The Nonpartisan Leader Newspaper, February 21, 1921, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

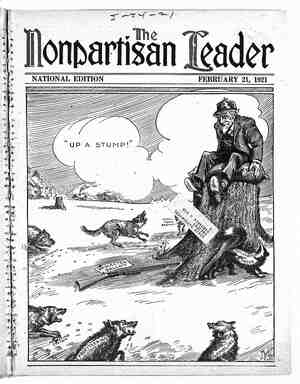

PR A R R Keeping Up With Mr. Allen of Kansas Governor of the Sunflower State Puts Out a New Batch of Falsehoods— - North Dakota Man Answers Him ;]ON. HENRY J. ALLEN, Governor of Kansas and Ed- itor the Wichita Sunday Star and Beacon, Topeka, Kan. Dear Sir: On the front page of the issue of your pa- per for January 16, 1921, there appeared an article under the caption, “Weighed and Found Wanting,” in which you make certain statements regarding the situation in North Dakota, all of which are either directly false or misleading. You say that “Townley now turns to Kansas as a last hope.” And that “the organizers, well-trained in evasion and de- ception, will tell a number of half-truths” in order to win members in Kansas. If the telling of half-truths is the worst thing League organizers are guilty of in Kansas, you have already far surpassed them in iniquity. In hardly a single in- stance do your statements contain even half-truths. You say that, “according to reputable authority,” the citizens of North Dakota will have to pay $15,000,000 to put the Bank of North Dakota on its feet. The Bank of North Dakota is already on its feet, has been from the beginning, and is standing firm as a rock in a situation which is giving many of the strongest banks in the country a great deal of concern. As of December 15, the demand assets of the Bank of North Dakota amount to $11,675,270.14, while its demand liabilities were only $10,268,985.86, in addition to state funds that will be drawn out only in the orderly course of state business. The Bank of North Dakota challenges any other finan- cial institution in the country to make a better showing. - You say that state banks in North Dakota are glutted with post-dated notes of farmers, held as security for loans used in promoting various so- cialistic enterprises of the sure-thing variety. You say that, as a result of this frenzied finance, 4C banks in the state have been closed for some time, and that the number is growing alarmingly. Do you make this statement on verified informa- tion, or are you accepting the statements of propa- gandists employed by Twin Cities grain buying in- terests to spread falsehoods about North Dakota for the purpose of defeating a program that prom- ises to break their monopoly? To what responsi- ble official in North Dakota did you write to find out just what is the trouble in the North Dakota banks which have closed their doors? THE FACTS ABOUT NORTH DAKOTA BANK CLOSINGS The state examiner of North Dakota, who under the law has the supervision of these banks, is re- sponsible for the statement that in the majority of cases nothing is wrong with them, except that their reserves have been temporarily depleted. He ascribes the embarrassment of these banks to the slow selling of farm products on account of the disastrous slump in prices. North Dakota bankers, who are not at all friendly to the North Dakota state enterprises, in their re- ports to eastern correspondents, minimize these so- called bank failures. They point out that the banks are small, that their aggregate capital is insignifi- cant, and that their temporary closing is not a matter which should cause alarm. Furthermore, it is well known in the state that the embarrassment of these banks is in no way caused by the carrying out of the North Dakota state industries, or of -the alleged socialistic enterprises to which you refer. You say that “in some of his new projects” Townley’s method is to sell the farmers preferred stock and to keep the common stock himself, so as te maintain control. You intimate that Townley has organized numerous projects of this kind in North Dakota. The truth is, as you could easily have found out if you had made inquiries of re- sponsible persons, that there is only one co-opera- tive or joint stock enterprise in North Dakota or- ganized by Townley or other League authority, and that is the Consumers United Stores. That enterprise is completely in the control of the stock- holders, and is and has been a going concern. And instead of its paper contributing to the embarrass- ment of the banks mentioned, it has itself expe- -In previous issues of the Leader we have answered statements by Governor Allen of Kansas, attacking League leaders and members as unpatriotic and dis- loyal. We showed that statement after statement was either a half-truth or a complete lie. The Kansas gov- ernor, paying no attention to the fact that his earlier statements have been completely disproved, recently issued a new attack, made up.of the most barefaced lies imaginable. W. G. Roylance of the department of sta- tistics and publicity of the Bank of North Dakota, at Bismarck, has written the following open letter to ‘Governor Allen, citing lie after lie in Allen’s statement. We hope every Leaguer reads this letter. only one criticism to make of Mr. Roylance’s letter, and that is that he handles a careless or willful liar much more tenderly than he deserves. rienced considerable difficulty owing to the fact that some of its assets are tied up in these banks. And while on the question of the closing of these small banks it will be as well to remind you that they are operating under the state depositors’ guarantee law, which gives absolute protection to all depositors. . You say that North Dakota taxes (presnmably meaning state taxes) “jumped 115 per cent from 1918 to 1919, and 200 per cent from 1918 to 1920.” According to dn official document issued by the North Dakota state tax commissioner the increase of 1919 taxes over 1918 taxes was 111.91 per cent. According to the same authority the state levy for 1920 is $2,847,186, while the levy for 1919 was $3,743,209, a difference of $896,023, or a reduction of 24 per cent. Is your statement a half-truth, or an unqualified falsehood? Not only is the increase in state taxes from 1918 to 1919 less than you give it, but, notwithstanding ' the increase actually made, per capita taxation was less in North Dakota in 1919 than in any other northwestern state. . It was less than in Kansas, if we exclude the soldier bonus levy in North Dakota, and only 39 cents higher including the soldier bo- nus levy. Furthermore, local taxes in North Da- kota are showing a decline, equal to or greater than the reduction in state taxes, while in most other states all taxes are increasing. And before leaving the subject of taxation, may I ask you on what authority you make the state- ment that the North Dakota state tax rate, aside from the hail insurance tax, is 4 mills? It is 1.9 mills for 1920, and this includes a levy of .75 of a mill for the soldier bonus fund, so that the North Dakota levy for purposes exclusive of the soldier bonus fund is 1.15 mills, less than the Kansas levy. DON'T YoU - COME TO KANSAS —’ THIS 1S MY \ ".:7;’:'\!'- R SR S R F AP T A R S We have ~ . You say that farm land, after the amendment to the North Dakota tax laws, carries 70 per- cent of the tax burden, while it carried only 50 per cent before these amendments were made. It has been shown by-the North Dakota state tax commissioner that the actual shift of the burden of taxation to farmers, consid- ering both land and other farm values, has been less than eight-tenths of 1 per cent. You say that city property received the benefit of this alleged shift of the tax bur- in North Dakota loudly complain that they are taxed on business improvements at 100 per cent of full value, while farm improve- ments are exempted. You say that “city property under $2,5600 was admitted tax free,” and that “city property worth be- tween $2,500 and $3,500 was taxed at $1,000.” There is nothing of this kind in the law. In fact, your statement is such a jumble of absurdities that it is useless to attempt to analyze it. “And in this connection may I remind you that you have overlooked the fact that the exemp- tion of all farm improvements and farm equipment up to $1,000 in value has given a material advantage to the farmer owning and cultivating his own farm over the man who rents out his farm to the actual farmer. You say that North Dakota has had difficulty in selling its bonds, “as their validity has not been es-. tablished by the courts.” Is it possible that you are not aware of the fact that suits attacking the valid- ity of these bonds were decided favorably to the state, in the federal district court and in the su- preme court of the state, and that both of these de- cisions were affirmed by the supreme court of the United States? It seems that that is what we must infer. Four._your information on this matter let me cite you to Green vs. Frazier, vol. 40, Supreme Court Reporter, 499. . LIES ABOUT HAIL INSURANCE MONEY ARE PALPABLY FALSE Referring to the North Dakota hail insurance law, you say that “the man with no wheat pays wheat insurance the same as the man who raises wheat.” Apparently you assume that North Da- kota hail insurance is for the benefit of wheat grow- ers only. Do you really believe that any legislative body in this country would have been guilty of such an absurdity as passing an act providing for pro- tection of wheat from hail losses, and not for the protection of barley, oats ar other field crops? It should hardly be necessary to say that all farm crops are protected under the North Dakota hail insurance law. But even ‘with this correction your statement is still wrong. The man with no crop subject to hail losses pays a tax if he is the owner of cultivated land; but that tax is a flat tax of 3 cents per acre. Those who actually take out insur- ance under the law pay an additional indemnity tax, or premium, which is computed on the basis of the total losses for a given year. Your statement that the money derived from this tax is used for the support of “various extravagant and fanciful plans proposed by Townley” is so palpably false as to be unworthy of further attention. Finally, you say that the part- of the law requir- ing funds of state, county and city to be deposited in the state bank has been invalidated in the su- preme court. To the contrary, this law was upheld by the supreme court. It is true that an initiated law promulgated by certain banking interests in North Dakota, evidently carrying out the will of Twin Cities banking and grain trade interests, . made optional the depositing of local public funds in the bank. The depositing of all state funds in the Bank of North Dakota is still compulsory. This last statement of yours, perhaps more clear- ly than any of the others, indicates the unreliabil- ity of your information. Any one at all acquainted with the North Dakota situation, whether League or anti-League, would haye told you you were wrong. And if you were as uncertain of your facts in all these statements as in this particular case, how can you excuse this reckless attack upon the fair name of a sister commonwealth % - Frankly, Governor Allen, is this not a situation in - which the late Colonel Roosevelt, of honored mem- den to farmers. Yet city property owners— ) oy M Sl Qe T ok o o O1 vy < Fhh