The Nonpartisan Leader Newspaper, September 19, 1921, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

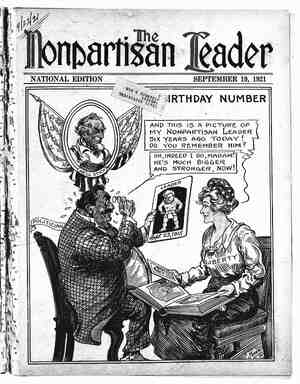

Money Kings Plan a New Exploitation Financial Ring Will Let Business Revive After Congress Passes Tariff, Tax and Railroad Bills—Fourth Article Exposing Reserve Banks ’ John Lord is the pen name of a student of financial, political and economic questions, who until recently was financial editor of a large eastern daily newspaper. BY JOHN LORD HE federal reserve banks possess th. | power of making considerable profits, but they are not likely to exercise that power except when circumstances of their own making force them to do so. The reason is that the reserve banks as such have nothing to gain by making much money. The reserve act limits the payment of dividends to stockholders to 6 per cent on the capital actually subscribed, which is about $100,000,000. The banks are also permitted to keep 10 per cent of their net annual ‘earnings and pass the amount to the sur- plus fund. The balance of the net earnings of the reserve banks must be paid to the government. The government may use this money to increase the gold reserve of the treasury, or the secretary of the treasury may use the money to retire government bonds or certificates of indebtedness. The reserve banks turned over to the government last year a little more than $60,000,000. The reserve banks pay no taxes—federal, state or local—except on such real estate as the banks hold, which means the buildings and lots where the banks do business. The reserve banks loan no money to individuals. The reserve banks do business only with member banks. Any member bank may borrow money at any time of the reserve bank in the district where the member bank is located. The security on which such money is loaned may be notes, trade accept- ances, mortgages or bonds. The reserve banks fix the discount or rate of interest on which such loans are made, and it is by means of fixing this rate high or low that credit is made easy or diffi- cult. By lowering the rate of interest, credit is ex- panded. By, raising the rate, credit is contracted. The reserve board, therefore, may create hard times whenever they so desire, and they may do the reverse simply by raising or lowering the in- terest rate. I do not mean to say that the re- serve board is powerful enough to con- trol all conditions, natiohal and inter- national. What I do mean to say is that the reserve board may and does control credit and the supply of money. Nearly half of the banking capital of the nation is now directly affiliated with the reserve banks. RESERVE BANK MONOPOLY GROWS In a few years more the reserve banks will include practically the whole of the American banking capital, because private banks can not compete with banks which are members of the reserve system. The private banks may get along all right when the reserve banks are putting out large issues of paper money, because this fresh money ultimately flows into all banks in the form of deposits. But during a 'period when the re- serve banks are contracting the currency they could soon run the private banks out of available new money capital. The “squeeze” which the reserve banks recently have been putting on the country, both as to credit and money sup- ply, has made the going very hard for private banks. 3 You hear much complaint from Washington while the tax discussion is on about investment by the rich in tax-exempt securities. Congress is going to reduce the income taxes on the rich on the theory that the rich will then invest their income in busi- ness instead of tax-exempt bonds. They tell us that investment in tax- exempt bonds has dried up capital and there is no new capital for invest- - Farmer—“Yes, by gosh! John Lord concludes his exposure of the reserve bank monopoly and ruinous deflation policy in this article, and on this and the opposite page he tells their plans for the future. The rest of his articles, to appear in coming issues of the Leader, will deal with trusts and monopolies and the cause of high prices. In the meantime he will be glad to answer questions of readers regard- ing the reserve bank system. Send your questions to John Lord, care of the Nonpartisan Leader, Box 2072, Minneapolis. Leader readers owe a debt to Mr. Lord for his plain, easily understood, but interesting and impor- tant explanation of the bank and money monopoly. To act intelligently farmers must understand this difficult subject. John Lord’s articles can be understood by any one who can read. Don’t miss his arti- cles in coming issues! ment. The absurdity of this claim will be apparent as soon as you stop to think that when people in- vest money in tax-exempt securities, such as state, county and city bonds, this money is used by states, counties and cities and“passes into circulation and ultimately into the banks. There is no less capital, because such money becomes banking capital through deposits. The real reason why capital is " scarce is that the federal reserve banks-have dried up over $800,000,000 of capital by destroying or re- NEXT WINTER l —Drawn expressly for the Leader by W. C. Morris. . Banker—“My good man, you’re not burning corn for fuel, are you?"”" ’ You fellows haven’t helped me to get lower freight rates so coal prices will come down, and every election you vote against our candidates so that market gamblers’ men win, down to nothing.” /7 . I/ T\ and they keep corn prices PAGE SIX - : s . tiring that much money in the form of reserve notes. But, to return to my contention that the reserve banks as such will not seek to earn large profits, there are two reasons why this is true: - RS 1. The reserve banks have to pay the bulk of their profit to the government and there is nothing to be gained by the banks in paying profits to the gov- ernment. 2. The earning power of the reserve banks is based on the interest rate. If the reserve banks raise the interest rate, the member banks then have to raise THEIR interest rate, and when the interest rate rises too high investment stops. Interest gefs so high that no one borrows, except necessity com- pels borrowing. When bank loans decline banks make less money. ¢ RESERVE SYSTEM WAS CREATED IN INTEREST OF THE BIG BANKS The reserve system was created for the ben- efit of bankers as a class, and for the benefit of the big clients of banks. The reserve sys- tem is bound to serve the interest of the bank- ers and the bankers’ big clients. I might illustrate what I mean by comparing the reserve bank system to the British empire. Every- body who knows the English at.all knows that the English gentleman will give up his last “tuppence” to preserve the British empire. ‘The British em- pire, as such, is simply an organized commercial machine run for the benefit of the British wealthy class. The sun never sets on the British flag, be- cause the British have gone to all points of the world compass in order that they may have the rice and hemp and the tea of India, the cotton of Egypt_, the diamonds and gold of South Africa, the ivory of Central Africa, the wool of Australia and the wheat of Canada. The little island of Britain can not feed or clothe its inhabitants from its own resources. England | draws its raw materials from its co- lonial possessions and manufactures the raw materials into goods in Eng- land. British ships carry the raw product to English shores and the manufactured product back again to its colonies. Prior to the war Britain was the world’s greatest exploiting nation. - Taken as a whole, it was the richest nation in the world. But its common people were not the richest in the world. .On the contrary, the workmen of England were the poorest paid, comparatively speaking, of all the civilized people of the globe. The profits of the British empire are en- joyed by a comparative few. These few are the landed and titled gentry, . who, with bankers, commercial bar- ons and shipowners, constitute what a British writer has called “The Brit- ish Empire Company, Limited.” The members of this company know how to play the game. They preserve the company at whatever cost.’ During the war and since the wealthy class of England subjected themseive, to taxation almost to the Iiiait of their income. They know that thzir ndividual power to make money deg mds on keeping the British flag flyin, and the British ships on the seas. The English will compromise relizion morals or local customs with their colonists to the limit, as did the Rormaens. provided that the British c.mmczeial flag is not hauled down. _ in like manner the federal reserve " system may be styled “The American Financial Corporation, Limited.” The federal reserve banking system was created for the ex- press purpose of making it easy for the member banks and the financial magnates who are clients of their banks to exploit the people of America in partic- et =