The Nonpartisan Leader Newspaper, June 27, 1921, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

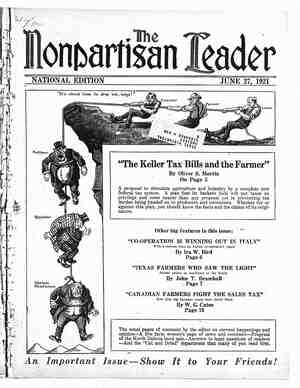

. Canadian Farmers Fight the Sales Tax il How the Revenue System Big Business Advocates in the United States % Works Out Where It Is Now in Force The author of this article is a resident of Ottawa, Cana~ da, in touch with the activities of Canadian farmer organ- izations and with economic conditions in the Dominion. BY W. G. CATES HE agrarian group in the Canadian parliament, which represents both the organized farmers and labor, and which has a very large following throughout the country, is opposed to the sales tax as it is now being levied Owing to the fact that the very heavy in Canada. war expenditure had rendered it necessary to im- pose heavy taxation, there was a strong disposition on the part of all classes to give this method of taxation a fair trial, for it was felt that all should bear a fair share of the burden. But in its latest application, the tax, instead of spreading taxation over all classes in proportion to their ability to pay, is now being made the means whereby the war taxes are being shifted from the backs of the well- to-do to the backs of the mass of the people. Being, for the most part, strong supporters of the principle of direct, as opposed to indirect, taxa- tion, there was also a disposition on the part of the leaders of the farmer group to give the sales tax a fair trial on the ground that the collections would go directly to the government; but last year’s tax of 1 per cent has this year been increased so that in the aggregate it undoubtedly amounts to more like a straight tax of 2 per cent. For in addition to a 50 per cent increase on general sales, there has been introduced a tax of 1 per cent additional on im- ports, so that the sales tax has really been used as a lever to raise the tariff. To some of the best inform- ed of the agricultural leaders the sales tax never did look good, for it was manifestly a consumption tax, and this tax always weighs most heavily upon the great mass of the people. They contended that it would place an additional obstacle in the way of trade at a time when every effort should be made to remove such obstacles. Besides, it looked too much like an attempt to place taxation on the [mq [Fn- wrong spot. The very quarter from which the sales tax pro- posals came made them sus- picious. PUTS BURDEN ON LEAST ABLE TO PAY These views have been more than confirmed by the experi- ence of thespast year. Today _the Canadian sales tax stands . " clearly revealed as an attempt to lift the burden from the backs of the wealthy and to place it on those who are not nearly as able to pay. Besides, not satisfied with a 1 per cent measure, which advocates of the tax generally have insisted would be more than sufficient to raise the large revenues re- quired, an almost double dose has now been administered. Canada’s experience with this tax has shown beyond all shadow of a doubt that even as a revenue producer it is a much overrated measure. Dur- ing the 11 months up to April 30 that it has been in opera- tion, it produced $40,000,000 in revenue, but during the last six months of this time the collections— fell from a little over $5,000,000 a month to less than $2,900,000. Indeed, at the time that the changes were made in the tax it was only bringing in about $2,500,000 a month. One can just imagine <how far that would go towards =7 (! “/”H “ ) FOR WHEAT \:\ - I'NE BEEN PAYINC AT THE RATE oF $2%° PER BUSHEL ——— /s = A well-known millers’ publication durin, The Leader has secured this report of how the sales tax is working out in Canada as a contribution to the contro- versy over the question in the United States. The big business interests want the excess profits taxes and cor- poration taxes abolished and the sales tax substituted. The sales tax is op- posed by farmer and labor organiza- tions and progressives generally. The agitation for it by the special interests is bringing great pressure on congress, and it will be well for Leader readers to learn from Mr. Cates how it has worked out in- Canada, and then write your congressman about it. ~—~ meeting an expenditure of nearly $600,000,000 a year in Canada. The failure of this tax as a revenue producer is a feature that concerns the financier, the business man, the farmer and laborer. It is absolutely necessary that any measure of taxation adopted should bring in the money. If it does not do this then, even if it has other features that would rec- ommend it, it should be ruled out. larly true when it is proposed to let go certain taxes that are bringing in vast sums of money and to 3 FRAIN GAMBLERY AND NOW i il -1 i () This is particu- . SAY,MR. GRAIN Z/ WHAT DID YOU DO | TO THIS PUMP - SHE'S NEARLY DRY T = replace them by the uncertain returns of the sales tax. To date Canada’s experience shows that if this is done the last state of the treasury will be worse than the first. It is in the interest of the people of the United States that this feature of the situation should be known, as some very glowing promises have been made. Jules Bache of New York, one of the most influential of sales tax advocates, in April, 1920, wrote the following over his own signature in a special issue of his own “Bache’s Review”: “If any such sum can be raised, as would appear probable, predicted on the figures submitted, ail in- come taxes of $5,000 or less would become unneces- sary, and a nominal tax on all other incomes would be sufficient. Today an income of $5,000 pays be- tween $120 and $160. Under the new tax, if it is expended in toto for the purchase of commodities, the income of $5,000 would pay a tax of $50, as- suming that every article purchased has had the tax added and the consumer has had to pay it. But on many articles the tax is so small that it is ab- sorbed or paid by the seller out of his normal profits and not added to the purchase price.” STATEMENT IS DISPROVED BY FACTS IN CANADA It would be well for the American public to un- derstand that nothing like this has happened in Canada. When the sales tax was introduced last year not only was the income tax not reduced, but the exemptions on it were not extended. On the con- trary, the tax on incomes of $5,000 was somewhat increased. This year, when the tax was very considerably in- | AND NOW THE MILLERS ARE GETTING WISE | g, e e —W////// income tax. If the claims made respecting this tax were valid, then what has been promised by its advocates in the United States should have taken place in Canada. It has worked out that the average Canadian not only pays all the income taxes he ever did, and a new tax, that on sales. But those who are making a great deal of money out of business have fared much bet- ter. In Canada the business profits tax has been repealed, and to make up for the loss of this revenue the sales tax has been increased. In other words, the mass of the people, the farmers and workingmen, are being called upon very largely to make up for what the others have escaped. It requires.no argument to demonstrate that the business profits tax as levied in Canada was not as great a hardship on those who paid it as the sales tax is to the average person. The busi- ness house paid it only on profits above. 10 per cent; but the sales tax is paid by the people who spend nearly all they make in order to buy food, clothing and the general GAMBLER § necessities of life. Take the FEFAFEMAQOC FRFFF7IMNMAL business house again, it. only paid the business profits tax AFRERMERMBRT rerrg@grrvr PAGE TEN . —Drawn expressly for the Leader by John M. Baer. g the war actually came out with the statement that the millers were better off during the time the government abolished future trading than be- fore. And now it is claimed that the milling interests have not joined the Chicago Board of Trade in the fight on the bills in the Illinois legislature intended to stop grain gambling. The millers are beginning to question the gambling system of marketing grain that they have so long supported. Every legitimate business should stand with the farmers in the struggle to eliminate the vicious practices of the grain exchanges. when it made money, but it has to pay the sales or turn- over whether it makes money or not. It is this unfair feature, this shifting of the burden from the backs of those well able to pay to the backs of those who have all they can do to make ends meet, that has aroused strong opposition among the farmers this year. As Dr. Michael Clarke, one of their most elo- quent advocates put it, “the (Continued on page 13)