- tutions are moving cautiously with each check, the time required by the mere mechanics of handling them is creating the problem, “We simply must ask the public to be patient with us,” Mr. Vass sald to- day, “until we can handle this tremen- dous volume of work. Today every- body’s been splendid in the spirit they've shown us and it is through that co- operation that this problem will be| solved. Our staff here at Ricgs has| been working night and day on the job and we're trying to do our part in handling this problem.” | Harry G. Meem, president of the ‘Washington Loan & Trust Co., added to the general statement that condi- | tions were encouraging the report that deposits of gold are coming in to his| bank. The gold, he said. will be turned over immediately to the Treasury “in | support of President Roosevelt and the | THE EVENING STAR, WASHINGTON, D. C., TUESDAY, MARCH 14, 1933. SECRETARY WOODIN F UNDS FOR QUAKE SEES END OF FEAR, VICTIMS SOUGHT Declares Public Has Demon- strated It Has Regained Confidence. (Continued From Pirst Page.) using the reopened banks banks were intended to be used—as a con- venience in paying their bills and safe- guarding their funds. In other words, | the country understands what the ad- ministration is doing and is showing its confidence—that means everything. Permanent Reform Planned. ‘The Secretary apologized for being | unable to answer some quetsions, saying too many things were in the formative stage. Permanent legislation to reorganize the banking structure and vigorous prosecution of law violators turned up by the Senate stock market investiga- tion were uppermost in administration minds today. Happy at the public reception of his plan for the progressive resumption of normal banking operations, President Roosevelt saw introduced in the Senate & bill to do some of the things he sug- gests. He let it be known, too, that he had Instructed the Justice Department to follow evidence taken by the Senate Committee when it resumes its inves- tigation and to prosecute law violators. Mr, Roosevelt was said to be working today on & message to Congress on a banking program designed to prevent situations similar to that which has kept him 5o busy in the 10 days since his inauguration. New Currency Circulated. ‘Thus, the President was preparing in two directions to carry out his inaugural address statement that “there must be a strict supervision of all banking and credits and investments; there must be an end to speculation with other people’s money.” He believed he already had maude good on the pledge in the same speech “for an adequate, but sound cur- rency,” for it was new currency that enabled many of the licensed banks to reopen. Exactly what his banking message would recommend remained to be seen. He has, however, taken considerable ad- vice on monetary and banking matters from Senator Glass, Democrat, of Vir- ginia, so interest centered on the bill Glass introduced. It would, so its sponsor contends. block speculation with deposits and bol- ster national banks by requiring closer supervision. This bill was referred yes- terday to a Senate Banking Subcom- mittee, headed by Glass, which ap- proved it last Congress. Other Proposals. ‘There was some discussion of the| President’s attitude toward the bill by Senator Robinson and to those of Sen- ator McAdoo, Democrat, of California, Government.” One of the most graphic jllustrations of the banking trend in the first hours | of business today was shown at the| Security Savings & Commercial Bank. | Francis G. Addison, jr., said that at| :30 o'clock this morning a total of | $52,000 came in in the checking de- | partment, while only $600 went out. In | the savings department request for | withdrawal of only $211 was made. B. Agee Bowles, vice president of the | Potomac Savings Bank of Georgetown, | said that his institution expected its | license “any day.” He pointed out that | the Potomac Savings Bank of George- town did not place any restrictions on | its business prior to the national holi- day and that, in fact, it didn't want the holiday at all. Until the license | is granted, he said, however, his bank | will continue to do business on the| holiday basis. Other banks which have not yet re- ceived licenses and which will continue to operate under the restrictions of the | national banking holiday proclamation | include the Woodridge-Langdon Savings | & Commercial Bank, the Washington | Savings Bank, the United States Sav-| ings Bank, the Seventh Street Savings Bank and the Park Savings Bank. Many former depositors in the Com- mercial National Bank have inquired if it were possible for this bank to obtain a license from the Government and re- open on a normal basis. The bank was in receivership before the Nation-wide holiday went into effect and under those conditions no license can be issued. | BANK HOLIDAY'S END | BOOMS PLAYHOUSES| Box Office Spurt at Broadway Thea- | ters May Keep Many of Them Open. By the Associated Press. NEW YORK, March 14 —A box office spurt that perked up Broadway like its | 2 am. cup of black coffee led the lane of lights to hope today that the “play | will go on.” As late as yesterday afternoon, some legitimate producers wagged heads in glum conferences and said “most of the shows will be closed by Slturday."g Show business, not very hale and hearty for some time, had gone into a decline with the bank holiday, they indicated. ‘The holiday ended with a whoop yesterday, however, and last night most box offices reported that business was “excepticnally good.” The League of New York Theaters, a producers and managers’ group, sent a letter yesterday saying the responsi- bility for “further unemployment in the theater” would rest on the Stage Hands’ and Musicians’ Unions. An attempt to agree on & wage reduction for members of these unions had failed. Concessions offered by the stage hands were described in the letter as “wholly inadequate.” Hearing that Lo- cal 802 of the American Federation of Musicians had agreed to a 20 per cent wage cut in motion picture houses, the league registered a protest “against the giving of any reduction to moving picture houses and vaudeville theaters without allowing similiar reductions in the legitimate playhouses.” Prank Gilmore, president of Actors’ Equity, said actors would accept cuts if other groups did, but would “no long- Street Light Rate Reduced. A reduced rate for electric power | used to light street lamps operated less than the standard number of hours per by the Public Utilities Commission. The order is in line with the recent general reduction in electric power rates ordered by the commission. —_ ADDRESSES CITIZENS Russell Traces Growth of Park View Association. A brief talk outlining notable ac- complishments by the Park View Citi- zens’ Association since its organization 25 years ago was given last night by George H. Russell, a charter member, at a meeting of the association in the Park View School, Warder street and Otis place. The speaker traced the growth of the association and pointed out the to establish an insurance fund for the protection of depositors, and Senator Gore, Democrat, of Oklahoma, to per- mit Federal regulation of State banks. ‘The Senate Committee’s investiga- tion, said Chairman Fletcher after a talk with President Roosevelt, will for a time concentrate on private bankers engaged in the investment security business, trust companies dealing in securities and the organization and practices of the Stock Exchange. Lively Business Upturn. The American dollar displayed a| strength on foreign Bourses that sur-| prised speculators, the price in some instances rising above that which pre- vailed before the bank holiday. Many cities reported a lively business | upturn, it being noticed especially in | department stores and in an increase in advertising in newspapers by retailers. A large New York department store “apologized” today in advertisements for its inability to meet buyer demands yesterday for certain sale articles. A special sale of low-priced leather shoes started at 9:30 o'clock in the morning, and more than 10,000 pairs were sold within a few hours. The store said that “twice as many” could have been sold if the store had expected “any such army of customers.” Hundreds of -banks in more than 250 cities of the land were authorized to open today. in-line with the plan of President Roosevelt which called for the progressive opening of “sound banks.” Banks permitted to open today were those located in cities having rec- ognized clearing houses, an exception being the banks of the 12 Federal Re- serve Bank cities, where openings were authorized yesterday. In addition to banks in clearing house | cities, institutions in smaller citles were | in some instances permitted to open today, provided their applications for re- opening had had time to receive the attention of designated officials. More to Open Tomorrow. Additional banks will open tomorrow, and progressively throughout the week. In all cases certain Treasury Depart-|( ment restrictions prevail. The one re- peatedly emphasized is that no gold or gold certificates are to be paid out. ‘The new currency, issued under the emergency banking legislation initiated by President Roosevelt last week, al- ready is circulating, adding its impetus to business revival. They are in ap- pearance almost identical with Federal Reserve banknotes, which have been a main source of the Nation's currency for years. g The clearing of checks—a vital bank- ing service to the Nation’s business—will probably b on a country-wide basis before the end of the week. Approxi- mately 90 per cent of American business is done by check, and clearing houses everywhere were prepared today to éx- pedite this work. In New York City, through which much of the country’s commercial credits | pass, the clearing of checks between | banks in the Federal Reserve cities was | resumed yesterday. Checks on banks in 250 clearing house cities were being cleared today, and tomorrow the clear- ing of checks will be on & Nation-wide sis. ‘The reopening date of the stock ex- change and of various commodity ex- changes which take their cue from it, has not bzen set, but it is expected to be soon. Members of the exchange at present are permitted to deal in United States Government bonds. There was only a light turnover in these bonds yesterday, with modest advances shown in the price of some long-term issues. “Gold Squad” Organized. Although the period in which holders of gold may return it to Federal Re- serve banks has been extended until Friday, the Government does not tend that an opportunity shall be of the métal. A special “gold squad” of police has been organized in New York to watch all outgoing passenger (the Middle West and the East. | Roosevelt at Chicago and voted for the forded hoarders to make away with any | da Red Cross Issues Appeal for $500,000 to Aid California. By the Associated Press. ‘The American Red Cross appealed today for $500,000 of contributions for small home owners and others without resources who suffered in the California earthquake. At the same time, the Red Cross an- nounced it had contributed $50,000 to the fund. “The 7,500 owners of small homes wrecked in this catastrophe are the most serlously stricken, now that the emergency has been met,” Chairman John Barton Payne said. “The majority of these families are without resources. “California citizens are not themselves able to bear the whole burden, and the Red Cross is confident that thousands of our sympathetic citizens in other States will want to give to a relief fund for these gravely stricken families. “So the Red Cross is asking help lfim Cross chapters everywhere will accept contributions from the public. “It should be borne in mind that for decades Californians have given gen- ' erously to relief funds to help victims of disasters in other parts of the Na- tion, but themselves have received no help, through the Red Cross or other- Wise, since the 1906 disaster in San Francisco. “Despite the distressful conditions that affect ail of our citizens, the Red Cross confidently asks for this $500,000 for these sorely afflicted families, be- lieving that the tragic story unfolded in the press and over the radio in the past few days has touched the heart of the Nation.” The Red Cross said 60,000 persons were being fed in the earthquake are PATRONAGE AWAITS LEGISLATIVE ACTION Opinion Obtained as Fn?ey Con- fers at Democratic Head- quarters. By the Assoclated Press, i NEW YORK, March 14—“Big .Hm“] Farley, President Roosevelt's Postmaster | General, spent 12 hours at Democratic headquarters yesterday talking patron- age and telling how it feels to be the | head of “an outfit doing an $880,000,000 | annual business.” Word passed through headquarters as he held a rapid round of conferences that most appointments will be held up ! until the President’s emergency legisla- tion has been acted upon Farley conferred about patronage with Edward J. Flynn, Bronx County leader, whose followers supported Mr. Roosevelt legislation in the House of | Representatives last' week. In political circles Curry and Mc- Cooey are represented as being much concerned over the prospect of having little voice in making appointments. | Farley weeks ago made it clear he him- self would do the picking of New York- ers to be rewarded with jobs. It is now understood that Flynn, a non-Tammany Democrat, who was Mr. | Roosevelt's secretary of state here in New York, will aid him. Farley, whose driving energy had much to do with launching the Roose- velt presidential boom. was brimming ;11;!} enthusiasm about his own “new ob.” He knows little so far about the in- tricate workings of the department, he said, but already he has found a lot of ways to save the Government money. | “I discovered one item alone,” he re- marked with a chuckle, “where we can | save $4,000.000 a year. 'And I expect to | find other items, t0o.” He laughed in telling that he has a private elevator and an office filled with pictures of Republicans—past Postmas- ters General. He finds “formality” and “stiff necks” ! vanishing from the Carital. “The chief's good humor and in- formality are contagious,” he said. “There’s a different spirit. Harmony, you know. All the boys are singing now.” FORMER CANADIAN RAIL HEAD IS SERIOUSLY ILL Are Reported Have Set in After Operation on Stomach. Complications to By the Associated Press. NEW YORK, March 14—Sir Henry W. Thornton, former chairman of the Canadian National Railways, was re- ported in a serious condition today from complications which set in after an :bdormml operation performed last week. Sir_Henry underwent the operation last Wednesday at Doctors’ Hospital. Today it was reported that he w suffering from pneumonia and euremic Ppoisoning and that his condition was extremely grave. The operation was performed by Dr. J. F. ‘dman and Dr. J. J. Moorehead. uses in trade, by affidavit of the person re~estiny cuch gold. ‘The bank governor announced also that 2dwuona, interpretations had been issued by the Treasury Department of t | ) tron "ore. New Faces 4 ] 'molns_ FRANCIS FORD WORKED AS A REPORTER HERE. BY WILL P. KENNEDY. IOMAS FRANCIS FORD, new member of :‘hesrnfld ‘War. years' experience as a newspaper mhl::fl(-l;‘m‘" -nnyedlt?r. Delcrtn. b{’:[ e says—“Yes, I am a fighting Irishman, born in the United States of Irish, Welch, Scotch and English ancestry. My hair was red when I was a boy, but it his settled down into a respectable brown.” He was born in what is known as “The White House,” on the banks of the Mississippl, 18 miles south of St. Louls. He studied law two years, and then became a reporter. the staff of the Los Angeles Times from 1916 to 1920 as reporter, State editor, magazine editor and with his wife as literary editor. For years Mrs, Ford has been literary editor of the Los Angeles Times. Realizing in 1918 that the war had put the United States in a new relation jto the world by making it creditor instead of a debtor Nation, the Fords worked intensively on the publication of a book on the economics of foreign de that would give college students -;Ad tu:; p\n}nc ’l‘h: facts about balance of trade, forel exchange, forel debts, forelgn investments, tariff l‘:'dl! all the rest. The book. published in 1920, under | the title, “The Foreign Trade of the | United States,” was adopted as a text- in Chngress THOMAS FRANCIS FORD. book by many colleges. and Mr. Ford | ‘was appointed special lecturer on for-‘ eign trade in the University of South- | ern California. | Economics is his hobby. e boasts | that he has read practically every book on economics published in the last 13 years. ROOSEVELT PLAN OPENS VAST AREA Huge Store of Natural Re- sources Made Available in Tennessee Basin. (President Roosevelt proposes, through economic planning by the Governmen 0 rebalance the population between d_rural sections and thereby unemployment and its causes. seeks authority of Congress to carry on a giant experiment in the Ten- nessee Valley. in the development of hydro-electric’_power. navigation. flood control_and reforestation and reclama- tion. Navigation is treated in this ond of a series of stories dealing with the four phases.) sec- By the Associated Press. FLORENCE, Al March 14, — The rambling old Tennessee may pack a bigger load on his back and heave it smoother and a little sprightlier, in assuring evidence the “new deal” is on, but it will be ever the same to the men who, because they have big muscles, keep the river traffic moving. These husky fellows who stoke the | packets and tug with heavy freight will tell the same river stories, sing the same songs and day to day live and enrich the lore which is the perpetual | wealth of rivermen. . | But along the water fringes, if Presi- dent Roosevelt's vision of a giant ex- periment in planned economy is car- | ried to realization, they will see new cargoes of minerals and manufactured | products come down from the resource- ful hills, see new forests on the slopes laid bare by loggers, and flelds Jong since abandoned to erosion presently reclaimed and tilled by veterans of fu- tile battles for sustenance in the citles. Vast Store of Deposits. This will mean heavier shipping. drawn from a vast store of natural de- posits and the labor of farming people. ‘The population of the Tennessee Basin is about 2,000,000, half of which is en- gaged in farming. The principal val- ley cities are Chattanooga, Knoxville, Johnson City, Kingsport and Cleve- land, Tenn.; Asheville, N. C.; Bristol, ‘Tenn.-Va., and Florence. Farm products consist of cotton, live stock, corn, tobacco, wheat, oats, pea- nuts,” hay ‘and sweet potatoes. The | most important minerals are coal, iron ore, limestone, sand, gravel, zinc and copper ore. In addition, asphalt rock, bauxite, clay, marble phosphate rock and slate are produced. The upper basin is one of the few regions of the world where are found in such proxim- | ity iron ore, coal and limestone, which | is used as a flux In smelting to remove | sllica. | The chief mineral resources are shown in a table compiled by Govern- ment engineers as follows: Produced 1926 (tons), 11,691,000 00 Resources (tons), 1.835.000.000 inexhaustible inexbaustiby 98.000.00¢ Minerals, Coal . Limesto Sana’ and @ravell Zinc ore Phosphate 3 00 1000 166,047.000 Marble .00 000 arge) There are 69 terminals on the river, which is navigable on a limited basis for shallow-channel craft its entire 652 miles, Equipment in service in a re- cent”report was shown to consist of 61 towing vessels and 183 barges owned by 39 operators. The commerce in 1926 was 1,982,252 tons, with the av- erage haul 20 miles. Of this, 48 per cent was forest products, 23 per cent jron and steel, 15 per cent sand and gravel, 7 per cent farm products and 7 per cent miscellaneous freight. Cites Economy in Water. An Army engineer’s report set cost of transporting the 1926 traffic at $842- 7117, with the estimated cost of moving it by rail, $2,720,481. The engineer found that year approximately 9,559,000 tons of freight was moved by rail which could have been transported more economically by water if there had been a 9-foot waterway from to Knoxville, as will be “regulation No. 10,” which is that regu- | ti lation which authorizes “certain activi- ties by national or State banking institutions.” Pay Taxes in Cash. Under the interpretations made pub- dic today the payment of monies on account of pensions, workmen’s com- pensation, disability insurance, relief and unemployment is authorized. Funds m:{obe ’;lmthe' mrh’“ hase of cotton under on regulation No. 10, which pm‘:’cl‘de.l for “necessary current expenditures for the purpose of maintaining employment and for similar essential purposes.” Funds al arc to be released, under the new in- terpretation, for payment for nursery stock “where such payments are abso- lutely necessary to prevent destruction of stock in transit March 6, or prepared lort and awaiting shipment” on that e. ‘There was a normal activity in food markets as the banks began reopening. Supplies were reported plentiful at vir- ships to prevent the carrying out of gold. Each passenger will be asked to sign an affidavit to the effect that he carries no gold. Persons suspected of betng hoarders will receive special scrutiny. ‘The State Department (which issues passports), the Immigration Bureiu (which supplies permits to_aliens going abroad), and the Internal Revenue De- partment (which issues sailing permits to passengers who have paid income taxes), are co-operating with the Fed- eral Reserve bank in this move to pre- vent gold from leaving the country. The Federal Reserve bank has the names of all persons who have withdrawn gold from member banks in any appreciable quantity in recent years, ‘The governor of the Federal Reserve in New York the g concerning the release ;t value it has proved to the eommunity. Tottine bustncss. . V- Haje, president, routine ess. F. V. " presided. deemofl"}b‘yy d?'gnhwhmhg sucl required for legitimate and customary tually unchanged price levels through- out the country. Internal Revenue offices on Manhat- tan found citizens supplied with an abundance of cash as they crowded in to pay their income taxes, due be- tal business contin- ued to thrive with deposits far in ex- cess of withdrawals. Figures of the New York General Post Office for Sat- deposi of $157,791. This represented the ing of 1,114 new accounts on that day alone and the closing of 214—a net gain muenunzumlormm .dm A e count e ‘weré busy arranging bank lations, but dividuals and structed along the river. The engineer figured that, with nor- mal growth, by 1950 there would be movement of 17,800,000 tons at a saving of $22,800,000. In addition, he expects a further increase will develop within the same period because of the great acceleration of commerce and in- dustry incident upon completion of the water stairway and development of electric power. But all this is so much picture puzzle w“u:e strong men who inhabit river craft. cargoes moving Mississippi, Ohio, Missouri, Great Lakes, the Gulf and to the world’s corners, but their loves are for the river and boatin’, and i1} all be the same. ECONOMY PLAN FAVORED BY FIVE LEGION POSTS Chicago Groups Approve Presi- dent’s Proposed Cut of Veterans’ Funds. had the approval of five Chicago '.‘t“mmmu" of the They_included the Board of une Post, SN | HED Dr. Pordney is professor of crimology at a famous university. His advice is often sought by the police of many cities when confronted with particularly bafing cases. This problem has been taken from his case- book covering hundreds of criminal fuvesti- sations. Try your wits on it! Tt takes but ONE NUTE to read! Every fact and_every clue necessary to its solution are in the story itself —and there is only one answer. How good a detective are you? | On the Spot. { | BY H. A. RIPLEY, | | ROF. FORDNEY elbowed his way | through the crowd gathered in front of the narrow cul-de-sac between two buildings. He took only a few hurried steps into the passageway and suddenly stopped as his foot brushed against a head. His flash- light disclosed a man, lying face down. stretched full length, one arm pinned beneath him. Turn- ing him over he recognized “Snipe” T Morrisey, notorious gangster. A glance at the end of the alley showed no light over the door of Heinie's “restau- rant.” . “Say,” remarked a bystander anxious to offer information. “I was standing across the street a few minutes ago and T saw ‘Snipe’ jump from acarand tun in here. Then | 1 saw another guy sneak out of that building on the left. He must have plugged ‘Snipe’ ‘cause there wasn't any one else around. Had a silencer on his rod, I guess. I didn’t hear no shot.” “That's probable,” agreed Fordney, with & nod to Inspector Kelley to keep an eye on his in‘ormer. Leaving the homicide squad to its routine he walked to Heinie’s. Though the place was in darkness it was soon opened and the professor admitted through the only door opening onto the alley. “I tell you I don't know nothing about 1t.” insisted Heinie in reply to Fordney's inquiri “Ain't seen ‘Snipe’ in a month. “No?" queried the professor. “Well, 'hsmpe' was killed by somebody from ere.” Opening the door he called to Kelley: | “Bring that witness down here, in- spector, You'd better talk fast, Heinie!” | HOW DID THE PROFESSOR KNOW | IPE" HAD BEEN SHOT FROM INIE'S? (For solution see page A-4.) . Fire Auxiliary to Meet. ARLINGTON, Va, March 14 (Spe- cial) —The Woman's Auxiliary of the ! Arlington Volunteer Fire Department | will meet at the home of Mrs. J. F. }Scheflel, Jefferson avenue, tonight. If you haven't received Cottage Cheese, either mail Milk bottle. Gentlemen: Cheese. Address . . Chestnut Fa MILK Physicians for its PU Pirone Pot. anti-trust law. | lieve acute competition among selling ...or drop it in your Chestnut Farms Chestnut Farms Dairy Please send me a free sample of Chestnat Farms Creamed Cottage Clip This Coupon Tonight! SELLING AGENCIES FOR COAL UPHELD Supreme Court Decision Aids Hard-Pressed Bituminous lndifitry. By the Associated Press. Organization by the hard-pressed bituminous coal “industry of selling agencies to pull it out of the depression | Ré:l r:he legal sanction of the Supreme In an opinion handed down yester- | day by Chief Justice Hughes, to which | only Justice McReynolds dissented, the | Supreme Court reversed the findings of | a three-judge Federal court which had held invalid the Appalachian Coals, In- corporated, organized as = selling agency by about 138 bitur aous coal | producers in Virginia, W: . Virginia, Kentucky and Tennessee. | It announced, however, that while all the facts indicated the agency would not be able to monopolize business in violation of the Sherman anti-trust law, the court would retain jurisdiction, and that the Government, should vio- | lations later occur, would be free to renew the proceedings against the agency. | The three-judge Federal court was sympathetic with the demoralized bitu- minous industry, and felt it was en- | titled to some relief, but concluded this | could come only from Congress. Chief Justice Hughes emphasized the | findings of the trial court with regard to conditions prevaiing in the bitu- minous coal industry, and pointed out | that in the United States Steel Cor- poration case the Supreme Court had found mere size of itself did not con- stitute monopoly in violation of the | | In the biluminous coal industry, Hughes sald, there was reason to be- | agencies organized by the different filelds would continue, so the industry | could not be monopolized to the detri- | ment of the public or in violation of | the anti-trust law. He said that inter- state commerce in bituminous coal had in recent years been crippled by eco- | nomic conditions, and employment had been paralyzed. It's Tulip Time Gude Bros. Co. Tulips—H y a ¢ i nths—sym- bols of Spring—seem some- how to have been created just for this season. Send her a bouquet or potted plant whether it's a special occasion or not. Gude's flowers are abundant and inexpensively priced NOW! Gude | fl U ) [1 ree Branch Flower Stores tional 4276—4277—427 A-s SILVERWARE in Security Safe Deposit Vaults under guarantee, Per mon and up for a case Brorage Gompang 1140 151, St. — a safe depository for 43 years, We Pay Cash for Worn Tires Worth Retreading LEETH BROS, 1220 13th St. N.W. Metro, 0764 GULDENS W Mustard 43 For HEALTH’S sake Keep Internally Clean Don’t run the risk of personal neglect. Hex- asol promotes good health by combating con- stipation and eliminating poisons from the intestinal tract . . . safe, sure and pleasant to take. When you need a good laxative or cathartic, don't resort to nasty-tasting oils or upsetting pills. Depend upon Hexasol, a physician’s {8 prescription that has been used and recommended for more than a quarter of a cen- tury. Hexasol is reliable, fe'and pure. Agreeable to take, due to the nicety of its blend. Get a generous bottle for only 60c today at your nearest drug store. Hexasol must bene- fit you or your money back. The First Thing in The Morning for Health HEXASOL The Safe, Pleasant Saline Laxative at the” Stores Bros. Co. Main Store, 1212 F Street N.W. Over a half a million square 1] feet undcr glass. Quality is Master UALITY is master in du Pont TONTINE washable shade cloth. We would not have it changed to meet a price. Neither would you. Du Pont TONTINE washable, fadeless, moisture-proof window shade fabric is used in the best homes because its beauty and long life make it the cheapest by virtue of its remarkable service. your FREE SAMPLE of Chestnut Farms Creamed this coupon Is at our —-—72 SV, 830-13™StNW. COTTAGE, _CHEESE made fresh daily World’s Model Dairy Plant delivered fresh daily every morning with your milk B e e SR and sanitarily packed —to retain its full flaver, its deliciousness, its natural smoothness and high quality. Place your order TODAY for a regular supply throughout the Lenten season. rms R,erommended by Washington RITY. SAFETY ana SUPERIOR QUALITY ac 4000 for 5 e