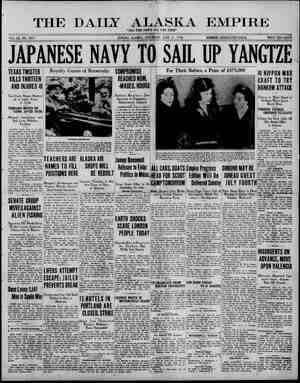

The Daily Alaska empire Newspaper, June 11, 1938, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

" FA BUILDING HERE BETTERS . 100 THOUSAND 28 Modemrizarlrion and 14 New-Building Loans A:e Made by Two Firms That residents of Ga ea Channel and the surrounding se tions of Northern Southeast Alaska have awakened to their oppor- tunities to secure the livin ditions' they have long dieca evidenced by the number amount in which Federal Hoi Administration home buildaing ani property improvement loans have: been completed since the pitiing into effect of the revised FIA Loan Plan Figures on FHA loans for mod- ernization under the amended Title I, completed by his firm so far this year were made public here this morning by T. A. Morgan, head of the Columbia Lumber Com- pany of Alaska, authorized FHA lending institution. Mr. Morgan also announced the number and amount of loans for new home building completed here this year under Title II of the FHA Pro- gram, by the Alaska Federal Sav- ings and Loan Association of Ju- neau, of which company he is likewise president. Mr. Morgan stated that his com- pany has made 28 loans for mod- ernization, totalling $21,366.38 in improvements. There are now pend- ing three other modernization loans aggregating $4,400 which are ex- pected soon to be completed. Loans for new building under Title II, completed by the Alaska Feedral Savings and Loan number 14, and total $89,900 in amount of money being spent, according to Mr. Morgan, Total loans completed in both classes amounts to. $112,- 166.38. FHA ISSUES NEW HAND BOOK FOR HOUSE SURVEYS Suggested Procedure Will Standardize Data on Vacancy-Occupancy The Federal Housing Administra- tion has prepared and now has available a handbook giving sug- gested procedure for making local residential occupancy-vacancy sur- veys. The purpose of the handbook is to enable interested groups to gather and compile comprehensive, accurate data bearing on the sup- ply and demand for housing within their city and its suburbs. Special stress is laid upon classifying by rumber of rooms in vacant dwell- ings and apartments and by well- defined districts. information developed by such survs will be, Federal Hous- ing Administration officials believe, of material assistance in the crea- tion and maintenance of a sound mortgage market. A number of cities have made cccupancy-vacancy surveys in past years, but a need has developed for greater. uniformity in the type of data. Use of Data Locally the information garnered from a residential occupancy- cancy survey is of direct benef: and immediate value to builders and to financial institutions in judg- ing the market for various types of new homes, as well as to present and prospective home owners, pub- lic utilities, and local governments. Brjad sponsorship is recom- mended by the FHA. Participation in annual or semi-annual surveys affords a means of acquainting per- sons in the following groups of the importance of bringing about great- er stability in the home real estate market: 1. Real estate and build- ing groups, including operative builders, building contractors, and subcontractors. 2. Lumber and building-supply dealers. 3. Archi- tects and engineers. 4. Public-util- ity companies or organizations, whether privately owned or pub- licly owned; transportation, elec- tricity, gas, telephone, water, and sewers. 5. Mortgage-lending finan- cial institutions. 6. Newspapers. 7. The chamber of commerce, serv- ice clubs, women’s clubs, and other civic organizations. 8. Property holders and home owners generally. 9. City governments, including the local housing authority. The suggested form for local surveys, which was prepared by the FHA Division of Economics and Statisties with assistance from a number of other Government or- ganizations, is available on request to any interested civic groupd or city governmental agencies. It con- tains suggestions as to'how the sur- vey may be set up, administered, and financed and how the information obtained may be presented to be most useful and readily understood. - | Hiram Walker's DeLuxe Rye or| Bourbon whiskies are Bottled-in- | Bond and are 7 Years Old. Available | at popular prices. Ask your dealer!! ndv.' Aromatic, Cedar Clothes Gloset Valuable, Home High up on the list of unwel- comed summer visitors is the moth No matter how well screened or how careful people are about not leaving unprotected door oven these pests seem to be able to come in, make themselves at home, and sit down to a nice meal of blue THE DAILY ALASKA EMPIRE, SATURDAY, JUNE 11, 1938. 5€ . fur coat, or wool blanket. A fine protection against these possible ravages of moths is a prop- erly constructed cedar closet, where winter blankets, furs, and clothing may be stored. ax The entire surface of the closet, including the inside of the door should be covered with three- eighths-inch aromatic cedar lining 1t is preferable to line the floor with thirteen-sixteenths-inch, but three: hths-inch can be used. The door should be tight fitting and close against felt gaskets. The lining may be placed directly over plaster if care is exercised to nail it to the studding. Face nailing is suggested, but blind nailing may | erning the eligibility of improve-|tary regulations which treat with be used if de d. The corners should be fitted with quarter-round cedar moulding. Ce- dar shelving may also be used with The more aromatic added effect | wood employed the better the check A further precau- any moths to thoroughly article before stor Funds to build a cedar closet m be oblained under the Property Im provement Credit Plan of the Fed- eral Housing Administration. tion clean SUPPLEME SN FOR NHA TITLE 1 regulations Supplementa gov- 0 | | ments to property financed under air-conditioning systems fences, struction is strong enough to carry the Federal Housing Administra-| equipment and appliances, kitchen the additional weight | tion’s Property Improvement Credit| cabinets, screens, shutters, and new Funds with which to finance roof- Plan have been released to further and nonresidential structures. ing may be obtained from private explain the general statement of - financial institutions operating under | policy included in the eligibility NEW ROOFING AP the Property Improvement Credit booklet published several months PLACED OVER WORN § Plan of the Federal Housing Admin- ago. istration The regulations govern the re- stored property improvement credit | plan which became operative Feb- | ruary 4, following the signing of | amendments to the National Hous- ing Act by President Roosevelt. | All private financial institutions approved by the Federal Housing Administration to make insured | loans e received supplemen- - o SMALL HOME INTERIOR BEAUTIFIED BY PAPER When a wood shingle roof needs replacement both time and labor can be saved by puiting down the new roofing over the worn shingles. By so doing stiffness and heat resistance are incre: and dirt inside and outside the house, usu- ly to be encountered during a reroofing job, avoided Repiacement materials can be of any type provided the roof con- of small homes lend themselves to effective decorative schemes by means of wallpapers. As a substitute for draperies, a dec- prator can use strips of paper in appropriate patterns In a room with dormer windows. Interiors 5 right up to th the effect d papering walls ceiling line gives greater height. Funds for the purpose of r papering a house can be obtaind under the Property Improvemes Credit Plan of FHA. e So far as known, the first office for the general public wi established in 1516 between Vien and Berlin. In 1523 England estal lished a postal system, but it wi used only for communications b tween members of the royal famil -——— Robert Sheriff's play “Journe; End” was translatea into v iu guages. You Can Secure Your FHA Loan and Be Ready to Construct-In Approximately 1 WEEK CASTLES All Share in the Benefits of FHA MODERNIZATION CREDIT Advantages to the FHA Borrower — low financing cost! long repayment term! payments suited to your means! and COTTAGES Property Improvement Loans . . . . for Home, Farm, Business Investment . . . . and New Building. New FHA legislation encourages the repair and improvement of property: Homes, farm and business buildings. may now enjoy greater home comfort on their income . . . main- tain the value of their property . . returns on their Property Improvement Loans Up to $10,000 may be made by priv- ate financial institutions approved by the Federal Housing Ad- The borrower must have an adequate income, good credit rating, and own the property to be improved (or hold a lease on it running 6 months longer than the term of the ministration. loan). These loans must be used to make improvements to the property itself—not to buy or install machinery or equipment. (Logns up to $2,500 are available for new construction under certain con- ditions). investment. or pave the way for better Many families orating, a new roof, or driveway. Property Improvement Loans provide credit for extensive altera- tions: The addition of a new wing, or other remodeling. For re- pairs such as the replacement of worn floors, painting and dec- Living comfort may be in- creased by installing a modern plumbing or heating system . . . up to date wiring. tain the property value. Structural changes or Income property, as well as homes, may be modernized with an FHA-Insured Property Improvement Loan. Apartments, insti- tutions, factories, office and other business buildings may be re- habilitated to put them on a more productive basis or to main- repairs may be made. Such loans frequently pay for themselves. up to 10 years. Convenient Payments (monthly, semi-month- ly or weekly) over a period up to 5 YEARS! F HA Development Committee Property Improvement Loans Up to $2,500 Are Also Available for New Construction such as houses, garages, barns, etc. On new home construction, repayment may be budgeted over a period ‘ REPAIR NOW and Save Extra Cost Next Year