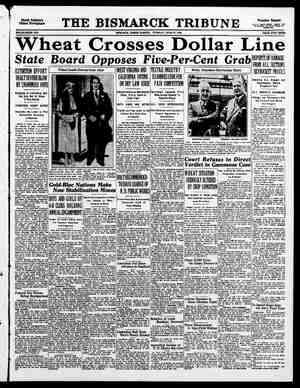

The Bismarck Tribune Newspaper, June 27, 1933, Page 2

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

THE BISMARCK TRIBUNE, TUESDAY, JUNE 27, 1933 Z NYE ASSERTS GREED FORCED GOVERNMENT TO DRASTIC ACTION North Dakota Senator, Praising Roosevelt, Says He Seeks Fair Play Atlantic City, N. J., June 27—(?)}— Senator Gerald P. Nye, Independent Republican of North Dakota, assert- ed Monday the government has taken steps for the drastic regulation of in- dustry because of the “greed” of in- dustrialists. “The passage of the Industrial Re- covery Act,” he told the National As- sociation of Retail Grocers in annual convention, “is a pleasant surprise and means that the government and congress have at last admitted that the old order has prevailed and con- gress have at last admitted that the old order has prevailed too long.” Senator Nye expressed the view that governments should get into the busi- ness of banking “because it (bank- ing) was in the main responsible for the terrible plight we call the depres- sion.” Praising the “courageous leadership of President Roosevelt who has dared to seek new ways of fair play to all” and end “favoritism to a few,” the senator also urged the association to align itself with the government's pro- gram under the Industrial Recovery Act. “Under the act,” he said, “Amer- ican business goes into partnership with Uncle Sam. How it works out remains to be seen and depends not entirely on trade but largely on the government's administration of the act.” The senator criticized investment bankers who, he said, unloaded billions in worthless securities; the manipula- tions of power magnates to gain vast control and specifically indicted the heads of the Bethlehem Steel corpora- tion. “Bent on higher salaries, the execu- tives of that corporation looted the stockholders of $31,000,000 in bonuses during the last 13 years,” he said. “To make it worse, the bonuses continued to be paid the executives even when the common stockholders received no vrofits. “Such greed forced the hand of the government and brought the dictation of a new policy to take the place of the one termed the “masses and workers be damned.” “Now there must be a new start to bring about the restoration of buying power and this can be done only through more employment and fair treatment of industry's labor.” OT ; Weather Report | FORECAST For Bismarck and vicinity: Fair to partly cloudy tonight and Wed- nesday; not much change in temper- ature. For North Da- kota: Fair to part- What They Think of Sales Tax in State Where It Has Been Tested | ‘The sales tax issue is one which must be decided by North Da- kota’s voters. Application of such a levy was held up only by the filing of a referendum petition af- ter circumventing the militia. ‘The following article analyzes the workings of the sales tax law in Mississippi, one of the first States to adopt the system and pointed to as a model by advo- cates of this tax in North Dakota. By J. OLIVER EMMERICH Editor, McComb (Mississippi) Enterprise (It is a ‘soak the poor’ measure, an annoyance to the public, and an imposition on the shopkeeper, believes this Mississippi editor.) Budget-troubled states of the na- tion have centered eager attention upon Mississippi's lately introduced retail sales tax. In a sense this state has become a tax experiment station, and this experience can be relied upon largely to prove or disprove the sound- ness of the retail sales tax polfcy. It is Mississippi's show, yet Mississip- pians both applaud and heckle the program. This new tax on bread and meat and telephone bills and overalls has balanced Mississippi’s once badly dis- torted budget. It has conserved Mis- sissippi’s credit and preserved Missis- sippi’s institutions. It has been effi- ciently adminstered by an able tax commissioner, and courageously es- poused by a governor devoted to the task of balancing the income and outgo of a ship of state whose finan- cial sails have been badly tattered. The Mississippi retail sales tax is an emergency enactment. In fact, it is recorded as the “Emergency Act of 1932,” and is to be automatically re- pealed on June 30, 1934, As an emer- gency revenue producer, it has helped Mississippi. But after making these admissions, there is a preponderance of injustices, fallacies, complexities, and impracticabilities which brand the retail sales tax idea as unsound in policy. A physician wisely gave adrenalin to a patient who collapsed because of a heart attack, but if he were to go about town promiscuously injecting hypodermic needles into the arms of healthy men, he would soon be rushed to an insane asylum or a jail. Start- ling and spectacular deeds may during @ crisis be sensible, and yet be absurd and ridiculous during normal times. The chief trouble with our tax sit- uation during this emergency is not altogether that taxes are too high but that incomes are distressingly low. Many people could not pay their 1932 or 1933 taxes even if their tax bills were slashed in half. But let us get down to cold reali- ties. In the first place, the retail sales tax is founded on a fallacy. Pro- ponents contend that there are thou- sands of citizens who own no prop- erty and who pay no taxes, and that the retail sales tax converts these tax dodgers into tax payers, If this is so, then there has not been an individual, @ company, or a corporation that has collected a dime’s profit in fifty years. ly cloudy toni ight a Wednesday; fair tonight and Wednesday; not so warm central and east ions. For Montana: Partly cloudy to- night and Wednesday; cooler extreme southeast, warmer west and north- central ions tonight, warmer south-central and extreme east por- tion Wednesday. For Minnesota: Partly cloudy to- night and Wednesday, probably local showers and thunderstorms, except in west portion Wednesday; slightly cooler along Lake Superior and Wed- mesday in south portion. ‘GENERAL CONDITIONS Low pressure covers the district with centers at (The Pas, Man. 29.66; Pierre, S. Dak. 29.72; Winnemuce: Nev. 29.78). High temperatures con- ‘tinue over the Plain States, Southern Plateau, Mississippi Valley and Lake Region with temperatures far in ex- cess of seasonal normals, Except for very light scattered showers in east- ern North Dakota, Minnespta and Northern Texas no precipitation was Repo ed. lissouri river Bake at Ta. m. 7.8 ft. 24 hour change, 0.1 ft. Bismarck station barometer, inches: %8.11. Reduced to sea level, 29.84. PRECIPITATION REPORT For Bismarck stetion: Total this month to date Normal,t his month to date Total, January Ist to date Normal, January Ist to date Accumulated deficiency to dat NORTH DAKOTA POINTS High- Low. BISMARCK, cldy. . Amenia, cldy. .«. Beach, peldy. ° Bottineau, cldy. Carrington, cld; Crosby, clear . Devils Lake, rain Dickinson, clear Drake, cldy. .. Dunn Center, Jamestown, cldy, Kenmare, peldy. ax, cldy. . Minot, cldy. ..... Napoleon, cldy. . oe aes arshall, peldy. ... Pembina, cldy. . Sanish, cldy. . Williston, pcld Wishek, cldy. t.!is not economical to collect. Now it MINNESOTA POINTS High- Low- Moorhead, cldy. St. Paul, olds, 888 ‘00 | Out the state, and escape the tax. Not |The Mississippi State Tax Commis- Taxes must precede profit, The renter pays the taxes with his rent. Forget this emergency for the mo- ment and consider this problem from an all-time basis. If the retail price of an automobile does not carry a proportionate part of the tax bill on the automobile plant, the makers can declare no dividends. The only way @ man can dodge taxes is to live ina swamp, eat fish, and go naked. And to make a complete job of it, he must caich his fish with his hands or he'll pay taxes on the factory that makes fish hooks. There can be no tax dodgers. Rea- son declares it. Yet, friends of a re- pelled to serve as tax collectors with- out pay. It does not take into consid- eration the efforts of tens of thous: ands of clerks who must make hun- dreds of thousands of petty transac- tions. It fails to consider that these 6,200 imposed upon merchants their thousands of clerks must make these collections not once @ year, but every day; not in stores alone, but at filling stations, hotels, restaurants, lumber yards and so on. This costly situation, which is more or less exasperating, may be ignored in a general consideration of this sub- ject, but if merchants are interviewed, 'as I have interviewed scores of them, it would be readily seen that the ef- fort and inconvenience, to say nothing. of the expense, are irksome. The cost’ of collecting this tax from the mer- chants may be low, but the cost of collecting from their customers is im- measurably high. The retail sales tax lacks fiscal ade- quacy, that is, productivity. A two Per cent sales tax on all merchandise and| pointed out that an increase in ad much as a two or even @ four mill reduction on his present ad valorem assessment of from forty to ninety mills, that he would pass this benefit to his tenant? Everyone knows the answer. It is just another means of transferring a greater share of the burden to the people who are on the bottom rung of the economic ladder. There has been no ad valorem tax decrease in Mississippi since the ad- vent of the sales tax. However, in fairness to the advocates of the re- tail sales tax, it should be definitely valorem would likely have otherwise been essential, due to the sudden and drastic reduction in property assess- ments, The United States is in a mood to consider any tax panacea. But the states of this nation will do well to consider the unsoundness of the re- tail sales tax policy. Founded on fal- lacy; unneeded, except possibly as an emergency; unequitable to merchants and customers alike; uneconomical to administer, considering the army of unpaid and harrassed merchant-col- lectors; inadequately productive in view of the small percentage of the state’s total revenue returned, the re- tail sales tax is just another tax burden, psychologically dangerous, sold, on all telephone, telegraph, Power, light, and gas bills, on all in- trastate railroad passenger and freight receipts, and a one-eighth of one per cent jobbers’ tax, and a one-quarter of one per cent manufacturer's tax, all combined in Mississippi yielded but two million dollars. Compared with the total taxes paid to the state, coun- ties, municipalities, and other sub- divisions, this is a mere bagatelle. In truth, the mountain labored. Eight mills ad valorem brought the state only four million dollars. If this were replaced by a sales tax, it would be necessary to increase the sales tax to six per cent. A six per cent sales tax would be confiscatory to business, And yet, even with a six per cent sales tax there could be comparatively little property tax relief, for the burdeh in this state, as in other States, is largely with local, county and municipal governments. A low sales tax does not justify the immense effort and annoyance. A high sales tax would be ruinous to the business life of any state. The structure of the sales tax is simple, but the system of collecting it from the public is both complex and complicated. Many merchants absorb the tax. Others shift it along to their customers. There are varied schedules of collections. For example, grocery merchants of McComb, Mis- sissippi, (population 10,057) adopted the following schedule: sales from $.01 to $.19 tax exempt; $.20 to $.59, one cent tax; $.60 to $1.19, two cents tax; $1.20 to $1.59, three cents tax; and on up. After a few months it was discov- ered that this schedule was inade- quate for suburban grocers because the average sales were so low that most of the trade fell in the tax exempt classification. Uptown stores in most instances lost a few cents daily or broke even on this schedule. Credit grocers found it simple enough because they charged the two per cent to their accounts at the end of the month. Dry goods stores in this city adopted the following schedule: sales under $.25 tax exempt; $.26 to $.74, one cent tax; $.75 to $1.25, two cents tax. Drug stores maintained a schedule of their own arrangement. Five and ten cent stores absorb the tax. Stores selling usually in odd figures such as 23 cents, 48 cents, 97 cents, find it easy to absorb and collect the tax. One haberdasher whose chief eom- Petitor absorbs the sales tax ex- claimed, “Most of my items are sold in even figures, 25 cents, 50 cents, and a dollar, How can I absorb the tax without a loss? But what else is there to do?” This lack of uni- formity indicates the complexity of this type of taxation. tail sales tax argue that a sales tax puts the tax burden on an otherwise tax-free people. Particularly is this argument applied in regard to the ne- gro tenant farmers in Mississippi. The landlords, however, can be trusted to take care of themselves. In Mis- sissippi it was reasoned that only fif- »| teen per cent of the population paid property taxes. Considering that only family heads, and not babies and school children, usually pay the direct taxes, and that the average family consists of five or more, it would seem from this figure that the percentage ot property taxpayers is surprisingly igh. Printed reports of the Mississippi Tax Commission indicate that the av- erage monthly per capita sales tax collected last year was only 9.7 cents. Yet, ic is freely admitted that prop- erty taxes are high; and Mississippi’s two million people paid four millions in ad valorem taxes to the state, which is only 16 2-3 cents average monthly Per capita. All tax burdens, reduced to a per capita basis, seem compara- tively inconsequential. A grievous objection to the retail sales tax is that it is not equitable. 00|In theory it taxes the capacity. of an individual to spend. In reality it levies a 100 per cent assessment on the small wage earner. The smaller ‘00 | the income of an individual, the larger is the percentage of his income that goes into tax channels. It is a “soak the poor” tax. It is paid in advance, Particularly in the case of the poor, because they must pay before they eat. It taxes most those least able to Pay. . Indirect taxes shuffle to the bot- $8\tom. ‘The retail sales tax is a direct tax which pyramids the cost which the uitimate consumer must pay. It broadens the base, so to speak, and increases the cost of living of those least able to stand it. Individuals with larger incomes can make their more expensive purchases from with- so with the poorer classes. They must spend close to home, They cannot travel, The retail sales tax fails in that it is highly probable that proponents of the retail sales tax will immediately think that I have missed the facts. However, the trouble is that they have failed to think the matter through. The retail sales tax isalsoa disturb- ing factor in business. Conditions would be different if all states adopted the sales tax law. But why fool our- selves? All states will not adopt such a system. With border states free from this commercial handicap, home merchants are penalized. Particularly js this true in border counties, and thirty-four of Mississippi's eighty-two. counties are on the border. Incidentaily, we should not confuse @ federal sales tax with a retail sales tax. If the federal government were to impose a sales tax, it would be col- lected directly from the manufacturer; from the tire maker, for example, and not from ten thousand retail tire dealers. It would be a different sit- uation entirely. Mail order houses are indisputably benefited by a retail sales tax. All out-of-state merchants can offer a discount equivalent to the sales tax charged within the state. A discount is a sales advantage. Large opera- tors would welcome a shifting of the tax from property to a sales tax. It would be simple enough for such op- erdtors to purchase most of their mer- chandise from without the state and thus escape taxation. Talk about tax dodgers! The retail sales tax points the way. Furthermore, if a tariff is & protection to business, then, most assuredly and undeniably, a retail Sales tax is the reverse. Now here is another serious ‘objec- tion. At best, people complain a great, deal about taxes. Why remind the public every hour of the day of tribute to Caesar? Why demand taxes every time a person buys a meal, a hotel room, or a pair of socks? There is a moral liability to good government in this situation. It is psychologically bad. Instead of being a painless tax, as advocates say, it is a constant dull headache. ‘This form of taxation cre- ates resentment, and this resentment registered against the government. People are human, and the human element of people cannot be disre- irded. In Mississippi many com- plaints have been silenced because of @ patriotic realization that our state 4s confronting an emergency, but de- spite this appeal to patriotism and reason, the sales tax is unpopular and unwanted. In a consideration of this problem, we cannot overlook the nature of poli- ticians. to spend all of the money at their sion makes the creditable showing of only 3.8 per cent administrative cost. But this does not include the 6,200 Mississippi merchants who are com- Okla. City, O., cldy..... Pr. Albert, le miloops, B. C., peldy. 68 City, Mo., cldy.. a 3388888 Modena, + Pel 86 No. Platte, Neb., tear: 96 00 Sioux City, Ta., cldy..... 98 Spokane, Wash., peldy.. Swift Current, §., clear. The Pas, Man., clear.... 7 Toledo, Ohio, clear . command. The constant demands of the public make this true, but it is true nevertheless. If a retail sales tax is permitted to become permanent __|in the states of the union, it is highly likely that it will only be an addi- tional tax rather than a transfer of taxation from a tangible to an in- tangible source. In 1924 Mississippi adopted an income tax. It was ad- vocated as a “lieu” tax. Instead, it became just another tax.. Property continued to bear its ci bur- den. There is a likely danger that a retail sales tax might become an ad- ditional tax rather than a “lieu” tax. Incidentally, when a renter pays @ sales tax, he should rightfully expect @ reduction in his rent. But, is it 833888888888Sss5 [ermeaa » N., Wi likely that if @ landlord did get as It is characteristic of them | cide. NTINUE commercially harmful, and socially «from page one’ unjust. co D Reports of Damage From All Sections Skyrocket Prices those who were caught short in the rampaging market, burned out all op- Position to the rise. ‘The July option in wheat opened at 92% cents, up 3%, while December touched 97%, with September at 95%, all options were selling well above the tentative price of 90 cents men- tioned by the agricultural department as the goal sought under the new farm act to be operated by reducing acreage and paying the farmers for idle land from processing taxes of some 30 cents a bushel. Demand Increased Wheat demand increased as the first half hour of turmoil to buy set the pits seething. September wheat touched 96% cents, up 5% from Mon- day when it made a seven cent gain. May hit $1.04, up 5 cents. While the future quotations are higher than farm prices, the rise has given the grower a price in the fields of about twice that at the start of 1933, Secretary of Agriculture Wallace, now in the middlewest working out details for the processing tax to get wheat prices up to the prewar aver- age level, said Monday in Des Moines that there was no danger of a famine, even if the drought and heat killed most of the crops, as there is a large holdover surplus of grain, including 350,000,000 bushels of wheat. ‘The big rise invited tremendous profit-taking and before the first hour had passed there was a reaction of around 1% cents a bushel in wheat. Private reports of showers in the Plains states helped cool off the ram- pant bulls. AMERICAN THREAT IS EFFECTIVE AT LONDON London, June 27—(?)—A renewed SPANISH WAR VE RAP ‘PENSIONITIS’ Say Prejudice Against Reward- ing Nations Defenders Will Die Out Soon Minot, N. D., June 27.—(@)—An epidemic of “pensionitis” which has spread over the nation, leading to the cuts in soldiers’ pensions which were made in the economy act, will even- tually die out and the present “gloomy outlook” for Spanish-Amer- ican war veterans will brighten, as- serted Major O. W. Coursey, Mitchell, S D.,, national chief-of-staff for the United Spanish war veterans, ad- dressing the North Dakota depart- ment in Minot Monday evening, The encampment Tuesday elected M. G. Brown of Dickinson as depart- mental commander and named Major J. M, Hanley, Mandan, and O. B. Christianson, Grand Forks, as senior vice-commander and junior vice- commander, respectively. J. L. Kelly, Bismarck, was chosen delegate-at- large to the national encampment. In a resolution the department “noted with alarm the proposed plan of the national government to en- tirely change the established policy of affording relief to its defenders in the older wars” and expressed belief that “the proposed new policy is un- fair to the veterans of the Spanish war and amounts to repudiation of the debt owed by the government to its defenders.” The resolution urged legislation which “will replace on the pension rolls of the nation each and every veteran of the Spanish war Whose name was stricken from the roll under authority of the recent alleged economy bill.” Major Coursey was one of several speakers who addressed the opening session of the encampment. T. O. Kraable, Fargo, veterans service com- missioner, William Lemke, North Da- kota congressman, John A., Simpson of Oklahoma, president of the na- tional organization of the Farmers Union and the Rev. Dr. Frank G. Beardsley of Minot were among those ‘who spoke, South Dakotans Nab | Bank Robber Suspect Sioux Falls, 8. D., June 27.—(P)— Floyd Strain, 28, was identified Mon- ; day as a participant in bank robberies at Okabena, Minn., May 17, and Ihfen, Minn., about two weeks ago, and as one of two men who shot their way out a Huron bank after failing in a holdup effort. Strain was seized here Saturday night along with four other bank rob- ber suspects. Witnesses and ‘holdup victims from Havana, !N. D., Worth- ington, Minn., and Vermilion, 8. D.. failed to identify any of the suspects. Bank officials from Maylor, 8. D. where one man was killed in @ rob- bery, were expected here to view the risoners. 5 Sheriff C. F. Magnussen of Jackson, Minn., and County Attorney P. N. Grottum took immediate steps to have Strain removed to Minnesota to face charges. threat of chaos and price debacles which will follow if the American and Canadian wheat surplus of 500,000,000 bushels is “dumped” on the world market acted Tuesday to save from breakdown the wheat acreage restric-| j-¢; tions negotiations of the four principal wheat producing nations. A conference of representatives of the “Big Four” broke up after being in session for an hour. Stanley M. Bruce of Australia told the represen- tatives of the United States, Argen- tina, and Canada that three Aus- tralian states were adamant in their opposition to the restriction scheme. Bruce himself is not willing, he de- clared, to: work out some plan where- by Australian adherence to the project could be assured, but he commented the difficulties of his position could not be minimized. Americans Are Firm The Americans, in reply, merely called attention to what the release of the North American surplus would do to world ‘markets and said in ef- fect: “Gentlemen it must be done.” The position now is that the con- ferees have adjourned sine die, but it is hoped further ‘cable conversa- tions, which Bruce will carry on with Canberra, will result in another meet- ing being called, perhaps within four or five days. Argentina's discouragement at de- velopments was tempered by the Am- erican conviction of eventual success. Conversations between Bruce and me of the smaller producing na- ions during the next few days are considered likely, and/it is possible the Argentines will be drawn in. In quarters close to the conferees it was stated that the use of the surplus in the event of failure to reach an a- greement, was only hinted at by the Americans until the last two meet- ings. Then, after the speech in the United States of the Secretary of Ag- riculture, Henry a Wallace, in which he spoke of the possibility, it was laid before other delegations in so many words and it had the greatest influ- ence on the negotiations. OF Strange But True News Items of Day (By The Associated Press) $5,000 PEANUT Lincoln, Neb.—Upon a peanut hinges the sum of $5,000. Attorney for the executors of the estate of Mrs. Harry Carl Johnson of Blanchard, Ia., contended the pea- nut, lodged in her esophagus, led to her death and that her demise could be ‘classified as accidental. An in- surance company contended death was not accidental, within the meaning of the terms of an insurance policy. Federal Judge T. C. Munger will de- LIGHTNING PLAYS PRANK Appleton, Wis.—Lightning came down a stovepipe at Daniel Sch- mit's home at Grand Chute, took the top off one of his shoes, burned his foot and left him standing on the sole of the other . ‘ Otherwise he was unhurt. RATE REDUCTION ASKED Citizens of Ray, Arnegard, Dawson, Alexander, Watford City, Charbon- neau and Cartwright have filed pe- titions with the state railroad com- mission asking for reduction in elec- tric rates and charges. The Montana- Dakota Power company services the communities. Hearing has been set for July 12 at Watford City. ——————m_ IN BANKRUPTCY 8788-316 he District Court of the Unite: sthtes for the District of North Da- In’ the Matter of Carl Oscar Kell Bankrupt. ‘0 the creditors of Carl Oscar Kell, of McKenzie, County of Burleigh and District aforesaid, a bankrupt: 1 Notice is hereby given that on June | 22nd, 1933 the said Carl Oscar Kell was duly adjudicated bankrupt and | that the first meeting of his creditors will be held in the office of Alfred Zuger, No. 4 Webb Block, in Bismarck. N. D.,on Thursday, July 6, 1933, at 10 o'clock A. M., at which time the cred- ; ftors may attend, prove their claims. | appoint a trustee, examine the bank- | Tupt and transact such other business as may properly come before such ting. meting" mimarck, X. Dy-Sune 2, cau ALFRED ZUGER, Referee _in Bankruptcy. NOTICE OF SALE OF LAND. Notice is hereby given that, pur- suant to an Order of the County Court of the County of Burleigh, State of North Dakota, made on June 20th, 1933, the undersigned as Administra- trix’ of the Estate of William G. Hoerr, Deceased, late of the City of Mankato, Blue Earth County, Minne- sota, will sell at private sale to the highest bidder the following describ- ed land, situated in Burleigh County, North Dakota, to-wit: The Southeast Quarter (SE%) of Section Twenty- five (25) Township One Hundred For- ty-three (143) Range Seventy-five (75) West of the 5th P, M, Burleigh County, North Dakota. hat’ said sale will be held on of after the 8th day of July, 1933, All bids for the purchase of’ said land must be in writing and may be deliv- ered to the undersigned personally at Mankato, Minnesota, or to C, L. Fos- ter, Resident Agent for Administra- trix, at his office in Bismarck, North Dakota, or said bids may be filed with the Cotnty Court of Burleigh County, North Dakota on or before the day of gale. Said land will be sold either for all cash or may be sold for not less than one-fifth cash and the balance in not over five years time, either payable in gross or installments, unpaid portion bearing interest at hot less than 5 per cent per annum and secured by mortgage on the land sold. Dated this 20th day of June, 1933. A V. HOERR, . As Administratrix of the Estate of William G. Hoerr, Deceased, Hyland & Foster Attorneys for Administratriz Bismarck, N. D. ‘The honor of serving you at a time when expert and efficient service is so badly needed obligates us to do everything as near- ly perfect as possible. You can rely upon us. WEBB BROS. Faneral Directors Phone 50 Night Phone 50 or 887 country back to prosperity. If that is what is meant, then we plead guilty to the charge. . Pointing to the reemployment of & million men and a 16 per cent in- crease in commodity prices in the last 30 days in the United States, Gold-Bloc Nations Make New Stabil- ization Moves will be unavailable for conference con- sultations until Wednesday. he said, “we expect to pull our coun< McReynolds Strikes Back . try out of this depression.” Representative Sam D. ie Po-) |i : U. 8. prison’ population fox licy committee Tuesday, struck back j fast 100,000 Saad Te 119 ig at charges that the United States had é 1880 to 95 tn 1923. gone nationalistic. He asserted mone- tary stabilization should be under- Pains and Dizziness Disappeared taken by all nations rather than only three or four. The Tennessee delegate spoke in a After She Began Taking Lydia E. Pinkham’s Vegetable Compound e Show Girl Now Is Buddhist Nun private meeting, but his address was made public later at American head- quarters. The speech created much comment in conference circles, par- ticularly because he took an oppor- tunity to dive into home politics. McReynolds, who is chairman of the house of representatives foreign affairs committee, agreed with for- eign spokesmen that the American tariff act of 1930 was unjust and ex- plained it was a Republican measure. He ascribed President Roosevelt’s election in part to discontent over a high protective tariff. Referring to the failure of the pres- ident to ask and receive tariff-mak- ing powers from congress, l= nolds gave assurance that “any agreement reached,” which the pres- ident approves, “will be ratified by congress.” “Our congress is entirely behind | ot per bd said. le descril e up of new tariffs and quotas inthe past three years by various nations as particu- Mrs.-C. I. Chester, o| geles, above, a former chorus girl, has .become a Buddhist nun, the second, American woman to enter the oriental order. « At a simple ordination she received the name of Kwa- Sho, “A Flower in the Tree- tops.” Soon she will leave for Kyoto, Japan, to enter a con- vent ~ saying this would stabilize markets and open’ the road to prosperity. power of the dollar, to give employ- are trying to place our own house in| ment and to once ARE YO MORE Economical THAN YOUR Grandmother WAS??? YOU SHOULD BE. . . It’s so much easier today For your Grandmother, economy was a necessity‘ that required ingenuity, thé constant use of all her faculties, and a great deal of her time. For she could not buy on faith and there were no advertisements to act as her shopping guide. For you, the practice of economy is simple . . . instead of taking your time it saves you time. Use the advertisements in this paper as your’ guide and you are on the sure road to economy and safisfaction. Use the advertisements in this paper to plan your buying and they will save you many hours of shopping time. Use the advertisements in this paper for the information that means savings to you—economy, comfort and convenience in your home. The Bismarck Tribune The Home Newspaper for Bismarck, Burleigh County and the Missouri Slope woaeo bya PR ne en ee ee eT eee AMb>eN wae ve ana ee 4 eee hota CeEesZeenaoaonsag