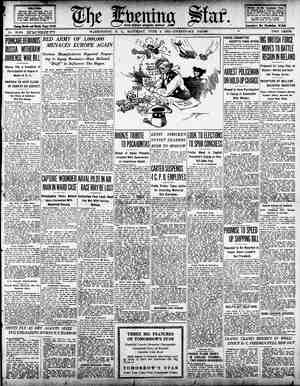

Evening Star Newspaper, June 3, 1922, Page 19

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

LOCAL WHOLESALE rmzu o Eggs—Strictly fresh, aelected, - dled, per dozen, 26; average receipts, 2; southern, 4. “ RIS ive poultry—Roosters, per Ib.. turke; pw Ib.. 25230; spring chitkens. per 1b.,'50a55; keats, youas, each, 508 60; fowls, 2. Dressed poultry—Fresh-killed wit- ter chickens, per Ib., 30a40; hens, per ‘ Ib., 30; roost per lb., 18; turkeys, Der ib, 35a40; Keats, youns, each, (0. Live ' stock—Calves; choice, : 104; medium, 9a10; thin, 5a7. Lambs, choice, per Ib., 13al4. Live hogs, per 1b., 11220, Green frujt—Apples. per bbl., 5.00a 9.00; per bu. basket, 2.00a western, 25, California oranges, 0a8.50. Lemons, per boX, 3.50a7.00. Grapefruit, per box, 6.00a 8.00. Florida oranges, 8.00a10.00. Straw- berries, southerr, ‘Sals; homegrown, Vegetables—Potatoes, old, No. 1. per 1ot 50a per sack. 3.00a3.25; r bblL. No. 1, 5.00a 6.00; No. 2, 2.002.75. Yams, 1.50a3.00. Letiuce, crate. 75al.25. Romaine lettuc 150. Cymblings, per crate, 1.00al. Onions, per crate, 2.00a2.50." Cabbag per cwt., 1.00a: Cucumbe 2. Eggplants, per_crate, 3.00 box, Florida, 2. 5a 1.50a3.00. Pepper: Kale, 5021.00. Asparagus. per doz. 3.00. Spinach, per bbl., 50a1.00. new potatoes, pe DAIRY MARKETS. BALTIMORE. June 3 (Special).— Live poultry—Spring chickens, pound, 55: medium, 50; small and white leg-: horns, 40a45; young winters, 40ai3 old hens, 26a27; small and white leg- horns, 25a old roosters, 16; ducks, 20a23; poor and thin, 18; spring ducks, 32a35: pigeons. pair. 35a40. Ezgs (loss off)—Native and nearby, firsts, dozen, 23a24; southern, 22a23. Butter — Creamery Y. pound, prints, 38a40; nearby cream- ery, 34a3n; ladles, 26a28; rolls, pound, store packed, pro; CHICAGO. May 3.—Butter—Higher; receipt packages; creamery extras, firsts, 31a34! seconds, 26a 30; standards, 3i Eggs—Stea receipts, 23,121 cases. firsts, 23a2314: ordinary firsts, 21%a 22; miscellanequs. 223%a22%; storage packed extras, 2. storage packed firsts, 24%a. NEW YORK. June 3.—Butter—Firm; receipts. 16,796 packages. higher than extras, 36%2a37; extras (92 score), 36: firsts (88 to 91 score), 33a35%: packing stock, cur- rent make, No. 2, 24a24 Eggs—Irregular; receipts, 25,217 cases. Fresh gathered, firsts, 24%a26. Cheese—Steady: receipts, 5,251 boxes. Live and dressed poultry—Quiet; prices unchanged. CARIBBEAN IS BANKRUPT. NEW YORK, June 3.—An involun- tary petition in bankruptcy was filed in federal court here against Caribbean Steamship, which operates between New York, the West Indies and South America. The petition of three credi- tors alleged that the liabilities were §717,000, ; dairy prints, ess butter, 28a29. Basking in a EHIND a Continental high brick fence is a commodious town house, cozy as a cot- tage. It’s of red brick, adjacent to homes of elegance, 3 rooms and 5 baths, but, besides, it’s an inviting, appealing home place. Its roomy porch, brick-walled and terra-cotta railed, gives southeast exposure on all floors. Smaller porches on two upper floors face the southwest. space, house telephone system, built-in bookcases. the garden, roses, rhododenrons, holly and yew! An old- worldly domicile of joyous comfort. It’s for sale. for a peep at its possibilities. 821 15th Street D @ Improvements Cement Sidewalks. Fine Graded Streets. 14 MINUTES from 12th and Pe: Alexandria Electric—the best Subu Telephone or writs WALTER 1309 H St. N.W. Creamery, | John W. Thompson & Co. Tncorporated ! ";(‘2?'#¥fij;;§\;/_j BIGREDUCTION ON 50-FT. LOTS Pure Artesian Water Under High Pressure. Modern Sewer System to Potomac River. Electric Lights on Streets. Telephone connections. 1 BRICK STATION ON PROPERTY. ' 25 Fine Houses There Now. 5 Under Construction. A Lot 50x135 Only Costs $675 . On Easy Terms, and Still Less for Cash Aurora Hills, Virgm’ia, for appointment to take biles, or come in and talk about special prices to Terms—$25 Cash Each Balance * Month Exclusive Agent Branch Office {n Property DR - GRAIN AND mvu!ont.“ BALTIMORE, June 3 (Special).— Potatoes, white, 100 pounds, 1.25a1.50. No. 2, 50a75; new potatoes, barrel. Ni 5a3.00: sweets and S Aspiyragus, .dozen, 2. .20; 4 1. :ul‘l;u Beans, bushel, 1.5012.00. Beets, hundred, 4.00a6.00. Cabbage. 1.10a1.25. Carrots, hundred, Corn, crate, 1.5024.00. Cu- rs, . basket, 1.50a2.00. plants, crate, 1.0022.50. Kale, bushel, 20a25. Lettuce, basket, 30a50. Onions, 100 3.50a5.00; No. 2, 2.50a3.00; S 1.25a2.0f spring and Op P otona Fundred.” 1004350, Peas b BY J. C. ROYLE. oulons. hundred, u- , 1.50a2.50. Peppers, crate. 1.50a ; Special Dispateh to The Btar. So0. ‘Radlohe n‘:.".fdna.s 40002200, | NEW'YORK, June 3—Business and Rhubarb, hundred, 4.0025.00. Spin-|inqustry in the United States are back e DUl . U oreae " |at normal right now in the majority Apples, packed, .50;+| of lines. But many merchants, man- ufactyrers and bBusiness men have not No. 2, 5.00a6.00; bushel, 1.75a2. apples, 2.50a4.00. Blackberries, QUATL. | 011 eq 1t because they are making their ‘comparigons with ‘abnormal 18a25. Cantaloupes, crate, 2.50a4.00. years. Manufacturers who are oper- Cherries, pound. 5a20. fruit, box. 5.00a7.00. Huckleberries. quart. ating at 70 to 80 per cent of present capacity fail to recognize that their 20a30. Oranges, box, 8.00a210.00. Peaches. bushel, 2.00a2.50. Pine ap- - output now is far jn egcess of 100 per cent acity in 1915. Moreover, 1 ples, crate, 00a25.00. Raspberries, pint, 15a18. Strawberries, quart, 10a 5 many industries are working at a pace which bids fair to exceed records 23. 'Watermelonc, each, 50a7i CHICAGO, June .3.—Wheat prices even for the hectic years of expan- sion and huge war and post-war averaged slightly lower here today during the early dealings. The local element was extremely bearish and |profits. 3 the pit element has been on . the| The retailers of the country actual- selling_side since the start. Execu-|ly are beginning to admit that busi- ness is approaching normmal. M them had cried, “Business is rotte tion_of stop loss orders under $1.17 for July was responsible for the sharp u break soon afler the opening. Sup. |so long and so hard that even after I port was lacMng, except from. shorts, | the turn came they continued to de- |and the market has been showing a |clare, "Well, that's my story, and I'm heavy undertone. going to stick to it" It is'a pretty After starting at unchanged figures | hard story to stick to now, however. to % lower. with July 1.17% to 1.18 Some Business in Sight. Cdn;e;xsus of Views and September 1.17 to 1.17%, the = market declined "rapidly, ‘the July| Both wholesale and retall mer- getting under 1.16, the lowest of the : Sh&nts are beginning to acknowleds that when over a hundred and ten week on the present downturn. Trade in corn was almost: entirely of a local character, the market in the main following wheat. After opening at unchanged figures to %& X% off July 61% to 61%, the corn market underwent a slight sag all around. Oats started % million of people have to have food, clothing and other necessities, and have the money ‘to pay for them. there Is bound to be some.business for a wide-awake merchant to do. There are jobs, and jobs at a livi lower, with July shelves are emptying faster than they can be filled on the old hand-to- mouth-buying policy many retailers have been following. As a conse- quence the retailers are coming’ into the wholesale markets more freely and with orders for future as weil as present requirements. Some of them are finding that they have postponed thefr buying too long and that they are missing sales be- cause they cannot now replenish de- pleted stocks as rapldly as they could wish. How Buying Spells Joy. This new buying by consumer and retailer is spelling better business for the producer, manufacturer and wholesaler. {DRY GOODS FAIRLY ACTIVE !utfle Change in Prices From Early Week Quotations. NEW YORK, June 3 (Special).— Some fair sized orders were in evi- dence in the.cotton goods market to- day at prices which showed little change from earlier in the week, but many traders confined their opera- tions to covering over week end. Shecetings were in fairly good demand t firm prices. Safeens were some- what higher and osnabergs were ac- tiv 3 Raw silk was somewhat less strong in conformity with the trend in the orient, but this did not stimulate buying to any large extent. —_— CHICAGO LI STOCK MARKET. CHICAGO, June 3.—(United States bureau of markets). — Cattie — Re- ceipts, 1,000 head; compared with a week ago, beef steers strong to lu cents higher; better grades beef cows and heifers steady; lower grades and canners and cutters, 25a40 lower; 35850 lower; veal calves, 25a50 {higher; stockers and feeders very scarce and mostly steady; week's ex- treme top yearlings in load lots, 9.25 {elght head strictly prime experiment- lally fed vearlings, top heav. {steers, 9.20; week’'s bulk prices beef steers, 8.10a8.75: stockers, 6.75a7.65; meaty Wisconsin feeders, 8.20a! Ibutcher she stock, 5.50a7.25; canners jand cutters, 3.25a4.35; veal calves, 9.75a10.25. Hogs—Receipts, 5500 head: opened |strong to 5 higher; on a few loads jchoice light; later the early advance lost; mostly steady to 10 lower than Friday's average on light and me- dium “weight butchers; mixed hogs | mostly steady; top, early out of line. 10.70. practically top; bulk, 10.05210.60; packing sows, 15a25 low:- er; pits steady; heavy weight, 10.25a 10.45; medium, 10.40a10.60; light, 10.60 210.65; light light, 10.25a10.60; pack- |ing sows, smooth, 9.20a9.50; packing sows, rough, $.90a9.25; killing pigs, 9.25a10.30. Sheep—Receipts, 4,500 head BANANAS ARE PLENTIFUL. BALTIMORE, June 3.—Bananas are becaming an important figure in im- ports here. With more than 100,000 bunches already received this week, the steamer Joseph J. Cuneo is due today with a cargo from Puerto Cortes, Honduras. For next week the | Bowden. to the United Fruit Company, from Jamaica. the Runa_from Cuba. to the Atlantic Fruit Company, are due Monday. The Vildfugl will arrive Tuesday from Jamaica to the Baltimore and Jamaica Trading Com- 3/ 2N AN Rose Garden | stories and basement, 19 Generous closet And in Phone us today's market minal; compared |fat and feeder lamb; 75a1.00 lower: ll: vearlings, wethers nd handy fat heavy ewes, 1.00a bulk prices desir- 13.50a15.00; shorn yearlings, 8.00a 28.00; ewes, 3.00a r lambs, 11.40a —_— NEW YORK BANK STATEMENT. NEW ' YORK, June 3.—The actual condition of the clearing house ban! and trust companies for the week hows that they hold $26.641,170 in excess of legal requirements. This is an |kncrolle of $8,017,730 from week. Already Made —_— BAR SILVER QUOTATIONS. EW YORK. June .—Forelgl:*blr N stlver, 71%; Mexican dollars, LONDON, ‘June 3.—Bar silver, 33% pence per ounce; money, 2 per cent. Discount rates—short bilis, 2 5-16 per three-nionth bills, 2%a2 7-1€ per c cent. Suburban Investment I will sell a bungalow that is rented till Sept. 1st, 1923, at $420.00 per year, rent paid cash &aflvnnee. for $4,200. $200 cash d $50 per month secures the contract. No interest charged .on balance and will allow {nter- st _on lyments until end of lease. nspection. by appoint- ment only. Excelent location in Clarendon, Va. Many other opportuniti in Virginia dwellings and vacant lots. Very easy terms. [ Address R. S. Roberts (Owner) West Falls Ch: Va. * N BUSINESS PROPERTY . Vicinity of 14th & L Sts N.W. .. Three stories, brick, apart- ment building, electy'c light, hot-water heat; can’ be eco- nomically converted; lot is "22%105 to an alley. .To Tenant Making Alterations | Thomas J. Fisher & Co... Inc.: 738 15th Street N.W. mnsylvania Avenue on Washington- rban fervice out of ‘Washington. you in our automo- home builders. Phone Main 4928 (')unhlhfly 'BUSINESS IS NEARING NORMAL . ports Shows Trade Leaclers R:usured wage or better, for all who want Jol 38%. and held close to the initial There arenot. nd mever Have {:“3 o G o and never will be, enough high-price 11 Ereyisious wers tetay, jobs for low-priced men, but. there WHEAT— Open. High Low Close |are plonty of jobs. In fact, in many Kt L17% 118 L14% Ll4% lines the compensation for those jobg # L1vi L15% 113% |is increasing rather than diminish- L19% 118" 118" |ing. -Every tithe one of those jobs is . 1% .80% <oy |filled it means a new customer for ; ‘64% 3% .63 | the retailer who can buy, and pay. 4 s 0h o« Retailer Forced to Buy. | July 38% 38 .37% .37i| These new customers have forced | Septemie: 40" 40 39" 3% |the retailer to buy, and to pay. Their 'he 10sa in | | ed to $3,946, e TDING S ACTIVE: AT STEADY PR Lessed Wire to The Star. NEW YORK, June 3.—Dealings were large on the curb exchange today, and the market was firm. Profit-taking, which is usual on Saturdays, was en- countered from the floor traders, but the offerings in most instances were ‘well absorbed. Independent Oil shares took the lead. - Mexican Seaboard was in active demand, and touched a new high record before realising sales caused a recession. A new top :uo ad- o Metibhwide Re- o e e timistic. ;i Labor troubles appear to be sub- siding. Some of the largest cotton mills of New England tied up by strikes for months will resume next week. Experts usually not unduly optimistic expect the coal strike to be settled by July. ‘The settlement of wage disputes in the shoe trade has sent between 15,000 and 20,000 men back to work this week. Bullding operations are on the iucrease despite labor troubles that have involved disorders and violence. Seldom Had Lumber producers seldom had such a dery are far above production, price are advancing and the amou coming from the woods is deemed in- sufficient to meet future demand Steel plants, the country over, are approaching capacity produetion, and n some lines. premiums are being pald for rapid delivery of certain nished products. ‘Wool shows no signs of halting in its steady advance. Cotton is firmly maintained above the 20-cent level, and the recent advances in the price of sugar have produced a flood of orders from canners and preservers Wwho fear that they have delayed their purchases too long. o Commodity Reports From Various Sections ol CHEYENNE, Wyo., June 3 (Special). —Drilling rigs, pipe and tanks are now being moved into the Ferris field Carbon county by the Producers and Refiners’ Corporation in prepara- tion for drilling six new wells in that fleld. The company has just brought in one well and now is completing severa] more. ; was made in Skelly and Marland Mexico wi Kentucky, Imperial Oil of Canada, I ternation Petroleum and Anglo-Ameri- can holding firm. Interest in New Stocks. Interest in the miscellaneous group was confined mainly to the when-lssued stocks. North American Steel was in heavy supply and broke sharply, de- spite the supporting orders which had N put into the market. Tobacco };roducu was firmer and rose a frac- tion. preferred were higher. The radio issues were _ irregular, holding steady, while radio common was heavy. Motor stocks wed only small changes. Hudson and Packard were firm, while Reo was easier. Bonds were In fair demand and steady. Freeport Texas 7s were again in demand, and reached another new high record. MOVEMENTS OF STOCKS ERRATIC, CONFLICTING NEW YORK, June 3.—Erratic and conflicting movements of prices in the financial markets this week were precipitated to a considerable extent by unexpected developments, some of which assunted international im- portance. The 10 per tent reduction in rallway freight rates, decision of the United States Supreme Court deal- ing vitally with the values of the Southern Pacific and Reading securi- ties and the granting of a one-year moratorium of financial respite to Germany were the most noteworthy happenin Call money rose to maximum quo- tations of the past three months as a result of heavy June demand: Supplies of time funds diminished, probably for the same reason, both conditions, however, being regarded as_merely temporary. High-grade rallroad and industrial stocks were sluggish and reactionary at times, in sharp contrast to the tone of the bond market, where movements were almost exactly reversed, with pronounced strength and unusual ac- tivity in liberty i 3 The investment market continued its strong trend, many new corporate offerings being oversubscribed. Among these were the Bolivian Republic loan of $24,000,000, the $17,500,000 par- and Great Northern rallway issue of $12,150,000 6 per cent by the Tennessee Electric Power Company. European exchanges were featured by a rise in British rates to the highest levels in three years. The advance w popularly associated with the Germ moratorium, from which England is expected to derive especial trade advantage: EARLY WEEK’S ADVANCES EHECKED BY U. S. REPORT EW YORK, June 3—Early week advances were checked by realizing or liquidation ineadvance of the gov- ernment’s first cotton crop report of the season. This report, placing the condition of the crop as of May 25 at 69.6 per cent of normal, compared | with 66 last year, 62.4, the low record of 1920, and 74.6, the ten-year aver- age. As private crop reports on condition {had averaged 68.2, and a canvass of w York.Cotton Exchange members had pointed to a condition 69.5, the market appeared to have been pretty well prepared for the official figures. Before they appea’ed October con- tracts, which had sold at 20.85 on Monday, had eased off to 19.96, and sold at 19.93 right after their publi- cation. It seemed, however, that there had been short selling as well as liquidation on a belief that bullish condition figures were discounted and there was covering or rebuying at the decline. Consequent rallies met scattered southern selling later in the after- | noon, which gave the market rather | an unsettled appearance, but the tone | was firm at the close of the week. Rather more favorable crop advices have been reaching the trade from the southwest during the past two or three days, but there have been more | complaints from eastern belt sec- tions owing to continued wet weather, and claims that boll weevil are nu- merous are coming from practically the entire south. Serious damage from this insect is apprehended later in the summer, and here has been talk of a surface- vooted plant suffering in the event of ! dry, hot weather, but June is usuaily a ‘month of crop improvement, and there have been reports of scattered selling this week on the expectation of better crop advices during the next few weeks. WOOL SLACKENS PACE. BOSTON, June 2.—The Commercial Bulletin's wool review says: “The pace has slackened in the wool markets of the country this week, al- though prices are everywhere maintain. ed on a firm basis as compared with a week ago. The country markets are very strong; even stronger perhaps than the eastern seal markets, with the 2lip of the entire country prob- ably close to three-quarters sold. The manufacturers have been obliged to mark up worsted s further this week, although they say they have not yet covered tae advance in raw mate- ich Seasonm. retailers have Rubber. YOUNGSTOWN, Ohio, June 3 (Spe- cial).—Republic Rubber has resumed production of tires at Youngstown vlant and is producing 1,500 tires dally at Canton plant. Sales of hose, belting and packing are also reported on the increase. Clothing. ST. LOUIS, June 3 (Speciall.—The manufacture of men's clothing is on a prosperous basis and additional s are being recorded. . The de- nd is chiefly for medium-priced ‘l"l. Seasonal goods are selling ast. . otea. SEATTLE, June 3 (Special).—Retall merchants here are sending more buyers to Germany to secure German- made goods, including sil goods, cottons, toys and and enameled kitchenware. RAIL BONDS FIRM, AT FAIR ADVANCES By Special Leased Wire to The Star. NEW YORK, June 3.—The publica- tion of Atlantic Fruit Company's plan for the readjustment of debt and capitalization caused a 5-point jump in the 7 per cent debenture bods to- day. They were only a couple of points below their high for the year. Under the ‘plan which has been sub- mitted to the stockholders the de- Posit of the debenture bonds before July 1 is called for, and according to an official of the’company. the adop- tion of the plan is a necessity. A ldeflelt for 1921 of $1.728,744 w: | ported. { In the railway sectlon of the mar- ket, the Peoria and Eastern Incomes, which had such a sharp upturn Fri {day afternoon, advanced to a new high price for 1922. The Erle Con- vertible D's gained over a point and the new international and Great Northern Adjustment 6s, which were ! floated this week, were very active at |about 541 as compared to yesterday's {low of 53%. The general railyay list was strong. especially in the speculative quarter, with some irregularity among high- grade mortgages. Greater New York traction bonds were fairly steady, the Interborough 5s crossing 69 and then dropping fractionally. Industriai issucs moved unevenly. American Sugar 6s were up about a half point, United States Steel 5s were firm around 102 and Distiller Securities went up about a point. Governments Steady. Liberty bonds were active at yester- day's closing level. United Kingdom 5%s of 1922 and 1929 reacted slightly. Czechoslovakian 8s when issued ad- varced, while Mexican 4s and 5s lost ground. Following a month or more of only moderate activity in the New York market, in Canadian provincial bonds, the volume trading fe- creased late this week and there was a greater demand for securities. Manitota 58 of 1923 were 99 bid, of- jfered at 99%; the 6s of 1930 were {100% bid, offered at 101, and the 6s of 1946 were 106% bid and 107% asked. Ontario 68 of 1923 were 100% bid and 100% asked; the 6s of 1930 were 100% bid, offered at 100%. and the 6s of 1943 were 107 bid, offered at 107% ——— WOOL TRADING LIGHTER. at Boston Eases Off. Prices Are Firm. BOSTON, June 3 (Special).—Volume Qf trading eased off slightly in the wool market here today, but prices femained as firm as ever with gains fully maintained. Buyers are still ac- tive In the west and me clips in Wyoming have sold as high as 42 cents a pound unscoured. Kentucky wools are bringing high prices, sales being -récorded around 44 to 45 cents a pound. PIERCE OIL SURFLUS CUT. NEW YORK, June 3.—A preliminary statement of Plerce Oll's annual re- port for 1921 shows a total reduction of $5,535,658 in surplus for the year. inventory account amount- 843, depreaiation and de. pletion - charges totaled $1,702, nd interest charges and rese: alled for $379,845, $6,629,355. Net operatin the year was $1,093, total deduction of year $5,5635,858. I Volume FINANCE AND TRADE NOTES. Production and sales departments of Studebaker shattered all previous rec- ords in May, according_to statement by its president. . Approximately 14, 000 fotor cars were sold, 10,853 car: were. produced and $17,000,000 wa: collected. _ Sales in May, 1921, were only 7,389 cars. Car Joading of Illinois Central in- creased 11.7 per cent in May, while Minneapolis s and St. Paul increased May copper sales, fo mestic, are estimated to have been between 200,000,000 and 210,000,000 pounds. 5 : Royal Dutch declared final divi- dend of 16 per cent for 1921 accord- ing to word from London, making a es | total of 31 per cent for that year compared_with 40 per cent for 1920. R. J. Reynolds Tobacco's regular quarterly dividends of 3 per cent on for the | common and common B stocks and 1% per oent on preferred will be payable July 1 to stock of record June 18. ‘Terms of the merger of Midvale Steel, Republic Iron and Steel and In- land Steel are being widely discussed 8 in financial circles. Announcement 12% | that negotiations are pending for 260 | acquisition _of other properties by !the new unified company probably to | be called North American Steel gave rise- to numerous rumors, affecting other steel independents. FAILURES LESS FOR MAY. NEW YORK, June 3.—Business failures ~ throughout the droj er cent to 1,803 in May, 4s _compa: April, according ';mlkin[ the FOREIGN EXCHANGE. b x e: |oheR, TR, s d-fonie o i ey T statistica. The total was 33.77 per} cent less than the -record, month of ter than January, but 25 per cent h”l record fifth 8 3 hitherto. month. Total liabilities in May are flvln at 'Gl,lllil‘li. or 33 per cent less than in 17 Sweden, demand, 21.83. 19. Spai: . r cent less than in y six X Lok Armentine. de- | times "‘?'n‘:{li-bfl‘:' 9, and 3 le- o . B0 “mrasil, Qemand, 13.57. | more than double. the toral in May demand, 991-16. 19186, e UNITE High./ Low. Liberty 3%s, 1982-47. ... 100 00 Liberty 2nd 48 192742... 9980 Liberty 1st 4%s 103247.. 9998 we Liberty 84 4%s 1925, »® Liberty 4th 43, 1083-38. 9998 9994 Victory 4%s 192223, 10060 10058 FOREIGN GOVERNMENT, STATE AND MUNICIPAL. Sales. Argentine 7s. .. ity Copenhagen 5% City of Lyon 6s. City Marssille City Riode Jan City Rio de Jan 88°47. Cazech !E:!ginn! FEELEE M LELLL FL Kingdom Belgi Rep of Bolivia 101% Republic Chile s 104% Republic Chile 8s '26 102% i U 8 of Brasil 8s. U 8 of Mexico 5s. U 8 of Mexico 4: 5 MISCELLANEOUS. Ajax Rubber 8s. Am Agri Chem 734 Am Smelting 1st 58 Am Sugar Ref 6s Am Tel & Tel cv 6s. Armour & Co 434 tlantic Fruit 7s 1sf §FasgaRfalf sefRES § & Cerro de Pasco 8s. Chile Copper 6s. Con Coal Md 1st ref 5s. EELLT $53zlisslEtaegy Cuba Cane 8 cv deb Cuban Am Sugar 8s. . Diamond Matca s ¢ Du Pont de Nem 7%: Fisk Rubber 8s. Goodyear Tire 8s°'41 Inter Agricul Corp 58 Inter Mer Marine 6: Inter Paper 1st5s B. Kayser (Julius) st 7 Kelly-Springfield 8 Lackawanna Steel Liggett & Myers 5s. Liggett & Myers 7 rillard 5s. Marland Ol temp 7 Mexican Petroleum ¥s. Midvale Steel 5 Montana Power bs §3%y :ifi'z':saggtéii Packard Motor 8 Sinclair Oil 7s. Southern Bel Tel 5s. Stand Oil Calif 7i Tobacco Prodsf 7s U 8 Rubber 1st U S Steel s f 58 Va-Car Chemical 7% ‘Western Union 6% Westinghouse 7s Wilson & Co 1st 68 Wilson & Co cv Wilson & Co cv NEW YORK CURB. In New York Curb Market. Quotations furnished by the Associated Press. My w2 INDUSTRIALS. Sales. High 12 Acme Coal . 4600 Acme Packing . 300 Ama! Leather 800 American Drug 100 Amer H § 8 . 100 Beechaut 500 Brit-Amer fob coup 100 B C ae 2000 Buddy Buds . :& Cent Teresa 8ug Co 400 Chicago Nipple 4 Cleveland Acto . 700 Columbia Emeraid. 500 Continental Motors. 600 Cuban Dom Sug. 1700 Danfels Mot . 200 Dort tor 100 Dublier C & 900 Durant Motors 300 Durant Motors I Frootenac Motor 500 Gardoer Moter . 100 Glen Alden Coal 1900 Goldwyn Pictures. 500 Goodyear Tire . 100 Goodyear Tire 200 Crant Motor . ¥ 14 o e LM & FETEFEE F BB Eon P # F EREEESEEEEE 2580 nB5TSun e SRR E SRS *® 5 L F & ) = 1% 19 i 2% % 100 Key Sol. 8% 8% 200 Libby McNeill 2 2w 300 Lincoln Motors A.." 2% Trans. .20 ] 0% % By i 50° 4T 2y 21 185 183 16 1 83 gt o 12 4 * ‘ o2 FEEREER FRE TEEF * B R F31 §B e SR B e » 100 United ar. 500 United Retail Candy. 800 Wayne Coal .. 200 Willys Corp 1st ...;;‘a's...:sn.m's.s':z'azaw:: 18 18 STANDARD OILS: 10700 Anglo-American Oil 25~ 24 (R i 7l R 1114 15 Buckeye Pipe Line. 97 97 55 © 5 214 30 O} P 60 7400 81 4300 85 25 Vacuum Ol «..... INDEPENDENT OILS. 4 160 13400 Boston Wyoming . 200 Best Con O 30200 Bkell 9000 Bou 100 nsi YoanON'DS muoll Received by Private Wire Direct to The Star Office. D STATES WAR BONDS. High. Low. Closs. ~ @mREEE, NONEY FLURRY 5 BUT TENPORAR) RAILROADS. m 8 ¥ = Due to Tax Payments—Pro motion After Long Service:~ Joins the Assoclation, | agziegish o 3 31 aaangg w EERnOve i to the most g ! May is the month of tax paymenty and natura! back to th - 2993 e the er. but within a fe nks needed by city try unty and state official More than this with June 15 coma the second’ iastaliment on the 192 income taxes and much preparatio 15 _being made for this. That there is anything more thai & temporary stiffening of the mone] market is next to impossible, ai bankers are at @ loss to place thek surplus cash to advantage even to day, and the 313 per cent offer o six months' Treasury certificate brought tenders for twice the amoun desired. The combined reserve eral reserve banks stan cent, as compared with 77.5 per c& & week ago, and 7.4 per cent, a yew ago. . i z §aBE =ejEREGRRig=sfafeyafisasy e EIPINTRTEF I §3°59rsyBilsesiztaipeijeggezyenryy i S e e o Mo Pacific 6s. . N O Tex & Mex inc 58. §pasgefalparapegtiiegeintafgatfoszagnsanatognyeyly “§‘§§§"!ii§§2§3’Hfi;}i?i;iiififi‘fli!“‘3"2"#'!!5‘%55'!3 New Haven cv deb 6s. N Y West & Bos 4 %8 Norfolk & West cv Northern Pacific 3s North Pac ref imp é: Nor Pac-Gt Nor jt 613s. . Ore Short L con 58 46. ... Ore-Wash 1st ref 4s. Oficers Elected. Potomac Savings Bank o Georgetown announces the electio 61% | of W. Edmund Freeman and C. Wen 106 [del Shoemaker as assistant cashien 106% | of that institution 101% | Both of the officials have been witl Pt the institution for fifteen years, Mr Freeman as paying teller and Mr. Shoe maker g8 note teller, so that the eivt service of the highest order h: followed in making the promotione. Joins Bankers’ Association. The International Bank, ‘with head quarters in the Southern building, a1 investment banking corporation. e been admitted to membership in The following officers and director goyeifegage § District Bankers' Association. § 615 have been designated (o represent thi s 2% | bank at the aunual convention of tht association at Hot Springs a 4 905 | hence. pine i 9% 6% | John R. Waller, presiden: ook & (L Symonds, vice presiden 99% | B. Lawler, secreta Austin C. Wal. Tome s |ler. treasurer, and J. A. M. Adair, di % | Union Pacific 1st N The International Bank was organ. ized in 1820 by a number of bankeri 2nd business men caled to Washing: ton during the war from all parts of the country. It is said to be one of the strongest of the state institutiony here and controls several financial in- stitutions in the west, as well as be. Wabash 1st 5s. % 64l 0% IRELARAR Y NEW . XORK e A s custa ol P o e well, Leffler & Lowe, stock brokers (From Xational Cits Rark Cirealsr) dre flsica st 8200000 and assets at thore are” o "larye” Suppites. being {consumption until it has been con: | the world depending upon’ full cropt tary petition in h-:kruntcvx:"‘usemfl_ {ington banking affairs. 106% | in federal court here agal Business Review. d members of the New York Con-{ In the case of foodstuffs and j- lidated Stock Exchange. Liabilities |leading raw materials of industrs carried over, unless we except corn which does not enter readily inte 9 T verted into meat. Thre grains chiefly used for bread are closely used ug 300 Venes Pet. . jeach year. In tte chief materials o clothing, wool and cotton, the ca: over which has existed since the waT- has been reduced in an important de. L. |Bree during the past vear. Thést 15% | conditions give an assurance of a de- gree of stability in the principal ag- ricultural staples which has not beex felt since the fail of 1920, The state of ease that has devel oped in the money market, as eyi- denced by the liquidation of the fed- eral reserve banks, the ready absomp- tion of investment securities and the rise of the bond and stock markeu is a condition favorable to businéss expansion. It does not follow, how. ever, because a Substantial revival from the extreme state of depression ot esebs & Lo e Bugrs 8RR B Y n RBu 2 BERE . 1 1 | has taken place, that we shall have ES uninterrupted or rapid recovery e o full activity in =il lines. A readjust- 43 i ‘16 ment of industrial relations is undet 14| 14000 Harmill Divide Mia 10 s | way and has produced the improve. },5’ 100 Hecla llnmc- 13 {ment in sight, but complete read- justment has not been accomplished either in our international or our do- mestic relations. Foreign Trade Better. : Forelgn trade is better. The South American countries which pfo- duce raw materials and foodstuffs sre finding better markets., working off o LT T i RV R IR TR : the surplus stocks of merchandise 4 5% | 2300 Ray Hebeuics Mines % | which have embarrassed them. ahd o 3™ |1 3000 Rex Comeolidated.. .11 ° .10 ° .11 | beginning to buy again in substantial 100 Bheldon 1% 1% 1% lamounts. Conditions in Asia are im- == 10% | 14000 Silver Ho 08 48 98 |proving. the price of silver—above 7t =2 | e N eid . 3% ‘tm 3y |cents—is 10 cents or more above the (I 4| 0 e A ioiar. 00" .ox" 087 |low point, and is helpful to trade f 1852 | 7000 Buperstition Lot 07 |with Asia. The foreign exchange: 1§ 1% | 700 Tonopah Betmont.. ‘it 14 {are stronger, which means a more = iy | 10000 Tonopah Cash Boy. .07 07 | favorable condition for foreign buy- &% 1945 % Tom-: gi;(dv; fl,’,‘ ers in this market. = ’fi;‘ 700 ;mn Ifn.ln“: 17y Improvement Not Uniform. . | “# 31, | 12000 Topopah N Star... .00 The revival indicated above n S 24 l% ;n‘;‘nuuhng and D g urally ras affected all lines to some e BB ] 00 ity e e extent, but the improvement is mot |Tg %3 4 3000 Unitd Bastern 14 uniform. Retail trade the COUNUIy ms “20% | 200 Un Verde Extension 30% over is not back in full proportions =% 4% | 2000 Volcano . and the industries ministering to the = 20 500 West End Cons.... 15 common needs of the population are . 0 2% | 2000 White Caps Mining .10 still under normal activity. This i1 ‘3= BT e S RS true of clothing, dress goods and 'Zm shoes, although these are picking up. |& BIE| 6 Altied Packer se.... 98y Tho tanning industry etill complains |35 1% 3 Am T and T 6s 1922 1008 of narrow margins, hides having . 07 Anaconds Cou 7s. '29 1081, vanced more than leather. The slow &% 5, s consumption of staples reflects econ- =% g 03 omy in personal expenditures, espe. |#% 1% cially In the agricultural dist Fol 18 where ttere is pinching to pa. an ever, continue sxic—d od showing, the figures for — 9% | as compared with 751,186 in the cor 91% | responding week last year, and 843.- 145 in the corresponding weck (! FEF . Fr R EHT R gosaaze =8 o § H P if ‘estern Elec 7s.... 107% FOREIGN ‘BONDS. Bans 5 u-Beanswuneuattzil 726 or Biberreids 5a. n; ’ga lberfeide 5a. 6 4% 84 § il X 50 U “ 4 “«U W 9% Bl ™ o =. » -.883 28 8 BT w05 s NEW_ YORK, June 3. —American Steel Foundries report for quarter jed March 31 shows a surplus of and federal taxes, equivalent after allowing~for preferred dividends to share (par value $331- 000 common stock. Surplus 1 rch, 1921, quarter was $518.28¢ hare on common. Cur- | drowned in are in excess of divi-|alligator upset the from dend rulll:nm ‘while bhe was fishing, according to 8, which averaged about 50 per cent in ts received here. tioln't.u“rfir, are about 75 per r%uuu was used to kh'u il..*z.u; tifi 8. % -