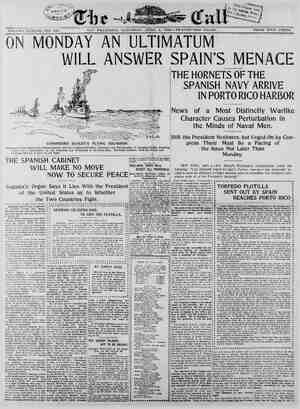

The San Francisco Call. Newspaper, April 2, 1898, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

CHARTER FOR THE CITY AND COUNTY OF SAN FRANCISCO. kinds of material or supplies than has been actually received, shall be deemed guilty of misfeasance and shall be re- moved from offic All' contracts.provided for in Chapter must. be in writing and execute® in the name of the City and County by the Mayor. All such cgn- tracts must be countersigned by the Clerk of the Supervisors, and register- ed by nymber and date in_a book kept by him fOr that pury >. When a con- tractor falls to enter into the contract to hint or to'perform the same, | must be invited, and a con- | as provided herein In | When the Supervis- | es bid are too | ave combined to iltat the public hter ibserved thereby, they may refct any.and-all bids and cause notice for-propos to be readver- | | lighting | reets, public buildings,:places or of- | s, shall be made for a longer period | r, nor shall’any contract 6.- No_ contraet ‘ifor as; glectrie light or any il- lumin material at a higher rate than the mininmum price charged to any other consumer, be - valld. Demands for Iighting public buildings shall be | ted monthly to the board or de- partment using. or -having charge | f, and shall specify the amount electric . light or illuminating | I consumed in’ such building | the month. B ; ARTICLE IIL | FINANCE AND TAXATION. | CHAPTER I Levying of Taxes. SECTION 1. On or before the first onday of April in each year the heads 5, office boards and comimi the City and County it send to the Supervisors an e: in writing of the amount s specifying in detail the ob , required in their re departments, -offic board commissions, including a. statem the salaries of their subordinates. Du- plicates - of _these estimates shall be Be at the same time to the Auditor. 2. On or b.fore the first Monday v in each year the Auditor shall mit to the Supervisors an estimate of the probable .expenditures of the v and County government for the | xt ensuing fiscal year, stating the gunt required to meet the interest and sinking funds for all outstanding funded debts, and the wants of all the department municipal govern- 1t in detail howing specifically wry- to be apportion- i in the treasury; also f the amount of income and other sources ive of taxes upon probable amount re- be levied and raised by taxa- M Sec. 3. The Supervisc shall meet annually betw the first Monday of N Airst Monday of June, and j of all the mem- budget of the be required to conducting the : Cit~ and County fiscal year. The d in such de- to the- s ite: sum and the | reof allowed to each depart- board or commission, as shall deem.advisable. mining upon the s shall fix such may be ime or times 4 v to allow the taxpayers to be rd in regard: thereto, and the Super- s shall attend at the time or times appointed for such hearine | s Any item.in sald budget may, | within ten days. be.vetoed in whole or | in part by the M or, and it shall re- . fifteen votes of the Supervisors | ome such veto. Action thereon . taken before the last Monday r the final estimate is made in 1 h, it shall be signed and the vlerk of the Su- several sums shall ated for the ensuing r to the several purposes and ments thereon namec: The esti- | 11 be filed in the office of the Ja appropr part sh The. Supervigors ‘'must (‘ansp{ ed annually according to law, cted by tax, the amounts so | the' amounts re- | from fines, licenses and other s of revenue: | 6. Fxcept as otherwise pro- 1:in this Charter, no money shall | be dra from the’ treasury unless in | consequenice of - appropriations made | hy-the Supervisors and upon warrants v drawn thereon by the Auditor. . 7. No warrant shall he drawn bt upon an. unexhausted specific aprropriation. Sec. 8. The Super—isors mav appro- priate thirty-six thousand- dollars a | ar for urgent necessities not other- | se provided for b= law. No money 11 be paid out of this appropriation | s authorized by a five-sixths vote | 1 the membe:s of the Board of isors and approved by the appropr ceived SO Superv Tt shall not be lawful for the isors, or for anv board, depart- ent, officer or ‘authority having power |- to tncur. authcrize or contract liabili- tiez against the treasury, to incur, au- thorize, allow, contract for, pay or ren- der pavable in the present or future, in ny one month. any expenditure, de- 1and or demands, against any appro- which, taken with all other expenditures, indebtedness or liability de or incurred up to the time in such month of making or incurring the same, shall exceed one-twelfth part of the amount of the appropriation for the fiscal year. When any board, department or offi- | cer having nower to incur liabilities | against the treasury shall make any | agreement for obtaining supplies or | having labor performed, such- depart- ment, officer or hoard shall.register | such agreement by number and daté, | and all demands arising under such agreement shall be payable in“the or- der of such registration. Such depart- ment, board or officer must inform the person with whom it is proposed te make such a~reement of the amount of money avallable or likely t~ »~ avail- | able in the fund froin which such de- | mands are pavable. - If, at the beginning of any rhonth, | a money remains unexpended in any. appropriation which might lawfully have been expended during the pre- ceding month, - such unexpended sum | or sums. ‘except o much thereof asmay be required to pay all unpaid eclaims upon such appropriation, may be car- ried forward aud expended in any suc- ceeding month of such fiscal year: but not afterward, except in payment of claims lawfully incurred during such al year. Appropriations nrovided meet the expense of elections; for upport and maintenance of the essor’s and Tax Collector’s depart- ment: and for urgent necessities. <hall be exempt from the provisions of. th ection. 10., No contracts made, the ex- pense of whose execution is not pro- vided by law or ordinance to be paid by sments upon the property ben- hall be binding or of any force, 5 the Auditor shall indorse there- certificate that there remains pended and unapplied as herein vided, a balance of the appropria- tlon or fund applicable thereto, suffi- clent to pa. the estimated expense of executing such contract. as certified by the board or officer making the same. This provision shall not apply to work done, or supplies furnished. involvine the expenditure of lege t% hrao dred and fifty dollars, unless the same is required by law to be done by con- tract at public letting. The Aud- ftor shall make such indorse- ment unon every such contract so presented to him, if there remains un- applied and unexpended such amount | so specified by the officer making the contract, and thereafter shall hold and retain such sum to pay the expense in- curred until the contract shall be fully performed. The Auditor shall furnish weekly to the head of each department a statement of the unexpended bal- | ances of the appropriation for his de- partment. Sec. 11. On or before the last Mon- day of June in each year the Super- visors shall levy the amount of taxes for City and County purposes required to be levied upon all property not ex- empt from taxation. The amount shall be sufficient to provide for the payment during the fiscal year of all demands | upon the treasury authorized to be paid out of the same; but such levy, exclu- sive of the State tax and the tax to pay the interest and maintain the sinking funds of the bonded indebtedness of the City and County, and exclusive of the tax to pay for the maintenance and | improvement of the parks, squares and public grounds of the City and County, shall not exceed the rate of one dollar on each one hundred dollars’ valuation of the property assessed. The Super- visors in making the levy shall appor- tion the taxes to the several funds. Sec. 12. In making the apportion- ment, the Supervisors shall take into account and, apportion to the several funds the income and revenue esti- mated to arise during the fiscal year from licenses, fees and other sources; but the inc the interest on the bonded indebtedness and provide for the sinking funds shall always be provided for out of the tax on property. Sec. 13. The limitation in section eleven of this Chapter upon the rate of tion shall not apply in case of any gre ty or emergency. In such case the limitation may be temporarily suspended so as to enable the Super- yrs to provide for such necessity or gency. No increase shall be made the rate of taxation authorized to be ed in any fiscal year, unless such in- crease be authorized by ordinance sed by the unanimous vote of the Supervisors and approved by the Mayor. The character of such neces- sity or emergency shall be recited in the ordinance authorizing such action, and be entered in the Journal of the oard. othing in this sectlon shall author- ize the incurring of liabilitles against the treasury not allowed by law, or which cannot be paid out of the income and revenue provided,collected and paid into the proper fund as its proportion of the same for such fiscal year, or per- mit liabilitles or indebtedness incurred in any one fiscal year to be a charge upon or paid out of the income or reve- nue of any other fiscal year. Sec. 14. The Supervisors shall fix the amount of municipal revenues and pro- e for the collection thereof. They rall from time to time provide for the payment of the interest and principal of the bonds for which the City and County is liable. Sec. 15. The Supervisors shall au- thorize the disbursement of all public moneys, except as otherwise specifically provided in this Charter. Sec. 16. At the close of each fiscal year, if all demands against each fund have been paid or satisfied, and all dis- puted or contested demands finally ad- judicated, the Supervisors shall direct the Treasurer to transfer all surplus moneys to a fund to be called the Surplus Fund, except such surplus moneys as are in the several interest and sinking funds, in the Common School Fund, in the Park Fund, the Li- brary Fund,thePolice Relief and Pen- sion Fund, in the Firemen's Relief and Pension Fund, and in such other funds the disposition of whose surplusmoneys is in this Charter otherwise provided | for. sy CHAPTER IL The Several Funds. SECTION 1. The income and revenue paid into the treasury shall be at once | separate | apportioned to and kept in funds. It shall not be lawful to trans- fer money from one fund to another or to use the same in payment of de- mands upon another fund. The provi sions of this section shall not apply to fees.paid into the treasury and placed temporarily to the credit of the Unap- portioned Fee Fund under the provi- sions. of Chapter III of this Article. Sec. 2. The several funds in the treasury authorized by law at the time this Charter takes effect, or provided for by this Charter, shall continue thereir so long as there shall be occa- sion therefor; and the moneys therein, or which may belong thereio, shall not be used for any purpose other thanthat for which the same were raised except as otherwise provided in this Charter. The General Fund shall consist of moneys received into the treasury and not specially appropriated to any other fund. The Park Fund shall consist of the moneys annually apportioned to said Fund by virtue of the tax provided for in this Charter for the maintenance, preservation and improvement of the parks, squares, avenues and public grounds of the City and County; of all moneys accruing from rents of build- ings under the jurisdiction of the Park .Commissioners; and of all moneyscom- ing into the hands af said Commission- ers whether from donations or other- wise. Out of said Fund shall be pald all the expenses of every kind for the preservation, maintenance and im- provement of the parks, squares, ave- nues and public greunds of the City and County. - The Library Fund shall consist of the moneys annually apportioned to said Fund by virtue of the tax provided for in this Charter for the maintenance of Library and Reading Rooms, and the purchase of books therefor. Out of said Fund shall be paid all the expenses necessary. to the maintenance of such Library and Reading Rooms and the purchase of books therefor. Sec. 3. The Surplus Fund shall con- sist of the moneys remaining at the end of any fiscal year in any other funds (except the Common School Fund and the other funds by this Charter other- wise expressly provided f&) after all valid demands, indebtedness and lla- biliti against . said funds incurred within such fiscal year have been paid and discharged; provided, that all dis- puted or contested claims payable out of such funds have been finally adjudi- cated. The Surplus Fund shall be used for ;ht' purposes .nd in the order follow- ng: 1. In payment of any final judgment against the City and County. 2. In ligiidation and extinguish- ment, under such regulations as the Supervisors may adopt, of any out- standing funded debt of the City and County. : 3. To be carried over and appor- tioned among the funds and used in the ensuing fiscal year as part of the income and revenue thereof. Sec. 4. The Special Deposit Fund shall consist of: 1. All moneys paid into court and deposited with the Treasurer by the County Clerk. 2. All moneys received by the Pub- lic Administrator and deposited by him with the Treasurer. 3. All mon -'s deposited with Treasurer on special deposit. * The moneys in the Special Deposit Fund shall be paid out in the manner prescribed by law. Sec. 5. Except as otherwise provided in this Charte” any moneys remaining at the end of any fiscal year in any in- terest and sinking fund or a fund pro- vided by a special bond issue for a specific pyrpose, the Common School Fund, the Park Fund, the Library Fund, the Fir.men’s Relief and Pen- sion Fund, Police Relief and Pension Fund, and the Public Building Fund shall be carried forward and appor- tioned to said respective funds for the ensuing fiscal year. Sec. 6. Any demand against the treasury or against any fund thereof remaining unpaid at the end of the fiscal year for lack of money applicable to its payment, may. be paid out of any the | money which may subsequently come into the proper fund from delinquent taxes or other uncollected income or revenue for such year. Such demands shall be paid out of such de:...quent revenue, when collected, in the order of thelr registration. Sec. 7. When there shall be to the credit of any sinking fund in the treas- ury a sum not less than twenty thou- sand dollars which may be applied to the redemption of any outstanding bonds to which such fund is applicable, which are not reueemable before their maturity, it shall be the duty of the Mayor, Auditor and Treasurer to ad- vertise for thirty days, inviting pro- posals for the surrender and redemp- tion of the bonds. . After such advertisement the money in such Sinking Fund, or such portion thereof as may be required therefor, shall be awarded to the person or per- sons offering to surrender said bonds for the lowest price. Upon such award, when duly audited, the Treasurer shall, upon the surrender of the bonds, pay the amount to the person or persons to whom the same was awarded. No bid for the surrender of any of the bonds shall be accepted, which shall require a greater sum of money for their redemp- tion than the then worth of the princi- pal and interest of the bonds, calculat- ed with interest, not exceeding four per centum per annum. CHAPTER III The Custody of Public Moneys. SECTION 1. All moneys arising from taxes, licenses, fees, fines, penalties and forfeitures, and all moneys which may be collected or received by any officer of the City and County or any department thereof, in his official capacity, for the performance of any official duty, and all moneys accruing to the City and County from any source, and all moneys directed by law or this’Char- ter to be pald or deposited in the treasury, shall be paid into the treas- ury. All officers or persons collecting or receiving such moneys must pay the same into the treasury. No officer or person other than the Treasurer shall pay out or disburse such moneys, or any part thereof, upon any allowance, claim or demand. Sec. 2. Salaried officers shall nou re- ceive nor accept any fee, payment, or compensation directly or indirectly, for any services .performed by them in their official capacity, nor any fee, pay- ment, or compensation, for any official service performed by any of their dep- uties, clerks, or employees, whether performed during or after official busi- ness hours. No deputy, clerk, or em- ployee of such officers shall receive or accept any fee, compensation or pay- ment, other than his salary as now or hereafter fixed by law, for any work or service performed by him of any offi- cial nature, or under color of office, whether performed during or after offi- cial business hours. Sec. 3. Every fee, commission, per- centage, allowance, or other compensa- tion authorized by law to be charged, received, or collected by any officer for any official service, must be paid by the officer receiving the same to the Treas- urer in the manner herein provided. Sec. 4. It shall be the duty of every | officer authorized by law to charge, re- ceive or collect any fee, commission, percentage, allowance, or compensation for the performance of any official serv- ice or duty of any kind or nature, or rendered in any official capacity, or by reason of any official duty or employ- ment, to deliver the same to the Treas- urer at the expiration of each business day. The Treasurer shall thereupon deliver to such officer a receipt for the money so paid, which shall show the amount of money received, the day and hour when paid, the name of the officer paying the same, the nature of the service performed, and the name and official designation of the person by whom the service was performed; and like entries shall be made upon the stub of such receipt, which shall be kept by the Treasurer. The Treasurer shall place all such moneys in a fund to be designated the *“Unapportioned Fee Fund,” which is hereby created, and shall keep such fund as other funds in the treasury are kept, and shall be lia- ble-on his official bond for all money so received. Sec. 5. The Auditor or other proper officer must prepare and deliver from time to time to the Treasurer, and to every officer authorized by law to charge any fee, commission, percent- age, allowance, or compensation, for the performance of any official service or duty, as many official regeipts as may be required, charging therewith the Treasurer or other officer receiving them. Such officlal receipts must be bound into books containing not less than one hundred such receipts, and numbered consecutively, beginning with number one in each class required for each officer for each fiscal year, and provided with a stub corresponding in number with receipt. When the books containing receipts are exhausted by the officer receiving them, he shall re- turn the stubs thereof to the Auditor or other proper officer, in whose custody they shall remain thereafter. Sec. ‘When a receipt as herein provided is issued by the Treasurer he must state therein the date of pay- ment, the name of the person making the payment, the amount of such pay- ment, the nature of the service for which the charge is made, and the name and official designation of the of- ficer performing the service, and shall make corresponding entries on the stub of each receipt. Sec. 7. When any receipt is issued by any officer other than the Treasurer as herein provided, he shall state therein the day and hour of the delivery to him of the Treasurer’s receipt, the nature of the service therein described, and the amount charged therefor, and the name of the person by whom such receipt is delivered to him, and shall make corre- sponding entries on the stub to which such receipt is attached. Sec. & On the first day of each month the Treasurer must make to the Auditor a report under oath of all mon- eys received by him during the preced- ing month, showing the date and num- ber of the receipt on which the money was received, the amount of each pay- ment, by whom paid, the nature of the service, and the name and official des- ignation of the officer performing the service. At the same time, or oftener, if required by the Auditor, the Treas. urer shall exhibit.to the Auditor all of- ficlal receipts received by him during the previous month, and all official re- ceipts remaining in his hands, unused or not issued, at the close of business on the last day of the preceding month. Sec. 9. On the first day of each month every officer authorized by law to charge any fee, commissicn, per- centage, allowance or compensation, must make to the Auditor a report under oath of all official receipts issued by him during the J)recedlng month, showing the date and number of each receipt, to whom issued, the nature of the service for which the charge was made, and the amount of such charge; and must at the same time, or oftener, if required, exhibit to the Auditor, or other proper officer, all the Treasurer’s receipts deposited with him during the preceding month, and all receipts re- maining in his hands, unused or not issued, at the close of business on the last day of each preceding month. Sec. 10. Upon receiving the reports prescribed by sections eight and nine of this Chapter, the Auditor shall exam- ine and settle the accounts of each offi- cer, and apportion such moneys to the fund or funds to which they are appro- priated by law, and certify such appor- tionment to the Treasurer, who shall thereupon transfer from the “Unappor- tioned Fee Fund” the amounts so certi- fied, and credit each fund entitled thereto with the proper amount so ap- portioned. ¢ Sec. 11. Every officer who is by law allowed to charge and collect mileage for the service of process, or other like service, shall at the end of each month, prepare and deliver to the Auditor a statement showing each process served, the title of the cause, the name of the deputy or other subordinate officer who made the service, the number of miles actually traveled in making such ser- vice, the exact day when such service was made, and between what hours of the day, and such statement shall be verified by the oath of such officer. The Auditor shall examine such statement, and issue his warrant upon the Treas- urer for such amount of money as will reimburse such officer for his lawful expenses in making such service. Such warrant shall be paid by the Treasurer, without further approval, oukor the “Unapportioned Fee Fund.” 0 extra | mileage shall be charged or allowed for | service of two or more processes served | on the same trip by the same deputy | or deputies, except for extra mileage actually traveled in serving additional process. All mileage charged in viola- tion of this section shall be disallowed by the Auditor, and all amounts disal- lowed for any reason shall be appor- tioned as other moneys in the “Unap- portioned Fee Fund.” Sec. 12. When an officer, legally au- therized to employ & person other than one of his deputies or assistants at a stated compensation fixed by law, has employed such person, and in pursu- ance of such employment such person has rendered the service for which he was employed, such officer shall, at the end of each month, prepare and deliver to the Auditor a statement verified by the oath of such officer, showing the case or instance in which such service was performed, for whom performed, the name of the person so employed, by whom the service was performed, the amount of the charge therefor, the time actually employed in performing such service, and the dates of the be- ginning and ending of the period during which such person was so employed. The Auditor shall thereupon examine | such statement, and if he finds the same correct, he shall audit and allow the verified demand of such person so | employed and performing the service | for the sum or sums so earned by him | for such service, and the Treasurer shall pay such demand so audited and | allowed, without further approval, out of the “Unapportioned Fee Fund.” Sec. 13. The demand of the Auditor for his monthly salary shall be audited and allowed by the Mayor. All other | demands on account of salaries fixed by law, ordinance, or this Charter, and made payable out of the treasury, may be allowed by the Auditor without any previous approval. All demands pav- | able out of the Comraon School Fund | must, before they can be allowed or | paid, be previously approved by the | Board of Education. Demands pay- able out of the treasury for salaries, wages, or compensation of deputies, clerks, assistants, or employees, in any office or department, must, before they can be audited or paid, be first ap- proved in writing by the officer, board, | department or authority under whom, or in which, such demand originated. | All other demands payable out of any | funds in the treasury, must, before they | can be allowed by the Auditor, or rec- | ognized, or paid, be first approved by | the department, board or officer, in | which the same has originated, and in all such cases must be approved by the | Supervisors. | Every demand against the City and | County shall, in addition to the other entries and indorsements unon the | same required by this Charter, show: 1. The ordinance or authorization un- der which the same was allowed. 2. | The name of the board, department or | authority authorizing the same. 3. | The fiscal year within which the in- | debtedness was incurred. 4. The ap-| propriation provided to meet the de- | mand. 5. The name of the Specific | fund out of which the demand is pay- | able. Each demand shall have written | or printed upon it a statement that the | same can only be paid out of the in- come and revenue provided, collect- ed and paid into the proper spe- | cific fund in the treasury for thei fiscal year within which the indebted- | ness was incurred, and shall refer to | Chapter IT of this Article, and be num- | bered with reference to the fund out | of which it is payable. Sec. 14. Whenever any person has, or | has received, moneys or other personal | property belonging to the City and| County, or has been intrusted with the | collection, management or disburse- ment of any moneys, bonds, or interest | accruing therefrom, belonging to or held in trust by the City and County, | and fails to render ah account thereof to, and make settlement with, the Treasurer within the time prescribed or, when no particular time is specified, fails to render such account and make such settlement, or who fails to pay into the treasury any moneys belonging to the City and County upon being requested to do so by the Audi- tor, within twenty days :fter such requisition, the Auditor must state an account with such person, charging twenty-five per centum damages, and interest at the rate of ten per centum per annum from the time of such fail- ure. A copy of such account in any suilt therein is prima facie evidence of the things therein stated. In case the Au- ditor cannot for want of information state an account, he may in any action brought by him aver that fact, and -al- lege generally the amount of money or other property which is due to or which belongs to the City and County. The City Attorney must prosecute all ac- tions that may be brought under this section within ten days after notifica- tion by the Auditor. CHAPTEK IV. Payment.ot Claims. SECTION 1. The salaries and com- pensation of all officers, including po- licemen and employes of allclasses,and all teachers in the public schools, and others employed at fixed wages, shall be payable monthly. Any demand upon the treasury accruing under this Charter shall not be paid, but shall be forever barred by limitation of time, unless the same be presented for pay- ment, properly audited, within one month after such demand became due and payable; or, if it be a demand which must be passed and approved by the Supervisors or Board of Education, or by any other Board, then within one month after the first regular meeting of the proper board held next after the demand accrued; or, unless the Super- visors shall, within six months after the demand accrued as aforesaid, on a careful examination of the facts, re- solve that the same is in all respects just and legal, and the presentation of it, as above required, was not in the power either of the original party interested or his agent, or the present holder; in which case they may by or- dinance revive such claim; but it shall be barred in the same manner unless presented for payment within twenty days thereafter. No valid demand aris- ing subsequent to the claim which may be revived as aforesaid shall be ren- dered invalid by reason of such revival exhausting the fund out of which sub- sequent claims might otherwise be paild. Such revived claim shall take rank as of the day of its revival. ARTICLE IV. EXECUTIVE DEPARTMENT. CHAPTER I The—ijyor. SECTICN 1. The chief executive offi- cer of the City and County shallbedes- ignated the Mayor. He shall be an elector of the City and County at the time of his election, and must have been such for at least five years next preceding such time. He shall be elected by the people and hold office for two years. He shall receive an annual salary of six thousand doliais. He may appoint a Secretary who shall receive an annual salary of stwenty- four hundred dollars; an usher who shall receive an annual salary of nine hundred dollars; and a stenographer and typewriter who shall receive an annual salary of nine hundred dollars. L | ally suppressed. | ploy or service of the City and County, | the City and County, or with any offi- | form his dutles, a member of the Board All of said appointees shall hold their positions at the pleasure of the Mayor. Sec. 2. The Mayor shall vigilantly observe the official conduct of all public officers and the manner in which they execute their duties and fulfill their obligations. The books, records and official papers of all depart- ments, officers and persons in the em- ploy of the City and County shall at all times be open to his inspection and ex- amination. He shall take special care that the books and records of all de- partments, boards, officers and persons are kept in legal and proper form. When any official defalcation or will- ful neglect of duty or officlal miscon- duct shall come to his knowledge, he | shall suspend the delinquent officer or | person from office pending an official in- | vestigation. The Mayor shall from time to time recommend to the proper officers of | the different departments %uch meas- | ures as he may deem beneficial to pub- | lic interest. He shall see that the laws of the State and ordinances of the City and County are observed and enforced. He shall have a general supervision over all the departments and public institutions of the City and County, and see that they are honestly, eco- nomically and lawfully conducted, and shall have the right to attend the meet- ings of any of the Boards provided for in this Charter, and offer suggestions at such meetings. He shall take all proper measures for the preservation of public order and the suppression of all riots and tumults, for which pur- pose he may use and,command the.po- lice force. If such police force is in- sufficient, he shall call upon the Gov- ernor for military aid in the manner provided by law, so tkat such riots or tumults may be promptly and effectu- Sec. 3. The Mayor shall see thaf all contracts and agreements with the City and County are faithfully keps and fully performed. It shall be the duty of every officer and person in the em- when it shall come to his knowledge that any contract or agreement with cer or department thereof, or relating to the business of any office, has been or is about to be violated by the other contracting party, forthwith to report to the Mayor all facts and information within his possession concerning such matter. A willful failure to do so shall be cause for the removal of such officer or employee. The Mayor shall give a certificate on demand to any person reporting such faets and information | that he has done so, and such certifi- | cate shall be evidence in exoneration from a charge of neglect of duty. The Mayor must institute such ac- tions or proceedings as may be neces- sary to revoke, cancel or annul allfran- chises that may have been granted by the Cityand County to any person,com- | pany or corporation which have been | forfeited in whole or in part or which for any reason are illegal and void and | not binding upon the city. The City Attorney on demand of the. Mayor must institute and prosecute the neces- sary actions to enforce the provisions of this section. The Mayor shall have power to post- pone final action on any franchise that may be passed by the Supervisors until | such proposed franchise shall be rati- fied or rejected by a majority of the votes cast on the question at the next election. Sec. 4. The Mayor shall appoint all officers of the City and County whose election or appointment is not other- wise specially provided for in this Charter or by law. When a vacancy occurs in any office, and provision is not otherwise made in this Charter or by law for filling the samey the Mayor shall appoint a suitable person to fill such vacancy, who shall hold office for the remainder of the unexpired term. Sec. 5. The Mayor shall be President of the Board of Supervisors by virtue of his office. He may call extra ses- sions of the Board and shall commu- nicate ‘to them in writing the objects for which they have been convened; and their acts at 'such sessions shall be confined to such objects. Sec. 6. When and so long as the Mayor is temporarily unable to per- shall be chosen President pro tempore, who shall act as such Mayor. When a vacancy occurs in the office of Mayor, it shall be filled for the unexpired term by the Supervisors. CHAPTER 1I. The Auditor. SECTION 1. The head of the Finance Department of the City and County shall be designated the Auditor. He shall be an elector of the City and County at the time of his election and must have been such for at least five years next preceding such time. He shall be elected by the people and hold office for two years. He shall receive an annual salary of four thousand dol- lars. The Auditor must always know the exact condition of the treasury and every demand upon it. He shall be in personal attendance at his office daily during office hours. He shall be the general accountant of the City and County, and shall receive and preserve in his office all accounts, books, vouchers, documents and papers relat- ing to the accounts and contracts of the City and County, its debts, reve- nues and other financial affairs. He shall give information as to the exact condition of the treasury and of every appropriation and fund thereof, upon demand of the Mayor, the Supervisors, or any committee or members thereof. Sec. 2. The Auditor shall appoint a Deputy Auditor, who shall possess the qualifications required of thé ‘Auditor, and who shall receive an annual salary of twenty-four hundred dollars. The Auditor may also appoint two assist- ant deputies who shall each receive an annual salary of fifteen hundred dol- lars, and two clerks who shall each re- ceive an annual salary of twelve hun- dred dollars. He may employ such number of extra clerks during the time their services may be necessary for the lawTul discharge.of his official duties, as the Board of Supervisors may des- ignate. Such extra clerks shall receive a salary not to exceed one hundred dol- lars a month for the time they shall be actually employed. *The Auditor shall be allowed to expend not exceeding eighteen hundred dollars a year for counsel and attorney’s fees. Sec. 3. The Auditor shall keep an ac- count of all moneys paid into and out of the treasury, and the Treasurer shall pay no money out of the treasury ex- cept upon’ demands approved by the’ Auditor. ‘Any ordinance or law provid- ing for the payment of any demand out of the treasury or any fund thereof (whether from public funds or from pri- vate funds deposited therein) shall al- ways be construed as requiring the au- diting of such demand by the Auditor before the same be paid. Sec. 4. He shall number and keep an official record of all demands audited by him, showing the number, date, amount, name of the original holder, on what account allowed, against what appropriation drawn, out of what fund payable, and, if previously approved or allowed, by what officer, department or board it has been so approved or al- lowed. It shall be misconduct in office for ‘the Auditor to #eliver a demand with his officlal approval until this re- quirement shall have been complied with. Sec. 5. The Auditor shall approve no demand unless the same has been al- lowed by every officer, board, depart- ment and committee required to act thereon. ° - Sec. 6. No demand shall be allowed by the Auditor in favor of any corpora- tion or person in any manner indebted to the City and County, except for taxes not delinquent, without first de- ducting the amount of any indebted- ness of which-he has notice; nor in fa- vor of any person having the collection, custody or disbursement of public funds, unless his account has been pre- sented, passed, approved and allowed as herein required; nor in favor of any officer who has neglected to make his officlal returns or reports in the man- ner and at the time required by law, ordinance, or the regulations of the Su- pervisors; nor in favor of any officer who has neglected or refused to comply with any of the provisions of law regulating his duties, nor in favor of any officer or employee for the time he shall have absented himself without legal cause from the duties of his officé during office hours. The Auditor must. always examine on oath any person re- | ceiving a salary from the City and County touching such absence. . The Auditor may require any person presenting for settlement an account or claim for any cause against.the City and County to be sworn before him touching such account or claim, and mand presented, also when presented, the date, amount, name of origina? holder, and on what account allowed and against what appropriation drawn and out of what specific fund payable. All demands shall be paid in the order of their registration. Each demana upon'.being so registered shall be re- turned to the party presenting it, with the endorsement of the word “Register- ed,” and dated and signed by the Treasurer; but the registration of any demand shall not operate to recognize or make valid such demand if incurred contrary to any of. the provisions of this Charter. J 'CHAPTER 1IV. The Assessor. * when so.sworn, to answer orally as to any facts relative to the justice.of such account or claim. Moneys placed in. the Special Deposit Fund shall not he subject to the provisions of this “sec- | tion. Sec. ' 7. Every demand ' upon the Treasurer, except the salary of the Au- ditor, must, before it can be paid, be presented to the Auditor, who shall sat- isfy himself. whether the money is le- gally due, and its payment authorized by law, and against what appropriation payable and out of what fund it is pay- able. If he allow it, he shall endorse upon it the word “Allowed,” with the name of the fund out of which it is payable, and the date .of such allow- ance, and sign his name thereto. No demand shall be approved, allowed, au-; dited or paid unless it specify each spe- | cial item, date and amount composing it, and refer by chapter and section to | the provisions of this Charter authoriz- ing the same. Sec. 8. The Auditor shall keep a reg- ister of warrants, showing the funds upon which they are drawn, the num- ber, in whose favor, for what service; the appropriation applicable to the pay- ment thereof, when the liability ac- crued, and a receipt from the person to whom the warrant is delivered. He shall not allow any demand out of its order, nor give priority to one demand over another drawn.upon the same spe- cific fund, except for the purpose of de= termining its legality. X CHAPTER - III. The Treasurer. SECTION 1. There shall be a Treas- urer of the City and County, who shall be an elector of the City and :County at the time of his election and who must fave been such for at least five years next preceding such time. He shall be elected by the people; and hold his oflice for two yvears. He shall. receive an annual salary of four thousand dol- lars, which shall be in -full compensa- ticn' for all his services. He may ap- point a chief deputy -who shall receive an annual salary of twenty-four hun- dred dollars, two assistant deputies who shall each receive an annual- sal- ary of eighteen hundred dollars and one clerk who shall receivé an annual salary of twelve hundred dollars. Sec. 2. The Treasurer :shall receive and safely keep all moneys which:shall be paid into the treasury. - He shall not lend, exchange, use, nor deposit ‘the same, or any part thereof, to or with any bank, banker or person; mor pay out any part of such moneys, nor aliow the same to pass out_ of his personal custody, except upon demands author- ized by law or this Charter, and aftér they shall have been approved by the Auditor. At the close of business each day he shall take an account of and en- ter in the proper book the exact amount of money on hand. At the end.of every month he shall make and file with the Mayor and publish quarterly in the offi= cial newspaper a statement of the con- dition of the treasury, .showing the amount of receipts .into.and pay- ments from the treasury, and on what account, - and out. of what fund. If he violate any of the provisions of this section, he ‘shall be guilty of misconduct in office, and be liable to removal therefrom, and be pro- ceeded against accordingly.’ He shall keep the accounts belonging to each fund separate and distinct, and shall in no case pay demands. chargea- ble against one fund out of moneys be- longing to another. He shall be in per- sonal attendance at his office each day during officé ‘hours. No fees of any kind shall be retained by him, but the same, from whatsoever source received or derived, shall be paid by him into the treasury. Sec. 3. For the better security.of the moneys in the treasury, thére shall be provided a joint custody safe in -which shall be kept the moneys of the City and County. Said safe shall have two combination locks, neither -one of which alone will open the safe. The Treasurer shall have the knowledge of one combination and the Auditor of the other. The Auditor shall-be joint custodian with the Treasurer of all| funds in the joint custody safe; but shall have no control over them except to open and close the safe in conjunc- ' tion with the Treasurer, when request- ed to do so In his official capacity, and shall not be held responsible on his of- cial bond for any shortage which may occur in the treasury. The gold shall be kept in bags con- taining twenty thousand dollars each, and the silver in-bags containing one thousand dollars each. To each bag shall be attached a tag showing the nature an amount of. coin contained herein. Each bag shall be sealed with the seal of each custodian. There shall be kept in the safe a joint custody book, showing the amount and description of ‘all: funds in the safe, and whenever any amounts are with- drawn, the Auditor and Treasurer shal] make the proper entry in the joint cus= tody book and .initial thé same. If on account of sickness or urgent necessity the Auditor ‘~ unavoidably absent the Deputy Auditor shall perform his du- ties. The estimated amgunt of money required daily for ‘the payment of de- mands against the treasury shall be taken from the joint custody safe and kept in another safe; and the money therein shall be balanced daily at the close of business hours.. - Sec. 4. The Treasurer, on receiving any money into the treasury, shall makeé out and sign two receints for the money. Such receipts. shall be alike, except upon the face. of gne of them shall appear the word “Original,” and upon.the face of the other shall appear the word “Duplicate.”” Such receipts shall be numbered and dated, and shall specify -the amount, on what account and from whdt pefson or officer re- ived, and into what fund or on what %ount paid. The Treasurer shall en- tér upon the stubs of 'such receipts a. memoranidum of the conténts thereof, and deliver the receipt marked “Orig- inal”, to the person or officer paying such money into the . treasury, and forthwith deliver the .receipt marked “Duplicate” to the Auditor, who shall writé upon its face the date of its de- livery to him, and charge the Treas- .urer with the amount specified there- in,.and file the receipt in his office, Sec. 5. No demand shall be:paid by the Treasurer unless . it specify each several item,date and amount compos- ing it, and refer by title, date and section to the law, or ordinance or pro- vision of this Charter authorizing the same; but.the allowance or approval of the Auditor, or of the Supervisors, or of any department, board or officer, of any demand which is. not authorized by law or this Charter, and which upon | its face appears not to have been ex- préssly made payable out of the funds to be charged therewith, shall afford no warrant to the Treasurer for paying the same. 5 Sec. 8. Everv lawful demand upon the treasury, andited and allowed as in this Charter required, shall in all cases be paid ‘unon presentation, if there be sufficient money in the treasury ap- plicable to the payment of such de- mand, and on ~avment canceled with a punch, cutting the word “Canceled” therein, and the proper entry thereof made. If, however, there be not suffi- cient money so applicable, then it shall be registered in a book kept for that purpose by the Treasurer. Such regis- ter shall show the special number given by the Supervisors or other authority, and also by the Auditor to each de- SECTION 1. There shall be an As- sessor of the City and County, who shall be an elector of the 'City -and County at the time of his election and who must: have. been such for: at.least five years next preceding suchtime, He shall be. élected by the people and hold office for four years. -He shall receive |.an ‘annual salary of four thousand dol- lars, . which:shall bé in full eompensa- tion for all his services. He may. ap- point a chief deputy who- shall receive an annual salary of twenty-four humn- dred dollars; one cashier who shall re- celve an- annual salary of eighteen hundred dollars; six assistant députies Who_shall.each.receive an annual sal- ary .cf eighteen hundred dollars; twen- ty-one clerks who shall" etich receive an. annual. salary. of -‘twelve ~hundred dollars; -and ‘during four months of the year not.more than .one hundred clerks | Who shall’ each be paid at the: rate of not moreé than -one: hundred dollars a month during the time of their employ- | ment. B | Sec. 2. "The Assessor shall assess-all | taxable. propérty ivithin the City -and | County at'the'time and in the manner ]g‘res:.cribed by -the” general laws of the ate. CHAPTER V. The Tax Collector. SECTION 1. There shall be a Tax Collector ‘of ‘the City and County, who | shall be_ an elector of the City and | County -at.the time of his election and who must have been such for at least | five .years next preceding suchtime. He | shall-be elected by the people and hold | office ‘for two. years. He shall receive an annual salary of four thousand dol- lars, which shall be in full compensa- tion for all his services. He may appoint one chief deputy, who shall receive an annual salary of twenty-four hundred dollars;- one eashier who shall receive anammual salary of twenty-four hun- dred doHars; fifteen deputies who shall each receive an annual salary of fifteen hundred dollars, and extra clerks who shall each be .paid at the rate of not more than one hundred dollars a month during the time of their em- ployment,” but the total- amount of paymerit’ for such extra clerks shall not exceed thirty-six thousand dollars a“ year. : Sec. 2. The Tax Collector must col- iect-all licenses which may at any tima be required by law or ordinance to be collected within the City and County. He shall be charged with all taxes lev- ied upon real and personal property within the City and County, upon the final settlement to be mades by him ac- cording to law, or this Charter. Hs ‘shall pay into the treasury, without any deduction for commissions, fees or charges of any kind or on. any ac~ count, the full amount of all taxes, as | sessments.and moneysreceived by him, and not previously-paid over, includ- ing all moneys paid under protest, and money reéceived for taxes paid more than once, and for street assessments, He shall-also be charged with, and be debtor-to the City and County for, the | full amount of all taxes due upon the delinquent tax list delivered to him for collection, unless it appear to the satis-. faction of the Supervisors expressed by | resolution, that it was out of his power | to collect the same by levy and sale of property liable to be seized and sold therefor. Sec. 3. The Tax Collector may ap- |'point -an- attorney to prosecute actions for the. collection of delinquent taxes, | and may-agree on paying him as com- | pensation therefor a stated percentage rout of the amounts recovered: but such |-percentage shall in no case exceed fif- |-teen per’centum of the amounts ree tcovered. Sec. 4. He shall examine all persons | liable to pay licenses, and see that | licenses are taken out and paid for. In the performance of their official duties, he and his deputies shall have the |'same powers as police officers in serv- |ing process and in making arrests. He | may demand the exhibition of any | license for the current term from any person, firm or corporation engaged or employed in the transaction of any business for which a license is re- quired; and if such person, firm or corporation shall refuse or neglect to exhibit such license, the same may be | revoked forthwith by the Tax Collec- tor. Sec. 5. The Auditor shall from time to time deliver to the Tax Collector such City and County licenses as may be required, and sign the same and charge them to the Tax Collector, spec- ifying in the charge the amounts thereof named in such licenses respec- tively and the class of licenses, ana take receipts therefor, and the Tax Collector shall sign and collect the |same. The Tax Collector shall once In every month, and oftener when re~ quired by the Auditor, make to the Auditor a report under oath of all | licenses sold and on hand, and of alt amounts paid to the Treasurer, and shall also in that regard comply with the regulations which may be pre- scribed by the Supervisors. At the time of making such report, the Tax Collec- tor shall exhibit to the Auditor all licenses on hand and the Treasurer's receipts for all moneys paid into the treasury. CHAPTER VI L The Coroner. SECTION 1. There shall be a Coro- ner of the City and County,who shall be an elector of the City and County at the time of his ‘election, and who must have been such for at least five years next preceding such election. He shall be elected by the people and hold office for two years. He shall receive an an- nual salary of four thousand dollars. He shall perform such duties as may be prescribed by law or ordinance. He shall have the control and manage- ment of the Morgue of the City and County under such ordinances as the Supervisors may adopt. Sec. 2. He may appoint an autopsy physician who skall receive an annual salm‘x of twenty-four hundred dollars; a chi’f deputy, who shall receive an an- nudl salaryof twenty-four hundred dol- lars; three assistant deputies whoshall each receive an annual salary of fifteen hundred dollars; a stenographer and ‘typewriter who shall receive an annual salary of eighteen hundreddollars; and a messenger who shall receive an an- nual salary of nine hundred dollars. CHAPTER VIL The Recorder. SECTION.1. There shall be a Re- corder ‘of the City and County, who shall be an elector of the City and County at the time of his election- and who must have been such for at least five years next preceding such election. He shall be elected by the people and hoid office for two years. He shall receive an an- nual salary of thirty-six' hundred dol- lars. He may appoint a Chief Deputy, who shall receive an annual salary of eighteen hundred dollars; two assist- ant deputies who shall each receive an annual salary .of fifteen hundred dol- lars. He may also appoint as many copyists 'as he may deem necessary, who shall receive not more than eight cents for each one hundred words ac- tually written; but no copyist shall be paid a greater compensation at this rate than amounts in the to one hundred dollars a month. Sec. 2. The Recorder shall take into