Evening Star Newspaper, January 7, 1932, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

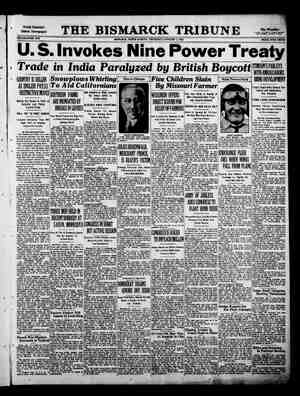

THE E\'i-]\'ING STAR, WASHINGTON, D. C. THURSDAY, JANUARY 7, 1932. CURB SHARES RISE i Advances of Fractions to| Five Points Scored in Strong Market. BY JOHN A. CRONE, @pecial Dispatch to The r NEW YORK, January 7.—Opening strong today, Curb Exchange stocks turned active on the rise and netted gains ranging from fractions to 5§ points. | Electric Bond & Share was up only a fraction, which also was true of Cit Service, Standard Oil of Indiana and Gulf Oil of Pennsylv United Gas | convertible preferred, however, ran up almost 5 points on a few trades. Following the advance here Wednes- day, foreign markets, especially Lon- don, Paris, Montreal and Toront opened higher, and this trend was mir- rored locally at the start of trading to- day. The sudden rise in Toronto of Ford Motor of Canada A, on indications of the proximity of a new 8-cylinder Ford model, was belatedly felt here in the last five minutes of trading Wednes- day, so the stock resumed the advance today. Ford Motor, Ltd., likewise The strength of General Electric, Ltd in London was not felt here in the forenoon, nor w the n in Brazilian Traction, which, how did hetter elsewlorc The opening on the curb was higher. ‘The strength of fore mark mir- rored Wednesday's session here and brought renewed buying some of these issues today. Ford Motor of Canada A pointed up- ward as a result of new models soon to be shown Ford Motor_Ltd., at 5%, likewise was firmer. Electric Bond & Share in a 3,000-shsre block, at 117, was unchanged, but Cities Service, at 5%, was a shade lower. Standard Oi! of Indiana at 15', Niagara Hudson Power at 615, and United Light & Power A at 6%, all gained slightly. National Transit, at 7lg, Wwas firmer, as Was United Gas at 2'. Aluminum Co. of Americaquickly rose a point to 52. American Gas & Electric also was up a point in a few trades. INDEX OF WHOLESALE PRICES HOLDS STEADY By the Associated Press Fluctuations in wholesale commodity prices were arrested during the week ended January 2, on the basis of meas- urements of the National Fertilizer As- sociation. The association’s index, Wwhich in- cludes 476 individual quotations, re- mained unchanged at 65.1, representing 1926-28 averages as 100. The associa- tion points out that wholesale trade during the latest period was very inac- tive, due to the holiday season Seven of the fourteen main groups constituting the index were active, with three groups advancing and four de clining. The advances included textiles, foods and grains, feeds and live stock, with all gains being less than 1 per cent. The declining groups were fats and ofls, metals, bullding materials and fertilizer materials. Fats and oils lost almost 3 full points, due to lower prices for lard, butter and tallow. Advances were made in the prices for 14 commodities, while declines were ghown in 17. Higher prices were noted for cotton, corn, lightweight hogs, apples, sugar, flour, turpentine and rub- ber. Losses were shown for lard, but- ter, corn ofl, tallow, eggs, heavyweight hogs, finished steel,’ copper, tin, silver, silk and cottonseed meel. a firmed. BONDS ON THE CURB MARKET. Bales in thousands 4 Alabama Pow 55 2 Aluminum Ltd 55 3Am Cmwlh Pw 6s 1Amer EI Pw 65 A 5 Amer G&E 5s 2028 16 Amer P&L 65 2016 1 Amer Roll Mill 5s € Appalach Gas 6s 2 Appalach_Pow 55 5Asso GAE 4'us 33 Asso G&E 4725 ' 41 Asso Gas&El 55 9 Asso GasdkEl 2A G&E 545 '3 1 Asso’ G&E 5'us 8 Asso TAT 51.5 A 18 As Tei Ut 5755 2 Bell Tel Can 5s B 5 Bell Tel Cun 55 C '60 14 Can Nat Ry 4% 1 Caterpillar Tr 5 2Cent Ll P S 55 1 Cent_Pow&Lt 17Gen Pub_Ser 5 15Cen St Elec 5 2 Cen St P&L 5 38 Cities Service 7Cit Ser Pow 9 Clev EI 1lI 5 Comwh Ed 4 6 Comwh Ed 4135 1 Comwh Edis 3Con G Hal 5! 10 Cont G&E 55 A 3 Pk Iny 55 Bosto 7Elec P&L 55 A 8 Empire O&R 2 Federal Wat 5 i Firestone C 4Florida P & 7 Gatineau Pow 1 Gatin 10 Gen 2 Gen DOMESTIC BONDS '68 43 40 57 5 2 5435 41 B1 00 56 9215 911, 80 105% 62 82 24 2 Gulf Oil Pa 55 9 Hous L&P 4125 ndnap P&l I Ut NEW YORK CURB EXCHANGE Received by Private Wire Direct to The Star Office. { Low Clo Add 00. Open. Hirh Prev. 1931.- Stock and Low Dividend Rate. 1% Agfa Ansco Ainsworth Mfg Afr Investors vie. Ala Gt South pf(4).. Ala Pow cum pf (7). 108 79 Alumtnum Co of Am 36508 5 Alu Co of Am pf (8). Aluminum Co Ltd. .. Am CapitalA....... Am Cit Pow & LUA. . AmCit Pw & LtB Am Com Pow A Am Com Pow B. Am Cyanamid B, Sales— High 19% 13 1% 115% 224 109% 102 10 38% 10 17 Am For Po Am Founde Am Gas & Elec (11). Am Invest Inc (B).. Am Lt & Trac (23%). Am Maize Prod (2).. Am Meter (3).... Am Superpower. . Am Superp Ist (6) Am Superp pf (6)... Am Thread pf (2Gc). Anchor Post Fence. . % Appalachian Gas.... , Appalachian Gas wr. Arkans NatGasA ... AssoG&T % Atlas Uttl Corp . Atlas Utilities war.. Auto Voting Mach Auto V Ma cv prpt2 Bellanca Afr v.t.e.... Bell Tel of Can (8).. Beneticial 1 L (1% Blue Ridge Corp. ... Blue Ridge cv pf(a3) Bourjois, Ine (50¢). . Brazil Trac LU&P (1) Brit Celanese ret: Buff N& EP 18t (5). Buff N&EP pf (1.60). Burma rets 127 3-5¢. an Marconi. 0A (2).. ton Co (j1%). negie Metals. . Cent Pub Svc A b5 %, Central States Elec. . Cities Service (g30¢c) Citles Serv pf (6). Claude Neon Lts Inc, Colombia Syndicat Colon Oil. Col Oil& Gas vte. . Columbia Pictures Commwith Edison Cmwlth & Sou war Consol Auto Merch. . Consol Auto M cu pt. Cou Gas Balto (3.60) Consol Gas Utility A, Cont Sharescv pf. Cord Corp. Corroon&F Cosden Oll. ... Creole Petroleum Cumberland P L (2).100s Dayton Air & Eng... 6 Deere & Co. 20 De Forest Radio. 3 Derby Oil Refining. Detroit Atreraft.. Draper Corp (4). Duraat Motors. East Sta Pow (B) East Util Assoc (2). Eisler Electri¢. ..... Elec Bond&Sh (b6 % ) Elec B & Sh cu pf5.. Elec B & Sh pf (6). Elec P& Ltopwar.. 4 3 Elec Pow Assoc A (1) 2 Emp G & F cu pf(7). 1508 Emp G & F cu pt(8). 508 Europ E Ltd A (60¢) Fajardo § Federated Cap cu pf. Ford Motor, Can., A. Ford Motor, Can., B. Ford Mot Ltd 36 3-50 Foundation For Shs. Fox Lheater (A) Gen Alloys.... Gen Aviation. . Gen Theat Eqcv pf.. Glen Alden Coal (4). Globe Underwrit 40c, Gold Seal Elec new. . @o'dfield Consol. Goldman Sachs. Goth Knitback Mch.. Graymur Corp (1)... GrtA&P Tean v (6). 308 Grier Stores pf.. Gult Ofl of Penna. Hartford EI L H. Itine Corp (1).. Hires (CE) A (2)... Hollinger Gold t70c. Horn & Hard (2%)..25508 Hudson Bay M & S 1 Humble Oil ( . 20 Hydro El Securities. 1 11l Pow & Lt pf (6).. T8 1mp Otl of Can (50c) Imp O Can reg (50c). Imp'l T GtB&I(1.12), Insull Inv (b6%) . Ins Co ofNo Am 12% Int Petroleum (1) Int Product Int Utilities B. ..... Irving Air Ch (50¢). ltallan Superpow A. Kolster-Br (Am Sh). Lake Shore Min (72) Letcourt Realty 1.60 Leh Co & Na (1.20).. Leonard Oil. ..... Libby McNeil & L. ., Lone Star Gas n 8sc. Long Island Lt (60c) Long 1sld Lt pf (7) 13 Louisiana Lan & Ex. & Magdalena Synd.... 3 1 37 1 1 1 20 12 93 1 1 30 23 256% 109 2% % % - 1% W 101 57 1% 1% 54% 1 15 4% 51% T 3% m 3 1% 560 1 1 130 5 25% 48 6 181 3 23 1% 44 51 8 1125 90 Comment NEW YORK, January .7.—Brokerage { house market commentators were mostly the opinion today that the rally | would carry further, on momentum if | nothing else, since the short interest bas been very large. Hornblower & Weeks—Although it is not to be expected that the recovery |of 6 Koppe 5 Koppe L El 6 & Gum { mcvement should continue at the rapid pace set yesterday, we would not ex- pect too much in the nature of a trac 1 reaction at this time, believing tha bstantial buying orders just under the arket probably followed up the ad- vance yesterday, which factor, together | with the likely existence of a short in- terest of substantial proportions, should | prove a sustaining influence during nor- trading reactions occasioned by profit-taking . homson & McKinnon—The broad scope and vigor of yesterday's recovery was indeed encouraging. Judging by the strong tone on the close and late s 1 the bank shares, it is not it this vigor has been entirely Redmond & Co.—Although Wednes- dey’s rally appeared rather fast, in the absence concrete news develop- mer ~tly has gained suffi- itum to carry somewhat her. We would be inclined to re d the current rally as only a tempo- turn in the market and would not | prised to see a further testing out recent lows. !lds & Co.—Further rally is to pected, but it will be unwise to oo hopeful of the concrete ef- | the measures planned to halt There is a possibility of an | of an it apj cient mom , | inflationory period, but there is no evi- | 25 A td §s A '35 9 Baxon Pyb wk 55 '32 30 Stinnes 15 ‘46 xw... ww—With warrants ZW—_Without warrants. New. - When ssued. 29% dence of real leadership thereto at the ent. Until there is, only temporary nterruptions of the downward price rend are to be expected. E. F. Hutton & Co.—A slow, steadily ng market for stocks that would not dge the short interest is much to be d at this time. It is much too ¥ to hazard a guess as o the dura- rally. There seems ounder basis for ex- d movement at this 1 the case for months. Paine, Webber & Co.—A further price aboui the size of yesterday our judgment, make a rally | top and be followed by a setback, at ileast of corrective proportions. Stein, Alstrin & Co.—The rails have made double bottoms, and a8 we ex- A 274 2% 44n 6 Bl | organizaticn, L1931 Low. Y% ~Prev. High 5% Mas Mid Sta ewmont Mining. .. ipbuilding Cp. N Y Telpf (6%).... Niag-Hud Pow (40c) Niag Share(Md) 20c. Niles-Bemt-Pond (1) Nipissing. . B NY Nitrate s Nor St Pow A (8)... Nor St Pow pf (6) Ohto Copper. Ohio Oil cu pf (6 PacG&E 1stpf 1%. Pac P 8§ Pandem Ofl Pantepec Ofl ¢ Penn Mex Fuel(pl) Pennroad Corp (40c) Peppere Phila Co (new) 11.60 1 Philip Morris (ne... 2 Phoenix & Pilot Rad Tube A Plon G M Ltd (12c).. Pitney Bowes (b4 %) Plymouth Oil (50c) Premier Gold (12c) Prod Roalty (b10%) . Prudential Invest. .. Pub Util Hold xw... Pure Ol pf (6).....0 9! Radio Products. .... Reite Roc Ross Segal L Southld tson Sunray Swift & Swi T Unit Lt USE Util Po Y 01l 4% 5 8% | Dividend ra | nual payment. a Payable in cash dividend. fplus 5% stock, § Pl in stock. nPlus 8% in 98 % Stock and Dividend Rate. Mavis Bottling (A). Marion Steam S Util Assoc.... Meniph N Gas (60c). Mercantile Michigan Gas & Oil. Mid West Ut (b8%). Mid W Ut cv pf xw 6 Mo-Kan Pipe Line. .. Mo-Kan Pipe L (B). Mohawk Hud 1st(7). 508 Mohawk Mining (1). Nat Aviation Nat Bd &8 Corp (1). at DPrpf A (7)...1008 at Food Prod B....- b Nat Fuel Gas (1). Nat Pow & Lt pf (6).650 Nat Pub Sv A (1.60). at Service Co at Sh T Sec A b at Transit (1).. il 1 Al New Bradford Ofl... 2 ¥ : New Eng Pow pf (6) 10s Rellance Int A Reliance Manag Republic Gas Corp. . Reynolds Invest Rhode Is P S pf (2 Roan Antelope Mi! nd L&P (90¢). Intl Corp Ryan Consolidated. . St Regis Paper. .. Seaboard Util (28¢). Seeman Bros (3). Sle Ind al ctfs(5%) Sentry Safety Cont. Skenandoah Corp. .. ith (A.0.)... outh Penn Ol1 (1).. So Cal E Sou Pipe Line (2) Stand Oll of I 3 Stpnd Ol of Ky 1.60. tand Pwr & Lt (2).. and P (A)&Co (1.60) . Stutz Motor Car. Swift Internat'l (t4) Am Syracuse W Mach B. Tampa EI Tastyeast Inc (8). Technicolor Inc. ... ch Hughes (60¢c). . enn E1 P 1 Trans Air Trans Trans Lux DL P S.. Tri-Utilitles. . Tubize Chatel. B Union Oil Assoc (2) Unit Corp war. ... Unit Elec Service. .. Unit Founders Unit Gas Corp. . Unit Gas Corp war Unit Gaspf (T)..... Unit L & Pwrepf(6). U S Dairy (A) (6) U S Foil (B) (50¢c) U S & Intl Secur U S Inter Sec 1st pf Unit Stores v.t.c. Utah Apex. Utility Equities. . Util & Ing .. Utility & Ind pf(1% Van Camp Pkg pf... Vick Financial (30¢) Walgreen Co lker. H (23c) h Grpe J Wenden Copper. Western T & S Wil-low Cafeterias. . Woolwth Ltd 17 4-5¢ Youkon Gold Com Edison.. .. 1% Pub Sve N II .Feb in dollars based on last quarterly of semi-an- Ex dividend or stock in stock Sales— Add 00. Open 1 S . Low. Close. 1 ¥ hov. 2 1 ERi(l).. 2 12 Pet vte B. 1 1 2 1 1 1 5 5 1 ey Zinc B 258 1101 110' 110% 110% 47 6% % 6y 8 2% 3 8la 5 Corp new pf(1.30) 9 1 31 . 208 11 Mfg (4). pf (3). 1 0 1 1 4 1 1 4 5 3 s 3 6 1 & Hdwr. A pf B (1%). Royalty 2 &Lpf (7)., (J B) oil.. Co (2) D (8).. tric (3. pL(7).. 25, s & Pw A (1). 'S Pow ww. &L %) 3 | the | demand came from without the country | | has gone to silver. | Brussels sprouts, FAILS AS TRADE AID England Has Apparently Not Benefited by Suspending Gold Standard. BY CHAS. P. SHAEFFER, Associated Press Business Writer., Trade reports reaching the Govern- ment from United States observers abroad indicate abandonment of the gold standard in many important com- mercial nations has failed to bring about an upturn in business A recent dispatch to the Commerce Department from London told that British exports have failed to improve while imports were showing a slight gain—quite the reverse of the result expected in British trade circles. Many similar statements are on reco Suspension of the gold standard be- gan earnestly with England as a neces- sary economic measure. It quickly spread to other foreign countries which were forced to adopt similar measures because of adverse trade effects. Japan aptly illustrates this point With the pound sterling selling at 30 per cent below par, Great Britain was at once in a position to undersell her competitors. This was particularly true in the case of Japan, which saw her lucrative trade in cotton with China, | India and the Dutch East Indies seri- ously threatened. As a result, Japan, too, went off the gold standard. Ap- proxim: 20 nations have abandoned standard since England started the ment. he gold standard, succintly, means | that a nation’s curren rtible | into gold at a fixed rate of exchange. When it is abandoned, it means simply that gold becomes a commodity with price fluctuations based on the volume of gold circulation and the country’s internal supply of the metal ‘When England inaugurated the move- ment, mainly as an economic remedy to her rapidly vanishing gold supply, she hoped that the lowered depreciation would make the country an attractive one in which to purchase. The reduc- tion in internal purchasing would tend to discourage imports, she felt, while the decrease in costs would act as a stimulus to exports. But trade dis- patches deny that this is true in any single case. Economic factors which are said to have forced England to forego the gold standard included a demand for gold of such dimensions as to make it impos- sible to maintain convertibility. This mov rather than from within, and hoarding of the metal was considered too infini- tesimal to cause other than negligible effect. 1 The jmpression that is more or less widely held that a country reverts to a standard of silver when gold is aban- | doned is entirely erroneous. Silver is | not the complement of gold, nor does | the standard depart from one to the other. The Federal Reserve Board points out in this connection that no country previously on a gold standard When gold is aban- doned it means simply that the country has assumed an irredeemable paper standard, the board points out. Baltimore Markets Special Dispatch to The Star. BALTIMORE, Md., January White Potatoes, 100 pounds, et potatoes, bushel, 40a80; yams, barrel, 1.00a1.50; beans, bushel, "2.00a | 250; beets, per hundred, 2.50a3.50; per quart, 121:a25; bushel, 40a50; cartots, per 100, 2.50a3.50; cauliffower, crate, 1.75a 2.00; celery, crate, 1.25a2.50; cucum- bers, hamper, 3.0025.00; lettuce, crate, 4.0025.25; onions, per hundred pounds, 3.00a4.00; peppers, crate, 150a2.75; spinach, bushel, 50al110; squash, buchel, 150a2.00; tomatoes, _crate, 1.25a3.50; turnips, hamper, 15a25; ap- ples, bushel, 35a1.25; eggplants, crate, 150a2.75; grapefruit, box, 1.25a3.00. Dairy Market. voung, 17a21; Leghorns, | 14a17; old hens, 15a21; Leghorns, old, | 15216} ters, 10a12; ducks, 12a23; guinea fowls, pair, 25a40; 16a30. Eggs—Receipts, receipts, 15a20; nearby firsts, 21. 300d and fancy creamery, 7= 75a90; cabbage. Chickens, current 25; 1,324 cases; hennery whites, & Gas. 0 T ST e N SIS A I - R TR S M e IR R 201 W 0 DTS 5 RiIGHTS—EXPIRE 28 8 1 1% 1la 21 1% tPartly extra. IPlus 4% in stock. bPayable in stock. e Adjustmen K Plus 6% in stock. kPlus 10% in stock. m Plus 39 in P Paid last year—no regular rate stock. stock. BALTIMORE REJECTS 84 BID FOR BONDS al Dispatch to The Star. BALTIMORE, January 7.—For $4- 200.000 of municipal bonds offered by Le Baltimore Commissioners of Finance esterday, only one bid was received proifer—$84 for every $100 of par was the lowest received in many for the city's securities and was ted by the commissioners bid was made by a syndicate d by the Wnion Trust Co. of and, which included the Bankers Co., the Chase-Harris-Forbcs ration, the National City Co., Bacon & Co. the Northern Co. of Chicago, the Baltimore- Co., R. H. Moulton & Co., and urg-Redhann & Osborne. The e between today’s price of $84 price received for city obliga- 1st September was $22 per $100 luc he hid of $84 per each $100 par 0f bonds the city would have received $3.528.000 for its $4,200,000 of obliga- tions. or $672.000 less than par. At the last previous sale of Baltimore bonds. held September 17, 1931, the city recelved the highest price paid in a duerier of a century for a total offering 1 $6.827.000 1 As compared with 5.15 per cent which he money would have cost the city on phe Present issue, if today's offer had boen accepted, ip' September Alexander rown & Sons ad ciates paid u $6,897,000 $106 5 (: o for ssue bearing to the city cent. e SEABOARD AIR LINE. PROSPECTS ARE BETTER By the Associated Press. w SMPA. Fla, January 7—Ethelbert Wi Smith, co-recetver of the Seaboard S ”nf: Railway, says the outlook for eenancing it is better despite increas- m% difficuities for railroads generally. m He was Tampa today on an inspec- on tour. He will return to his head- qu in Norfolk, Va., Sunday. al j-b of receivers,” he said, g enough money to get the in shape for some kind of r We are making progress. e for the money of 3.56 per pect railroad news to be more favorable the next few weeks, we believe these boltoms may ' be maintained, which should help the industrial group. ut_coupon, which was a cost | | |Prices and Values | { BY GEORGE T. HUGHES It goes without saying that security prices at the bottom of a bear market | have little relation to values. Never- theless, the sight of steadily declining quotations discourages the holders to the point where they sacrifice their in- vestments not because of any known change in the merit of the stock or bond, but because there seems 1o stop- ping of the downward movement. If one inventories his investments periodically at the market prices and is influenced by the decrease in net worth shown, he is apt to feel that he should liquidate while there is still something left. Yet there are offsetting considera- ions. In the present bond market it | s to be remembered that there is prac- | tically no short interest and that bond: | offered for account of institutions or | individuals have to be sold at the price fixed by the buyer. It is a little better in stocks because of the technical posi- tion of the share market. Predictions that this or that corpora- ticn will show a deficit from operations at the year end are also to be inter- preted unfavorably only if all the con- ditions are known. For instance, the writing down of inventories may change | a net profit into a net loss without af- fecting the cash position and certainly without impairing the ability of the company concerned to meet its fixed charges, Some day the commodity markets will turn and then instead of inventory losses there will be inventory | gains to be written up, but this will in- | volve no increase of financial strength until the inventories are turned into finished goods and sold to the con- sumer. One more disturbing influence in year-end markets which is of no sig- | nificance with regard to the status of {the corporation is the recording of losses for income tax purposes. Under the present law an investor is allowed |to write off on his income tax return .| to_choce, hPlus 1% in | | 24.00; fair to m |5.40 | 29.50. ladles, 20a22; process, 24a25; o ‘packed, 1415 Live Stock Market. Cattle—Receipts, 75 head; light sup- ply: market steady. | Steers—Cholce to prime, none; good 7.0028.00: medium to good, 55606.75; fair to medium, 4.25a5.25; plain to fair, 3.50a4.00; common to plain, 3.00a3.50. Bulls—Choice to prime, none; good to choice none; medium to good, 4.00a 14.50; fair to medium. 3.50a4.00; plain to fa ; common to plain, | 3.00; Cows to choice Choice ‘to prime, none; good none; medium to good, 3.75 edium, 3.2523.75; plain to 2508325, common to plain, 1.508 Heifers—Choice to prime, none; good to_choice, 5.00a6.00; medium to good, 450a5.00; fair to medium, 4.00a4.50; plain to fair, 3.0084.00; common to plain, 2.50a3.00 Fresh cows and Springers, 30.00260.00. | Sheep and lambs—Receipts. 200 head; light supply; market steady; sheep, 1.00a3.00; lambs, 4.00a7.50 H Receipts, 1,000 ) supply: market higher; lights, 5.15a 1 5.40; "heavies, 4.50a5.00; medium, 5.15a roughs, 3.75a4.10; light pigs, 4.50 10; pigs. 5.00a5.35. Calves pts, 100 supply steady. ir, head; light head; Calves, Rec ma t and Grain Prices | export. no > red Winter, garlicky, 60'g; January, 60%; quotations; No. spot, domestic, February, 61 Corn—No. 44a45; cob corn, Oats—No. 2 51, No. 3, Rye—Nearby, 40a45. ] Hay—Receipts, none. New hay is starting to arrive in increasing quan- tities, but so far no official grading has been ‘attempted, selling being strictly on merit. Demand for old hay slow and market is dull and quiet, with prices in buyers' favor at a range of 13.00a 16,50 per ton. Straw—No. 1, wheat, 8.5029.00 per | ton; No. 1, oat, 9.00a10.00 per ton. New Live Stock Unit. BALTIMORE, January 7 (Special) . — A Maryland unit of the Eastern Live Stock Co-Operative Marketing Associa- tion will be sponsored by the Maryland | Farm Bureau Federation, directors of | the latter organization decided yester- | day. The home office of the co-operative group will be established at the Union stockyards here. The decision was reached after con- siderable discussion, with one faction of the federation supporting a plan to organize a co-operative marketing group that would have no affliation with the interstate organization. The federation began its sixteenth annual domestic, spot, new, 2.00a2.10 white, domestic, 1,235, yellow, spot} |losses in securities provided an actual sale is made and provided that there isl no repurchase of the same security in | 30 days. In a bear market this operates to depress prices, just as in a bull mar- ket the withholding of securities be- ise the investor does not wish to ord a profit operates to maintain | prices. After the first of January thi: factor disappears. (Copyright, 1932.) A. J. Mason, aged 54, recently played in & foot ball game at Ashburton, New Zealand, and says he expects to be an active player when he is dw | ceonds three-day meeting here yesterday. CHICAGO' DATRY MARKF1. CHICAGO, January 7 () —Butter— Receipts, 6,809 tubs Creamery— | Special (93 score) extras (92 | score), 2515; extra firsts (90-91 score), 1a24; firsts (88-89 score), 23a2315; | (86-87 score), 21a22i5; stand- | ards (90 score, centralized carlots), 24%.. | Eggs—Receipts, 2,854 boxes; about | steady; extra firsts, 23a23';; fresh| graded first, 22a221,; current receipts, 20; refrl;enwr firsts, 16; refrigerator extras, 17, CURRENCY CHANGE [Svee WAGE PARL resentatives Show FINANCI AL. ESSFUL OUTCOME IN RAIL EY IS PREDICTED Both Carrier Officials and Employes’ Rep- More Conciliatory Attitude Toward Pay Readjustment. BY CHARLES F. SPEARE. Special Dispatch to The Star. NEW YORK, Jenuary 7.—There is not so much uncertainty today over the response of the members of the four railroad brotherhoods to a request from their employers for a voluntary reduc- tion of 10 per cent in their wages as concerns the character of the conces- sions in the way of additional employ- ment that the brotherhood representa- tives may place before the railroad ex- ecutives at their meeting in Chicago on January 14. It is generally expected that the men will agree to the wage reduction, and that they will, by a large majority vote, give their representatives at the joint conference the authority to reach a conclusion with the nine railroad presi- dents who will debate the case with them., Voluntary Wage Reductions. The voluntary reductions made since the Chicago meeting in December by various railroad organizations, especial- ly shopmen, has increased the senti- ment in favor of accepting a cut in pay A deeper realization of the cris through which the carriers are going also has arisen from such incidents as defaults in interest on railroad bonds, the passing of dividends by numerous roads and the reduction Tuesday in the dividend on_Atchison common stock. which has long been regarded as the one least, vulnerable to any unfavorable changes in the transportation situation. | It was indicated at the last meeting between the railroad employes and a representative of the carriers that, should the brotherhoods accept the 10 per cent reduction in wages, considera- tion would have to be given to the em- ployment of additional railroad workers, and that at least a portion of the $200, 000,000 saved by the roads would have to be spent in reducing the lists of the unemployed. There has been strong dissent to this proposition on the part of different railroad managements. The most vigor- ous objection to it has come from the roads west of the Mississippi. Those in the East have been more conciliatory and agreeable to some sort of a com- promise. It is significant, however, that some of the Western lines that were not at first inclined to go along with the majority and move in a regular way | toward the objective of a general 10 per cent cut have been less active lately in promoting their policy of giving notice of an early 15 per cent reduction in wages. | Employes' Contention. The contention of the railroad em- | ployes involved in the present wage con- trove: is that, if there this should be allowed in the way of giving more work to men who are either on short hours or have had little em- | ployment for months. The difficulty | from the railroad standpoint in agree- ing to this is that the outlook for rail- road business is uncertain and promise | of additional employment might have to be violated if traffic fails to pick up in | the first half of the year. | There is little doubt that if the rail- | roads are successful in obtaining the wage cut most of them will use some portion of the savings in a more. active maintenance program. There is consid- | erable deferred maintenance, both on | track and on equipment, that the car- | riers would be pleased to correct. The president of one Western railroad has | just announced that his company in- tends to spend such money as is saved from reduced wages in improving the | physical condition of his road and that | | the benefits of the cuts would not be restricted to individual labor groups but would be spread out to include from the different railroad departments. 1t is also quite likely that the bene- | fits of a reduction will be felt by the railroad supply and materials com- panies, which have had relatively few orders from their largest customers in | the past year. One of the anticipated incentives for | more activity in the iron and steel trade ils the improved credit of the railroads, which is expected to follow the wage re- duction. Although the railroads have a large amount of idle equipment at the | present time, they would have been in the market for additional locomotives and cars of modern types had their bor- rowing power not been at such a low | state and their securities on such a | depreciated basis, due to the heavy monthly losses indicated in net operat- ing income. (Copyright, 1932.) Everybody’s Business Reconstruction Finance Cor- poration Aid Expected to Stop Bank Failures That Cause Liquidation. BY DR. MAX WINKLER. Special Dispatch to The Star. NEW YORK, January 7.—The crea- tion of the Reconstruction Finance Cor- poration is ‘one of the most definitely the | constructive developments which Government has undertaken thus far. Formed to extend aid of a financial nature to banks, insurance companies and other bona fide financial institu- tions in need of accommodations, it should succeed in bringing about a stop to the disheartening bank failures re- ported within the last two years, which were largely responsible for the con- tinued liquidation. The work which the corporation is ex- pected to engage in should be of a more concrete character than that of the National Credit Corporation, organized with private capital. The situation had become too serious for private initiative to cope with. Government action could no longer be delayed. While it is true that the National Credit Corporation was created to aid financially embar- rassed banking institutions, its provi- sions were such that a bank eligible for assistance did not have to go to the corporation, but could obtain readily all the ald it needed elsewhere. Activities Require Courage. Courageous advertising plus aggressive merchandising will accelerate economic recove according to Gllbert T. Hodges, president of the Advertising Federation of America. There are thousands of individueds, Mr. Hodges continues, with ample funds who should make purchases now. Cour- age, not timidity, is the essential qual- ity for the alert business executive who hopes to move financial reserve into active channels. The outlook for the railroads is not discouraging if remedial measures are not too long delayed, says H. D. Pollard, president and general manager of the Central of Georgia Railway. Mr. Pollard thinks the adjustment of wages and the slight increase in freight rates authorized by the Interstate Com- mercé® Commission will be helpful. He also points out that legislative action ta regulate, tax and supervise competitive forms of transportation on a basis com- parable to that of railroads will assist, and the revival of industry and com- merce will have a favorable effect. Annulment of a recent order allowing a reduction of grain rates in the West- ern territery should help the St. Louis- San Francisco Rallway to the extent of $1,750,000, according to E. N. Brown, president. Mr. Brown believes that the road is cared for at least until March 1, when interest on the consolidated mortgage bonds falls due. If the Reconstruction Finance Corporation is actually going to do the things which are expected of it, the Frisco as well as other transporta- tion systems similarly situated should be able to secure the necessary accom- modations, thereby insuring the .con- tinuance of interest and sinking fund payments on their bonded indebtedness. Private Debt Payments. Private debtors are going to pay un- less extraordinary political or economic forces make it impossible, Clarence Dil- lon, head of Dillon, Read & Co. told the United States Senate committee in- vestigating American loans abroad. In every country the integrity of the private person still remains, said Mr. Diilon, adding that the larger private | corporations to which his firm has loaned money are solvent, and that wherever there is any difficulty in meet- ing their foreign obligations it is a | question of transfer; that is, their abil- | ity to get dollars rather than their | solvency. At the last' dividend meeting of West- inghouse Electric Co. it was intimated rather vaguely that unless there was a turn for the better in the way of busi- ness . disbursements to stockholders might have to cease, temporarily at #least. Bookings early in December showed some gain, but orders since the middle of the month have slumped, accord- ing to reports. Declaration of a dividend at yester- day's meeting came, despite the reduc- tion. as a pleasant surprise, and may be interpreted to mean that the West- inghouse management is viewing the future with a certain degree of op- timism. Short-Term Credits. German short-term credits, of which about $600,000,000 are estimated to be held in the United States, probably will be extended for another year at the expiration of the former Stillhaltung (stand still) agreement, February 29. The original plan to fund them into a long-term loan, to be repaid in in- | stallments over a period of years, ap- | pears to have been dropped. The aban- | donment is due to necessity rather than choice. In the meantime interest is | being paid promptly and punctually, and if a reasonably satisfactory basis is reached in regard to the reparations | problem there should be no difficulty in | repaying all outstanding credits. The advance in German issues regis- tered in recent sessions is probably in anticipation of pending favorable de- velopments. These may include a post- ponement of reparations payments for two or more years, extension of short- | term credits, with an agreement on the | part of Germany to liquidate them while | the reparations moratorium is in force; reduction of military expenditures by Europe, and concessions by the United | States in connection with interallied | . The steadily mounting deficits of the French railways is not to be covered | by means of “an increase in freight | rates, according to authentic reports | emanating from Paris. It is expected | that the government will authorize the roads to issue bonds up to 3,110,000,000 francs, or about $125,000,000. It will be recalled that, according to an agree- | ment between the French carriers and | the government, railroad issues consti- tute to a certain extent obligations of the French government. (Copyright. 1932. by the North American Newspaper Alliance. Inc.) BALTIMORE TRUST CO. OFFICIAL WILL RETIRE Special Dispatch to The Star. | BALTIMORE, January 7.—Waldo | Newcomer will retire as chairman of ‘me Executive Committee of the Balti- | more Trust Co. next Tuesday, the occa- |slon of the annual meeting of the stockholders, but will continue a mem- ber of the Executive Committee and board of directors. |~ Announcement that the resignation had been received with deep regret was made by Howard Bruce, chairman of the board and chief executive officer of the company. Mr. Bruce said Mr. Newcomer wished to retire from active dutles after a banking career of 26 years. Mr. New- comer is one of the best known bankers in Baltimore, having started his bank- ing career in 1905, when he became president of the National Exchange gmk. nucleus of the Baltimore Trust 0. STOCK AND BOND AVERAGES By the Assocl: ed Press. From Yesterday's 5:30 Edition. STOCKS. 50 Indu: 2 .62l Previous day. Week ago. Month ago.. Year ago. Three years ago. Five years ago Migh. 1931-32 Low, 1931-32. High, 1930 Low, 1930 High, 1929. .. Low, 1929.. Today Previous day. Week 2g0. . Month 2go. Year ago. s Two years ago Three years ago. High, 1931-32 Low, 1931-32. High, 1930 Low, 1930. High, 1929 Low, 1929. 90.4 strials. (Copyright, 1932, Standard 20 Rails, 32.9 30.5 323 39.0 98.2 134.9 105.0 106.2 30.3 1416 86.4 20 Utilities. 99.0 3.0 99.1 113.1 166.1 196.2 103.4 203.9 92.7 281.3 146.5 353.1 156.3 20 Utilities. 82.6 817 81.4 87.0 99.2 98.4 99.6 101.5 80.2 1014 96.6 99.8 96.0 1 96.3 Statistica Co.) is to be a: 10 per cent cut, some compensation for / men | MOTOR CARRIERS CONTROL IS URGED Drasfic Legislation Proposed I in Report to Interstate Com- merce Commission. BY GEORGE E. DOYING. The most sweeping regulation of mo- tor carriers in interstate commerce yet proposed is expected to be recommended to Congress by the Interstate Commerce Commission on the basis of the report made by Leo J. Flynn, one of its examiners. Transportation experts here expressed the opinion tod: that the commission will adopt the Flynn report substantially as it stands. The Teport, covering about 150 pages, is an exhaustive review of the motor carrier situation and is based upon a serles of Nation-wide heéarings con- ducted by Mr. Flynn for the commis- sion last year! Cites Court Decision. In addition to reiterating previous recommendations by the commission for Federal legislation to regulate inter- state motor busses, the present report includes not only the common carrier trucks, but contract carriers as well. Mr. Flynn cites a decision of the Supreme Court of the United States handed down more than half a century ago, in the case of Munn vs. Illinois, to support his contention that con- tract carriers can and should be con- trolled by Congress. In that decision, | relating to warehouses, the court de- {clared that a statute for their regula- tion simply extended the law to meet a new development of commercial progress. “The regulation of contract trucks,” says Mr. Flynn, “would by merely ex- tending a principle of law to meet a new development of commercial progess. “Considering the effect of unregu- lated contract motor carriers engaged in interstate commerce on such com- merce,” he continues, “they are clothed with a public interest and Congress has the power and the duty to protect and insure the continuance, permanency and steady operation of transportatioh by all agencies of interstate commerce. If warehousemen, stockyards, packers, boards of trade and fire insurance are clothed with a public interest, it is rea- sonable to say that motor vehicles oper- ating for hire and using the highways which belong to the public and are primarily for the use of the public as places of business are clothed with a public interest.” Insurance Provision. It is proposed that these contract carriers be required to register with the Interstate Commerce Commission and to carry liability insurance or indem- nity bond for the protection of the public. The commission, according td the report, should be authorized to fix the minimum but not the maximum rates to be charged by such carriers. Similar regulation, except as to rates, would be provided for the “anywhere for hire” carrier operating interstate. The railroads and water lines, it is recommended, should be specifically authorized to engage in interstate commerce by means of motor vehicles, but would be required to secure certifi- cates of convenience and necessity, the same as independent operators. Modi- | fication of the Clayton anti-trust act is proposed to the extent necessary to per- | mit carriers to acquire competing lines in the interest of economy and effi- ciency, and carriers subject to the in- terstate commerce act would be per- mitted but not required to participate in through routes and joint rates with authorized motor carriers. It is suggested also that the rall- roads should consider whether economy and efficiency could be promoted by utilizing the Railway 'ss agency as a medium for hand! all Jess- than-carload freight with expedition in service and reduction in charges to the shipper. (Copyright, 1932.) Grain Market By the Associated Press. CHICAGO, January T.—Fresh up- turns in grain values early today ac- companied Liverpool reports of good general demand for wheat, and were simultaneous also with New York Stock Market advances. There were author- itative predictions, too, that it would be a long time before any empire wheat quota proposals were adopted in Great Britain. Opening ’4 to 5% higher, wheat aft- erward held near the initial limits. Corn started unchanged to ! higher and continued firm. Supplies of Russian wheat in Great Britain were reported today as rapidly diminishing, and Black Sea shipments were smaller, indicating that wintry conditions were curtailing the move- ment of grain. Forecasts of Argentine wheat exports were also devoid of in- dications of any important increase. Furthermore, domestic receipts of wheat at primary centers continued to shrink, totaling but 275,000 bushels, against 467,000 a year ago, and Omaha reported that out of 58 cars arriving there today 40 were from other ter- minals. In various quarters, significance was placed on assertions that the United States Farm Board had booked at least a little vessel room to Antwerp, pre- sumably for the export of wheat from this country. A moderate amount of overnight export business in North American wheat from the Pacific Coast was noted. Meanwhile, Winnipeg ad- vised that Canadian rural holders of wheat were selling little or nothing. Corn and oats displayed relative firm- ness owing largely to wheat price up- turns. Provisions were steadied by a rise in hog values. New York Cotton Special Dispatch to The Star. NEW YORK, January T7.—Cotton prices were about 50 cents a bale higher at the opening of the market today. There was a brisk demand from shorts. This, coupled with good bid- ding from the trade and foreign houses served to absorb all offerings and create briskly rising price trend that caught stop loss covering orders. Opening prices were: January, 6.38, up 8; March, 6.49, up 10; May, 6.65, up 9; July, 6.85 up 10; October, 7.07, up 10, and December, 7.20, up 8. GUARANTY TRUST CO. REPORTS RESOURCES Special Dispatch to The Star. NEW YORK, January 7.—Guaranty Trust Co, in its condensed statement as of December 31 last, shows total re- sources of $1,494,040,051, compared with $2,022,425,111 a year earlier. Surplus and undivided profits amounted to $194,959,038, compared with $207,442,- 797 a year ago, or a decrease of $12,- 483,759, which was caused by amounts taken out of undivided profits account and added to the company’s reserves. .. Bank of France Statement. PARIS, January 7 (#).—The weekly s.atement of the Bank of France shows the following changes in francs: Gold increased 382,000,000; sight balances abroad decreased 676,000,000; bills dis- counted at home increased 320,000,000; bills bought abroad increased 297,000,~ 000; advances increased 13,000,000; cir- culation increased 2,178,060,000; current accounts decreased 1,431,000,000. Rate of discount, 2% per gent. 1