Casper Daily Tribune Newspaper, December 31, 1924, Page 7

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

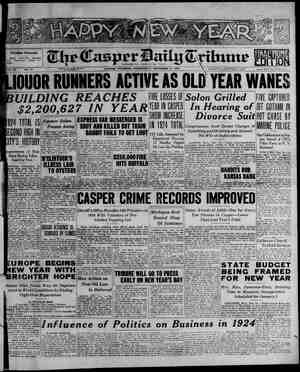

DAY, DECEMBER 31, 1924 Oil :: Finance Che Casper Dally Cridune Stocks : Bonds the prosperity ‘and the basis’ of progress, this should foretel ‘prosperity for A Polley for 1925. “Two years ago at dur summer conference at Babson Park, the late De. Steinmetz was answering ques- tions in the auditorium. Someone asked whether ho thought our pres- ent civilization was due to. follow that of Greece and Rome into decay “Whether or not our present civilization is going pleces,’- answered the Doctor, pends very largely upon your diges: It 1s much the same with the miscellaneous prophets who take the stump at this particular season of the year. Their findings depend largely upon their business" livers and their conclusions are-drawn to A great extent from the figures on their own balance sheets.” “I should feel very badly to sec any sudden spurt in general busi- ness end commodity prices similar to what has been witnessed on the On the other hand, if we will let Nature take its course and let the readjustment which completed, run course, then we can gradually enter into a period of prosperity which should last us for some time. 1925 will become’ a year of stabiliza- tion, a year when wages could be investments prices stabilized and,’ most of all, the hearts of men stabilized. There- fore, can’t we make ‘Stabilization’ the watchword for 1925? “Let us forget tho bull markets and the bear markets,” Mr. Babson. CURRENT SITUATION AND PROSPECTS FOR NEW YEAR OUTLINED Difficulties of Last Twelve Months and Im- provements Effected Summarized in Forecasting Future. BABSON PARK, Mass., Dec. 31. —Roger W. Babson, the statistician, returning from a trip that has taken him into practically every section of importance in the United States and Canada, today summarizes his finding on the general business sit- uation and Analyzes the trends that promise to shape our fortunes for Bankers and bust- ness men, cashiers and clerks, far mers and factory workers, chants and manufacturers, will al’ find much to think about in the facta brought out by Mr. Babson's observations and studies. 1924 | Difficult Year. “No one should be discouraged if he has failed to have good business in 1924. The great bulk of business men had hard sledding," says Mr. Babson. “Of course there are some exceptions. Certain lines, such as the chain store people, public utility intereats, bakeries and dairy com- panties, seem to have had a pros- Derous year. “Considering li sections of the country and all lines of industry, 1924 has been a far less prosperous year than 1923. For many manufac- turers and merchaats the year has been one of intens disappointment. Grons business has fallen off and it has been almost impossible to reduce expenses, thus im many cases eliminating profits altogether. An analyris of the lead-, ing barometric 1924 with 1923 dinky accurately: STOCKS GLOSE (GRAINS SCORE YEAR ON wlGh) EARLY ADVANGE General Electric Leads Spurt After Slow Opening yf the heaviest days in the ot the New York Stock Ex- “Many wonder whether the bull market has culminated or whether 1925 ve seo even baa ae prices. Based experiences bull mmaruete, I believe ees ine will see higher prices in the case of many securities than was witnessed in the best days of 1924. Certainly at no time in history has the stage been better set for a con- tinuatioa of the upward movement which cas been in progress since June, 1924, and which really began in earnest with the elections. Other Possibilities “When any reader, however, bases hope for higher prices on a resem: blance of 1900, let him also remem- ber the disastrous crash that fol- lowed in May, 1901. it is very dangerous to use a part of = comparison without carrying it through to a conclusion. Although it is entirely possible that 1925 will see a great bull movement, yet !f , it will also witness drastic de- The trees never grow to Rockets go up but the sticks also come down. securities go, the more dangerous it is to fool with them. Hence, if we do have much higher stock market prices in 1925, we are likely to have @ great collapse in 1925. what statistics indicate and what the Babsonchart confirms. means that great care should be ex- ercised in the purchase of securitics from now on, and that no one should be guided by tips or rumors. All purchases should be based on care- ful study or recommendations by people in whom you have the great- ‘If you cannot afford to get expert advice, go to your local banker and ask him to help you, Otherwise, leave your money on deq Posit or invest it in life insurance, local mortgages or something you know about. “A great many people feel that money in the bank is Idle. is a great mistake. invested just the same whether it is on deposit in the bank or in The main difference ts in the bank {s being invested by people trained in the investing of money, while money that you invest yourself fs often lost owing to your lack of knowledge and experience. everybody to keep a good bank ac- count during 1925. ey into life insurance, especially I'fe annuities, and if you have plenty © a local mortgage at 6 per cent from someone whom you know. ; Stocks and bondsare not the only form of investment. is not necessary to send money to Czechoslovakia or some other dis. tant country in order to ‘invest’ it. Often the best 6 per cent investment can be oba'ned on first mortgage on some house in your neighbor- General Outlook for 1925 “As we look forward to the new year, we are confronted by two facts, one of which makes us timid and the other maxes us courageous. The fact which makes me a little timid {s the uncertainty as to Eu- ropean imports. Europe must get onto its feet, and in order to get onto its feet, {t must sell more goods. is no reason why we should not ex- Export Business Brings Price Recovery on Chicago Exchange and oblivion. NEW YORK, Dec. 31.—Spectacu- lar advances tn~spectal stocks: fea: tured the closing stock market ses- sion of the year which Uisplayed a strong undertone, was the sensational performer, soar- while Radio Copora- tion added 8 points to its recent re- Sales approxt- mated 1,500,000 shares. GRAIN MARKET— C 31.—Helped by sharp early advances in price. O night demand from Europe for rye + Was said to have been on The wheat market ap- peared to be responsive also to re ports that an ice pack which was said to have formed over a of domestic winter wheat territory was somewhat similar to pack which 12,000,000 acres in 1917. ing, which ranged from %c to 1% , with May $1.75 to $1.75%, y $1.50% to $1.61, was fol- additional gains some cases went nearly above yesterday's finish. Corn and oats sympathized with Corn opened at decline to %eo advance, and then rose to a material extent all around. In oats, the start was at ic lower to 4c higher, May 62%4c to 63%c. Later, there was a moderate general General Electric condition of ae best interests of all, no one group ing 25 points, in any one country can take an arbitrary position at the expense of others. A comparison of wage cuts and increases giyes us the following: That is to say, NEW YORK, ular jump of 11 - 31.—A spectac- points in General y high price at 308 1,000 shares fea- tured the opening of today's stock market, recgnsideration of the benoe- fits to stockholders which will accrue through segrega holdings and of new stock led to heavy buying of After extending its ad- vance to 310 the stock subsequently dropped back to 304%. ments elsewhere were Irregular. end settlement of. specula- counts continued to give an ance to trading, with stock exchange. on an initial sale ‘Commodity prices, cost of living move more or in the same direction. things have always gone together in the past and they will alwa: together in the future. ‘ Tho Investment Situation. “As a result of the decreased business in 1924 money has been idle and plentiful. is dull, money is always plentiful, and 1942 was no exception to the rule. The following figu average call rates on the New York Stock Exchange for the last five years shows very clearly what has taken place in this regard: These three Price move- When business “Let. us cease to try to artificially stimulate or artifictally Let us not try to prove this or that, but let us be content with the middle of the road, Then we shall have completed in a natural way the great readjustment period and be preparing ground for an- other periog of real prosperity.” Bana se a tas Woolen broke two points from the without significant changes. Announcement oo LIVESTOCK Omaha Guctstions. OMAHA, Neb., Department _of Aaficituitas oes —Receipts, 23,000; mostly 10c lower; spots 15c off on lights; bulk 200 to 250 pound butchers, $10.004710.35; desirable 160 to 200 pound weights, mostly $9.00@9,50; $9.65@9.80; feeder pigs, $6.50@ 7.50; bullc of all sale: average cost Tuesday, $10.01; weight, kc back 3% and losses of a point each were recorded 8. Cast Iron Pipe Gulf Sulphur. maintained in General “which: later-snapped back Syndicate operations were resumed in “a number stocks bringing advances of a point in Fletschmann, and Foundry American Agricultural Chemical pre- American Can also Foreign exchanges were Stéady with the exception of sterling which opened about a cent lower. “Low money rates have banks to buy bonds with their sur- plus funds, and we have witnessed @ very good bond year: Yields of active bonds closed December 31, 1923, with an average of 5.39% and are closing this year about 0.4 points the nearer we get to the top the Jess opportunity there is for further ris should not be surprised in some in- stances to see even higher prices in 1925 than in 192; strugglo_and New York Stocks Last Sale. It is being Allied Chemical & Dye American Can 2 Am. Car & Fdy -------. Am. Locomotive the situation that money Smelting & Refg -. 20,000 Inc. Number of Failures —.------- Fatlure Liabilit $638,306,000 tes -+-------- Bank Clearings ~—--<---------$199,392,000,000 $197,507,000,000 Bmployment TY. State oo ‘Wage Index in Mfg. est. in N. ‘YY. State .. overshadowed other , features the forenoon With the price fluctuating one to $375,050,000 » Cattle—Receipts, 4,000; beef steers and she stock, steady to’strong at Tuesday’s average; yearlings and heavy beeves, odd lots tight weights up to $10.00; bulk feed steers and yearlings, $6.75 @9.00; bulk canners and cutters, 75@3.25; heifers, $5.00@6.50; Put more mon- . Water Works stock swiftly mounted to gain of more than 16 points over lJast night's close, many other issues on a large scale enabled the market to throw off its early irregularity, and at prices throughout Were surging upward. The closing was strong. General Electric ran off five point from the top on profit-tak'ng; but Congo- Anaconda Copper Accumulation of 238% 22 Prey .909,000° = $2,123,000,000 Atl. Coast Lino Baldwin Locomotive BH 559, 000 Bethlehem Stee! Ca‘ifornia Pet, - Canadian Pac. mostly unchanged; practical $10.00; stockers and feeders, steady; $8,070,000,000 Commodity Prices (Brad. Index) fi . ¥. Stock Exchange (Shares Traded) R. R Gross per Mils -------. Car Loadings Sheep — Receipts, . 25@75c lowe: erns, $16.00@16.75; top, $18.90; sheep, weak; ewe top, $9.50; feeder: early sales feeding = SILVER | NEW YORK, Dec. 21- poe silver, Cerro de Pasco Chandler Motor Chesapeake & Ohio -. . & Northwestern ~ bulk fed west- Pipe Preferred; per wk.) ------.- Sugar preferred, and Unfilled Steel Orders Qfonthly Pig Iron Production (Tons) --. *Bome 1924 figures estimated where totals for last few weeks are not yet available. ‘Working Conditions Have Been “Nickel Plate” lambs, $15.00@ were marked up 8 to Chie. R. I. & Pac. Chile Copper ---. Butter and Eggs Colorado Fuel. -. .“The stock market continued to work in a sidewise manner until the nominations took place in June. When it was seen the major parties selected good men, the banking interests took courage and ‘began to lay constructive pro- stams for financing large develop- The actual business, was held back until élection day. When it was found that Prest- dent Coolidge was re-elected by such a tremendous throttle was opened wide and the stock market had a tremendous volume of business. business was largely made up of orders which like a stream of water, pending the Consolidated Gas Corn Products Coaden Oil --- crucible Steel Cuba Cane Sugar, pfd Davison Chem Du Pont de Nem 1.—Butter—Un- situation has “The employment been working out the same . ‘There have been no bread lines dur- ing 1924, and wages have he'd up pretty well, but in many sections of the country there has been consid- erable unemployment. This espec!- ally bas been true in the union coal mining districts in the central wert, where more idleness has prevaticc for years. The t the shoe industry and other preanteed lines have suf- during 1924 from much idle- that both of 36% @38 gc; “Eggs—Unsettled: Offsetting this one disadvantage, ; firsts, 50@64c; ordinary firsts, we have better conditions ef the West, the South, and other agri- cultural sections. The Northwest, which has been suffering for some years, should have a distinctly better year in 1925 than it had in 1924. This will also be true of many other farming séctions of the States. The farmer is once more coming into his own, fair growing weather, 1925 should be a better year for him than 1924, As the farmer js the foundation of NEW YORK, Dec. 31.—Call money easier; high 5; dow 444; ruling rate closing bid 4%; offered at 4%; last loan 4%; call acceptances 314. 41%%c; firsts, 39@40c. SUGAR NEW YORK, Dec, 31—No changes d. Promp ship- Generel Asphalt -----. General Electric General Motors --. Gt. Northern pfd - Guilt States Steel Houston Oil ---. Hudson Motors Mindis Central loans against Time loans firm; mixed collateral 60-90 days 314@3%: prime commercial popular vote, 4-6 months 3% @ Of course, this. and, given Bo ee PARIS, Dec. 31.—(By The Assocl+ ated Press.)—The ambassadors this “With the world's market once more normal so that goods can flow back and forth as needed and in the to $7.10, while for y 12 to 17 shipments, on re- fined avas quoting $6.65. Refined futures were nominal. akc tote dit POTATOES . Mer. Marine, pfa - pereea) st $8: Invincible O0 Kelly-Springfield Kennecott Copper allied council afternoon approv- ed the text of a collective ncte to Germany regarding ment of the which was to have taken place Jan- 10 under the Versailles treaty. was decided not to publish the commumication had 31.—Potatoes, no} been delivered to the German gov- Louisville & Mack Truck - Marland /Oil - Max. Motors Mex. Seaboard Oil - Mo., Kan & Tex. Missourt Pac. pfd besa Lala Ward -. A Picture of American Business e ge led Cs Lage WASHINGTON, Dec. er investigation of the prohibition private investigators was Getermined upon today by the spe- celal senate committee, Senator Couzens, republican, Michi- 8 . shipments, 674 cars; on track, Babsonchart American Business OIk SECURITIES By Wilson Cranmer & Co. New York Central .. Norfolk & Western ~ Nor. American Northern Pacific Pacific Ol ~~~ Wyoming .. Buck Creek Pennsylvania Phila, & Rdg. Blackstone Salt Creek Anglo “American Of] Borne Serymser Central Pipe .. Consolidated Royalty... Cow Gulch 02 Chesebrough Mfg. Chegebrough pfd. Sears: Roebuck ---- Sindlair Con. -..... Sloss-Sheff. Steel Southern Pacific ~~. Southern Ry, Standard Oil, Standard Oil, N. J. -----.. Stewart Warner . . Sig. Old pfd. . Sig. New pfd. Kinney Coastal Lance Creek Royalty Marine --.. Mike Henry --. Mountain “@ Gulf .. New York Oil Indiana Pipe - National Transit New York Transit Northern Pipe of prosperity short in duration may be offset by a miid depression of long duration. On the chart these conclusions became simply a matter of comparing areas, On the Babecn- chart above, the area of prosperity “B" is exactly equalled by the area The abnormal nade up the areas Tne ine running alternately above and below present state of trade and shows our progress through suing periods of prosperity, depression and imprevement, This Babsonchart is not only val- uable as a reliable and unbiased ple- ture of the buriness conditions, but it also reflects the governing action le of action and reac- . The effect of this basic law on accepted but is parc, originated by . Babson and complied by his as- sociates, from which they study and interpret busin @ composite picture of the leading barometers of business, which in- clude such items as, New building, crops, check transactions, immigra- International Pete — Penn Mexican ‘Texas & Pac! Tobacco Products Transcont Oil - Union Pacific United Drug - , B, Cast-Iron Pips U, 8, Ind, Alcohol - U, 8, Rubber - Royalty & Producers -. Tom Bel Royalty ---- Exploration... 2. Western States of depression business which Fates (adjusted scales), failures, com- modity prices, stock prices. An index of Canadian business conditions is also included. The central line of the chart (X-Y ifMe) divides the areas equaliy above And below and growth of American the development fountry’s resources the condition of busizess ut the mo- ts exactly offset by the ensuing de- So, Penn Oil p ‘H," The great period of war and post war inflation “KY” ts being offset by the area "'G.” This readjustment Is well along in its development, as Mr. Babson points cut in the accompany- y YORK CURB CLOSING readjustment Glenrock OIL Creek Producers Creek Consolidated. 6,25 New York Om . Wabash pid. Westinghouse Elec Willys-Overland alto often misur perlods of ab+ normal and submoral business found only by multiplying the time y the intonsity of each movement. intense period indicates the 8. O. Ohio “pfd. Swan and Finch ae ~ For results try & Classified-ad, The star indicates the present po regardless of sition of business. ~ 0, ~Tadtena: : Grain :: Livestock :: All Markets AND QUOTATIONS BY LEASED V BSON HOLDS OUT BRIGHT HOPE IN ANNUAL REVIEW PAGE SEVEN. SHEEP MEN FAVORED DURING LAST YEAR Good Financial Retums Chalked Up While Cattlemen Continue to Suffer From Marked Depression. By L. .C. GRUNDELAND, (Copyright, 1924, Casper Tribune. Records for the year of 1924 un- doubtedly will show that. tho re- celpts of livestock at principal mar- kets fell somewhat short of the record breaking total of 1923 when 18,501,883 animals were sold. In- complete figures for this year place the total roughly at 0,000, Prices gener were high at the year end Tho yolumo of feeding cattle sent to the country from leading market centers this year, howed a de crease of about 25 per cent com pared with last year. The general Nquidation of th cattle during the last few months seems to indl- cate that the farmer no longer is able to “hold the bag.” When farm- ers are compelled to sell their corn in order to cover loass, they cannot and the con- un- doubtedly be felt In shortage of fat continue feeding cattle, Sequence of this situation will cattle within a short time. Year's Low Point. While May showed lUght all kinds of livestock, lower. cattle ‘dropped 30 cents below previous month. During cattle prices again dropped. steers went at $11.50. Eart period. Tho supply of August was the smallest for hut values were not able averago $9.20 at the close of the month. The cattle supply for and October continued ght, nativi ment of the latter. supply of these was light. prime yearlings going at $14.50. Supply, Near Last Year’ at 3,150,000. Prices By GEORGE C. SCHNACKEL (Copyright, 1924, Casper Tribune) clalist in cash grain. the Board of Trade history market for trading in cott fu tures. Confidence Pervaded Trade. From the start of the year a feel ing of confidence seemed to p: vade the trade in wheat. The tall end of the 1923 crop, however, proved to. be too big to insure suc- cess for thé bulls, However, the poor outlook for the. 1024 crop tend- ed to inspire enthusiasm and for the firat time in the knowledge: of the oldest grain trader the new crop fu: tures ld at a carrying chfrge over the old crop months. Early fore- casts proved misleading. The crop was favored with Ideal weather con ditions up to the time of maturity and one of the largest crops « 4 cent years was harvested. ‘The far mer, however, did not suffer be cause of this yield. He benefite y the misfortune of the grower the world over, For the first: four months of the crop year the United States export ed approximately .125,000,000 bushels of wheat and-flour, or more than twice the amount exported the same time a year ago. This represents half the surplus sald/to be avaflable from this country. High Prices for ‘Farmer. Prices for wheat were the high est wince 1920 and ‘In view of the heavy. crop production the ‘mer was in a much ter financial shape than he was a.year ago, The latest figures on crop production show over 100,000,000 bushels more than last year on ‘a smaller acre- age Corn prices also entered the rec ord-breaking~ class and in December the high points establirhed were the best in five years. ‘The crop pro duced was nearly 600,000.000 bushels less than a year ago and this was the biggest factor in the upturn. However, reduced feeding opera tions are expected to into the domestic consumption materially. There. were 102,000,000 bushels of the old crop carried over which made up for some of the “deficit in therew ‘crop, Bit ry A serious problem is the decrease in range cattle. This year's supply stood about 172,000 against 219,000 last year, and 254,000 tn 1922. With the population growing the country will have to look for other sources of supply, as the range meat will soon be of little volume. The cattle feeders’ condition will have to im- prove or the meat production of this country will not have to look to export demand disposition of the supply Record for Light Hogs. runs of values were The average price of beet the June, Best in July prices fell to the year's low point, but values gained again Inter in the cattle for the corresponding month in seven years, to hold notwithstanding the light run, and price for beef cattle was September but values continued downward. Grassy and plain westerns competed with good quality stuff to the detri- Top yearlings went to $12.90 in October, but the In De- cember the market was at the high point for choice ight animals, with In-round figures the supply of cattle for the year 1924, Is placed Thia compared with Prosperity came back to the grain trade in the year of 1924. ‘All grains and provisions were in greater de: mand than in‘any year since 1920. Bull fever ran high in the latter part of the year and this always means activity in the speculative market. Crop production compared favorabiy with bumper years and this insured prospertiy to the spe- Among the outstanding events in for the year of 1924 was tho opening of a Estimating the few last, days of the present month, the supply of hogs for the year 1924 fel! below the previous year. High prices of feed played a big part in the mar- ket. Farmers were forced to send so many light hogs to market that all records were broken for a single weeks run when 493,395 hogs ar- rived at the local ds during the first week in December. On Decem- ber 15, the largest number of hogs ever tharketed in one center in a day were errs in Chicago the total being The to pei of hogs for the year was placed at 10,200,000 Against an actual number of 10,- 460,134 during the previous year. Sheep Man Favored. With the livestock situation gen- erally unsatisfactory to cattle and hog raisers the sheep man. has the best of it. In the early fall, when the°farmer took thin lambs out for more finish, traders in the yards felt that the country feeder was due for a god financial spanking but he {s now reaping the reward for his foresight. At present choice lambs go at $16 and better, and the feeder is taking profit beyond what was looked for at the time he took the stuff out for finish. The total supply of sheep and lambs for the year will stand about 4,100,000 against an actual run of 4,097,833 last year. Top lambs went to $14.75 during the first two months of the year, and reached $17.10 in April. Values were lower again in May, but in July the mar- ket again advanced, and top lambs sold at $14. In September the trade was low, but all kinds were high at the close of the year. Grains and Provisions Score Big Comeback in to Close Year The outlo k is very encouraging for an enlarged foreign demand for American corn this year. Argentina, the biggest competitor in the export trade, has suffered a material reduc- tion in the crop promise as have most of the corn tries this year. Oats growers were hahdsomely re- ‘ded despite the fact that the crop was one of the largest on ree- produging coun- ord. The shortage in corn and the high pi prevailing for that feed stuff led to much substitution of cheaper ns und ant these oats was the leader Provision Values Up. Pr values also e visi record-breaking class F for cured hog products were so unsatis« factory and prices for feeding mate- rial > high that the producer m As conipelled to curtain his output. The effect of this re- duction in production has not be felt as yet because of the panic! marketing of hogs by producers who ia not care to take the risk of fat- tening them. Benefits of Dawes Plan. It would be remiss, in reviewing grain and provision markets for tho year, not to call attention to the benefits derived from the settlement of the reparations questions by means of the Dawes plan. The big absorption of American agricultural products can be attributed largely to this fact, Agricultural prosperity for 1925 seems a virtual certainty. Prices for grain and provisions have not as yet reached their peak, judging by the supply and demand situation ex- {ating in all grains. Ane < Big Muddy . - 16 Mule Creek - 60 Sunburst - Hamilton Dome - 60 Ferris - 1.05 Byron - 1.30 Notches - Pilot Butte ~ 5014 Lander .. - 70 Cat Creek $1.20 Lance Creek - 115 Osage . wstae 116 Grass Creek, light 1.20 Gyeybull 1.20 Torchlight - ~ 1.20 Elk Basin 1.20 Rock Creek + 2 Salt Creek ~ aA Statistics of ahirty and ible for seventy ‘Uie “defalcations “that how that young men under are te- “per cent of ue.