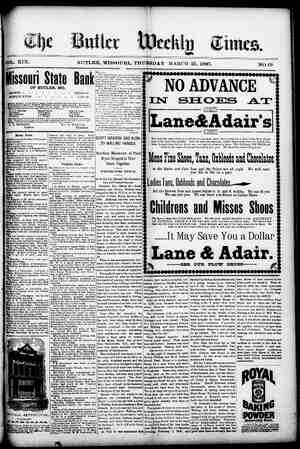

The Butler Weekly Times Newspaper, March 25, 1897, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

“apn Outline of the New Revenue Measure Be- fore Congress. fis Aim Is to Increase Reve- pues and Encourage Industries. | Committeo Aimed at a Compro- miso Between the Wilson and the McKinley Laws. Agricultural Items in Detail—Co ion Schedule Not Much Changed— The Free List. Washington, March 16#—The new tariff measure presented to the lower pranch of congress by Chairman Ding- ley, of the ways and means con jgentitled: “An act to provide revenue for the government and toencourage the jadustrics of the United States.” The date when the new tariff is to go into effect is named in the preliminary draft submitted to the house as May 1, ° 4897. The bill, as a whole, is a pro- tective measure. ‘The average rates are little, if any, below those of the McKi pill, and in some of the schedules they are slightly higher. Specific duties have been substituted, as far as possible, for ad valorem rates. It is intended to raise from $50,000,000 to $60,000,000 gore revenue under the bill than is pro- vided by existing laws under similar business conditions. When the task of preparing a new Dill was first under- taken the committee was disposed to bevery conservative and framea me we which would be in the nature of a compromise between the McKinley law and the present law. The followir outline of the various schedules i cates the general character of the me wre and the more important cha from the present law which have been made: Schedule A, dealing with chemicals, fF and paints, is far more nearly like the pres- feat law than the McKinley bill, but some important changes have been made. Blue Mitriol is taken from the free list and made ble at 2 cents per pound. Crude borax increased to 3 cents per pound, borate of to 2 cents and refined borax to 3 cents und, Copperas is taken from the ist and made dutiable at the rate of tenths of a cent per pound. The Mc- y yeie is restored on magnesia and ofl. The duties on all lead products ar treased to correspond with an increase tn the rate on lead and lead ore. Acetate of lead is made 3 cents per pound; litharge, 2 eents; nitrate of lead, 142 cents; lead and oe paint containing lead, 3’ cents per ittee, a phate of soda is taken from the free , a and restored to the McKinley rate. ur ore is taken from the free list made dutiable at 49 cents per ton. im tartar is made dutiable at 3 cents per pound. y _ Earths and Earthenware. No schedule in the bill has given the fommittee so much trouble as that relat- to earths, earthenware and glassware. orts were made to devise a satisfactory Classification to serve as a basis for spe- instead of ad valorem duties on pot- but a compromise was effected as fol- lows: f _ Bire brick, $1.25 per ton; glazed, enameled, Omamented or decorated, 20 per cent brick, 25 per cent: if glazed or dec orated in any manner, 39 per cent. Til m@eaustic, ccramic-mosaic and all tarthenware tiles for floors and walls, Yalued at not exceeding 49 cents per squar 8 cents per square foot; exce x 40 per square foot, 10 cents per square and 25 per cent. Cement, Lime and Roman, Portland and other hydran' F tment, in barrels, sacks or other pac ges, $ cents per 100 ponds, inclu Weight of barrel or package: in bulk, 7 | ents per 100 pounds: othe cent. Lime, 5 ht of barrel or package. Plaster. ined, $1.60 per ton. mice stone, wholly or partially man- ured YS ¢ facture. tured one-half cent per pound. not specially provided for in Earthenware and China. /fmmon stoneware and crucibles, ina, stone and crockery ware, including cloc » tages with or without movements, plaque ) @aments, toys, toy a a and statuettes, Mained ‘Wise decorated or ornamented in a _ ‘her, Ae cent. supera per, painted, tinte r cent. _ All other china, porcelain, parian, bisque, ware ae the is the component material of chief ainted, stained, enameled, printed, gilded Otherwise decorated or ornamented in if not ornamented p earthen, sto and crockery Manufactures thereof, or of which fame Malue, by whatever name known, if manner, 60 per cent x decorated, 55 per ce it. icles composed of earthen or mineral in any manner, nces, if not decorate cent.: if decorated, retorts each; cents gross and 15 rie lighting and. per cent. filter tubes, | Without metallic connections, 20 per cent. : AsAWware, been ‘- int increases. | fom 5 to 6 cents per t it, and not exceeding freased frem 8 to L quare foot: rates. vered plate glass and look 8 not exceeding 16x24 inches . to 12 MMabove that reduced to 88 cents. Marble and Stone. Rot: marble of all kinds and % Marble of a nds and ony dressed, ing tiles or mosaic cubes, n 4 cubic inches each, ae but in measurement no shall be computed at les ickness. rT, chalcedony, chr: %, jasper, jet, mala or rock crystal, includ: or without movem tone, granite, sandstone, Other building and monumental hufactured or un ed, 10 cer © foot. Building and except marble and onyx, dor polished, 40 per cen Chimney pieces, mantels, nili nite, clock Fre re hewn Slates u of slate, 20 per.cent. The Metal Schedule. athe metal schedule the rates of the and steel. The McKinley band iron, ete., have been tt exception that cotton tenth of one cent per ion to the duty imposed upc the iron or eel from which they instead of 2 cents. In the pres are on the free list. ion is ch to dates, bologr ory rates on hoop, root, tallow, 4, WILE hes, oranges, od in the pars haat ged a head; over + $15 | sther liv scially pro- | Vided for in th i vaippeme The duty on tin | Bar V« iets cents per pound. Ur ft ) cents, i is 11-5 cents On steel ingots, etc the present law is the suc nds 1 the duties are a compromise about half way between oe Sk conte a : 56 those of the McKinley act and the present | pads Maize 1 cents per bushel of 56 law, beginning ¥ n-twentieths of a | Pounds. ) : 4 Sere a por rt | pounds. sound or le : Macai valued above Is cents a pot Vacations Wir On iron or steel wire kn w ete., the duty is to 45 per cent., with a provi manufactured from iron or s shall pay the maximum duty on wire and 134 nt per | cents per pound additional. On anchor broken, w mill ire the rate used 0 2 sieve, one- one-half ils are re- Z stored to r bushel pentnieee flour -half of cent per pound . £5 cents per bushel There is > new ¢ rem ive lued at n | r, 6 ce 40 cents per dozen are dutiab | per pe 5 it.: all ot Cheese ents a 2 Milk, f > blades, at i having three 4 per dozen and per cent.; all having four blades or more, §: nd y per cent In ¢: year shell, 50 cent dded on knives of two blades and 75 those of more than two bla restored on ra 40 per cent. om corn, $$ per 1 carving kr d forks wit handles of pearl or ivory will pay 15 cents ar dozen and 15 hh of bone or cellulo 12 cents per doze r 15_ per cent. of iron, other metal, e lor glazed, th its per gallon. is increased f ) 40 per cent, ce er pound Nails and Other Hardwere. 49 cents per bushel. = Cut nails nged from per Suen TG Conte nee Wiehe cent. to of a cent per pound; sutsiieribisvelron au Gants e nails from 30 per cent. to 2 cents eauerscof otter sia @ noun nails from 29 per cent. to one- per pound. half, five-cighths and 1 cent a pound, ac- bral hia? ait Bae pale ves a POUT Ae shrubs and vines of all y known as nursery stock 2d valorem horseshoes fr vi le r poun for kr orem to tting or other cement, 20 per cents per 100 pounds, including ter of paris or gypsum, ground or earths, unwrought or unmanu- d, $1 per ton; wrought or manufac- this per ton; china clay or kaoline, $2 per » Common yellow and brown earthenware, 20 per porcelain, parian, bisque, earthen |, enameled, printed, gilded or other- n- if plain white and without ded ornamentation of any kind, 55 lava tips or burners, er cent.; carbons for 50 per fent.: porous pots for electric batteries, McKinley rates on glassware have restored throughout, with some im- Plate glass not exceed- mE 16x24 inches square has been increased above x30 inches square, cents. There is no in- in the larger sizes over the McKin- ng-slass square been increased to § cents per square + above that, and not exceeding 24x30 cents; above that, and not ex- ding 24x60 inches, decreased to 23 cents; Marble or onyx, in blocks, not dressed cents per cubic sawed including marble cr onyx stabs, containing ubic . tile or Manufactures of agate, ala- olite, cornelian, marble : ases s, 30 per cent. limestone per monumental slabs for Tooting state and all other manu- 1 of 69 poune machir from 25 per cent. to $1 -ents per ousand 20 per cent: all’ other Riga Cag aly snot specially cd for, from er cent ailwi re changed from 2 per cent. to one f cent a pound: rivets gricultural s: d oth- from r cent. its per pound: saw eae es pine a tee not provided for, from 25 to 40 f all kinds, cent 2 ad val Umbrella and para are clas- ae sified by number of ribs c duties prune are impose quivaler nt ad d valore valorem of 39 per c ad valorem. tailway wheels sed per pound ; sae ae ee. 1 Dun and sardines. in tin bos to 1% cents. Ant is taken from : r neias tae ca ring not more than 5 inches long, 4 ibial RSE deep, 10 cents per cent per po dt nd. nree-fourths of a : in half boxes, measuring not rr ran Silver, Brass and Copper. s inches long, 4 inches wide and Phe Mel<inles Ss are reimposed on =P, ts each: in quarter German silver, brass and copper, except ensuring not more giana meues wide and 1% inches deep, : when imported in any other “ent. ad valorem. that copper in rolled plat vents per pound instead of sheath tes will be 24 » per cent., and lich copper is the principal Motinonent lenis re eee Fish, pickled, in barrels or half barrels, ent, Molcinlen rate and instead of | and mackerel or salmon, pickled or salted, weld leaf, silver leaf and lead ore and |? cent per pound. ; fead. ‘Mica ‘is changed from 2) ver tent te |. hish, prepared for preservation, and fresh tig conte pound eagce pence Tait fish, not specially provided for in this act, ley rates are restored oa pins ‘and type | three-f 3 of 1 cent per pound; fresh metal. Chronometers are increased from | !@Ke fish, one-half cent per pound. 10 per cent, to 40, and watches and clock Becrings. “picdied or relied, .one-tele frofn 25 per cent todd) Mele eee eae gkS | cent per pound: herrings, fresh, one-fourth restored on zine. e 4 p r pound. i f - ish in cans or packages except an- Lumber Rates. chovies or sardines, 99 per cent. ad va- In the 1 vhs mber schedule all of the ated in the free list of t m. lor Fs neor| ¢ 5 cents per bushel. present law are restored to the dutiable list desiccated or prepared in at the McKinley + with the ption ner, 2 cents per pound. of white pine, which is now classed with 60° cent arrel of 3 cubic spruce and pays $2 per thousand feet, - ity or fractional part thereof; stead of $1 as under the McKinley la 1 providing for an ad- ditional duty of 25 per cent. ad valorem on plums and prunes, 2 cents per pound; pine- 2 sents each and 15 per cent. cents per pound, a lumber to be imposed in retaliation fn Orar lemons and limes, in package any country imposes discriminatir at the te of 8 cents per cubic foot of ca on similar articles proposed to pacity; in bulk, thre Sourthis of a. cent per ported to the United State pound, and in addition thereto a duty of toothpicks is changed from 3 or . ad valorem upon boxes or bar- 11g cents per thousand. SUGAR. Ad Valorem Rates Changed to Spe- cifice—The New Duties. The sugar schedule is specitic throu out. Sugars not above No. 16, Dutch sta ard in color, tank bottoms, Sirups of c juice, melada, concentrated melada, cor crete and concentrated molasses, testing by the polariscope not above 75 degrees, 1 cent per pound, and for every additional de- eserved asses or spirits not spe rin this act, and jellies per cent. ad valorem, of al ad valorem. candicd, 2 cents per pound. Almonds, not shelled, 5 cents per*pound; ar almonds, shelled, 7% cents per pound. ilberts ar is of all kinds, Hed, ound; shelled, 6 cents rved in their own juices, 30 peel or lemon peel, preserved or d not I ———EEe————————— SS F to as to fron au $1.50 and not more t cents per dozen and ore than $3 per doze. | per cent. Thé present rat ete., and on all m specially provide $ ner CeL i fo In the flax, hemp and the articles placed on thé E restored ist at MeKinley rates ex which is increased fro: ne cf one-half of a cent a pou Jute yarn is changed from valorem to 1 cent a poun Cables, cordage and tw provided for are taxed at 1 ¢ binding tw tries plac from the cent per pound; mp, b eee pe oe lc 5 cents per sou bu ES cent.; burlap bags a pound and 15 per There is a new ¢ netting, etc. Wh higher than pound and 15 5 No. 25, 24 cents per p to No. 40, 40 ees cent.; finer than No. per pound and 2: m0 to cent.; Threads, twines er ramie, not finer per pound: finer, f ditional for each |! flax or ramie, valued z per pound, 3’ cents cent.; valued at ab: 12 cents per pound a and cuffs compo: cents a dozen a of whole or in p: cezen and 20 per wearing apparel no composed in whole or per cent. Laces, or in part of a posed of flax, jute, cott table fiber are taxed at lorem, The basket clause in the fl jute schedule imposes a com all manufactures containi 100 threads per square inc on all above 100 threads. FREE THE Revenue. Acids—Arsenic or arseni drochloric or muriatic; pieric or nitro-picr Aconite, acorns, agates line salts. Any animal imported sy; ing purposes shall be admitt« vided, that no such animal 5s) record established for t r Animals brought into the L ricultural or racing assoc shall be given in accor treasury; also, teams of anim: their harness and tackle or other vehicl ally ow emigrating from foreign cc United States with the actual use for the purpose of tion under such regulations tary of the treasury may p zoological collect cational purpose profit. Annato, roucou, roucoa or all extracts of. Antimony ore, Apatite, arrowroot and not manufact phide of, or orpime line. Art educational stor mt and metal and valued at not cents per gross. Articles in a cr s Seger not specially prov act. Articles the growth, produ ufacture of the United Stat turned, after having out having been advanced in proved in condition by any pr ufacture or other means ecarbers, bags and oth ean manufacture, exported American products or e returned filled with fore eluding shooks when rei or boxes; also quic: of either domestic or foreign which shall have been actu from the United States; but and not erude sulphi in $ nk Flax, Hemp and Jute. gs notm a.bumen, alizarin, amber, ambergris, temporarily for a period not « months for the pury of ex competition for prizes offered } tions prescribed by the secre wild animals intended for exhibition ns for scien’ ca r vessels of Ameri- preducts, { ? lver flasks per doze ut. dozen and BD! s, braids, colton not ; | valued at | | | hemp and idu re than er cent. LIST. List of the Articles That Will Pay No Ny for breed- ed free. Pro- all be adm: ted free unless pure bred of a cognized breed and duly registered in the book of uding 1 the wagons d by persons ntries to the r families and in h emigra- s the secre- rescribe, and in tifle and edu- for sale or orleans, and te of. tural sta and osed of glass nore than 6 dyei orint ded 1 man- en re- va filled w: lempty a alt proof of the exported gree or fraction of a degree shown by the | per px identity of such articics shall be made polariscopic test, three-cne-hundredths of Suits of all kinds, shelled or unshelled, not | der general rezwat to be prescribed by 1 cent per pound additional; and on sugar ly provided for in this act, 1}z cents | the secretary of the treasury, but the above No. 16, Dutch standard in color and on all sugar which has gone through a process of refining, 1.875 cents per pound molasses testing not above 56 degrees. 3 cents per gallon; testing degrees and above, 6 cents per gallon; sugar, tank bottoms, sirups, cane juice or beet juice, melada, concentrated melada and conc and concentrated mola . tke produ: any country w etly or rectly a bounty export thereof, whether imported directly and in condition s exported therefrom or otherw nall pay in addition to the foregoing duty equal to such bounty, thereof as may be in exce lected by such country or upon the beet or & produced. Provided, contained shall be so construed as to abro- any manner impair or affect the provisions of the treaty of commercial reciprocity concluded between the United States and the king of the Hawaiian on the 30th day of January, 1875, or pound. Racon and hams, 5 cent Beef, mutton and por Meats, prepared or pr ad_valorem. of me s per pound. 2 cents per pound. served, <5 per cent. ‘ents per pound; per pound, pared a act, 6 ¢ cent per pou Chocolate ssed for the execution of the 1 prepared or ma’ provided for in t Ss per pour Maple Sugar. Maple sugar and maple sirup, 4 cents per pound: glucose or grape sugar, 1! per pound; sugar cane in its natur or_unmanufactured, 20 percent ad valo Saccharine, $2 per pound and 15 per ce ad valorem. Sugar candy and n tionery and all other articles made wholly or in part of sugar, valued at 15 cents pe pound or less, and on sugars after t refined, when tinctured, colored or in way adutterated, 8 cents per pound and 29 per cent, ad valorem: valued at more th tter or cocca butterine, s prepared, a sub age ir y shall apparently de- 1 the importa- d, ‘actured, not act, 2 cents cents emption of bags from duty sh to such domestic b by the exporter thereof, and hereby prohibited exc duties equal to the ¢ to any article manufa on of la ided en n whi shall be retai collector of cu stamps in parme placed tI > Asbestos, in from the earth, advanced in any mann Ashes, wood and lye ashes Asphaltum and bitume 2 advanced oms until f nt of the I Ss nat Binding ported from a cou been made, the reimportation of which pt upon whacks allowed: or ed rehouses and exported under an a pro’ pply only gs as may be imported 1 if any such articles are subject to internal tax at the time of exportation such tax shall be proved to have been _pe before tion and not refunded. Provided, paragraph shall rot apply to a upon which a wance of dra ayment of in bonded nro- furt 2 al state as taken not assorted, purified or san import y on like articles imported from the United States. which shall be subject to a n fa of one-half of 1 cent per pound. 5c Ss per pound and not more than 35 ish on the Bells, broken, and bell metal. cents per pound, 12 cents per pound and je navigable waters of the| Pirds, stuffed per cent. ad valorem: valued at above 3: cents per pound, 50 per cent. ad valorem. The weight of paper and other immediate wrappers, tickets, labels, cans, cartons, boxes or coverings other than the outer used f this pre has bee ft stated e purpos ties in same shall be remitted: that exporters of meats, whether packed t é prov tes, and upon proof that the salt 1 on the ied, further, Biris and land and water Bismuth. Bladders, crude or salted, tion only_and manufactured. Blood, dried. packing case or other covering shall be in- | or smoked, ch have been cured in the Sones. cluded in the dutiable weight of the mer- | United St with imported salt shall, | Book chandise. upon sati tory proof, have refunded to | ines, for ToORACCO. them from the treasury the duties paid on | Btess. TOBACCO. the salt so used in curing such exported | Brazil paste. ee meats in amounts not le Brazilian pebble. Nothing Is Lower in This List Than arch, including all preparations fit for | Breccia. McKinley Rates. There is no change from the McKinley rates in the duty on leaf tobacco suitable for cigar wrappers, but all other leaf, un- stemmed, is increased from 35 cents to 70 cents per pound, and stemmed from 8 to 0 cents. Leaf tobacco suitable for cigar wrappers, if not stemmed, $2 per pound: if stemme 2.73 per pound. Provided, that if an. tobacco Hees in any bale, box or pac use as starch, 2 cents per pound. rch, gum subs cents per pound. nd or preserved, 10 ¢ per pound. Spices, ground or pawdered, 4 cents pound: caye' epper, 214 cents per poun unground 3 cents per pound. Vinegar, 2 cer Tt gallo! There shal! be allowed plate used in the manufacture of can a i teedi boxes, pack @ all articles of t age or in bulk shall contain exceeding 1 . pack all | ; per cent. thereof of leaves suitable ware export. rer empty or filled with adrawback eq n plate, less 1 per cent duty, which shall be retained fo: of the Ll ed States. pirits and Wines. the present law are cen gar wrappers, the ent bacco contained in such bale, age or in bulk shall be dutiable, if not stemmed, at $2 per pounds & f stemmed, at per pound, All other tobacco in leaf, unman tured and not stemmed, 65 cents per pound; if stemmed, 8) cents per pound Tobacco, manufactured, of ail tions not specially provided for in this act, 40 cents per pound, Snuff and snuff flour, manufac’ tobacco, ground dry, or damp and ates scented or otherwise, of all descriptions, 40 cents per pound. i Cigars, cigarettes, cheroots of al 80 5 COTTON AND COTTON GOODS. pound and and paper ci wrapper ies as are her per | the Wilsen Lines. AGRICULTURAL. on Produce and Provisions— | Rates Transfers from Free List. h few excep been restored per he m it law have been pretty well adhered the imported tin | This Schedule Bullt Practically cn note than $1.4 and 1d or silver. h Bullion, £o Burgund: Cadmium. Calamine. Camphor, crude. Castor oil. castoreum. | Ceretum. crude. ue clay. r Cocculus indicus. Cochineal. Cocoa, or cacao, cr Old copper. Copper and copper cement. With a proviso that horses Valued at mare ha than $100 shall pay a duty of per cent. more rt dozen, 75 cents per Fans, common p- ad valorem. The following articles have | dozen and 2 per cent.: valued at more than Feldspar. been taken from the free list and made | $3 per dozen, $1 per dozen and 2) per cent. Felt. dutiabl Farina, cabbages, sauer-krau* Shirts and drawers valued at not more Fibrin. der, nursery stock, f8: for bai | then $1.50 per dozen, 35 per cent.; valuedat} Fish fowls. for preserva- Catgut, whipgut or wormgut. f iron or chromic cre. oal stores of Amer- {coal tar and personal nilar per- in the r improved tn sor or Man be ad d to their value , rough 3 sot orange , fally pr the rough, or not cut into lengths rellas, parasols, ods or walk- n um i munjette, c¢ or prepared, stat- re, the pro- or or native tatuary rawing t artis », bisque or porcelat: copies thereof in naterial, any of the free artis ° or other ported for tural or unmani Med of gold, silver 8 stowed as trophies or prizes. I be admitted free of Meersct lations as the secre- M iry ma escribe, but 2 to the United States mposed by law pro as shall not be hin § months after such im- tion or for the pay ment of lawful duty i vVeEMer for mac rue any of the articles td, transferred or otherwis y to this provision, and such ill be subject at any time to ex- ation and i weetion by the proper of- s of the customs, The secretary of asury may extend such period for a r term of 6 months in cases where ation is made, and the privileges of t section shall not he allowed to asso- ciations, corporations, firms or individuals aged in or connected with business of a private or commercial character. Yams, seafer7 Ree ROC unma ami paper- ining current L at stated periods ~Brazil nuts, cre. and paim nut kernels shell and broken cc not shredded, desic anner. Nux vomica. Oa Oilcake. Oil—Amber, cr palm nuts in the opra, or prepared in any ry. Provisions Aimed to Ald Our Foreign Trade Relations. purpose of the committee to de- » that rectified, ambergris, lee tpn faerie egnes ts OW will enable reci- ear err toniin cies coe procity. treaties to be made, not only to se 1, jasmine or jasimine, jitglandium larger importation of American juniper, mace, neroli or orange flower, nut so oohd ape its Ms nee oils or oil of nuts not specially provided bi UE RIEO TO Oper ise for, olive or olive ofl foots imported ex ropean countries, particu for manufacturing or mechanica! and France, to thé freer Sahn cau only for mich t pal erican meats and agricultural thyme, origanum, red or white: valeriar ally and also spermaceti whale and other fish dy been ae cee to pis ae of American fisheries and all other e-list of goods which ica thse rbenGts of soni aak will be used for reciprocity arrangements roleum, crude er refined, pr . ntries = if there be imported into the t crude petroleum or the product petrol imposes a duty on R oleum or its products exported from the United States there shall be levied, pald and collected upon erude petroleum or its products so imported cent. ad valorem. : chil liquid Ores of gold, silver, copper or nickel and Mineral wai Argols. Chic Feathers and tmillisery ornaments. On all the foregoing articles, imported S = fe re! pri mally from Great Britain and France, nickel matte; Sweepings of gold and silver. | fro" Quitios will be reduced in consideration Potiadiai nuval of restrictions and for other Sarees arrangements in favor of Amer- ine pus te, such as breadstuffs, live nd meats changes are made in the adminis- features of the existing law. The present internal revenue laws are not touched at all, either as to rates or regu- ations, Parchment, and veilum Pearl, motier of, and shells not sawe cut, polished or otherwise manufactured ¢ ss ee adv din value from the natural state. MURDER IN THE AIR. Personal effects, not merchandise, of cit- ESS izens of the United States dyin foreis A Terrible Experience Among Blood- countries. er and old b Thirsty and Merciless Natives, annia metal. prude — tive. During the recent Mashona uprising slants, tr shrubs. roots, seed cane] , Ae : 7 a ees eee ae ne pocernment. | it was reported in England that W. E. Plaster rock of gyp crude and not calcined, wise advanced from the . in ingots, t . um, unmanufac her um, or terra -| Brand,a young prospector,had been mur- round or other- dered by the natives. He afterward c bled from Fort Salisbury that he was safe. In a letter to his parents, who lived at the Instow, in North Devon, he nar- his experien: Among other rates =a, 2 crude, or salts:"’ nitrate | things he write eae ee tpeter, sulphate of capeocoe 3 AE, as eae ees eee or Groves and myself started from Lo Magundi on June 10, two days before the war broke out, with seven ‘boys,’ two Mashonas and five Zembezis. I met iwo policemen on the road, 45 miles from town; next merning both were murdered. I reached the store on the as or phate of and all alka ona bark otherwise specially prov! Rennets, raw or prepared. 2 safflower and extract of, and 15th and met Grovesthere. We left the nise, caraway, card store next morning and started for iepontis fenugrec Angwe, 20 miles off. As we passed giong we thought there was something suspicious, as the niggers all had guns and were hiding in the long grass. 1 went up to a kraal and asked for my things which I had left there five months ago, but they refused to give them up, so I cleared. “We finished our work at Angwe and came back. When we got to the store e saw four men who had been brutally murdered, evidently by battle axes. They were lying on their stomachs. und had been dragged out of the store into the veldt. They were blown out to’ a tremendous size, and when we turned them over their faces were ecten away. We walked to Jameson's camp to see if we conld find any more bodies. *n we walked on to Ayres farm, we thought we should it I had to shoct both my for safety, and lucky for me id. We arrived at Ayres at seven here we thought we were going ea good breakfast, as we bad had ‘| nothing to eat for two ¢ I rushed ?] up to the huts like mad. and just as 1 j reached the first the brutes jumped up | all round us, with bat xes and knob- kerries, and yeiled. red about ared. All ali the foregoing bored . raw; or as re fren coco not doubled. twisted or advanced ufacture; silk cocoons and silk was kWworm eges. letons and other ato ot preparations itrate of or of. m. mens eubie n ry, botar ted for cab- of natural ms; mace, nut orw , and p All the forego t, unground punk. Spurs and stilts used of earthen, porcelain an and sand: burr wh Pe rm: The 29 shots at us before we cl nd then they blow on th but cut only hot six and ran urrows, bullets iM around us, us. One hat, which was - At last got away. i t have been 2060 or 409 of the i bretes. We gotinto a wood and dodged end then my legs gave way, and I could go no further. “Wearrived at Fort Salisbury like tre )broken-<down tramps.”—N. Y. World. ‘ -