The Nonpartisan Leader Newspaper, June 13, 1921, Page 11

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

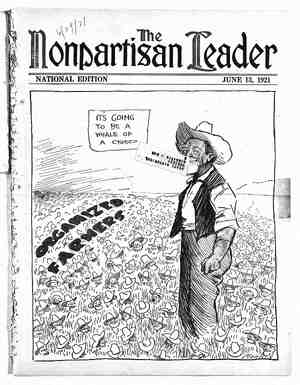

[ NShYlo‘cks- of 1921 in the Cotton Bele The Credit Merchant and His Grip on the Farmers of the Sunny South— Plain Facts About a Present-Day Situation -~ The author of this article is a Chicago journalist who some time ago made a trip into the South and was aston- ished at the conditions_he found there. The conditions which Mr. Bramhall describes still exist through most of Texas and other cotton growing states. In his next arti- cle, which will be- published in an early issue of the Leader, Mr. Bramhall tells what one group of progressive farmers did to better their condition. BY JOHN T. BRAMHALL z7] E IS a dangerous man, sir, a dangerous #| man! Beware of him!” Such was the warning given me by the secretary of the chamber of commerce of Tyler, the county seat of Smith county, in East Texas, when I inquired about the mild-mannered organizer of the co-operative farm- ers’ clubs in that county and the objects of his work. What were these co-operative associations, and what were they trying to do? The editor of one of the county papers put me wise, thus: “Well, they’re farmers’ clubs. I'm not saying anything against farmers’ organizations, as such, mind you. They have a perfect right to organize to establish a minimum price for cotton, and all that, but when they antagonize the commercial in- terests it’s another thing. And when any one goes about to agitate against the mercantile houses and the banks, it’s destructive and tending to socialism and anarchy. And as for this man Brown, he is a blankety-blanked-blank, and I would advise you to have nothing to do with him.” This, I found, was the prevailing sentiment among the influential class of the town. Mr. Brown was a gentleman of the county, a lawyer of good standing, so far as I was able to learn, except that he had successfully defended some debtor farmers and thereby won the ill will of the creditor class. I ventured to talk with him. BLACK AND WHITE ALIKE SUFFER FROM CONDITIONS “What are these co-operative farmers trying to do?” I asked. “They are organizing to get free, to get out from under the load of debt that has been crushing them, and the farmers of the South generally, for years, that is all—and they are going to do it. And they are doing it.” “White farmers as well as colored ?” “White farmers and negroes, rich and poor, it makes no difference. One man’s money 1s as good as another’s.. The cotton planter with a thousand acres is in debt to his factor, just the same as the small farm- er, white or black, with 10 acres, and the credit man puts on the screws just the same.” “Is the condition con- fined to the cotton farm- er?" “Principally, because cotton is a quickly mar- ketable commodity, like tobacco, and easily con- vertible into money. The cotton mortgage farmer has been the serf of the credit merchants and the bankers ever since’ cot- ton became a commercial staple. The one-crop sys- tem and the rented farm are responsible for this condition. The single crop — cotton, tobacco, rice, cane — comes in at harvest time with its quick money return, the 6ne money visitation of the year.” . “But that ought to make them clear.” “It ought to, but it yuever docs, The farmer Shylock, the Jewish money lender of the middle ages pictured by Shakes- peare, who demanded a pound of hu- - man flesh to satisfy his debt, has stood for hundreds of years as the symbol of inhuman greed and depravity.: But in our own country today, as Mr. Bram- hall points out, there are hundreds of men whose usury and cold-blooded scheming are ruining thousands of American families every year, driving them from their homes and condemn- ing them, their wives and children to want and misery. The farmers of America do not need to suffer from these leeches. Texas farmers can over- throw the power of their credit mer- chants just as North Dakota farmers overthrew the power of grain gam- blers—by political organization. never sees any money—I am speaking of the small farmer now. _The credit merchant must be taken care of first, or, rather, he takes care of himself. He has staked the farmer with seed, implements, provisions, clothing and general supplies. He is a most accommodating man; dispenses everything from patent medicines and hosiery to“galluses and fertilizers. All he requires is your note, in the form of a chattel mortgage, and he advances goods at credit prices fixed on a scale of his own. There has been some improvement in this condition, help- ed by the more progressive merchants and bankers, but the evils have been by no means removed.” .“The credit merchant marks up his.goods 15 or 20 per cent,” I innocently conjectured. The lawyer regarded me with pity. “Fifteen or 20 per cent? Fifty per cent would be moderate. I A 100 PER CENT ANTI-FARMER TOWN ON A BUSY DAY l John Baer has drawn here what he has often seen in the Middle West—a country town, dependent up}n the farmers, that has ruined itself by its hostility to the men that fed it and kept it alive. “business men” of the South are equally blind to their own best interests in many cases, as the author of the article on this page sets forth, and organizers for co-operative enterprises meetsthe same abusive epithets that. are applied to Leaguers in the Northwest today. PAGE TWELVE , . The only limit is the care necessary to preserve the 2 goose that lays the golden egg. You can buy of your credit merchant and no one else; and you can sell to your credit merchant and to no one else. He . sells to you, on credit, at his price, and he takes your cotton, at his own grading, at his own price. And what are you going to do. about it?” I said I was mighty glad that I wasn’t a cotton farmer. : i “It pays pretty well, if you don’t run in debt,” observed the lawyer. By accident I came across a pamphlet entitled, “Farming Credit in Texas,” issued by the Agricul- tural and Mechanical college of Texas, February, 1917. I would call it a “History of the Decline and Fall of the Southern Farmer.” A critic denounced it as a misleading and unreliable production, the printing of which should never have been permitted. Take your choice. It appears that the faculty of the college got wise to the fact that there was something rotten in the state of Texas, materially affecting the prosperity of its people, and they un- dertook an inquiry into the. credit system, which was suspected of being at the bottom of the trou- ble. Clarence Ousley, head of the college extension service and later assistant secretary of agriculture under President Wilson, sent Walter Peteet of the college staff to gather the information. The in- quiry was conducted -with fairness and the report is marked with a desire to serve the best interests of the people. It says: INTEREST RATES RANGE UP TO 40 PER CENT “Texas debtor farmers have been paying to banks 10 to 40 per cent interest per annum, or to credit merchants 10 to 60 per cent above cash prices. This credit system, éither as cause or effect, uni- formly prevails with all-cotton farming, or all- wheat farming or any other form of one-crop farm- ing. As shown in this bulletin, reform may be ac- companied by patient education, stimulated by con- constructive legislation, to the end that both debt- or and creditor may un“- derstand their mutual in- terest in better farming and cheaper credit. “Farm ownership in Texas is not increasing in proportion to the in- crease of rural popula- tion. With few excep- tions both farm owners and tenants express the opinion that under pres- ent conditions the av- erage “man - can not ac- quire a farm by his own labor. In this state of mind but few men will even undertake to ac- quire farms.” - .The price paid by the Texas farmer for credit, says the report, -is al- most unbelievably high. It is highest in the small- farm district of East Texas, and lowest in the cattle and wheat regions of West Texas. It varies widely, however, in each of . these regions. ' The trucker and dairy farmer of East Texas pays less for credit than the -all- cotton farmer, and the all-wheat farmer of the West pays more than the farmer-stockman of the same region. The maxi- mum price is paid by-the all-cotton tenant farmer, who gives,a mortgage on his livestock and_ grow- ing ~crop for security, and the minimum by the (Continued on page 19) P 3 So-called