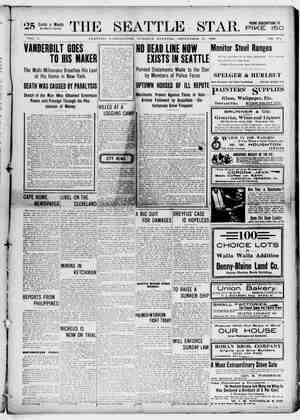

The Seattle Star Newspaper, September 12, 1899, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

THE ATTLE PAR, WHY MINES NEED CAPITAL, Good “Prospects Must Have Means to Develop Them. Of mines which pay comparatively few woul ever t me valu without the afd of capital, and t mary requisite the claim owner usually lacks, He may have muscle and grit and may be willing to work faithfully to the end, but at t hin efforts will develop the mine superti elally Those who are fortunate to own a claim ao favorably located that the development can be accom. plished by means of tunnels have an easier road to fortune than those who must sink @ #haft to accomplih the saine purpose, In either case cash is necessary for the purchase of tools and supplies. The facility with which a mine may be opened depends wholly upon its situation. Those ideal locations, where the vein may be opened by ad- its with a thousand feet of backs; where there is an abundance of fine timber to be had for merely cuttin, at; where a splendid water power ie situated at the t of the hill, and where every ton re ie rich, are not found. Good proapects, which have oped into great mines, in many cases have been situated in a region dim. cult Of access, timberless and dev of water, at least for power, and with every conceivable disadvan rounding them. These mines r ed capital to equip aad develop them, and the result has been satisfactory to the investor The prospector whe fortunately finds 4 vein of ore from which he can ship with profit at once needs no apital; indeed capital immediately eceks him and endeavors to purchase his claim, usually at @ price consid- erably below what the finder thinks it t» worth. The other prospector who found @ vein of low-grade ore is helpless without nancial aid, realizing his delplessness, while firmly believing in the value in the value of his Property, he looks to those having capital to invest in his mine. In con- sideration of there facts, éf it te so good a thing?” is as ab- ound as it Would be to aek the owner of @ high-grade property, “Why do you not sell your mine since it is #0 @o0d?''—Mining and Scientific Press. Revelution In the Copper tn- dustry. The time appears to be at hand when @ genuine scarcity of copper will Be net only made manifest but remain ynsatistied indefinitely, un- feee fresh deposite of unusual rich hess are discovered or are distribut- ed wm conditions whieh will render theit development possible at a cost that will enable the product to be marketed at « profit. The statement ts made on the authority of the Bn- ginerri and Mining Journal that in the rich Lake Superior copper areas, a period of three years and an expenditure of $750,460 are neces- e@ary ir, order to prove the vatue of a mine and put ft in a, profitable pro- ducing condition. The average production of copper in the United States for several years last peet. has been approx!- mately 2.000 tons per month. Lur- ing the first six months of 1499 the output reached the tote! of 124,487 tons, or an average of 20,748 tons per month. The mines of Europe, within this same period, have produced a total of 43.629 tons. The broad state- ment ts made that at the present Gate ail the copper produced in thie sountry is in process of manufacture and that not @ free ton of the com- metty is obtainable. In Burope, not- withstanding the bulk produced @inew January 1. end given above the entire stock of copper does not exceed 16,000 tons. Wiihin five years the price of cop- per Ras advanced from 10 cents to 18% and 19 cents per pound in New York. In 15954 copper was produced from the best mofines and delivered in that city at about § cents « pound. Tuday the cost of production and de- livery i* 6 cents a peund, and on this basis of calculation the owners are realizing @ profit of 10 cents per pound on their product. On the oth- er band there are many mining prop- erties which have for several years been l¥ing idle for the reason that they could not be operated at a mini- mum of profit with the selling price ruling at lets then 12. 12 or 14 cents ly increasing use of copper in electrical devices and « piiances of every sort has ann welled the demand for the m not only here, but in Burepe, wher- ever slectricity is being introduced and its generative industrial powers evailed of. Since 1604 the demand has increased % per cent. Previous to th@s gate thore was an annual in- crease in production of about 10 per cent., but thenceforward it has aver- ed a fraction less than 4 per cent Meanwhile the demand upon the United States from European coun- tries has been constantly augmented and since January 1 the Unite States has exported to the United Kingdom and the continent 63,420 tons. In order to meet the demand from all sources copper scrap is be- ing sought wherever available, for melting over and casting into bars In this connection the interesting statement is made that recently 10,- 000 bags of copper coins were import- ed from India for resmelting and casting into commercial copper While at the present the advance in the price of this metal i# unques- tionably dué to the Increased de- mand, there are indications that the closeness of the two conditions of supply and demand are likely to be availed of by combinations for the future control of the output. It has been quite appropris ked by an Eastern expert that a copper gine is of more value than a gold mine.—Minneapolis Times, Alluminum 's Not a Substitute J. R. Bentley, alurninum expert of Buffalo, N, Y., says “There im a good deal of talk at prevent of aluminum being used asa substitute for copper in electric ea- bies, etc., owing to the recent big ad- ance in price of the latter metal ut I am skeptical of the prac bility of the scheme. Copper t# stil! nearly 15 cents « pound the cheaper of the two and aluminum has only about three-fourths its conductiv- ity.” MINING ACTIVITY. Never Before Has there Been So Much of It Evidenced. THE COPPER BOOM No Red Metal Accumul YOU CAN'T ALWAYS TELL Cheap Mining Prospscts That Developed Into Splendid Never before In the wortd has there . Mines been such general and widespread tions at the Smelters. Mr. Willlam tf. Hardy, writing to activity In mining in all parts of the : " 4, Waehy, ts work! and for all the important mins IT 1S SOLD IMMEDIATELY Mont. talin the following stories Il. erals Thle activity s more ¢ = lustrative ¢ h wet th ‘ the eentrated and Intense in the United rt expert sant tell fast & : States than elsewhere, but it ts From All Quarters We Hear phan ed spreading in every region. Auatratia “The Demand Equals the In Heptemt ik 1 ca n Afrtea, China, the lelands of the Pa- az the bend eos Ca nr fei ra cifle, Europe, South America, British Supply. witeiat work in what they called North Am a. Mex are all in the - toh aloe ange ned the caine rugh aa well as are vy { the United The strength of the copper situa- and in conversing with the i al States, It in an age of mining tion is best eeen by the steady dis- Mearasd that they came from Cal: CG tes appearance of the metal out of the fornia ahd would soon return, as the We have passed Great Britain now producers’ hands. Formerly a good cany \ines were bilks and frauds in the output of coal, far excel any deal of the output from the mines I noticed the large quarts croppings othe® country tn our production of was allowed to accumulate at the (since called Gold Hill), but it was fran ores, we ralre a big part of the emelting work distributed to at that time considered worthless Various points to awa Little did they dream that there was copper that comes out of the earth, 1 lead p 4 the consummation of sales guld and allver there to enrich 10,000 and ainc, lead, antimony, ete, and ing companies re comp men, that there would in ten years @ the development of gold mining carry a considerable proportion of city spring up and 10,000 laborers be kee up with the procession, In ev their product until able to work it employed; yet the past t# a real his ery mining @tate and territory of the off n the market Now, however, tory and the r de may be re- Union there is an amount of work producers have their output sold up ferred to. while jt i# yet in the mineral, or even Again, 1 think it was in 1878, nome going on not heretofore equaled, The possitiy in the rock before it hes mining men from Ch > employed Old Helds are giving out enlarged yeached the stamp mill, and it is a me to act as an exp It seems that Yields and the new ones are con rurh bring it from drifts and # party had repor to them tantly coming forward, Coal is the shafts, put it through the stamping there was @ copper prospect dasie of modern energy, and steel ' ens, hurry it to the town of Prescott, I do not Mect and copper the body and nerves of it on the rm if there was any name to the pros- fastest and moe consumer, who has it tn pect. I found the 5 pect, got a vond on the property at $10,000, and modern appliances and machinery in the art and industrics This has with an alacrity that t# truly in- in case a real sale wan made I was given ® foundation to mining which digenous—Westers Miner apd Fin- to have a part of this money. 1 went has taken from It speculative, uncer. ane, Le UV ee UY vu on to Chicago and found my men, tain features which have long kept but they were off. Al great copper lake copper mine ft owt of what called itself “legiti- ak pper mines place 1 had made Mate business Today there is no te Pebnet to tha eifoct th Dusiuess so “legitimate,” so ble ty or copper claim w 80 certain of giving good returns for fraud and not worth a day's work. capital and labor put in as min- Preturnea home Injured about $200, ing, whether for iron ¢ al or gold her parties tried the claim and ‘at; finally a man by the name of Clark visited the claim and bought or silver. The world needs, for ite modern progress, the mineral wealth it, and soon developed what is now of the earth, and capital is as ready the United Verde at Jerome, a mine to go int ining now as into the that experts value at $100,000.00 “Bo, you see, we can't slways geometimes tell what is in the ground et fret sight I could W mines with a similar history. There is no doubt that mining in the United States is in its infancy.” ‘ PROSPECTIVE DIVIDEND PAYERS encanta anna nena ~ Sunset (now shipping) $1.00 Per Share lost (reek =: - | OD Copper Bell - - - 2.4 annnecnnnnmncncccccdl Buy These Copper Stocks for Investment and Sure Profits. We are entircly familiar with the affairs of these companies, and believe that a purchase of any one or all three of these stocks will yield: handsome returns in a few months. most favored lines of other industry or productiogweNew York Financial News. i JOHN E, McMANUS & SON, 9718 Second Avenue REFERENCE: SEATTLE, WASH. Seattle National Bank. FACTS WELL STATED. From a pamphict recently tesue@ How. the Copper Senator Be- by the Montana Copper Mining Co., we take the following excerpt, which came a Multi-Millionaire. euitathe eeveral tacts very forcibly fet . $ stated Senator William A. Clark, one of Wetash wekad daneeis the copper kings of America, who sgl tacks tu ce owns almost all the stock tn the ‘ Montana i# true, bi United Verda, one of t richest cop- treasury stocks in good prospects. @ay laborer in a mine to be a multl- ‘The present phenomenal prosper. Millionaire, While this i uy (Gat tae ate at Mecatane Ww lo true, the statement, according to Mr. great extent due to the hundreds of John Stanton, conveys a false im- people who have made comfortable pression of Mr. Clark's career fortunes out of very small, insigni+ Said Mr. Stanton not “es ag ficant investments in this way.” “Mr, Clark cage into my office in thin city on e matter of business some years ago, and upon my @x- presing my pleasure on meeting him he said that tt was not our first meeting. He then told had worked for one « SENATOR WM. A. CLARK. have been re- per mines of much larger of people have derived cc and handsome profits COPPER MEN HAPPY. spper produc ver #@ happy a* now e average cost of companies in the Lake per delivered in New York ta not gion, and he reminded me of above § cents a pound. The average he had with me on one occasion selling pri 18 cents a pound, and p o rs were nr when I visited the min I rememe the demand is #0 active that every vered him then very distinctly pound of it offered is eagerly snap- It appears that Mr. Clark had been y up. engaged in some mercantile busle >» wonder the copper men wear ness, but, not finding it satisfactory, emiling faces, and no wonder that he studied the «ituation and became copper stocks are prized as are ru- convinced that his forte was mining, bies In order to acauire a thorough Copper ia king and his reign bide LARGE DIVIDEND PAYERS. knowledge of the business he went fair to be long and lasting.—Copper to work in a mine, first as a Inborer Situation, It in said that the largest dividend and afterwards as a full-fledged payer excepting one among the min- miner. Then he returned to this city ing companies in America and prob- and took a regular course in metale ably in the world last year was the lurgy in Columbia college Thu Calumet and Hecla, which distribut- thoroughly equipped for mining he ed among Its stockholders during the returned to the business, thie time y $7,000,000, ‘This mount is ex- going went ceeded by the De # Consolidated The United Verde had been twice Mines, whioh paid in dividends last condemned as worthless when he year @ total of $7,687,200, In addition bought it, réport says, for about $70,+ to this the latter company paid $862,- 000. He developed the mine, and it is 600 as interest on its debentures, and now returning him annually about $642,400 for retiring a portion of its six millions of dollars in profits. Hea bonded debt, making a total of %,- emptied his purse into his head, and 604,900, bringing the total payments his head has since not only Mled his in the nature of profits to $9,192,200 pockets but his bank coffers as well, or $2,192,200 more than the Calumet Mr. Clark is now building a verit- and Hecla, The proportion of profits able palace on Fifth avenue, in this to the capital stock of the De Beers city, and while in Europe this sum company was 40 per cent., while that mer he is credited with purchasing of the Calumet and Hecla was 280 pictures and statuary for ite adorn- per cent, the capital stock of the ment costing over a third of a million latter being rather small.—Copper dollars. Situation, THE DEMAND FOR COPPER ‘The history of the copper market from month to month is a recoré of unimpaired strength, Demand for the metal continues to grow just o little faster than production, and the which tt goes to consump r t corat for futu “ eI sleeps tn ite and bed where ¢ placed it co jess oF 10 ding to the best information obtainable, it appears that in the « f copper 4 universally anocepted natural law haw failed to operate ao cor to th nome rule, It ts taught that th aw of eubstitutior ‘ nmodltle wave brings for v a wecor ymmodity to take the place of th t. in cane there te @ xuMciont wear of the fret te r sit in @ considerable advance in ite market value i the increase in ite price sev. eral comparatively new uses for cop- per have apparently aprung | istence, Rallroad cars, which were 2 with wo paper, tin, ete, are now being covered with copper, Indeet, the experiment has been tried of entirely covering pame- enger cars with o sheathing of cop- formerly re per, and it ts said that the succéss attending the expe 1 even- tually result im its universal adop- tien It will undoubtedly be foun@ that copper in the cheapest car cov- ering that can be used—cheapest bee best. Railroad companies pay from $5,000 to $16,000 each for thetr passenger cary, One of the very im. portant items of expense in thets construction is to finish the owtep surface, fill and paint it and cover 4 with @ varnish that will etand heat and cold, sun, wind and rain. When this is accomplished it lasts only @ year or two, and then must be re- newed A copper sheathing shuts out per- fectly all of the elements. It t# prae- tically weatherproof. Exposed, is takes on that rich and beautiful mé tallic color which has won {t the name of the red metal All of the woodwork of the oar is secured from moisture inside euch @ sheathing, and the outside will need nesther paint, varnish or ‘polish; it will lagt until the car goes out of style. Obn- sidering the present egpense the roads are willing to go te in erder to et the best, the added cost of a cope per covering would not be relatively important Modern buildings, with their cop- per-covered fronts, gutters, ete., in- atidibly declare that the architects have learned and agreed that cop- per in the beet metal to withstan@ the Increasing attacks of the weath- er. In the great, though comparatively new field of electrical equipment, copper has its stronghold. Twenty years ago telegraph and telephone wires were almost universally of iran. and steel. At present copper wires are the rule, and tron and eteel the exceptions. In some districts the ola iron wires still remain, but they are rapidly giving way to wires of that Metal which laste many times longe? and has vastly greater eieotrioal cone ductivity In the street railroad world etée- tricity is universally conceded, te by all js the best motive potter. This power has, indeed, made t) street ratiway popular. Since its edoption these roads have epread like @ prairie fire. and now reach out from the metropolis to th burb, and on through the oountry districts, And still they grow and reach farths er away. Furefe lp beginning to equip her tramways With electricity, ana wee ing so she unconsciously arrany to keep the price of copper up to a high ficure for several yeare to come. With electrical equipment must corte longer trolley routes on the eontif- ent, there the same as here. The twentieth century will got long tolerate the snorting, puffink 1e06- motive, with {ts noise, smoke end dust. The ownership of sufficient present-day relling stoek te do buple ness with is a streng argument against & change to the average trunk line management. The fast, however, that an express in Welgha fifty time as much as the = sengers it is capable of carrying, and the manifest waste of such a system, is already presenting a problem to intelligent capitelists for solvtion. Already branches of several large d systems have been equipped ‘1h eleetricity: and but a few years’ operation will be required to prove the great economy of the change. Lighter rolling stock that ean travel short 4 nees quickly and make Stops at ht expense is in the lige ef progress, All this means electricity and copa per. How much copper it will require to equip the trunk lines of this coun- try with electricity is incalculable, ‘The mines now In existence certain- ly uid not supply the demand for copper which would grow out of such a change in motive power. It would have an effect on the price of copper similar to that which the general adoption of the Incandescent electric lamp had upon the price of plati- num. Before this sudden demand for platinum arose the market for this cau 1 al was dull and quiet at between $4 and $5 per gunce, when it came the price promptly advanced to above per ounce and hardened Bieel, ete were used, but unsuccese- fu as substitutes. After a year or two the prices sagged back tem- porarily below $10, and then rose to $15 and $16, where it has ruled for several years. If electricity as a motive power reaches the plane of popubarity where It is adopted by steam raile roads, substitutes for copper will have to be used until the various di tricts where the metal is found are developed and sufficient copper pr duced to displ the substitutes, While this. re being accom- plished the pri will net- urally be ga ry its relation to other meta a standpoint of luctivity There are bears in all markets, and h sper bows to the universal rul ars there are who have worn thr re every conceivable argu- men the present price ts un- warranted. They have made somo success in scaring people with alum- inum as a substitute fer copper, be- cause {t is a metal of which so little is popularly known,—Copper 6ituae tion, \