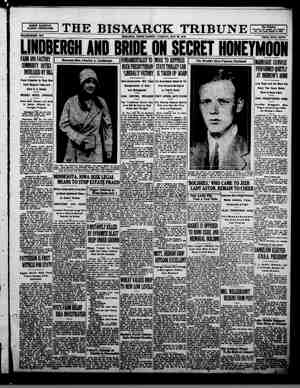

The Bismarck Tribune Newspaper, May 28, 1929, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

inser eects SSS AAR L ERE LEE ERSEREIICRDSR RO LRDELENISRIRDEDER EWE CNE ES TOE EEE EEE TON Coe b meme + a 5 q Ts ¢ tf trrecetetere Pee ETE “ef 4" t ayer en ete Cece aki CC CCEGCET Et t Real Facts for the Voters on the Memorial Community Building Issue Ten Things to Remember 1. The Bismarck Taxpayers association’s only interest in opposing this proposal is that Bis- marck shall not be mortgaged for a luxury at a time when home owners and renters are hardly able to make both ends meet. 2. The increase in taxes will be $3.00 on each $1,000 assessed valuation. (See table below.) 3. We have a swimming pool and an auditor- ‘jum, which will do us for several years. 4, We need a court house and need it mighty bad. If the old court house should burn down, it will cost each property owner $125 to quiet title on the property he or she owns in Burleigh county. 5. We need a high school and must build it inside of a few years. 6. Many of the boosters for a community building have not paid their personal property taxes for several years. (See the tax records in the treasurer’s office.) 7. High taxes and rents will kill any city. 8. The net indebtedness of Bismarck is over one million and a half dollars. 9. Many Bismarck lots have recently been ad- vertised by the county auditor and tax deeds will be issued to the highest bidder. 10. If the taxes are increased any more, many more lots will go for taxes in the future, so if you desire to see Bismarck prosper and grow, VOTE NO TWO TIMES ON MAY 31, 1929. SOME MORE TO REMEMBER A community building is a fine thing, if we can afford it. An automobile is also a fine thing, but many cannot afford one. People do not kick about high taxes, until they must pay them. The East Side has just been paved. The extra tax will make many sweat blood to pay this and keep the home fires burning. The community building will create many more jobs and extra expense. We are confident that the unselfish resi- dents of Bismarck will realize that an added tax for a community building is not going to benefit the home owners and renters, and on May 31 will vote NO TWO TIMES. . WHY THE*HURRY? Burleigh county levied .975 mills in 1928 for a memorial building. This will raise $21,- 000, of which $13,000 has been paid. If another one mill levy is made in 1929, 19380, and 1931, the county will have collected on January 1st, 1933, about $80,000 for this project. The county is not pledged to make this levy. only a gentlemen’s (?) agreement by the county commissioners, which does not make it very cer- tain. Who will furnish this money if the county commissioners fail to live up to the gentlemen’s agreement? Why the hurry? Because some of the Bismarck business in- terests back of this movement realize that if the home owners and renters have a chance to think this matter over, they will not permit a mortgage of a quarter of a million dollars to be placed on the homes in Bismarck. Why is a certain Bismarck professional man investing his money in Minnesota bonds? The following figures can not be disputed and will stand the acid test. Memorial Building Bonds 5% interest for 20 years 20 years maintenance @ $8,000 Net assessed valuation of Bismarck in 1928, $7,039,713, Annual levy necessary to meet the prin- cipal and interest , Annual levy for upkeep and maintenance 8,000 5% of the taxes levied are uncollectable and that much more must be levied each year to raise the required To raise this amount on a $7,039,713 valua- tion, a three mill levy is necessary and the cost per $1,000 of assessed valuation will be as fol- - lows: $1,000 valuation $3.00 $ 60.00 in 20 years 1,500 valuation 4.50 90.00in20years ; 2,000 vaulation 6.00 120.00 in 20 years 2,500 valuation 7.50 150.00 in 20 years 3,000 valuation 9.00 180.00 in 20 years 3,500 valuation 10.50 210.00 in 20 years 4,000 valuation 12.00 240.00 in 20 years 4,500 valuation 13.50 270.00 in 20 years 5,000 valuation 15.00 300.00 in 20 years In addition Bismarck taxpayers must pay 1-3 of the $80,000 county levy, or about $27,000 of the memorial tax. There is also great doubt as to the constitutionality of this tax. _Taxes on Bismarck property now amounts to 55.57 mills, or more than 514%. Special assessments will increase this to from 71/4 to 9%, or even more. HOW MUCH MORE CAN YOU STAND, BISMARCK TAXPAYERS? PROTECT YOUR HOME AND FAMILY, AND VOTE NO TWO TIMES ON MAY 31, 1929, Bismarck Taxpayers Association ODD Dd a TD 8 2d ame Saar ere Co Ce) PE aa 2 2 i wee)