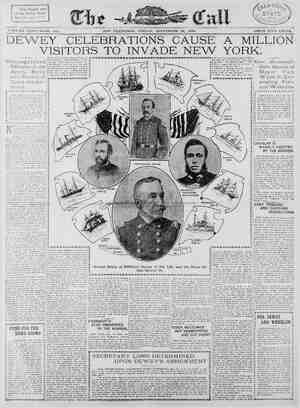

The San Francisco Call. Newspaper, September 29, 1899, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

THE SAN FRANCISCO CALL, FRIDAY. EPTEMBER 29, 1899 SUMMARY OF THE MARKETS. Dried Fruits looking up in Ne Advance in the cheaper grades of Salt. Pig Lead advanced. Silver and financial quotations unaltered. Wheat ¢ Barley higher, but dull on th Qats firm, but quiet. Hay dul omtinues its slow upz ut Feeds Il and weak. Beans and Seeds continue inactive and unchanged. D veased imports of specie Linseed Oil lower and Turpentine higher. Meat market as previously quoted. Fair demand for Prot Heavy Eastern sales of Prun Limes out of market for the >eaches higher and scarce. 101 Less Poultry on the market. Potatoes and Vegeta bles abo e to advance. Eggs cont Rye and Corn unchanged. Butter and Cheese unchanged w York. vard movement. ¢ spot. tuffs firm. this vear. on Govermment account. es for export. moment. Cranberries lower. Game still scarce. ut the same. Charters. a Ala load mdse for r Hilo. Lu, coal at Tacoma for Hono- lumber on the Sound for chartered prior to ar- prior to ar- follows, 50 1bs at Salmon 1 n Englanc | i new ved * oons Tt urse e in 1 gale | gone witho rs oceurrin worst of W kely to | uit Looking Up. ! INCREASING ACTIVITY AND FIRMNESS | REPORTED FROM NEW YORK. ew York say of dried long waiting dealers in dried n @ more active and con- A advance in spot J e ling on the coast, which is mani self in the market for future or 3 re held with more < await the announce- sumption very rapidly, there is a better r peiches. Int ns of this ch i noted _dur ast weel t not until within & day or two atficlently marked to i appreciable change in trading. With | likely at any the o ling all along the three months. ch have been picked ing probable lan 1t upon es of antial | &-q\. [ said that exporters have 1 y at 3c basis far the four El2 but It is not absolutely certain th There is great reluctance t a dealers, while they G t cutright, refu: ¥ , if they have them to I {les previously reported | & g been consun » has been for active | mover the holid; There is | y ttls change in quotations on xpot goods, | 1 held firmly up to quotations, and | sitlon to shade is shown. | ported as doing better, par- ‘T It is said that con- g made, chiefly for the proepect is. that the ccurate estimate, total Is no Many ni that there will be enough to go ng prices much above the | Some liberal sales have been is market recently, and there are gaid to be negotiations in progress for others, but the particulars have not been glven out. . ““Apricols are in better demand and the en- tire trade has a better appearance. While no quotable change In prices has occurred, holders | are more in earnest and refuse concessions which they have made heretofore to influence Weather Report. @20th Meridlan—Pacific Time.) SAN FRANCISCO, Sept. 25, 5 p. m. Teh following maximum temperatures were reported from stations in California to-day: §an Diego. .66 I LS4 no Los Angeles . Red Bluft : San Luis Obier Francls | m temperature, | approach of a blow Island. There > over Califor- ure has fal are some indications of the ff the coast north of Vancouve t Tise in the frutt rted al g ureka. | Francisco for thirty | September 2 lifornia—Cloudy northern portion 6 ~riday, with light southeast- thern California—Cloudy Friday; light erly winds. r Nevada—Clou, cooler Triday. zdy Fri- light south- ancisco ning in the morn ALEXANT ; threat ing; | SR G. McADIE, Forecast Official. -~ — s * EASTERN MARKETS New York Stock Market. 25 —The market for se- and tame affair by | NEW YORK, Sept urities to-day was a so contrast with the viole: fluctuations of the arlier period of the money stringency. The | rate for call money vibrated between 12 and 14 per cent during the perlods of active demand, but after that was satisfied well by quick | stages to 3 per cent. The need of borrowers over the ensulng holidays was satisfied in large part in anticipation of pressure for ac- | co and consequently to-day’s | \er rate did not reach within & per cent of terday. The bank statement was unfavor- beyond all expressed anticipation. Al- ough the Outgo to the sub-treasury was re- luced to $1,196,000, four days of busin the of cash to the interior brought the total in the reserve up to $4545,800. In| reduction in loans of $7,752,700 the lus reserve was still further re- 5. It is obvious that loans made W days on the Stock Exchange do s showing, and the ac- figure largely in t¥ 2 commodations were p secured by dealers | oney who had slfed themselves time some time ago a 0 put their sup- plies out again at the profitable ruling rates in place of the loans called the banks to e October settlement. The showing of and the continued tight- | ness of money were offset by the additional en- | meet gold for import and the drop in| for sterling exchange to very nearly . The sentiment on the | regular import ra hange was that further relief to the market from this source is now avail that a regular movement of gold inaugurated ) pressure of liquidation was st, and present holders of stock awnit a more favorable turn of affairs. The in further gold imports was em- - by the fallure -© the Bank of Eng- Jand to advance its official discount rate, not- withstanding the fact that the principal de- | mand for money in London is now thrown Upon tne central institution by remson of the | higher prevailing private rate of discount. A fali in sterling exchange in response to the former discounts there suggested additional sure in London for gold from that source . With gold moving to New York, some | are of protection by the bank at an early may be accepted as a certainty. The in- terior money markets in this country gave no vidence of & relaxation Of the pressure upon New York for funds, New York exchange at in aay terfor points tending rather downward. Some | relief is anticipated next week from dividend | and interest disbursements and from the | money left in the city by the visitors to the Dewey _celebration. Ixcept for a recovery of | 21, in Tennessee Coal, gains of 1% and 2 in the | 3 outhwestern stocks and wide move- a tew usually Inactive stocks, to- | market was without notable Incident. total dealings fell to the level of the mid- | mer period of dullness. Dealings In bonds = on a emall scale and price changes were mixed. Total sales, par value, $1,325000. United States new 4s declined % in the bid Pihe eltmination of two days from the busi- | ness week, and the prospect of dullness next week consequent upon the yacht races, ac- uated the speculative stagnation which | ays follows a period of unusual activity in stock market and limited the transactions of the last four days. | The hope is expressed that the dividend and | Interest disbursement may serve to rellve some- | what the lo ket. Many wild als) of the effect of expenditures Visitors on the local money supply. the main causes of the depletion of banking re- | serves, it is manifest that the needs of the in- | to move the crops are not yet terior for mone appeased. Netther Is any cessation of the absorption of the money by the treasury in as the Government’s expenditures are | tunning well under receipts. The August | A apparently be doubled in Septem- July deficlt {8 more than wiped out, leaving a growing surplus as the fiscal vear | progresses. There has been constant demand | for all the gold certificates which have been available at the New York sub-treasury. But, | as these simply served to convert the gold of | New sork banks into a form more desired by | the depositors, their distribution has aug- | mented rates rather than relleved the decline | on New York banks, Many of the clearing houte institutions started the week with their reserves under the legal limit and with addi- tional demands upon them there has been further calling of loans. The stock market has | been unprepared to move upward under the | clroumstances, but it has shown signs of resist- = to a decline also which made the bears of raiding stocks. It 15 evident that stocks aré much less vunerable to attack and | hat weak speculative holdings on margin and with borrowed money have been shaken down upon a more solid foundation. Stocks with in- trinsic merit were taken as such times by powerful interests not dependent upon _or- | dinary money market reserves. Some of these | provided ‘themselves with funds in time to answer hefore the present stringency set in and have a handsome profit avallable now by re- loaning on call. No small part of the current transactions in money are of this character and | naturally do not affect the showing of the | banks at all. There have been several monthly | Teports by great railway systems during the week, showing extraordinarily favorable re- sults and reports of -weekly gross earnings show the high level well maintained. The Transvaal developments caused but slight in- fluence on the local stock market ber and NEW YORK STOCK LIST. Closine Stocks— Bid. Atchison ... 20% Atchison prefd Baltimore & Ohlo... Canadian Pacific Canada Southern Central Pacific mum, i0; mr‘»‘u\. | pressure . has pidly over the | ern half of the Pacific pe, and there | Chicago Ind & Loulsville... Chicago Ind & Louisville prefd. Chicago & Lastern Illinois.......... %3 | Chicago & Northwestern | Chicago Rock Island & Pac, ex div.112 | € C & St Louis..... | | Colorado Southern . 3 Colorado Southern Ist prefd... Colorado Southern 2d prefd........ Delaware & Hudson. ... Delaware Lack & Western Denver & Rio Grande............. Denver & Rio Grande prefd... Brie il Erie 1st prefd. Great Northern pre Hoeking Coal Hocking Vall 7 | s | ‘entral Iowa Central prefd....... Kansas City {Pttsburg & Guit. Lake Erie & Western.. Lake Erie & Western prefd. Lake Shore Louisville & Manhattan L _........ Metropolitan Street Ry, ex div. Mexican Central .. Nashville | Minneapolis & St Louis....... | Minneapolis & St Louis prefd. Missouri Pacific | Mobile & Ohio . : Missour! Kansas exas. Missouri Kansas & Texas pre New Jersey Central ....... New York Central, ex div Norfolk & Western .......... Norfolk & Western prefd... rthern Pacific ... orthern Pacific prefd. Ontario & Western Oregon Railway & Oregon Railway & Nav pref Pennsylvania ... Reading .. Reading Jst prefd Rending 2d prefd. Rio Grande Western.. Rio Grande Western prefd. O 69 521 | T4 | | i St Louis & San Fran... Bt Louis & San Fran Ist pref St San Fran 2d pref St Louis Southwestern Lauis Southwestern prefd. Eeaul . Paul prefd ....... Paul & Omaha . 5% | St Southern Pacific Southern Raflway . outhern Railway prefd. xas & Paciflc Union Pacific .. g Union Pacific prefd . Wabash .. Wabash prefd . Wheellng & Lake Wheeling & Lake Wisconsin Central ... | Miscellaneous— | American Cotton Ofl... American C Amerjcan merican American American ton Ol prefd. . Maiting. .. Malting prefd... 65 3 | 8614 American 3ia . American 303, American Hoop 1314 merican Steel Hoop pre a1, merican Steel & Wire 50% American Steel & W ierican Tin I A Ameri Americs ‘obacco prefd dn Mining Co ntinental Tobacco ontinental Tobacco prefd. Steel ede Gas.... onal Biscult. A tional Biscult prefd. i tional Lead..... ceen.. 281 National Lead prefd....... 110% onal Steel........ . 30 tional Steel prefd. ew York Air Brake North American. 5 | Pacific Coast. ific Const 1st pretd... cific Coast 24 prefd.. Pacific Mail.. le's Gas Pressed Steel Car......... Pressed Steel Car prefd. Pullman_ Palace Car. Standard Rope & Twine Sugar Tennessee Coa United States Leather..... United States Leather pre ‘nited States Rubber.. United States Rubber prefd. Western Union......... Republic Iron & Steel. Republic Iron & Steel prefd. : 2% 2 230,200 Shares Sold. CLOSING BONDS. | U S 25 reg. M K & T 2ds Do 3s Do 3s Do new 46 rex. Do new 4s co Carolina fs Do oid 4s reg.....111% | Do 4s Do old 4s coup...113 N Pacific lsts Do 55 reg.........111% | Do 3 | Do 58 coup 1% | Do 4 eeeen 1083 Diet of Col 3.65s....117 T 1e] L 48,1075 | Ala class A 103 & W con 4s...... 941§ Do class B. 109 | Do gen Gs. 135 Do class C........103 Do currency......100 Atch gen 4s. 102 Do adj 4s T Can So 2ds. voee Or Nav Ists Do 4s. Or Short Line 6s. Do _con 5s. Reading gen is. [ & Ohio 414 R G W Ists........ 985 I ¢ St L & I M con 5s.112% Chi & N con t L & S F gen 6s.124%; | Do S F deb 120 St Paul cons. Chi Term 4s 41 StPC& P lsts D & R G Ists......106% Do 58........ Do 4s.. ETV &G lst: Erie gen 4s... FWE&DC 9914 So Railway 5s.. Stand R & T 68 1% Tenn new set 3s i Tex & Pac Ists.. Gen Elec o8 119" | Do 24s......... GH &S A 6 08 |U Pacific 4s Do 2d: <108 'Wabash 1sts | H&T 110%| Do 2ds........ | Do con 6s. 2111 West Shore 48. 1127% | Towa C4 J114% Wis Cent Ist: | K CP &G lsts. .. 7% Va Centurles....... 8714 | La new con 4s.....106 Do deferred 5 o] L & N unt 4s 10%.C & S 4s. &% | . MINING STOCKS. | GOllAL oot Ontario cee 85 | Crown Pofnt - 15 Ophir E Con Cal & Va. 1 65 Plymouth .... 8 Deadwood . 70 Quickstlver 200 Gould & Curry..... 20 Do prefd 750 Hale & Norcross... 3 Sierra Nevad 66 Homestake 165 00 Standard ........... 320 | | Iron Silver ......0" B3/ Unton Con...... % Mexican Yellow Jacket...... 2 BOSTON STOCKS AND BONDS. | Meney— Unfon Land........ 5% | Call loans 4%@6 | West End... 931, Time loans. 5 @b Do prefd..........113% | Stocks— Westinghouse Elec 47% AT &S F. . 20%| Do prefd.......... 68 Do prefd e Bell Telephone .. 3 58 | Atchison 4s.........100 Amerfcan Sugar...143% | Mining Shares— Do prefd..... 18 |Adventare ......... 7 Boston & Albany..259% Allouez Mining Co 5 Boston Elevated...1013% Atlantic .......... Boston & Maine....200 ~ Boston & Mont...3%0 CB&Q........12% Butte & Boston.... 78 Fdison Elec TNI....208 |Calumet & Heela..790 Fltchburg prefd....122 | Centennlal 241 General Electric.. 119% Franklin ........... 18 Do prefd... <M1 Humboldt ........ l* | Federal Steel ... 53 | Osceola ... w6y | Do pretd.......... 8% Parrot .. 435 Mexican Central... 14 Quincy .. 155 | Mich Telephone....108 Santa Fe Copper.. 12% 0ld Colony. (206 | Tamarack ..........224 0ld Dominion. . 3415 Utah . ubber .. inion Pacific. The Money Market. NEW YORK, Sept. 28.—Money on call easier at 3@14 per cent; last loan, 3 per cent. Prime mercantile paper, 5%@6 per cent. Sterling ex- | change heavy, with actual business in bankers' bills at $4 $45@4 5% for demand and at $4 81 | @4 1% for 60 days. Posted rates, $4 S214@4 83 | and $4 $6@4 $61. Commercial bills, $4 S0%. | Silver certificates, [0@60c. Par Silver, @80, | Mexican Dollars,” 47%c. Government ~bonds | weak: State bonds inactive; reliroad bonds ir- | regular. . 47% Winona. . -.. 44% Wolverines Imports of Specie. NEW YORK, Sept. 2 i this week were §15,565 gold and $46,269 silver. | The imports of dry goods at the port of New | York this week were valued at $2,007,138. | .—The Imports of specia Cash in the Treasury. | WASHINGTON, Sept. 25.—To-day’s statement | of the condition of the treasury shows: Avail- | sble cash balance, $289,246,200; gold reserve, $254,336, 614, me;t Market. NEW YORK, Sept. 28.—The Commercial Ad- vertiser's London financial cablegram eays: The markets here to-day were dull as dish- water waiting the Cabinet meeting and the | threatening a | pected, owing to exhaustion of supplies. | ber of advances, notab! The tone was drooping, but Dewey holidays. Americans were scarcely to a barren basis. becalmed. Spanish 4s were 60%: Tintos, 45%; Anacon- das, 1011-16 and in some demand; Utahs, § bid, a rise of 5-16, caused by a puff in Truth. The bank rate was not changed, but a rise‘ls expected next week. CLOSING. LONDON, Sept. 28.—Canadian Pacific, 83% Northern Pacific preferred, 77; Atchison, 21% Grand Trunk, 7%; Anaconda, 10%. Bar Silver, steady at 27d per ounce. Money, 2!z per cent. — Associated Banks' Statement. —_— NEW YORK, Sept. 28.—The Flnancler savs: The statement of the New York clearing-house banks, fssued Thursday, September 25, covers the average operations of the preceding four days only. The showing 1s not favorable, but prospects fndicate that the current exhibit will be the last to convey evidences of the liquida- tion which has been a marked feature of the situation since the opening of June. The main feature of the statement is the loss of four and a half millions in cash, mostly in the form of legals. The knowr business of the week to date did not call “or a decrease of that magnitude. The banks:met the contrac- tion in large part by decreising their loans. The loss in that item hasi been $7,752,700. Deposits show a loss of $17,226,200, whi is rather more than the chankes in cash and deposits called for, but the cohtraction lessened reserve requirements by over three millions and the remainder, or $1,239,20, came out of the surplus reserve, bringing the excess cash in banks down to $1,714,450. ' The next state- ment of the banks will not abpear until Octo- ber 8, and the ensuing nine or ten days will probably show improvements, €0 far as the New York banks are concerned. As a result of the holidays in New York an amount | of money not easy to calculate will come into the banks here, and while this is an uncertain and temporary factor there s no question that its effect will be to increase the current sup- plies of cash. The gold engaged for Import will not arrive in time to figure in the next statement, but the fmports and the rising na- tional bank circulation figures show at least the general trend of the situation and what may be expected {n the near future. The de- mands for remittance to the Interfor are not increasing and while interior banks have doubt- less loaned heavily here it {s not expected that these funds will operate to the disad- vantage of local Institutions once the pressure is over. At about this season every year re- serves in New York begin to recuperate and it 1s only natural to look for the usual recovery from this time on. Unless all signs fall, there- fore, it may be set down that the critical point in the fall money movement has been weathered. This does not mean, necessarily, that money rates will strike an exceptionally low rate soon. of the Dewey reception gave a hollday appear- ance to the whole week in the stock market. Large Interests seemed to be doing nothing and the public took no part. The professional room traders were, therefore, in control and at first depressed prices with comparative ease on the ect of the Transvaal situation, ally on the Increased firmness of our own market. The New York bank state- ment of last Saturday showed, 1t is true, an in- crease of $2,600,000 in surplus reserve, but the figure displaying a further loss of $2,500,000 ash and a contraction of $17.800,000 in loans could only Indicatae that the banks have been meeting enormous interior demand for funds by calling in loans In the stock market. The same process was apparent in the state- ment put out on Thursday from the clearing- house for the four days ending then. Shipments of money to the Interior continues this weel, ana the October disbursements and the holidays also scarcer and the demands of the market tem- porarily more pressing. As a result we have ad not only a 6§ to 10 per cent money market this week, but one in which, as on Wednes- day, 15 per cent or more wis pald for very considerable amounts. This naturally caused some further liquidation of speculative ac- counts, though the opportunity large degree now exhausted, weakly ke being pretty thoroughly shaken out Brookiyn Rapid Transit held its position as the active feature. Further conflicting reports as to the control of the company carried the price up to 931 and from there back to STi, with another rise to $2%. The stories afloat, including, as they do, references to a possible combination of all traction interests, caused both Manhattan and Metropolitan to advance. American Tobacco was one of the features. It declined from 124% to 115% on selling, which was explained by the declaration in the West of only the regular 116 per cent dividend with- out the expected increase. United States Leather common has been strong, rising to 15 on the ex- pected appearance of the readjustment plan. The industrials, however, —apart from some signs of manipulative support in the Steel group, were neglected, selling off easily on moderate pressure and rallying with equal fa- cllity. and more esp held 2 d . Bradstreet's on Trade. W YORK, Sept. 28.—Bradstreet’s will say: The notable feature of the business week is the strength of agricultural products. Eall trade continues good, though It is conceded at sev- eral markets that the biggest part of the fall business been done and that reorders from now on will cut the largest figure. Weather conditions, while favorable to cotton harvest- ing, are claimed to be hurtful to further growth because of the dry weather. Outside specula- tive interest in that staple, short covering partly, it is claimed, on foreign account, and the exceptional strength of the manufacturing industry, the products of which are in active demand ‘and_tending upward, are all reflected in the ravid advances for both futures and spots. Visible supplies, while considerably larger than in recently preceding years, are slightly smaller than they were in 1%, since when consumption has unquestionably heavily increased. Middling uplands are now &c higher than at the beginning: of the month., 1ic hicher than last year, and 2c above the lowest point reached on the 158-89 crop. The extension of the price agreement as regards print cloths, the new one, however, covering all classes of the product, has strengthened the | situation tn cotton goods'and at the same time 1s credited with presenting an obstacle to tie progress to the proposed combination talked of for some t'me vast Wheat has remained steadily strong, growing firmer toward the close on enlarged forelgn buying and uncertainty as to the outcome of South African affairs. Sympathetic strength is displayed by corn and other cereals. Increased foreign demand is reported largely responsible too for the stronger tone and advances shown in hog products. Wool has continued strong and in active demand both at home and abroad. Some American buying is reported at the Lon- don sales, which will close earlier than ex- In the manufacturing branch of the trade the demand is_reported active. There is a quieter tone at most of the mar- kets for steel, and large buyers have been, most of them, out of the market. There Is no diminution in strength, however, and a num- on_Southern iron and Complaints of back- Lum- steel billets are reported. ward deliveries are as numerous as eyer. ber remains active at most markets, complants of slow delivery, due to lack of cars, are also heard Southern manufacturers have advanced the price of stoves, which are nearly a third higher than a year ago. and plow manufacturers have also joined in this movement, making the third advance within a year in this branch of farm implements. An_ equally strong tendency as to price ig noted in hardware, particularly builders’ grades. Wheat, includinc flour, shipments for five days aggregate 3,332,500 bushels, against 4,630,- 765 bushels last week, 5,306,875 bushels in the nding week of 1598, 5,834,2i6 bushels in 4,215,794 bushels In 1596 and 2,613,866 bush- els 1845. Since July 1 this season the exports of wheat aggregate 49,066,000 bushels, against 47,000,897 bushels last year and 56,144, 71 bushels in 1897~ 1595. Business fallures for the week in the United States, five days, number 131, as compared with 147 last week, 166 in this week a year ago, 189 in 1597, 3% in 15% and 245 In 1895 Business failures in the Dominion of Canada for the week, five days, number 11, as compared with 13 last week, 23 in this week a year ago, 33 in 1597, 23 in 1896 and 87 in 1865. —— | New York Grain and Produce. [ f——————¢ NEW YORK, Sept. 28.—FLOUR—Receipts, 25,144 barvels; exports, 19,111. Moderately active but firer with wheat, closing with an upward tendency. WHEAT—Recelpts, 170,800 hushels; exports, 184,473 Spot, firm: No. 2 red, Ti%c f. o. b. aficat spot; No. 1 Northern Duluth, Si%c f. o. b afloat to arrive; No. 1 hard Duluth, Stc to arrive; No. 2 red, To%c elevator. Options opened firm at an’ advance of %c on better cables than looked for and disappointing North- weet recelpts further advanced them c. Cov- ering followed renewed and louder war talk. There were numerous partial reactions on de- creasing sales, but the general temper of the market was much better, with speculation more active than for some time past. The market was finally firm at an advance of %@% points; May, 79 15-16@S0%c, closing at §0%c; Septem- ber, ' @754, closed Tage; October, U@ Ti%e. closed Tifc; December, TH@TAC, closed e HOPS—Dull. WOOL—Strong. PETROLEUM--Strong. METALS—Interest in metals was not broad, nor were there any variations of importance in the local metal market to-day. As news from Europe and primary points in the West portrayed no significant new phases in the nfluenced the situation, call money being | for this Is to | though | situation at these centers buyers and sellers were Inclined to procrastinate until after the )mll‘lrlg)'s, At the close the Metal Exchange called: tP’l‘GSIRON—W'urnmt very dull and nominal at $is. * COPPER—Dull at $18 50. TIN—Qulet, with $32 85 bid and $32 12t asked. LEAD—Quiet, with $4 60 bid and §4 65 asked. The brokers' price for lead is 3+ 40 end for copper $18 373%@18 50. 2 SPELTER—Quiet, with § 30 bid and $ 40 asked. COFFEE—Options closed changed to 5 points lower. including: October, $ 25; November, $ 30 December, $4 55@4 60: January, $ 60; March, 4 T5@4 80; May, $4 S5@4 90; June, $4 90; Jul: $4 95@5. Spot coffee—Rlo, quiet but stead: mild, steady. SUGAR—Raw, dull and easy. BUTTER—Recelpts, 6043 packages. Firm: Western creamery. 17@23c; June creamery, 19@ 22¢; factory, 13%@i5%c. BGGS — Receipts, 17930 packages. Market steady; Western ungraded at mark, 13@1Sc. Dried Fruit in New York. NEW YORK, Sept. 25.—California dried fruits quiet and steady. steady, met un- Sales, 23,750 bags, nominal and weak; refined, EVAPORATED APPLES — Common, _T%c; prime wire tray, 7h@S%c; cholce, $%@%ci fancy, 9@9%e. PRUNES-—31%@8c. APRICOTS—Royal, 12@13%c; Moorpark, 1@ 16c. PEACHES—Unpeeled, T%@%c. —_— Chicago Grain Market. — CHICAGO, Sept. 25.—Liverpool played a prominent part in influencing the early tone of wheat trading. That market opened lower, but quickly recovered, and at the opening here showed good advances. This was regarded as indicating the seriousness of the Transvaal situation. Early indications also pointed to large clearances for the day. Outside buying was quite heavy at the opening, New York houses being especially prominent. The open- ing in December was at 13%@73%c, an advance of %@%c over yesterday's close. 'This was at call price, and for a time the market met heavy selling agalnst these privileges. A good deal of general profit taking was aiso done and a decline in December to 73%c took place, but be- fore 11 o'clock the market had again become strong with heavy and general buying. The continual falling off in receipts at prominent recelving points attracted more attention, and the belief was more general that the winter wheat supplies from now on would be much lighter. New York and St. Louis at the same time reported numerous acceptances of yester- | day’s cabled offers. Best prices were obtained in the last hour of trading. The market during | that time exhibited a good deal of nervousness {and the price changed rapidly, though within a narrow range, Realizing was heavy, but on all slight breaks the market received substan- tial support, and though best pri ‘were not maintained, the close was at a substantial ad- vance. A good improvement In the demand for flour was reported and this had an influence on speculative trading. The market at the close showed a marked growth of bull sentiment Jamong local traders, and trading throughout showed the effects of increased outside interest. A bull feature was the falling off of 800,000 bushels in primary receipts in the past four da: December advanced to 74'4c and reacted to 73%c, where it closed. Considerable trading was done in May, more strength than anything else on the floor. It closed %c higher at 3%c. Corn was fairly active and irregular. There was heavy liquidation of September by the in- terests supposed to be most prominent on the |long side and this influenced the market all day. Deferred futures, in which trading was mostly of a sealping nature, were weak ‘or a time in sympathy, but later recovered on cover- iz by shorts and closed steady. December closed e higher at 30jc. September closed ac lower at 32%gc, Oats reflected the action of corn, September | being weak on moderate liquidation in spite of | emall receip ile deferred futures were steady. Trading was small and mostly of a scalping nature. The cash demand was rathe December closed a shade higher at 227 | September closed %o lower at 22%c, | Provisions were firm and in good demand. The | chief influence was the heavy cash demand and | fair advances were scored during the morning on buying by local operators and exporters. | Later heavy selling by packers caused a re- action, but the market ciosed steady at slight changes January pork closed 2lc lower at $950. January lard unchanged at $5 621 and January ribs a shade lower at § The leading futures ranged as elow. @23 Articles— Open. High. Low. Clos | Wheat No. 2— | september ... Y MH WY 4% December . WY TR @R 7% v 8 6% 6 T6% Corn No. 2— sptember 3 33 32 32 | December ... ) % WY 30 Mey ... . 30% W% 0% 30% Oats 2% 2% 2% 2 2 23 uy BH Uy October 822 822 December . B4 840 January . 5 8215 .9 821 Lard, ver 100 pounds OCtober ...eeveeeb 45 545 December . 55 65 January . 565 565 Short Ribs, per 100 pounds— October 174 January 51 follows, Cash_ quotations were as 115c; No. firm: No. 3 spring wheat, 6@ T314@T4Y%e; No. 2 corn, 321@32%c; Ne | 223@sse: % white, 25%@25%c; No. 3 white, 241,@25%c; No. 2 rye, 581c; No. 2 barley, 35@ { $ics No. 1 flaxseed, $112; new flaxseed, $113; prime timothy seed, §2 25@G2 30; mess pork, per | barrel, $7 60@8 25: lard, per 100 pounds, $5 35@ | 550; srort ribs sides (loose), $ 0:@5 40; dry salted shoulders (boxed), 6@6t%c; short clear sides (boxed), $5 50@3 00; whisky, distillers’ fin- ished goods, per gallon, §1 2 Articles— Recelpts. Shipments. Flour, barre! . 25,000 12,000 Wheat, bushels 18,000 Corn, bushels . 706,000 | Oats, bushels ... 275,000 | Rye,” bushe E 1,000 Barley. bushel 16,000 On the Produce Fxchange v the butter market_was firm; creamery, 10@22%c: dairy, 13 @1Sc. Cheese, firm; 11@11%c. Eggs, firm; fresh, | 16%4@17c. Foreign Futures. LIVERPOOL. Wheat— Sept. Dec. Mar. Opening ... . 510% 6% § 2% Closing 51k 61 63 PARIS. Wheat— Sept. Jan.-Apr. Opening . 1915 20 15 | Closing ... . .. 19.00 20 10 Flour— Opening . 25 50 26 55 Closing 25 30 26 45 —— California Fruit Sales. —_—————— | The Earl Fruit Company’s sales of California | fruit: NEW YORK, Sept. 28.—Grapes—Malaga, 6@ c, single crates; Muscat, 30@7ic; Tokay, Tic@ { | | { |8 | §180, single crates; double crates, $1 40@2 45. | Peaches—Levi Cling, §1 20@1 35 box. Plums— | Coe's Late Red, S0c, single crates. Pears— Bartlett, §105@2 40 box: S0c@$i 20 half box. | Prunes—Ttalian, $1@1 05. Twelve cars sold CHICAGO, Seépt. 28— Grapes—Malaga, 60@90c, single crates. Peaches—Elbert A, 8c@8$1 10 box. Pears—Bartlett, $1 75@2 80 box: $1@1 20 half box. Prunes—German, 80@%c, single crates; Gros, $0c@$1. Bight cars sold to-day. LONDON, Sept. 28.—Pears—Clairgeau, $1 two-fiths boxes: Dil, $120%1 26; Ducomice, §1 7471 86: Duchesse, $§1 32@1 50. Plums—Co- Tumbla, $1 35, single crates; Golden Drop, §1 80 @1 92; Kelsey, $3 34. Quinces, $1 44 box. BOSTON, Sept. 28 —Grapes—Malaga, _single | crates, Sic: Tokay, S0c@$110, average Sic: Sa- | bulskorkol,” $130@1 35, average $§1 Peaches— George's Late, hoxee, $1@l 20, average $1 0! | TLevi Cling, $105@125. average $114; Salw $1 1501 75, average $1%5. Six cars sold to-day. Favorable weather. » London Wool Market. - » | LONDON, Sept. 28.—Offerings at the wool | auction to-day amounted to 16,360 bales. Queens- land new clip greasy was well represented and competition for this grade was very Keen, Eng- land and the Continent securing the bulk of it. Scoured merinos formed a large portion of the catalogue, much of it bringing fancy prices. The low qualities were irregular. Crossbreds were in large supply and sold briskly to the | home trade. Germany and America pald high | figures for their specialties. Medium and fine ! ecoureds showed a hardening tendency. Lower, | coarse clips were irregular. A fair selection of ‘alkland Islands stock was offered and it sold well at an advance of 10 per cent. The sales | to date number 114.000 bales. | Eastern Livestock Market. | cHICAGO, Sept. 28 —CATTLE-Trade was lively to-day, desirable lots being in active de- ! mand at an ‘average advance of about loc. 1 Good to cholce cattle sold at $5 75@6 90, com | moner lots at_$i 4075 70; stockers and feeders Drought $34 85 bulls, cows and helfers, §1 0@ i Texas steers, 3310@4 10; ransers, $3 35 {510 and caives, et e nae | Active buying In Chicago packers and | Bastern thippers made & strong hog market Heavy hogs 4 T1%: mixed lots at $4 45@4 S2i5 | and prices averaged 5c higher. Sd tene ot 840k s0r Figs b ght . rought $4 1 80, | and culls $1 5034 15, wt %ot SHEEP—Trade in sheep and lambs was | rather slow at the decline in prices. Sheep sold ‘I( $225@¢ 8, —ecotly Weatern rangers. ear- and that future developed | brought $4 10@4 40 and feeders $3 2583 T5. J e ' 3us 75 for culls, up to $ 50 B S0 oy choleal N atye] flocks. Western range lambs brought $4 50@5 15. Recelpts—Cattle, 7000;. hogs, 22,000, 14,000, sheep, Imports at New York. NEW YORK, Sept. 28.—Imports of dry goods and merchandise at the port of New York for the week were valued at $11,538,562. Portland’s Business. PORTLAND, Or., Sept. 28.—Exchanges, $278,- 120; balances, $38,39. Northern Wheat Market. OREGON PORTLAND, Or., Sept. 25.—The forelgn and Eastern markets showed further improvement again to-day, the war scare having assumed dimensions_which are already making a firm wheat market in England with a_sympathetic following in this country. Walla Walla wheat sold at 60c to-day for a choice lot and it was reported that a round lot changed -hands in | Umatilla County at 50c in the imterfor. Valley, 60c. WASHINGTON. TACOMA, Wash., Sept. 25.—Wheat continues elaw. Better receipts are making exports easier. | Club, 38%c; blue stem, 613c. Foreign Markets. LONDON, Sept. 28.—Consols, 106%{.Stiver, 27 French Rentes, 100f 5ilc; wheat cargoes off coast, buyers and sellers Indifferent operators; cargoes on passage, quiet and steady; No. 1 Standard California, 30s 94; English country markets, firm. LIVERPOL, Sept. 28.—Wheat, firm; wheat in Paris, weak; flour in Paris, weak; French coun- try markets, dull. COTTON—Uplands, 3%d. CLOSING. LIVERPOOL, Sept. 28.—WHEAT—Spot No. 2 red Western winter, firm, 5s 113d; No. 1 North- ern spring, firm, 68 3d. Futures—Steady; Sep- teber, & 11%d; December, s 1%d; March, 6s 8d. CORN—Futures, quiet; September, 3s Tikd; October, 3s T%d; November, 3s 7d. -— LOCAL MARKETS. Exchange and Bullion. Sterling Exchange, sixty days.... Sterling Exchange, sight. Sterling _Cables. | New York Exchange, sight New York Exchange, telegraphic Mexican Dollars.. | Fine Silver, per ounce. Wheat and Other Grains. WHEAT—The Inverameay takes for Cork 13,496 ctls, valued at $14,170. The market continves to advance and Is very stiff. Liverpool came through lower and Paris higher. Chicago opened inactive, but with a firm undertone. Broomhall cabled that the | strength abroad was caused by the increased | seriousness of the Transvaal situation. The { market was small, however, with local scal | ing. Later on, however, clearances of nearly i | g SEnEene L3 & 1,000,000 bushels Wheat and Flour, coupled with large Antwerp acceptances at St. Louis and rumors that the September shorts were to be squeezed hardened the market, which continued firm the balance of the da: | Spot Wheat—Shipping, $105@107%; $1 10091 12%. CALL BOARD SALES. Informal Session—9:15 _o’clock—December— 4000 ctls, $111%:; 2000, $111%. milling, | “Second Sesslon—December—4000 ctls, $112% 112,000, $1 121 ; %000, $112%4. May—S000, 31 1814, | “Regular "Morning _Session—December—5.00 | ctis, $11214; 4060, $112%: 6000, §112%. May—2000, ‘u 1854: 40,000, $1 18%: 2000, $1 1S3%; 2000, $1 18 Afternoon Session—Decemb $112%: 14,000, $112; 6000, $1 12 | $118%: 14,000, $1 15; 6000, §118%. | U BARLEY—The Earl of Dunmore takes for | London 17 ctls, valued at $10,000. Inveram- say, for Cork. 35,458 ctls, at $35,502. A shert interest is being squeezad on call, and this hardens the whole market. At the same time, the advanced asking quotations deter buyers and trade is dull. Offerings are larse. Feed, T5@S5c: 90@%c; Chevalier, $1@1 12% per ctl. CALL BOARD SALES. Informal Session—8:15 o’clock—No sales. Second Session—No_sales. Regular Morning _Session—10,000 ctls, §Tc; | 18,000, $7c; 2000, 87ic. Seller '89, new—2ud), 85igc; 2000, 85gc: 2000, S53jc; 4000, E5%cC. Afternoon Session—No sales. OATS—The market is firm cnough, but dull. White, $105@1 25; Red, $1 06@1 12%; Black, 92%c @s1 0215, CORN—Eastern large Yellow, §105; White and_mixed, $1 02@1 05 per ctl. RYE—90@%c per ctl BUCKWHEAT—Nominal. Flour and Millstuffs. FLOUR—California family extras, $3 6033 T, usual terms; bakers' extras, $3 40@3 50; Oregon and Washington, $3 40G3 50 per barrel for ex- tra, §3 25@3 40 for bakers' and §2 25@3 for su- perfine. MILLSTUFFS—Prices in sacks lows, usual discount to_ the trade: G Flour, $3 25 per 100 Ibs; Rye Flour. £2 7 Meal,'§2 50; Rice Flour, §T; Cornmeal, $2 50; ex- tra Cream Cornmeal, $3 25; Oatmeal, "$4 50@4 T Oat Groats, $ 75; Hominy, $3 25@3 50; Buc] | wheat Flour, $4@4 %5; Cracked Wheat, $375; Farina, $ 50; Whole Wheat Flour, $3 50; Rolled Oats (barrels), $6 55@6 95; In sacks, $6 35@8 T Pearl Barley, $5; Split Peas, $4 50; Green P $5 per 100 1bs. Hay and Feedstuffs. Dullness continues to characterize the Hay market. Feedstuffs are rather firm than other- wise. BRAN—S$15 50@17 per ton. MIDDLINGS—S$17 50@19 50 per ton. FEEDSTUFFS—Rolled Barley, $17 50@18 per ton; Ollcake Meal at the mill, $27@2S; Jobbing, §28 50@29; Cocoanut Cake, $20@21; Cornmeal, §23 50@24 50; Cracked Corn. $24@25: Mixed Feed, $16@16 50; Cottonseed Meal, $25 per ton. HAY—Wheat, $7@8 50 for common to good and $0@$ 25 for choice; Wheat and Oat, $3@ 8: Oat, $5@8; Barley, §3@7; Island Barley, $5@ 5'50; Alfalfa, $5@6 75 per ton; Compressed, $6 504, STRAW—20G35c per bale. Beans and Seeds. Brewing, are as fol- Dealers quote a firm but dull market for Teans and a dull market for Seeds. BEANS—Bayos, §165@175; Small White, §2 102 15: Large White, $160@175; Pinks, $2 15@2 2; Reds, $i; Blackeve, $2@3 25; But- ters, nominal; Limas, $4 05@4 15; Pea, §2 10@ 215: Red Kidneys, $250 per ctl. SEEDS—Brown Mustard, 24@3c; Yellow Mustard, 3%@4c; Flax, nominal; Canary Seed, 3%c per Ib for Californla and 4c for Eastern; Alfalfa, nominal; Rape, 2%@3c; Hemp, 4@4%c; Timothy, 4@4ic. DRIED PEAS—Niles, $1 50@1 65; Green, $1 75 @1 90 per ctl. Potatoes, Onions and Vegetables. Quotations for all descriptions under this head remain about the same. Sweet Potatoes have sold off readily of late, and Tomatoes still glut the market. Peas continue to ad- vance, Otherwise there is nothing new. POTATOES—River Reds, 50@Tc: Early Rose, 40@%5c; Burbanks, 10@65c per ctl; Salinas Bui banks, $0c@S1 10; Sweet Potatoes, §125 for Riv- ers and $150 for Merced. ONIONS—70@T5c per ctl; Pickle Onlons, 50@ %5¢_per ctl. VEGETABLES—Green Peas, 3%@ic per 1Ib; String Beans, 2@3c; Lima Beans, 13%@2c; Cabbage, 50@fic; River Tomatoes, 10@15c; A meda Tomatoes, 15@30c; Egg Plant, 25@8ic; Green Okra, 23@50c per box; Dried Okra, 123%c per Ib: Garlic, 2@3c; Green Peppers, 25@3sc for Chili and 25@3c per box for Bell; Carrots, 30@ 40c_per sack: Bay Cucumbers. 25@3ic; Pickles, §175 per ctl for No.'1 and 75¢ for No. 2; Sum- mer Squash, 25@3ic; Marrowfat Squash, $S@10 per ton, Green Corn, 20@i0c per sack; 50c@$l per crate for Alameda and 40@8c for Berkeley. Poultry and Game. Turkeys are weak and Hens are firm. Other- wise quotations stand about as before. There is less Pouitry on the market than at the be- ginning of the week. Receipts of Game continue slender, son for everything opens on the lst. POULTRY—Live Turkeys, 1518 for Gob- lers and I3@l6c for Hens: Young Turkeys, 18@ | 18¢; Geese, per pair. $1 5@2: Goslings, $1 T5@2: | Ducks, $4@5 for old and $5@6 50 for " young: Hens, $4 50@5 50; young Roosters, $#4 50@5; old Roosters, $4@5; " Frvers, $3 50@4; Broilers, §3.2:@3 50 for large, $2 75G3 for smail; Pigeons, §1 5@1 50 per dozen for old ard $173@2 for quabs. GAME—Doves, §1 25 per dozen: Grouse, Cyras. | fagepriens, = Mountain, Quail, ;" Hare T abbits, 50; Geese, B Jack Snipe, —— per dozen el Butter, Cheese and Eggs. Butter is still dull and the views of dealers differ widely as to the condition of the mar- ket. Those who are overstocked are weak, While those who are lightly supplied are firm. The sea- Quotations remain unchaneed. g5 are s r. Chy B{:TTER—- eese is unchanged. Creamery — Fancy Creamery, 2c, with specials at %c: seconds. 23G@24c. Dairy—Fancy, 2234@23c; good to choice, 214 22¢; store, nominal. Pickled roll, 21@21%c; Eacters 18 tor adle packed, ern, c for 3 ] CHEESE—Choice mild ‘new, ile; firkin, 20; creamery old, 10@ AUCTION SALES. EDWARD S. SPEAR & CO., Auctloneers....31-33 Sutter st.; Tel, Maln 5isL Biliiard and Pool Tables AT AUCTION, SATURDAY, SATURDAY.... ....SEPTEMBER 80, 13%) At 12 o'clock, in salesrooms. We will sell, by order of the manager of the California Hot2l (on account of changing their Billiard Hall into a Banquet Hall), THREE CAROM BILLIARD ’{ABLEE and TWO POOL TABLES, COMPLETE, with Balls, Cues, Racks, etc. Tables now on exhibition in .. our SalesroOlS ARD §. SPEAR & CO., Auctioneers, 31 and 33 Sutter st. 10%c; Young America, 11@11%c; Eastern. 14@ | 15¢. GGS—Quoted at 21@25¢c for store and 2@ "3»5 %Ex— e fanch; Eastern, 2%@2c for selected, 21@2% for No. 1 and 17@20¢ for sec- onds. Deciduous and Citrus Fruits. Wine Grapes continue to sell readily at the high prices. Table Grapes continue cheap and elow. Cranberries are in limited demand and lower. Other berries are dull. Peaches are higher and coarce, and the season- ie about over. Plums, oo Care in small supply. Good Apples and Penrs show no weakness, though they are not active. Melons are about the same. The market is bare of Limes, but fresh sup- plies are expected In a day or two. Lemons are quiet and unchflngeg. DECIDUOUS FRUITS— A Rpples. 35Gsc per box for common and Too 25 for good to choice. O TS Blackberrics, $4@5 per ches Steawberries, $7G8 per chest for small and 32G3 for large berries. Raspberries, "Swl per c{\pfl[ N chioberries, 5@ic_per Ib; Wisconsin Cra acies, §150 per bbl; Caps Cod Cranberries, $5@8 2. x 25@t5c per box for Sweetwater, 5@ 100 Tor Black, z?@wcd]znr Muscat, %040 for v 5 Seedless, or Corni- L P Tsabellas: crates sell 10@15c a_35@40c for ghon and A" Grapes, 21625 per ton for Zinfandel and $17@20 for White. A Tmelons, $5G15 per 100. it | Cantaloupes, 75c@$l 25 per crate; 2@30c per box. omegranates—0@lc per box. :’g::‘ Bartlett, ‘le 25@1 50 per box; 75¢ per box. e A 6e "ver box for double layers of black; white are unsalable. Poaches, 5@l per box. Plums and Prunes, $a75c 30@50c per box. Quinces, HGRCITS — Temons, $1G2 tor com- | i Nutmegs, Winter per box and crate. CITRUS 3@4 for good to choice: Mexican Ilrfl(%’x‘es?m——’; O iffornta Limes, $1G125; Ba- nanas, $150@2 50 per bunch; Pineapples, 3@ 260 per dozen. Dried Fruits, Nuts, Raisins. The situation is rapidly improving in the East, as will be seen in the first column. The New York Journal of Commerce says that it is reported that for some time past there has een an active export business in Prunes, but the facts have been kept below the surface. | The movement has been large, however, and estimates place it at 1000 cars, of which rs were sold last week. This business has n on a o basis. Pe e demand for all frults is steady on this market and full figures are generally obtained. ‘Large Prunes are meeting with more inquiry. | i | | | | DRIED FRUITS (New Crop)—Prunes,” in sacks, 5%c for 40 s, 4%c for 50-60s, 3?.0 for 0'%, 3@3%c for T0-80's, 3G3%e for 80-90's and 215@2%c for %-100's: Apricots, 10@lle for Roy- ais, 14@isc for Moorparks and 12@12iec for Blen- helms: Peaches, 4l@jc for Standards, 5%@6c for cholce and 6%@ic for fancy; peeled Peaches, 10@ile; Evaporated Apples, 8@6lc; Sun-dried, i@sc per 1b; Nectarines, Th@Sc_per 1b for ted and 8@c for white; Pears, 5@Tc for quar- rs and 7%@Sc for halves; Black Figs, 3c; White Figs, Plums, [%@6c for dark and | c_for bleached. 10;.7?151.\$Vhl(achnd Thompson's—Fancy, per Ib, 6c: choice, Sc; standard, Sc; prime, Gci uns | bleached Thompson’'s, per Ib, 6c. Sultanas— | Fancy, per Ib, €isc: cholce. Tie: standard, §%c; | prime, 6c; unbleached Suitanas, 5c¢; Seedless, 2-crown loose Muscatels, Siac 6c; London Layers, 2- s §18. Fancy Clusters, $2; Dehesa, $250; Imperial, $3. A prices are f. 0. b. at common shipping points in California. NUTS—Walnuts, new crop, 8%c for standards and $%c for softshell; Almonds, 10%@1l%c for paper-shell, 8@ic_for soft and 4@sc for hard- Shell; Peanuts, 5%@6%c_for Eastern; Brazil Nuts, 8%@Sc; Filberts, 11@11%c; Pecans, T4@S ocoanuts, $4 50@5. O ORET Comb, 113c for bright and 10%c for 1ight amber; water white extracted, T%@7ic light amber extracted, 6%2@7c; dark, 5% per P EESWAX—24@2%c per Ih. Provisions. Quotattons remain undisturbed. The demand 1s fair and largely on Government account. CURED MEATS—Bacon, $c per Ib for heavy, $36@10c for light medium, 11%c for light, 13c for extra light and 13%c for sugar-cured; Eastern sugar-cured Hams, 13%c; California Hams, 13c; Mess Beef, $11,per bbl; extra Mess, $12 50; Fam: ily, §14; extra Prime Pork, $12 50: extra clear, $16'50; mess, $15@15 50; Smoked Besf, 1c per Ib, LARD—Tierces quoted at 6@Gk%c per Ib for compound and T%c for pure: half barrels, pure, $c; 10-ib tins, $%c; 5-1b tins, Sc. ¢OTTOLENE—Tierces, 6%@7%c per lb Hides, Tallow, Wool and Hops. HIDES AND SKINS—Culls and brands sell abovt lc under quotations. Heavy salted steers, 11c; medium, 10%c; Ught, 10c; Cow- hides, 9%@i0c; Stags, 6c; Salted Kip, S¢; Calf, 10c; Dry Hides. sound, 17¢; culls and brands, 13¢; Dry Kip and Veal, l6c; dry Calf, 17c; Sheepskins, yearlings, ~ 20§30c each; ' short Wool, 35G60c each: medium, 70@%0c; long Wool, 0e@$1 10_each; Horse Hides, salt,’ §2g2 25 for large and $1 2331 50 for smali; Colts, Z@sde. TALLOW—No. 1 rendered, 4%@sc per ib; No. 2, _4@4%c; refincd, —; grease, 2G2%c. WOOL—Spring Clips—Valley Oregon, 17@1Sc; Eastern Oregon. 12@ldc for choice and $@11%0 tor fair to good. Fall Clip—San Joaquin Lambs, $@l0c; do plains, 7@Sc; San Joaquin and Southern Moun- tain, T%@9c: Northern free, 9@llc; do, de- fective, T:@l0c per Ib HOPS—Quoted at 10@12c per Ib. San Francisco Meat Market. Dealers quote the old prices, with fair supe plies of everything. Wholesale rates from slaughterers to dealers: 1b boxes, 5¢ 3-crown, 6c; i-crown, crown, $150 per box BEEF—7@7%c per 1b for Steers and §%@Ta for Cows. VEAL—7@10c per Ib. MUTTON—Wethers, ‘7c; Ewes, 6%c per Ib. LAMB—Spring, 8G@Sc per 1b. PORK—Live Hogs, 5%@3%c for small, 5%c for medium and 3izc for large; stock hogs and Feeders, 5%c; dressed Hogs, 7@Skc. General Merchandise. BAGS—Calcutta Grain Bags, T@T%e; Wool Bags, 26@28; Fruit Bags, 5%c, c and 6c for the three grades of white and 7@7%c for bleached jute. COAL—Wellington, $3 per ton; New Welling- ton, $8; Southfleld Wellington, $7 50; Seattle, §6; Tryant, $: Coos Bay, $: Wallsend, §7 50 Scotch, §8;" Cumberland. $9 50 in bulk and $10 75 in sacks;’ Pennsylvania Anthracite Egs. $12; Cannel, $8 per ton: Rock Springs and Castle Gate, 37 60; Coke, $12 per ton In bulk and §14 in sacks. SUGAR—The Western Sugar Refining Com- pany auotes, terms net cash; in 100-lb bagss Cubes, A Crushed and Fine Crushed, 5%c; Powe dered, 5%c: Candy Grandulated, 5ci Dry Gran- ulated, #%c; Confectioners’ A, 4%c; California A, Magnolia A, 44c; Extra C, 4%c; Golden C. 4%c; barrels, 1-16c more; half barrels, ¥c more; boxes, Yc more; 5i-lb_bags, ¢ more. No order taken for less than 75 barrels or its equivalent. Dominoes, half barrels, 5%c; boxes, 5%c per lb. LINSEED OIL—Is lower at 5lc per gallon for raw and 53c for bofled In barrels. Cases, 5o ore. TURPENTINE—Is higher at Tic per gallon in cases and 6Sc in drums or iron barrels. CANNED GOODS—The Earl of Dunmore | takes for London 250 cases Asparagus, 77,981 cases fruft and 22,652 cases salmon. LIQUORS—Shipment of 40,010 gallons Wine and §739 gallons Brandy to London. PIG LEAD—Is higher at $4 75@5 T5. SALT—The cheaper grades of Liverpool are higher at $15 per ton; best grades, $22 8. Receipts of Produce. FOR THURSDAY. SEPTEMBER 28. Clour, qr sks. 0,512 Sugar, sks.. fheat, ctis.. 3480 Sugar, bbls, Barley, ctls 3330 Chicory, bbls. Corn, East, ctls.. 1,200/ Wine, “gals, Cheese, ctis.... 307! Leather, Butter, ctls....... 132 Ralsins, bxs... Tallow, ctl; 260 Eggs, doz. Beans, 'sk: 260) Wool, bags. Potatoes, sks..... 3,161 Pelts, bdls..... Onlons, sks. 634 Hides, No. | Miaditngs, sks... 3% Hops, bales Bran, sks......... 1483 Straw, tons. Mustard, sks 302 Hay, tons Shorts, sks. 2 OREGON. Flour, qr sks..... 1816 Oats, ctls.. 2520 —_—— L — THE STOCK MARKET. - e Securities were only fairly active on both calls, and beyond a slight improvement in Giant Powder prices showed no changes wor(hy of_note. Mining stocks were about as usual, with Continued on Page 11. ’