The Seattle Star Newspaper, July 28, 1920, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

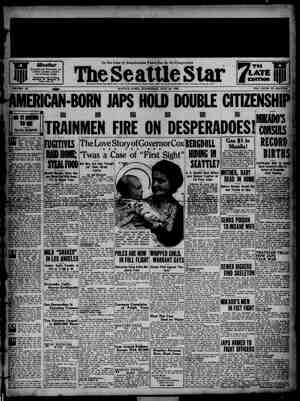

MRT Te eee eS Nan AIP ea Sie eet THE SEATTLE STAR ‘WEDNESDAY, JULY 28, 1920, HOW TO ENCOURAGE HOME OWNERSHIP Seema student of political history knows that many corporations in this country have made the mistake of opposing, on general principles, all legis- lation affecting their interests, and have by this method invited antagon- isms and paved the way for. successful appeals, demagogic in many instances, to the prejudices of the people. “An ounce of Prevention is worth a pound of Cure.” Being engaged in the savings bank business I am naturally interested in the subject of savings fund legislation. I firmly believe that one of the best ways to prevent the enthronement of “radicalism” in our States is to pro- -vide laws designed to encourage Thrift and Home Ownership. It only. requires a cursory examination of the facts to convince one. that those states which have the best laws governing savings institutions, carry, by this very fact, the best insurance against radical domina- tion. It is a fact that the States whose citizens have had the vision and patriotism to enact adequate laws governing savings institu- tions, have within their respective boundaries a maximum of savers and property holders. RAYMOND R. FRAZIER President Washington Mutual Savings Bank —Photo by Curtis Studio, In California, for example, where they have a strict law pro- It is gratifying that in our own state, despite strenuous oppo- viding for the segregation and restricted investment of sav- ings deposits, they have within a comparatively short time built up a savings bank business which puts them, so far as the West is concerned, in a class by themselves. In California one-half of the entire population—men, women and children included—have savings accounts averaging $700 each! In New York and the New England States, as well as in Penn- sylvania and Ohio, we find equally startling proof of the con- tention that sound laws calculated to entourage and safe- guard the management of savings institutions, is the best way to encourage Thrift and Home Ownership. In Massachu- setts, where the laws governing savings banks are most rigid, we find, according to official government reports (comptroll- er of the currency) that two million four hundred thousand people—which means two out of every three of the population —have savings accounts aggregating $455 each, or a grand total of over $1,000,000,000. In New York there are three million five hundred eighty thousand savings depositors whose accounts average more than $600 each, or a total of more than $2,000,000,000. sition on the part of a group of selfish men, some progress has been made in savings fund legislation; for we have here a good mutual savings bank law copied from the New York law, - and also a fairly good savings and loan association law, which is‘also patterned after the savings and loan association law of New York state. There remains.a bigger work to do, and that is to provide . legislation for ‘governing the segregation and restricted in- vestment of savings deposits held by commercial banking institutions. : President D. H. Moss, of the Washington Bankers’ Associa- tion, and the governor have appointed a commission of twelve men to study the “Departmental Bank Act” of California with a View to its adoption in this State. When, and if that is done, we may confidently look to the enthronement of thrift in the State of Washington. People will be encouraged to save and to place their money in the savings banks and thus they will become more contented, happy and prosperous. Owner- ship of money, like ownership of land, makes men and women better citizens because it makes them more patriotic and more interested in good government. NORTHWEST INDUSTRIAL EDUCATIONAL BUREAU