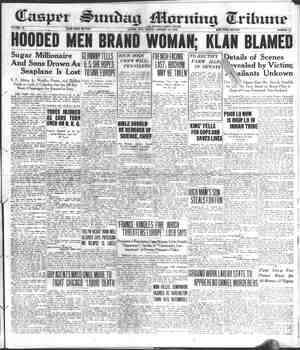

Casper Daily Tribune Newspaper, January 14, 1923, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

SUNDAY, JANUARY 14, 1923. WYOMING’S LEADING OIL, BUSINESS AND FINANCIAL DEPARTMENT BUSINESS BETTER THAN SINCE | ~ QGTOBER, 1920, BABSON ASSERTS Chart Shows Normal, as Against Minus 21 Percent Last Year and Minus 13 Percent Year Ago, Financial Expert Explains; Prosperity Can Last. WELLESLEY HILLS, Maas., Jan. 13.—Roger W. Babson today issued the following statement in which he further discusses the points that aroused ‘greatest interest in his.““Out- look for 1928” which appeared in these columns on Jan. 1. “Whatever 1923 brings forth it is starting out exceedingly well. As explained last week, ® better position than it has been since October 1920. ‘Taking all sec- tions of the country and all lings ot business, the Babsonchart {s ‘practic: ally nermal today. This compares with minus 21 per cent a year ago, and minus 13 per cent two~ years Mr. Babson. a the improvemerr has been so rapid) during the past’ few weeks that it probably cannot hold up during ithe entire year of 1923. However, most Mines of business are doing well today and we should make tho best of this opportunity. Those who are not. in Ines which are im- proving should get busy and find out why. Certainly the ultimate consum- ers of most goods are tOday in posi- tlon to &4y, in reagonable quantities. Every businessman should be doing business with them and sharing their prosperity. “The farmers are feeling better,” continued the statistician, “than they have fof som} years. The value in money of the crops just harvested is over 30 per\cent greater than the value of the. previous crop. The bank- ing situation in the farming sections is liquidating, Fatlures are running only 400 a week compared with. 500 - or 600 a year ago. My records from the mail order. houses show that De- cember has again been a record month, and that most farmers’ fami- lies had a sumptuous Christmas, This, applies not only to the grain sections of the west, but most cotton sections of the squth. Conditions in Texas are better than they have been for some time. Since the textile workers ave returned, the cotton mills are yery busy. Cotton should rémain firm until we know something about next year's crop. “The iron and steel industry is in a better conditién than it has been for thre> years, Pittsburgh had a prosperous Christmas, Most plants fare working 80 per cent of their ca pacity and the demand for this time of year for their products is excep, tionally god. Ordinarily many stee’ plants close down this, seagon, but there is little cliahee St it at present. Most railroads’ arg: ‘buying «locomoy tives, cars, rails and other track ma- terial. Building, which is usually dull this time of year, continues’ to be active, and the demand for. bricis; lumber, and hardware ia greater than ever before at this season. The de- mand} for copper is increasing and I would not be surprised to see higher prices during the next few months. ‘The coal industry continues, to boom, and so long as the present cold eather continues, there should be no Iet-up in the producing end of the in- dustry. Certain sections of — thep' country, however, which have been suffering for lack of coal should soon et plenty. Coal prices should be lower in 1923 than in 1922. “Foreign trado is holding up bet- ter than most people anticipated. Various reasons exist for this, but the principal one is the renewed in- terest which President Harding is tak- ing in foreign affairs. The state- ments last woek by Senator Borah should be beneficial to the foreign trade situation. Export business is dependent on confidence. Nothing will help so much to restore our foreign trade as a feeling that Bu- rope {s to be kept from bankruptcy. My financial friends have been very} pessimistic over the Furopean, situa- tion during the past few months. Reports which I havo received this week in regard to Europe seem brighter and more hopeful. “There is even a bright side to the labor situation as we begin the New Year. Although most employers be- Ueve that labor is too high and many feel that it is becoming inefficient, ”\ the fact remains that strikes are few r. There has not been a January for many years with so few strikes. Apparently both capital and Iabor got @ good scare during the rafiroad strike, for certainly they both lost. As a result, both sides have since counted ten before pulling off a strike or lockout. There {s r-uch talk about changing the immigration laws to re- lieve the situation. It, however, will take more than changing the quota statistically business is now in of immigrants. The fundamental dif- fieulty with the skilled labor situa- tion is that the war killed, crippled, dad shocked a great mass of workers. We complain that 1 are anxious to he. clerks lasterers, but thi real truth 4 t the physical conditions of wi workers has, Ubrough war and Other causes, so de terioreted them that only a” small proportion of the men have, today, the physical endurance to do the hard manual work. “It, therefore, will be seen that we are starting the year under very happy circumstance: ‘The Babson- chart this week registers minus 3 per cent. Our job during 1923 will not he to open the throttle wider but to hold the prosperity which we have to- Gay. This {s the task before us, To this end we must work. This means,” concluded Mr. Babson “that We must substitute service for greed, thrift for indolence, efficency for in- efficency, and an honest dest to give a dollar = service and materia) for every dollar that we get. If we do this our present good conditions could continue through 1923; but if we again get careless, business will again quickly fall off, because these better conditions cannot continue without a strong and broad founda- tion on which to build and grow.” > WHEAT MARKET. HAS WIDE RANGE “TNTOAY'S TRADE Early Hammering by Bears Effective—Rallies Made With Closing Firm « CIRICAGO; 3 Tah. 13,.+-Wheat...prices, Dolnted yintrand at the close today With Indiéations of a-revival in export demand, It was, reported that wheat, corn and rye, were included in Euro pean acceptance: ‘Wheat c'osed firm at the same as yesterday's finish to Yee higher, with May $1.19 to $1.19% and July $1.13 to $1.18%. CHICAGO, Jan. 13—With — the opening today buying lacked volume with the resulting loss of a cent or more a bushel on wheat. This drop was nlso due largely to the general selling by commies'on houses. Bear ut stress on an opinion from a lead- Ing’ authority that the world’s visible supply of wheat at the present t'me is very large and that supplies exceed requirements by a safe margin. The opening, which ranged from % to % lower, with May 1.18% to 1.18% and July 1.12% to 1.12%, was followed by further setbacks and then a slight rally. Subsequently, gossip that export business was in progress helped bring about a decided rally. Corn and oats were easter with wheat. After opening unchanged to Yee off, May 71% to 72, the corn mar- ket continued to sag. Oats started at a shade to %o de- clin May 44% @44% to 44 8-4, Addi. tional weakness ensued. Lower, quotations on hogs had a bearish effect on provisions. Later difficulty in purchasing was encountered on the part of shorts and they bid prices up rather briskly. The close was unsettled at % to 1@1%c net advance with May 78@73% to 718%e. 4 POTATOES © CHICAGO, Jan. 13.—Potatoes steady; receipts 65 cars; total United States shipments 622; Wisconsin sacked round whites 80@90c cwt.: dusties sacked 95c@$1.00 cwt.; dusties bulk $1.05@1.10 cwt.; Idaho sacked russets branded fancy $1.65. cwt.; Idaho sacked russets bakers $1.65 cwt. WEEK’S WHEAT PRICES HIGHER AS WAR POSSIBILITIES LOOM CHICAGO, Jan. 18.—A tendency to- ward higher prices has been notice able during most of the week in the wheat market, with possibilities of war in Europe being the main con- uting factor, The net advance this jorning as, compared with a week o ranged from % to 1% a bushel with corn up % to 1c and oats vary- ing from Y%e decline to %4@1% a bushel with corn up} to le and cate varying from %c decline to %#@%e gain, The week's changes in provi- ona extended from a shade off to rise of 25¢. Wheat traders appeared to be tgnor- « to a large extent the previous current view that foreign finuncial nditions indicatg# sharp curtail: | ent of Bbeddstuff buying. on the} part of Germany in particular French troops on the move| in the Ruhr, the old time opinion was acted upon that such events meant as a rule, higher prices for grain. As the week drew to a close, almost complete absence of export business in wheat had a countervailing influ- ence and profit taking sales wiped out to @ considerable degree, the gains which had preceded. It was pointed out that the present cost of a single cargo of wheat to Germany as figure’ in marks would equal the entire German national debt before the world war. On the other hand, would be speculative sellers of wheat were somewhat inclined to caution as the result of an increasing unfavor- able crop outlook for domestic winter wheat. Corn and oats sympathized with the wheat advance. Despite lower hog values, provi- ons were firmer, responding to the action of grain, New York Stocks Aled Chemical a ; Alle ‘Chalmers is hi ca nBeet Sugar American Can ae American Car & Foundry American Hide -& Leather pta American International Corp. Atl, Gulf and West Indies _. Baldwin Locomotive __... Baltimore and Ohio Bethlehem Stee] “B" Chandler Motors _ Chesapeake and Ohio = Chicago, Mil-and St, Paul Chicago, R. I. and Pac. Chino Copper Colorado Fuel an Corn Products Crucible Steel Erie Famous Players Lasky General Asphalt Goneral Electric General Motors Goodrich Go. ---- 2. Great Northern pfd. Ilinols Central Inspiration Copper International Harvester Int. Mer. Marine ptd. -. International » Paper Invineible Of. _ Kelly Springfield Tire — Kennecott Copper -. Louisvile and Nashville -. Mexican Petroleum Miam! Copper Mid¢le States O11 Midvale Steel Missour] Pacific _ New York. Central Y..NvE Norfolk and Western Northern Pacific - Oklatoma. Prod. and Ref. Pacific Oil Pan American Pennsylvania People’s Gas Pure Ol! Ray Consolidated Copper Reading” ~ Rep. Iron and’ Stee! Royal Dutch, N. Y. Sears Roebuck Sinclair Con Ofl — Southern Pacific Southern Railway Standard Ol of N. J. - Studebaker Corporation - ‘Tennessee Copper Texns ‘Co: -... Texas and Pacific - Tobacco Products | Transcontinental Ofl Unton Pacific United Retail Stores Xf, 8: Ind Alcohol United States: Rubber ; Tinited: States Steel Utah Copper: _..- Westinghouse Electric . Willys Overiane American Zinc, Lead and Sm, — Putte afasdperior < Cala .Potroleum. Montana Power - 6B Shattuck Arizona - 9% Great Northern Ore — - 31% Chicago Northwestern - 79 Consolidated Gas - - 125 Maxwell Motors B -. ~ 1634 American Linseed Oil - 32% Live Stock Prices. CHICAGO, Jan. 18.—{U. 8. Depart- ment of Agriculture.) ~ Hogs—Re- celpts 15,000; 25 to 36c-lower; bulk 140 to 175 pound averages $8.40@8.60; top 88.55; bulk 225 to 275 pound butch: ers. $7,00@8.00; packing sows mostiy around $7,25; desirable pigs $7.75@ 8.25; estimated holdover 16,000; heavy hogs $7.80@8.00; medium. $7.90@8.25; light $8.15@8.55; light. light $8.15@ 8.50; packing sows smocth $7.26 @7.65; packing sows rough $6.90@7.25; kill- ing pigs $7.75@8.25. Cattle—Recetpts 1,500; compared with week ago: beef steers, yearlings, stockers and feeders 25 to 50c higher, mostly 50c up; extreme top matured best ‘long yearlings beet cows mostly 25c up; beef heifers 50 to 750 higher; canners, cutters and veal calves large- ly steady; bulls 50 to Téc higher; week's bulk prices beef steers $8.25@ 10.25; and feeders $6.50@7.2! beet. and heifers $4.75@7.1! ners and cutters $2.90@3.65; calves $10.26@11.00. Sheep—Receipts 4,000; mostly, direct today; compared with week ago: bulk wooled lambs steady to shade lowe! clipped lambs to more; fed yearling wethers mostly steady; fat sheep 25 to 50c. lower; spots 100 lower; heavy ewes off. most; feeders strong to 10c higher; week's extreme top fat lambs $15.15 to city butchers; closing top $15.00 to packers; bulk desirable wooled kind $14.50 to $14.90; clipped lambs‘ $12.26@12.75; choice $0 pound fed yearling wethers $12.75; heavy fat ewes $5,50@6.50 mostly; ght weights up to $8.50; week's top feeding lambs $14.85. veal OMAHA, Neb., “Jan. 13—(United States Department of Agriculture.)— Hogs—Receipts 12,600; active, mostly 10@15c lower; bulk packing grades $7.25@7.50; bulk butchers 180 to 250- | pound averages $8.10@8.20; top $8.25. | Cattle—Receipts 300; compared with week ago: Beef steers, she stock and pulls 25@40c higher; veals 26@507 lower; stockers and feeders 15@25c higher; bulk beef steers $7.50@9: week's top $11; top veals $10.50; stockers and feeder top $8.10. Sheep—Recetpts 500; compared with week ago: Lambs 25@50c: low- er; yearlings and sheep 25c lower; feeders steady. ———e Oll leases, real estate, owners of Teapot townsite. Representatives wanted. Cali or write us. Teapot | Development Co., 218 Midwest Bldg.. | Casper, Wro, 18-tf | Uncle Bim has a Columbia 1-14-2t Casper Sunday Morning Cridune Oil Securiti Furnished by Taylor and Clay. Cspitol Pete -.----... ow Gulcn ~.-.. Domino E. T. Willams Kinney Coastal _ Compess rants ..-.--.-...---- 5. Gates ------.------. 10 Jupiter m= «03 Lance Creek Moyalty. 02 Mike Herry 02 Mountain & Guif — Outwest c Red Hank —18 a Picardy --—. mn OS 4 Preston 00% OL Royalty & Producers — .13% 14% Tom Bell Moyalty -- 01% 02% Western Exploration_ 2.35 Wyo-Kans. - Wyo. Tex. - Western States Yon NEW YORK CURE CLOSING Mountain Producers -$.17.12 § 17.25 Merritt 9.00 9,12 Gelnrock 1.75 2.00 Salt Creek Prds. - 21.12 21.26 Salt Creek Cons. - 11.25 11.50 Marine new 5.00 6.00 Mutus' —__ 12.87 1300 Prod. and Ref. 9.00 12.00 8. O. Indiana — 62.87 63.12 Cities Service Com. - 178.00 © 180.00 Fensland -- 16,62 16.87 New York OM — 1600 18,00 Mammoth Oll - 52.12 (62.37 LIBERTY po> 3s - -$101.08 Firet 4s - 98.62 Second 48 - 98.12 First 4%s - 98.76 Second 4% - 98.26 Third 44s - 98.82 Fourth 4%s - 98.58 Victory 4%8 - - 100.28 Crude Market Hamilton Cat Creek Mule Creek Big Muddy Sait Creek Rock Creek - Osage Lance Creck - Grass Creek - Torchitght - Sunburst. - Elk Basin Geeybull Lander SHORT SESSIO SEES RAISE | STOCK PRICES NEW YORK, Jan. 13.—During the short session of today oll shares were carried substantially higher due large ly to the anticipation of favorable div- fdend action at coming directors’ meetings. The demand embraced a vide list but was particularly effective in the. can, rubber, mo- tor, oils, food and merchan- dising shares. High priced coalers also registered some good gains, but selling appeared in a few of the cheaper rails, especially New Haven and St. Paul, preferred. Marine com- mon dropped a point and. the pre: ferred 3% to thelr lowest! prices in more than a year. Some of the ex- treme gains were Postum Cereal 7%; Chicago Pneumatic ‘Tool 4% and Texas Gulf Sulphur, Delaware and Hudson, May Department Stores and ‘American Linseed preferred all up 3 points or more. The closing war strong. Sales approximated 600,000 shares, NEW YORK, Jan. 13,—The stock market opened today with a firm tone prevailing with the demand good for specialities and unusually good buying noticeable in some of the leaders, especially Studebaker, which made a net gain of a point and Bald: win with 1% points to its credit. Postum Cereal advanced 3% points and Endicott-Johnson gained one on Speculative expectations of a 20 per cent stock dividend. Gains of a point or more also were scored by Asso- elated Oil.and Manat! Sugar. Postum Cer@al extended its gain to ix points, another new high record, and May Department Stores advanced 2%. Other shares to register gains of @ point or more were Pan-American “A” and “B", Hartmann corporation, Iron Proucts, Consoliated Gas, Loose- Wiles Biscuit, Internadonal Paper, United States Rubber, Kelly-Spring- fold and Texas Gulf Sulphur. Rails showed only fractional gains, some of the active shares being Union Pacific Canad'an Pacific and Baltimore and Ohio. _ Foreign exchanges opened SWAN UNDERRE s AT YOUR JPPLY STORE EDITED BY L. C. BAILEY: | demand or large buying. MARKET GOSSIP-AND FIELD NEWS ‘Tensleep which it is expected will be encountered within the next 50 or 75 feet and being located on the same anticlina! fieli as the Fargo well on South Casper Creek which has al- reudy penetrated 200 feet of saturated sand in its wei!, it is believed that the same horizon will be found in this well. at approximately the same depth. Judging from the formations pene- trated {s believed certain that the sand will be found.in place and if as big @ producer as the Fargo will open up one of the largest fields to produc- tion in the country as the structure covers a large area. The California Of] company of Wyo- ming which is drilling on section 2- 34.84, on land of the Evans Ot! Cor- poration, has been closed down for some time but owing to the strikes made in the Alaska well and also dye to the fact that the hole is now just above the sand, arrangements are being made for the immediate resumption of operations and the hole will be carried to completion as quick- ly as possible. Quiet at Teapot. All is reported as being quiet in the Teapot with nothing of importance having happened during the past week. Several wells ars ready to drill in but no move has been mnde toward their completion. It is expected that some of these will soon be drilled into the second Wall Creek. Preparationa are being made for two more operations in addition to those now under wi A rig is being completed on the southeast quarter of section 20-39-78, and tools are now being moved into another rig on the same quarter. Preparations are being made to cement tho hole on the southwest quarter of section 27-89-78. Consid_ erable interest is centered on the re. sults of this operation as it is near the cast side of the field and the bringing in of a good producer at that point will result in considerable drill- ing just out side the reserve line in that vicinity. Test Near Newcastle. Preparations are now being made by the Western Oil company to drill ‘a test at a point three miles south. east of) “Newenstle. | This - location adjoins the LAK ‘ranch on which oil Was encountered last year by men who wero drilling a water well at around 400 feet. The showing was not developed but it was thought that seven or eight barrels could have been taken from the hole a day. As this location in near the outcrop of a sand {tis believéd that by drilling nearer the center of the structure that commercial production. wifl be developed at’a depth of approximate- ly 800 feet. Barks Hold Big Surplus. NEW YORK, Jan. 18.—The actual condition cf clearing banks and trust companies for the week shows that they hold $5,093,640 in excess of legal requirement ‘This is an increase of $42,106,580. Dividend Expected. It {= rumored on authority that Endicott-Johnson will declare a 20 per cent common stock dividend. Pipeline Runs, Pipeline runs for the first week of the new year showed a decided slump asa result in the curtatling of runs from Salt Creek amountng to approx. mately 7,000 barrels daily, It is ex- pected that ths will soon be over: come and that the amount transport- ed will soon be back to normal. The following able shows the average daily runs from all fields in Wyoming end Montana for the weeks ended January 6 and December 30: Districts, Jan.6 Dec. 30 Salt Creek =. 86,400 93.700 Big Muddy 3,280 3,045 Lance Creek ~ 720 715 Pilot Butte 110 120 Lander -. - - 105 535 Lost Soldier - 1,050 1,150 Rock R'ver - 4,100 4,200 Grass Creek - 4.680 4,850 Hamilton Dome ---... 505 500 Elk Basin ._.. 2.000 = 1.950 Cat Creek - 7.360 6,650 Osage 1000 465 Greybu 20 Ferrla -. 2. - 500 510 Sunburst __ - - 230 685 Miscellaneous __ 500 525 112,680 119,275 Merger Being Considered. PITTSBURGH:—J. C. Trees, presi- dent Arkansas Natural Gas says pro- posed consol!dation of that company with Transcontinental Oil and Union Ofl of California ts still under con- sideration and will be until something more definite is reached. Statement Issued. Secretary of the New York Curb sued the following statement: “Owing to many buying orders for large amounts of Yellow Tax! Corpn. New York stock, company and com- mittee on listing of securities of New York Curb exchange have deemed it advisable not to deal in this stock on a when os and {f issued basis. Buying Demand Continues. NEW YORK, Jan. 13.—Dun's says; “With some extension of previous gains, business has more than held its favorable position. The holiday season has brought less than the usual slowing down to basic industries and for the first fortnight of the new year has been marked by sustained While the MORE OIL FOUND IN PINE MOUNTAIN After having drilled through ten feet of highly saturated | oil sand at 2300 feet, the Alaska Development Company yes- | terday drilled through another stray of approximately the same thickness at around 2350 feet-in its test on the south- | east quarter of section 35-35-84 in the Pine Mountain field. This test is being drilled for the purpose of proving the! price movement is irregular, with certain sellers making concession, there is well defined strength in some {important branches, as in iron, steel and textiles, The question of delivery becomes more prominent and the mat- ter of price of smaller importance in cases where the urgency of needs is disclosed, and it is reassuring that current shipments of gcods are being facilitated by the improvement in the car situation. Instances are not un- common, however, where manufac- turers being engaged for some time ahead cannot accept orders for early forwarding, despite the higher rate of production. “Weekly 182,000."" bank clearings, $7,370, Lower Surplus Expected. NEW YORK.—Annual statement of Ynited Retail’ Stores corporation duc next month should show contraction in surplus of around $1,000,000, owing chiefly to distribution’ as special divi- dend of 400,000 United Retail Candy Stores shares and sale of part of its interest in Montgomery Ward to a syndicate last August. Bullish Operations Expected. Market sentiment shows relief over European situation at this week end d bullish operations may continue special stocks. Professionals are still fighting improvement. Big Gain in National Biscult. NEW YORK.—National Biscutt year ended December 31 last, net $11,024,- 980 after taxes equal to $4.53 on com- mon. This compares with net of §! 677,461, or $13.48 on old stock previous year. Moratorium Plans Prepared. Poincare prepares new plan of two year moratorium based on French holding Ruhr and control of German finances. Reported premier seeks conference with Britain, Belgium and Italy and perhaps United States Reparations commission meeting in Paris expected to grant delay in moratorium decision until February 1 Germans Organize Company. Germans organize potash importing corporation of American here to mar ket output of German potash syndl- cate in United States, Canada and Porto Rico. Morgan Gets Bond: Syndicate headed by J. P. & Co. submits highest bid of 99.77 for 30 year $50,000,000 5% per cent Cuban bonds and award expected shortly. Business Holds Good. Dun's Review says: Business has more than held its favorable position this week and in many cases there has been extension of previous gains. Big Order by ©. & N. W. Chicago and Northwestern to order 3,000 freight cars at $7,000,000. More Failures this Week. Bradstreet's reports 550 failures tn United States this week against 445 previous week and 717 a year ago, Rubber Capitalists Coming. British capitalists representing 70 per cent of the world’s rubber produc- tion are coming to America to discuss the market situation here, especially in regard to prices. Standard Oil Stocks Anglo American 19% 19% Buckeye - 91 93 Continental 157 160 Cumberland 90 94 Galena 59 60 Iinois Pip: 167 169 Ind. Pipe 96 99 Natl. Transit —-.— 26% 17% N.Y, Transit 132-186 Northern Pipe 107-110 Orto ON - 16 78 Prairle OM - 230-233 Prairie Pipe 1100 «114 Solar Rg. ---- 1756185 Southern Pipe — 102 104 Southern Perin O11 170 «174 8, 0. aKs, -~ 42% 43% 8. 0. Ky 83 85 5. 0. feb. - 185 196 8. 0, Ohio . 300 306 Vacuum 45% 45% Butter and Eggs CHICAGO, Jan. 13.—Butter lower: creamery extras 51% @52c; standards 49%c; extra firsts 40@50%c; firsts AT@48c; weconds 45@46c. Figgs lower; receipts 6,520 cases: firsts 36%c; ordinary firsts 33@34c; miscellaneous 36 @36: NEW YORK. Jan. 13.—Butter un settled; creamery higher than extras 53% @b4c; creamery extras 53c; firsts 49% @52%4c. iggs unsettled; fresh gathered extras firsts 45@46c; ditto, firsts 42@440; Pacific coast whites extras 52@58c; ditto firsts to extra firsts 48@51c; refrigerator firsts 31@32c. Cheese firm. i eas NEW YORK, Jan.- 13.—Liberts bonds closed: 3% $101.14; first 4%e $98.86; second 4\s $98.32; third 4\%u $98.92; fourth 4%49 $98.60; victory 4%a ncalled) $100.20; U. 8. treasury 446 19.96. os Cotton. EW YORK, Jan. 13.—Spot cottor quiet; middling $27.80. | Meet mo at the Smoke House, PAGE THREE. Dom, of Can., os2% notes, 1920 -. French Hepublic, 8¢ —_ French itepublic, 748 Kingdom of Belgium, 7%s8 - Kingdom of Belgium, ¢s Kingdom of Norw U. Kof G. B. & 1, |U. K. of G. B. & 1,6 American Sugar 66 American Tei. and Tel., col. tr., 6 Armour and Co.. 4%s Baitimore and Ohio., c: | Bethlehem Steel re: Bethlehem Stoel Chi. Burl. joodyear Tire 8s, 1931 — Goodyear Tire, Se, 1941 _ Grand Trunk Ry of Can., Grant: Trunk R#, of Can.; Great Northern, $s A - Great Northern f i-3s E Mo. Kan, & Texas new adj., fissouri Pacific gen., ds — Montana Power, 5 A Northern Pacific pr. lien.. 48 Oregon Short Lino ref., 49 - 6s - Pacific Gas and Hlectric, bs kPenn. R. R., gen., be Reading Gen.. 43 Standard O1 lof Cal., deb., n Pacific First, 4s 8. Rubber, 74s S. Rubber, 69 Utah Power and Light 5s — Western Union 6% Westinghouse Electric, 109 88% 91% 111 1$8 107% NEW YORK, Jan. 13.—Few mate. rial changes were made in the stock market during the week, the situat!on of German reparations placing a re- straint on trading. Aggressive pool operations were conducted on a num ber of special shares with the result that some of them were advanced to “| new high record for over two years, Low call money rates and the vast supply of funds available for loaning purposes materially assisted specu- lators for the advance in boosting the prices for their favorites. The definite announcement that the French would invade the Ruhr caused @ flurry of speculating selling In the middle of the week but these offerings were well absorbed and the upward movement was resumed, ‘Traders generally Cerived a feeling of confi dence from the strength of the for. eign exchanges, which are widely re- garded as a fairly accurate barometer of European banking opinion on con ditions abrcad California Petroleum was one of the most popular stocks this week ed in the ten years history of the company on rumors of buying by new interests and its possible acquis! tion by another of the large com- panies. Other shares which moved into new high ground on the present bull movement were Postum Cereal Hartmann corporation, Cosden, Nast: Motors, Beechnut Packing and Owens Bottle. Reduction of 94,432 ons in he un- fied orders of the United States Steel corporation on December 31 was not whclly unexpected because De- cember is normally a dull month in the industry and consumers seldom care to add to their inventories towards the end of the year. Copper shares were inclined to weakness on the theory the French cccupation of the German industrial centers would further restrict European demand for their product, the price of which h: recently become stabilized just below 15 cents a pound. November export were published durini WOOL MARKET [o AGTIVE WITH UPWARD TREND figures. which the week, re- BOSTON, Jan. 13.—The Commercial Bulletin say: “Yhe wool market has been fairly active this weck both heré and shroud and prices have shown a strong upward tendency. Vaiuns are slightly highs: in this market on the whole. Advances or five per cent were scored in Sydney at the resumt Lon of the sales there and further ad vunces are rerorted in Souta Amer tea, Predictions are that tha Lendon sales opening January 23 will aiso show higher prices for all descrip- tions. “The goodn markets healthy condition, in spite of the higher prices asked for goods, A tendency to firmer fabrics 14 notice- eble. Little news is heard from the west except that the clip now prom isen to be a good one. “Mohair is very strong with limit are in oa «@ buying.” Wool quotations follow: Domestic; Wisconain half blood 48 @50; % blood 51@53; quarter blood 49@49%5. Scoured basis: Texas fine 12 months 1.35@1.40; fine 8 months 1.20 @1.26; fine fall 1.15@1.20. Calffor- niaNorthern 1.30@1.35; middle coun- ty 1.16@1.20; southern 95@1.00. Oregon, eastern number 1 staple 1.36@1.40; fine and from combing 1.25@1.86; eastern clothing 1.20@ ritory-fine staple cholce, 1.42@1.45; % blood combing 1.25@1.30; % blood combing 95@1.05; %% blood combing 90@93. | Pulled: Delaine 1.30@1.38; AA 1.20 | @1.30: A supers 1.15@1.20. | Mohatrs: Best combing 78@83; best carding 10@75 reaching the highest price ever record: | 1.26; valley number 1, 1.20@1.25; ter-| REPARATIONS SITUATION KEEPS STOCKS INACTIVE DURING WEEK flected the crop shortage in European and revealed possible reasons for the depreciation in some of the European exchanges. Ordinarily Euro crop requirements in the United States are filled before November, the exports for that month in 1921 being $43,000,- 000 less than the month before. Last November they increased $9,700,000 over the previous month's total and $62,400,000 over November, 1921. Shipments to France last Novem- ber were the largest of any month since January, 1921, and $12,600,000 over November, 1921, a percentage in crease of approximately 65 per cent. Heavy sales of French exchange through drafts on Paris to pay for goods purchased here undoubtedly were a contributing factor to the weakness displayed in recent weeks by French remittances, which als have been heavily sold by specultors on the unfavorable reparations develoy menta, Grman exchanges dropped so low that marks were quoted at 92-100ths of acent a 100. French exchange got down slightly below 6.70 cents, but rallied later to more than 7.00 cents Demand sterling came within a smail fract'‘on of $4.68 or almost within a cent of its recent top price Satisfactory progress of the British war debt refunding negotiations was a factor, as was the British foreign trade statement for December show ing a heavy increase in exports which was construed as indicating a revi of trade condition: Foreign Exchange NEW YORK, Jan. 13.—Foreign ex. changes easier. Quotations in cents: Great Britain demand 4.67%; cables 4.67%; 60 day bills on banks 4.65% France demand 6.94; cables 6.95. Italy demand 4.94; cables 4.94%; Belgium demand 6.33; cables 6.334 jermany demand .0095; cables .0086; Holland demand 39.60; cables 39.63; Norway demand 18.65; Sweden demand 26.89; Denmark demand 19.97; Switzerland demand 18.87; Spain demand 15.70; Greece demand 1.25; Poland demand 0049, Czecho-Slovakia demand 2.88: Argentina demand Brazil de- mand 11.62; Montreal 991%. ee SILVER LONDON, Jan. 13.—Bar silver 31%d per ounce. Money 1% per cent. Foreign bar silver 65%; . Mexican dollars 50%. Sock eS ea William de Mille, who recently re- turned to the West Cy it after spend- ing several weeks in New York in conference with his scenario writer, Clara Beranger, has started at the Lasky Studio on jrumpy,” which Mrs. Beranger pted from the stage play by Horace, Hedges and T. Migney Percyval In th cast are Theodore Roberts, May McAvoy, and Conrad Nagel featured players and also Casson Ferguson, Charles Ogle, Bertrand Johns, Bernice Frank and Fred Huntley. Uncle Bim has a Columbia 1-14-2t WAN RREAMERS “J “YOUR SUPPLY. STOR IBRIbeEPORT | Surveying aud Locations Geologists Oil Experts Oil Field Maps, Blue Prints WYOMING MAP AND BLUE PRINT CO. P. O. Box 325 Room 10, Daly Bldg.