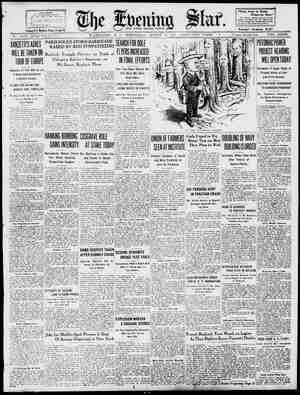

Evening Star Newspaper, August 24, 1927, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIALY? STAR, WASHINGTO! N, D. 0; WEDNESDAY AUGUST 24, 1997. ‘'FINANCYAT: Mortgage Money Loaned at Low Interest Rates Eeonomie_Conditions Tyler & Rutherford Loan Uorrespondent Matual Benefit Life 1520 K Street ~ Main 475 Bonds for Anything Consult Experts Geo. H. Price Co., Inc. F. H. Deland, Pres. 815 15th St. Main 4793 REAL E 512 % FRED T. NESBIT 1010 Vermont Ave. Main 9592 & 1 Have a Fund of $100.000 to loan on desirable Second Trusts at very reasonable rates Prompt Answers J. DALLAS GRADY M. 6181 904 14th N.W. FOR SALE * 61,9 FIRST MORTGAGE NOTES Secured on Northwest Property in the District of Columbia Wm. S. Phillips & Co. Incorporated Main 4600 1516 K Street N.W. GINGER TIGER "k NONE BETTER A. G. HERRMANN 750 Tenth St. S.E. LOANS—— on RESIDENCES APARTMENT HOUSES BUSINESS PROPERTIES In Washington or Nearby Maryland, in Large or Small Amounts at 5Y5% WM. H. SAUNDERS CO., INC. 1433 K St. N.W. Main 1016-17 Loan Correspondent Provident Mutual Life Insurance Company First Mortgage L_oans Applications Invited at . 5%% 0: Tipeaved Property Construction Loans at Minimum Rates Glover & Flather 1508 H St. N.W. ELIEVING that all Thinking Business Men demand— Investments That Are Dependable And Remunerative We Offer First Mortgage Notes Secured by Improved Real Estate in the D. C. ASSURED ANNUAL RETURN Mortgage Invest. Dept. LUCH W, HANNON_ 1435 K Street Main 2345 NEW BOND ISSUES FEATURE MARKET Australia’s $40,000,000 Well Sold—Development in In- ternational Finances. BY CHARLES F. SPEARE. | Special Dispatch to The Star. ¢ YORK, terest was ta n today in the pro- motion of new issues on the market than in the fluctuations in_existing securities. The market was moderate- ly active and firm. The Australian loan of $40,000,000 brought out with a 5 per cent coupon |at 98, was reported as well _sold. The price’ compared with_one of 981 at which the original 5 loan was quoted and with 893, at which the latter was offered in July, 1925. The first loan from point was never affected quite | the controversy Australian debt about 6. in and sold down to tional Bids N The New South Wales {up fractionally today between them and the new 5s was regarded as too wide. 1, points under the issue rificant development in inter- 1 financing is the purchase by panese Bank of the City of $30.000,000 loan, for whigh an bankers have been bidding the past six months. As business con- ditions in Japan have been slack since the April panic, funds have accumu- Iated rapidly and better terms were vailable to the municipal authorities of Osaka at home than from abroad. An important piece of domestic financing is the forthcoming issue of $40,000,000 Chicage, Rock Island & Pacific 415 per cent bonds to be se- cured by the Rock Island refunding 4s. It is expected that these will be brought out on about a 4.90 basis. The refunding 4s have recently ad- vanced above 95, where they also vield 4.80 per cent and are regarded as one of the choice moderately short- term issues in the market. Shading in High-Grade Rails. There was some shading of prices today in the high-grade rails, es- pecially the new 412 per cent issues that have recently been selling at a premium over par. Among specu- lative rails Missouri-Kansas-Texas adjustment 5s, New Haven 6s and 4 per cent debentures, Delaware & Hudson convertible 5s, Erie 5s and the Seaboards were prominent. An active movement in J. Kayser 5%s to about 103 furnished the main interest in the industrial department of_ the market. Norwegian 5%s and 6s, Denmark 6s, Chile 6s and Chile Mortgage Bank 63%s, Italian municipals and Argen- tine 6s were all strong. The French group was irregular following yes- terday’s advance in most of them to the highest on record. The same was true of the Belgian issues. United States Governments were steady. R IEES Washington Stock Exchange SALES. Bart 6%5—$2.000 at 06 R o 208 S0 325, Barber & Ross com~—25 at 37 : AFTER CALL. Elec. pfd. 5%93—10 at 101%. 10'at 10077 at 101% 3 at 40 at ’ 101%. District_Nat Wash C B nid.—7 at Amer. Séc. & Tr. Co—10 at 448,10 at 44815, 5 at 450. Money—Call loans. 5 ard 6 per cent. BONDS. Bid and Asked Prices. PUBLIC UTILITY. Bia. 1% at 4i7%, 10 A Gaor. n Potomac Potomac Potomac Ele: Wash. Alex & Wash, Alex, & [ Mt.. Vers ME V. s Hs A Gas Gs serics B. . Rw c. 4s ‘Wash. Rwy. & Elec. gen. MISCELLA Barber & Ross. Inc. 6 Chestnut Farms Dairy Chevy Chase Club D. C. Paper M Pot. Joint Stocl () e R arker 50 1048, araman Park Hotel 5138 STOCKS. PUBLIC UTILITY. Tel. & Telza & e : 2 igin i 300 1 Di | Farmers & " Mec o Federal-American rt: RES .. . Second LT National Banic of Wash! TRUST COMPA ngs & Trust. . & “Trust Sast Washil Potomad v Mtze. & Ty sles Drig Stores pid Modical Bide s dward & Lothrop bld “Ex dividend pece o NEW YORK PRODUCE. W YORK, August 24 (Special). ot 24 heads of the big Bos- uce peddled out principally In a few instances extra y reached 1.00, while some in- ferior sold down to Green peas from ) |in bushel baskets sold mainly at .00a2.50, occasionally 2.75a3.00, while ordinary and poor ranged from 75a 1.50. Colorado peas, packed in crates of approximately 4 pounds | changed hands at 3.50a5.50, mostly ison County Some extra £ 75a4.00, and off grade sold from 1 2.00 | State celery in the rough, packed lin two-third crates, wholesaled at 1.50a2.50, . August 24.—More in-| Lib3%s... Sales Lib2d 4%s Lib3d 4Y%s. US4s1044. US4%ss2. 51 109 Argentine 6s Ju §9. 10 Argentine 6s Oct59 13 Argentine 63 A.. Argentine 6s B.. Belgium 7s. Belgium 7s ot. Belgium 7% Belgium 8s. Bolivia 8s Brazi) 8s. Canada 6s 1931 Canada bs 1952 Canada 5%s 1929.. Chile 7s 1943 Chile 83 1941. Con Pow Japa! Copenhagen 5%s. Cuba §%s... Czecho 8s 1951 Czecho 83 53. . . Danish Munic 8s B. Denmark 63 . DET5%s Mch 53. Dutch East | fs 47. Dutch East T 6s 62 El Salvador Finland s f 6s Framerican 7% French 7s. French T4%s French 8s. German Bl P6%s. . Greek 7s. Halt! 6s.. Hollan Italy 7s. Italy Pub Marseille 6s Mexico 4s 10 asntd. Netherlands 6s 64. Nord 834s. . Norway 5%s. Norway 6s 1943 Norway 6s 1944 Norway 6s 1952 Paris-Ly-Med 8s. Paris-Ly-Med 7. Paris Orleans 7: Poland 8s. Porto Alegre Queensland s Rio de Jan 8s 1946 Rio de Jan 8s 47 Rome 6%s... Sao Paulo 851936 Seine 7s 42 Serbs Crot Slo 8s Solssons 6; Swaeden 6s. Swiss 533 1946 Swiss Confed 8s. ‘Toho Elec Pow 7s.. Toklo 53 Utd Kingm 5% Utd Steam Corp 6s. Uruguay 8: Yokohama 6s. Sulismenns Voo folim: it s 28t —aBal w3hw .18 Am Agri Chem 734s Am Repub deb 6s. . Am Smit & R 1st 62 Am Sugar ref Am Writing Pap 6s Anaconda 1st 8 1 Anaconda cv db T AndesCop deb 7s 43 Armour&Co 4% 39 Armour Del 6%s.. 2. Associated Ol 8s Atlantic Refin 5s.. Barnsdall 681940, . Bell Tel Pa5sC.... Beth Stee! p m bs.. Beth Steel 5%3 63, Beth Steel 6s. ... Bklvn Union 5%s. . Bush T Bldg 53 60. Central Leather 6s Con Coal Md 1st 5s. Con GasN ¥ b%s. . Consumers Pow 58 Cuba Cane ov 7 Cuba Cane cv £: Cuban Am Sug 8s.. Det Edison 58 40... Dodge 6s. . East Cuba Sug 7% BmpG & F 6%3. Emplire G & F 7% Goodrich 63%s Goodyear 83 19 Hershey 6%4s. Hoe & Co 6138 Humble O & R6%s Illinots Bell 1st 6: Indiana Steel &8. Int Mer Marine 6 Int Paper s 47 Inter Paper cv Inter Paper fd Int Tel&Teleg 4%s % Kan G & E) 68 52. Laclede G 5%s62. . Licgett & Myers 53 Louisv G & E 58 52 Manat Sug sf %8s Midvale Steel 6s... 1 Mor's & Co 1st 4%s New Eng Tel 5s.. Pac Gas & B 6. Pac T & T 1st5S... Pan-Amer Pete fs. Pan-Amer Pete 7 Phila Co6%s 38. PhilaCorfésA. Phila& RAC& I 68 Plerce-Arrow 8 Public Service s P ServGas5'%s 64. Punta Alegre 7s. .. Remington Arms 6# Sinclair Ol 6s Sinclalr Oll % Sinclatr Ol 7s. " Stin Crude Ofl 6s... Southwest Bell 58, Standard Ofl N J 58 Sug East Orient 7s ‘Toledo Edn 1st 7: United Drug 6s U S Rub st rf 63 U S Steel sf 6 Ttah Pow & Lt bs. Vertlentes Sug 7s. West Elecbs...... Westinghousa 68 White Sew Mch 6s. Willys-Ov 615 33. Wilson & Co 1st fs Winchester A 7%s. Youngstn S&T fs.. Atchison adj 4s. Atchison gen 4s Atlantic C Licl 4s., Atlantio C L 1st 48, Atlan C L 4%9 64.. Atl & Dan 1st 4s 47 Brdwy & 7th Av bs Bklyn Manhat Buff R & Pitt 4% 22 Can Nat 4%830.., 2 57 1017 Libist4%s 20 1038 83 1009 84 1014 Lib 4th 4% e 200 1043 US3% 43-47 47 10029 RAILROAD._ N NEW YORK Received by Private Wirs Direct to The Star Offica. 101 103 100 11 104 ONDS o] UNITED STATES. (Sales are in $1.000.) Higt. Low Close 5 1017 R 7 1038 1007 2 1012 104 3 100 23 100 29 108 29 108 29 9% 100 100% 9% 981 2 11229 11329 11 FOREIGN. Sales. Hich. Low. Close 99% 99% 100% 109% 103% 100% 0214 96 106% 4 101% 105% 102 102 109% 9RY 4 101% 101% 102% 102% 10314 6% 1024 101% 101% 1051 <5 111% 9% 103 97 2 100% 96% 100% 100% 101% 104% 104% 8% 2% 974 95% 100% 102% 107% 107% 9974 100 100% 99% 98 91% 99% 104% 106% 101% 105% 102% 10214 109% 981 101% 102% 108 1073 1% 1054 4 103% N 10114 100% 100% 20 102% 9% 101% 102% 1024 1034% 95% 102% 112% 105 105% 9014 106 103% 100% 98% 104% MISCELLANEOUS. 102% 99y 103 104% 99% 104% 104 100% 96% 100% 100% 104% 103 100 1085 1074 £3% 108% 100% 100 103% 10315 13014 1023 101% 106 1017 89% Y64 92% 107% 103% 1% 95% 104% BT% 2% 974 08% 100% 105% 105 10714 96 105 106 15 110% 984 107 97 100 101% 95% 95% 91t 101% 100% ~ Sales. High. Low, Closs. Can Nat 4%s864... 1 97% 97% 97% Canad North 7 5 114% 114% Canad Pao ded 47 S6% Can Pac4%s846... Cent Pac 1st 68 90, ChesaCorp 5s wi Ches & Oovays.. CM&StP deb 43 cfs CM&StPgn8s.. CM&StPoy CM&SPcvbscfs 14 CM&StP6s..... Chi & NW gn 834s. Ch! & NW gen 4s.. Chl NW 415 2037, 3 Cht & NW ref bs. Chi T H inc 6s 60. . Ch! Union Sta 5s ¢4 C&WI16%s62... CCC&StLrf6sA. Clev Term bs. Clav Term 6% C&S1stdis2) Cuba RRAN...... Cuba Nor 5% scts. . Del & Hud 1st rf 48 Del & Hud cv 55 35 Del & Hud 6% Den & Rio G cn 4s. D& Rio G imp 5s. D RIn G West b3 Det United 4%a. ., Erle 1st cons 43... Erie gen 4s.. Erfe conv 4s B Erfe conv 43 D Erfe cvt bs 67 w! FlaEC5s 74 Gr Trunk stdb 6s. . Gt Nor 4%s 76 D.. Gr Nor gen 7s..... Green B & W db B. Hud & Man ref 6: Hud & Man aj 102% 105 Int Rapld Tran bs. Int Rap Tr 6s stpd.1 Int Rap Tran 6s... Int Rap Tran 7s... Int & G Nor ad 6 Int Rys C A 6i Towa Cent rf 4s.... Kan City Term 4s. Lake Shore 4s 28. . Lake Shore 4s 31. . Lehigh Val 552003 Lonis&Nash uni 48 L &N 4%s 2008... Louls & Nash Man Ry 1st 90 Market St 78 ¢0. Mich Cen deb 4s 29. Mil El Ry & L 68 61 M1l El Ry & L 63 61 M St P&SSMends MStP&SSMAs38gtd MStP & SSM 64%s MK&Toprin ilA: MEK&TE6EsC... Mo Paclifie 4 T ‘Mont Trm ref 5s 41 Nassau E Ry 48 57. 7 NYCh1&StL 5%sA. 27 NYChI&StL 6%sB. NYC&StLésA. 5 o, S 1 TN X el GamuounEat Tl Rulls Northern Pacr i 6s Ore Short L rfs Ore Wash 1st 4s Pennsyl gen 4% Pennsyl gen b Pennsy) 6s 84, Pennsy! 6 Pennsyl gold Pere Mara 1st PCC&StL5s PCC&StL 6= B 75. Port RL P 62 47. Port RL&P 7%s 46 Reading gen 4%8.. RTArk& L é%s.. St L IM&S R&G 48 StL&SFpl4sA. St L&S F pr In bs, StL &S Fadi6 StL &S Finc 6 StL&SFplésC. StT,S W con 4s 32. St P & KCShL 4%s8 San A& ArnPds -t 0. Blw—cia SBAI1 Fla 6835A ... SB All Fla 6s 36B Sou Pac 48 29. Sou Pacific clt ¢ Sou Pacific ref 4s. SouPac 41484 77.. - e - B 116% TexArk FS5%s50. 105% Third Av ref 48 60, Third Ave adj Baldronclul Bal ves Un Pac 4%s 67. Un Pac 1st ref 5 Virginia Ry 1st 68 Wabash 6%s 75, West Maryland 4 West Md 5%877. Western Paciic b Wilks-B&E1stbs 9 77 WisCengndsdéd... 1 83% SHORT-TERM SECURITIES. (Reported by J. & W. Seligman & Co.) 8 ) o B=SE Am. Tel & Tel. Co. 48 1939, American Thread Co. 68 1928 Anconda, Copver 8 120. itimore. & Ohio 6 1039 Cor. 4% 1943 ' Petetra Ry 4% Rwy Cg. 4 .wv Paul 555, 2 233IE8ZR FERETEER = 2233328 « Chi.. Mi), & St. Chi. R. I & PRy, 4% Coniinental G. & E. Cunard 8, 8. Co. By Dela. & Hud. Rw: | Erie Rwy Co. 7s 19: Gen'l Petroleum Cor. T. & R. FRENE PR T 2 2333353337823 S FERRRS 2232383233333 SRR FR R 2555200 SRR 22552255 3283 SRS e S5 FEEEE = Pac, R, United L. & P, 1. 8. Rubber 7% 525! Ersd 7 S Smelting, Wheeling Steel C. 5 FEDERAL LAND BANK BONDS. (Quoted by Alex. Brown & Sons. Closing.) 82 s it s 20 i 0 23RS 228R! 2 b SOMRALARARS] BIDBID 3383 COTTON PRICES MOVING UPWARD New High Records, Due Partly to Reports From Foreign Spinners. By the Associated Press. NEW YORK, August 24.—The buying movement responsible for re- cent advances in the cotton market was renewed today, prices making new high records for the season on all positions. Apprehensions of reduced crop estimates were stimulated by bull- ish features in the weekly weather re- port, while buying also was promoted by reports that forelgn spinners were showing increased interest in securing forward requirements. December contracts after from 21.74 to 21.46 under heav ing, advanced to 21.77, or 3 net higher and held around mid-afternoon, when the general mar- ket showed net advances of 15 to 20 points. Trading was extremely active later. After selling up to 21.74 for December, or 29 points net higher, prices eased off under heavy realizing, but offer- ings were absorbeed on reactlons of some 10 or 20 points. The market firmed up again after the publication of the weekly weather report. There was renewed realizing on the bulge and later fluctuations were irregul December sold off t point of yesterday's elosing quota- tions, but at midday was selling at 21.69, the general list showing net ad- vances of about 20 to 24 points. LIVERPOOL, August 27 (#).—Cot- ton, spot better demand, improved business; prices stead. American strict good middling, 1 good mid- dling, 11.87; strict midd . 11.52; mid dling, 11.22; strict low middling, 10.82; low middling, 10.47; strict good ordi- nary, 10.12; good ordinary, 9.67. Sales, 7,000 bales, including 5,200 American. Recaipts, 7,000 bales; American, 1,100. Futures closed steady. October, 11.16; January, 2146, or within a | ¢ SYNDICATE PLANNING ROCK ISLAND REFUND New Issue of $40,000,000 4 1-2 Per Cent Gold Bonds Proposed to Meet Railway's Obligations. By the Associated Press. NEW YORK, August 24.—As the first step in preparing to refund $126,- 472,000 bonds of the Rock Island Rail- road falling dfie in 1934, a new issue of $40,000,000 4% per cent gold bonds of the Chicago, Rock Island & Pacific will be offered tomorrow by a syndi- cate headed by Speyer & Co. at prices yet to be determined. Aside from equipment_trust certificates, this is the first Rock Island issue to be of- fered to the public in more than five years. The bonds, part of a total of $80.- 000,000 to be authorized under a trust fndenture which stockholders will be asked to approve at a special meeting October 31, will be secured until 1934 by $45.000,000 first and refunding 4 per cent bonds, which fall due in that year. In accordance with the provi- s of the loan, the company will 924 a new mortgage to se- e the present issue. The proceeds of the sale of the se- curities will be used to approxi- mately $28,862,000 of notes to be called goon, including a 6 per cent note to the Government for $7,862,000. The remainder is to be used for various general corporate purpos GERMAN BONDS AND STOCKS. 1 Leased Wire to The Star. NEW YORK, August 24.— (Quoted in dollars per million marls.) 118 nlhli ,_;\n‘xw) Gt (war In)_Bs 1914-1 00.00 75 00 gi‘;nb:lrr 4%s 1910..... 65.00 80.00 (Quoted_in dollars per thousand marks.) n Elec 4348 pre-war. 25.00 27.00 ihs 1019... 200 Berlin 4s 5. Hamb 3s. 3% b. Hamburg Ami Li North German Lioyd 41 M 48 pre-war. . Munich 4s pre-war. . . A E G (Ger Ge Elec). A E G (Ger Ge Elec) pf Commerz & Privat Bank G. Farben . ellschaft, soeee e andels . Dresdner Bank Deutsche Bank . . Darmstaedter Bank Mercur Bank Vienna. Heyden Chemical, . , Austrian A E G (Gén Elec) Commodity News CLEVELAND, August 24. — Nego- tiations are under way looking to a merger of the Ameridan Ice Co,, the largest maker and distributor in_the country, and the Cifty Ice & Fuel Co. of Cleveland. (jombined sales would total about $35,800,000 a year. The companies have 145 plants, scat- tered from Boston tw Omaha, and from Windsor, Ontario, to Florida. KANSAS CITY, Aughst 24.—More than 250 buyers from this trade ter- ritory have been in Kolnsas City in the last week arrangiyg for their holiday stock of gifts anil jewelry. NEW ORLEANS, Augist 24.—Mills of the Southern Pine Ashociation for the last week show a deciyase in new business of 8.59 per cent ) 49,349,000 feet. There were 49,682,000 feet ship- ped and 47,942,000 feet privduced. To- tal unfilled orders amount jto 171,563, 000 feet. A brain is only as strowg as its weakest think. New Bond Issues NEW YORK, August 24 (Special).— Public offering is being made by a banking group headed by J. P. Mor- gan & Co. of the $40,000,000 Common- wealth of Australia external loan of 1927, 30-year 5 per cent gold bonds, maturing September 1, 1957. The bonds are priced at 98 to yield over 514 per cent. The bankers reported the issue had been oversubscribed and the books closed. A syndicate made up of Speyer & Co., National City Co. and J. & W. Seligman & Co. has purchased, sub- ject to the Interstate Commerce Com- mission’s approval and ratification by stockhollers, an Issue of $40.000,000 Chicago, Rock Island & Pacific Rail- way secured 415 per cent bonds, series “A,” maturing September 1, 1952, The award of $1,500,000 City of Bos- ton temporary loan, payable October 7, 1927, to the Old Colony Corporation at 3.40 per cent plus $90 premium, has been made by the city treasurer BOS ' RESIDENCES, December, 11. 11.29; March, 11.34; May, 11.36; July, 11.28. i s R 7 The Dixie Gas & Utilitles Co. has obtained franchises to supply natural gas for domestic and industrial uses in Orange, Rusk, Jacksonville, Nacog- doches, Timpson, Crockett and Living- ston, Tex. Laying of mains will be started soon. As subscriptions have been received in exci CALL MONEY RATES. NEW YORK, August 24 (#).—Call money steady; all loans 3%; closing bid 315; time loans steady; mixed col- lateral, 60-90 day, 3%ad4; 4-6 month, 4'4a4%; prime mercantile paper, 3% a4. - this advertisement appears MAIN 9300 PROMPT LOANS MADE} ON REAL ESTATE LPS BY $ M0 PHE 1§OUNDED 1907 REPRESENTING g Life Insurance Company v INTEREST .._)1/2 PER CENT BUSINESS P‘ROPER'R‘IES IN DISTRICT OF COLUMBIA AND NEARBY MONTOMERY CO., MD. APARTMENTS. 1417 K ST. only as a matter of record. $40,000,000 Commonwealth of Australia EXTERNAL LOAN OF 1927 THIRTY-YEAR 5% GOLD BONDS Dated September 1, 1927 September 1, 1952, at 102% and accrued interest; on or after September 1, Interest payable March 1 and September 1 NOT REDEEMABLE PRIOR TO SEPTEMBER 1, 1947 Redeemable, at the option of the Commonuwealth, as @ whole or in part, upon 60 days' notice, on any interest payment date, as follows: on or after September 1, 1947, ands prior to at 100% and accrued interest. Coupon Bonds in denomination of $1,000. of the amount of bonds offered, \ 1 Due [Scprember 1, 1957 L1952, Principal and interest payable in New York City, either at the office of J. P. Morgan & Co., or at The National City Bank of New York, in gold coin of the United States of Ameris of the present standard of weight and fineness, without deduction for any Australian twxes, present or future. The following statement has been made on behalf of the Commonwealth of dustiralia by its Commissioner in the United States of America, Sir Hugh R. Denison, K. B. E.: GENERAL enjoy the highest credit and constitute a legal investment for Trustees in Great Britain. This Loan is issued by the Commonuwealth of Australia as a central borrower on behalf pf itself PURPOSE OF 1SSUE and the States of Australia. The Commonuwealth of Australia is an integral part of the British Empire and comparable in importance with the Dominion of Canada. Loans of the Commonuwealth issued int.London The proceeds of the Loan will be used for developmental and productive public works and for the payment of maturing debt. SINKING FUND The Commonuwealth has established a Sinking Fund for its public debt under the Nhtional Debt Sinking Fund Acts, which provide that, during a fifty-year ments from revenue to the Sinking Fund must be made at the rate of not less than riod beginning in 1924, pay- % per annum of the aswount of the Commonuwealth loans outstanding in 1923 and loans subsequently issued, except those raised for the py rpose of making local advances which are to be repaid to the Commonuwealth and credited to the Sinking Fund. All German reparations received by the Commonuwealth and one-half of the net profits of The Commonwealth ,Bank of Australia must also be paid into the Sinking Fund. Bonds acquired for the Sinking Fund must be cancellal and sums equal to interest at 5% per annym on such bonds must be paid from revenue into the Sinking Fund (ea:cept as to bonds repurchased or redeemed out of repaid advances, out of German reparations and out of surplus ren:nue paid into the Sinking Fund). The Sinking Fund is under the administration of a National Debt Commist:ion, which applies the Sinking Fund moneys to the retirement of Commonuwealth debt by the repurchase of \ans in the open markets, by the redemption of loans prior to maturity, or by the payment thereof at maturity. In addition to the mandatory payments into the Sinking Fund, the Treasurer of the Commonuwealth , has authority to apply surplus revenue to redemption of debt, and in the four years ended June 30, 1927, uc.n:inz of surplus revenue has been so applied. The total amount applied from all sources to debt redemption in he same period of four years was $126,808,454, equivalent to an average annual rate of redemption of about 1% %. GOVERNMENT The total gross debt of the Commonuwealth as of June 30, 1927, amounted to i:m,f“J\?, DEBBT B19. Asked! Pk | $1,225,149,430 internal debt. At a recent conference of Premiers, an Agreement was entered into for adjusting the financial relationshiza between the Commonwealth and the States of Australia. This Agreement will operate for two years, before thw end of which period the people will be asked by referendum to embody the terms of the Agreement permanenti in the Federal Constitution. The Agreement contemplates that the Commonwealth shall take over the debt: of the States, the Commonuwealth to apply for a period of fifty-eight years from July 1, 1927, towards the interest on those debts, a sum equal to the total of the per capita payments in the year ended June 30, 1927, and the States to provide the balance of the interest. consisting of $402,196,472 external debt in the hands of the public; $416,440,265 debt to e British Government (to be amortized by 1956 under a funding agreement of 1921); avd by the Commonuwealth to the States There is a further provision that the Commonuwealth and the States, out of their respective revenues, shall make annual contributions t Sinking Fund, designed to extinguish the present debts of the States in a period of between fifty and sixty w:r: from the present time and all future loans within a similar period from the time of their issuance. All future borrowing for the purposes of the Commonuwealth and the States is to be arranged by the Commonuwealth, in ac In re with decisions of the Loan Council, which is representative of the Commonuwealth and of the States. t of such borrowing, Commonuwealth securities are to be issued, except where the Loan Council unani- mously decides that the securities of a State may be issued, in which case the Stat itics guaranteed by the Commonuwealth. e State securitics so issued are to be REVENUES AND The ordinary revenues of the Commonuwealth in the fiscal year ended June 30,1927, amounted to $380,405,716, and its ordinary expenditures to $367,392,466, resulting in a surplus of $13,013,250. The expenditures include $16,110,188 applied from revenue to the redemption of debt. EXPENDITURES MONETARY SYSTEM The monetary unit of Australia is the pound sterling, the gold standard having been restored on April 28, 1925, coincidently with similar action in Great Britain. The Commonweaith Bank of Australia has the sole power of note-issue and holds a gold reserve of over 45% against its out- standing notes. All figures stated in dollars in the above statement have been converted from pounds sterling at par of exchange. THE ABOVE BONDS ARE OFFERED FOR SUBSCRIPTION, SUBJECT TO ISSUE AND DELIVERY 'D, AT 98% AND ACCRUED INTEREST, TO YIELD OVER 6%, TO MATURITY. TO US 48 PLA) Subscription books will be opened at theoffice of J. P. Morgan & Co. at 10 o’clock 4. M., Wednesday, August 24, 1927, and will be closed in their discretion. applications, and also, in any case, to award a smaller amount than applied for. The right is reserved to reject any and all The amounts due on allotments will be payable at the office of J. P. Morgan & Co., in New York funds, the date of payment (on or about September 7, 1927) to be stated in the notices of allotment. Temporary Bonds or Interim Receipts will be delivered, pending the preparation and delivery of definitive Bonds. J. P. MORGAN & CO. HARRIS, FORBES & CO. \ BROWN BROTHERS & CO. New York, August 24, 1927. THE NATIONAL CITY COMPANY FIRST NATIONAL BANK, New York GUARANTY COMPANY OF NEW YORK . BANKERS TRUST COMPANY, New York LEE, HIGGINSON & CO. KIDDER, PEABODY & CO.