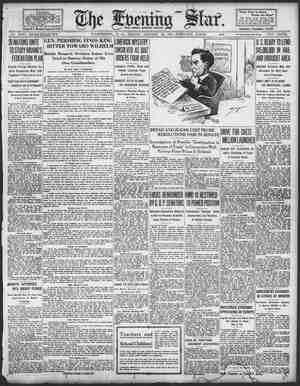

Evening Star Newspaper, January 16, 1931, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

Utilities Continue to Eeature Market—Price Changes Narrow. _ BY JOHN A. CRONE. 1‘ @pecial Dispatch to The Star. rvice opened ter crossed bli¢ utilities firmed siightly as the -urninx session progressed. Petroleum s, however, inclined toward soft- ~4pess. In the higher-priced industrials eclines predominated. Food and chem- dcal shares showed mixed trends. the early afternoon natural gas radio luuas snapped out of their alul- ln A, 0 ‘Smith Corporation dipped more than 2 points. Even the lower-priced shares of pipe makers declined. This was true of Dresser Manufacturing B. Cooper-Bessemer, which also is linked to_the ofl industry, eased. The movement of food stocks was ir- Tegular. Packing shares have been af- fected by recent price declines in inven. tories. This was emphasized in Swift & Co’s report. Today Trunz Pork showed net sales in 1930 gained 55,964 while net profits dropped $90,584. Di- Tectors therefore rediced the dividend © from $1.60 to 81 a year and the stock opened a half point lower, Weakness in London was transmit- ted here in the first hour. British- American Tobacco B was slightly lower. Hydro-electric securities, Ford Motor, Ltd., and similar issues did not move in ihe same direction as domestic groups. In the metals, Consolidated Mining & NEW YORK CURB MARKET Note—All stocks are sold e by e —Prev, 1930.— Mmmlwchm-l-& -'l‘v 1930.~ M ": Aero Und 2 ero Un 9% AMilated Prod 1.46 79 Ala Great Sou (nl h Bales— Alum Ltd A war. Aluminum,Ltd Bwar Aluminum,Ltd Cwar. Aluminum,Ltd Dwar. e % Amer Austin Car. .. 13% 5 AmCapital (B) ... 49 27 AmCP&L (A) (a3). 28% 4% AmCityPRLBB10%. Mw 10 AllcomPAI;tti:;u u u. Am Batitie 76% 11% Am For Pow 6% 3 Am Founders. Am Gas & Eln 109% 104 Am Gas & El pf (6) 16 8% Am Invest Inc (B T8 14 Am Invest (war) 404 25% Am Maize Prod (2) 4% % Am Maricabe. 19% 2 Am Natural Ga: . 89% 9 Am Superpowr (40¢) 10215 80 Am Supernwr igt(4) 15% 3% Am Ut& G B vtc 20c. 7% 1 Am Yvettene 14% Anpalachian G o BoSuSannmommom— wnBeacmant o POTo 65 100 ArkP&Lof (1) 815 Art Metal Worke 11% Asso Gas & Blee. . 13% Assoc G & EL A (a2). 86 AssoG&EDL(B). . 65 As350G & Elctfs (5). Assoc G & Eall ctfs. 1 Ass0oG&E (A)dbrts Assoc G & El war... 31% A 3% Atl, 1 Atlas Utilitles war. . 16% Aviation Cor of Am.. 14 Bahia Corp 3% Blue Ridge Corp. Blue Riage cvpf (a3) 194 lrnn‘rrtLu»ts». 98 BriATeouB117 $«10c 284 Brit Am To1.17 8. 24% Buff N&EP pf (1. 20 1% Canada Maréon:. ... 22% Carnation Co (J1%). 48 Celanctistpt (17%) 508 14 CentHG&EnSle.. 1 11% Cent Pub lnAtM Bmelting was up a point, while New- t Mining moved ‘bouz 4 point lower, Tsey Zine opened down a point & , SUCl nma erde, dur- iod weré & trifle soft. From the chemical trade came news of improvement in alkali prices, but few of the active chemicals on the Curb were affected by such developments. IN the drug field Zonite and United Chemicals ting preferred reacted. Dow lost a point. mr-m Walker was active in the mwm mrf: g iy ‘was accom] a of more & half point in the forenoon. NEW YORK COTTON NEW YORK, January 16 (Special).— Opening eotton rlfl today wsre 2t 7 points h:?:i:mm p?l:.ox support 5 . and gained $2,121.35, !nm BOURSE PRICES. er' 16 () .Trading vudnk Drices were heavy on the Three mne::cmm:omnuas wmflmw i mz‘ London, 123 francs 89 | centimes, ‘nzdolhr was quoted francs 521, centimes. s BONDS ON THE CURB 55 H23BITIRRIBISS 3 mig izt I8 2 338, Fid FERS FSP 33 iq TE OIS SIS geSERSray s PP ssiEniianadsiistey & & S232RBI2NR2ENIIIL 3TNV SN2 F F Se: 5 & s-gzsasSenesiaiFenust ST Sasa3s S ngugics-psnas! S Eaaasi ga3s egsseisses £ S ,,:u geSaRensneds SE 03 S550m = W ST 7% Cent St E (ke0e) .. 4% Centrifug Pipe (80c) 17 5% Chain Stores Sto 28 13% Chat PhAln.v. (1).. 1847 100% Chesebrough (16% ). 44% 13% Cities Serv (g30c). .. 30 93% 784 Cities Serv pf (6)..+ L) T% CitSvpf B (60c)iiss R Colombia S7ndictte, n M ColOl1 & 8. 000 onhlwnr..... 'm Com Wat Bv (8% ). con-l 10 140 3% 45% 35 17% 3% 14% 3 I, - S0 Bmmmn 5 16 on(1) 240 con-ld! (ul\i).. :o- 1l Stores & Consol Trac NJ (4). 508 Contl Share cv pf (6)450s Cooper Bessemer (2) 3 Cord Corp. ......... 17 Corp Sec Ch (b6%). Creole Petroleum. .. Creason Consol (4¢). Curtiss Wright war. Cusi Mex Minii Dayton Alr & Bng... Deere & Co (£1.20).. De Forest Rad Do® Cuemionl ¢ e P T Swmwo~ BastG & F Asso.... Bast Util Inv (A). ... % Eisler Blectric Corp. Eles & 8h (b8) . ElBond &Shecupfh. E1.Bond & Sb pf 8). Elee Pow Ags0 (1).. Elec Pow Asso A (1) El Pow & Lt op war. Elec Shareholdg (1). Bmpire Corporation. Bmp G&F cupt (1).. Emp P Ser A (21.80) Empire Steel Corp. .. Employ Reins (1%). Fabrics Fintshing. .. Fansteel Produets. .. Flintk6te Ca (A)...s Florida P&L pf (1).. Ford M Can A (1.20). Ford Mot.Can B 1.20. 25 Ford M France p28c Ford M Ltd 1»!1;, Foremost Dnlry r Foremst Dal Fox Theater G1 (A} Gen Alloys. . .. 4eneral Aviatiol MENELT il - N - Neow amweS-3 Gen G&E cv pt B (6) 1608 Gen Laundry Mach.. 2 Gen Petroleum wi. .. 2% Gen Thev pf w.o(3). 24 Gen Tire & Rub (16) 10s Gleaner C Harv new. 1 Globé Underwrite 8 Gold Coin (new). 1 Golden Center.. . 7 Guldman Sach TC 21 Grt A&P Tea n.v.(5).1008 Groc Strs Prod v.te. Guenther Law (2)... Gulf Otl of Pa (1%). Hartman Tobacco. .. Helena Rubenatein. . Hollingér Gold (65¢) (mp O} of Can (806) (nd Ter 111u 01l (A). Ind Ter Illy Of) (B). Indus Finan ctfs Insull Inv (b6% ) Insurance Sec(79¢). . int lofhtinent et n Int’dydro cv pt 3% 11% ‘0t Petroleum 1) 20 IntBuperp ($1.10)... 4 Internat Utll (B)... BY CHARLES F. SPEARE. 8pecial Dispatch to The Star. TN FETES 3 S2RR222WIZIZ 22! & & S 3 e 3 23S sponseSenSEie Sty 22283852 2838352285232% = ugsyeEsssER e TSN T & & e & & &5 TR F I 822082238 3382:1323 328, 833! BN &S NEW YORK, January 16.—Two ex- ! haustive studies of the relation of stock 'and bond prices and yields to each Founders Corporation, the largest of the mnuemenz investment h-ulu. other un-l trend ! stock ylelds to a level much above periods of deptession, o é%’ Stock a Disidend Rats. A6 60, Oven. High. erwriters. . Low. OClose. 8 8 TS LA % 75 Kol M 108 Ml m 8 B e e, Wayne Dividend ek 5% Lefcourt Realty 1.60. Libby McNell & L. Lion Oll & Refin! Loew’s Inc war) Lone Star Gasn. Long Isl Lt pf (1) % Louisiana Lan & Bx. Mapes Con (13%) 1% Mavis Bottling Memph N G €o (80c) Met & Min Ine (1.20) Mich Gas & 011 Corp. % MidSt PetvtcB.... Montecatini del Mount Prod (1.00) Nat Pow & Lt pf . Nat Pub Sve pf (7).. Nat 8h Tr BecA (50c) Copi mu olloofl :‘“ 10 100% Ohio Pub 8v pf A () 2 Outboard Mot (B)... l.u 284 Pumlfi"(l‘) ac Light Paramount Cad Parke Davis (1. u). Penuroad Co: hl fll .Dl‘ ll“). l Publie Util Mola war lumo: l.un PraA. l.el Ll.' l'.l)cu 2%/ Rossia Int Corp. y Of Switt & Co new (! Teen Hushes (8063; U « . Texon OlléLand ui. Trans Lux D L Tri Utilities ll: l‘). Tubize Chatel «B)... Un N G of Can (1.40) Utd Carr Fasten Unit Chem pt pf (8 Utd Corp (war). Received by Private Wire Direct to The Star Office Jer Cen P&L pf (7).. 50s 107 Br (Am Sh). » 0o a 0900 0o e ke s robaba 00 i s 10 B 10 p0 e 25 ow Jersey Zinc(13) Newmont Min (4). N ¥ Hamburg (234). NYP&Ltpf(6)... N Y Transit (1.60).. %4 Niag-Hud Pow (40c) Niag-Hud Péw A w. Niagera Sh_Md(40¢) Niles-Bem-Pond (2). Noranda Mines. ... 1% No Am Aviat A war. m hov-dol-AnuN\fi). oFa ..§.... “ ”a‘.... 20 §-=__. S g £ R FFFET "ET s > e > P St R 2 A 285522, 2 PORS JOr v - Sz 008 s s B e s o - it (. 0) (fln--. 1104 ist. 2 o 5 2 EIEF 1L (BE%® ). .. % 6% o .-:._-ESE- B L 1pt (1), 5 % 16% 8 4% 16% 8 PETIES ™% 9 Utd Publlc Service. . Utd Shoe Mach 143 . U S Daity (B)...... U 8 Eleé Pow ww. Walker (H) “)- Welch Grape I West Auto 8 A (3).. Wheatsworth (11%) Zomite Products «13. RIGHTS. Com Edison. Feb 2 7 Pacific Gas & Elec. Iates In doliars *Ex d Expire. 58 based STOCK YIELDS EXCEED BOND RETURN AT PRESENT PRICES ‘Economists’ Charts Give Strong Argument | for Purchase of Equities—Analyses Cover Period of 34 Years. bear markets.” However, i the recent bull market stock pricés advanced while bond prices were falling, until in September, 1929, which méasures the high point of the inflation in common n. prices were almost 70 per cent above the old nomul level. the end of last December stock prices were 21 per cent below no: " gmmm«nmtmm n’.‘"“m'l’:'m of tne Tucker e 14 tudy was to y the come parative yeld of T o high-grade ¢ bonds wnd and what, in tion, e o has been 1F i w unz nbli(ltlfln! to raise w upihl. Q:u average yield on bonds about 8%, per cent and in that yur the average return on stocks nnr 1% per cent. Coming ‘DVln to 1929 we find that, at the summit of the stock speculation in Beptember and October, the average re- turn on “blue chips” was only 2 per cent, whereas t.l;ae‘ gc‘umnb yie"ld %l was near] per cent. ians and % | were increast | ¥ork around with decline * | vals of from three s | fo only a uf 4 murys FRUT SHNENTS .| SHOW RECENT GAIN Vegetable Supplies Also Larger at Markets—De- mand on Increase. Shipments of . lnd Vi January, ant Bureau nomics, Market News Service. po- tota movement gained sharply from Maine, Idaho and Colorado. Prices have Ei S TR e lle of monm of 5 w 10 cents per 1 nds. m’l"he Great Lakes region, usually a source of Mberal supply, is not lhmpkll many pototoes this season. Mic] 'uoouln and Minnesota, _tog have shipped scarcely mofe much as Maine alone. Long shipped more potatoes than an ese three Western to States. cers will nat:fl wlt interest t.h‘:t the avy shipments of potatoes Colorado from Maine and Lohg 1:?":'.« lll higher than most other potal Potato Holdings Modenu. Although mest of the great mrkeu report slower the holditigs on frack are still erate despite the heavier lhlpmmh, indicating t con: siderable buying is taking place for f ture requirements as a result of the up- ward price tendency of the first half of Jlmury Demand is reported fairly active at New York and Boston. Afll' to six cars from Cah- rted at these markets . Maine Green Moune Ada da and at Philadel, are re| Ip] 6% | tains follow a_fairly steady jobbing nn£ At $1.80 to $2.15 per 100 quem markets. Prince and potatoes bri $2 to $2.25 lopoum Prings $1.75 to $1.90 per 100 Island potatoes topped market in New York at $2.35. Chicago tato prices have held about steady "t Shipping points,ate 'Sfl"ud‘?.f rms to shipping points are re Western New York, ifie and Middle West, with aull tly M mMarkets in these produc: to shipments from Florida lmount ew cars daily as yet. Confli- }.um of the Florida and Texas erop is .:l.r!lygoodnnm’llwmsnlmr- Carlot supplies of sweet potatoes from all scurces average now only about 50 % sack. Pennsylvania stock o % | ears daily, but prices have decl! little in "the face of decreasing ments. Tennessee furnishes about one- third of the dally carlots. Maryland, 8% | Delaware and New Jersey are still fairly active. Nancy Halls from Tennessee fange $1.15 %o $1.60 per bushel. Rican stock from North Carolina ¢line slightly to $1.25 to $1.40. Jm fange on Maryland potatoes is $1.5 t6 $1.75 in mtem cities. Some New Jer- :ant reached top of $2.75 in a few Onion Prices Hold. After the slight declines of January, <7|'Ala.l|\|h markets o “fl’ steady tendency near we middle :; the on the best stock, New York yellow onions were % unutouperwopoundsmmwvm-k and Boston, but best lots reached $1.25. Dull, slow mnuh revlued in Eastern prncuclnfi‘ sales around 80 ht supply and demand was reported from Western Michigan, with 4 steady prices, and most Western pro- flu:l.n. sections quoted markets un- changed. Omaa clined to move their 8s fast as they can find such a pelicy tehds fairly liberal supplies tern market centers. rom New York and New Engl prise about 10 per cent of the uu’ re- ceipts. The bulk of shipments are from the Middle West, and Colorado. More Southern Cabbage. Shipments of new cabbage from Texas and Florida now comprise from one-third to. one-fourth the ww ou-lot supplies. Prices of old cabbage feel the added competition, although prices were holding fairly well near the middle of January. Moderate supplies of North- ern stock are reported from all Eastern market centers, but demand is slow and grlces no more than steady. New ork cabbage of the hard, long-keeping varieties sells at $20 to $22 per ton, or 81 to $1.25 per 100 pounds. Pennsyl- Vania stock brought $1.15 per 90-pound sack in Cleveland. New York red cab- bage sold as high as $25 in New York on small lots. Virginia cabl of the Bavoy type sells at $1.50 per batrel in Philadelphia. Southern ?t irregular prices, with ange of $2.50 to $3 per Western ci Bouth Carolina early stock ranges ‘! 50 to $1.90 per 1 -bushel Philadelphia, Baltimore lnl ton. Slow demand pxlgca ‘?gevlu .1:: N:'w Y h &in cabbage shipping poin! Supplies of old erop Aare mostly from wuurn Nu York 'mey Eastern mar- gell at irregul gflu. kets, moatly % Ma pér bushel. Bales in bulk at 88 r ton are reported in Western New York, where demand and trading aré freported slow. Texas is shipping catrots liberally from its large, new tfi‘t:p S Dflc:“ I:lm\;: f California car- ward f‘ul' of nnm luppll. and some lmmvemnt in de- mand. The compartively heavy stocks femaining in growers' hands in several of the lnpr produclng sections seemed to be held with a fair degree of con- fidence. The Michigan country market was strengthe! n little because of lighter offerings by growers at present rices, slightly above swr 100 pvunds n buik for choice hand-picked Apple Supply Moderate. Nelrly all the large Eastern markets rt apple supplies moderate. Apple Res have beets one of the few steady n.urel of the produce situation for some time, although demand has con- Stock | tinued rather slow and unsatist: yields, the Tucker analysis states: “In Beptember, 1029, the ‘blué chips’ were ylelding only 42 per cent as much as ;| that follow the average e rice tendency in of the month, and few jobbing sales of Greenings exceeded 1.25 per bushel. l'rhe mm b tn- changed on barrel s e other Eastern markets eased Off about 10 cents - per bushel on some varieties. New York McIntosh @eclined a little in New York, but held firm in Midwestern markets. Eastern Yorks were s u Baltimore and wulm.: $1.2 $1.75, u\d Eastern sold l‘ about the same price in these and thef Eastern markets. iwins advanced in munch-nadinm {i‘:unh:‘ugsmbum‘:h INTEREST RATES By the Associated Press. N Call mone; @eml reced mm poln- ‘t;m the hpr‘o:e‘m d':pnnwn T a st it week after regisi . % i riod. during the prior pe: e classes of funds is given for comparable - based, ealoulations by the Price movement was mefl: 48 conditions in the wholesale and jobbing trade, the retail trade and manufacturing and industry, as well as the state of colléctions, reported to Bradstreet's this week from the following centers: Wl;ol!uh and job trade. Retail mnu(-cnmn‘ Collec~ mma tions. ‘ Qlle‘ Quiet Quiet Fair Quiet Quiet Quiet Fair Fair Slow Fair Quiet Quiet Pittsburgh—Steel production increasing; glass manufacturers book $15,000,000 in orders. Clevoland—Increase in auto trade takings help steel, which is at 50 per cent. Detroit--Automobile production increasing; many thousands of men retum to part-timé employment. Chicago—! capacity increased; bars, plates and shapes firm ‘Wholesale trade, especially in oom h-;a silks, better; steel Milwaukee—Absence of ice and timism in trade and industry. building snow umm ‘Winter wurk more op- Louisville—Slight improvement in Spring jobbing; more optimism; Wm—-lflnlnc and lumber quiet; colder weather helps clothing. Minneapolis—Slight improvement) no matiked activity.- St. Paul—Immediate trade active; future trade light; retail “sales” ahead of 1930. Des Moines—Building at low ebb; manufacturing improving; consid- erable unemployment. nmrmgonm or rain. it séén; colder weather should help unlnhu back on road; colder weather hélps retailing of coal nnd clof Louis—Salesmen on road report a slight gain; lead mines more Aetlve “shoe “sales” off. Baltimore—Retailers feature “sales” with fair sucéess; hardware and Mmachine GRAIN MARKET CHICAGO, January 16 (#).—Sharp new downturns in wheat resulted to- tools less active. heat| NEW YO weneral | S 05 tone, ¢ price breaks were in the face 3§ of reports of duststorms over Southern instead time of year a decided inc: usual at bearish nce. A Wlm of wheat were than week and more than d:mbu ' that of & 8 year ago. It was asserted that big shorts both in May and July wheat had evened up their accounts and that attempts to unlwd sizable holdifigs would mea; lines. Corn ana Dl“ wheat ‘Weakness. mmmmwm-meflbynnuh hog values. nmx STOCKS INCREASE. !ed to 203« uu highest on m. against 189,925 on November {105,137 on December 31, 1929, O.M .\lbfl Manufacturers’ Associatiol n_reports. Crude nlbber -flon fot nited States .v::u-q 16 ). 0 Stocks m IN STEEL OUTRUT Loss in Operations Since Early in November Reported as Recently Recouped. Steel production has expanded this week to about 45 per cent, all districts save Buffalo reportiig increased or une changed rtes, says Steel 6f Clevelsnd. This is & galn of 3 points over last week and recoups all of the loss in operations since mid-November. &wwmmw low of rolling. ‘To a moderate extent, further sup- port may be expected from expanding rail output, but it is incres pfinnt um in the main the mill m& actull consuming requirements m further appreciable advance in mn is no_diminution of confidence that the trend in consumption of steel is up, and neither lucers nor cons fl have .ly lfl M it is mom "of the o largest mod cers wers vm producers were rised by the cofiviction the de fon is over and slow but sustained provement is ahead. Building continues the most active outlet for finishe teel, this week's o R o Sy 'Rlbulnd 21:::3 0. Autamobile requires menu stil ll’k he vigor usually ime parted by Ford uld Chrysler, and probs ably will the remainder of this month, although on Lbe whole slightly more 1, is movlnl Detroit. mmmm.mummm. the al being about 60 per cent of & Bnm raw material to finished prods if6n and steel markets lack 085, tons s | 20,00 4 tons Deécems 1929. comuqun of crude n Decembe 21,493 tons, against 23479 In_ November and 38, December, 1029, otin 1530 soraien 13,608 tons, against 460,- 805 tons in 1929 and 441,338 in 1928, #SILVER QUOTATIONS. NEW YORK, January 16 (#).—Bat silver, 2815, STOCK AND BOND AVERAGES By the Assoclated Prom Yesterday's 5:30 umon. Corporat! wvufilthmunotmflfltmm ter M‘J.‘J"“u}."' ms than in flwflfl new few n ce. Basic iron h easier n‘:’ Eastern sales continue M%.mmflzrm orcing bars are being Bars and plates le price of 1. ivalent, to avers ARLINGTON TRUST CO. RE-ELECTS DIRECTORS %"fi““‘f Investment Opportunities of a Decade RPORTUNITIES for successful in- vestment in utility debenture bonds ate more favorable now than in a decade. Sound bonds may be purchased at levels which afford ateractive yields with prob- able appreciation. Associated Gas Company bonds average in yield compared with similar issues of other leading utilities. This is proved by an analysis showing yields of 63 similar bonds of 20 comparable com- panies as a group. “This compatison, based on tests such as are used by banks, insurance companies, and investment banking houses for de- termining the value of public utility bonds, proves farther that Assoclated Bonds Are Above Average in Security, For example, Associated Gas and Blectric Com- pany has a rela- tively small amount of sub- stdiary company ebligations, the General 61 Broadway ratio 6f such obligations to the parentcom- pany’sbondsbeing 429 less thanin thecase of 20 other utilities as 4 group. This in- creases Associated carnings directly appli- cable to the parent company bonds. On an “overall” basis, Associated earnings before and Blectric are above depreciationare2.26 timesinterestrequire- fents compared with an average of 2.06 In spite of declining earnings and re- duced business activity by many indus- tries, Associated Gus snd Eleceriec Com- pany gross earnings each quarter of last IR ‘W LR Y ‘WHM 1l I‘H I TN s TETRRER i year were shead of the same quarters of preceding years. This is due to the essential nature of atility services and to the desirable public atility ateas served. Debenture bonds of the Asoclated Gas and Electric Company arg available to yield about 6%. Our letter, with an ap. i M i :':t flil[lllmlllm wmm Ao Write for Folder A-124 Seécurities New Yt;tk