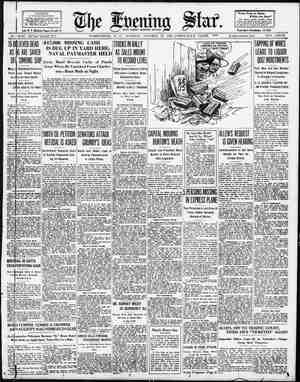

Evening Star Newspaper, October 29, 1929, Page 14

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

14w MARGIS REDUGED INBROKER OFFES Requirements Cut From 40 to’ 25 Per Cent Today Because | of Improved Conditions. BY EDWARD C. STONE. The rush to Washington borkerage houses by speculators and investors to | see the opening of the New York Ex-| change today was greatey than it was during the 12,000,000-share day last | week. | Long before the quotations began to | flicker across the transiux and the room ' attendants started to post the prices on | 1 the boards the seats were all taken, every inch of standing room was in use and people were standing at the en- trance waiting for enough traders to come out to let some more get inside. No such interest has ever been dis- played in the broker offices in this city. On'the 12,000,000-share day many peo- ple did not know what was going on until the close of the market or near that time. But yesterday's open break and weak closing indicated another sell- ing wave at the opening today, and evirybody holding stock, or being sold out on lost margins, was present to see what might happen. One local brokerage house got a mes- ge shortly after 10 o'clock, saying This was probably the worst opening in the history of the New York Stock | Exchange, especially after such vicious | declines. 'Rally seems imperative.” | The quotations showed both state- | ments to be true. Just before the open- | ing w rd received here said there were | nothing but selling orders on the floor in New York. An hour later tremen- dous buying orders were being poured into the market. It was also stated that call money would open and remain at 5 per cent during the entire session. Margin Requirements Reduced. Early in the day George A. Garrett, resident partner of F. B. Keech & Co., with offices in the Metropolitan Club Building, announced that his firm had reduced margin requirements from 40 to 25 per cent “because of the improved market conditions.’ ‘This, of course, was an extremely im- portant move and one which will be taken by brokerage houses all over the country—in fact, already has been taken by several other firms. Margin require- ments have been 40 and 50 per cent for many months, bei.z steadily ad- vanced as the stock market climbed higher and higher. The fact that ex- pert brokers now belleve stocks are down where 25 per cent margin~is ample will mean that hosts of stock buyers who are temporarily out of the market will go back in. Most everybody in the boardroom today had a buying or selling order it his hand. It was evident that a great many people were anxious to take ad- vantage of the “bargains” in gooa stocks as soon as they believed prices were at or near the bottom. The con- versation in the broker offices and on the street indicated many severe stock losses locally. Brokers looked tired and worn today. re has been no such thing as regular hours for them for more than a week. Local bankers also have been ‘working exceptionally hard keepirg the usual close check on their loans ana giving an extra amount of financial advice. In the broker houses here perhaps the most striking feature of the deally sessions is the rumber ot women who frequent the boardroom: eager to get the latest quotations ana market gossip. In the old days one was shocked to see a Woman in = broker office. Today they are constant attendants, ever having their own quo- tations boards in some offices. ¢ LoealsSecurities Selling Off. The New York market break got to the local stock exchange today for the first time. Capital Traction opened at dropped to 77 and closed at 76;. The day’s trading in this issue totaled 180. Mergenthaler Linotype sold at 101 and Lanston Monotype changed hands at 124, Several other issues on the board showed lower quotations. National opened at 570 and | closed at 560 on a very small turnover. Several other bank stocks were dealt in, some revealing lower quotations. Bonds were active, with only slight changes in recent quotations. The low- er prices in the stock division were said to due to selling to protect securi- ties on the New York Exchange which are held locally. Transactions were unusually heavy. Bankers Off to Convention. Bertram Chesterman, president of the Morris Plan Bank, in this city, will a tend the convention of the Financial Advertisers’ Association, which opens a four-day session in Atlanta tomorrow. Robert L. Flather, assistant secretary of the American Security & Trust Co., is also to attend from Washington, as will Miss Frances M. Pearce of the new business department of the Federal- American National Bank. As already noted, Eliot H. Thomson of the Washington Loan & Trust Co., is on his way by motor to the same convention. John Poole, president of the Federal-American National, hopes to get away for the closing sessions. Financlal advertising experts from all over the country will be present and a most instructive program has been arranged. Heard in Financial District. T. Hunton Leith, assistant cashier, Security Savings & Commercial Bank, and national executive councilman of the American Institute of Banking, at tended a recent banquet given to in- stitute group study classes at Fre erick, Md., by the Maryland Bankel Association. Net income of Southern Railway Co. for nine months ended September 30, 1929, is estimated at $13,891,000 after taxes and charges, equivaient after al- lowing for dividend requirements on 5 per cent preferred stock to $8.96 a share earned on 1,300,000 shares of common stock _This compares with $12,342,000 or $7.76 a share in same period of 1928. Estimated net income for September was $1,729,000 after taxes and charges against $1,686,000 in September, 1928. “The opportunity to buy stocks at bargain prices does not come Very often—about once every five years—ac- cording to one economist. Last Thurs- day was the big bargain day,” says the Wall Street Journal, “but few were able to take advantage of it, as the dips and rallies were too fast to enable one to buy at much lower prices than now prevail. But there are many stocks that are still selling at bargain prices. | They may go a little Jower, but in the| long run they will sell higher. They| are cheap from the viewpoint of earn- ings as well as yield. The problem is to select the right stocks.” PAINT CONCERN RAISES DIVIDEND ON COMMON Byecial Dispatch to The Star. {CLEVELAND, October 29.—Directors o} the Sherwin-Williams Co., Cleveland, ir'creased the quarterly dividend on the cimmon stock from 75 cents regular with 25 cents extra to $1 regular with 1312 cents extra, This is equivalent to an annual rate of $4 regular with 50 chnts extra, as compared with $3 regu- lgr with $1 extra. iThe quarterly common dividend of $7.121; will be payable November 15 to stockholders of record October 31. ubual preferred quarterly dividend of $:.50 will be payable December 1 to holders cf record November 15. Earnings of the company for the year ending August 31, after all charges, were $6,019.475, or $8.25 per share on 635,439 _outstanding shares of common siock, President George A. Martin an- nounced. This compares with umhég o7 $4,901,840, or $6.99 per share, for previous year. i ¢ The | ., FINANCIAL, . ~Prev 1920~ Stock and High. Low. Dividend Rate 577 38l AbItIbI Power & Pap 13 Adams Millis (2)... 10474 13 Advance Rumlev . 119 23 Advance Rumley pf., 4% 1 Ahumada Lead. 223% 954 Alr Reductn (t43%4).. 10% 415 Alaska Juneau 25 8 Albany P W Pap 5614 27% Alleghany Corp....e {ula 231 357% Allis Chalm (n) (2).. Alpha Port Cemt(3).. 4% Amali Leather. 21% Amerada Corp 7% Am Agricul Chem Am Agricui Ch pf. Am Beet Sugar pf. Am Rosch Magneto. . Am Rrake Snoe 2.40. 110' Am Car & F of (7) 44 AmChicle(2). .. 72'i Am & For Power 1083 104 Am & For Pw of (7). 88 Am & For Pw 2d pf.. Am Hawallan (1) 49% Am Home Prd (3 60) 30% Am Hide & Len f. 3715 American Ice (3) 89% Am Icepf (6)..... Am Internat (32). 8% 34 Am La F & Foamite, 136 100 Am Locomotive (8)., 119% 112 Am Loco bf (T)....a 279% 147% Am Mach & Fdy(15). 17% 3% Am 0 1756% 78% Am Pow & 104 Am Pow & Lt pf ( 84 Am P&L of A st (5)., Bt Am Ra&Std San 1% 648, Am Renublics. 1445 Am Roll Mill (e2). 748 Am Safety Raz (16 41 Am Seating (2).... Am Ship & Com 90 Am Sm & Ref (4) 39% Am Snuff (3). 45% Am Steel Fdy (; 71% Am Sugar Rfg (). 10214 Am Sugar Rfg pf(7). Am Sumatra (3). 7 180% 49 7 4% 111 Am Tobacco B (8)... Am Tobacco pf (6! 67% Am Water Wks (c1). 5% Am Woolen. . 28% Am Woolen pf. 39 Am Writ Papr pf (3). 10% Am Zine LA&Sm. 92 Anaconda Copr (7. 8 43 Anchor Cap (2.40). 164'¢ 1024 Anchor Cap pf (6%4). €8% 40% Andes Copper (3) 49's 29 Archer-Dan-M (2). 95 82 Armour Del pf (T)..s 18% 6% Armour Il (A)..ccen 104 31 Armour Il (B)...e 407 12 Arnold Constable. . 30 19% Artloom (2).. 30% 25% Art Metal (1%) 58% 43 Asso Appl Ind (4) 107 881 Asso D G 1stpf(6). 298% 195'4 Atch T &S Fe (10). 104% 99 Atch T&SF pf (5) 209'% 169 Atl Coast Line (110). 867 3214 At1G & W Indi 627 45% At1G& W Lof 77% 40 Atl Refining (13). 140 85 Atl 514 175 1% 2% 32 5114 Austrian Cred (4.49). 85% 221 Autosales. 45% 36% Autosales pf (3). 50 38% Auto-Strop Ras (3) 20 814 Aviation Corp. Del... 66% 15 Baldwin Loco (new). 145% 115% Baltimore & Ohlo (7) 90% 60 Bang & Aroos (3%4).. 49% 20% Barnsdall (+2%).... 131 93% Beatrice Cream (4).. 101 70% Beech-Nut Pack (3).. 17% 9 Belding-Heminway.. 104% 40 Bendix Aviation (2 607 40% Best & Company. 140% 128 617 384 Bloomingdale Bros. . 136% 50 Bohn Alumn&B (16). 89% 77 BonAmiA (16) 11% 3% Booth Fisheries. Botany Con M (A).a 51% 36 55% 294 Bruns-Balk:Col(3). 44% 10 Bruns Ter & Ry 8. 42% 22 BucyrusErie(1). 50 35% Bucvrusevpf (24). 22% Budd (EG) (%) 9674 £9% 42'% Bush Term (g2) Copper & Superior (2). A M., By-Prod Coke (1) 84% 170% Calit Packing 4 1% Callahan Zinc & L. 4915 25 Campbell Wyant (2), 98% 60 Canada DryG A (5). 265% 200 Canadian Pac (10).. 48% 35 Cannon Mills (2.30).. 65% 44% Cap Adminstratn A.. 39% 38 Cap Adminis pf (6) 79% 42% Cejotex (3)... 48% 30 Cent Aguirre As13% 40% Cant Alloy Steel (2 Century Rib Mills. 120 75% 811 47% Certain-teed pf. 80% 40 Checker Cab Mf, 23% 10% Chi Great Western. 63% 22 ChiGreat Wi 44% 25% Chi M1l St P¢ . Chi M1l 8t P&Pac pf. 47% 23 61% 48% Chi Pneu T of (3%). 143% 115 Chi R 1 & Pae (7) 102% 98% Chi R1& Pacpf (6). 105% Chi R I& Pacof (7)a Chickasha C O1l (3) 62% 49 CityIce & F (3.60)... 7% City Stores (1)...e0s 248 CCC&StL(8). 72% 41 Cluett Peabody (5) 16414 120% Coca-Cola (4) 46% Coca Cola A (. 20 Collins & Atkma 86 Collins & Alk pf ( 39 Colo Fuel & tron. 5315 Col Gas & EI ;‘:) % Comm Solvents (n) Comm&So (b5 %stk) Conde Nast Pub (2)w Congoleum-Nairn... Cong Cigars (16%).. 45 Consol Cigar (7). 18% Consol Film pt (3) 95% Consol Gas (3) . 96% Consol Gas pf (5)... 50 Consol RR Cub pf(6) 1% Consol Textile. Container Corp B.... 65 6% Contl Motor: 251 Contl Ofl of Del 82 Corn Prod (13% 32 Coty Inc (x2) #91% Crossley Radio 85 Cructb % Cuba Cane 10% Cuban-Ame! 42'% Cudahy Packing (4). 11% Curtiss Wright Corp. 7% 15 Curt Wright Corp A. 1 58% Cutler-Ham (3%)... 126% 63 Cuyamel Fruit 69% 35% Davison Chem. 467 226 77% 55% Denv& RG W of. 11w 8 Dome Min 54 23 Dominien 92 34 Dunhill Inter (34) 287% 16 Dupian Silk (1). 231 150 Du Ponide Ni14lg). 119% 112 Dupont d N deb (6) . 3914 27 East Roll MIIl (13%) 264% 165 1castman Kodak(18). 76% 34 Faton Axle& 8 (3).. 9214 Klec Auto Lite ¢ 109% 103 104% 77 1 2% Eme 79% 47 . Eng Pub Serv ({ 123% 90 tEng PubSvept (5). > 3 Sales— Add 00. High. Low. THE EVENING STAR. WASHINGTON, D. €., TUESDAY, OCTOBER 29, 19%. Prev. 3:15. Close. 40 40 40 44% 26 26 26 274 fly R R 13% 20 15 15 23 1 1% 110 5 5% B% 1 1 128 1004 5% % 5% 6 5% 8 24% 18% 20 29% 218 204% 214 245 122 121 121 I:'I“A 3614 78 60 6 106'; 106% 106% 90 % 103% 102 33 30% 230 207 1941 182 193 182 102 3015 216 65 24 % 15% 23 25% 43 9214 251 103%4 244 221 102% 101% 101% 169% 169 169 70% 68 68 B4% 54% bdw 38% 30 36 93% 85 86 172 140 120 4 32 32 32 53% 524 b52% 25 38 374 37% 87% 37% 8 6 7 21% 19 19 117% 112% 117 63 58 58 22 20 92% 87 68% 68 ™ 17 7 89% 304 30% 35 . 8 36% 36% 28 8 40% 39% 34% 3L 344 34 150% 114% 27 40% 40% 215 4 Goodyear Tire (5) Stock and Dividend Rate. Eng rub Sve uf15%) Eaquitable BIdg (2% ) Erle R R Erte R R Eureka Vac Cl (4)... Kalrbanks Morse (3) Fed Mining & Smit. . [ed Motor Tr (80¢) Fid Phen F Ins (3). Sales— Add 00. High. Low. 5:15. Close Follansbee Bros (3). Foundation Co, Fox Film A (4). Gabriel Snub A. .. Gumewell Co (5)...s Gardner Moto; . Gen Am Tnk Car(34) Gen Asphalt. ... Gen Bronze (2). Gen Cable, Gen Cable A (4) Gen Cable pt (7). Gen Electric (16)... Gen Elec spec (60c) Gen'l Food Corpn (3) Gen Gas&El A (elig) Gen Outd Ad vte (2). Gen Outd Adv A (4). Gen Public Serv(b$) Gen Ry Signal (5) Gen Refrac (14).... Gillette Saf Raz(c). Gimbel Brothers. ... Glidden Co (m3) GOld DUSt (2% ). 00a Goodrich B F (4). Goodyear 1st pt (7) Gould Coupler. . Graham-Paige ct, Grand Stores (1 Grant (W.T. oo Granite City Stl (4).. Grt North pf (6)...e Grt North ptet (5).. Grt NorOre (a1%).. Grigsby Grunow (2). Hahn Dept Stores. ... Hahn Dept S pf(6%). Hartman A (2). Hartman B (1.20 Hawaltian Pine t2 Hayes Body b8 % stk Hercules Mot (1.80)., Hershey Chocol . 'shey Ch pr pf(6), Hershey Choe pf (4). Holland Furn (e2%). Homestake Min (7). Hsehld Fin pf 13.10.. Household Prd (14)., Hud & Man Ry 3.50., Hudson Manh pf(5).. Hudson Motor (5). Hupp Motor (f2).... Illinols Central (7).. Independ O11 & G (3)/ Indian Motor Cycl Indian Refinin; Indian ning et. Industrial Rayon. Intercontinental Rub Intl Agricultural. Intl Cement (4). Int Combustion..... Intl Cmb Eng pf (7). Int Shoe (2%) Intl Silver (18)... 401 Int Tel & Teleg (2).. Inter Dept 8t (2).... Intertype (ft13). Island Creek Coal(4) Johns-Manville (3). Kan City Sou (6). Kolster Radfo. . Kraft Ph Ch pf (614) Kresge S S (1.60).... Kreuger & Tol(1.34). Kroger Gr&Bak(cl)., Lambert Co (8). Lee Rubber & Tii Lehigh Valley C¢ L‘eh Val Coal pf ¢3) Loose- Wiles (2 60).. Lorillard (P) Co ILouG&EIA (1%). Ludlum Steel (3). Ludlum St of (6%) Mac A & Forb(t: McCrory B (2).. McGraw-Hill (2). McKesson & Rob (). McKes & Rbpf(3%). Mack Trucks (6).... Macy (RH)&Co(ct3) Magma Copper (§).. Mandel Brothers. Man Elec Supply . Man Elev mod (d5) Man Shirt (2). Market St Ry p Market St Ry 2d pf. Marmon Motor (4)... Martin-Parry. Mathleson Alk (e2).. May Dept Stors(c2). Maytag Co (12 Maytag Co of (3 Metro Gold pf (1.89), Mexican Seaboard Michigan Steel (13).. 8id-Continent P (3). Middle States Ofl.... Middle States Of! et.. Midland Stl pf(112). Miller Rubber. . Minn Moline Pwr. .. Minn & St Louls Mo Kan & Texas. .. Mo Kan & Tex pf(7 Missourt Pacific. . Missour! Pac of (6). Montgomry Ward(3) Morreil J (3.60)..... Motor MeterG& B.. Motor Wheel (4).... Mullina Mg, . Myer(FE)& Bro (3). Nash Motors (6). Nat Acme (1%) Nat] Alr Trans. Natl Bella Hess(31). Nat Biscuit (173%4) .. Natl Biscut pf (7). .- Natl Cash Reg A (14) Natl Dairy(e1%).... % Natl Radlator p 324% 4 Natl Supply 118). Natl Tea (1%) Nelsner Brother Nevada Copper ¢3).. ewton Steel (3). N Y Alr Brake (3) N Y Central (8 N YChi & St L pf(§) N Y Dock pf (5).. NYNH&HDL (T).. Norfolk&Wstn(t10). North Am (b10% stk) North Ampf (3)...a Nor Ger Lioyd (3. Northern P'ae (5 North Pae et (5). Norwalk Tire & R Oltver Farm Equip. . Olivr Fr By ev nt(3). Olivr Fr Ea pf A(6). Omnihus Corp ... Omnihus pf A (8)... Otis Elevator (15).. Otls Steel (2%)..... Otls Steel pr of (7)., Owens 111 Glass (4).. Pacifie Ofl stubs. Packard Motor. Pan-Am Petroleum. Pan-Am Pete B. Panhandle P Paramount- Park Utah, Sales— d 00. Hij —Prev 1929— Stock and gh. Low. Dividend Rate. 3 Fenn Coal & Coke. ... Penn Dixie Cement. « Penn Dixie Cm pf(7); Pennsylvania RR(4) Pen (JC) pf A v Pere Marquette (18). Pet MUK (1%).. 000 Phelps Dodge (3)... Phila& Read C& T, - Phillp Morris (1)...e 4 Phillips Pete (1%).u Phoenix Hoslery. ierce Ofl.. Plerce Petroleum. ..y Pillsbury Fl (12% )., Pirelli Co A (2. Pittsburgh Coal. Pittsburgh Coal pt Poor & Co (12).. P Rican Am To (B % Postal Tel & Cpf(7), 0 O11&Gas 12% Proc & Gambl Pub Sve NJ (¢ Pub 8ve NJ pf Pub Sve NJ pf (7 Pub Sve NJ pf (8), Pullman Corp (¢ Punta Alegre Suga: Pure O11 (1%). 3 Purity Bakeries (4).. Radlo Corp. oo Radiopf A (3%)...e Radio pf B (5). . Radlio-Kelth-Orph A. Raflway & Exp (2) Raybestos Manh: Reading (4). Reading 1st pf Reading 2d pf (2). Neal Silk (5) Rels (R) & C¢ Remington-Rand. ... ¢ Reo Motora (11.60).. Repub Ir & Steel(4).. Rep Ir & Stl pf (7).41 Reynolds Spring. .... Reynolds Tb B(2.40). Richfield O11 (2)..... Rio Grande Ofl (k2 Royal Dutch (ai Rutland pf.. Safeway Stores (3).. St Joseph Lead (13). ). ). St L Southwn pf (! Savage Arms (2) Schulte Retail Strs.. Seagra v 1.20).... Sears Roebck (32%), Sharon Steel H (2).. Shattuck (F 3) (1).. Shell Union (1.40) Simmons Co (3).. Simms Pet (1.60). SinclairOfl (13%)... Skelly O11 (2). Sloss ShefMeld steel.. Snider Packing pf... Sclvay Am Inpf 6% Southern Cal EA (2). Southern Dairfes B.., Southern Pacific (§) 8 Stand Gas & El (3}4) Stand G & E pf (4) Stand O1] Calif (13 Stand OJI N J (12) Stand ONIN ¥ 4 Stand Plate Glass. ... Starrett(LS)Co(2).. Sterling Sec A)..... Sterling Sec cv pf(3) Stewart Warn(j3%). i Stone & Webster.... Superior Ofl. 4 Telautograph 11.95.. Tenn Cop & Ch (1)... Texas Corp (3) Tex Gulf Sul (4).sca &Pac(5)..... P C&Oil (b6). Pac Land Tr.. Thatcher Mfg....... Thatcher pf (3.60)... TRANSACTIONS ON THE NEW YORK. STOCK EXCHANGE ~Prev. 1929~ High. Low. 51 34% 62 40 Prov. 3:15. Close. 5% igh. Low. 13 4% 7 T 0% 5 2314 1 5% 34% 4 139% 6% The Fai; ‘Thomps 14 16 73% Timken 2% 1 3 9% 6% 38% 18% 44 91 14% Stock and Dividend Rate. Tide Water Asso. ... ‘Timkn Det Axle t300 Tobaceo Prod 1.40. ‘Tob Prod ctfs 1.« ‘Tobacco Pr A (1. Transcontinental. Trico Prod (2% ) Truax Traer (1.60). Truscon Stl (£1.20) ., FINANCIAL. Sales— Add 00. High. Low. 35 35 39 13 13% 0% 3 Prev. 3:15. Elm: r(2.40).... ig‘a 3.60) on J R (3.60) 1 19% Roller (3) s(ll Underw-E1-Fish(4) .. Union Bag & Paper. « Union Carbide(2.60). Un Oil of Cal (32)... Union Pacifie (10). Union Tank Car(5) Utd Cor Utd Ga, S&F Fre! Ina cacacaaqaaa nunnnenane | Unly Py, Vadsco vadsco Waldor! Wi o W Wi W Wileox willys- wilson Wilson Wilson ‘Worthii Wrigle; Yale & Yellow Zenith Col Car! Det Edi Domin. Iaration. n jPlus 8% o ock. 2% stock. Unit'd Cig St. Utd Frult (c4)..... Utd Gas & Imp (4).. Leather.... Leather pr pf(7) Pipe & Fdry (3). Pipe 2d pf (1.20). Rubber. Rubber 1st pf... Smelt Ref (314). Smelt Ref pf 3% U SSteel (7)..00ue0 U S Steel pf (7).. Util Pwr & Lt A ( Vanadium (14)...% e Van Raalte... Vick Chemical(2%) = Virginia-Car Chem. . Virginia-Car pf (1).. Westn Dairy (B, Western Maryland. Western Md 2d pf. Western Pacific Western Pacif pt. Western Union (8).. Westngh Alr Brk(2). Westngh E1&M (4).. ston El A (2).... vaco Chlor (2). eling & L E pt White Eagle Oll (2 White Motor (1)...e White Sewing Mach White Sw Mch pf(4). % Young Spring (3) 0 Bangor&Aroos Nov 9 Gen. Asphalt. Sim'ons Co...Nov. 14 Sales of Stocks on New York Exchange. Divi 1d_rates as ayments based on the latesi ca5R P of trading sase than 100 ferred AT im0, ot ek, poration. & Im pt(§) or Sec pf(8). ght (3) - Alco (6). pe & Rad. Sal e Sales pt (7) f Systm (1%) STOCKS REBOUND | INLATE DEALINGS Market Closes Lower on Day, However—Sales Hit Record. By the Associated Press. NEW YORK, October 29.—Stock prices again crashed disastrously this forenoon, hundreds of issues reaching new lows for the year and many sell ing from % to %2 of their high levely of a few weeks ago. Large-scale bank« ing support was immediately organized, J. P. Morgan & Co., the National City Bank, Guaranty Trust and other lead- ing institutions -reducing their margin requirements for demand loans from about 40 to 25 per cent, thereby re- leasing an enormous amount of credit to support the market. Stocks appeared to have struck bot-, tom by midafternoon and a vigorous rally set in, similar to that of last Thursday. New York Central com- pletely regained a loss of 9 points and ed a gain of 2%. Westinghouse Electric, .having sold down about 4% points, cut its loss in half. Standard of New Jersey reduced its loss of 101§ to 6. United States Steel sold up l‘ 177, where it was off 9 points. having' reviously touched 171. ' The close waj ower. Total sales approximated 16, 000,000 shares, a new high record. * Many stocks crashed 5 to nearly 1§ points in opening blocks of 5000 tq 50,000 shares, hesitated for a time, and then encountered another huge wave of selling, crushing several to new loa levels. United States Steel sold down 11 points to 175, Westinghouse Electrig 20 to 125, American Telephone off 1% to 220, General Electric off 34'; an American Can, 17 to 119. Yesterday's precipitous drop severely impaired mare & Sn pf (4) gins, touched off thousands of stop-losy orders and frightened thousands of in« vestors who had held their shares over long periods to dump them at the cur. rent low levels. e ‘Trading was in enormous volume, bui owing to the many huge blocks, the ticker was able to keep closer to the trading than in recent frenzied markets falling little more than half an how behind the market toward midday. Call money renewed at 5 per cent the lowest of the year, and contras to ordinary procedure, was announc Ol & Gas.... Over (c1.20).. &Co. &CoA. & Co pf. Woolworth (2.40). ngton Pump.. y Wm (6) Towne (4) Truck & C. Radlo (2). Frve ey bon ..Nov. 11 son . Strs M - 3 o 23 FEER & - % % kel » 12:00 Noon. 8,378,200 P.M 13838,000 darierls ‘or Bal} Yoaris”ave: anares. tParity estra. $Pius bie “:mk’.n:?lu' (] ML nr?n 3% 1o stock. 3,259,800 000 on the ticker tape prior to the opening NEW YORK COTTON. NEW YORK, October 29 (#).—Cottoy opened barely steady today at a deciini of 10 to 21 points under heavy liquida: tion which appeared to come from Wal Street sources and which was attributed to the weakness of the stock market Some large blocks were sold during th first few minutes, but the trade seemet to be buying more actively, and the of- ferings were absorbed at 17.82 for De cember, at 18.35 for March, with th market later becoming less active. Al the end of the first half hour price ‘were fairly steady and within 6 or 1/ points of yesterday's closing quotationy Bu; on the opening decline wal probably promoted by unfavorable feas tures in the weather news and fairl) steady Liverpool cables. Private cablel said there had been hedging and lqui. dation absorbed by Bombay and contl nental buying in the Liverpool marka| and reported an improved inquiry fol cotton cloths from India, but depressing advices from China. . More than $800,000 worth of silk and rayon hosiery was shipped from thy United States to South Africa in th last 12 months. Washington Ticker BY CLINTON COFFIN, Associated Press Financial Writer. In the course of a few moxrths now, as an incident to the complete installa- tion of the new and smaller sized cur- rency, the United States Governmert and all its fiscal agencies will be able to make a determination of how much has been gained by the permanent de- structior: and loss of the outstanding volume of paper money. It has always been considered certain that a lot of paper money was continually being lost past recovery, burned up in fires, sunk in the ocean, or allowed to molder away in hoards, but, except in a trivial way, the Government has never been ;b]:sw take advantage of the known acts. “The trouble always has been that there was no way of tellicg how much it was, or of making sure that out- standing paper would not presented some time,” said Edmund Platt, vice governor of the Federal Reserve Bank, in suggesting why the r.ew-sized money would bring ur the ibility or realizing on the losses. “Now, however, with nbsolulelie:ll of the paper money coming in, to completely replaced by new issues, I think something can be done about it. Certainly, there will be some basis on which can be comparea the total amount issued and the total amount turned back. “The Federal Reserve currency, of course, is comparatively new, and there isn’t much data for computing perma- nent *-sses it has sustained. The oldest paper issue in general circulation 1s made up of United States rotes—the so-called greenbacks—and personally 1 think that out of the $350,000.000 or those put into circulation at least $5,000,000 has been destroyed. The ‘Treasury has credited {itself with an allowance of $1,000,000 on the score, ard will be able, in my opinion, to credit a good deal more when the total of the returned old bills is finally at- tained.” The exchange of new-sized money for the old, begun-last July, is ob- viously nearirg its completion, and has been speeded up in its later stages. For October the Federal Reserve Bank fig- ures show that $362,477,000 of new money has gone into circulation, prac- tically balanced by withdrawal of u like amount of old money. Sirce the total of reserve currency outstanding is about $1,800,000,000, it is apparent that the new-sized money already makes up the bulk of bills outstanding. ‘There was rither less of excited ap- peal to Washington from New York financial and speculative quarters this week when the staggerging stock mar- ket evinced signs of feeling renewed punishment. The Reserve Board sec- tion of the Treasury on Monday, as comgned with last Thursday, was shy of visitors, and business in progress was obviously of routine nature. Secretary Mellon, whose long monetary experience makes him the most frequently picked target by advice seekers of all classes, was as carefull guarded in statement as ever, but much less.approached. President Hoover having spoken last < on the general business outlook, officials from cabinet rank downward were less inclined to touch the matter. It secms fair to say that Washington is as non-plussed by the stock market performances as any other quarter of the country, and though an unusual number of men in high office under this administration have been personal fac- tors in finance of the highest caliber, few, if any, want to venture personal predictions as to the immediate course of prices. Nevertheless, there seems to be every sign of sincerity in the reiterated. opin- fons that the general business of the country can. wi it but 4 reference to the Then, too, the Washington outlook is influenced much by the opin- ion of representatives of money borrow- ing interests at home and abroad. The prospect that rates are due to fall and fall sharply with the finish of the stock market boom gives real satisfaction pot alone to the borrowing officers of V- ernment establishments, of which there are several, but also international banking interests who have for months been postponing flotations because bonds couldn’t be sold. By the test of customs records on the staple article of copper, Germany, in spite of the degree of industrial recov- ery it has shown since the war, has not come back to proportionate pre-war performance, while France is doing rather better in industrial matters than she did prior to 1914. The last recorded monthly figures show that Germany, by far one of the best copper custom- ers of the United States among nations, took 12,855,000 pounds of that metal, while the United Kingdom took 13,071.- 000 pounds, and France took 9,390,000 pounds. All of these are sizable figures, but the relations as among the three chief industrial nations shows consid- erable change. In this connection, the last month reported is hardly a final showing of what a year's performance will be. Copper movement from the United States to world consumption this year has failed to be a regular or stabilized affalr and totals vary greatly from month to month. One of the really unprecedented in- creases of American exports this year has taken place in the humble com- : modity classification of scrap fron. All of the big industrial countries have been engaged in levying on American Jjunkyards. “There have been several contributing causes to the unprecedented shipments of iron and steel scrap to foreign coun- tries from the United States,” says a Commerce Department statement on the point. “In some instances foreign furnaces are being charged with as much as 60 per cent scrap and only 40 per cent pig iron. Prices of this com- modity have risen until it is now prof- itable to ship the material great dis- tances from the United States to a market. “Japanese purchases of scrap have been turned to the United States be- cause of the unsettled conditions pre- vailing in China. Then there has been ¢ the battlefields and a partial exhaustion | of the Spanish iron ore deposits.” | CHECK TOTAL INCREASES. | By tie Associated Press. | Checks drawn last week in leading | business cities, as reported by the Fed- | eral Reserve Board, aggregated a total very considerably in excess both of that for the preceding week and for the same week last year. Figures for the comparable periods follow: Week ending Oct. 23..$20,330,082,000 Preceding week. . 18,586,903,000 Same week last year.... 17,419,908,000 In the New York district checks drawn last week amounted to $12,648,- 623,000, against $10,799,203,000 in the same period last year. Chicago dis- trict checks for the same period were $2,219,293,000, against $1,653,105,000. STEEL MARKET BETTER. NEW YORK, October 29.—Iron and steel makers in the Middle West re- | port decided betterments in the tone of the market with improvement in re- quirements from the automobile indus- g‘)’. W)llc:\mll’:l Mwwuw b: !e".&:‘l e operating ents next month. In the meantime, however,. schedules | are at the lowest level of the year, with 30 of 51 inde it hearth fur- in Europe & completion of salvage from | 2o TODAY'S \CORPORATION NEWS By the Assoclated Press. NEW YORK, October 29.—The fol- | lowing is today's summary of all im-| portant corporation news prepared by | Standard Statistics Co., Inc, New York, for the Associated Press. News Trend. ‘The trend of corporate news contin- ues along recent lines, consisting largely of rallroad and industrial earnings. ‘The constant liquidation of securities has undoubtedly contributed to the dearth of corporate news outside of earnings reports. The larger railroad systems are generally publishing small- er earnings for September compared with a year ago, while some of the smaller units, such as Gulf, Mobile & Northern, Bangor & Aroostook and Buffalo, Rochester & Pittsburgh, show | sizeable gains. Early reports on oil output for past week indicate that crude production ! dropped about 45,000 barrels daily to 2,863,000 barrels. This decrease erases to a great extent the unusually large gain reported in the previous week. ‘The Companies. American Multigraph declares extra of 121, cents and regular quarterly di- vidend of 622 cents on common. ° Auburn Automobile subsidiary, Lycom- ing Mfg., receives contract to !up‘)ly H. E. Dodge Boat & Plane Corp. with 1930 motor boat engine requirements. Bangor & Aroostook September sur- plus, after charges, were $181,338 against $26,666; earned $7.28 per share | in_9 months against $4.78 year ago. Buffalo, Rochester & Pittsburgh Rail- way September net up 15 per cent; nine months, 5 per cent above year ago. Canadian Car & Foundry places new common on $1.76 annual dividend basis against $7 pajd before four-for-one split. Canadian Pacific Railway September net off 20 per cent; nine months, 10 per _cent below year ago. Chicago, Burlington & Quincy Sep- tember net off 3 per cent; nine months, 12 per cent above year ago. Chicago, Rock 1Island & Pacific earned $9.30 per common share in nine months against $8.41 year ago. City "Ice & Fuel, earned $3.95 per share in nine months against $3.11 year 0. Edison Electric Illuminating rights proposed; one new share for each seven held, price to be determined later. Follansbee Bros. earned $6.98 per share in nine months to September 30 against $5.25 year ago. General Refractories earned $6.33 per share in first nine months against $3.93 | year ago. Gulf, Mobile & Northern September net up 23 per cent; nine months, 20 per cent above year ago. Hocking Valley September net off 12 per cent; nine months’ net equal to $34.15 per share against $27.56 year ago. Illinois Central earned $5.64 per share in first nine months against $4.63 year ago. Mengel Co. earned $2.75 per share in nine months, against $1.57 year ago; had $2,410,000 unfilled orders on Octo- ber 21, against $2,185.000 year ago. Michigan Central Railroad September net off 7.3 per cent nine months; 4.5 per cent above year ago. Pitisburgh & Lake Erie September net up 20 per cent nine months; 13| per_cent above year ago. Quincy Mining rights, 3 for 20 shares held at $25. Reo Motor earned $1.05 per share in first nine months, against $2.28 year 2go. First Mortgages For Sale JAMES F. SHEA 643 Louisiana Ave. N.W. SECURITIES MARKET on thes NEW YORK PRODUCE EXCHANGE (lncorporated 1862} INDISPENSABLE The indispensable character of the service rendered this Market, lies not so muc in the fact that it provides a market for securities not traded in on other New York exchanges, but that it provides complete exchange service for stock trading. Every feature for the transaction of business characteristicof New York two larger exchanges, is found here. Those dealing in securities not otherwise traded on New York exchanges should ascertain if their securities are among the more than 650 designated on this ’Seom‘ties Market. A statistical manval of ite and list of members maybehad. Address Room 216, No. 2 Broadway, New York Investments When you wish to make selections, either for funds available, or for any advisable rearrangement of your present investment holdings, we extend to you the benefit of our knowledge and ex-c-'~~ce. GiLreTr & Co. BANKERS INVESTMENT BUILDING WASHINGTON, D. C. Southern Bell Telephone, 9 months to September 30, net after taxes up 5 per cent over year ago. Square D Co. earned $6 per class B naces mglflnhl and 80 of mluo val- ley sheet under power, share in nine months, against $5.01 in entire 1088, & Telephone National 2460 A COMPLETE INVESTMENT SERVIOR