The Nonpartisan Leader Newspaper, May 2, 1921, Page 7

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

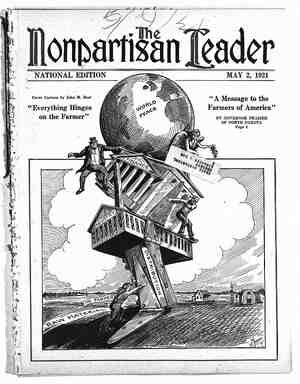

Four Billions—What Became of Them? Exposing the Railroads’ Record of Graft and Incompetence, as Shown by Ofticial Records—How Wall Street Works It BY E. B. FUSSELL N THE last issue of the Leader we studied the railroad question and found that the railroads had recently gotten about $4,000,000,000 from the people and the government, of which about $2,000,000,000 was in increased rates under the Esch-Cummins act and the other $2,000,000,000 consisted of grants or advances by s the government. The shippers (principally the farmers) paid the first $2,000,000,000 directly to the railroads in increased freight rates. The other $2,000,000,000 was collected by the goverrnment in the form of war taxes and then turned over to the railroads. ¢ Yet, in spite of receiving this $4,000,000,000, the railroads are before congress today saying that they are broke and asking for still more money. What became of the $4,000,000,000? This article is to answer this question so far as it is possible. The railroad men who are before congress are trying to make the people believe that it went prin- cipally to pay increased wages to railroad employes. Last summer, it will be remembered, the- railroad employes were granted a wage increase which, it was estimated, would amount to approximately $600,000,000 a year. This looks like an immense amount of money and it would be—if the employes got it—though even then it did not increase wages to the extent that the cost of living had advanced. However, the increased wages actually paid by the railroads will not total $600,000,000. This is due to two causes. In the first place the railroads have been laying off | Knowy Hows men ever since the increased wages were | "Fecie granted. It is estimated that 15 per cent ILL TELLTHE of the men who were employed last summer are now out of work. In the second place the railroads have recently started a wage-cutting campaign in violation of the wage agree- ment with the workers made last summer. At the outside the increased expenditures by the railroads for wages do not amount to more than $500,000,000. This leaves $3,500,000,000 which the railroads got and spent, still to be accounted for. The Esch-Cummins act provided, it will be re- membered, that railroads should be granted rates sufficient to pay them 5% to 6 per cent if they had paid all their cperating expenses. This was clearly placing a premium on extravagance. The govern- ment was saying to the railroads: “Spend as much as you like. You can charge whatever rates you need to make it up.” In response to this invitation the railroads certainly started spending the money right and left but their workers didn’t get it. Who did then? About the time the new wage scale for railroad workers went into effect the great railroad com- panies, although they maintained enormous repair shops of their own, began turning an increasing - amount of their repair work over to private repair companies. One reason given for this was that the railroad shop employes were all unionized while the private repair companies worked on a nonunion basis. A person might think that the railroads adopted this policy because it would save them money but this certainly didn’t turn out to be the case. COST OF LOCOMOTIVE REPAIRS JUMPS FROM $5,000 to $16,000 To see what actually happened, take the case of the Pennsylvania Railroad company and the Bald- win shops. In April, 1920, the Pennsylvania com- pany had 13 locomotives of the big Mikado type re- paired with what is known as “class 3” repairs. These repairs are “flues all new or reset, repairs to firebox and boiler, tires turned or new, repairs to machinery and tender.” Seven of these locomotives were sent to the Bald- win shops for repairs. The bills at the Baldwin shop ranged from $15,147.56 to $18,022.67, averag- 'ing $16,250.01. The other six locomotives were re- paired in the company’s own shops and the cost for this repair work ranged from $4,087.47 to $5,883.28, an average of $5,310.56, or less than one-third of the average cost of the repairs in the outside shop. This was not an exceptional month by any man- ner of means. cost of class 3 repairs at Baldwin shops was $19,- 272,63, while the average cost of class 8 repairs at the company shops was $4,609.13. In this month the cost of class 4 repairs at Baldwin shops was $20,781.52 and at the railroad shops $4,200.08. The cost of class b repairs at Baldwin’s was $18,338.52. The cost of class 5 repairs at the company’s shops during the same month was $3,750.67. All of these figures are for exactly the same type of locomotives and for the same class of repairs. *We could fill the entire issue of the Leader with statistics dealing THE FARMER PAYS | ! JUST HATE To DO THIs MR FARMER BUT (Ve yusT GoT To mve with the cost :)f repairing locomotives of other types and with the cases of other railroads and repair companies, but these figures would all show the same thing—that the same class of repairs cost the railroads from three to four times as much in the private shops as they did in the company shops. Now the interesting question is, why were the railroads anxious to pay three er four times as much for their railroad repairs as they could get the work done for in their own shops? To answer this question we will have to see who owns the railroads and who is running them today. Senator La Follette of Wisconsin, known through- out the country as one of the most thorough stu- dents of the railroad question, said recently in con- gress: - “I have studied transportation for 30 years of my life and I want to tell you that there was a time when real railroad men were at the head of the railroads in this country. The financiers of Wall street are running the railroads today. Beginning about 1900 a change came and the railroad manage- ment of the country passed out of the hands of men who had come up from the ranks and who were cap- able of running the railroads and believed in bal- ancing service against transportation charges. The management of the railroads passed into the hands of representatives of Wall street and from that hour on the railroads of the United States have not been run by men capable of running the transportation of the country. They have been run by the repre- sentatives of great financial houses, by the pro- moters, by the banks.” . ‘What does Senator La Follette mean by the state- ment that Wall street runs the railroads? The rail- roads themselves will tell you that they have 600,- 000 stockholders and will cite you to the report of - the interstate commerce commission to prove this statergent. i PAGE SEVEN In May, for instance, the average- —&./ —Drawn expressly for the Leader by 'W. C. Morris. But this same report of the interstate commerce commission shows that the majority of the stock in every first class railroad in the country is held by less than 20 of the big stockholders. The report further shows that less than 1.3 per cent of the stockholders of class 1 roads, numbering only 8,301 individuals, controls the total amount of stock of 97 per cent of the railroad mileage of the nation. But this does not mean that even 8,301 men actually control and operate the transportation system of the country. The real power which today controls the railroads of the United States is a group of 12 New York financial institutions making up the New York banking combine. TWELVE BIG BANKS AND. COMPANIES THEY CONTROL These 12 financial institutions are J. P. Morgan & Co., the Guaranty Trust company, National City bank, First National bank, the Equitable Trust company, the American Surety company, the Na- tional Surety company, the Chase National bank, the Me- chanics & Metals National bank, the New York Trust company, the Mutual Life Insurance com- pany and the Equitable Life As- surance company. Members of the boards of di- rectors of these banks and finan- cial houses control approximate- ly 270 directorships in 93 class 1 railroads., Most of these rail- roads only have about 15 direc- tors and the banks listed av- erage four or five members on the boards of each of the prin- cipal systems. Taking the banks individually, the Guaranty Trust company has 50 railroad directorships, the National City Bank 48, the Equitable Trust company 34, and so on. But what has this to do with the question of why the rail- roads pay three or four prices for their repair work with pri- vate repair companies? Sim- ply this, that this same group of 12 banks also controls the prin- cipal equipment and repair companies. The number of directors which these 12 banks have on the boards of directors of the different railroad repair com- panies is as follows: Baldwin Locomotive, 2; Amer- ican Locomotive, 4; American Brake Shoe & Foun- dry, 4; Midvale Steel, which controls Cambria Steel, 6; American Can & Foundry, 1; Standard Steel Car, 1; Woodman Iron company, 1; New York Airbrake, 2; Westinghouse, 3; Bethlehemn Steel, 4; United States Steel, 3; Lackawanna Steel, 3; Pullman com- pany, 4; Haskell & Barker, 3; Safety Car Heating & Lighting company, 2; Railway Steel Spring, 2; Lima Locomotive works, 3; Pressed Steel Car, 2; Southern Wheel, 2; Rail Joint company, 2. The railroads were returned to their owners ' March 1, 1920. The practice of turning their repai- work over to the private companies was started im- mediately by all the big eastern roads and month by month more of their work was turned over to the private companies and more of their own em- ployes were discharged. Day by day as men were being discharged from the railroad repair shops the stock of the railroad equipment companies was going up in the New York Stock exchange point by point in spite of the fact that the prices of most stocks were being low- ered. To show what happened with the equipment stocks from the New York Stock exchange a mar- ket letter sent out by Schmidt & Deery, a firm of Wall street stock brokers, December 10, 1920, states that from November 20 to December 10, a period of 20 days, the prices of six equipment stocks—the American Car & Foundry, American Locomotive, Baldwin Locomotive, Pressed Steel Car, Railway Steel Spring and Haskell & Barker averaged ine creases of 42 per cent. This firm, in its market letter, advises all its patrons to buy these equip- ment stocks on account of the plan of the railroads (Continued on page 1_]_.)