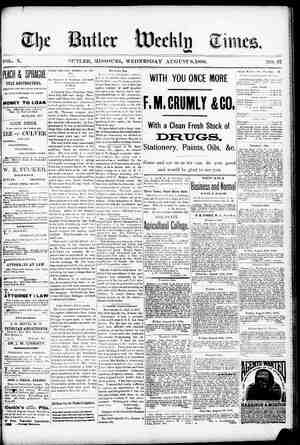

The Butler Weekly Times Newspaper, August 8, 1888, Page 2

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

A GREAT SPEECH. Judge U. H. Krum Denounces the Republican Platform. Public Declaration of His Reasons for Abandoning His Party and Uniting With the Democrats—The Tariff Question. Mr. Chairman and Gentlemen: One who has been a republican ever since he became a voter appears before you to-night to evidence his with- drawal from the party of his former affiliation. Having no ulterior pur- pose and having taken this step after serious deliberation, he hopes that his utterances will be received as frank, candid and truthful expres- sions of carefully considered thoughts upon matters of national signifi cauce. The people are about to choose a president. For the first time since the close of the war of the rebellion the two great political parties of this country have joined issue upon a question of public policy whose de- termination must and will constitute } | | congress in opposing its passage. We condemn the proposition of the democratie party to place wool on the free list, and we insist that the duties thereon shall be adjusted and maintained so as to furnish full and adequate protection on that in- dustry. The republican party would effect all needed reduction of the national revenue by repealing the taxes upon tobacco, which are an annoyance and burden to agriculture, and the tax upon spirits used in the arts and for mechanical purposes, and by such revision of the tariff laws as will tend to check imports of such arti- cles as are produced by our people, the production of which gives em- ployment to our labor, and release from import duties such articles of foreign production (except luxuries) the like of which cannot be produced at home. If there shall still remain a larger revenue than is requisite for the wants of the government, we favor the entire repeal of the internal taxes rather than the surrender of any part of our protective system at the joint benest of the whisky trusts and the agents of foreign manu- forbidden. Every individual, in every community, without exception, will purchase whatever he may want on the cheapest terms within his reach. The most enthusiastic re- strictionist, the manufacturer most clamorous for special protection, will each individually pursue the same course and prefer any foreign com- modity or material to that of domes- tic origin if the first is cheaper and 57 to 208 per cent; window glass, 85 per cent; horse-shoe nails, 116 per cent; castor oil, 180 per cent; mixed woolen goods, 77 per cent, and cheap shawls at 68 per cent. By reason of these and like imports upon articles of necessary and common use in this country, a vast surplus revenue ac- cumulated in the national treasury each fiscal year and causes to every {ana general welfare of the United observant capitalist, merchant and business man in this broad land the utmost possible solicitude and appre- hension. REPUBLICAN WAR TARIFF. War in the United States ceased twenty three A new generation has sprung up. The child, which at Farmville heard the thunder of Custer’s last guns at Ap- pomattox station, is now a full grown man and voter. The stirring inci- dents of a most momentous struggle have become mere matters of history. States have been reconstructed and the vast machinery of government for twenty years has been moving smoothly and without friction. But a war tariff, created by a bill to ‘in- crease the revenue,” remains for the the law does not forbid him. All men ever have acted, and continue under any system, to act onthesame principle. It is impossible that they should universally act in that manner, unless it was evidently their interest todo so. The tariff system is founded upon the principle that what is true of all men individually is untrue when applied so them col- lectively. We can not consider the adherence of enlightened nations to regulations of that description but as the last relic of that system of general restrictions and monopolies which had its origin in barbarious times. If the corn laws are the most odious of those protecting monopo- lies it is because they enhance the price of that which is still more years ago. most part unaffected and unchanged. as in 1812 when ruinous results fol. owed, with such suffering in Ne England that secession was threa, ened; sometimes reduced, as in 189 when the renewal of Prosperity fy, lowed, and in 1832, when there wag, slight reduction of duties, followeg by a marked improvement if pog ness—untilin 1846, the tariff “a reduced from 33 to 50 per cent various articles of importation, This was a marked reduction, but % ‘Was not followed by general disaster to any interests. On the contrary, the statistics show that commerce and shipping received a great impetus; there was a rapid growth in‘ many. factures, agriculture enjoyed? extra. ordinary prosperity and there wag an advance in wages such as has not been known in this country down to the present day. The panic if 1857 intervened between 1846 and A861 as a disturbing element not attributable to the tariff, but as early as 1858 the effects of the panic had disappeared and the years 1859 and 1860 were period of great prosperity in agri. culture, commerce and manufact undoubtedly brought about by a duction of the tariff adopted prior States?” There is and has been no system of American protection in the United States such as the republican platform would tenderly preserve. I appeal to the history of tariff legis- Jation. I admit that benefits to eertain lines of production have been incidents of tariffs imposed for pur- poses of revenue. But I deny that what every ,well advised citizen of the United States now admits ought to be changed, namely, excessive in- direct taxation in the shape of duties upon imports, continued as a means of benefitting special moneyed in- terests—I deny that such a system is an American system of protection. T assert that the originators of the constitution, the immortal founders of the republic of the United States, solicitous as they were for the wel- fare and zrowth of the infant ine dustries in their early legislation upon the tariff, went no further than to recognize two fundamental prin- ciples: First, that the taxation of the people by duties levied on im- ports must, under the constitution, be for the purpose of raising revenue for the support of the government; factures.” Such is the platform of the repub- lican party, and the people are asked to give it their support. But, tlemen, uo citizen of the United the dominant feature of the national campaign. To this one question all others are subordinate. All contro- versies, based on sectional differences, are happily at an end. Matters of personal consideration, as affecting candidates, will not be present to present a proper review of princi- ples. ‘Lhe great parties are practic ally agreed upon questions of civil service reform. As Iam not a can- didate for office I venture to explain that when I say there is an agreement upon questions affecting the civil service, I mean that each party gives as little practical application of the theory of reform as will satisfy a strict construction of the law. The millennium of American polities has not yet come in this great republic. The lion of office seeking is not, as gen- States ought to approve such an declaration of principles. From every standpoint of free government and public eeon- ory it is the most atrocious party utterance which has been made in the history of American polities. It finds extenuation neither in necessity nor concern for the public welfare. It is based upon no substantial foun- dation. It is subversive established principles of astounding party of well political It finds no sanction in the constitution. Its sole purpose to maintain upon the statutes of the United States laws which the neces- sities of actual war created, but which can now, by so-called protec- tion benefit less than 3,000,000 peo- ple, who happen to be its favored recipients only at the expense of over 42,000,000, who are expected to remain quiescent and unwilling vic- tims of unjust and now unnecessary tariff discriminations. econoiny. yet, found lying down peacefully with the lamb of suftrage—at least not to au alarming extent. None of us, however, are perfect, and lest I might be charged with not having too much reverence for the dogmas of civil service reform, I hasten to leave these matters where I find them—in a happy condition of agree- mentin the ranks of both of the contending parties. It is with them as Fluellen had it in “Henry V:” “There is a voice in Macedon, and there is also, moreover, a river at Monmouth; it is called Wye at Mon- mouth, but it is out of my brains what is the name of the other river; but ‘tis all one; ‘tis alike as my fingers are to my fingers, and there is salmous in both.” HAS NO EXTENUATION. I say that the tariff plank of the republican platform find no extenua- tion in necessity. It was not called for by the exigencies of public affairs. Had the public debt been increased, so that the public revenues ought to be augmented? Had the national treasury been suddenly depleted of its accumulated millions? Had pub- lic complications arisen which threat- ened danger from abroad or formi- dable dissensions at home? Had the public credit been impaired by unforeseen expenditures for public purposes? Had even manufacturing interests spontaneously lapsed from the virility of mature growth to the tender uncertainties of infancy anda new begining? Had the workman suffered diminution of wages, or the employer been threatened with speedy and irreparable disaster? Not at all. Notat all. Not one exigency |had arisen to justify the further maintenance of so-called protection. In no degree whatever had the public situation been changed from that of only four years ago, except that there had come about a perfect demonstration that the tariff laws must be amended. In no sense of THE TARIFF. The one controlling political ques- tion of the present hour is that which concerns the tariff. Toa brief consideration of that question I now ask your attention. I do not profess te explore new fields or develop new lines of thoughts. The principles which control a proper determination of the subject are so plain and clear- ly established that he who runs may read. I hope, therefore, to merely express views which will meet with your approval as thoughtful citizens who are indisposed to acquiesce in doctrines of public economy, which involve, as their immediate conse- | quence, detriment and harm to the mass of the people, as distinguished from the few whose interests will be fostered and enhanced. It hangs over this country like a vast incubus. The growth of its accumulations in the treasury has been insidiuously sapping the life blood of American industries, year after year, until a surplus of revenue, sin 1885 was over seventeen millions, increased in 1886 to nearly fifty millions, in 1887 unted to fifty five and a half millions and by June 30, 1888, had swollen its enor- mous proportion to one hundred and forty millions. This unhealthy growth has been, I insidious. It has not ed by the people. Like vampire of fable, the 1864 is draining the veins of its victim, while its wings of have said, been = SOME War tw “protection” are lulling the victim The very fact that the tax has not been felt has exposed to the The te idirectly takes the people. It imposes no direct burden. For that reason the people have not had these matters called to their immediate attention. Tariff discussions have been looked upon as the refinements of the theorists, and as the burdens of taxation under laws imposing duties have not fallen directly upon the people they have listlessly suf- fered themselves to lapse even into as melancholy a condition as that of the Englishmen in 1820, described by Sydney Smith and familiar to every reader of English literature: “The schoolboy whips his taxed top, the beardless youth manages his taxed horse with a taxed bridle on a taxed road, and the dying English- man, pouring his medicine which has paid 75 per cent into a spoon that has paid 15 per cent, flings himself back upon his dainty bed which has paid 22 per cent and expires in the arms of an apothecary who has paid a license of £100 for the privilege of putting him to death.” into repose. scople the greater danger. AN INIQUITOUS PARTY. Had the people been taxed directly, so as to create a yearly surplus of 140,000,000, there never would have been created cr tolerated that iniquitous system now called “our American system of protection” —a system justly reprobated by the president as one which “benefits certain classes of our citizens at the expense of every householder in the land; a system which breeds discon- essentially necessary than sugar, salt, clothing or fuel; and we may safely predict that their repeal will be the first result of an improved represen- tation of the people.” Yet, when the people have become aroused by their now apparent dan- ger and the republican party isasked to consent to the removal of the tax upon even as common an article as castor oil, the reply is No! FREE WHISKY. The obscurities of the abdominal viscera, under “our American system of protection,” can only be moved by the taxed article, because whisky must be free. Mixed woolen goods are taxed 77 per cent, but when it is proposed to remove that tax the republican party finds no way to save the country from impending ruin but to make whisky. Bourbon whisky, free. Eleven and one-half millions of dollars are to be taken from sugar, but the republican platform de- nounces the “Mills bill,” which seeks this beneficient rather than suffer Americans to have cheap sugar, whisky alone must be even result. because, free. Salt, lumber. wool and rice, wire, window glass and common cotton cloth are not to go upon the free list, to the end that millions of pec- ple in the republic shall enjoy needed relief from onerous duties, but whis- ky shall be free. When every business interest in this broad land is jeopardized by the unceasing accumulation of surplus revenue in the national treasury; when well advised financiers deplore the situation and counsel a speedy change; when merchants, working men, business corporations, skilled artisans, farmers and capitalists stand liable to be involved in one common financial disaster by the pernicious taxation now called “‘pro- tection,” the republican party say that “rather than surrender any part of our protective system we favor the entire repeal of internal taxes,” that whisky, the new shibboleth of republicanism, shall be free. When, formerly, I humbly stood in the shadow of great men in the republican party and heard their masterly attacks upon democracy, I used to think that free whisky was the exclusive and distinguishing feature of democratic faith. But the but that, secondly, it is constitution- alto so average the taxation of imports as to afford incidental bene- fits to home industries. But that excessive duties, imposed by the reason of the exigencies of a gigan- tie war, are to be upheld year after year, upon the return of peace, as an “American system of protection,” because, although not needed for revenue, they are beneficial toa few, isamonstrous deduction from the history of all tariff legislation in the UTnited States. Who was the most pronounced expounder of the doctrine that duties should be imposed so as to incident- ally benefit manufacturing interests? No less a man than Henry Clay. Yet in 1828, the requirements of government led to the imposition of duties on imports, which averaged 41 per cent. It was soon found that the revenues were unnecessarily large, and that the national debt was being paid too rapidly. Was Henry Clay found contending that his American system of protection should not be impaired? Was whisky to be free rather than suffer such interference? Not at all. But in 1830 he intro- duced a “Mills bill” in the shape of the following resolution: “That the existing duties upon articles imported from foreign coun- tries and not coming in competition with similar articles made or pro- duced within the United States ought to be forthwith abolished, except the duties upon wines and silks, and that those ought to be re- duced.” The republican platform declares that the president and his party propose to destroy the American system of protection. The president and his party, as I understand the situation, do propose to modify the tariff imposed during the war of the rebellion, and which has been main- tained without sufficient modification since peace happily resumed its sway; they propose to do what Garfield advocated; they propose to do what Ulysses S. Grant urgently recon. mended; they propose to revise the tariff laws, which Chester A. Arthur declared needed revision; they pro- pose to do just what the republican party in 1854 said ought to be done —namely, correct the irregularities of the tariff and reduce the surplus revenue. They do not propose, how- 1857 in order to dispose of tKe sur. plus of revenue which contitiued accumulate even under the iwodified tariff of 1846. : In 1861, the war of the rebellion having unfortunately come on, a war tariff was enacted, whose rates wer enhanced ix 1864, but if the’ future of protection to infant industries of the United States was uppermost it the minds of congress when the bi were passed, the fact is not evidenced] by the acts themselves. The’ dati imposed were purely war duties Certain manufacturers realized Ia fortunes during their continuanee But that the duties thus impoged aad! which, modified, are the duties whid democrats are now striving te havd still further modified, ought to b maintained, as our American systeu of protection, is a travesty upon constitution and an outrage upo the rights ef the American peopld From 1861 down to the present ti such reductions of the tariff as hat been made have not been followe by disaster. They have added noth ing to the bank account of the us' aud have caused sheriffs no incre of feés. Violent financial distu ances have taken place, but they havaly not been attributable to moditication of the tariff. None will be led a by the empty declaration tiiat modifications of the tariff have alwai led to finaneial disaster. The s\ ment is not true. The facts otherwise. Figures are rarely in esting, yet the census of 1880 fprni es some instructive results in fl direction. Between 1850 and 1868 under alow tariff, manufacturers ga ed 89.39 per cent; between 1860 « 1870, under a high tariff, they‘zai only 67.80 per cent; between and 1880, also under a high, only 64.66 per cent. Betweeh 18 and 1860, under the low tariff fi ing lands and personal propetl gained 60.66 per cent; between 18 and 1870, under high tariff, gained only 11.52 per cent, and tween 1870 and 1880 only 36 p cent. ° THE MILLS BILL. ¥ ’ So, too, does the denunciation 6 the Mills bill fall short of the! truth, It is denounced as being“ des ive to the general business, the bor and the farming interests’ of country.” This is what Butler, In national convention the repub- lican party have declared as follows: “Weare uncompromisingly in favor of the American system of proteetion; we protest against its destruction, as political economic exigency was the tent, because it permits the dupli- “Hudibrass,” calls “leather or republican party required to depart one jot or one title from its declara- tion of 1884, when it went before cation of wealth witheut correspond- ing additional recompense to labor: which prevents the opportunity to the public upon the following sig- nificant publie utterance and solemn pledge of fidelity to the welfare of proposed by the president and. his party. They serve the interests of Europe; we will support the interests | the whole country: of America. “The republican party pledges We accept the issue and confident- | itself to correct the irregularities of ly appeal to the people for their | the tariff and to reduce the surplus judgment. The protective system | not by the vicious and indiscriminate must be maintained. Its abandon- | process of horizontal reduction, but ment has always been followed by | by such methods as will relieve the general disaster to all interests, ex-| tax-payer without injuring the la- cept those of the usurer and the’ borer or the great productive inter- sheriff. jests of the country.” We.denounce the Mills bill as de- | Yabor and the farming interests of } of 1SS42 Imported salt is taxed by the country, and we heartily indorse , the existing tariff at 85 per cent; the consistent and patriotic action of | rice at 160 per cent; wire from 1 the [republican representatives in! to 155 per cent; common cotton clot | essenti: work by stifling production and lim- iting the area of our markets, and which enhances the cost of living beyond the laborer’s hard earned ages.” Hadthe burdens of the tariff fallen directly upon the people they would long ago have approved the profound reflections of Galla- tin: “Let it be recollected that the sys- tem is in itself an infraction of an maust any gove private pi uits of individuals, to \ forbid them to do that which in it- “lay and collect taxe self is not criminal. 3 one would most vy do i be | tion.” nent to interfere in the} | nd which every- | f not} . times have changed and the republi- can party has changed with them. Whisky may be the root of some evil, but your platform proclaims it a right esculent root—dig. therefore, republicans, dig! So much, gentle- men, for the situation which has prompted the republican party to become faithless to its promises. I ask your indulgence in still further considering the extraordinary dec- larations of the republican platform NO SYSTEM OF AMERICAN PROTECTION. “Weare uncompromisingly in favor al part of the liberty of the | of the American system of protec- Citizens. The necessity ? And, gentlemen, how does the urgent and palpable which authorizes | system of protection? Does it find Structive to the general business, the | platform of 1888 redeem the pledges , t But what is the American its authorization in the power dele- gated by the people to congress to - duties. the debts posts and excise: and provide for the ¢ im-! rmon defense Il ever, to do what the republican party has done—to keep the word of promise to our ear and break it to our hope. The work has actually been begun, and I, for one, say God speed them in the enterprise! A LIE IN fHE PLATFORM. But the republican platform says that the so-called protective system must be maintained. ‘Its abandon- ment has always been followed by general disaster to all interests ex- cept those of the usurer and the sheriff.” This declaration is a per- version of the truth. In 1789 con- gress adopted the first tariff act, entitled “an act for laying a duty on goods, wares and merchandise int ported into the United States.” From that time down to 1846 the tariff was maintained with modifi- cations—sometimes being increased- nello.” It must have been pit under the inspiration of that offdistillation which the p! elsewhere declares shall be Mr. Mills, himself has disposed of! in a vigorous speech deliverd in York on the Fourth of July. Ye will find it in the Republic of 5. I commend it to your careful; rusal. It will not be circulated ss republican campaign document, B it is. nevertheless, mighty inten ing reading. The absurdity of change is shown by the fact # while the existing tariff provides! rate of taxation which yields anav@} age of $47.10 on every $100 worth goods imported which are subje¢ tax, the Mills bill proposes to2ed this average. which is about 47 cent to 40 per cent. The republi Continued on next pages