The Bismarck Tribune Newspaper, July 12, 1935, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

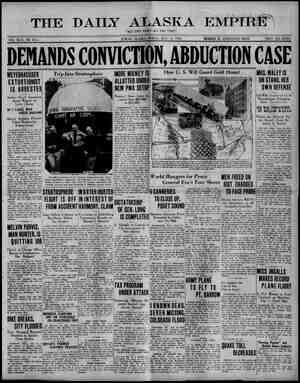

' Hampton | By ELIZABETH KOPPY The John Weber family of Linton épent this week visiting at the Her- ‘man-Backhaus home. Willie Schiermeister of Gayton was @ business caller in this vicinity Fri- day afternoon. : Merle Dilly and son accompanied by Chris Bosch of Linton transacted business in this community Saturday afternoon. : _ Business callers in Linton from this vicinity Friday were Herman Back- haus, Sr., Steve Koppy, daughter, Re- gina, John Ohlhauser, Sr., Mrs. Frank Lawler and sons, Mr. and Mrs. Fred Ohimauser and sons and Ed Weller. Callers at the Steve Koppy home Sunday from Linton were Miss Rose Schmaits, Mr. and Mrs~ John Schmaltz, son, Melvin, Leo Materi and Flegel ] E. M. THOMPSON ° | Harriet e Mr. ad Mrs. Oscar Weitstock and family who have spent the past week visiting relatives in Redfield, Iowa, returned to their home here Sunday. Albert Schmidt and S. Watts of Bowdon spent Sunday at the H. T. ‘Williamson home. Mr. and Mrs. L. L. Zimmer and daughter, Thecla, left Tuesday for Grand Forks, where they will spend 10 days visiting relatives. Miss Ruth Thompson, who is em- ployed at the F. W. Bertelsen home at Steele spent several days at the home of her parents, Mr. and Mrs. A. O, Thompson. Mr. and Mrs. Christ Wetzel and Gaughter, Verna Mae, and Mrs. A. O. ‘Thompson and daughter, Helen, were business callers in Bismarck Monday. Mr. and Mrs. Elmer Josephson called at the E. R. Leach home Thurs- day. Mr. and Mrs. John Merkel and fam- ily were business callers in Tuttle ‘Wednesday evening. Mrs. A. O. Thompson and daugh- ters, Edith and Ruth, were callers at the H. F. Williamson home Saturday. Martin Gellner, a member of the CCC division, stationed at Fort Lin- toln, spent the week-end at his par- ental home here. . ing 1 By MARTHA MUELLER Ruth Lytle, who has been visiting relatives in Minnesota returned to her home Wednesday. Mr. and Mrs. J. O. Lein and family, und Mr, and Mrs. M. Lein visited rel- ttives at Driscoll Sunday. Nic Laschkewitsch of Goodrich was 2 Visitor at the John Mueller home Mpnday morning. «Lucille Dalbec,. who. is employed at Bismarck, spent the week-end at her home. The boys’ basketball team defeated the Regan team on the Regan field, Gunday. The score was 20-1. Leo and Leonard Kremenetsky and John Mueller, Jr., were Bismarck call- ers Sunday evening. Lavona Newman, accompanied by Beverly Olson and Bernice Glanville left by train Monday morning for her home at Brainerd, Minn. Beverly and Bernice will remain there for a short visit. Ben McCloskey and daughters, Alice and Margaret, and Helen Harty were Bismarck shoppers Tuesday. Mr. and Mrs. H. Beall of Bismarck were visitors in this vicinity Sunda; Mr. and Mrs. John Harty and Fam- ily were week end visitors at New Rockford. Mr. and Mrs. Roy Anderson and family of Still visited at the George Anderson home Sunday. Ferne Glanville left last week for > | NEWS OF OUR NEIGHBORS Mr. and Mrs. Ralph Falkenstein and family,’ and Mr. and Mrs. John Herdebu and family spent the Fourth at the Israel Keator home near Still. Mr, family tthe. Mr. . and. Mrs. Herbert Fricke and of Were recent guests al home.of local relatives. . and Mrs. Frank Stitzer of Bis- marck spent Sunday with relatives in this community. OO - Sibley Butte \ ° By MRS. ELMER BLOOMQUIST Mr. and Mrs. Earl Evans and chil- dren attended the ball game at Mc- Kenzie Sunday. Mr. and Mrs. Henry Larson and daughter, Vivian, Mrs. 8. E. Clizbe and sons, Byron and Clarence, attended the 4-H picnic at the Menoken grove Sunday. _ Mr. and Mrs. Einard Juhala visited * the Harry Hedstrom home Sun- Y. Mr. and Mrs. L. Davenport and children, and Bill and Leo Shaffer visited at the Elmer Bloomquist home Monday. Elmer Bloomquist and Wayne, and is the J. W. Doan home Sunday morn- 8. Mr. and Mrs. Lloyd Wildfang and family visited at the 8. E, Clizbe home Sunday evening. ¢ i Richmond t | | By MARTHA BOSSERT G. A. Bossert and Donald Rhodes were Capital City callers Wednesday. Arthur and Jacob Weber, who are stationed at the OCC camp at La- kota, spent a few days at their par- ental home, Bernice Hien spent Thursday with be grandparents, Mr. and Mrs. Jacob en. Miss Christine Bossert, who is at- tending confirmation school in Tuttle, spent the week-end at her parental home. Sunday visitors and guests at the Bossert home were, Mr. and Mrs. Fred Borth, sons, Fred and Reymond, and daughters, Ruby, Viola and Leona, Mr. and Mrs. Fred Plines and daugh- ters, Christine and Ruby, Hans Jacob- son and Theodore Nolen. Mr. and Mrs. John Weber, Jr., mo- tored to New Rockford Saturday to visit Mr. and Mrs. Gottfried Weber and family. ¢———_________—_¢ i Clear Lake | + e By MYRTLE CHRISTENSEN Mrs. Ingeborg Rasmussen, who has been visiting with friends at Rugby and Minot the past week, has re- turned home. Mr. and Mrs. W. F. Keeler and chil- dren were Bismack shoppers Wed- nesday. Mr. and Mrs. Ben Oren and family of Driscoll spent the Fourth with Mrs. Oren’s parents, Mr. and. Mrs. B. F. Paslay. ‘ Mr. and Mrs. Allen Van Vleet and family and Mrs. Emanuel Liebelt and two sons of Glen Ullen, who have been visiting relatives at Detroit Lakes, Minn., returned home Monday. Mr. and Mrs. Roy Olson and son were July 4th visitors at the Clar- ence. Olson home. George Chappell of Bismarck spent Wednesday evening at the Albert Christensen home. Mr. and Mrs. Ole Newland and family were Sunday evening visitors at the Adolph Hansen home. Marion and Gladys Christianson spent Monday with their grand- mother, Mrs. Marie Alauson. Miss Martha Keeler is visiting with her uncle and aunt, Mr. and Mrs. Ole Newland. - 2 > | Lyman Glenfield, N. D. She plans a camping |. trip with friends from there. Mr. and Mrs. Dave Hein and chil- dren were supper guests at the A. Fel- ton home Sunday . Elizabeth Mueller left Monday for Goodrich, where she will visit at the 6. E. Laschkewitsch home for some e. Art and Jake Weber and Herman Jacobson, who are in the CCC camps spent the week-end at their parental homes. Dr. W. E. Anderson spent a few days. at his farm here. He is now located at the CCC camp at Bottineau, N. D. Mr. and Mrs. John Weber, Jr., spent the week-end visiting friends and rel- tives in New Rockford. Bertel Anderson returned home after attending school in Chicago the Past few weeks. ° pe | Baldwin o——____ By MRS. FLORENCE BORNER The FERA baseball team of Bis- wnarck defeated the local team here Sunday by a score of 14 to 12. Next Sunday the Baldwin team will play the team from Smith on the local diamond. | ° Mr. and Mrs. A. W. Nedervold and son, Glenn, arrived here Wednesday evening from their home at Tacoma, Wash., to visit with the C. A. Nord- strom family. Saturday morning they left for Harvey where they will be guests at the home of Mrs. Nedervold’s parents. Mr. Nedervold is employed in the postal service at Tacoma and is on his vacation. Mr. and Mrs. John Oshanyk and daughter, Lugene, of Wilton, spent Sunday at the home of Mrs. Oshanyk’s sister and brother-in-law, Mr. and Mrs. Ernest Lange of Wilton is vis- iting relatives in the community. The Presbyterian Ladies’ Aid met at the home of Mrs. G. G. Rupp in Baldwin Wednesday afternoon. Mr. and Mrs. Al Erickson and fam- ily of Bismarck visited over the Fourth with Mrs. Erickson’s parents, Mr. and Mrs. E. A. Fricke. Mr. and Mrs. Laurence Spitzer, who hhave been spending a couple of weeks on Mr. Spitzer's father’s farm east of here, have returned to their home at Arnold. Mr. and Mrs. C. A. Nordstrom and family and their guests, Mr. and Mrs. A. W. Nedervold and son, Glenn, of Tacoma, visited over the Fourth at the home of Mr. and Mrs, Fred Erick- son near Price. Mr. and Mrs. Andrew Olson and family at the Mr. and Tra Mrs. Herman Meyer, Mr. Falkenstein and By 8. GYLDEN Miss Tyne Eckholm, who has spent the past two weeks at her home, re- turned to the Schlabach home to re- sume her duties as housekeeper. Wayne Inget and Andrew Linska spent Gunday at the C. L. Linska home. — Matt Setala spent the week-end visiting at John Gylden’s. , Walter Ojanen, Leonard Kavonius, Mr. and Mrs. Seth Gylden and family, John Gylden and John Kangas were Bismarck callers ‘Wednesday. Mrs. Gust Eckholm and _ son, Andrew, were visitors at William Harju’s, Sunday Tyne Eckholm stayed at the Louis @ Olson home from Monday until Tues- day evening. Miss Alice Freshour of Starling spent the past week visiting with Miss Martha Siirtola. Miss Hulda Siirtola was a guest last week of the Misses Lempi and Wilma ‘Wirta. a Gerald Dronen, who has spent the past two years at the Sharpe home, {returned to his home last week. Again ody | McKenzie | e—_—_- —_—_ -—#« By MBS. T. T. HUGHES Visitors and dinner guests at the Eric Slovarp home Sunday were Mrs. Eric Villa of Portlend, Oregon, sister jof Mrs. Slovarp, John and Gilbert Slovarp of Fosston, Minn., Mr. and | Mrs. Alfred Slovarp and family and Mr. and Mrs: Mike Victor and family. Mrs. M. A. Johnson has returned home after a four month stay in Iowa where she was called by the death of her father and serious illness of her ‘mother. The Ladies’ Aid will meet ‘with Mrs. E. L. Adams Wednesday afternoon. : Wayne.-Ayers of Menoken spent Saturday night and Sunday with his cousin, little Lester Hughes. The funeral of W. L. Wilton which was held Saturday here at the church was largely attended. Pallbearers were H. E. O'Neill, Glen Baker, M. A. Johnson, R. C. Boren, B. F. Coons and W. C. Belk. Mr. Wilton was a pioneer | resident of McKenzie and Menoken townships. Interment was in the family lot in Menoken cemetery. Mr. and Mrs. T. T. Hughes and son attended the entertainment given in the Bismarck M. E. church Sunday | evening by the Rust College Jubilee | Singers of Mississippi. Mrs,.C. Roberts of Jamestown vis- | ited her parents, Mr. and Mrs. P. E. | Roth, the past week. lily spent the Fourth at the McMur- Bill Anderson were business callers |* *|for Fargo Sunday morning. Mr. Erick- > Henry Thayre, THE BISMARCK TRIBUNE, FRIDAY, JULY 12, 1985 Lee and D. B. Leathers, returned home Sunday night after a week's vacation at Osage, Minn., lakes. Mr. and Mrs. John Gable, Sr., of Gibbs township visited their daugh- ter and son-in-law, Mr. and Mrs. George Hughes, Sunday. — | Telfer By MRS. WM. McMURRICK Mr. and Mrs. Bert Buckley, daugh- ters, Corrine and Neomi, and Mr. and Mrs. Glen Oder returned from a trip through parts of South Dakota, Montana and Wyoming, Thursday. Mr, and Mrs. R. B. Fields and fam- Tick home.. _ Miss Louise Gardiner, teacher at) the Spur school, is having an enter- tainment and basket social the eve- ning of July 17th. The date for the celebration of the S0th anniversary of the Glencoe church has been set for July 2ist. This will be an all-day service. Bismarck callers Saturday included Jacob Dietrich, Mrs. Ruth McMurrick, John Becknel, Willie Stewart, Mr. and Mrs. Wm. McMurrick and Mr. and Mrs. Howard Kershaw and daughter, Helen. Mr, and Mrs. Christ Koch, and son, Jack, of Bismarck, visited at the R. B, Fields home Sunday. —_______— Still By I. 8. HAGSTROM Mr. and Mrs. John Law and daugh- ters, Ruth and Margaret, were guests of Mrs. Signe Johnson Sunday. Mr. and Mrs. A. H. Erickson left son is to arrange for some exhibits at the fair. Mrs. Erickson will go on to Stillman Valley, Ill., to spend some time with her parents, Mr. and Mrs. Edward Johnson. Miss Alma Benson of Flasher spent several days last weék visiting her brother-in-law and sister, Mr. and Mrs. John Asplund. vie Misses Velma Johnson and Leona Broehl of Bismarck spent Sunday at their respective homes here. Mr. and Mrs. O. N. Erickson spent Thursday at the golden jubilee at Minot. | Mr. and Mrs. Charlie Noon and Mr. and Mrs. Wilbur Noon and fam- | ily spent Thursday with the Alms) south of Regan. Mr. and Mrs. August Nordquist of Wright, Minn., were guests at the L. M. Nordquist home from Wednesday | until Friday. Mr. and Mrs. John Asplund and! sons, Lloyd, Kenneth, Robert and Norman, are visiting with Mrs. As- plund’s parents at Flasher. Ned Asplund called at the Hag- strom home Friday. Mr. and Mrs. Fred Johnson, sons, Phillip and LeRoy, and Miss Nellie Hagstrom were supper guests at the Nordquist home Wednesday. The Sunshine Workers 4-H club met at the home of Hilma Johnson Wednesday, July 10. —— @ | Schrunk | o ° | By EDNA MARCHANT Miss Clara Johnson, who is em-) ployed in Bismarck spent a few days | visiting at her parental home. Mr. and Mrs. Herman Neiters are visiting their relatives in St. Cloud, Minn., at this writing. Gus Witt departed on Monday for Lakota, N. D., where he entered the | CCC camp. Wm. Witt who has been in St. Alexius hospital for several weeks, re- turned home on Friday somewhat im- proved. Mr. and Mrs. John Witt and Lorraine Wentz visited with the former's mother at the hospital in Bismarck on Saturday. Mr. and Mrs. John Witt visited with her. sister, Mrs. Herbert Hoff- man, north of McClusky. Mrs. Herbert Hoffman. spent Satur- day evening visiting at the James Ol- son home in Wing. Mrs. Ed Nolan and family spent Saturday in Wing. Mrs. Herbert Hoffman and daugh- ter, Carol Daphne, are visiting rel- atives over the week-end. Mr. and Mrs. Marchant, Mr. and Mrs. John Witt, Lorraine Wentz and Mrs. Hoffman and Carol visited at the John Reile home on Sunday. Mrs. Philip Zelmer died from apo- plexy on Monday and wes buried on Friday in Regan. ° By MRS. WALTER DIETZMAN Mr. and Mrs. Gilbert Melick went to Mandan Monday afternoon where Mrs. Mélick is taking treatments. Tebbo Harms and son, Jake, were business callers in Bismarck Monday afternoon. Jake remained in Bis- marek, Mrs. Bill Madland and son, David, who are visiting at Lawrence Mad- land’s went to the Chas. McCormick home Tuesday afternoon to visit for 9 few days. Mr. and Mrs. Clyde Monroe left Monday evening for the Black Hills where they will spend a week on a wedding trip. Those from this vicinity who at- tend the miscellaneous shower at the Wilbur Rogers home Tuesday for Mrs. Ed. Hawley were Mrs. Laurence Mad- land, Mrs. Vern Thysell, Mrs. Gilbert Melick, Mrs. W. A. Dietzman and daughter, Mildred, Miss Hathy David- son and Mrs. Earl Evens. The shower was sponsored by the senior 4-H club of McKenzie. Mr.-and Mrs. Walter Dietzman, son, Edwin, and Fred Cox were caliers at the home of Mr. and Mrs. Floyd Owen Tuesday evening. A special township meeting was held at the home of the clerk, Tebbo Harms, Tuesday after noon. All mem- bers were present. Mrs. A. Kruge and son, John, Mrs. Adam Schauer and sons, Reynold and Albert, Mr. and Mrs. Floyd Owen and family, Joe Fischer, Mildred and Ed- win Dietzman, were shoppers in Bis- marck Wednesday. Mr. and Mrs. Tebbo Harms, Mr. and Mrs. Gilbert Melick, Mr. and Mrs. Wm. Kershaw and son, Arthur, spent the afternoon of the Fourth in Bis- marck. Mr. and Mrs. Laurence Madland | and Ruth Ann Thysell spent the! Fourth with relatives at Hazelton. | Mr. and Mrs, Walter Dietzman en- | tertained Mr. and Mrs. Floyd Owen Makes Non-Stop Hop! LAURA INGALLS Burbank, Calif, July 12—()— Laura Ingals Friday dreamed of new aviation laurels after conquering the transcontinental skyways in the first non-stop east-to-west flight by a woman. The brown-haired, 120-pound avia- trix mede the gruelling but uneven- ful trip in 18 hours, 19 minutes, 30 seconds—too slow for a record be- tween the oceans. As she rested after landing Thurs- day night she. mulled over tentative plans to attack anew the west-east flight which has balked her twice recently. “I may try for a west-to-east flight for a record that way within a few days,” she said. “I'll know de- finitely soon.” Miss Ingalls brought her new $40,- C09 black-cowled monoplane to a safe landing at Union air terminal at 7:51 p. m. (10:51 p. m. EST). “Boy, what a long ride,” she ex- claimed, yanking a tiny beret off her head. “It was an ordeal and I'm glad I made it.” Leaving Floyd Bennett Field at New York at 4:31 a. m. EST, Miss Ingalls followed the course over sas City artd on to the coast. William Kershaw and son, Arthur, Mrs. Gilbert Melick, Mrs. Walter Dietzman and daughter, Mildred, and son, Edwin, John Olsen, Mrs. Tebbo Harms and son, John, Robert Miller and John Kruger. Miss Dena Harms came out from Bismarck Saturday evening to spend the week-end at her parental home. Carl Muth, who went to Rochester, Minn., several weeks ago to receive treatments for his eyes returned to Bismarck Saturday. Mrs. A. Kruger and son, John, and daughter, Elsie, visited at the home of Mr. and Mrs. Herman Kikul near Baldwin Sunday. The members of the Three Leat Clover Homemakers club and their jfamilies enjoyed a picnic: dinner at the Menoken picnic grounds, Sunday. Mr. and Mrs. Vern Thyeell, Mrs. Bill N. D., John Olsen and Miss Dena Harms and Rubin Tellinghausen of Bismarck were visitors. A number of friends of Mr. and Mrs. Vern Thysell gathered at the Laurence Madland home Sunday evening to charivari them. Mr. and Mrs. Thysell were presented with a purse of money as a wedding gift. ° its H . A | Missouri o=- By MRS. K. R. SNYDER project in this community dug up two Skeletons Tuesday, believed to be those of Indians which were buried there many years ago. Between them was found the head of a buffalo. Madge Wallace was a Wednesday visitors at the William MacDonald home. Mr, and Mrs. Grant Hartley and daughter, Joan, were Friday evening visitors at the John Crawford home. Miss Betty Jane Small is visiting at the home of her aunt, Mrs. Art Morris, in Harvey. Bob McDonnell of Bismarck was a Sunday visitor at the John Clark home. Mr. and Mrs. Studie Woodworth and family, Mr. and Mrs. Emory Woodworth and Billie Ann, W. E. Cleveland, Mr. and Mrs. Walter Woodworth and family, Bernard Wingle, William Clark, Mr. and Mrs. Oscar Swenson and son, Bobby, Mr. jand Mrs. Ginner and daughter, Mr, and Mrs, Paul Linssen and son, Ver- non, Mr. and Mrs. J. E. Chesak and family, Mrs. Edna Robinson and fam- ily and Joe Erickson picnicked in the woods the Fourth of July. Mr. and Mrs. Leslie Clark and Er- est Doehle spent the Fourth of July at Midway, Miss Vidette Robidou is visiting at the home of her aunt, Mrs. C. D. Kimball, near Brittin. Mr. and Mrs. W. E. Snyder and family, Charles Snyder from near Menoken, Mr. and Mrs. C. D. Kimball from near Brittin, Mr. and Mrs. James Robidou and family gathered at the John Crawford home the Fourth. A pot-luck dinner was served and then a trip to the river and woods was enjoyed later. Mr. and Mrs: William MacDonald had as their Fourth of July guests, |Mr. and Mrs. James MacDonald, Mr. |and Mrs. Alex Anderson and family, Mr. and Mrs. Andrew Irvine and fam- ily and Miss Eleanor MacDonald. SUMMONS. STATE OF NORTH DAKOTA, COUN- y OF BURLEIGH, ss, IN DISTRICT COURT, FOURTH SEMA. NEUBAUER, ‘r "PLAINTIFF. vs. ARTHUR NEUBAUER, ) ORTH DAROTA, HE STATE OF Ni . Re ABOVE NAMED DEFEND- ANT: You are hereby summoned and re- quired, to answer the Complaint of the plaintiff in the above entitled ace tion, which said Complaint will be on file in the office of the clerk of the above named Court, and to serve a copy of your answer upon the sub- seriber and undersigned, at his office in the city of Steele, county of Kidder, and state of North Dakota, within thirty days after service of this sum- mons upon you, day of such service exclusive: and, in case of your failure to so answer or to appear herein, plaintiff will take judgment against you hy default for ‘the relief In said and family, Miss Gladys Tooker and | Ivan Sherman at dinner the Fouth of July. | Those who transacted business inj} Bismarck from this vicinity Saturday | Mrs. Arthur SEPA ae an Mrs.| -Mr. and Mrs. George Watson, ac- | vere Mr. and Mrs. Adam Schauer and complaint demanded. Dated at Steele, North Dakota, this 6th day of June, 93! J. N. McCarter, Attorney for plaintift, Residence and posto: fice addres St North Dako! , Marie.‘companied by Mr. and Mrs. Marion | daughter, Violet, and son, Alfred, Mis. |6/7-14-21-28 7/5-12. Pittsburgh, Cleveland, Chicago, Kan-|p, Madland and son, David of Pembina, | di The men working on the FERA|p TO COUNTY AUDITORS: I, James D. Gronna, secretary of state of the state of North Dakota, in accordance with the provisions of Article 26, Amendments N. D. Consti- tution and Section 979, C. L. 1913, do hereby ceritfy that th ferred measure will be submitted to the voters at the special election pro- claimed by Acting Governor Walter ee to be held on Monday, July I, Clair G. Derby, County Audito: Burleigh County, North Dakota, cer. tify that the following is a true and correct copy of this Tax Sale Measure to be voted upon as called for in a Special Election to be held at the various election precincts in Burleigh County, ‘North Dakota, July 15, 1986. In Witness whereof, I have’ her unto set my hand and’ affixed the of- ficial seal of the County of Burleigh, City of Bismarck, this 20th day of Tune 1935, (SEAL) CLAIR G. DERBY, County Auditor, SALES TAX ACT Submitted by referendum petition: Referendum of 8. B. 813, 1935 legis- lative assembly: Approved by governor, March 11, 1935, as an emergency measure. Referendum of a measure desig- nated as ‘Senate Bill No, 313," enacted by the twenty-fourth legislative as- sembly of the state of North Dakota, at the regular 1935 session of said legislative assembly, being an act pro- viding for a sales tax on the retail sale of all tangible personal property within this state, providing for ad- ministration and for the collection and distribution of moneys received therefrom, and repealing all laws or Parts of laws in conflict therewit! And the full text of which act is follows, to-wit: An act to equalize taxation and re- place in part the tax on property; to Provide the public revenue to’ be used for such replacement by im- posing a tax on the gross receipts from retail sales as defined herein: to provide for the collection of such tax, the distribution and use of the revenue derived therefrom, and the administration of sald law; to pro- vide for certain deductions and ex- emptions; to make an appropria- tion for the administration of this act; to fix fines and penalties for the violation of the provisions of this act; to repeal all laws or parts of laws in conflict herewith and de- claring an emergency. Be It Enacted by the Legiaiati = sembly of the State et, ‘North Das Bete Section 1. DEFINITIONS.) following words, terms and phrasce, when used in this division, have the Meanings ascribed to them in this section, except where the context clearly’ indicates a different meaning: (a) “Person” includes any individ ual, firm, copartnership, joint adven ture, association, corporation, munici- pal corporation, estate, trust, business trust, receiver, or any other group or combination acting as a unit, and the plural as well as the singular num- (>) “Bale” means any transfer, ex- change, or barter, condttional or otherwise, in any manner or by any means whatsoever, for a considera- (c) “Retail sale” or “sale at retail” means the sale to a consumer or to any person for any purpose, other than for procersing or for resale, of tangible personal property and ‘the sale of gas, electricity, water, and communication service to retail. con sumers or users, and shall include th ordering, selecting or alding a cus tomer to select any goods, wares oF merchandise from any price list, of catalogue, which such customer might ender, oF be ordered for such customer shipped dire a Mont PP etly to such cus (d) “Business” includes any activit engaged in by any person or caused fo,begngaged in by him with the ob- of gain, benefit, or adva either direct or indirect. weet (e) “Retailer” includes every per- son engaged in the business of sell ing tangible goods, wares, or me chandise at retail, or the furnishin of gas, electricity, water and com munication service, and. tickets. or admissions to places of amusement and athletic events as provided in this visi (f) “Gross receipts” means the total amount of the sales of retailers, val- ued in money, whether received in money or otherwise, provided, how- ever, that discounts for any purpose allowed and taken on sales shall not be included, nor shall the sale price of property’ returned by customers when the full sale price thereof is re- funded either in cash or by credit, | Provided, further, that on all sales of retailers, valued in money, when such | Sales are made under conditional sales contract, or under other forms of sale wherein the payment of the principal sum thereunder be extended over a period longer than sixty (60) days from the date of sale thereof that only such portion of the sale amount there- of shall be accounted, for the purpo of imposition of a tax imposed by this il], as has actually been received in cash by the retailer during each quar- terly period as defined herein, (gz) “Relief agency” means the state, any county, city and county, city or district thereof, or any agency engaged in actual relief work. (hy) “Commissioner” means the tax commissioner of the state of North Dakota. Section 2, TAX IMPOSED.) There is hereby imposed, beginning the first day of May, 1935, and ending May 1, 1937, a tax of two per cent (2%) upon the ‘gross receipts from all sales of tangible personal property, cons: ing of goods, wares, or merchandise, except as otherwise provided in this livision, sold at retail in the state of North Dakota to consumers or users; a like rate of tax upon the gross re- ceipts from the sales, furnishing or service of gas, electricity, water and communication service, including the gross receipts from such sales by any municipal corporation furnishing gas, electricity, water and communication service to the public in its proprietary capacity, except as otherwise pro- vided in this division, when sold at retail in the state of North Dakota to consumers or users; and a like rate of tax upon the gross receipts from all sales of tickets or admissions to Places of amusement and athletic events, except as otherwise provided in this division. The tax herein levied shall be com- puted and collected as hereinafter provided. Section 3. EXEMPTIONS.) There are hereby specifically exempted from the provisions of this division and from the computation of the amount of tax imposed by It, the following: (a) The gross receipts from sales of tangible personal property which this state is prohibited from taxing under the constitution or 1. United States or under th tion of this state. (b) ‘The gross receipts from the sales, furnishing or service of trans- portation service, (c) The gross receipts from sales of tangible personal property used for the performance of a contract on public works executed prior to the effective date of this divi (a) The gross recel; of tickets or admissions county, district and local fairs, and the gross receipt: religious, or where the entire eipts ligious or charitable purposes. Section 4. Taxes paid on gross r ceipts represented by accounts found to be worthless and actually charged off, for income tax purposes may b credited upon a subsequent payment of the tax herein provided; provided, that {f such accounts are thereafter collected by the retailer, a tax shall be paid upon the amount so collected. The provisions of this act shall not apply to sales of gasoline, cigarettes, snuff, insurance premiums, or any other product, business or occupation upon which the state of North Dakota now or may hereafter impose a spe- cial tax, either in the form of a li cense tax, stamp tax or otherwise. EDIT TO RELIEF A relief agency may apply to the commissioner for refund of the amount of tax imposed hereunder and paid upon sales to it of any goods, wares, or merchandise used for free distribution to the poor and needy. 2. Such refunds may be obtained only in the following amounts and the manner and only under the following condition: (a) On forms furnished by the com- missioner, and during the time herein provided ‘for the filing of quarterly tax returns by retailers, the rellef agency shall report to the commis- sioner the total amount or amount! valued in money, expende or Indirectly for goods, wares, or mer- chandise used for free distribution to the poor and n (>) On the agency shall 8 ws of the constitu- Section 5. CR AGENCY.) sons making the s: order, together wii it or to its the dates of the following re- | 1 » and the total amount so ex- pended by the relief nev, (c) The relief agency must prove to the satisfaction of the commis- sioner that the person making the sales has included the amount thereof in computation of the gross re- ceipts of h person and that such person has paid the tax levied by this vision, based upon such computa- tion of gross receipt 3. If the commissioner {s satisfied that the foregoing conditions and re- quirements have been complied with, he shall refund the amount claimed by_the relief agency. Section 6. Retailers shall, as far as practicable, add the tax imposed under this act, or the average equiv- alent thereof, to the sales price or charge and when added such tax shall i constitute a part of such price or charge, shall be a debt from consumer or user to retailer until paid, and shall be recoverable at law in the same manner as other debts. Agreements between competing re- tallers, or the adoption of appropriate rules and regulations by organizi tions or associations of retailers to provide uniform methods for adding such tax or the average equivalent thereof, and which do not involve rice fixing agreements otherwise u jawful, and which shall first have tl approval of the commissioner, are ex- Pressly authorized and shall be held not to be in violation of any anti- trust laws of this state. Section 7. UNLAWFUL ACTS.) It shall be unlawful for any retailer to advertise or hold out or state to the public or to any consumer, directly or indirectly, that the tax or any part thereof imposed by this division will be assumed or absorbed by the retail- er or that it will not be considered as an element in the price to the con- Sumer, or if added, that it or any part thereof will be refunded. Section 8 RECORDS REQUIRED.) It shall be the duty of every retailer required to make a report and pay any tax under this division, to pre- serve such records of the gross pro- ceeds of sales: as the commissioner may require and it shall be the duty of every retailer to preserve for a@ Period of two years all invoices and other records of goods, wares, or mer- chandise purchased for resale; and all such books, invoices, and other rec- ords shall be open to examination at any time by the commissioner or any one of his duly authorized agents. Section 9. RETURN OF GROSS RE- . The retailer shall, on or before the 20th day of the month following the close of the first quarterly period as defined in the following section, and on or before the 20th day of the month following each subsequent quarterly period of three months, make out a return for the preceding quarterly period in such form and manner as may be prescribed by the commissioner, showing the gross re- ceipts of the retailer, the amount of the tax for the period covered by such return, and such further information as the commissioner may requi enable him correctly to compute and collect the tax herein levied; pro- vided, however, that the commissioner may, upon request of any retailer and a proper showing of the necessity therefor, grant unto such retailer an extension of time of not to exceed thirty (30) days for making such re- turn. If such extension is granted to any such retailer, the time in which he ig required to make payment as provided for in section ten (10) of this act shall be extended for the same period. 2. The commissioner, if he deems it necessary or advisable in order to in- sure the payment of the tax imposed by this division, may require returns and payment of the tax to be made for other than quarterly periods, the pro: visions of section ten (10) or else- to the contrary notwithstand- }. Returns shall be signed by the retailer or his duly authorized agent, and must be verified by oath. Section 10, PAYMENT OF TAX— BOND.) 1. The tax levied hereunder shall be due and payable in quarterly in- stallments on or before the 20th day of the month next succeeding each quarterly period, the first of such per- fods being the’ period commencing with May 1, 1935, and ending on the 30th day of June, 1935. 2, Every retailer at the time of making the return required here- under, shall compute and pay to the commissioner the tax due for the pre- ceding. period. 3. The commissioner may, when in his Judgment it is necessary and ad- visable to do so in order to secure the collection of the tax levied under this division, require any person subject to such’ tax to file with him a bond, issued by a surety company author- ized to transact business in this state and approved by the insurance com- missioner as to solvency and respon- sibility, in such amount as the com missioner may fix, to secure the pay- ment of any tax and/or penalties due or which may become due from such person. In lieu of such bond, securi- ties approved by the commissioner, in such amount as he may prescribe, may be deposited wtih him, whic securities shall be kept in the custody of the commissioner and may be sold by him at public or private sale, with- out notice to the depositor thereof, it it becomes necessary so to do in order to recover any tax and/or penalties due. Upon any such sale, the surplus, if any, above the amounts due under this division shall be returned to the person who deposited the securitle Section 11. PERMITS—APPLICA- TIONS FOR.) . Thirty days after the effective date of this act, it shall be unlawful for any person to engage in or trans act business as a retailer within this state, unless a permit or permits shall have’ been issued to him as herein- after prescribed. Livery person desir- ing to engage in or conduct business as a retailer within this state shall file with the commissioner an appll- cation for a permit or permits. Every application for such a permit shall be made upon a form prescribed by the commissioner and shall set forth the name under which the applica transacts or intends to transact bus! ness, the location of his place or places of business, and such other in- formation as the commissioner may require. The application shall be signed by the owner if a natural per- ; {n the case of an association or partnership, by a member or partner thereof; in the case of a corporation, by an ‘executive officer thereof or some person specifically authorized by the corporation to sign the appli- cation, to which shall be attached the written evidence of his authority. . At the time of making such ap- plication, the applicant shall pay to the commissioner a permit fee of fifty cents (50c) for each permit, and the applicant must have a permit for each Place of business. . Upon payment of the permit fee or fees herein required, the com- missioner shall grant and issue to each applicant « permit for each place of business within the state. A per- mit is not assignable and shall be valld only for the person in whose name {t is issued and for the tran action of business at the place desig- nated therein. It shall at all times be conspicuously aisplayed at the Place for which issued. Permits issued under the pro- visions of this division shall be valiad and effective without further pay- ment of fees until revoked by the commissioner. 5. Whenever the holder of a permit fails to comply with any of the pro- visions of this division or any rules or regulation of the commissioner Prescribed and adopted under this di- vision, the commissioner upon hear- ing after giving ten days’ notice of the time and place of the hearing to show cause why his permit should not be revoked, may revoke the permit. The commissioner shall also hi h power to restore licenses after such revocatlo: 6. The commissioner shall charge a fee of one dollar for t! of a permit to a retailer wh has been previously revoke: Section 12. FAILURE TO FILE RETURN—INCORRECT RETURN.) If a return required by this division is not filed, or if a return when filed Is incorrect or Insufficient and the maker fails to file a corrected or sufficient return within twenty da: after the same is required by not! from the commissioner, such commi: sioner shall determine the amount of tax due from such information as he may be able to obtain and, if nece: sary, may estimate the tax on the basis of external indices, such as number of employees of the person concerned, rentals paid by him, his stock on hand, and/or other factors. The commissioners shall give notice of such determination to the person Hable for the ta: Such determina- tion shall finally and irrevocably fix less the person against whom it is Se! shall, within thirty days after the giving of notice of such determination, apply to the commissioner for a hearing or unless the commissioner of his own motion shall reduce the same. At such hear- evidence may be offered to su! such determination or to prove permit in, port that {t ts incorrect. After such h ing the commissioner shal! give noti of his decision to the person liable for the tax. Section 13. APPEALS.) 1. An appeal may be taken by the taxpayer to the district court of the county in which he resides, or in which his principal place of business is located, within sixty days after he shall have received notice from tl commissioner of his determination as provided for in the preceding section. 2. The appeal shall be taken by a written notice to the commissioner and served as an original notice. When said notice is so served it shall, with the return thereon, be filed in the of- fice of the clerk of said district court, and docketed as other cases, with the taxpayer as plaintiff and ‘the com- missioner as defendant. The plain- tiff shall file with such clerk a bond for the use of the defendant, with sureties approved by such clerk, in Penalty at least double the amount. of tax appealed from, and in no case shall the bond be less than fifty dol- lars ($50.00), conditioned that the plaintiff shall perform the orders of the court. . The court shall hear the appeal in EY and determine anew all questions submitted to it on appeal from the determination of the com- missioner. The court shall render its decree thereon and a certified copy of said decree shall be filed by the clerk of said court with the commis- sioner who shall then correct the as- sessment in accordance with said de- cree, An appeal may be taken by the taxpayer or the_commissioner to the supreme court of this state in the same manner that appeals are taken in suits in equity, irrespective of the amount involved. Section 14, SERVICE OF NOTICES.) 1, Any notice, except notice of ap- peal, authorized or required under the pro ions of this division may be given by mailing the same to the per- son for whom it is intended by regis- tered mail, addressed to such person at the address given in the last re-| turn filed by him pursuant to the provisions of this division, or if no re- turn has been filed, then to such ad- dress as may be obtainable. The mail- ing of such notice shall be presum| tive evidence of the receipt of the same by the person to whom ad- dressed. Any period of time which is determined according to the provi- sions of this division by the giving of notice shall commence to run from the date of registration and posting of such notice. The provisions of the North Da- kota code relative to the limitation of time for the enforcement of a civil remedy shall not apply to any pro- ceeding or action taken to le ap- praise, assess, determine or enforce provided by this division. Section 15. PENALTIES—OF-) FENSES.) 1. Any person failing to file a re- turn or corrected return or to pay any tax within the time required by this division, shall be subject to a penalty of five per cent (5%) of the amount of tax due, plus one per cent (1%) of such tax for each month of delay or fraction thereof, excepting the first month after such return was re- quired to be tiled or such tax became due; but the commissioner, if sa’ fied that the delay was ex ble, may remit all or any part of such Penalty. Such penalty shall be paid | to the commissioner and disposed of in the same manner as other receipts under this division. Unpaid penalti be enforced in the same ner as the tax imposed by this division. . Any person who shall sell tang- ible personal property, tickets or ad- missions to places of amusement and athletic events, or gas, water, elec- tricity and communication service at retail in this state after his license shall have been revoked, or without procuring a license within sixty (60) days after the effective date of this act, as provided in section 11 of this act, or who shall violate the prov: sions of section seven of this act, and the officers of any corporation who shall so act, shall be guilty of a misdemeanor, punishment for which shall be a fine of not more than one thousand dollars or imprisonment for not more than one year, or both suc fine and imprisonment, in the discre- tion of the court. - Any person required to make, render, sign, or verify any return or supplementary return, who makes any | false or fraudulent return with intent to defeat or evade the assessment re- quired by law to be made, shall be guilty of a felony and shall, for each such offense, be fined not less than five hundred dollars and not more than five thousand dollars, or be im- prisoned not exceeding one year, or be subject to both a fine and imprison- ment, in the discretion of the court. 4. The certificate of the commi. sioner to the effect that a tax has not been paid, that a return has not been filed, or that information has not been supplied pursuant to the provi- sions of this division, shall be prima facie evidence thereof. Section 16. The tax commissioner of the state of North Dakota is hereby charged with the administration of [this act and the taxes imposed there- by. Such commissioner shall have the power and authority to prescribe all rules and regulations not incor sistent with the provisions of this ac necessary and advisable for its de- tailed administration and to effectu- ate its purposes, including the right to provide for the issuance and sale by the state of coupons covering the amount of tax or taxes to be pald under this act, if such method is deemed advisable by said commis- sioner. Section 17. All fees, taxes, interest and penalties imposed and/or col- lected under this act must be paid to the commissioner in the form of re- mittances payable to the treasurer of the state of North Dakota, and said commissioner shall transmit each payment dally to the state treasurer to be deposited in the State Treasury to the credit of a fund to be known as the special tax fund, which fund is hereby created and established. Section 18. GENERAL POWERS.) 1, The commissioner, for the pu: pose of ascertaining the correctnes of any return or for the purpose of making an estimate of the taxable income and/or receipts of any tax- Payer, shall have power: to examine or cause to be examined by any agent or representative designated by him, books, papers, records or memorand: to require by subpoena the attend- ance and testimony of witnesses; to issue and sign subpoenas; to admin- ister oaths, to examine witnesses and receive evidence; to compel witnesses to produce for examination book: papers, records and documents relat- ing to any matter which he. shall have the authority to investigate or determine. 2. Where the commissioner finds the taxpayer has made a fraudulent return, the costs of said hearing shall be taxed to the taxpayer. In all other cases the costs shall be paid by the state. 3. ‘The fees and mileage to be paid witnesses and taxed as costs shall be the same as prescribed by law in pro- ceedings in the district court of this state in civil cases. All costs shall be taxed in the manner provided by law in proceedings in civil cases. Where the costs are taxed to the taxpayer they shall be added to the taxes as- sessed against said taxpayer and shall e collected in the same manner. Costs taxed to the state shall be certified by the commissioner to the state treasurer, who shall issue warrant for the amount of said costs, to he paid out of the proceeds of the taxes collected under this act. In case of disobedience to # sub- poena the commissioner may invoke the aid of any court of competent jur- {sdiction in requiring the attendance and testimony of witnesses and pro- duction of records, books, papers, and documents, and such court may issue an order requiring the person to ap- pear before the commissioner and ive evidence or produce records, papers and documents, as t' case may be, and any failure to obey such order of court may be punished by the court as a contempt thereof. 5. Testimony on hearings before the commissioner may be taken by a deposition as in civil cases, and any person may be compelled to appear and depose in the same manner as witnesses may be compelled to appear and testify as hereinbefore provided. Section 19, The commissioner, with the ap- 1 of the governor, may appoint , auditors, clerks and em- he may ‘deem necessary and fix their salaries and compen- sation and prescribe their duties and powers and said commissioner shall have the right to remove such agents, auditors, clerks and employees so ap- pointed by him. 2, All ‘such agents and employees shall be allowed such reasonable and other necessary traveling expenses as may be incurred in the performan: of their duties not to exceed, how an now or may aw. 3, The commissioner may require the collection of any tax or penalty | 7 the duties in such sum and wit! sureties as it may determine a: state hall pay, out of the p the tazes collected under the sions of this act, the premiu’ such bonds. woth 4. The commissioner may utilize the office of treasurer of the various counties in order to administer this act and effectuate its purposes, may appoint the treasurers various counties its agents to any or all of the ta: im, this act, provided, howeve: additional compensation paid to said treasurer by n- thereof. Section 20. INFORMATION DEEM- ED CONFIDENTIAL.) . 1. It shall be unlawful foF the commissioner, or any person having an administrative duty under act, to divulge or to make known fh any manner whatever, the business af- fairs, operations, or information ob- tained by an investigation of recordr and equipment of any pérson or cor- poration visited or examined in the discharge of official duty, or the amount or source of income, profits, losses, expenditures or any particular thereof, set forth or disclosed ih any return, or to permit ly return or copy thereof or any book containin, any abstract or particulars thereo! to be seen or examined by any person except as provided by law; provided, however, that the commissioner mi authorize examination of such re- turns by other state officers, or, if a reciprocal arrangement exists, = by ta: officers of another state, or the fed- eral government. rovi- son jon o1 of 1e tion shall be guilty of « misdemeanor and punishable by a fine not to ei ceed one thousand dollars ($1,000. Section 21. CORRECTION OF E: RORS.) If it shall appear that, as s result of mistake, an amount of ta: Benalty, or interest, has been pati which was not due under the provi sions of this act, then such amount shall be credited against any tax due, or to become due, under this act from the person who made the er- roneous payment, or such amount shall be refunded to such person by the commissioner, Section 22. Wherever by any vision of this act @ refund 1s author. ized, the commissioner shall certify the amount of the refund, the reason therefor and the name of the payee to the state treasurer, who shall thereupon draw his warrant on tl special tax fund in the amount specl- fied payable to the named payee. Section 23. If any section, clause, sentence, or of this act is for any reason held to be unconstitutional and invalid, such de- cision shall not affect the validity of ¢ this act. passed this act and. each section, sub-section, clau: sentence, or phrase hereof, irrespective of whether any one or mot tions, sub-sections, claw 5 or phrases be declared unconstitu- tional. Section 24. All laws and parts of laws in conflict with this act are hereby repealed. Section 25. ALUOCATION OF REV- ENUES.) “All monies collected and received under this act shall be.cred- ited by the state treasurer cial fund to. sales tax fund. state treasurer shall first pay tl expenses of administering and the payment of refuni under this act. The net amount of monies remaining in sald “retail sales tax fund” shall be allocated and dis- tributed as follows: (a) The state board of equalisation is authorized, directed, empowered and required, ‘at any regular or spe- clal meeting, from time to time, to transfer into “the state public welfa: fund,” created and established by house bill 338, pending in this legis- lative session, the sum of $500,000.00 per annum to be expended for t relief of destitute or Persons, in co-ordination wii supplementary to the funds mad available for expenditure for If purposes in North Dakota from:fun appropriated by congress and all cated by the federal emergency re- lief administration and/or other federal agencies. Such monies: may be expended either in the form of 4: rect or work relief. The said state board of equalization is further au. thorized, directed and empowered to transfer into the state public welfare fund the further sum of $100,000.00 per annum, or so much thereof as in the opinion of the said state board of equalization may be expended for mother: and/or old age or blind pension or. assistance in co-ordination with ted- eral funds as above set forth. (b) The state board of is hereby further directed, ered and required, at any re: special meeting, from time to time, to transfer from said “retail salés tax fund” to the state equalization fund, created by house bill 255, pending in this legislative session, the sum of $700,000.00 for the year’ 1938 ahd the sum’ of $1,950,000.00 for the year 1936. (c) Said state board waliza is further authorized, and empowered, at any regular or special meeting, from time to, time, to transfer Into the general fund of the state such portions of said. tail sales tax fund” as, in the opine ion of said board, are not required for carrying out the provisions of subs divisions (a) and (b) of this section, to be used by said state bokrd of equalization in replacement and re- duction of such of the levies for gen- eral state purposes as said board may deem just and proper. Section 26, There is hereby appro- priated out of any monies in the state treasury not otherwise appropriated, the sum of twenty-five thousand ($25,000.00) dollars, for the purpose of putting this act into operation and carrying out the provisions thereof until such time as sufficient funds are collected under this act. Section 27. EMERGENCY.) as the financial situation of this is such as to demand and require the immediate collection of additional revenue for the purposes stated in this act and otherwi fore, an emergency is hereby decl and this act shall be in full force and effect trom and after its passage and approval. In witness whereof, I have here~ unto affixed the great seal of the state of North Dakota at the eapitol in the city of Bismarck, State of Nortk Dakota, this 12th day ‘of June, 1985. JAMES D. GRONN, Secretary of State. ADM THE WILL ANNEXED — STATE OF NORTH DAKOTA, COUN: TY OF BURLEIGH. IN COUNTY COURT BEFORE HON, . C. DAVIES, JUDGE. IN_THE MATTER OF THE ESTATE) OF FRANK 8. ALLEN, DE-| CEASED. ; Frank E. Hedden, Petitioners! vs. Anna Skinkle Allen, Benjamin A Fleuchaus and Edward 8, Al~ en, Re THE STATE OF NORTH ‘BARA TO, THE ABOVE Nast RE to the County Court of Burleigh, in said State, at the office} of the County Judge id Counts at the Court House in th ory of Bi: aid County and State on) y of July, A. D. 19; at the hour of ten o’clock in the for noon of that day, to show cau! ft any you have, why the will of Frank B. Allen should not be admitted te| probate and why Frank E. Hedden| should not be appointed Adminiatrator with the Will annexed; the late res: dence of the said Frank B. Allen was| the Borough of Bernardsville in th County of Somerset and State off New Jersey and a duly authenticated copy thereof filed for probate in thi court, Let service be made of thi citation as Feguired by jaw. Hhiscce this 3rd day of Jul; By the Court: appear :d the’ County of (SEAL) IC. Davies, Judge of the County: Cow: 1-85-12. Carole Ann Collier of Temple, Te: has four great-grandmothers, great-grandfathers, four grandp ents and numerous great aunts and uncles, a Experiments at North Caro State college showed livestock ly eat the cob as well as the.g such of the officers, agents, and e: loyees an it may signate to give d for the faithful performance of when ear corn is soaked in salt ter. . >